|

市場調查報告書

商品編碼

1906909

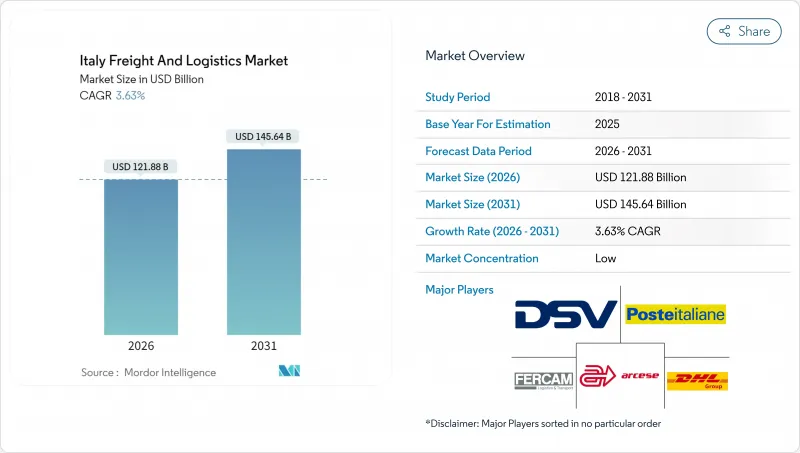

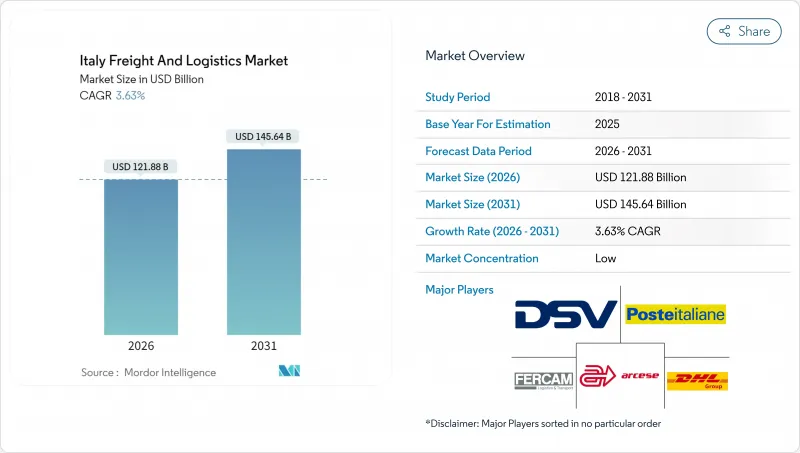

義大利貨運與物流:市場佔有率分析、產業趨勢、統計數據與成長預測(2026-2031)Italy Freight And Logistics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

預計到 2026 年,義大利貨運和物流市場規模將達到 1,218.8 億美元,高於 2025 年的 1,176.1 億美元。

預計到 2031 年將達到 1,456.4 億美元,2026 年至 2031 年的複合年成長率為 3.63%。

與國家復甦與韌性計畫 (NRRP) 相關的投資正在擴大港口和鐵路運力,而不斷成長的電子商務需求正在加速小包裹量的增加,對傳統的長途運輸網路構成挑戰。義大利的貨運和物流市場受益於其作為歐洲和地中海門戶的地位,但勞動力短缺和車隊老化正成為成本壓力。藥品和高檔食品出口對低溫運輸的需求不斷成長,刺激了對溫控倉庫的需求,而工業4.0下的自動化獎勵正在支持北部樞紐的現代化改造。諸如德迅收購Fercam Italia 80%股份等整合活動,凸顯了市場正向能夠處理複雜多模態的大型綜合供應商轉變。

義大利貨運物流市場趨勢及分析

電子商務小包裹激增和最後一公里投資

2024年,國內小包裹佔義大利宅配(CEP)市場的66.54%。這反映了線上零售的快速成長,其市場規模達到588億歐元(649億美元),年增6%。義大利的貨運和物流市場透過擴大其高密度儲物櫃網路來應對這一成長。 DHL和義大利郵政的合資企業計畫安裝1萬個自動化收件點,將都市區的小包裹遞送成本降低30%。亞馬遜物流將當日達服務擴展到15個城市,促使傳統承運商投資於微型倉配和電動車隊。承運商正在重組其樞紐輻射式網路,以適應重量低於100公斤的小包裹,這些小包裹在電子商務流通中佔據主導地位。促進都市區零排放車輛使用的政策與營運商的車隊更新策略一致。在配送需求尖峰時段,產能短缺仍然是一個問題,因此需要與雲端配送平台合作來吸收過剩的配送量。

食品和藥品出口導致低溫運輸需求增加

2024年,藥品出口占藥品出口總額的80%以上,支撐了對溫控運輸的需求。 UPS收購了Frigo-Trans和BPL,強化了其在歐洲的GDP級低溫運輸網路,並將米蘭的醫藥產業叢集定位為新興市場貨運樞紐。 2024年,溫控倉庫容量將佔總容量的7.81%,但由於疫苗物流和生物製藥生產的擴張,預計2025年至2030年將以3.53%的複合年成長率成長。米蘭、羅馬和波隆那機場貨運區的冷藏空間正在擴建,以滿足生物技術物流的需求。本地業者可以透過採用主動包裝技術的端到端檢驗運輸路線來獲得附加價值。節能型可再生系統可享有NRRP(國家再生能源計畫)為永續物流設施提供的補助。

駕駛人和卡車車隊老化

義大利只有2.2%的職業司機年齡在25歲以下,隨著資深駕駛人退休,可能會出現人員短缺的風險。重型車輛的平均車齡為19.1年,高於歐盟平均水平,這降低了車輛的可靠性並增加了維護成本。 2024年羅馬爆發的抗議活動凸顯了服務品質的下降,並促使人們呼籲加快外國司機的駕照發放。津貼項目涵蓋每位駕駛者高達24,000歐元(26,487美元)的培訓費用,但繁瑣的申請流程阻礙了補貼的普及。租賃公司正在推廣靈活的里程收費以加快車輛更新,但資金仍然是主導義大利貨運和物流市場的小規模車隊面臨的一大限制因素。

細分市場分析

到2025年,製造業將佔總收入的31.12%,這主要得益於遍Lombardia、Piemonte和Emilia-Romagna三大區的汽車、機械和生命科學生產基地。零件流通需要同步的準時交付,從而促進承運商和一級供應商之間的合作。批發和零售業是成長最快的產業,在2026年至2031年間,其複合年成長率將達到3.86%,這主要得益於全通路品牌對隔日達全國配送服務的需求。由於國家復甦計畫(NRRP)的實施,建築物流領域對骨材、鋼材和預製模組的鐵路和公路運輸需求不斷成長。

能源轉型政策導致石油和天然氣運輸投資下降,承運商轉向可再生能源計劃貨物運輸。農業、漁業和林業部門加強了優質橄欖油和葡萄酒的出口,增加了對低溫運輸和冷藏貨櫃的需求。可再生能源技術組裝和數位服務等新興產業正在使義大利貨運和物流市場的基本客群多元化,並降低週期性風險。

到2025年,貨運代理業務將佔義大利貨運和物流市場的重要性。該業務涵蓋了從北部工業叢集到全國各地消費市場的物流運輸。隨著網路購物重新定義配送頻率並加速網路複雜化,2026年至2031年間,快速配送服務(CEP)的複合年成長率將達到4.17%。在倉儲領域,隨著工業4.0計劃的推進,北部地區的設施正在實施多層自動化,從而確保更高的產能和擴充性。貨運代理業將利用義大利位於亞歐幹線上的位置來協調多式聯運。其他服務包括計劃貨物協調和危險品處理。

隨著承運商將清關和庫存管理納入運輸契約,綜合服務正在模糊功能邊界。義大利郵政的業務轉型已顯現多元化跡象,顯示2025年服務擴張的成效顯著,屆時物流收入將超過郵政服務收入。交叉銷售正在提高工業客戶的留存率,他們尋求的是門到門的可視性和合規性。在整合數位平台上整合運輸、倉儲和附加價值服務的營運商將在義大利貨運和物流市場中獲得競爭優勢。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 人口統計數據

- 按經濟活動分類的GDP分配

- 按經濟活動分類的GDP成長

- 通貨膨脹

- 經濟表現及概況

- 電子商務產業的趨勢

- 製造業趨勢

- 運輸和倉儲業部門的GDP

- 出口趨勢

- 進口趨勢

- 燃油價格

- 卡車運輸營運成本

- 卡車運輸車隊規模(按類型)

- 主要卡車供應商

- 物流績效

- 透過交通方式分享

- 海運船隊運力

- 班輪運輸連接

- 停靠港口和演出

- 貨運費率趨勢

- 貨物噸位趨勢

- 基礎設施

- 法規結構(公路和鐵路)

- 法規結構(海事和航空)

- 價值鍊和通路分析

- 市場促進因素

- 電子商務小包裹激增和最後一公里投資

- 食品和藥品出口引起的低溫運輸需求

- 國家復甦與再投資計畫(NRRP)和泛歐交通運輸網路(TEN-T)走廊的基礎建設

- 工業4.0稅收優惠促進智慧物流技術發展

- 儲物櫃網路改變了都市區自提點(取還)方式

- 由於設備升級導致鐵路服務暫停,運輸量轉移到公路。

- 市場限制

- 駕駛人和卡車車隊老化

- 北韓和南韓的營運成本存在巨大差異

- 到2025年,由於主要港口走廊的鐵路建設,運輸能力將出現短缺。

- 由於電池和危險材料法規,電動車物流合規成本增加。

- 市場創新

- 波特五力分析

- 新進入者的威脅

- 買方的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場規模與成長預測

- 終端用戶產業

- 農業、漁業、林業

- 建設業

- 製造業

- 石油天然氣、採礦和採石

- 批發和零售

- 其他

- 物流職能

- 宅配、速遞和小包裹(CEP)

- 按目的地

- 國內的

- 國際的

- 按目的地

- 貨運代理

- 透過交通工具

- 航空

- 海路和內河航道

- 其他

- 透過交通工具

- 貨物運輸

- 透過交通工具

- 航空

- 管道

- 鐵路

- 路

- 海路和內河航道

- 透過交通工具

- 倉儲

- 透過溫度控制

- 非溫控型

- 溫度控制

- 透過溫度控制

- 其他服務

- 宅配、速遞和小包裹(CEP)

第6章 競爭情勢

- 市場集中度

- 重大策略舉措

- 市佔率分析

- 公司簡介

- Amazon

- Arcese Trasporti SpA

- BRT SpA

- CMA CGM Group(Including CEVA Logistics)

- DHL Group

- DSV A/S(Including DB Schenker)

- FedEx

- Fercam SpA

- International Distributions Services PLC(Including GLS)

- Grimaldi Group

- GRUBER Logistics SpA

- Italsempione

- Italtrans

- Kuehne+Nagel

- Mercitalia Rail

- MSC Mediterranean Shipping Company SAA

- Poste Italiane

- Savino Del Bene SpA

- Transmec Group

- United Parcel Service of America, Inc.(UPS)

第7章 市場機會與未來展望

Italy freight and logistics market size in 2026 is estimated at USD 121.88 billion, growing from 2025 value of USD 117.61 billion with 2031 projections showing USD 145.64 billion, growing at 3.63% CAGR over 2026-2031.

Investment tied to the National Recovery and Resilience Plan (NRRP) is expanding port and rail capacity, while e-commerce demand accelerates parcel volumes that challenge traditional long-haul networks. The Italy freight and logistics market benefits from the country's gateway role between Europe and the Mediterranean, yet labor shortages and an aging vehicle fleet raise cost pressures. Rising cold-chain needs from pharmaceutical and premium food exports stimulate temperature-controlled warehousing, and automation incentives under Industry 4.0 support modernization in northern hubs. Consolidation activities, such as DACHSER acquiring 80% of Fercam Italia, highlight a shift toward larger, integrated providers capable of handling complex multimodal flows.

Italy Freight And Logistics Market Trends and Insights

E-Commerce Parcel Surge and Last-Mile Investments

Domestic parcels within CEP captured a 66.54% share in 2024, reflecting surging online retail that hit EUR 58.8 billion (USD 64.9 billion) and grew 6% year over year. The Italy freight and logistics market responds by adding dense locker grids; the DHL-Poste Italiane venture targets 10,000 automated pickup points and cuts per-parcel urban delivery cost by 30%. Amazon Logistics extended same-day coverage to 15 more cities, compelling traditional carriers to invest in micro-fulfillment and electric fleets. Carriers reengineer hub-and-spoke layouts to support sub-100-kilogram shipments that dominate e-commerce flows. Urban policy incentives for zero-emission vehicles align with operator fleet renewal strategies. Capacity challenges persist on peak shopping days, driving collaboration with crowd-shipping platforms to absorb overflow volumes.

Cold-Chain Demand from Food and Pharma Exports

Medicinal drugs sustained above 80% of the pharmaceutical export value in 2024, anchoring demand for temperature-controlled distribution. UPS acquired Frigo-Trans and BPL, bolstering European GDP-grade cold-chain coverage and positioning Milan's pharma cluster as a hub for emerging-market shipments. Temperature-controlled warehousing claims only 7.81% of total capacity in 2024, yet it is expected to expand at a 3.53% CAGR (2025-2030) as vaccine logistics and biologics production widen demand. Airport cargo zones in Milan, Rome, and Bologna add cool-room space to capture biotech flows. Regional specialization enables operators to capture value via end-to-end validated lanes with active packaging. Energy-efficient refrigeration systems benefit from NRRP grants earmarked for sustainable logistics facilities.

Driver Shortages and Aging Truck Fleet

Only 2.2% of professional drivers in Italy are under 25, creating succession risk as veteran operators retire. The average heavy-duty vehicle age of 19.1 years exceeds the EU average and lowers fleet reliability, inflating maintenance costs. Protests in Rome during 2024 spotlighted declining service quality and urged fast-track license recognition for foreign drivers. Grant programs cover up to EUR 24,000 (USD 26,487) per driver for training, yet uptake lags amid cumbersome application rules. Leasing firms promote flexible pay-per-kilometer schemes to accelerate fleet renewal, but capital constraints persist among micro-fleets dominating the Italy freight and logistics market.

Other drivers and restraints analyzed in the detailed report include:

- Infrastructure Upgrades Under NRRP and TEN-T Corridors

- Industry 4.0 Tax Credits Boosting Smart-Logistics Tech

- High North-South Operating-Cost Differential

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Manufacturing accounted for 31.12% of 2025 revenue, anchored in automotive, machinery, and life-science production hubs across Lombardy, Piedmont, and Emilia-Romagna. Component flows require synchronized just-in-sequence deliveries, fostering collaboration between hauliers and tier-one suppliers. Wholesale and retail trade grows fastest at 3.86% CAGR (2026-2031) as omnichannel brands demand nationwide next-day fulfillment. Construction logistics gains from NRRP works, shipping aggregates, steel, and prefabricated modules to rail and highway sites.

Energy transition policies taper investments in oil and gas haulage, nudging carriers toward renewables project cargo. Agriculture, fishing, and forestry strengthen export footprints in premium olive oil and wine, raising cold-chain and reefer container needs. Emerging sectors such as renewable technology assembly and digital services diversify the Italy freight and logistics market's customer base, cushioning cyclical risk.

Freight transport generated 62.88% of 2025 revenue, underscoring the centrality of road, rail, sea, and air moves in the Italy freight and logistics market. The segment captures flows from industrial clusters in the North to consumer markets nationwide. CEP services record a 4.17% CAGR between 2026-2031 as online shopping resets delivery frequency benchmarks and accelerates network densification. Warehousing and storage rides Industry 4.0 incentives to add multi-level automation in northern facilities, lifting throughput and assuring scalability. Freight forwarding leverages Italy's positioning on Asia-Europe lanes to orchestrate multimodal movements, while other services encompass project cargo orchestration and hazardous goods handling.

Integrated offerings now blur function lines as carriers embed customs brokerage and inventory control within transport contracts. Diversification is visible in Poste Italiane's pivot: revenue from logistics operations outpaced mail services in 2025, validating service expansion. Cross-selling boosts stickiness with industrial clients demanding door-to-door visibility and compliance. The Italy freight and logistics market rewards operators that fuse transport, warehousing, and value-added services under unified digital platforms.

The Italy Freight and Logistics Market Report is Segmented by End User Industry (Agriculture, Fishing, and Forestry, Construction, Manufacturing, Oil and Gas, Mining and Quarrying, Wholesale and Retail Trade, and Others) and by Logistics Function (Courier, Express, and Parcel (CEP), Freight Forwarding, Freight Transport, Warehousing and Storage, and Other Services). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Amazon

- Arcese Trasporti SpA

- BRT SpA

- CMA CGM Group (Including CEVA Logistics)

- DHL Group

- DSV A/S (Including DB Schenker)

- FedEx

- Fercam SpA

- International Distributions Services PLC (Including GLS)

- Grimaldi Group

- GRUBER Logistics SpA

- Italsempione

- Italtrans

- Kuehne+Nagel

- Mercitalia Rail

- MSC Mediterranean Shipping Company S.A.A

- Poste Italiane

- Savino Del Bene SpA

- Transmec Group

- United Parcel Service of America, Inc. (UPS)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Demographics

- 4.3 GDP Distribution by Economic Activity

- 4.4 GDP Growth by Economic Activity

- 4.5 Inflation

- 4.6 Economic Performance and Profile

- 4.6.1 Trends in E-Commerce Industry

- 4.6.2 Trends in Manufacturing Industry

- 4.7 Transport and Storage Sector GDP

- 4.8 Export Trends

- 4.9 Import Trends

- 4.10 Fuel Price

- 4.11 Trucking Operational Costs

- 4.12 Trucking Fleet Size by Type

- 4.13 Major Truck Suppliers

- 4.14 Logistics Performance

- 4.15 Modal Share

- 4.16 Maritime Fleet Load Carrying Capacity

- 4.17 Liner Shipping Connectivity

- 4.18 Port Calls and Performance

- 4.19 Freight Pricing Trends

- 4.20 Freight Tonnage Trends

- 4.21 Infrastructure

- 4.22 Regulatory Framework (Road and Rail)

- 4.23 Regulatory Framework (Sea and Air)

- 4.24 Value Chain and Distribution Channel Analysis

- 4.25 Market Drivers

- 4.25.1 E-Commerce Parcel Surge and Last-Mile Investments

- 4.25.2 Cold-Chain Demand from Food and Pharma Exports

- 4.25.3 Infrastructure Upgrades Under NRRP and TEN-T Corridors

- 4.25.4 Industry 4.0 Tax Credits Boosting Smart-Logistics Tech

- 4.25.5 Locker Networks Altering Urban PUDO Mix

- 4.25.6 Rail-Upgrade Disruptions Shifting Volumes to Road

- 4.26 Market Restraints

- 4.26.1 Driver Shortages and Ageing Truck Fleet

- 4.26.2 High North-South Operating-Cost Differential

- 4.26.3 2025 Rail-Works Capacity Crunch on Key Port Corridors

- 4.26.4 Battery-Hazmat Rules Raising EV-Logistics Compliance Cost

- 4.27 Technology Innovations in the Market

- 4.28 Porter's Five Forces Analysis

- 4.28.1 Threat of New Entrants

- 4.28.2 Bargaining Power of Buyers

- 4.28.3 Bargaining Power of Suppliers

- 4.28.4 Threat of Substitutes

- 4.28.5 Competitive Rivalry

5 Market Size and Growth Forecasts (Value, USD)

- 5.1 End User Industry

- 5.1.1 Agriculture, Fishing, and Forestry

- 5.1.2 Construction

- 5.1.3 Manufacturing

- 5.1.4 Oil and Gas, Mining and Quarrying

- 5.1.5 Wholesale and Retail Trade

- 5.1.6 Others

- 5.2 Logistics Function

- 5.2.1 Courier, Express, and Parcel (CEP)

- 5.2.1.1 By Destination Type

- 5.2.1.1.1 Domestic

- 5.2.1.1.2 International

- 5.2.1.1 By Destination Type

- 5.2.2 Freight Forwarding

- 5.2.2.1 By Mode of Transport

- 5.2.2.1.1 Air

- 5.2.2.1.2 Sea and Inland Waterways

- 5.2.2.1.3 Others

- 5.2.2.1 By Mode of Transport

- 5.2.3 Freight Transport

- 5.2.3.1 By Mode of Transport

- 5.2.3.1.1 Air

- 5.2.3.1.2 Pipelines

- 5.2.3.1.3 Rail

- 5.2.3.1.4 Road

- 5.2.3.1.5 Sea and Inland Waterways

- 5.2.3.1 By Mode of Transport

- 5.2.4 Warehousing and Storage

- 5.2.4.1 By Temperature Control

- 5.2.4.1.1 Non-Temperature Controlled

- 5.2.4.1.2 Temperature Controlled

- 5.2.4.1 By Temperature Control

- 5.2.5 Other Services

- 5.2.1 Courier, Express, and Parcel (CEP)

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Key Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (Includes Global Level Overview, Market Level Overview, Core Segments, Financials as Available, Strategic Information, Market Rank/Share for Key Companies, Products and Services, and Recent Developments)

- 6.4.1 Amazon

- 6.4.2 Arcese Trasporti SpA

- 6.4.3 BRT SpA

- 6.4.4 CMA CGM Group (Including CEVA Logistics)

- 6.4.5 DHL Group

- 6.4.6 DSV A/S (Including DB Schenker)

- 6.4.7 FedEx

- 6.4.8 Fercam SpA

- 6.4.9 International Distributions Services PLC (Including GLS)

- 6.4.10 Grimaldi Group

- 6.4.11 GRUBER Logistics SpA

- 6.4.12 Italsempione

- 6.4.13 Italtrans

- 6.4.14 Kuehne+Nagel

- 6.4.15 Mercitalia Rail

- 6.4.16 MSC Mediterranean Shipping Company S.A.A

- 6.4.17 Poste Italiane

- 6.4.18 Savino Del Bene SpA

- 6.4.19 Transmec Group

- 6.4.20 United Parcel Service of America, Inc. (UPS)

7 Market Opportunities and Future Outlook

- 7.1 White-Space and Unmet-Need Assessment