|

市場調查報告書

商品編碼

1885846

醫藥級蛋白水解物市場機會、成長促進因素、產業趨勢分析及預測(2025-2034年)Pharmaceutical-Grade Protein Hydrolysates Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

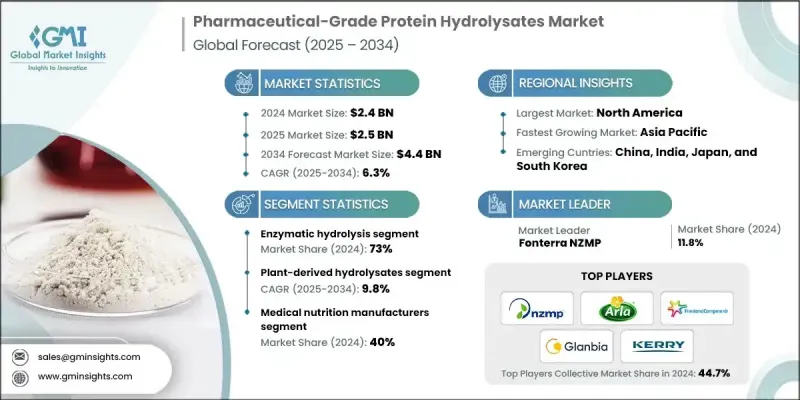

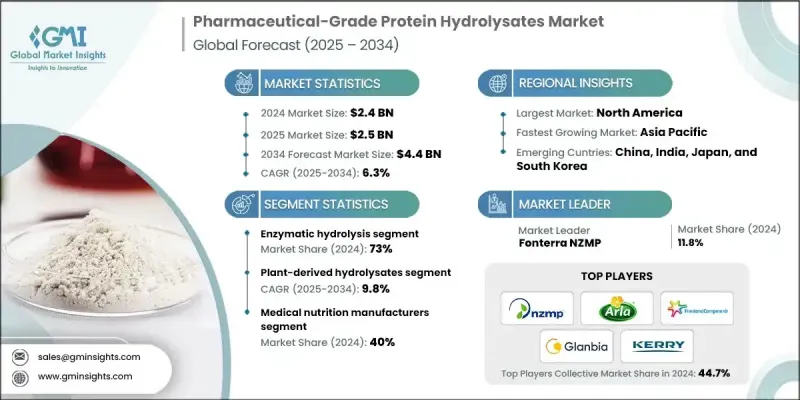

2024 年全球藥用級蛋白質水解物市場價值為 24 億美元,預計到 2034 年將以 6.3% 的複合年成長率成長至 44 億美元。

市場擴張的驅動力在於消費者對針對特定健康需求的營養和治療產品的需求不斷成長。蛋白質水解物是指透過酵素或酸基製程將蛋白質分解成較小的胜肽或胺基酸,從而提高其消化率和生物利用度。在製藥領域,這些水解物對於醫療營養、功能性食品和膳食補充劑至關重要,可用於解決營養不良、胃腸道疾病和免疫缺陷等問題。其高純度、安全性和有效性使其適用於嬰幼兒、老年患者和體弱者等弱勢族群。此外,它們還有助於肌肉發育、傷口癒合和免疫功能,進一步凸顯了其治療價值。醫療營養、藥物傳遞系統和運動營養領域對蛋白質水解物的日益廣泛應用,正推動市場需求的持續成長。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 24億美元 |

| 預測值 | 44億美元 |

| 複合年成長率 | 6.3% |

至2034年,植物蛋白水解物市場將以9.8%的複合年成長率成長。對永續發展的關注、消費者對清潔標籤產品的偏好,以及避免乳糖相關問題的需求,正在推動對大豆蛋白和豌豆蛋白等植物蛋白的需求。酵素水解可以改善植物蛋白的功能特性,例如提高其在酸性pH值下的溶解度,使其能夠應用於強化飲料和臨床營養配方中。

酵素水解法憑藉其精準性、安全性以及能夠以極少的副產物生產高純度產品的優勢,在製藥工藝領域佔據主導地位,預計到2024年將佔據73%的市場佔有率。製藥公司青睞該方法,是因為它符合嚴格的監管標準,並且適用於敏感患者群體。

2024年,北美藥用級蛋白水解物市場佔據36.9%的市佔率。該地區的成長主要受人口老化、慢性病盛行率上升以及個人化醫療日益普及的推動。對醫用營養品和臨床食品的高需求,加上嚴格的品質法規和先進的加工技術,促進了高品質水解物的生產。強大的醫藥和營養保健品產業,以及巨額的醫療保健支出,進一步支撐了市場的發展。

全球藥用級蛋白水解物市場的主要參與者包括雅培實驗室、AMCO Proteins、Arla Foods Ingredients Group、Fonterra NZMP、FrieslandCampina Ingredients、Glanbia plc、Hilmar Cheese Company, Inc.、Hofseth BioCare ASA、Ingredia SA、Kerry Group plc 和寧波英諾醫化有限公司。各公司致力於透過水解技術創新、提高生物利用度以及提供植物蛋白產品來拓展產品組合,以滿足不斷成長的消費者和治療需求。與製藥、營養保健品和臨床營養公司進行策略合作有助於擴大市場覆蓋率並開發應用。研發投入推動了嬰幼兒和老年人等敏感族群的高級水解物的開發。向新興市場進行地理擴張以及建立在地化生產設施,確保了合規性和更快的分銷速度。

目錄

第1章:方法論與範圍

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 供應商格局

- 利潤率

- 每個階段的價值增加

- 影響價值鏈的因素

- 中斷

- 產業影響因素

- 成長促進因素

- 產業陷阱與挑戰

- 市場機遇

- 成長潛力分析

- 監管環境

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 波特的分析

- PESTEL 分析

- 價格趨勢

- 按地區

- 按蛋白質來源

- 未來市場趨勢

- 技術與創新格局

- 當前技術趨勢

- 新興技術

- 專利格局

- 貿易統計(HS編碼)(註:僅提供重點國家的貿易統計資料)

- 主要進口國

- 主要出口國

- 永續性和環境方面

- 永續實踐

- 減少廢棄物策略

- 生產中的能源效率

- 環保舉措

- 碳足跡考量

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- MEA

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 合作夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估算與預測:依蛋白質來源分類,2021-2034年

- 主要趨勢

- 乳源蛋白水解物

- 乳清蛋白水解物

- 酪蛋白水解物

- 植物源蛋白水解物

- 大豆蛋白水解物

- 豌豆蛋白水解物

- 其他

- 動物源性蛋白質水解物

- 蛋清蛋白水解物

- 膠原蛋白/明膠水解物

- 魚/海洋蛋白質水解物

- 其他來源水解物

第6章:市場估算與預測:依製造流程分類,2021-2034年

- 主要趨勢

- 酵素水解

- 化學水解

- 微生物發酵

- 混合/順序過程

第7章:市場估計與預測:依應用領域分類,2021-2034年

- 關鍵趨勢

- 臨床/腸內營養

- 聚合物配方

- 寡聚體/胜肽基製劑

- 管飼應用

- 口服營養補充品

- 重症監護及ICU營養

- 特殊醫學食品/醫用食品

- 苯酮尿症和代謝紊亂製劑

- 腎臟疾病製劑

- 肝病製劑

- 囊性纖維化營養

- 治療/藥物應用

- ACE抑制胜肽

- 抗氧化生物活性胜肽

- 免疫調節應用

- 傷口癒合配方

- 藥物輸送系統

- 嬰兒配方奶粉

- 部分水解配方(水解度 10-30%)

- 深度水解配方(DH30-60%)

- 胺基酸配方(DH >80%)

- 低過敏配方

- 腸外營養

- 胺基酸溶液

- 二肽製劑(丙氨醯谷氨醯胺)

- 全腸外營養(TPN)

- 周邊腸外營養(PPN)

- 運動營養

- 快速吸收配方

- 肌肉恢復應用

- 性能增強產品

第8章:市場估算與預測:依最終用途產業分類,2021-2034年

- 主要趨勢

- 醫用營養品生產商

- 製藥公司

- 嬰兒配方奶粉製造商

- 營養保健品公司

第9章:市場估計與預測:依地區分類,2021-2034年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 歐洲其他地區

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 亞太其他地區

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

- 中東和非洲其他地區

第10章:公司簡介

- Abbott Laboratories

- AMCO Proteins

- Arla Foods Ingredients Group

- Fonterra NZMP

- FrieslandCampina Ingredients

- Glanbia plc

- Hilmar Cheese Company, Inc.

- Hofseth BioCare ASA

- Ingredia SA

- Kerry Group plc

- NINGBO INNO PHARMCHEM CO., LTD

The Global Pharmaceutical-Grade Protein Hydrolysates Market was valued at USD 2.4 billion in 2024 and is estimated to grow at a CAGR of 6.3% to reach USD 4.4 billion by 2034.

The market's expansion is fueled by rising demand for specialized nutritional and therapeutic products that target specific health needs. Protein hydrolysates are proteins broken down into smaller peptides or amino acids through enzymatic or acid-based processes, improving digestibility and bioavailability. In the pharmaceutical sector, these hydrolysates are critical for medical nutrition, functional foods, and dietary supplements that address malnutrition, gastrointestinal disorders, and immune deficiencies. Their high purity, safety, and efficacy make them suitable for vulnerable populations such as infants, elderly patients, and those with compromised health. Furthermore, they support muscle development, wound recovery, and immune function, reinforcing their therapeutic importance. Increasing adoption in medical nutrition, drug delivery systems, and sports nutrition is driving steady demand.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.4 Billion |

| Forecast Value | $4.4 Billion |

| CAGR | 6.3% |

The plant-derived protein hydrolysates segment will grow at a CAGR of 9.8% through 2034. Sustainability concerns and clean-label preferences, along with the need to avoid lactose-related issues, are pushing demand for plant-based sources such as soy and pea proteins. Enzymatic hydrolysis improves the functional properties of plant proteins, including solubility at acidic pH, enabling their use in fortified beverages and clinical nutrition formulations.

The enzymatic hydrolysis dominates the manufacturing processes segment, holding a 73% share in 2024, owing to its precision, safety, and ability to produce high-purity products with minimal by-products. Pharmaceutical manufacturers favor this method for its compliance with stringent regulatory standards and suitability for sensitive patient populations.

North America Pharmaceutical-Grade Protein Hydrolysates Market accounted for a 36.9% share in 2024. Growth in the region is driven by an aging population, rising chronic disease prevalence, and increasing adoption of personalized medicine. High demand for medical nutrition and clinical foods, combined with stringent quality regulations and advanced processing technologies, supports the production of high-quality hydrolysates. A strong pharmaceutical and nutraceutical sector, coupled with substantial healthcare expenditure, further underpins the market's development.

Major players in the Global Pharmaceutical-Grade Protein Hydrolysates Market include Abbott Laboratories, AMCO Proteins, Arla Foods Ingredients Group, Fonterra NZMP, FrieslandCampina Ingredients, Glanbia plc, Hilmar Cheese Company, Inc., Hofseth BioCare ASA, Ingredia SA, Kerry Group plc, and NINGBO INNO PHARMCHEM CO., LTD. Companies are focusing on expanding their product portfolios through innovation in hydrolysis techniques, enhanced bioavailability, and plant-based protein offerings to meet growing consumer and therapeutic demands. Strategic collaborations with pharmaceutical, nutraceutical, and clinical nutrition companies help improve market reach and application development. Investments in R&D enable the development of premium-grade hydrolysates tailored for sensitive populations, including infants and the elderly. Geographic expansion into emerging markets and localized production facilities ensures regulatory compliance and faster distribution.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Protein sources

- 2.2.3 Manufacturing process

- 2.2.4 Application

- 2.2.5 End Use industry

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By protein source

- 3.8 Future market trends

- 3.9 Technology and Innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code) ( Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint consideration

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates and Forecast, By Protein Source, 2021-2034 (USD Million & Kilo Tons)

- 5.1 Key trends

- 5.2 Milk-derived protein hydrolysates

- 5.2.1 Whey protein hydrolysates

- 5.2.2 Casein hydrolysates

- 5.3 Plant-derived protein hydrolysates

- 5.3.1 Soy protein hydrolysates

- 5.3.2 Pea protein hydrolysates

- 5.3.3 Others

- 5.4 Animal-derived protein hydrolysates

- 5.4.1 Egg protein hydrolysates

- 5.4.2 Collagen/gelatin hydrolysates

- 5.5 Fish/marine protein hydrolysates

- 5.6 Other sources hydrolysates

Chapter 6 Market Estimates and Forecast, By Manufacturing Process, 2021-2034 (USD Million & Kilo Tons)

- 6.1 Key trends

- 6.2 Enzymatic hydrolysis

- 6.3 Chemical hydrolysis

- 6.4 Microbial fermentation

- 6.5 Hybrid/sequential processes

Chapter 7 Market Estimates and Forecast, By Application, 2021-2034 (USD Million & Kilo Tons)

- 7.1 Key trend

- 7.2 Clinical/enteral nutrition

- 7.2.1 Polymeric formulations

- 7.2.2 Oligomeric/peptide-based formulations

- 7.2.3 Tube feeding applications

- 7.2.4 Oral nutritional supplements

- 7.2.5 Critical care & ICU nutrition

- 7.3 Medical foods/FSMP

- 7.3.1 PKU & metabolic disorder formulations

- 7.3.2 Renal disease formulations

- 7.3.3 Hepatic disease formulations

- 7.3.4 Cystic fibrosis nutrition

- 7.4 Therapeutic/pharmaceutical applications

- 7.4.1 Ace inhibition peptides

- 7.4.2 Antioxidant bioactive peptides

- 7.4.3 Immunomodulatory applications

- 7.4.4 Wound healing formulations

- 7.4.5 Drug delivery systems

- 7.5 Infant formula

- 7.5.1 Partially hydrolyzed formulas (DH 10-30%)

- 7.5.2 Extensively hydrolyzed formulas (DH30-60%)

- 7.5.3 Amino acid-based formulas (DH >80%)

- 7.5.4 Hypoallergenic formulations

- 7.6 Parenteral nutrition

- 7.6.1 Amino acid solutions

- 7.6.2 Dipeptide formulations (alanyl-glutamine)

- 7.6.3 Total parenteral nutrition (TPN)

- 7.6.4 Peripheral parenteral nutrition (PPN)

- 7.7 Sports nutrition

- 7.7.1 Rapid absorption formulations

- 7.7.2 Muscle recovery applications

- 7.7.3 Performance enhancement products

Chapter 8 Market Estimates and Forecast, By End Use Industry, 2021-2034 (USD Million & Kilo Tons)

- 8.1 Key trends

- 8.2 Medical nutrition manufacturers

- 8.3 Pharmaceutical companies

- 8.4 Infant formula manufacturers

- 8.5 Nutraceutical companies

Chapter 9 Market Estimates and Forecast, By Region, 2021-2034 (USD Million & Kilo Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Rest of Europe

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Rest of Asia Pacific

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.5.4 Rest of Latin America

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

- 9.6.4 Rest of Middle East and Africa

Chapter 10 Company Profiles

- 10.1 Abbott Laboratories

- 10.2 AMCO Proteins

- 10.3 Arla Foods Ingredients Group

- 10.4 Fonterra NZMP

- 10.5 FrieslandCampina Ingredients

- 10.6 Glanbia plc

- 10.7 Hilmar Cheese Company, Inc.

- 10.8 Hofseth BioCare ASA

- 10.9 Ingredia SA

- 10.10 Kerry Group plc

- 10.11 NINGBO INNO PHARMCHEM CO., LTD