|

市場調查報告書

商品編碼

1885855

精準發酵法製備蛋白水解物市場機會、成長促進因素、產業趨勢分析及預測(2025-2034年)Precision Fermentation-Based Protein Hydrolysates Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

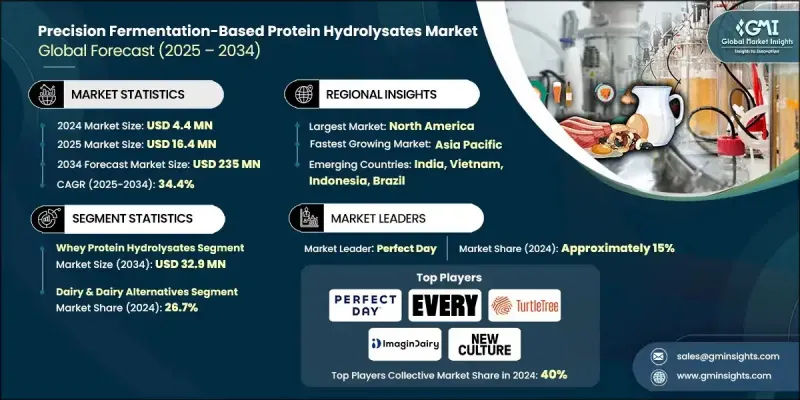

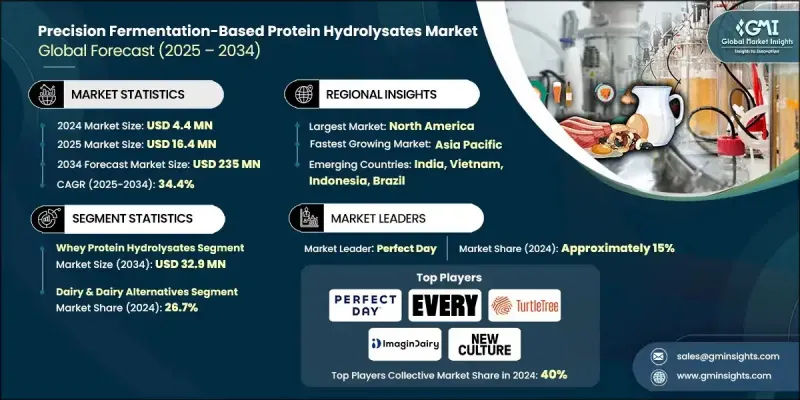

2024 年全球精準發酵蛋白水解物市場價值為 440 萬美元,預計到 2034 年將以 34.4% 的複合年成長率成長至 2.35 億美元。

市場發展勢頭正因多種因素的共同作用而加速,其中包括監管方面的進展,這些進展為新型精準發酵蛋白作為水解物生產的基礎原料進入商業管道鋪平了道路。年產能超過10萬公升的大型發酵廠正在陸續投產,顯著提升了供應潛力。隨著製程最佳化和規模化效率的提高,生產成本預計將越來越有競爭力,與傳統蛋白質來源相比更具優勢。同時,隨著營養、食品技術和製藥業的公司將精準發酵水解物整合到新產品線中,其應用範圍也不斷擴大。這些水解物在嬰幼兒營養、醫療配方、健康生活方式補充劑、功能性食品配料、化妝品應用和特種動物營養等領域都具有巨大的應用潛力,蘊藏著巨大的收入機會。此外,這些水解物也被設計用於提供具有抗氧化、抗菌、降血壓、礦物質結合或免疫支持等功效的生物活性化合物,這些功效已透過臨床研究證實,進一步提升了這些優質原料的差異化優勢。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 440萬美元 |

| 預測值 | 2.35億美元 |

| 複合年成長率 | 34.4% |

預計2034年,乳清蛋白水解物市場規模將達3,290萬美元,年複合成長率(CAGR)預估為30.3%。由於其在運動營養、嬰幼兒配方奶粉和功能性食品等領域的長期應用,該細分市場是蛋白質來源中最成熟的。其主要蛋白質組分具有顯著的功能特性,包括有效的起泡性、乳化性和凝膠形成性,這些特性通常可透過標靶水解而增強。

2024年,乳製品及乳製品替代品市佔率為26.7%,預計2025年至2034年間將以29.2%的複合年成長率成長。該領域仍是最大的應用領域,因為消費者熟悉乳蛋白,而生產商則依賴這些蛋白在飲料、發酵乳製品、冷凍甜點和其他富含蛋白質的食品中的功能性表現。日益增多的產業合作將繼續推動精準發酵水解物在主流消費品中的應用。

2024年,北美精準發酵蛋白水解物市場預計將佔據41.9%的市場佔有率,這主要得益於先進的生物技術環境、有利的監管路徑以及眾多專注於精準發酵的企業的強大實力。在美國,簡化的監管流程使得許多申請者能夠在大約10-12個月內完成核准流程,而其他一些地區的核准時間則要長得多。

精準發酵蛋白水解物市場的主要活躍企業包括Change Foods、Clara Foods、Cubiq Foods、Formo、Fybraworks Foods、Geltor、Helaina、Imagindairy、Jellatech、Modern Meadow、Motif FoodWorks、New Culture、Onego Bio、Perfect Day、Provectus AltoYuectus AlMmil、Spikid、Spifect Day、Provectus Albid、Ekot、SpiberTree、SpiFal、Treek、TheYat、Treek、Ek。這些企業正致力於鞏固其在精準發酵蛋白水解物市場的地位,並實施以擴大生產規模、提高成本效益和加速產品創新為重點的策略。許多企業正在投資高產能發酵系統以提高產量,同時改善下游加工流程以提高純度和產率。與食品、營養和生物技術公司的策略合作有助於拓展應用開發並確保長期市場需求。此外,企業還優先考慮監管合規,以縮短核准週期並擴大市場准入。此外,各公司正在對具有特殊功能和生物活性特徵的蛋白質和水解物進行工程改造,以創造差異化、高利潤的產品線,從而支持競爭地位。

目錄

第1章:方法論與範圍

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 供應商格局

- 利潤率

- 每個階段的價值增加

- 影響價值鏈的因素

- 中斷

- 產業影響因素

- 成長促進因素

- 產業陷阱與挑戰

- 市場機遇

- 成長潛力分析

- 監管環境

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 波特的分析

- PESTEL 分析

- 價格趨勢

- 按地區

- 按類型

- 未來市場趨勢

- 技術與創新格局

- 當前技術趨勢

- 新興技術

- 專利格局

- 貿易統計

- 主要進口國

- 主要出口國(註:僅提供重點國家的貿易統計)

- 永續性和環境方面

- 永續實踐

- 減少廢棄物策略

- 生產中的能源效率

- 環保舉措

- 碳足跡考量

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- MEA

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 合作夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估算與預測:依類型分類,2021-2034年

- 主要趨勢

- 酪蛋白水解物

- 乳清蛋白水解物

- 乳鐵蛋白水解物

- 卵清蛋白水解物

- 卵子黏液水解物

- 肌紅蛋白水解物

- 豆血紅素水解物

- 膠原蛋白水解物

- 彈性蛋白水解物

- 酵素水解物

- 生長因子水解物

- 功能性胜肽濃縮物

- 微生物蛋白水解物

- 其他

第6章:市場估算與預測:依應用領域分類,2021-2034年

- 主要趨勢

- 乳製品及乳製品替代品

- 液態奶及乳製品替代品

- 全脂牛奶替代品

- 脫脂和低脂牛奶替代品

- 風味牛奶替代品

- 咖啡師級牛奶替代品

- 起司替代品

- 馬蘇里拉起司(披薩、餐飲服務)

- 切達乾酪和硬質奶酪

- 奶油乳酪和軟乳酪

- 加工乳酪製品

- 優格及發酵替代品

- 希臘式優格

- 可飲用優格

- 益生菌配方

- 冰淇淋和冷凍甜點

- 高級冰淇淋

- 冷凍優格

- 新奇商品和酒吧

- 奶油、奶油和抹醬的替代品

- 乳製品成分替代品

- 乳清蛋白替代品

- 酪蛋白酸鹽替代品

- 牛奶蛋白分離物替代品

- 液態奶及乳製品替代品

- 烘焙和糖果

- 麵包和捲餅

- 三明治麵包

- 手工麵包

- 麵包捲和麵包卷

- 蛋糕和糕點

- 千層蛋糕

- 鬆餅和紙杯蛋糕

- 丹麥酥和羊角麵包

- 餅乾和曲奇

- 蛋液替代品

- 糖果及甜點應用

- 棉花糖和牛軋糖(充氣器、質地)

- 軟糖和果凍(膠原蛋白,營養強化)

- 巧克力及塗層(牛奶蛋白替代品)

- 麵包和捲餅

- 飲料

- 蛋白質水

- 清澈的蛋白質水

- 電解質和功能性水

- 運動及能量飲料

- 等滲透壓飲料

- 富含蛋白質的能量飲料

- 訓練前/訓練中飲料

- 即飲蛋白奶昔

- 植物性蛋白質奶昔

- 清澈的即飲蛋白奶昔

- 代餐

- 果汁和低pH值飲料

- 混合果汁

- 碳酸飲料

- 酸性官能基

- 酒精應用

- 啤酒(穩定劑)

- 葡萄酒(澄清劑)

- 加入蛋白質的酒精飲料

- 蛋白質水

- 肉類、海鮮及烹飪應用

- 植物肉應用

- 漢堡和肉餅

- 整塊肉(牛排、雞肉製品)

- 結構化肉品替代品

- 肌紅蛋白/血紅素用於調味和香氣

- 人造肉培養基及投入物

- 生長因子(IGF、FGF、TGF-α)

- 血清和胺基酸替代品

- 支架蛋白(膠原蛋白、細胞外基質類似物)

- 海鮮替代品

- 鰭魚(鮪魚、鮭魚類似物)

- 甲殼類(蝦、蟹)

- 烹飪應用(一般鹹味)

- 湯類和肉湯(乳製品/肉類替代品)

- 醬汁、肉汁和乳化劑

- 調味品和佐料

- 速食、即食食品、簡便食品

- 植物肉應用

- 運動與積極生活方式營養

- 蛋白質粉

- 發酵乳清類似物

- 發酵酪蛋白和雞蛋類似物

- 多源混合

- 功能性蛋白棒和零食

- 恢復和耐力產品

- 以支鏈胺基酸(BCAA)為重點的產品

- 肌肉/關節/免疫益處

- 運動後飲料沖劑

- 清潔標籤和高性能水溶性物質

- 蛋白質粉

- 醫學與臨床營養

- 基於胜肽的腸內營養配方

- 半元素

- 元素

- 口服醫學營養

- 癌症、慢性阻塞性肺病、老年病

- 治療應用

- 肝腎飲食

- 免疫支持

- 術後恢復

- 藥理胜肽

- 費雪比率寡肽

- 免疫調節水解物

- 基於胜肽的腸內營養配方

- 嬰幼兒營養

- 嬰兒配方奶粉(0-6個月)

- 部分水解

- 深度水解

- 胺基酸基

- 後續配方奶粉和幼兒配方奶粉(6-24個月)

- 水解後續

- 成長奶粉

- CMP過敏及低過敏產品

- 乳鐵蛋白和生物活性胜肽

- 免疫和腸道功能支持

- 嬰兒配方奶粉(0-6個月)

- 膳食補充劑與功能性健康

- 膳食蛋白質補充劑

- 粉劑、膠囊

- 蛋白質注射液

- 功能性軟糖和飲料

- 按功能分類的生物活性胜肽

- 心血管支持(ACE抑制劑)

- 抗氧化劑

- 抗菌劑

- 免疫調節劑

- 認知/壓力支持胜肽

- 膳食蛋白質補充劑

- 藥妝品及個人護理

- 保養品

- 促進膠原蛋白生成的乳霜

- 抗老精華液

- 保濕霜和眼霜

- 頭髮和頭皮產品

- 水溶性角蛋白型蛋白質

- 頭髮修復胜肽

- 口腔及牙齒護理

- 胜肽漱口水

- 口腔衛生補充劑

- 保養品

- 動物營養

- 寵物食品(犬貓)

- 高蛋白乾糧、濕糧、點心

- 水產飼料

- 鮭魚、蝦、鱒魚-促進消化的胜肽

- 牲畜飼料添加劑

- 豬、家禽、反芻動物性能

- 免疫和腸道健康胜肽

- 寵物食品(犬貓)

- 製藥與生物治療

- 治療性胜肽(例如,GLP-1類似物)

- 生物類似胜肽

- 基於胜肽的活性藥物成分

- 藥物遞送胜肽支架

- 傷口癒合與再生療法

- 抗菌及局部用藥

第7章:市場估計與預測:依地區分類,2021-2034年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 歐洲其他地區

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 亞太其他地區

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

- 中東和非洲其他地區

第8章:公司簡介

- Change Foods

- Clara Foods

- Cubiq Foods

- Formo

- Fybraworks Foods

- Geltor

- Helaina

- Imagindairy

- Jellatech

- Modern Meadow

- Motif FoodWorks

- New Culture

- Onego Bio

- Perfect Day

- Provectus Algae

- Remilk

- Spiber

- The EVERY Company

- TurtleTree

- Vivici

- Others

The Global Precision Fermentation-Based Protein Hydrolysates Market was valued at USD 4.4 million in 2024 and is estimated to grow at a CAGR of 34.4% to reach USD 235 million by 2034.

Market momentum is accelerating due to multiple reinforcing factors, including regulatory progress that is opening the door for novel precision-fermented proteins to enter commercial channels as foundational materials for hydrolysate production. Large-capacity fermentation plants exceeding 100,000 liters are being brought online, significantly boosting supply potential. As optimization improves and scaling efficiencies advance, production costs are expected to become increasingly competitive with conventional protein sources. At the same time, application development is broadening as companies in nutrition, food technologies, and pharmaceuticals integrate precision-fermented hydrolysates into new product pipelines. Revenue opportunities span high-value uses across infant nutrition, medical formulations, active lifestyle supplements, functional food ingredients, cosmetic applications, and specialty animal nutrition. These hydrolysates are also being designed to deliver bioactive compounds that have demonstrated benefits such as antioxidant, antimicrobial, antihypertensive, mineral-binding, or immune-supportive effects through clinical findings, adding further differentiation to these premium ingredients.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $4.4 Million |

| Forecast Value | $235 Million |

| CAGR | 34.4% |

The whey protein hydrolysates segment is expected to reach USD 32.9 million by 2034 at a projected CAGR of 30.3%. This segment is the most established among protein sources due to long-standing use across sports nutrition, infant formulations, and functional food applications. Its primary protein fraction offers notable functional properties, including effective foaming, emulsification, and gel formation, which are often enhanced through targeted hydrolysis.

The dairy and dairy alternatives segment held a 26.7% share in 2024 and is anticipated to grow at a 29.2% CAGR between 2025 and 2034. This category remains the largest application area because consumers are familiar with dairy proteins and manufacturers rely on the functional performance of these proteins in beverages, cultured dairy items, frozen desserts, and other protein-enriched foods. Growing industry collaborations continue to support higher adoption of precision-fermented hydrolysates across mainstream consumer products.

North America Precision Fermentation-Based Protein Hydrolysates Market captured 41.9% share in 2024, supported by an advanced biotechnology landscape, favorable regulatory pathways, and a strong presence of companies specializing in precision fermentation. In the United States, a streamlined regulatory route allows many applicants to move through approval stages in roughly 10-12 months, compared with longer timelines in certain other regions.

Key companies active in the Precision Fermentation-Based Protein Hydrolysates Market include Change Foods, Clara Foods, Cubiq Foods, Formo, Fybraworks Foods, Geltor, Helaina, Imagindairy, Jellatech, Modern Meadow, Motif FoodWorks, New Culture, Onego Bio, Perfect Day, Provectus Algae, Remilk, Spiber, The EVERY Company, TurtleTree, and Vivici. Companies strengthening their foothold in the Precision Fermentation-Based Protein Hydrolysates Market are implementing strategies focused on scaling production, improving cost efficiency, and accelerating product innovation. Many organizations are investing in high-capacity fermentation systems to increase output while refining downstream processing to raise purity and yield. Strategic collaborations with food, nutrition, and biotech firms are helping expand application development and secure long-term demand. Businesses are also prioritizing regulatory readiness to shorten approval cycles and enhance market access. In addition, firms are engineering proteins and hydrolysates with specialized functional and bioactive profiles to create differentiated, high-margin product lines that support competitive positioning.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Type

- 2.2.3 Application

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By type

- 3.8 Future market trends

- 3.9 Technology and Innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries ( Note: the trade statistics will be provided for key countries only)

- 3.12 Sustainability and Environmental Aspects

- 3.12.1 Sustainable Practices

- 3.12.2 Waste Reduction Strategies

- 3.12.3 Energy Efficiency in Production

- 3.12.4 Eco-friendly Initiatives

- 3.13 Carbon Footprint Considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates and Forecast, By Type, 2021 - 2034 (USD Million) (Tons)

- 5.1 Key trends

- 5.2 Casein Hydrolysates

- 5.3 Whey Protein Hydrolysates

- 5.4 Lactoferrin Hydrolysates

- 5.5 Ovalbumin Hydrolysates

- 5.6 Ovomucoid Hydrolysates

- 5.7 Myoglobin Hydrolysates

- 5.8 Leghemoglobin Hydrolysates

- 5.9 Collagen Hydrolysates

- 5.10 Elastin Hydrolysates

- 5.11 Enzyme Hydrolysates

- 5.12 Growth Factor Hydrolysates

- 5.13 Functional Peptide Concentrates

- 5.14 Microbial Protein Hydrolysates

- 5.15 Others

Chapter 6 Market Estimates and Forecast, By Application, 2021 - 2034 (USD Million) (Tons)

- 6.1 Key trends

- 6.2 Dairy & Dairy Alternatives

- 6.2.1 Fluid Milk & Milk Alternatives

- 6.2.1.1 Whole Milk Analogues

- 6.2.1.2 Skim & Low-Fat Milk Analogues

- 6.2.1.3 Flavored Milk Alternatives

- 6.2.1.4 Barista-Grade Milk Alternatives

- 6.2.2 Cheese Analogues

- 6.2.2.1 Mozzarella (Pizza, Food Service)

- 6.2.2.2 Cheddar & Hard Cheeses

- 6.2.2.3 Cream Cheese & Soft Cheeses

- 6.2.2.4 Processed Cheese Products

- 6.2.3 Yogurt & Fermented Alternatives

- 6.2.3.1 Greek-Style Yogurt

- 6.2.3.2 Drinkable Yogurt

- 6.2.3.3 Probiotic Formulations

- 6.2.4 Ice Cream & Frozen Desserts

- 6.2.4.1 Premium Ice Cream

- 6.2.4.2 Frozen Yogurt

- 6.2.4.3 Novelties & Bars

- 6.2.5 Cream, Butter & Spread Alternatives

- 6.2.6 Dairy Ingredient Replacers

- 6.2.6.1 Whey Protein Replacers

- 6.2.6.2 Caseinate Replacers

- 6.2.6.3 Milk Protein Isolate Replacers

- 6.2.1 Fluid Milk & Milk Alternatives

- 6.3 Bakery & Confectionery

- 6.3.1 Bread & Rolls

- 6.3.1.1 Sandwich Bread

- 6.3.1.2 Artisan Breads

- 6.3.1.3 Buns & Rolls

- 6.3.2 Cakes & Pastries

- 6.3.2.1 Layer Cakes

- 6.3.2.2 Muffins & Cupcakes

- 6.3.2.3 Danish & Croissants

- 6.3.3 Cookies & Biscuits

- 6.3.4 Egg Wash Replacers

- 6.3.5 Confectionery & Sweet Applications

- 6.3.5.1 Marshmallows & Nougat (Aerators, Texture)

- 6.3.5.2 Gummies & Jellies (Collagen, Fortification)

- 6.3.5.3 Chocolate & Coatings (Milk Protein Replacers)

- 6.3.1 Bread & Rolls

- 6.4 Beverages

- 6.4.1 Protein Waters

- 6.4.1.1 Clear Protein Waters

- 6.4.1.2 Electrolyte & Functional Waters

- 6.4.2 Sports & Energy Drinks

- 6.4.2.1 Isotonic Drinks

- 6.4.2.2 Protein-Enriched Energy Drinks

- 6.4.2.3 Pre-Workout/Intra-Workout Drinks

- 6.4.3 RTD Protein Shakes

- 6.4.3.1 Plant-Based Protein Shakes

- 6.4.3.2 Clear RTD Protein Shakes

- 6.4.3.3 Meal Replacements

- 6.4.4 Juice & Low pH Beverages

- 6.4.4.1 Juice Blends

- 6.4.4.2 Carbonated Beverages

- 6.4.4.3 Acidic Functionals

- 6.4.5 Alcoholic Applications

- 6.4.5.1 Beer (Stabilizers)

- 6.4.5.2 Wine (Fining Agents)

- 6.4.5.3 Protein-Fortified Alcoholic Beverages

- 6.4.1 Protein Waters

- 6.5 Meat, Seafood & Culinary Applications

- 6.5.1 Plant-Based Meat Applications

- 6.5.1.1 Burgers & Patties

- 6.5.1.2 Whole Cuts (Steaks, Chicken Analogues)

- 6.5.1.3 Structured Meat Alternatives

- 6.5.1.4 Myoglobin/Heme for Flavor & Aroma

- 6.5.2 Cultivated Meat Media & Inputs

- 6.5.2.1 Growth Factors (IGF, FGF, TGF-a)

- 6.5.2.2 Serum & Amino Acid Replacers

- 6.5.2.3 Scaffold Proteins (Collagen, ECM analogues)

- 6.5.3 Seafood Analogues

- 6.5.3.1 Finfish (Tuna, Salmon analogues)

- 6.5.3.2 Crustaceans (Shrimp, Crab)

- 6.5.4 Culinary Applications (General Savory)

- 6.5.4.1 Soups & Broths (Dairy/Meat analogues)

- 6.5.4.2 Sauces, Gravies & Emulsions

- 6.5.4.3 Dressings and Condiments

- 6.5.4.4 Instant Meals, RTE, Convenience Foods

- 6.5.1 Plant-Based Meat Applications

- 6.6 Sports & Active Lifestyle Nutrition

- 6.6.1 Protein Powders

- 6.6.1.1 Fermented Whey Analogues

- 6.6.1.2 Fermented Casein & Egg Analogues

- 6.6.1.3 Multi-Source Blends

- 6.6.2 Functional Protein Bars & Snacks

- 6.6.3 Recovery & Endurance Products

- 6.6.3.1 BCAA-Focused Products

- 6.6.3.2 Muscle/Joint/Immune Benefits

- 6.6.3.3 Post-Workout Drink Mixes

- 6.6.4 Clean Label & Performance Hydrosolubles

- 6.6.1 Protein Powders

- 6.7 Medical & Clinical Nutrition

- 6.7.1 Peptide-Based Enteral Formulas

- 6.7.1.1 Semi-Elemental

- 6.7.1.2 Elemental

- 6.7.2 Oral Medical Nutrition

- 6.7.2.1 Cancer, COPD, Geriatric

- 6.7.3 Therapeutic Applications

- 6.7.3.1 Hepatic/renal diets

- 6.7.3.2 Immune support

- 6.7.3.3 Post-surgical recovery

- 6.7.4 Pharmacological Peptides

- 6.7.4.1 Fischer Ratio Oligopeptides

- 6.7.4.2 Immune-modulating Hydrolysates

- 6.7.1 Peptide-Based Enteral Formulas

- 6.8 Infant & Pediatric Nutrition

- 6.8.1 Infant Formula (0-6 months)

- 6.8.1.1 Partially Hydrolyzed

- 6.8.1.2 Extensively Hydrolyzed

- 6.8.1.3 Amino Acid-Based

- 6.8.2 Follow-On & Toddler Formula (6-24 months)

- 6.8.2.1 Hydrolyzed Follow-On

- 6.8.2.2 Growing-Up Milk

- 6.8.3 CMP-Allergy and Hypoallergenic Products

- 6.8.4 Lactoferrin & Bioactive Peptides

- 6.8.4.1 Immune and Gut Function Support

- 6.8.1 Infant Formula (0-6 months)

- 6.9 Dietary Supplements & Functional Wellness

- 6.9.1 Dietary Protein Supplements

- 6.9.1.1 Powders, Capsules

- 6.9.1.2 Protein Shots

- 6.9.2 Functional Gummies & Beverages

- 6.9.3 Bioactive Peptides by Function

- 6.9.3.1 Cardiovascular Support (ACE inhibitors)

- 6.9.3.2 Antioxidants

- 6.9.3.3 Antimicrobials

- 6.9.3.4 Immune-Modulators

- 6.9.3.5 Cognitive / Stress Support Peptides

- 6.9.1 Dietary Protein Supplements

- 6.10 Cosmeceuticals & Personal Care

- 6.10.1 Skincare Products

- 6.10.1.1 Collagen-Boosting Creams

- 6.10.1.2 Anti-Aging Serums

- 6.10.1.3 Moisturizers & Eye Creams

- 6.10.2 Hair & Scalp Products

- 6.10.2.1 Hydrosoluble Keratin-style Proteins

- 6.10.2.2 Hair Repair Peptides

- 6.10.3 Oral & Dental Care

- 6.10.3.1 Peptide Mouthwashes

- 6.10.3.2 Oral Hygiene Supplements

- 6.10.1 Skincare Products

- 6.11 Animal Nutrition

- 6.11.1 Pet Food (Dogs & Cats)

- 6.11.1.1 Protein-Enhanced Kibble, Wet Food, Treats

- 6.11.2 Aquaculture Feed

- 6.11.2.1 Salmon, Shrimp, Trout - Digestibility-enhancing Peptides

- 6.11.3 Livestock Feed Additives

- 6.11.3.1 Swine, Poultry, Ruminant Performance

- 6.11.3.2 Immune & Gut Health Peptides

- 6.11.1 Pet Food (Dogs & Cats)

- 6.12 Pharmaceuticals & Biotherapeutics

- 6.12.1 Therapeutic Peptides (e.g., GLP-1 analogues)

- 6.12.2 Biosimilar Peptides

- 6.12.3 Peptide-based APIs

- 6.12.4 Drug Delivery Peptide Scaffolds

- 6.12.5 Wound Healing & Regenerative Therapies

- 6.12.6 Antimicrobial & Topical Therapeutics

Chapter 7 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Million) (Tons)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 UK

- 7.3.3 France

- 7.3.4 Spain

- 7.3.5 Italy

- 7.3.6 Rest of Europe

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 India

- 7.4.3 Japan

- 7.4.4 Australia

- 7.4.5 South Korea

- 7.4.6 Rest of Asia Pacific

- 7.5 Latin America

- 7.5.1 Brazil

- 7.5.2 Mexico

- 7.5.3 Argentina

- 7.5.4 Rest of Latin America

- 7.6 Middle East and Africa

- 7.6.1 Saudi Arabia

- 7.6.2 South Africa

- 7.6.3 UAE

- 7.6.4 Rest of Middle East and Africa

Chapter 8 Company Profiles

- 8.1 Change Foods

- 8.2 Clara Foods

- 8.3 Cubiq Foods

- 8.4 Formo

- 8.5 Fybraworks Foods

- 8.6 Geltor

- 8.7 Helaina

- 8.8 Imagindairy

- 8.9 Jellatech

- 8.10 Modern Meadow

- 8.11 Motif FoodWorks

- 8.12 New Culture

- 8.13 Onego Bio

- 8.14 Perfect Day

- 8.15 Provectus Algae

- 8.16 Remilk

- 8.17 Spiber

- 8.18 The EVERY Company

- 8.19 TurtleTree

- 8.20 Vivici

- 8.21 Others