|

市場調查報告書

商品編碼

1692558

日本公路貨運:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Japan Road Freight Transport - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

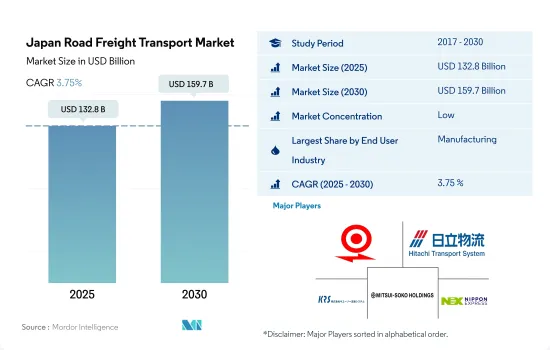

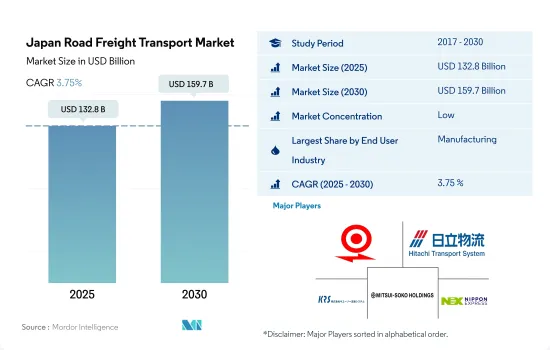

預計 2025 年日本公路貨運市場規模為 1,328 億美元,到 2030 年將達到 1,597 億美元,預測期內(2025-2030 年)的複合年成長率為 3.75%。

以汽車產業為主導的日本製造業一直推動著日本經濟的發展。

- 日本製造業是日本經濟的支柱,也是全球第三大經濟體,被譽為「製造業強國」。而且,預計2023年日本汽車出口量將年增與前一年同期比較%至442萬輛,而國內汽車銷量預計將達到近478萬輛。出口成長推動了公路貨運服務的需求。

- 零售和批發業也對日本經濟貢獻龐大,佔比超過13.00%。由於便利商店銷售額的成長,該細分市場在 2022 年實現了強勁成長。營收創歷史新高,達971億美元,與前一年同期比較增3.70%。 2022年的購物者數量與前一年同期比較增加了0.6%。這些正面趨勢顯示便利商店產業將強勁復甦。此外,預計從 2023 年到 2027 年,日本電子商務市場的複合年成長率將達到 9.75%。預計未來幾年網路銷售額的成長速度將比零售成長七到十倍。

日本公路貨運市場趨勢

隨著宅配需求的不斷成長和勞動力短缺,國土交通省正致力於建造自動化貨運道路和物流隧道

- 2024 年 5 月 17 日,在東京車站舉行的展覽會上,重點強調了高速客運列車上輕型貨運的不斷擴大。這一轉變是由於商用駕駛人短缺和新的加班法導致公路運輸成本增加高達 20%。自 2023 年 8 月起,JR 東日本將使用 12 節車廂的 E 系列專用列車實施從新潟到東京的當日送貨服務。運送的物品包括生鮮食品、糖果零食、飲料、鮮花、精密零件、醫療用品等。 2023 年 9 月,JR 東日本在東北新幹線推出了僅限貨運的服務,現在在其高速和特快網路中提供「Hako BYUN」品牌貨運服務。

- 2024年3月,由於靜岡縣持續反對環保問題,JR東海放棄了2027年前在東京和名古屋之間引入高速磁浮列車的計劃,該計劃可能會被推遲到2034年或更晚。中央新幹線的目標是以每小時 500 公里的速度連接東京和大阪,但靜岡的一小段路段構成了重大障礙。

儘管有政府補貼,2024 年 7 月燃油價格仍將上漲至 2023 年 10 月以來的最高水平

- 日本資源能源廳2024年7月宣布,一般汽油零售價已達每公升1.33美元。這一價格是自2023年10月以來約九個月以來的最高價格。零售價格的上漲是由於批發價格上漲。為了解決這個問題,各國政府向精製提供補貼,以壓低批發價格。此外,補貼金額也有所增加,6月27日至7月3日期間補貼金額為0.19美元,較前一週增加0.01美元。

- 日本天然氣公司預測,由於 2023-24 年天氣異常溫暖,城市天然氣使用量將下降,因此在 2024 年 4 月至 2025 年 3 月的會計年度中,城市天然氣需求將會增加。日本最大的瓦斯零售商東京瓦斯公司預測,到2025年,城市瓦斯銷售量將成長1.1%,達到114.22億立方公尺。其中,住宅用氣預計成長3.4%,達28億立方米,工業和商用預計成長0.3%,達86億立方公尺。

日本公路貨運業概況

日本公路貨運市場較為分散,主要有五家公司:福山運輸、日立運輸系統、KRS、三井倉庫控股和日本通運控股(依字母順序排列)。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章執行摘要和主要發現

第2章 報告要約

第3章 引言

- 研究假設和市場定義

- 研究範圍

- 調查方法

第4章 產業主要趨勢

- 按經濟活動分類的GDP分佈

- 按經濟活動分類的GDP成長

- 經濟表現及概況

- 電子商務產業趨勢

- 製造業趨勢

- 交通運輸倉儲業GDP

- 物流績效

- 道路長度

- 出口趨勢

- 進口趨勢

- 燃油價格趨勢

- 卡車運輸成本

- 卡車持有量(按類型)

- 主要卡車供應商

- 公路貨運噸位趨勢

- 公路貨運價格趨勢

- 模態共享

- 通貨膨脹率

- 法律規範

- 價值鍊和通路分析

第5章市場區隔

- 最終用戶產業

- 農業、漁業和林業

- 建設業

- 製造業

- 石油和天然氣、採礦和採石

- 批發和零售

- 其他

- 匯出目的地

- 國內的

- 卡車裝載規格

- 整車裝載 (FTL)

- 零擔運輸 (LTL)

- 貨櫃運輸

- 貨櫃運輸

- 沒有容器

- 運輸距離

- 遠距

- 短途運輸

- 產品成分

- 流體產品

- 固體貨物

- 溫度控制

- 非溫控

- 溫度控制

第6章 競爭格局

- 關鍵策略趨勢

- 市場佔有率分析

- 商業狀況

- 公司簡介

- DHL Group

- Fukuyama Transporting Co., Ltd.

- Hitachi Transport System

- KRS Corporation

- Konoike Group(including Konoike Transport Co., Ltd.)

- Mitsui-Soko Holdings Co., Ltd.

- Nippon Express Holdings

- Sankyu Inc.

- Seino Holdings Co., Ltd.

- Trancom Co. Ltd.

第7章:CEO面臨的關鍵策略問題

第 8 章 附錄

- 全球物流市場概覽

- 概述

- 五力分析框架

- 全球價值鏈分析

- 市場動態(市場促進因素、限制因素、機會)

- 資訊來源及延伸閱讀

- 圖片列表

- 關鍵見解

- 資料包

- 詞彙表

- 外匯

簡介目錄

Product Code: 92375

The Japan Road Freight Transport Market size is estimated at 132.8 billion USD in 2025, and is expected to reach 159.7 billion USD by 2030, growing at a CAGR of 3.75% during the forecast period (2025-2030).

The Japanese manufacturing sector, led by the automobile industry, has propelled the Japanese economy

- The Japanese manufacturing sector has driven the country's economy to the point where it is now the third-largest economy in terms of GDP and is regarded as one of the "Manufacturing Superpowers." Furthermore, Japan exported 4.42 million vehicles in 2023, up 16% from a year earlier, while domestic auto sales totaled nearly 4.78 million vehicles. The growth in exports drove the demand for road freight services.

- The retail and wholesale trade sector is another major contributor to the Japanese economy, with more than a 13.00% share. The segment grew significantly in 2022 due to increased sales in convenience stores. Sales reached a new high of USD 97.10 billion, representing a 3.70% increase over the previous year. The number of shoppers in 2022 rose by 0.6% compared to the previous year. These positive trends indicate a strong recovery of the convenience store industry. Moreover, during 2023-2027, the Japanese e-commerce market is expected to register a CAGR of 9.75%. Over the next few years, online sales are projected to increase seven to ten times faster than retail sales.

Japan Road Freight Transport Market Trends

With growing demand for home deliveries & labor shortages, the MLIT is focusing on construction of automatic cargo transport roads and logistics tunnels

- On May 17, 2024, a fair at Tokyo Station highlighted the growing use of high-speed passenger trains for light freight. This shift, driven by a shortage of commercial drivers and new overtime laws, has increased road delivery costs by up to 20%. Since August 2023, JR East has been running a same-day delivery service from Niigata to Tokyo using a dedicated 12-car Series E trainset. Items transported include fresh food, confectionery, drinks, flowers, precision components, and medical supplies. In September 2023, JR East launched a freight-only service on the Tohoku Shinkansen and now offers Hakobyun-branded freight services across its high-speed and Limited Express networks.

- In March 2024, Central Japan Railway Co. abandoned its plan to launch a high-speed maglev train between Tokyo and Nagoya by 2027 due to ongoing environmental opposition in Shizuoka Prefecture, possibly delaying the project until 2034 or later. The Linear Chuo Shinkansen aims to connect Tokyo and Osaka with trains reaching speeds of 500 kilometers per hour, but a small section in Shizuoka has been a major obstacle.

Rising prices of fuel in Japan witnessed in July 2024, highest since October 2023, despite government subsidies

- In July 2024, the Agency for Natural Resources and Energy announced that the retail price of regular gasoline reached USD 1.33 per liter, marking an increase of USD 0.006 from June 2024. This price point is the highest observed in nearly nine months, dating back to October 2023. The uptick in retail prices is attributed to surging wholesale prices. To counteract this, the government has been subsidizing oil refiners, ensuring that wholesale prices remain subdued. Moreover, the subsidy amount saw an uptick, rising to USD 0.19 between June 27 and July 3, which is an increase of USD 0.01 from the week prior.

- Japanese gas utilities expect city gas demand to rise in the fiscal year April 2024 to March 2025, following reduced usage in 2023-24 due to unusually warm weather. Tokyo Gas, Japan's largest gas retailer, forecasts city gas sales will increase by 1.1% to 11.422 billion cubic meters by 2025. Household sales are expected to grow by 3.4% to 2.8 billion cubic meters, while supplies to industry and commercial users are projected to rise by 0.3% to 8.6 billion cubic meters.

Japan Road Freight Transport Industry Overview

The Japan Road Freight Transport Market is fragmented, with the major five players in this market being Fukuyama Transporting Co., Ltd., Hitachi Transport System, K R S Corporation, Mitsui-Soko Holdings Co., Ltd. and Nippon Express Holdings (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 GDP Distribution By Economic Activity

- 4.2 GDP Growth By Economic Activity

- 4.3 Economic Performance And Profile

- 4.3.1 Trends in E-Commerce Industry

- 4.3.2 Trends in Manufacturing Industry

- 4.4 Transport And Storage Sector GDP

- 4.5 Logistics Performance

- 4.6 Length Of Roads

- 4.7 Export Trends

- 4.8 Import Trends

- 4.9 Fuel Pricing Trends

- 4.10 Trucking Operational Costs

- 4.11 Trucking Fleet Size By Type

- 4.12 Major Truck Suppliers

- 4.13 Road Freight Tonnage Trends

- 4.14 Road Freight Pricing Trends

- 4.15 Modal Share

- 4.16 Inflation

- 4.17 Regulatory Framework

- 4.18 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 End User Industry

- 5.1.1 Agriculture, Fishing, and Forestry

- 5.1.2 Construction

- 5.1.3 Manufacturing

- 5.1.4 Oil and Gas, Mining and Quarrying

- 5.1.5 Wholesale and Retail Trade

- 5.1.6 Others

- 5.2 Destination

- 5.2.1 Domestic

- 5.3 Truckload Specification

- 5.3.1 Full-Truck-Load (FTL)

- 5.3.2 Less than-Truck-Load (LTL)

- 5.4 Containerization

- 5.4.1 Containerized

- 5.4.2 Non-Containerized

- 5.5 Distance

- 5.5.1 Long Haul

- 5.5.2 Short Haul

- 5.6 Goods Configuration

- 5.6.1 Fluid Goods

- 5.6.2 Solid Goods

- 5.7 Temperature Control

- 5.7.1 Non-Temperature Controlled

- 5.7.2 Temperature Controlled

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 DHL Group

- 6.4.2 Fukuyama Transporting Co., Ltd.

- 6.4.3 Hitachi Transport System

- 6.4.4 K R S Corporation

- 6.4.5 Konoike Group (including Konoike Transport Co., Ltd.)

- 6.4.6 Mitsui-Soko Holdings Co., Ltd.

- 6.4.7 Nippon Express Holdings

- 6.4.8 Sankyu Inc.

- 6.4.9 Seino Holdings Co., Ltd.

- 6.4.10 Trancom Co. Ltd.

7 KEY STRATEGIC QUESTIONS FOR ROAD FREIGHT CEOS

8 APPENDIX

- 8.1 Global Logistics Market Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (Market Drivers, Restraints & Opportunities)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

- 8.7 Currency Exchange Rate

02-2729-4219

+886-2-2729-4219