|

市場調查報告書

商品編碼

1692556

中國公路貨運:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030年)China Road Freight Transport - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

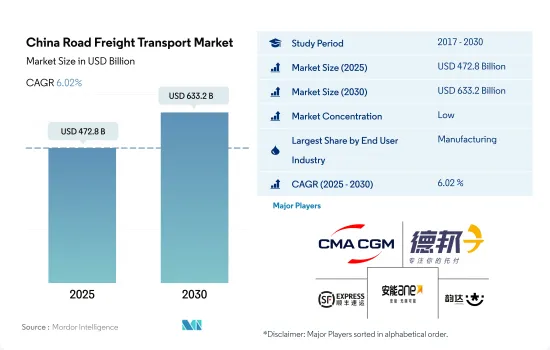

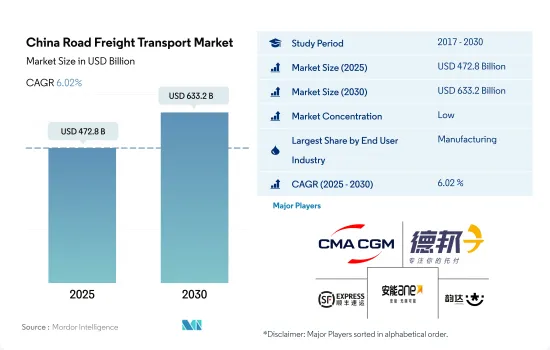

預計 2025 年中國公路貨運市場規模為 4,728 億美元,到 2030 年將達到 6,332 億美元,預測期內(2025-2030 年)的複合年成長率為 6.02%。

製造業產出成長和電子商務推動公路貨運服務需求

- 由於卡車運輸業在確保該國製成品的及時交付和分配方面發揮著至關重要的作用,製造業產量的增加正在推動對道路服務的需求。儘管面臨全球地緣政治挑戰和其他新興經濟體的競爭,中國製造業仍蓬勃發展。 2023年,中國製造業增加價值佔GDP比重將達31.7%。此外,中國位居2024年新興亞洲製造業指數榜首。受製造業復甦的支撐,中國2024年4月工業生產年增6.7%,高於2024年3月的4.5%。

- 道路、橋樑和機場等大型基礎設施建設計劃的發展正在推動建築終端用戶領域的發展。受「十四五」規劃(2021-2025 年)中基礎設施計劃投資的支持,預計 2025 年至 2028 年期間建設產業的複合年成長率將達到 3.9%。政府計劃在 2060 年投資 13.8 兆美元用於綠色能源轉型,預計這也將支持成長。因此,預計未來幾年建築終端用戶領域將會成長。

中國公路貨運市場趨勢

「十四五」規劃重點發展清潔能源基礎建設和交通運輸投資,推動經濟成長

- 2023年,中國清潔能源產業為國家經濟成長做出了重大貢獻。據中國能源與清潔空氣機構(CREA)稱,中國對可再生能源基礎設施的投資達到了8,900億美元,幾乎相當於當年世界對石化燃料供應的投資。清潔能源,包括再生能源來源、核能、電網、能源儲存、電動車和鐵路,到2023年將佔中國GDP的9.0%,與前一年同期比較7.2%。 2023年電動車產量與前一年同期比較成長36%。

- 中國在其「十四五」規劃(2021-2025年)中公佈了擴大交通網路的目標。到2025年,高鐵里程將由2020年的3.8萬公里增加到5萬公里,覆蓋95%的50萬人口以上城市,線路長度達到250公里。到2025年,鐵路營業里程達到16.5萬公里,民用機場270個以上,都市區地鐵營業里程達到1萬公里,高速公路營業里程達到19萬公里,高等級內河航道營業里程達到1.85萬公里。 2025年,實現全面發展是首要目標,重點轉變交通運輸方式,提高交通運輸對GDP的貢獻率。

受俄烏戰爭影響,中國柴油零售價格飆升至歷史高點。

- 預計2023年中國原油進口量將較2022年成長11%,達到5.6399億噸,即1,128萬桶/日。受俄烏戰爭影響,全球油價上漲,中國燃油價格創歷史新高。 2024年1-2月原油進口量達8,831萬噸,年增5.1%。這一成長是由於之前以較低價格購買了原油。布倫特期貨在2023年9月達到高峰97.69美元,12月跌至72.29美元,2024年3月升至84.05美元。 2024年3月OPEC+集團決定將減產協議延長至6月底,進一步推高了油價。此舉引發了人們對全球石油需求的擔憂,因為該組織將減產近6%的全球需求。此外,近期原油價格上漲可能從2024年下半年開始抑制中國的進口。

- 中國計劃根據近期國際原油價格波動調整汽油、柴油零售價格。價格上漲反映出全球供應緊張和需求前景改善。根據國發改委預測,2024年中國汽油和柴油價格將上漲28美元/噸。儘管預計燃料需求將下降,但到2035年,石油基燃料仍可能是主要選擇。

中國道路貨物運輸產業概況

中國公路貨運市場較分散,主要五大參與者為達飛集團(旗下有CEVA物流)、德邦物流、順豐速運(KEX-SF)、上海安能聚創供應鏈管理及韻達控股(依字母順序排列)。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章執行摘要和主要發現

第2章 報告要約

第3章 引言

- 研究假設和市場定義

- 研究範圍

- 調查方法

第4章 產業主要趨勢

- 按經濟活動分類的GDP分佈

- 按經濟活動分類的GDP成長

- 經濟表現及概況

- 電子商務產業趨勢

- 製造業趨勢

- 交通運輸倉儲業GDP

- 物流績效

- 道路長度

- 出口趨勢

- 進口趨勢

- 燃油價格趨勢

- 卡車運輸成本

- 卡車持有量(按類型)

- 主要卡車供應商

- 公路貨運噸位趨勢

- 公路貨運價格趨勢

- 模態共享

- 通貨膨脹率

- 法律規範

- 價值鍊和通路分析

第5章市場區隔

- 最終用戶產業

- 農業、漁業和林業

- 建設業

- 製造業

- 石油和天然氣、採礦和採石

- 批發和零售

- 其他

- 匯出目的地

- 國內貨運

- 國際貨運

- 卡車負載容量

- 整車裝載 (FTL)

- 零擔運輸 (LTL)

- 貨櫃運輸

- 貨櫃運輸

- 沒有容器

- 運輸距離

- 遠距

- 短途運輸

- 產品成分

- 流體產品

- 固體貨物

- 溫度控制

- 非溫控

- 溫度控制

第6章 競爭格局

- 關鍵策略趨勢

- 市場佔有率分析

- 商業狀況

- 公司簡介

- AP Moller-Maersk

- Changjiu Logistics

- China Post

- CMA CGM Group(including CEVA Logistics)

- Deppon Logistics Co., Ltd.

- DHL Group

- SF Express(KEX-SF)

- Shanghai Aneng Juchuang Supply Chain Management Co., Ltd.

- Shanghai YTO Express(Logistics)Co., Ltd.

- SINOTRANS

- STO Express Co., Ltd.(Shentong Express)

- Yunda Holding Co. Ltd

- ZTO Express

第7章:CEO面臨的關鍵策略問題

第 8 章 附錄

- 全球物流市場概覽

- 概述

- 五力分析框架

- 全球價值鏈分析

- 市場動態(市場促進因素、限制因素、機會)

- 資訊來源及延伸閱讀

- 圖片列表

- 關鍵見解

- 資料包

- 詞彙表

- 外匯

簡介目錄

Product Code: 92373

The China Road Freight Transport Market size is estimated at 472.8 billion USD in 2025, and is expected to reach 633.2 billion USD by 2030, growing at a CAGR of 6.02% during the forecast period (2025-2030).

Rise in manufacturing sector's output and e-commerce driving the demand for road freight services

- The rise in manufacturing production is driving the demand for road services as the trucking industry plays a significant role in ensuring the timely delivery and distribution of manufactured goods domestically. China's manufacturing sector thrives despite facing challenges due to global geopolitics and competition from other emerging economies. In 2023, the value-added by China's manufacturing accounted for 31.7% of its GDP. Moreover, China is at the top of the Emerging Asia Manufacturing Index 2024. China's industrial output grew 6.7% YoY in April 2024, up from the 4.5% growth in March 2024, supported by the recovery in the manufacturing sector.

- Developing large-scale infrastructure construction projects such as roads, bridges, and airports is driving the construction end-user segment. The construction industry is expected to record an average annual growth rate of 3.9% between 2025 and 2028, supported by investment in infrastructure projects as part of the 14th Five-Year Plan (FYP) (2021-2025). The government's plan to invest USD 13.8 trillion by 2060 in green power transformation is also expected to support the growth. As a result, the construction end-user segment is expected to grow in the coming years.

China Road Freight Transport Market Trends

Rising focus on developing clean energy infrastructure and transport sector investment under 14th Five-Year Plan driving growth

- In 2023, China's clean energy sector significantly contributed to the country's economic expansion. According to Energy and Clean Air (CREA), China's investment in renewable energy infrastructure amounted to USD 890 billion, almost matching global investments in fossil fuel supply for the same year. Clean energy, including renewable energy sources, nuclear power, electricity grids, energy storage, electric vehicles (EVs), and railways, constituted 9.0% of China's GDP in 2023, up from 7.2% YoY. EV production grew by 36% YoY in 2023.

- In the 14th Five-Year Plan (2021-2025), China revealed goals for expanding its transportation network. By 2025, high-speed railways will extend to 50,000 kms, up from 38,000 kms in 2020, with 95% of cities with populations above 500,000 covered by 250-km lines. The country aims to increase its railway length to 165,000 kms, civil airports to over 270, subway lines in cities to 10,000 kms, expressways to 190,000 kms, and high-level inland waterways to 18,500 kms by 2025. The primary objective is to achieve integrated development by 2025, emphasizing advancements in the transformation of the transportation system and its contribution to GDP.

China's retail diesel and gasoline prices were soared to historically high levels amid the Russia-Ukraine War

- In 2023, China imported 11% more crude oil than in 2022, totaling 563.99 mn metric tons (MMT), or 11.28 mn barrels per day. This surge was due to increased global crude oil prices amid the Russia-Ukraine War, causing fuel prices in China to reach historic highs. In Jan-Feb 2024, crude oil imports rose by 5.1% YoY, reaching 88.31 MMT. This increase was driven by purchasing crude oil at lower prices earlier. Brent futures peaked at USD 97.69 in September 2023, fell to USD 72.29 in December, and rose to USD 84.05 by March 2024. The decision made by the OPEC+ group in March 2024 to extend output cuts until the end of June has further boosted crude prices. This move has raised concerns about global oil demand, as the group is reducing production by nearly 6% of world demand. The recent increase in crude prices may also dampen China's imports starting from H2 2024.

- China plans to adjust retail prices for gasoline and diesel to align with recent shifts in global crude oil prices. The price hike reflects a tightening of global supply and a positive forecast for demand. According to NDRC, gasoline and diesel prices in China will increase by USD 28 per ton in 2024. Although there's expectation of declining demand for fuels, oil-based fuels will remain the primary choice until 2035.

China Road Freight Transport Industry Overview

The China Road Freight Transport Market is fragmented, with the major five players in this market being CMA CGM Group (including CEVA Logistics), Deppon Logistics Co., Ltd., SF Express (KEX-SF), Shanghai Aneng Juchuang Supply Chain Management Co., Ltd. and Yunda Holding Co. Ltd (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 GDP Distribution By Economic Activity

- 4.2 GDP Growth By Economic Activity

- 4.3 Economic Performance And Profile

- 4.3.1 Trends in E-Commerce Industry

- 4.3.2 Trends in Manufacturing Industry

- 4.4 Transport And Storage Sector GDP

- 4.5 Logistics Performance

- 4.6 Length Of Roads

- 4.7 Export Trends

- 4.8 Import Trends

- 4.9 Fuel Pricing Trends

- 4.10 Trucking Operational Costs

- 4.11 Trucking Fleet Size By Type

- 4.12 Major Truck Suppliers

- 4.13 Road Freight Tonnage Trends

- 4.14 Road Freight Pricing Trends

- 4.15 Modal Share

- 4.16 Inflation

- 4.17 Regulatory Framework

- 4.18 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 End User Industry

- 5.1.1 Agriculture, Fishing, and Forestry

- 5.1.2 Construction

- 5.1.3 Manufacturing

- 5.1.4 Oil and Gas, Mining and Quarrying

- 5.1.5 Wholesale and Retail Trade

- 5.1.6 Others

- 5.2 Destination

- 5.2.1 Domestic

- 5.2.2 International

- 5.3 Truckload Specification

- 5.3.1 Full-Truck-Load (FTL)

- 5.3.2 Less than-Truck-Load (LTL)

- 5.4 Containerization

- 5.4.1 Containerized

- 5.4.2 Non-Containerized

- 5.5 Distance

- 5.5.1 Long Haul

- 5.5.2 Short Haul

- 5.6 Goods Configuration

- 5.6.1 Fluid Goods

- 5.6.2 Solid Goods

- 5.7 Temperature Control

- 5.7.1 Non-Temperature Controlled

- 5.7.2 Temperature Controlled

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 A.P. Moller - Maersk

- 6.4.2 Changjiu Logistics

- 6.4.3 China Post

- 6.4.4 CMA CGM Group (including CEVA Logistics)

- 6.4.5 Deppon Logistics Co., Ltd.

- 6.4.6 DHL Group

- 6.4.7 SF Express (KEX-SF)

- 6.4.8 Shanghai Aneng Juchuang Supply Chain Management Co., Ltd.

- 6.4.9 Shanghai YTO Express (Logistics) Co., Ltd.

- 6.4.10 SINOTRANS

- 6.4.11 STO Express Co., Ltd. (Shentong Express)

- 6.4.12 Yunda Holding Co. Ltd

- 6.4.13 ZTO Express

7 KEY STRATEGIC QUESTIONS FOR ROAD FREIGHT CEOS

8 APPENDIX

- 8.1 Global Logistics Market Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (Market Drivers, Restraints & Opportunities)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

- 8.7 Currency Exchange Rate

02-2729-4219

+886-2-2729-4219