|

市場調查報告書

商品編碼

1692138

北美公路貨運:市場佔有率分析、行業趨勢和統計數據、成長預測(2025-2030 年)North America Road Freight Transport - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

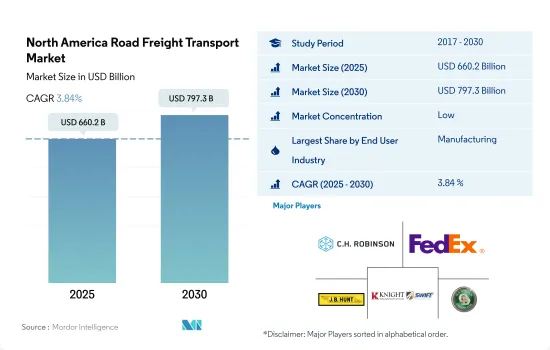

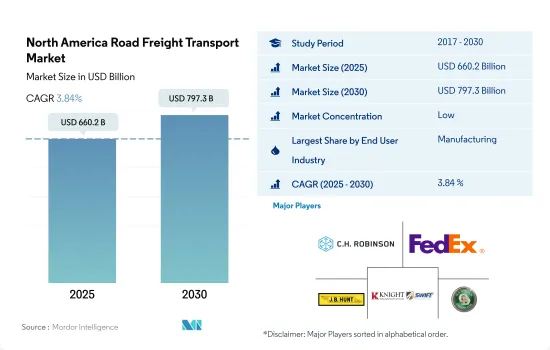

北美公路貨運市場規模預計在 2025 年達到 6,602 億美元,預計到 2030 年將達到 7,973 億美元,預測期內(2025-2030 年)的複合年成長率為 3.84%。

製造業和批發/零售貿易將推動公路貨運市場的成長

- 作為卡車貨運的主要驅動力,美國製造業將在 2024 年初恢復擴張趨勢,這表明工業活動復甦,運輸服務需求增加。此外,2024 年 6 月製成品出口額從 2024 年 5 月的 1,119 億美元達到 1,130 億美元。同樣,2024 年上半年製成品出口額達到 6,580 億美元,年增 2.62%。製造業出口的成長是公路貨運需求成長的主要原因。

- 美國政府於2024年7月津貼1.6億美元,用於制定環境產品聲明(EPD),推動低碳建築材料的使用,並提高建設產業的永續性。這項投資旨在減少新建房產的碳排放,並支持2050年實現淨零排放的國家目標。美國正致力於推動混凝土和鋼鐵等碳密集型材料的EPD。光是在 2023 年,GSA 的試點計畫就創建了 17,000 個 EPD。隨著產業轉向使用低碳材料,卡車運輸業預計這些專用產品的運輸量將會增加。

美國主導北美卡車運輸市場,但道路基礎設施投資預計將進一步改善

- 2022-2023年北美公路貨運市場將以美國為主。 2022年,墨西哥將成為美國最大的貿易夥伴。北美主要的公路貨運業務幾乎全部在美國、墨西哥和加拿大進行。 2023年1月跨境貨運總額為1,258億美元,與前一年同期比較增10%。卡車貨運量佔貨運總量的近62%(以金額為準)。底特律、休倫港和布法羅是美國-加拿大貨運的主要卡車港口,而拉雷多、埃爾帕索和奧泰梅薩是墨西哥境內的主要卡車港口。

- 未來幾年可能會完成一些道路基礎設施計劃,這將進一步改善卡車運輸業。這些計劃包括加拿大的戈迪豪國際大橋,預計將改善美國和加拿大之間的交通。在美國,金字塔公路改善工程已經提案,預計2025年完成。 680號州際公路走廊和路面的維修有可能提高680號州際公路的貨運流動性,維護運輸系統的狀況,並提高系統性能。各大公司也對電動車進行了大量投資。所有這些因素都將推動未來幾年公路貨運的發展。

北美公路貨運市場趨勢

美國是該地區 GDP 的最大貢獻者,這得益於加強港口和供應鏈的基礎設施計畫。

- 高效可靠的交通系統對經濟至關重要。加拿大政府透過國家貿易走廊基金投資改善供應鏈、減少貿易壁壘和促進業務成長,以創造未來的經濟機會。 2024年5月,交通部長宣布該基金將向19個數位基礎設施計劃提供高達5,120萬美元的資金。加拿大政府正在利用創新技術加強供應鏈,以便為加拿大人提供更快、更便宜的送貨服務。該計劃將促進與全國各地相關人員在數計劃上的合作,以有效解決運輸瓶頸、脆弱性和港口堵塞問題。

- 在美國,由於基礎設施建設和電子商務的興起,運輸和倉儲行業的就業預計將成長。根據美國勞工統計局 (BLS) 的數據,預計該行業從 2022 年到 2032 年將以每年 0.8% 的成長率成長,從而在此期間增加近 57 萬個就業機會。預計宅配和信使行業以及倉儲和儲存業將對該行業預計就業成長的 80% 左右做出重大貢獻。

中東地區緊張局勢加劇影響了石油供應,導致該地區油價大幅上漲。

- 到2024年10月,也就是總統大選前,美國汽油價格預計將在三年多來首次跌破每加侖3美元。燃料價格下跌主要由於需求放緩和原油價格下跌,為成本上漲而引發通貨膨脹的消費者帶來了一絲安慰。此類事態發展可能會增強包括副總統卡馬拉·哈里斯在內的民主黨人的支持,因為他們正在回應共和黨對油價飆升的批評。截至2024年9月,普通汽油平均價格為每加侖3.25美元,比上月下降19美分,比去年同期下降58美分。

- 預計2024年加拿大油砂廠的年度維護將照常進行。但工會領導人警告稱,由於兩個新的行業計劃,亞伯達將在 2025 年的轉折季節面臨勞動力短缺。亞伯達的生產商每年都會僱用數千名技術純熟勞工,用於油砂升級工廠、火力發電發電工程和煉油廠的關鍵維護。加拿大是世界第四大石油生產國,每天生產的 490 萬桶原油中約有三分之二來自亞伯達北部的油砂。短缺可能導致燃料價格最快在 2025 年上漲。

北美公路貨運產業概況

北美公路貨運市場較為分散,主要有主要企業(按字母順序排列):C.H.羅賓遜、聯邦快遞、J.B. Hunt Transport、Knight Swift Transportation Holdings 和 Old Dominion Freight Line。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章執行摘要和主要發現

第2章 報告要約

第3章 引言

- 研究假設和市場定義

- 研究範圍

- 調查方法

第4章 產業主要趨勢

- 按經濟活動分類的GDP分佈

- 經濟活動GDP成長

- 經濟表現及概況

- 電子商務產業趨勢

- 製造業趨勢

- 交通運輸倉儲業GDP

- 物流績效

- 道路長度

- 出口趨勢

- 進口趨勢

- 燃油價格趨勢

- 卡車運輸成本

- 卡車持有量(按類型)

- 主要卡車供應商

- 公路貨運噸位趨勢

- 公路貨運價格趨勢

- 模態共享

- 通貨膨脹率

- 法律規範

- 價值鍊和通路分析

第5章市場區隔

- 最終用戶產業

- 農業、漁業和林業

- 建設業

- 製造業

- 石油和天然氣、採礦和採石

- 批發和零售

- 其他

- 匯出目的地

- 國內的

- 國際貨運

- 卡車負載容量

- 整車裝載 (FTL)

- 零擔運輸 (LTL)

- 貨櫃運輸

- 貨櫃運輸

- 沒有容器

- 距離

- 遠距

- 短途運輸

- 產品成分

- 流體產品

- 固體貨物

- 溫度控制

- 非溫控

- 溫度控制

- 國家

- 加拿大

- 墨西哥

- 美國

- 北美其他地區

第6章 競爭格局

- 關鍵策略趨勢

- 市場佔有率分析

- 商業狀況

- 公司簡介

- AP Moller-Maersk

- ArcBest

- CH Robinson

- CMA CGM Group(including CEVA Logistics)

- DHL Group

- DSV A/S(De Sammensluttede Vognmaend af Air and Sea)

- FedEx

- JB Hunt Transport, Inc.

- Knight-Swift Transportation Holdings Inc.

- Landstar System Inc.

- Old Dominion Freight Line

- Ryder System, Inc.

- Schneider National, Inc.

- United Parcel Service of America, Inc.(UPS)

- Werner Enterprises Inc.

- XPO, Inc.

第7章:CEO面臨的關鍵策略問題

第 8 章 附錄

- 全球物流市場概覽

- 概述

- 五力分析框架

- 全球價值鏈分析

- 市場動態(市場促進因素、限制因素、機會)

- 資訊來源及延伸閱讀

- 圖片列表

- 關鍵見解

- 數據包

- 詞彙表

- 外匯

簡介目錄

Product Code: 90832

The North America Road Freight Transport Market size is estimated at 660.2 billion USD in 2025, and is expected to reach 797.3 billion USD by 2030, growing at a CAGR of 3.84% during the forecast period (2025-2030).

The manufacturing and wholesale & retail trade sectors support the growth of the road freight market

- The United States manufacturing sector, a major driver of truck freight, returned to expansion in early 2024, signaling a recovery in industrial activity and increased demand for transportation services. Moreover, manufactured goods exports reached USD 113 billion in June 2024, up from USD 111.9 billion in May 2024. Similarly, in the first six months of 2024, manufactured goods exports reached USD 658 billion, up 2.62% compared to the same period last year. The upturn in manufacturing exports is significantly contributing to increased road freight demand.

- In July 2024, the US government allocated USD 160 million in grants to develop environmental product declarations (EPDs) and advance the use of low-carbon construction materials, enhancing sustainability in the construction industry. This investment aims to cut the carbon footprint of new constructions, supporting the national goal of net-zero emissions by 2050. The US is focusing on advancing EPDs for carbon-intensive materials like concrete and steel. In 2023 alone, the GSA's pilot program created 17,000 EPDs. As the industry shifts towards using low-carbon materials, the trucking industry is expected to see a rise in the transportation of these specialized products.

United States dominates the North American trucking market, which is expected to improve further due to investments in road infrastructure

- The US dominated the North American road freight transport market in 2022-2023. Mexico was the largest trade partner to the US in 2022. Substantially, major road freight operations in North America take place in the United States, Mexico, and Canada. The total trans-border freight amounted to USD 125.8 billion in January 2023, registering a growth of 10% YoY. Trucks moved nearly 62% of the total freight (in value). Detroit, Port Huron, and Buffalo are the top truck ports for the freight flows between the United States and Canada, while Laredo, El Paso, and Otay Mesa are the top truck ports within Mexico.

- There are road infrastructure projects that may be completed in the coming years, which would further improve the trucking industry. These projects include the Gordie Howe International Bridge in Canada, which is expected to improve the transportation between the United States and Canada. In the United States, Pyramid Highway Improvement was proposed, which is forecast to be complete by 2025. The Interstate 680 Express Lane and Pavement Rehabilitation may improve the freight mobility of I-680, preserve the transportation system's condition, and improve system performance. There is also a substantial investment in electric vehicles by major companies. All these factors are set to drive the road freight in coming years.

North America Road Freight Transport Market Trends

The US dominates with maximum regional GDP contribution, fueled by an infrastructure program that boosts ports and supply chains

- An efficient and reliable transportation system is crucial for the economy. Through the National Trade Corridors Fund, the Government of Canada invests in improving supply chains, reducing trade barriers, and fostering business growth for future economic opportunities. In May 2024, the Minister of Transport announced up to USD 51.2 million for 19 digital infrastructure projects under this fund. The Canadian government aims to enhance supply chains with innovative technologies to expedite and reduce costs for Canadians. This initiative will drive collaboration with stakeholders nationwide on digital projects to address transportation bottlenecks, vulnerabilities, and port congestion effectively.

- In United States, infrastructure development and the rise of e-commerce are anticipated to boost employment in the transportation and storage sector. According to the Bureau of Labor Statistics (BLS), this sector is projected to grow at a rate of 0.8% annually from 2022 to 2032, resulting in the addition of nearly 570,000 jobs during that timeframe. The couriers and messengers industry, along with warehousing and storage, are expected to contribute significantly to about 80% of the sector's projected job growth.

Rising tensions in the Middle East are expected to affect crude oil supplies and lead to sudden price hikes in the region

- By October 2024, just ahead of the presidential election, gasoline prices in the US were projected to dip below USD 3 a gallon for the first time in over 3 years. This decline in fuel prices, primarily driven by waning demand and decreasing oil prices, offered a reprieve to consumers who had been grappling with elevated costs contributing to inflation. Such a development could have bolstered Vice President Kamala Harris and other Democrats in addressing Republican critiques regarding soaring gas prices. As of September 2024, regular gas averaged USD 3.25 a gallon, marking a 19-cent drop from the previous month and a 58-cent YoY decrease.

- Annual maintenance on Canada's oil sands plants in 2024 is expected to proceed normally. However, trade union officials warn of a labor shortage in Alberta's 2025 turnaround season due to two new industrial projects. Alberta producers annually hire thousands of skilled workers for essential maintenance on oil sands upgraders, thermal projects, and refineries. As the world's fourth-largest oil producer, Canada gets about two-thirds of its 4.9 million barrels per day of crude from the northern Alberta oil sands. This shortage might raise fuel prices in 2025.

North America Road Freight Transport Industry Overview

The North America Road Freight Transport Market is fragmented, with the major five players in this market being C.H. Robinson, FedEx, J.B. Hunt Transport, Inc., Knight-Swift Transportation Holdings Inc. and Old Dominion Freight Line (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 GDP Distribution By Economic Activity

- 4.2 GDP Growth By Economic Activity

- 4.3 Economic Performance And Profile

- 4.3.1 Trends in E-Commerce Industry

- 4.3.2 Trends in Manufacturing Industry

- 4.4 Transport And Storage Sector GDP

- 4.5 Logistics Performance

- 4.6 Length Of Roads

- 4.7 Export Trends

- 4.8 Import Trends

- 4.9 Fuel Pricing Trends

- 4.10 Trucking Operational Costs

- 4.11 Trucking Fleet Size By Type

- 4.12 Major Truck Suppliers

- 4.13 Road Freight Tonnage Trends

- 4.14 Road Freight Pricing Trends

- 4.15 Modal Share

- 4.16 Inflation

- 4.17 Regulatory Framework

- 4.18 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 End User Industry

- 5.1.1 Agriculture, Fishing, and Forestry

- 5.1.2 Construction

- 5.1.3 Manufacturing

- 5.1.4 Oil and Gas, Mining and Quarrying

- 5.1.5 Wholesale and Retail Trade

- 5.1.6 Others

- 5.2 Destination

- 5.2.1 Domestic

- 5.2.2 International

- 5.3 Truckload Specification

- 5.3.1 Full-Truck-Load (FTL)

- 5.3.2 Less than-Truck-Load (LTL)

- 5.4 Containerization

- 5.4.1 Containerized

- 5.4.2 Non-Containerized

- 5.5 Distance

- 5.5.1 Long Haul

- 5.5.2 Short Haul

- 5.6 Goods Configuration

- 5.6.1 Fluid Goods

- 5.6.2 Solid Goods

- 5.7 Temperature Control

- 5.7.1 Non-Temperature Controlled

- 5.7.2 Temperature Controlled

- 5.8 Country

- 5.8.1 Canada

- 5.8.2 Mexico

- 5.8.3 United States

- 5.8.4 Rest of North America

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 A.P. Moller - Maersk

- 6.4.2 ArcBest

- 6.4.3 C.H. Robinson

- 6.4.4 CMA CGM Group (including CEVA Logistics)

- 6.4.5 DHL Group

- 6.4.6 DSV A/S (De Sammensluttede Vognmaend af Air and Sea)

- 6.4.7 FedEx

- 6.4.8 J.B. Hunt Transport, Inc.

- 6.4.9 Knight-Swift Transportation Holdings Inc.

- 6.4.10 Landstar System Inc.

- 6.4.11 Old Dominion Freight Line

- 6.4.12 Ryder System, Inc.

- 6.4.13 Schneider National, Inc.

- 6.4.14 United Parcel Service of America, Inc. (UPS)

- 6.4.15 Werner Enterprises Inc.

- 6.4.16 XPO, Inc.

7 KEY STRATEGIC QUESTIONS FOR ROAD FREIGHT CEOS

8 APPENDIX

- 8.1 Global Logistics Market Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (Market Drivers, Restraints & Opportunities)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

- 8.7 Currency Exchange Rate

02-2729-4219

+886-2-2729-4219