|

市場調查報告書

商品編碼

1885805

老年營養蛋白水解物市場機會、成長促進因素、產業趨勢分析及預測(2025-2034年)Geriatric Nutrition Protein Hydrolysates Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

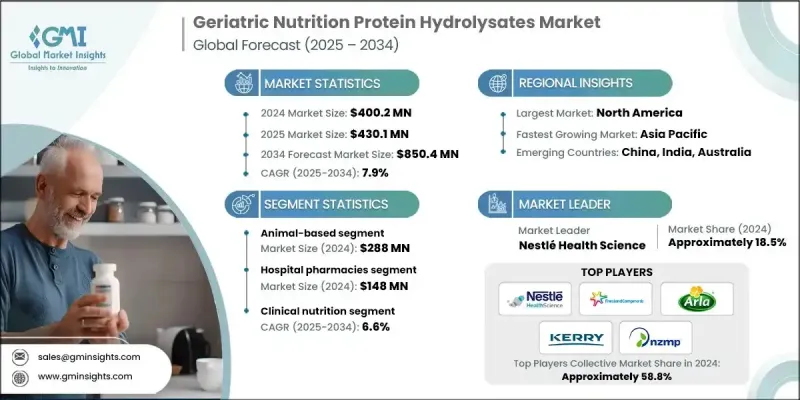

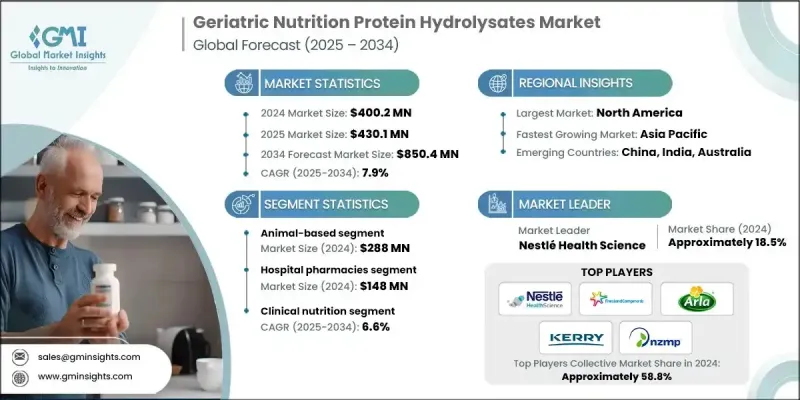

2024 年全球老年營養蛋白水解物市場價值為 4.002 億美元,預計到 2034 年將以 7.9% 的複合年成長率成長至 8.504 億美元。

隨著全球65歲及以上人口比例的不斷成長,市場持續擴張,對客製化營養解決方案的需求也日益旺盛。在成熟經濟體和新興經濟體,隨著老齡人口的成長,對能夠維持肌肉、活動能力和整體活力的蛋白質來源的需求變得愈發迫切。食慾下降、慢性疾病和生理機能衰退導致的營養不良和肌少症病例不斷增加,進一步凸顯了對專業飲食介入的依賴。與完整蛋白質相比,水解蛋白具有吸收快速、消化率高的優勢,因此逐漸成為老年營養的基礎。老年人通常面臨消化功能減弱、酵素活性降低和營養吸收速度減慢等問題,導致傳統蛋白質形式難以耐受。因此,水解蛋白在預防肌肉流失、促進恢復和幫助老年人保持功能獨立性方面發揮著至關重要的作用,這也確保了對先進治療配方的持續需求。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 4.002億美元 |

| 預測值 | 8.504億美元 |

| 複合年成長率 | 7.9% |

2024年,動物性食品市場規模達到2.88億美元,預計2034年將以7.3%的複合年成長率成長。動物源性水解物因其豐富的氨基酸組成和高消化率而繼續佔據主導地位,這對於老年人營養至關重要。它們在臨床環境、老年護理營養計劃以及旨在保護肌肉和支持代謝的特殊治療製劑中仍然廣泛應用。水解效率和風味開發的不斷改進正在提升其在老年消費者中的接受度。

2024年,醫院藥局業務創造了1.48億美元的收入,預計2025年至2034年將以5.7%的複合年成長率成長。醫院藥局在為老年患者提供水解蛋白類臨床營養方面發揮持續作用,這些患者由於醫療限制需要加強營養支持、加速康復或使用易於消化的配方。這些產品被納入慢性病管理、術後營養策略和住院患者餵食計畫中,隨著醫療保健系統適應人口老化,為患者提供可靠的、經醫療監督的營養配方。

2024年,北美老年營養蛋白水解物市場規模達1.44億美元。該地區的成長保持穩定,這主要得益於老年人口的不斷成長、完善的臨床營養基礎設施以及大量的醫療保健支出。水解蛋白廣泛應用於老年護理和醫療機構,用於控制與年齡相關的肌肉流失、改善復健效果以及減少營養不良。隨著消費者越來越重視健康老化,對粉狀、飲料型和老年人專用營養產品的需求持續成長,同時配方技術的進步和居家營養護理的普及也推動了這些產品的廣泛應用。

全球老年營養蛋白水解物市場的主要企業包括Arla Foods Ingredients、Kerry Group、Fonterra Co-operative Group、Nestle Health Science、Royal FrieslandCampina NV等。為了鞏固市場地位,各企業正致力於研發針對老年人消化和代謝需求的專用配方,強調高生物利用度和良好的耐受性。許多企業正在加大臨床研究投入,以驗證水解物在預防肌肉流失和促進復原方面的功效,從而推動醫療機構的採納和法規核准。拓展與醫院、養老機構和營養診所的合作關係,有助於品牌獲得穩定的需求管道。此外,各企業也正在改進產品配方,例如採用更簡潔的標籤、更佳的口味以及更便捷的包裝形式(如即飲型),以提高老年人的接受度。

目錄

第1章:方法論

- 市場範圍和定義

- 研究設計

- 研究方法

- 資料收集方法

- 資料探勘來源

- 全球的

- 地區/國家

- 基準估算和計算

- 基準年計算

- 市場估算的關鍵趨勢

- 初步研究和驗證

- 原始資料

- 預測模型

- 研究假設和局限性

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 供應商格局

- 利潤率

- 每個階段的價值增加

- 影響價值鏈的因素

- 中斷

- 產業影響因素

- 成長促進因素

- 產業陷阱與挑戰

- 市場機遇

- 成長潛力分析

- 監管環境

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 波特的分析

- PESTEL 分析

- 價格趨勢

- 按地區

- 依產品

- 未來市場趨勢

- 技術與創新格局

- 當前技術趨勢

- 新興技術

- 專利格局

- 貿易統計(註:僅提供重點國家的貿易統計)

- 主要進口國

- 主要出口國

- 永續性和環境方面

- 永續實踐

- 減少廢棄物策略

- 生產中的能源效率

- 環保舉措

- 碳足跡考量

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- MEA

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 合作夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估算與預測:依來源分類,2021-2034年

- 主要趨勢

- 動物性

- 乳蛋白水解物(酪蛋白、乳清蛋白)

- 蛋清蛋白水解物

- 肉類蛋白水解物

- 魚蛋白水解物

- 植物性

- 大豆蛋白水解物

- 豌豆蛋白水解物

- 米蛋白水解物

- 其他植物來源(例如小麥、玉米)

第6章:市場估算與預測:依配銷通路分類,2021-2034年

- 主要趨勢

- 醫院藥房

- 零售藥局

- 線上商店

- 專賣店

第7章:市場估計與預測:依應用領域分類,2021-2034年

- 主要趨勢

- 臨床營養

- 醫院營養

- 管飼配方

- 功能性食品和飲料

- 營養飲料

- 強化食品

- 膳食補充劑

- 膠囊

- 片劑

- 小袋

- 其他

第8章:市場估算與預測:依地區分類,2021-2034年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 歐洲其他地區

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 亞太其他地區

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

- 中東和非洲其他地區

第9章:公司簡介

- Arla Foods Ingredients

- Mead Johnson Nutrition

- Merck KGaA

- Fonterra Co-operative Group

- Agropur Cooperative

- Milk Specialties Global

- Tatua Co-operative Dairy Company

- Royal FrieslandCampina NV

- Hilmar Cheese Company

- Kerry Group

- DuPont (Danisco)

- Nestle Health Science

- Rousselot

- Gelita AG

- Evonik Industries

The Global Geriatric Nutrition Protein Hydrolysates Market was valued at USD 400.2 million in 2024 and is estimated to grow at a CAGR of 7.9% to reach USD 850.4 million by 2034.

The market continues to expand as the share of individuals aged 65 and above increases worldwide, establishing a lasting demand for tailored nutritional solutions. As aging populations grow across both mature and emerging economies, the need for protein sources that support muscle maintenance, mobility, and overall vitality becomes more pressing. Rising cases of malnutrition and sarcopenia-driven by reduced appetite, chronic health conditions, and physiological decline-are reinforcing reliance on specialized dietary interventions. Protein hydrolysates are becoming foundational in geriatric nutrition due to their rapid absorption and superior digestibility compared with intact proteins. Older adults often face weaker digestive function, diminished enzymatic activity, and slower nutrient assimilation, making traditional protein formats difficult to tolerate. Hydrolyzed proteins, therefore, play a vital role in preventing muscle loss, supporting recovery, and helping older individuals maintain functional independence, which ensures sustained demand for advanced therapeutic formulations.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $400.2 Million |

| Forecast Value | $850.4 Million |

| CAGR | 7.9% |

The animal-based segment generated USD 288 million in 2024 and is expected to grow at a CAGR of 7.3% through 2034. Animal-derived hydrolysates continue to hold a dominant position because of their strong amino acid composition and high digestibility, which are essential in elderly-focused nutrition. Their use remains widespread in clinical environments, eldercare nutrition programs, and specialized therapeutic preparations aimed at muscle preservation and metabolic support. Ongoing improvements in hydrolysis efficiency and flavor development are contributing to greater acceptance among older consumers.

The hospital pharmacies segment generated USD 148 million in 2024 and is projected to grow at a CAGR of 5.7% from 2025 to 2034. Hospital pharmacies maintain a consistent role in distributing hydrolysate-based clinical nutrition for aging patients who require enhanced dietary support, faster recovery, or easily digestible formulations due to medical limitations. These products are integrated into chronic care management, postoperative nutrition strategies, and inpatient feeding programs, providing reliable access to medically supervised formulations as healthcare systems adapt to aging populations.

North America Geriatric Nutrition Protein Hydrolysates Market held USD 144 million in 2024. Growth in the region remains steady due to the expanding older population, strong clinical nutrition infrastructure, and substantial healthcare spending. Hydrolyzed proteins are widely utilized in managing age-related muscle loss, improving recovery outcomes, and reducing malnutrition in eldercare and medical facilities. Demand for powdered, beverage-based, and senior-targeted nutritional products continues to rise as consumers prioritize healthy aging, while advances in formulation technologies and home-based nutritional care broaden the adoption of these products.

Key companies in the Global Geriatric Nutrition Protein Hydrolysates Market include Arla Foods Ingredients, Kerry Group, Fonterra Co-operative Group, Nestle Health Science, Royal FrieslandCampina N.V., and others. To strengthen their presence, companies are focusing on specialized formulation development tailored to older adults' digestive and metabolic needs, emphasizing high bioavailability and improved tolerability. Many are increasing investments in clinical research to validate the efficacy of hydrolysates in preventing muscle loss and enhancing recovery outcomes, which supports medical adoption and regulatory credibility. Expansion of partnerships with hospitals, eldercare networks, and nutritional clinics is helping brands secure consistent demand channels. Companies are also reformulating products with cleaner labels, enhanced flavor profiles, and user-friendly formats such as ready-to-drink options to improve acceptance among seniors.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Source

- 2.2.3 Distribution Channel

- 2.2.4 Application

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By product

- 3.8 Future market trends

- 3.9 Technology and Innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and Environmental Aspects

- 3.12.1 Sustainable Practices

- 3.12.2 Waste Reduction Strategies

- 3.12.3 Energy Efficiency in Production

- 3.12.4 Eco-friendly Initiatives

- 3.13 Carbon Footprint Considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates and Forecast, By Source, 2021 - 2034 (USD Million, Kilo Tons)

- 5.1 Key trends

- 5.2 Animal-based

- 5.2.1 Milk protein hydrolysates (casein, whey)

- 5.2.2 Egg protein hydrolysates

- 5.2.3 Meat protein hydrolysates

- 5.2.4 Fish protein hydrolysates

- 5.3 Plant-based

- 5.3.1 Soy protein hydrolysates

- 5.3.2 Pea protein hydrolysates

- 5.3.3 Rice protein hydrolysates

- 5.3.4 Other plant sources (e.g., wheat, corn)

Chapter 6 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 (USD Million, Kilo Tons)

- 6.1 Key trends

- 6.2 Hospital pharmacies

- 6.3 Retail pharmacies

- 6.4 Online stores

- 6.5 Specialty stores

Chapter 7 Market Estimates and Forecast, By Application, 2021 - 2034 (USD Million, Kilo Tons)

- 7.1 Key trends

- 7.2 Clinical nutrition

- 7.2.1 Hospital-based nutrition

- 7.2.2 Tube feeding formulations

- 7.3 Functional foods & beverages

- 7.3.1 Nutritional drinks

- 7.3.2 Fortified foods

- 7.4 Dietary supplements

- 7.4.1 Capsules

- 7.4.2 Tablets

- 7.4.3 Sachets

- 7.5 Others

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Million, Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Rest of Europe

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Rest of Asia Pacific

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.5.4 Rest of Latin America

- 8.6 Middle East & Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

- 8.6.4 Rest of Middle East & Africa

Chapter 9 Company Profiles

- 9.1 Arla Foods Ingredients

- 9.2 Mead Johnson Nutrition

- 9.3 Merck KGaA

- 9.4 Fonterra Co-operative Group

- 9.5 Agropur Cooperative

- 9.6 Milk Specialties Global

- 9.7 Tatua Co-operative Dairy Company

- 9.8 Royal FrieslandCampina N.V.

- 9.9 Hilmar Cheese Company

- 9.10 Kerry Group

- 9.11 DuPont (Danisco)

- 9.12 Nestle Health Science

- 9.13 Rousselot

- 9.14 Gelita AG

- 9.15 Evonik Industries