|

市場調查報告書

商品編碼

1693401

印尼密封劑:市場佔有率分析、行業趨勢和統計數據、成長預測(2025-2030 年)Indonesia Sealants - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

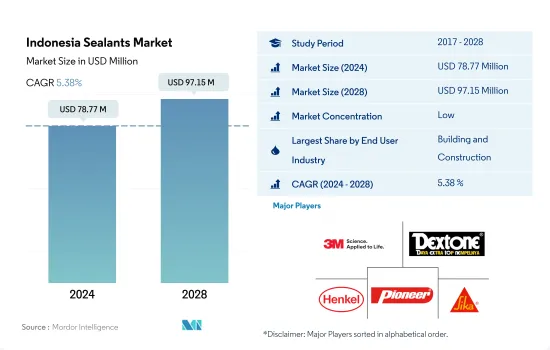

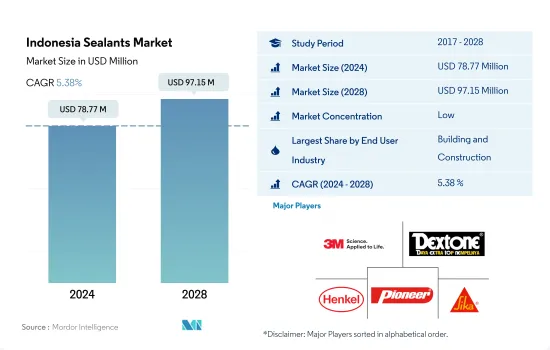

預計 2024 年印尼密封劑市場規模為 7,877 萬美元,到 2028 年將達到 9,715 萬美元,預測期內(2024-2028 年)的複合年成長率為 5.38%。

政府對電動車購買的激勵措施,加上電動車的日益普及,預計將推動印尼密封膠的消費

- 印尼密封劑市場主要受建設產業的推動,其次是其他終端用戶產業,因為密封劑在建築和建設活動中有著廣泛的應用,如防水、防風雨密封、裂縫密封和接縫密封。此外,建築密封劑的使用壽命很長,且易於應用於各種基材。建築業是 2021 年該國國內生產總值) 的第四大貢獻產業。然而,由於新冠疫情限制和原料短缺,2020 年建設活動有所下降。

- 其他終端用途產業預計將佔據印尼密封劑市場的第二大市場佔有率,因為它們在電子和電氣設備製造業中作為灌封和保護材料有著廣泛的應用,可用於密封感測器、電纜等。印尼電子市場預計將呈現顯著的成長率,從而在預測期內創造對密封劑的需求。此外,電子商務活動的快速成長以及消費性電子領域的強大市場定位預計將推動印尼密封膠市場的行業規模。

- 密封劑在醫療保健和汽車行業有著廣泛的應用,印尼最近在這些領域取得了重大進展。密封劑在醫療保健領域主要用於組裝和密封醫療設備零件。由於政府的利好政策和消費者對輕型車的偏好,對電動車的需求不斷增加,可能會逐漸影響對密封劑的需求。

印尼密封膠市場趨勢

政府和公共對住宅和非住宅建築計劃的投資將推動該行業

- 預計印尼建設產業在 2022 年至 2028 年期間的複合年成長率約為 3.43%。過去十年,印尼建築業的成長速度一直在下降,2019 年與 2018 年相比僅成長了 6.2% 多一點。然而,2020 年,由於新冠疫情,建築業經歷了大幅放緩。在 2022-2028 年的預測期內,印尼建築膠合劑市場預計將以約 3.37% 的複合年成長率擴張,以金額為準也將以約 5.42% 的複合年成長率擴張。

- 目前,該行業正在投資大型計劃以促進國家的發展。例如,印尼正準備斥資約 400 億美元擴建雅加達地鐵網路,以促進該國建設產業的發展。印尼政府也宣布將在婆羅洲島建設新首都,耗資466兆印尼幣(266億英鎊),耗時10年。

- 同時,三菱商事正與淡馬錫控股公司計劃在雅加達西南25公里處建造一座智慧城市。該智慧城市將包括住宅、購物中心和醫療設施,目標是容納 40,000 至 60,000 名永久居民。此外,政府還計劃維修印尼東部省份多達 2,200 套低品質住宅,總預算維修385 億印度盧比。發展,尤其是住宅建築的發展,往往會增加該國對黏合劑和密封劑的需求。

汽車零件出口額強勁成長帶動產業成長

- 印尼的汽車產業仍然是一個有前景的產業,為該國的經濟發展做出了重大貢獻。印尼共和國產業部長阿古斯古米旺卡塔薩斯米塔表示,2021年印尼汽車產業呈現驚人成長,成長率達到17.82%的兩位數。 2019年,印尼汽車產量約1,286,848輛,但受新冠疫情影響,2020年產量大幅下滑至690,176輛,降幅約46%。受此影響,2019年至2021年汽車產量變化約為-13%,而2020年至2021年汽車產量變化約為63%。

- 2019年至2021年,印尼汽車業貿易連續多年保持順差。 2020年,全球疫情導致進出口雙雙下滑,限制和擾亂了經濟活動,擾亂了全球供應鏈,打擊了整體生產。然而,2021年生產強勁,導致出口和進口均大幅成長,貿易差額達19.3億美元。儘管 2021 年的商業活動達到了近十年來的最高水平,但貿易順差與 2019 年和 2020 年相比卻是最低的,當時的順差分別為 20 億美元和 19.5 億美元。

- 從全球來看,電動車的發展預示著印尼交通運輸部門政策的根本轉變。鑑於該國的鎳蘊藏量,印尼完全有能力成為全球電動車供應鏈的主要企業。為了成為該地區電動車未來的一部分,印尼需要投資技術、人才、可再生能源和基礎設施。

印尼密封膠產業概況

印尼密封膠市場較為分散,前五大公司佔24.25%的市佔率。市場的主要企業有:3M、DEXTONE INDONESIA、Henkel AG & Co. KGaA、Pioneer Adhesives, Inc. 和 Sika AG(按字母順序排列)

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章執行摘要和主要發現

第2章 報告要約

第3章 引言

- 研究假設和市場定義

- 研究範圍

- 調查方法

第4章 產業主要趨勢

- 最終用戶趨勢

- 航太

- 車

- 建築與施工

- 法律規範

- 印尼

- 價值鍊和通路分析

第5章市場區隔

- 最終用戶產業

- 航太

- 車

- 建築與施工

- 衛生保健

- 其他最終用戶產業

- 樹脂

- 丙烯酸纖維

- 環氧樹脂

- 聚氨酯

- 矽膠

- 其他樹脂

第6章競爭格局

- 關鍵策略趨勢

- 市場佔有率分析

- 商業狀況

- 公司簡介.

- 3M

- Arkema Group

- DEXTONE INDONESIA

- Dow

- HB Fuller Company

- Henkel AG & Co. KGaA

- IKA GROUP

- Illinois Tool Works Inc.

- Pioneer Adhesives, Inc.

- Sika AG

第7章:CEO面臨的關鍵策略問題

第 8 章 附錄

- 全球黏合劑和密封劑產業概況

- 概述

- 五力分析框架(產業吸引力分析)

- 全球價值鏈分析

- 促進因素、阻礙因素和機會

- 資訊來源及延伸閱讀

- 圖片列表

- 關鍵見解

- 資料包

- 詞彙表

簡介目錄

Product Code: 92457

The Indonesia Sealants Market size is estimated at 78.77 million USD in 2024, and is expected to reach 97.15 million USD by 2028, growing at a CAGR of 5.38% during the forecast period (2024-2028).

Rising popularity of electric vehicles in addition to government incentives for the purchase of EVs predicted to raise the consumption of sealants in Indonesia

- The Indonesian sealants market is largely driven by the construction industry, followed by other end-user industries due to the wide range of applications of sealants in building and construction activities such as waterproofing, weather-sealing, cracks-sealing, and joint-sealing. Moreover, construction sealants are designed for longevity and ease of application on different substrates. The construction industry has registered as the fourth-largest contributor to the country's GDP in 2021. However, construction activities decreased in 2020 due to COVID-19 restrictions and the scarcity of raw materials.

- Other end-user industries are likely to obtain the second largest market share of the Indonesian sealants market owing to the diverse applications in the electronics and electrical equipment manufacturing industry for potting and protecting materials, and they are used for sealing sensors and cables, etc. The electronics market of Indonesia is expected to showcase a considerable growth rate which will create demand for sealants over the projected time period. Moreover, the rapid growth of e-commerce activities, along with the strong market positioning of the consumer electronics segment, would like to propel the industry size of the Indonesian sealants market.

- Sealants have considerable applications in the healthcare and automotive industries, and Indonesia has achieved significant development in these sectors in recent times. Sealants are used in healthcare mostly for assembling and sealing medical device parts. Increasing demand for electric vehicles due to favourable government policies, along with consumer preferences for lightweight vehicles, will gradually influence the demand for sealants.

Indonesia Sealants Market Trends

Government & public investments in residential and non-residential construction projects will boost the industry

- The Indonesian construction industry is expected to expand at a CAGR of roughly 3.43% from 2022 to 2028. Over the last decade, the construction sector in Indonesia has grown with a downward trend, reporting a gain of more than 6.2% in 2019 when compared to 2018. However, the building sector experienced a significant slowdown in 2020 as a result of the COVID-19 epidemic. During the forecast period of 2022 to 2028, the Indonesia building adhesives market is expected to expand at a CAGR of approximately 3.37% in terms of volume and 5.42% in terms of value during the forecast period.

- Currently, the industry is investing in large infrastructure projects in order to increase the development of the country. For instance, Indonesia has been preparing to spend about USD 40 billion to extend Jakarta's metro network, which is poised to boost the country's construction industry. Furthermore, the government of Indonesia revealed that the new capital city would be built on the island of Borneo with an investment of IDR 466 trillion (GBP 26.6 billion), and construction would take 10 years.

- On the other hand, Mitsubishi Corp., along with Temasek Holding, is planning to build a smart city 25 km southwest of Jakarta. The smart city includes homes, shopping centers, and medical facilities, with the goal of housing 40,000 to 60,000 permanent residents. Moreover, the government has planned to renovate as many as 2,200 low-quality houses in the eastern Indonesian province, which will be renovated and rebuilt with a total budget of IDR 38.5 billion. The development, specifically residential construction, tends to increase the demand for adhesives and sealants in the country.

Considerable growth of export values for automotive parts & components will proliferate the industry growth

- The automotive industry in Indonesia remains a promising sector that contributes significantly to the country's economic progress. According to Agus Gumiwang Kartasasmita, Minister of Sector Republic of Indonesia, the automobile industry in Indonesia witnessed tremendous growth in 2021, with a double-digit growth rate of 17.82%. In 2019, the country produced about 12,86,848 units of vehicles which drastically reduced to 6,90,176 units in 2020, accounting for a decline of about 46% owing to the COVID-19 pandemic. Due to this reason, the variation in automotive production between 2019 and 2021 resulted in about -13%, whereas between 2020 and 2021, the variation was about 63%.

- The trade in the automotive sector in Indonesia showed a surplus in all years from 2019 to 2021. Both exports and imports fell in 2020 as a result of the global pandemic, which generated limitations and disruptions in economic activities, so impeding the global supply chain and hurting total production. However, in line with the robust output in 2021, both export and import values increased significantly, with a trade balance of USD 1.93 billion. Although 2021 had the highest level of commercial activity in the prior ten years, the trade balance surplus was the lowest in comparison to 2019 and 2020, which had balance values of USD 2 billion and USD 1.95 billion, respectively.

- Globally, the development of EVs signaled a fundamental shift in the Indonesian transportation sector's policies. Given the country's nickel reserves, Indonesia is well-placed to become a major player in the global EV supply chain. To be a part of the region's EV future, Indonesia needs to invest in technology, talent resources, renewable energy, and infrastructure.

Indonesia Sealants Industry Overview

The Indonesia Sealants Market is fragmented, with the top five companies occupying 24.25%. The major players in this market are 3M, DEXTONE INDONESIA, Henkel AG & Co. KGaA, Pioneer Adhesives, Inc. and Sika AG (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 End User Trends

- 4.1.1 Aerospace

- 4.1.2 Automotive

- 4.1.3 Building and Construction

- 4.2 Regulatory Framework

- 4.2.1 Indonesia

- 4.3 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2028 and analysis of growth prospects)

- 5.1 End User Industry

- 5.1.1 Aerospace

- 5.1.2 Automotive

- 5.1.3 Building and Construction

- 5.1.4 Healthcare

- 5.1.5 Other End-user Industries

- 5.2 Resin

- 5.2.1 Acrylic

- 5.2.2 Epoxy

- 5.2.3 Polyurethane

- 5.2.4 Silicone

- 5.2.5 Other Resins

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and Analysis of Recent Developments).

- 6.4.1 3M

- 6.4.2 Arkema Group

- 6.4.3 DEXTONE INDONESIA

- 6.4.4 Dow

- 6.4.5 H.B. Fuller Company

- 6.4.6 Henkel AG & Co. KGaA

- 6.4.7 IKA GROUP

- 6.4.8 Illinois Tool Works Inc.

- 6.4.9 Pioneer Adhesives, Inc.

- 6.4.10 Sika AG

7 KEY STRATEGIC QUESTIONS FOR ADHESIVES AND SEALANTS CEOS

8 APPENDIX

- 8.1 Global Adhesives and Sealants Industry Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework (Industry Attractiveness Analysis)

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Drivers, Restraints, and Opportunities

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

02-2729-4219

+886-2-2729-4219