|

市場調查報告書

商品編碼

1693392

法國密封劑:市場佔有率分析、行業趨勢和統計數據、成長預測(2025-2030 年)France Sealants - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

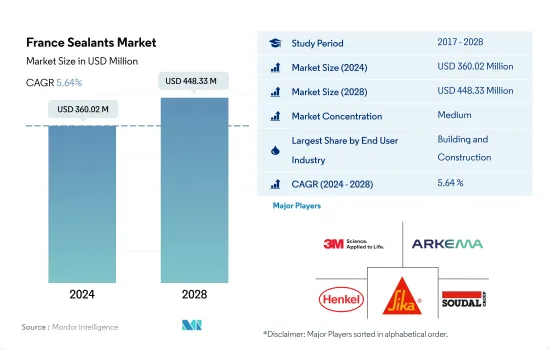

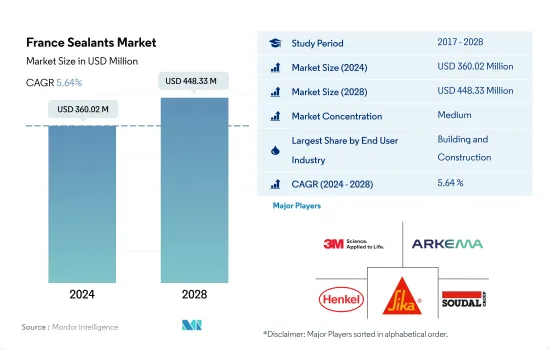

預計 2024 年法國密封劑市場規模為 3.6002 億美元,到 2028 年將達到 4.4833 億美元,預測期內(2024-2028 年)的複合年成長率為 5.64%。

住宅增加推動密封膠成長

- 法國的密封劑市場主要由建設產業推動,因為密封劑用於防水、防風雨密封、裂縫密封和接縫密封。 2021年,法國建築業產量激增10.5%,密封劑的需求也隨之增加。預計預測期內,住宅和破舊住宅維護的快速成長將持續推動法國對密封劑的需求。

- 其他終端用戶產業預計將佔據法國密封劑市場的第二大佔有率,這得益於其在電子和電氣設備製造業的灌封和保護材料等多種應用。它們特別用於密封感測器和電纜。法國電子市場在過去幾年中一直保持穩定成長,預計在預測期內將繼續產生對密封劑的需求。預計到 2027 年,電器產品領域的複合年成長率將達到 1.39%。此外,機車、船舶和 DIY 行業對永續和節能應用的密封劑的需求不斷成長,預計將在預測期內提升市場佔有率。

- 密封劑在醫療保健和汽車行業有著廣泛的應用,法國幾十年來一直在這些領域大力發展。在醫療保健領域,它主要用於組裝和密封醫療設備。此外,在汽車領域,密封劑用於各種基材,包括玻璃、金屬、塑膠和塗漆表面,主要用於引擎和汽車墊圈。預計這些因素將在預測期內增加法國對密封劑的需求。

法國密封膠市場趨勢

2024年奧運推動法國建築業發展

- 法國擁有歐洲第二大建築業。該國的建築業指數呈現溫和成長,產業銷售指數在過去幾年中一直緩慢上升。該國建築業在經歷了長達八年的衰退之後,最近開始復甦。

- 2020年建築業經歷了顯著下滑,建築業總產出和新訂單大幅下降。受新冠疫情嚴重衝擊,法國建築業成長下降逾-12%。

- 2021年第四季,法國建築業總產出與2020年第四季相比下降了0.2%,與去年同期相比下降了1.2%。該國2021年12月建設業產量年減2.6%,較上季下降7%,導致市場需求下降。

- 不過,2022年第一季法國建設業總產量與2021年第一季相比成長了0.9%,與去年同期相比成長了2.6%。 2022 年 4 月,該國建設業產量與去年同期相比成長了 1.5%,與 2022 年 3 月相比成長了 1.2%。預計住宅建築業從疫情中復甦以及即將到來的 2024 年奧運會將在預測期內推動市場發展。

- 因此,預計所有上述因素都會對所研究的市場產生影響。

除了在 2035 年實現汽車淨零排放外,電動車註冊量的增加還可能促進汽車產量

- 法國汽車工業的表現比其他歐洲主要國家好得多。汽車產量在2018年之前持續成長,但由於汽車市場受到新冠疫情的不利影響,2019年進一步下降了8.3%。

- 2020年汽車和輕型商用車產量為1,316,371輛,而2019年為2,175,350輛,下降了39.5%。疫情迫使全國各地的製造單位暫時關閉。原料供應有限也加劇了汽車產業面臨的挑戰。

- 2021年,法國插電式電動車新註冊量超過31.5萬輛,較2020年成長62%,提振了法國電動車市場的需求。因此,2022年3月電動車的市場佔有率與去年同期相比從16.1%成長至21.4%。

- 法國汽車業一致譴責歐洲議會投票決定從2035年起禁止生產內燃機汽車。該國計劃在2035年實現汽車淨零排放,這很可能在預測期內推動該國汽車市場的發展。

法國密封劑產業概況。

法國密封劑市場適度整合,前五大公司佔43.64%的市佔率。該市場的主要企業有:3M、阿科瑪集團、漢高股份公司、西卡股份公司和Soudal Holding NV(按字母順序排列)

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章執行摘要和主要發現

第2章 報告要約

第3章 引言

- 研究假設和市場定義

- 研究範圍

- 調查方法

第4章 產業主要趨勢

- 最終用戶趨勢

- 航太

- 車

- 建築與施工

- 法律規範

- 法國

- 價值鍊和通路分析

第5章市場區隔

- 最終用戶產業

- 航太

- 車

- 建築與施工

- 衛生保健

- 其他最終用戶產業

- 樹脂

- 丙烯酸纖維

- 環氧樹脂

- 聚氨酯

- 矽膠

- 其他樹脂

第6章競爭格局

- 關鍵策略趨勢

- 市場佔有率分析

- 商業狀況

- 公司簡介

- 3M

- Arkema Group

- CERMIX

- Dow

- Henkel AG & Co. KGaA

- ISPO Group

- MAPEI SpA

- RPM International Inc.

- Sika AG

- Soudal Holding NV

第7章:CEO面臨的關鍵策略問題

第 8 章 附錄

- 全球黏合劑和密封劑產業概況

- 概述

- 五力分析框架(產業吸引力分析)

- 全球價值鏈分析

- 促進因素、阻礙因素和機會

- 資訊來源及延伸閱讀

- 圖片列表

- 關鍵見解

- 資料包

- 詞彙表

簡介目錄

Product Code: 92448

The France Sealants Market size is estimated at 360.02 million USD in 2024, and is expected to reach 448.33 million USD by 2028, growing at a CAGR of 5.64% during the forecast period (2024-2028).

Growing construction in residential sector to foster the growth of sealants

- The French sealants market is driven mainly by the construction industry due to applications of sealants waterproofing, weather-sealing, crack-sealing, and joint-sealing. The construction industry of France surged by 10.5% in 2021 in volume, which increased the demand for sealants. The rapid growth of residential dwellings and maintenance of aged housing are expected to constantly foster the demand for sealants in France over the forecast period.

- The other end-user industries segment will likely account for the second-largest share in the French sealants market owing to the diverse applications in the electronics and electrical equipment manufacturing industry for potting and protecting materials. They are used for sealing sensors and cables, among others. The French electronics market has registered steady growth over the few years, and it is expected to continue, creating demand for sealants over the forecast period. The consumer electronics segment will likely register a CAGR of 1.39% up to 2027. In addition, the rising demand for sealants in the locomotive, marine, and DIY industries for sustainable and energy-efficient applications is expected to boost the market share over the forecast period.

- Sealants have considerable applications in the healthcare and automotive industries, and France has developed significantly in these sectors over the decades. They are used in healthcare primarily for assembling and sealing medical devices. The automotive sector also exhibits significant application of sealants to various substrates, such as glass, metal, plastic, and painted surfaces, and is mainly used in engines and car gaskets. These factors are expected to augment the demand for sealants in France over the forecast period.

France Sealants Market Trends

Hosting the 2024 Olympics is likely to boost the construction sector in the country

- France has the second-largest construction industry in the European region. The construction index in the country witnessed slow growth, with a gradual increase in the industry turnover index over the past few years. The construction industry in the country recently gained momentum after eight long years of decline.

- In 2020, the construction sector witnessed a huge decline, with the total construction output and new orders declining considerably. The growth of the French construction industry fell by over -12% due to the severe impact of the COVID-19 pandemic.

- The total construction production in France declined by 0.2% in Q4 2021 compared to Q4 2020 and by 1.2% compared to the previous quarter in the same year. In December 2021, the country's production from the construction industry declined by 2.6% compared to the same month in the previous year and declined by 7% compared to November 2021, decreasing the demand for the market.

- However, the total construction production in France increased by 0.9% in Q1 2022 compared to Q1 2021 and by 2.6% compared to the previous quarter of the same year. In April 2022, the country's production from the construction industry increased by 1.5% compared to the same month in the previous year and increased by 1.2% compared to March 2022. The recovery of the residential construction sector from the pandemic and the upcoming 2024 Olympics are estimated to drive the market during the forecast period.

- Therefore, all the abovementioned factors are expected to impact the market studied.

In addition to net-zero vehicle emissions by 2035, electric vehicle registrations growth is likely to propel the automotive production

- The automotive industry in France has fared much better compared to other major European economies. Automotive vehicle production experienced continuous growth till 2018 and further exhibited a decline of 8.3% in 2019, as the automotive market was negatively affected by the COVID-19 pandemic.

- In 2020, the country produced 1,316,371 cars and light commercial vehicles compared to 2,175,350 vehicles produced during 2019, recording a decline of 39.5%, as production came to a halt in 2020 due to the COVID-19 pandemic. The pandemic forced the temporary shutdown of manufacturing units across different parts of the country. Limited raw material supply added to the challenges faced by the automobile sector.

- In 2021, the country's new plug-ins electric vehicle registration stood at over 315,000, registering a growth rate of 62% compared to 2020, enhancing the demand of the electric vehicle segment in France. Along with it, electric vehicles registered a 21.4% market share in March 2022, up from 16.1% Y-o-Y.

- The French car industry has unanimously condemned the European Parliament's vote to ban the production of combustion engine cars from 2035. The country plans to achieve net-zero vehicle emissions by 2035, which is likely to drive the automotive vehicle market in the country over the forecast period.

France Sealants Industry Overview

The France Sealants Market is moderately consolidated, with the top five companies occupying 43.64%. The major players in this market are 3M, Arkema Group, Henkel AG & Co. KGaA, Sika AG and Soudal Holding N.V. (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 End User Trends

- 4.1.1 Aerospace

- 4.1.2 Automotive

- 4.1.3 Building and Construction

- 4.2 Regulatory Framework

- 4.2.1 France

- 4.3 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2028 and analysis of growth prospects)

- 5.1 End User Industry

- 5.1.1 Aerospace

- 5.1.2 Automotive

- 5.1.3 Building and Construction

- 5.1.4 Healthcare

- 5.1.5 Other End-user Industries

- 5.2 Resin

- 5.2.1 Acrylic

- 5.2.2 Epoxy

- 5.2.3 Polyurethane

- 5.2.4 Silicone

- 5.2.5 Other Resins

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and Analysis of Recent Developments).

- 6.4.1 3M

- 6.4.2 Arkema Group

- 6.4.3 CERMIX

- 6.4.4 Dow

- 6.4.5 Henkel AG & Co. KGaA

- 6.4.6 ISPO Group

- 6.4.7 MAPEI S.p.A.

- 6.4.8 RPM International Inc.

- 6.4.9 Sika AG

- 6.4.10 Soudal Holding N.V.

7 KEY STRATEGIC QUESTIONS FOR ADHESIVES AND SEALANTS CEOS

8 APPENDIX

- 8.1 Global Adhesives and Sealants Industry Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework (Industry Attractiveness Analysis)

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Drivers, Restraints, and Opportunities

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

02-2729-4219

+886-2-2729-4219