|

市場調查報告書

商品編碼

1692559

越南公路貨運:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Vietnam Road Freight Transport - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

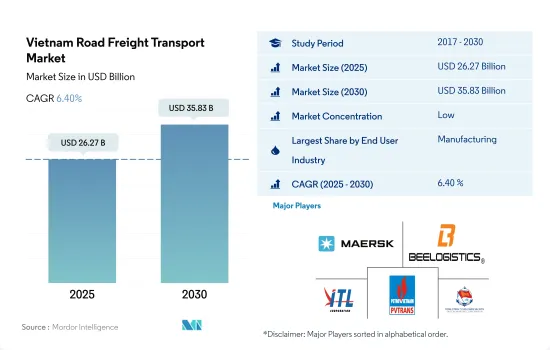

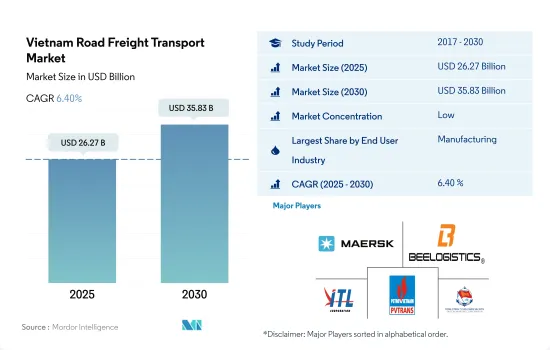

預計 2025 年越南公路貨運市場規模為 262.7 億美元,到 2030 年將達到 358.3 億美元,預測期間(2025-2030 年)的複合年成長率為 6.40%。

預計2023年至2027年越南電子商務市場的複合年成長率將達到12.38%,推動市場成長。

- 2023年,越南服裝、鞋類和紡織品領域的出貨收益最高,達1,914萬美元,這推動了對公路貨運服務的需求。此外,預計2022年越南工業生產指數(IIP )年增7.8%,其中第一季成長6.8%,第二季成長9.8%,第三季成長10.9%,第四季成長3%。 2022 年成長顯著的產業包括飲料,年成長 32.3%(啤酒成長 35.3%),其次是製藥、醫藥化學品和草藥(成長 19.2%)、機械製造(成長 19.1%)以及木材和木製品(成長 17.2%)。

- 越南零售市場正在經歷令人矚目的成長,為國際零售品牌提供了巨大的擴張機會。此外,預計越南電子商務市場在 2023 年至 2027 年期間的複合年成長率將達到 12.38%,到 2027 年將達到 193 億美元。因此,預計該國對公路貨運服務的需求將會增加。此外,政府計劃在2030年建造180萬套經濟適用住宅,預計將進一步促進市場成長。

越南公路貨運市場趨勢

政府的目標是到2025年底將高速公路總長度增加到3000公里。

- 2023年,政府將優先投資現代化交通基礎設施,包括公路、鐵路、海上和內陸水道以及機場。 2023年,南北高速公路計劃將動工12個,交通運輸計劃將新建9個,計劃4個。當年新增高速公路約475公里。其他將於 2023 年開始興建的大型交通計劃包括三條東西高速公路、隆城國際機場、富牌機場、奠邊機場、富宣二橋和永水二橋。隨著主要交通基礎設施項目於 2023 年竣工,交通運輸業的 GDP 成長預計將在 2024 年和 2025 年增加。

- 越南運輸部已破土動工14個基礎建設計劃,包括南北高速公路的關鍵路段,並計劃在2025年再完成50個項目。這是越南到2025年將高速公路從目前的2021公里擴建至3000公里目標的一部分。此外,位於同奈省、計劃金額達141.2億美元的隆城國際機場預計2025年完工。完工後,它將成為越南最大的機場,並將緩解胡志明市新山一機場的交通堵塞。

越南計劃在2030年投資高達114億美元擴大其國家燃料儲存能力。

- 2023年12月,越南連續第四次下調汽油和其他石油產品零售價格。 E5 RON 92 汽油價格每公升降低 509 越南盾(0.021 美元),至 21,290 越南盾(0.9 美元),RON95-III 汽油價格每公升降低 22,322 越南盾(0.944 美元)。負責這些調整的財政部、工業和貿易部選擇不使用汽油和石油價格穩定基金。今年迄今,越南已調整汽油價格35次。

- 2022年,越南RON95汽油零售價創下八年來的最高價,達到每公升26,287越南盾(1.14美元)。越南最大的煉油廠 Nghi Son 煉油廠因財務困難從 2022 年 1 月起減產 20%,導致國內汽油短缺,加劇了越南燃料價格上漲。儘管煉油廠已獲得臨時投資,但如果無法獲得足夠的流動資金和融資來採購科威特原油,它可能會被迫關閉。越南也核准了2030年擴大國家燃料儲存能力的計劃,投資額高達114億美元。這項投資將使越南原油和精製油的儲存能力從目前的65天提高到淨進口量的75至80天。

越南公路貨運業概況

越南公路貨運市場較為分散,主要五家參與者為 AP Moller-Maersk、Bee Logistics Corporation、Indo Trans Logistics Corporation、PetroVietnam Transportation Corporation(PVTrans)和 Saigon Newport Corporation。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章執行摘要和主要發現

第2章 報告要約

第3章 引言

- 研究假設和市場定義

- 研究範圍

- 調查方法

第4章 產業主要趨勢

- 按經濟活動分類的GDP分佈

- 經濟活動GDP成長

- 經濟表現及概況

- 電子商務產業趨勢

- 製造業趨勢

- 交通運輸倉儲業GDP

- 物流績效

- 道路長度

- 出口趨勢

- 進口趨勢

- 燃油價格趨勢

- 卡車運輸成本

- 卡車持有量(按類型)

- 主要卡車供應商

- 公路貨運噸位趨勢

- 公路貨運價格趨勢

- 模態共享

- 通貨膨脹率

- 法律規範

- 價值鍊和通路分析

第5章市場區隔

- 最終用戶產業

- 農業、漁業和林業

- 建設業

- 製造業

- 石油和天然氣、採礦和採石

- 批發和零售

- 其他

- 匯出目的地

- 國內的

- 國際貨運

- 卡車負載容量

- 整車裝載 (FTL)

- 零擔運輸 (LTL)

- 貨櫃運輸

- 貨櫃運輸

- 沒有容器

- 運輸距離

- 遠距

- 短途運輸

- 產品成分

- 流體產品

- 固體貨物

- 溫度控制

- 非溫控

- 溫度控制

第6章競爭格局

- 關鍵策略趨勢

- 市場佔有率分析

- 商業狀況

- 公司簡介

- AP Moller-Maersk

- ASG Corporation

- Aviation Logistics Corporation(ALS)

- Bee Logistics Corporation

- 達飛集團(包括CEVA物流)

- DHL Group

- Expeditors International of Washington, Inc.

- Gemadept

- GEODIS

- Hop Nhat International Joint Stock Company

- Indo Trans Logistics Corporation

- 近鐵集團控股株式會社(含近鐵世界快運株式會社)

- Linfox Pty Ltd.

- MACS Maritime Joint Stock Company

- MP Logistics

- Nguyen Ngoc Logistics Corporation

- Nippon Express Holdings.

- NYK(Nippon Yusen Kaisha)Line

- PetroVietnam Transportation Corporation(PVTrans)

- Royal Cargo Inc.

- Saigon Newport Corporation

- Transimex

- U& I Logistics Corporation

- Van Cargoes and Foreign Trade Logistics Joint Stock Company(VNT Logistics)

- Viet Total Logistics Co., Ltd.

- Vietnam Foreign Trade Logistics Joint Stock Company(VINATRANS)

- ViettelPost(包括 Viettel Logistics)

第7章:CEO面臨的關鍵策略問題

第 8 章 附錄

- 全球物流市場概覽

- 概述

- 五力分析框架

- 全球價值鏈分析

- 市場動態(市場促進因素、限制因素、機會)

- 資訊來源及延伸閱讀

- 圖片列表

- 關鍵見解

- 數據包

- 詞彙表

- 外匯

The Vietnam Road Freight Transport Market size is estimated at 26.27 billion USD in 2025, and is expected to reach 35.83 billion USD by 2030, growing at a CAGR of 6.40% during the forecast period (2025-2030).

The e-commerce market in Vietnam is expected to grow at a CAGR of 12.38% during 2023-27, driving the growth of the market

- In 2023 Vietnam accounted for the highest shipment value for the apparel, footwear, and textiles sector at USD 19.14 million, which drove the demand for road freight services. Moreover, Vietnam's industrial production index (IIP) in 2022 went up by 7.8% YoY, with a growth of 6.8% recorded in Q1, 9.8% in Q2, 10.9% in Q3, and 3% in Q4. Some of the sectors with impressive growth in 2022 were beverage with 32.3% YoY (beer 35.3%), followed by medicine, pharmaceutical chemistry and herbs (19.2%), machinery production (19.1%), and wood and wooden products (17.2%).

- The Vietnamese retail market is experiencing remarkable growth, providing substantial opportunities for international retail brands to expand. Moreover, the e-commerce market in Vietnam is expected to register a CAGR of 12.38% during the period 2023-2027 and reach USD 19.3 billion by 2027. As a result, the demand for road freight services is anticipated to increase in the country. In addition, the government plans to construct 1.8 million affordable houses by 2030, which is expected to support the growth of the market further.

Vietnam Road Freight Transport Market Trends

The government aims to increase the total length of expressways to 3,000 km by end of 2025

- In 2023, the Government prioritized investment in modern transport infrastructure, including roads, railways, marine and inland waterways, and airports. In 2023, construction began on 12 North-South expressway projects, with nine new traffic projects inaugurated and four completed. Around 475 km of expressways were added that year. Other key transport projects initiated in 2023 included three east-west expressways, the Long Thanh International Airport, Phu Bai Airport, Dien Bien Airport, Mỹ Thuận 2 Bridge, and Vĩnh Tuy 2 Bridge. As major transport infrastructure is completed in 2023, the GDP growth of the transport sector is estimated to increase in 2024 and 2025.

- Vietnam's Ministry of Transport plans to break ground on 14 infrastructure projects and complete 50 more by 2025, including key parts of the North-South Expressway. This is part of the goal to expand the country's expressways to 3,000 km by 2025, up from the current 2,021 km. Additionally, the Long Thanh International Airport, a USD 14.12 billion project in Dong Nai province, is on track to finish in 2025. Once completed, it will be the country's largest airport, easing congestion at Tan Son Nhat in Ho Chi Minh City.

Vietnam aims to expand its national fuel storage capacity by 2030, with an investment of up to USD 11.4 billion

- In December 2023, Vietnam reduced retail prices of gasoline and other oil products for the fourth consecutive time. The price of E5 RON 92 per liter was decreased by VND 509 (USD 0.021) to VND 21,290 (USD 0.9), and RON95-III petrol price was lowered to VND 22,322 (USD 0.944) per liter. The ministries of finance, industry, and trade responsible for these adjustments opted not to utilize the petrol and oil price stabilization fund. Since the start of the year, Vietnam has adjusted petrol prices 35 times.

- In 2022, the retail price of RON 95 gasoline in Vietnam reached its highest point in eight years, reaching VND 26,287 (USD 1.14) per liter. The increase in fuel prices in Vietnam was exacerbated by domestic gasoline shortages caused by the Nghi Son Oil Refinery, the country's largest refinery, reducing production by 20% from January 2022 due to financial challenges. Although the refinery has obtained temporary investment, it might be forced to cease operations if it fails to secure sufficient liquidity or loans to procure Kuwaiti crude oil. Moreover, Vietnam has approved a plan to expand its national fuel storage capacity by 2030, with an investment of up to USD 11.4 billion. The investment would raise the country's crude oil and refined fuel storage capacity to 75 to 80 days of net imports, from 65 days currently.

Vietnam Road Freight Transport Industry Overview

The Vietnam Road Freight Transport Market is fragmented, with the major five players in this market being A.P. Moller - Maersk, Bee Logistics Corporation, Indo Trans Logistics Corporation, PetroVietnam Transportation Corporation (PVTrans) and Saigon Newport Corporation (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 GDP Distribution By Economic Activity

- 4.2 GDP Growth By Economic Activity

- 4.3 Economic Performance And Profile

- 4.3.1 Trends in E-Commerce Industry

- 4.3.2 Trends in Manufacturing Industry

- 4.4 Transport And Storage Sector GDP

- 4.5 Logistics Performance

- 4.6 Length Of Roads

- 4.7 Export Trends

- 4.8 Import Trends

- 4.9 Fuel Pricing Trends

- 4.10 Trucking Operational Costs

- 4.11 Trucking Fleet Size By Type

- 4.12 Major Truck Suppliers

- 4.13 Road Freight Tonnage Trends

- 4.14 Road Freight Pricing Trends

- 4.15 Modal Share

- 4.16 Inflation

- 4.17 Regulatory Framework

- 4.18 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 End User Industry

- 5.1.1 Agriculture, Fishing, and Forestry

- 5.1.2 Construction

- 5.1.3 Manufacturing

- 5.1.4 Oil and Gas, Mining and Quarrying

- 5.1.5 Wholesale and Retail Trade

- 5.1.6 Others

- 5.2 Destination

- 5.2.1 Domestic

- 5.2.2 International

- 5.3 Truckload Specification

- 5.3.1 Full-Truck-Load (FTL)

- 5.3.2 Less than-Truck-Load (LTL)

- 5.4 Containerization

- 5.4.1 Containerized

- 5.4.2 Non-Containerized

- 5.5 Distance

- 5.5.1 Long Haul

- 5.5.2 Short Haul

- 5.6 Goods Configuration

- 5.6.1 Fluid Goods

- 5.6.2 Solid Goods

- 5.7 Temperature Control

- 5.7.1 Non-Temperature Controlled

- 5.7.2 Temperature Controlled

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 A.P. Moller - Maersk

- 6.4.2 ASG Corporation

- 6.4.3 Aviation Logistics Corporation (ALS)

- 6.4.4 Bee Logistics Corporation

- 6.4.5 CMA CGM Group (including CEVA Logistics)

- 6.4.6 DHL Group

- 6.4.7 Expeditors International of Washington, Inc.

- 6.4.8 Gemadept

- 6.4.9 GEODIS

- 6.4.10 Hop Nhat International Joint Stock Company

- 6.4.11 Indo Trans Logistics Corporation

- 6.4.12 Kintetsu Group Holdings Co., Ltd. (including Kintetsu World Express, Inc.)

- 6.4.13 Linfox Pty Ltd.

- 6.4.14 MACS Maritime Joint Stock Company

- 6.4.15 MP Logistics

- 6.4.16 Nguyen Ngoc Logistics Corporation

- 6.4.17 Nippon Express Holdings.

- 6.4.18 NYK (Nippon Yusen Kaisha) Line

- 6.4.19 PetroVietnam Transportation Corporation (PVTrans)

- 6.4.20 Royal Cargo Inc.

- 6.4.21 Saigon Newport Corporation

- 6.4.22 Transimex

- 6.4.23 U&I Logistics Corporation

- 6.4.24 Van Cargoes and Foreign Trade Logistics Joint Stock Company (VNT Logistics)

- 6.4.25 Viet Total Logistics Co., Ltd.

- 6.4.26 Vietnam Foreign Trade Logistics Joint Stock Company (VINATRANS)

- 6.4.27 ViettelPost (including Viettel Logistics)

7 KEY STRATEGIC QUESTIONS FOR ROAD FREIGHT CEOS

8 APPENDIX

- 8.1 Global Logistics Market Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (Market Drivers, Restraints & Opportunities)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

- 8.7 Currency Exchange Rate