|

市場調查報告書

商品編碼

1692139

歐洲公路貨運:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Europe Road Freight Transport - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

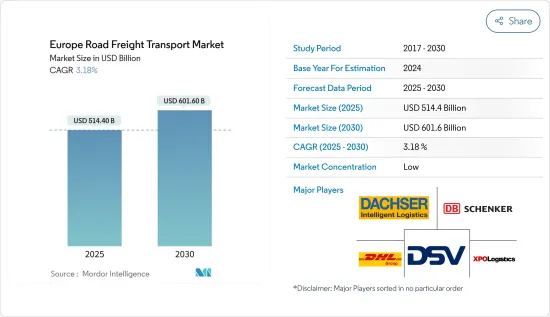

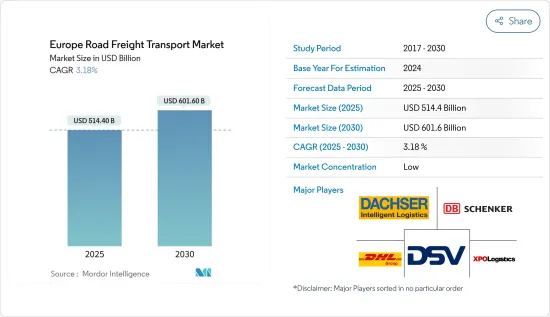

預計 2024 年歐洲公路貨運市場規模將達到 4,968.3 億美元,到 2030 年將達到 6,015.9 億美元,預測期內(2024-2030 年)的複合年成長率為 3.24%。

零售電子商務的激增正在推動批發和零售終端用戶領域的進步

- 2022 年,由於人機協作的增加,製造業終端用戶領域將實現成長,從而促進生產。德國是全球第五大機器人市場,各行各業共使用22,000台工業機器人,佔2021年全球安裝機器人總數的6%。此外,2021年,德國食品零售商施瓦茨集團成為歐洲領先的零售商,在該地區的總銷售額達到1,537.5億美元。在德國,預計 2022 年耐久財零售額將年增與前一年同期比較%。這得益於 2022 年私人消費預計將成長 5.40%。

- 在歐洲石油和天然氣、採礦和採石領域,德國的再氣化計畫是推動石油和天然氣終端用戶領域成長的因素之一。該國的天然氣需求由俄羅斯供應。因此,預計德國將在2022年至2026年期間增加歐洲最高的液化天然氣再氣化產能,占到2026年該地區總產能新增量的36%。 2022年,義大利的淨能源進口成本預計將增加一倍以上,達到1,132.4億美元。

- 批發和零售終端用戶領域預計在未來幾年內將經歷顯著成長,這主要得益於歐洲電子商務產業的預期擴張,預計2023年至2027年的複合年成長率將達到8.85。至於德國電子商務市場,預計到2025年將有6,840萬用戶進入市場,滲透率將從2022年的80.1%上升至81.9%。

歐洲各國政府大力發展公路貨運量和基礎設施,推動市場成長

- 2022年,法國在歐盟內外國際公路貨運噸位均排名第一。例如,2022年法國與瑞士之間透過道路運輸運輸的歐盟/歐盟以外的貨物總噸位佔道路運輸總噸位的7.3%,而法國與英國之間透過道路運輸運輸的歐盟/歐盟以外的貨物總噸位佔6.5%。 2022年上半年,道路運輸量佔義大利貨運量的68.1%,與前一年同期比較量(噸公里)較去年同期成長1.5%。截至 2022 年底,義大利道路運輸的公司數量達到約 100,797 家,比 2021 年底的 99,465 家成長 1.34%。

- 德國公路貨運市場在過去五年中保持穩定,約 35,000 家公路貨運公司,員工總數約 43 萬人。 2021年,德國負載容量3.5噸的汽車數量為964,696輛,較2020年增加1.3%,五年內成長3.4%。所有主要國家的經濟活動下滑,以及通貨膨脹導致的燃料和工資成本上升,導致 2022 年第 27 至 30 週期間荷蘭的卡車貨運量下降。從第 25 週開始,與 2021 年同期相比,卡車運輸量每週下降 9% 至 21%。

- 在北歐,2022年海外卡車銷量成長了6.7%。丹麥卡車出口的主要目的地是荷蘭、波蘭和德國,占出口總額的54%。對英國,前五名出口和進口國家一直保持相對穩定。然而,對德國的出口量已從 2000 年的 140 萬噸下降到 2021 年的 19 萬噸。

歐洲公路貨運市場趨勢

歐盟撥款57.6億美元用於135個交通計劃以促進經濟復甦

- 運輸和倉儲業在支援各行各業的業務中發揮著至關重要的作用,其中德國遙遙領先法國和英國。德國是全球第三大貨物出口國和進口國。德國聯邦政府宣布將增加對交通基礎設施的投資,2022年將為聯邦公路撥款超過120億歐元(128億美元),為水路撥款約17億歐元(18.1億美元),彰顯其改善交通網路的決心。

- 德國政府打算對鐵路網的投資大於公路網的投資。 2022年,德國鐵路、聯邦政府和地方政府將在鐵路基礎建設上投資約136億歐元(145.1億美元)。下薩克森州、漢堡州、不來梅州、梅克倫堡-前波美拉尼亞和石勒蘇益格-荷爾斯泰因州正在與德國鐵路公司合作,投資到 2030 年對其鐵路網路進行現代化改造。

- 2022年,歐盟核准為約135個交通基礎建設計劃提供54億歐元的津貼。這些計劃旨在支持歐盟成員國在大洪水後的經濟復甦,加強交通網路,促進永續交通,提高安全性並創造就業機會。所有受支持的計劃都是跨歐洲交通網路的一部分,連接歐盟成員國,並符合歐盟到 2030 年完成 TEN-T 核心網路和到 2050 年完成綜合網路的目標。

自2023年2月以來,俄羅斯的進口禁令導致來自中東、亞洲和北美的柴油進口量增加。

- 2022年第一季,歐元區19個國家中大多數國家的汽油價格上漲至每公升2歐元(2.13美元)以上。價格上漲的主要原因是俄羅斯與烏克蘭衝突導致的供應問題,而俄羅斯則供應了歐盟超過四分之一的石油需求。 2021 年,歐元區每公升汽油的平均價格為 1.30 歐元(1.38 美元),但 2022 年初每公升汽油的平均價格約為 1.55 歐元(1.65 美元)。

- 俄羅斯是歐洲最大的柴油供應國。 2023年,歐洲柴油價格下跌。自2023年2月歐盟實施禁止從俄羅斯進口石油產品禁令以來,俄羅斯對歐洲的柴油出口量平均為2.4萬桶/天,比2022年俄羅斯對歐洲的63萬桶/天下降了96%。從2月到5月,中東對歐洲的柴油出口成長了51%(16萬桶/天),亞洲成長了97%(14.7萬桶/天),北美成長了65%(4.7萬桶/天)。

- 丹麥的汽油價格最高,而芬蘭的柴油價格最高。奧地利的汽油最便宜,而西班牙的柴油最便宜。 2022 年英國燃油價格創下歷史新高,7 月平均汽油價格達到每公升披索披索,柴油價格達到每公升披索披索。到 2023 年為止,英國汽油的平均價格已超過每公升 150披索(1.80 美元),柴油價格上漲至每公升 152.41披索(1.83 美元)。 2023 年 1 月,西班牙的燃料價格比英國汽油每公升低約 20 美分,柴油每公升低約 40 美分。

歐洲公路貨運業概況

歐洲公路貨運市場較分散,前五大公司佔5.99%。該市場的主要企業有:Dachser、DB Schenker、DHL Group、DSV A/S(De Sammensluttede Vognmaend af Air and Sea)和XPO, Inc.(按字母順序排列)。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章執行摘要和主要發現

第2章 報告要約

第3章 引言

- 研究假設和市場定義

- 研究範圍

- 調查方法

第4章 產業主要趨勢

- 按經濟活動分類的GDP分佈

- 經濟活動GDP成長

- 經濟表現及概況

- 電子商務產業趨勢

- 製造業趨勢

- 交通運輸倉儲業GDP

- 物流績效

- 阿爾巴尼亞

- 保加利亞

- 克羅埃西亞

- 捷克共和國

- 丹麥

- 愛沙尼亞

- 芬蘭

- 法國

- 德國

- 匈牙利

- 冰島

- 義大利

- 拉脫維亞

- 立陶宛

- 荷蘭

- 挪威

- 波蘭

- 羅馬尼亞

- 俄羅斯

- 日本與斯洛伐克關係

- 斯洛維尼亞

- 西班牙

- 瑞典

- 瑞士

- 英國

- 道路長度

- 出口趨勢

- 進口趨勢

- 燃油價格趨勢

- 卡車運輸成本

- 卡車持有量(按類型)

- 主要卡車供應商

- 公路貨運噸位趨勢

- 公路貨運價格趨勢

- 模態共享

- 通貨膨脹率

- 法律規範

- 價值鍊和通路分析

第5章市場區隔

- 最終用戶產業

- 農業、漁業和林業

- 建設業

- 製造業

- 石油和天然氣、採礦和採石

- 批發和零售

- 其他

- 匯出目的地

- 國內的

- 國際貨運

- 卡車負載容量

- 整車裝載 (FTL)

- 零擔運輸 (LTL)

- 貨櫃運輸

- 貨櫃運輸

- 沒有容器

- 距離

- 遠距

- 短途運輸

- 產品成分

- 流體產品

- 固體貨物

- 溫度控制

- 非溫控

- 溫度控制

- 國家

- 法國

- 德國

- 義大利

- 荷蘭

- 北歐的

- 俄羅斯

- 西班牙

- 英國

- 其他歐洲國家

第6章競爭格局

- 關鍵策略趨勢

- 市場佔有率分析

- 商業狀況

- 公司簡介

- AP Moller-Maersk

- CH Robinson

- Dachser

- DB Schenker

- DHL Group

- DSV A/S(De Sammensluttede Vognmaend af Air and Sea)

- Kuehne+Nagel

- Mainfreight

- Scan Global Logistics

- XPO, Inc.

第7章:CEO面臨的關鍵策略問題

第 8 章 附錄

- 全球物流市場概覽

- 概述

- 五力分析框架

- 全球價值鏈分析

- 市場動態(市場促進因素、限制因素、機會)

- 資訊來源及延伸閱讀

- 圖片列表

- 關鍵見解

- 數據包

- 詞彙表

- 外匯

簡介目錄

Product Code: 90833

The Europe Road Freight Transport Market size is estimated at 496.83 billion USD in 2024, and is expected to reach 601.59 billion USD by 2030, growing at a CAGR of 3.24% during the forecast period (2024-2030).

Retail e-commerce surge driving advancements in the wholesale and retail trade end user segment

- In 2022, the manufacturing end-user segment grew due to the rise in human-robot collaboration, which boosted production. Germany is the fifth largest robot market globally, with 22,000 industrial robots utilized in various industries, accounting for 6% of the global robot installations as of 2021. Moreover, in 2021, the Schwarz Group, a German food retailer, emerged as the foremost retail company in Europe, with a total revenue of USD 153.75 billion within the region. In Germany, the retail sales of consumer durables were projected to increase by 1.50% YoY in 2022. This was supported by an estimated 5.40% increase in private consumption in 2022.

- In Europe's oil and gas, mining, and quarrying sectors, German regasification plans are one of the factors driving growth in the oil and gas end-user segments. Russia supplies the country's natural gas needs. As a result, Germany is expected to add the highest LNG regasification capacity in Europe between 2022 and 2026, accounting for 36% of the region's total capacity additions by 2026. In 2022, Italy's net energy import costs are expected to more than double, reaching USD 113.24 billion.

- The wholesale and retail trade end-user segment is poised for substantial growth in the upcoming years, primarily driven by the anticipated expansion of the European e-commerce industry, projected to register a compounded annual growth rate (CAGR) of 8.85 from 2023 to 2027. In the context of the German e-commerce landscape, it is projected that the market will encompass 68.4 million users by 2025, achieving a penetration rate of 81.9%, marking an increase from 80.1% in 2022.

Increasing road freight volume transported across Europe and government initiatives to develop the infrastructure are driving the growth in the market

- In 2022, the EU and extra-EU tons transported by international road freight transportation in France were major. For instance, the total EU/extra-EU transported by road between France and Switzerland held a share of 7.3% of the total tonnage transported by road, and the total EU/extra-EU transported by road between France and the United Kingdom held a share of 6.5% in 2022. Road haulage transported 68.1% of Italian goods during the first half of 2022, resulting in a 1.5% increase in transport (measured in tonne-km) compared to the previous year. The number of companies in the Italian road haulage sector reached approximately 100,797 units at the end of 2022, a rise of 1.34% from 99,465 at the end of 2021.

- The road freight transport market employs about 430,000 employees in Germany in about 35,000 road freight companies, which has been stable over the past five years. The fleet with a carrying capacity of 3.5 tons in 2021 was 964,696 in Germany and had a growth of 1.3% compared to 2020 and 3.4% over five years. The declining activity in all major economies and inflation, which led to a rise in fuel and wage costs, resulted in the decline of freight transportation through trucks between the 27th and 30th week of 2022 in the Netherlands. Since week 25, the weekly decrease in the movement of trucks was 9-21% lower than the same week in 2021.

- In the Nordics, the overseas shipments of trucks increased by 6.7% in 2022. The main destinations for truck exports from Denmark are the Netherlands, Poland, and Germany, with a combined 54% share of total exports. In the UK, the top five countries for exports and imports have remained relatively constant over time. However, exports to Germany decreased from 1.4 million tons in 2000 to 0.19 million tons in 2021.

Europe Road Freight Transport Market Trends

European Union allocated USD 5.76 billion to 135 transportation projects to boost economic recovery

- The transportation and warehouse sector plays a crucial role in supporting operations across various industries, with Germany leading as the dominant player, surpassing France and the United Kingdom. Globally, Germany ranks third in both imports and exports of goods. The German federal government expressed its intention to increase investments in transportation infrastructure, allocating over EUR 12 billion (USD 12.80 billion) for federal highways and around EUR 1.7 billion (USD 1.81 billion) for waterways in 2022, thereby demonstrating its commitment to improving transportation networks.

- The German government intends to invest more in rail than road network. In 2022, Deutsche Bahn, the federal government, and the local and regional governments invested roughly EUR 13.6 billion (USD 14.51 billion) in rail infrastructure. Lower Saxony, Hamburg, Bremen, Mecklenburg-Western Pomerania, and Schleswig-Holstein are partnering with DB to invest in modernizing their rail network by 2030.

- In 2022, the European Union approved EUR 5.4 billion through grants for approximately 135 transport infrastructural projects. These projects aim to aid post-pandemic economic recovery in the EU Member States, enhance transport links, promote sustainable transportation, boost safety, and create job opportunities. All supported projects are part of the Trans-European Transport Network, which connects EU Member States and aligns with the European Union's goal of completing the TEN-T core network by 2030 and the comprehensive network by 2050, all while aligning with climate objectives outlined in the European Green Deal.

Since February 2023, diesel imports from the Middle East, Asia, and North America have increased due to the ban on imports from Russia

- Gasoline prices surpassed EUR 2 (USD 2.13) per liter in most of the 19 eurozone countries in Q1 2022. The main reason behind the increased prices was supply issues due to the conflict between Russia and Ukraine, as Russia supplied more than a quarter of the EU's petroleum needs. In 2021, the average price for a liter of gasoline in the eurozone was EUR 1.30 (USD 1.38); at the start of 2022, the price was about EUR 1.55 (USD 1.65) per liter.

- Russia has been Europe's largest supplier of diesel. In 2023, diesel prices declined in Europe. Since February 2023, when the European Union implemented the ban on petroleum product imports from Russia, diesel exports from Russia to Europe have averaged 24,000 barrels per day (b/d), down by 96% from the 630,000 b/d Russia sent to Europe in 2022. From February through May, diesel exports to Europe increased by 51% (160,000 b/d) from the Middle East, by 97% (147,000 b/d) from Asia, and by 65% (47,000 b/d) from North America.

- Denmark is the most expensive country for petrol, and Finland is the most expensive for diesel. Austria has the cheapest petrol, and Spain is the cheapest for diesel. Fuel prices in the United Kingdom reached record highs in 2022, with the average price of petrol hitting 191.53 p-per-litre and diesel reaching 199.05 p-per-litre in July. The average cost of petrol at UK forecourts has risen to break 150p a liter (USD 1.80) since the start of 2023, and diesel has risen to 152.41p a liter (USD 1.83). Spanish fuel prices were lower than in the United Kingdom by about 20 cents per liter for petrol and 40 cents per liter for diesel in January 2023.

Europe Road Freight Transport Industry Overview

The Europe Road Freight Transport Market is fragmented, with the top five companies occupying 5.99%. The major players in this market are Dachser, DB Schenker, DHL Group, DSV A/S (De Sammensluttede Vognmaend af Air and Sea) and XPO, Inc. (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 GDP Distribution By Economic Activity

- 4.2 GDP Growth By Economic Activity

- 4.3 Economic Performance And Profile

- 4.3.1 Trends in E-Commerce Industry

- 4.3.2 Trends in Manufacturing Industry

- 4.4 Transport And Storage Sector GDP

- 4.5 Logistics Performance

- 4.5.1 Albania

- 4.5.2 Bulgaria

- 4.5.3 Croatia

- 4.5.4 Czech Republic

- 4.5.5 Denmark

- 4.5.6 Estonia

- 4.5.7 Finland

- 4.5.8 France

- 4.5.9 Germany

- 4.5.10 Hungary

- 4.5.11 Iceland

- 4.5.12 Italy

- 4.5.13 Latvia

- 4.5.14 Lithuania

- 4.5.15 Netherlands

- 4.5.16 Norway

- 4.5.17 Poland

- 4.5.18 Romania

- 4.5.19 Russia

- 4.5.20 Slovak Republic

- 4.5.21 Slovenia

- 4.5.22 Spain

- 4.5.23 Sweden

- 4.5.24 Switzerland

- 4.5.25 United Kingdom

- 4.6 Length Of Roads

- 4.7 Export Trends

- 4.8 Import Trends

- 4.9 Fuel Pricing Trends

- 4.10 Trucking Operational Costs

- 4.11 Trucking Fleet Size By Type

- 4.12 Major Truck Suppliers

- 4.13 Road Freight Tonnage Trends

- 4.14 Road Freight Pricing Trends

- 4.15 Modal Share

- 4.16 Inflation

- 4.17 Regulatory Framework

- 4.18 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 End User Industry

- 5.1.1 Agriculture, Fishing, and Forestry

- 5.1.2 Construction

- 5.1.3 Manufacturing

- 5.1.4 Oil and Gas, Mining and Quarrying

- 5.1.5 Wholesale and Retail Trade

- 5.1.6 Others

- 5.2 Destination

- 5.2.1 Domestic

- 5.2.2 International

- 5.3 Truckload Specification

- 5.3.1 Full-Truck-Load (FTL)

- 5.3.2 Less than-Truck-Load (LTL)

- 5.4 Containerization

- 5.4.1 Containerized

- 5.4.2 Non-Containerized

- 5.5 Distance

- 5.5.1 Long Haul

- 5.5.2 Short Haul

- 5.6 Goods Configuration

- 5.6.1 Fluid Goods

- 5.6.2 Solid Goods

- 5.7 Temperature Control

- 5.7.1 Non-Temperature Controlled

- 5.7.2 Temperature Controlled

- 5.8 Country

- 5.8.1 France

- 5.8.2 Germany

- 5.8.3 Italy

- 5.8.4 Netherlands

- 5.8.5 Nordics

- 5.8.6 Russia

- 5.8.7 Spain

- 5.8.8 United Kingdom

- 5.8.9 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 A.P. Moller - Maersk

- 6.4.2 C.H. Robinson

- 6.4.3 Dachser

- 6.4.4 DB Schenker

- 6.4.5 DHL Group

- 6.4.6 DSV A/S (De Sammensluttede Vognmaend af Air and Sea)

- 6.4.7 Kuehne + Nagel

- 6.4.8 Mainfreight

- 6.4.9 Scan Global Logistics

- 6.4.10 XPO, Inc.

7 KEY STRATEGIC QUESTIONS FOR ROAD FREIGHT CEOS

8 APPENDIX

- 8.1 Global Logistics Market Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (Market Drivers, Restraints & Opportunities)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

- 8.7 Currency Exchange Rate

02-2729-4219

+886-2-2729-4219