|

市場調查報告書

商品編碼

1693398

印度密封膠:市場佔有率分析、產業趨勢與統計、2025-2030 年成長預測India Sealants - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

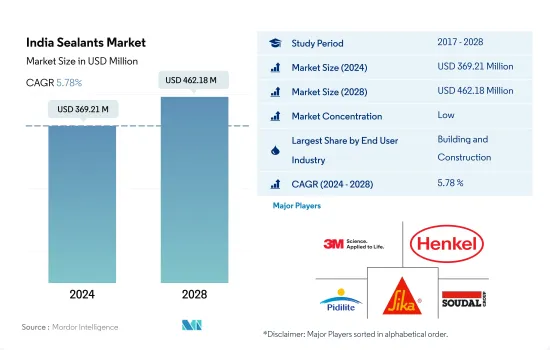

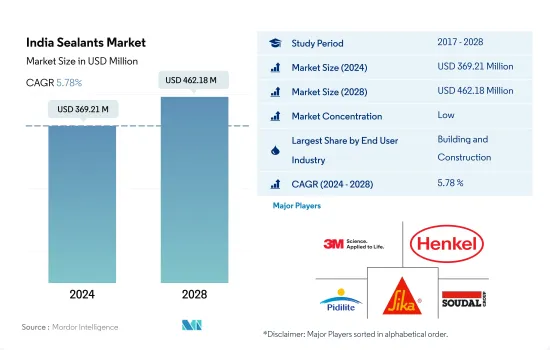

印度密封劑市場規模預計在 2024 年為 3.6921 億美元,預計到 2028 年將達到 4.6218 億美元,預測期內(2024-2028 年)的複合年成長率為 5.78%。

汽車市場和建築業的蓬勃發展預計將推動印度密封膠的消費

- 建築業在印度的密封劑市場中佔據主導地位,其次是其他終端用戶行業,因為密封劑在建築和建設活動中有多種應用,例如防水、防風雨密封、裂縫密封和接縫密封。建築密封劑具有較長的使用壽命,並且易於應用於各種基材。 2021年,印度建築業約佔該國GDP的9%,抵銷了新冠疫情帶來的不利影響。印度政府持續推動低能耗建築和永續發展,預計預測期內對密封劑的需求將逐步增加。

- 電氣設備製造中使用各種密封劑進行灌封和保護應用。它們用於密封感測器、電纜等。預計2021年印度電子市場將佔該國GDP的近2.5%,並且由於通訊和家用電子電器市場的需求不斷成長,未來幾年可能會出現可觀的成長。預計這將推動其他終端用戶工業領域對密封劑的需求。印度的機車、船舶和 DIY 行業正在呈現顯著成長,預計到 2028 年將推動對基本密封劑的需求。

- 密封劑在汽車工業中有著廣泛的用途,主要用於引擎和汽車墊圈,並為各種基材提供廣泛的黏合性。由於消費者趨勢向個人出行轉變,印度的汽車製造業取得了良好的成長,預計這一趨勢將在未來持續下去。因此,預計此類趨勢將在 2022-2028 年預測期內推動對密封劑的需求。

印度密封膠市場趨勢

政府在住宅領域的投資和舉措,例如「全民住宅」和 Pradhan Mantri Awas Yojana (PMAY),正在推動建築業的發展

- 建築業是印度第二大產業,對GDP的貢獻率約為9%,並在2019年呈現出良好的成長動能。然而,新冠疫情爆發導致政府短暫封鎖,建築業因此大幅下滑。建設業是印度第二大產業,對GDP的貢獻率約9%。預計到 2025 年,印度將成為世界第三大建築市場。此外,預計預測期內(2022-2028 年),建築業的複合年成長率約為 3.79%。

- 在住宅領域,政府正在未來幾年推動大型計劃。印度政府的「全民住宅」計畫旨在到 2022 年為都市區貧困階級建造超過 2,000 萬套經濟適用住宅。這將極大地促進住宅(市場上最大的類別),到 2023 年,住宅建設將佔到該行業總量的三分之一以上。此外,諸如 Pradhan Mantri Awas Yojana (PMAY) 等舉措旨在到 2022 年為大量人口提供經濟適用住宅。政府也致力於為建造或購買首套房屋的人提供部分抵押房屋抵押貸款利息補貼。

- 印度建築領域也吸引了大量外國投資者的興趣。 2000 年 4 月至 2020 年 3 月,建築和開發領域(鄉鎮、住宅、建築基礎設施和建築開發計劃)的外國直接投資 (FDI) 達到 256.6 億美元。全國範圍內基礎設施和建築業發展的增加將導致對黏合劑和密封劑的需求增加。

政府推出的 e-AMRIT 等措施以及汽車貸款利率降低 2-3% 將推動汽車製造業

- 到2020年,印度的汽車工業將成為亞太地區第四大汽車工業。政府在2021年撥款4.32兆印度盧比擴建道路等措施也導致道路上車輛數量的增加。預計這一成長趨勢將持續到2028年。

- 由於全國範圍內的封鎖、供應鏈中斷和整體經濟放緩,新冠疫情導致乘用車銷售量從 2019 年的 338 萬輛下降到 2021 年的 239 萬輛。不過,由於政府採取措施支持汽車製造業,包括將汽車貸款利率降低 2-3 個百分點,2022 年 3 月新車銷售量升至 272 萬輛。在乘用車領域,瑪魯蒂鈴木是最大的汽車品牌,2021 年的市場佔有率為 52%。預計這一成長趨勢將在預測期內(2022-2028 年)持續下去。

- 商用車方面,塔塔汽車銷售量最大,2022年3月市場佔有率接近43%。商用車銷量從2021年的568,560輛增加至2022年3月的716,570輛,這得益於2020年新冠疫情引發的虧損經濟復甦。商用車銷量從2021年的568,560輛增加至2022年3月的716,570輛,這得益於2020年新冠疫情引發的虧損經濟復甦。

- 印度政府透過 e-AMRIT 等舉措推動電動車製造業的發展,這將推動 2028 年前電動車產量的增加。與 2020 年相比,2021 年印度的電動車銷量將成長 108%。

印度密封膠產業概況

印度密封劑市場較為分散,前五大公司佔21.68%的市佔率。該市場的主要企業有:3M、漢高股份公司、Pidilite Industries Ltd.、西卡股份公司和Soudal Holding NV。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章執行摘要和主要發現

第2章 報告要約

第3章 引言

- 研究假設和市場定義

- 研究範圍

- 調查方法

第4章 產業主要趨勢

- 最終用戶趨勢

- 航太

- 車

- 建築與施工

- 法律規範

- 印度

- 價值鍊和通路分析

第5章市場區隔

- 最終用戶產業

- 航太

- 車

- 建築與施工

- 醫療保健

- 其他

- 樹脂

- 丙烯酸纖維

- 環氧樹脂

- 聚氨酯

- 矽膠

- 其他

第6章競爭格局

- 關鍵策略趨勢

- 市場佔有率分析

- 商業狀況

- 公司簡介

- 3M

- Arkema Group

- ASTRAL ADHESIVES

- Dow

- Henkel AG & Co. KGaA

- Jubilant Industries Ltd.

- Pidilite Industries Ltd.

- Sika AG

- Soudal Holding NV

- Wacker Chemie AG

第7章 CEO 的關鍵策略問題

第 8 章 附錄

- 全球黏合劑和密封劑產業概況

- 概述

- 五力分析框架(產業吸引力分析)

- 全球價值鏈分析

- 促進因素、限制因素和機會

- 資訊來源及延伸閱讀

- 圖片列表

- 關鍵見解

- 數據包

- 詞彙表

簡介目錄

Product Code: 92454

The India Sealants Market size is estimated at 369.21 million USD in 2024, and is expected to reach 462.18 million USD by 2028, growing at a CAGR of 5.78% during the forecast period (2024-2028).

Emerging automotive market and construction industry are expected to boost the consumption of sealants in India

- The construction industry dominates the Indian sealants market, followed by other end-user industries due to the diverse applications of sealants in building and construction activities, such as waterproofing, weather-sealing, cracks-sealing, and joint-sealing. Construction sealants are designed for longevity and ease of application on different substrates. The Indian construction sector accounted for about 9% of the nation's GDP in 2021 by offsetting the adverse impacts of the COVID-19 pandemic. The Indian government continuously promotes low-energy buildings and sustainable development, which is expected to increase the demand for sealants over the forecast period gradually.

- Various sealants are used in electrical equipment manufacturing for potting and protecting applications. They are used for sealing sensors and cables, etc. The Indian electronics market accounted for nearly 2.5% of the country's GDP in 2021 and is likely to record promising growth over the coming years due to the growing demand from the telecommunication and domestic appliances market. This, in turn, will foster the demand for sealants in the other end-user industry segment. India has showcased considerable growth in the locomotive, marine, and DIY industries, which is expected to boost the demand for the required sealants by 2028.

- Sealants have diverse applications in the automotive industry and exhibit extensive bonding to various substrates, mainly used for engines and car gaskets. India has achieved decent growth in automotive production due to the shifting consumer trend toward personal mobility, which is likely to continue over the coming years. Thus, such a trend is expected to augment the demand for sealants over the forecast period 2022-2028.

India Sealants Market Trends

Government investments and initiatives such as Housing for All and Pradhan Mantri Awas Yojana (PMAY) for the housing sector to lead the construction industry

- The construction industry is the second-largest industry in India, with a GDP contribution of about 9%, and it showed promising growth in 2019. However, due to the outbreak of COVID-19, the construction sector witnessed a significant decline, owing to the lockdown by the government for a brief period. The construction industry is the second-largest industry in India, with a GDP contribution of about 9%. India is expected to become the third-largest construction market in the world by 2025. Moreover, the construction industry is expected to register a CAGR of about 3.79% during the forecast period (2022 - 2028).

- In the residential segment, the government is pushing huge projects in the next few years. The government's 'Housing for All initiative aims to build more than 20 million affordable homes for the urban poor by 2022. This will provide a significant boost to residential construction (the market's largest category) and accounts for more than a third of the industry's total value by 2023. Furthermore, initiatives such as Pradhan Mantri Awas Yojana (PMAY) are intended to provide affordable homes to many people by 2022. The government is also into providing some subsidiary on interest on housing loans if a citizen builds/buys their first house.

- India is also witnessing significant interest from international investors in the construction space. Foreign Direct Investment (FDI) in the construction development sector (townships, housing, built-up infrastructure, and construction development projects) stood at USD 25.66 billion from April 2000 to March 2020. The increasing infrastructure and construction development across the nation leads to an increase in the demand for adhesives and sealants.

Rising government initiatives such as e-AMRIT and auto loan interest rates decrease by 2-3% to lead the automotive manufacturing

- The Indian automotive industry was the fourth largest in the Asia-Pacific by volume in 2020. With the government initiatives such as the expansion of roads in 2021 by allocation of funds of INR 4.32 trillion, the number of vehicles has also increased on roads. This trend of growth is expected to sustain in the coming years up to 2028.

- Due to the COVID-19 pandemic, there was a dip in sales of passenger vehicles from 3.38 million in 2019 to 2.39 million in 2021 because of nationwide lockdown, supply chain disruptions, and overall economic slowdown. But, with the government initiatives to support the automobile manufacturing sector, such as decreasing interest rates for auto loans by 2-3%, it moved up to 2.72 million vehicles by March 2022. Maruti Suzuki is the largest in the passenger vehicles segment, with a market share of 52% in 2021. This growth trend is expected to sustain in the forecast period, which is 2022-2028.

- In the case of commercial vehicles, Tata Motors is the largest vehicle producer by number, with a market share of nearly 43% in March 2022. The commercial vehicle sales increased from 568,560 in 2021 to 716570 by March 2022 because of recovering loss-ridden economy due to the impact of COVID-19 in 2020. With this growing post-pandemic economy, it is expected to increase in the mentioned period.

- The electric vehicle manufacturing push by the Indian government with initiatives such as e-AMRIT will lead increase in the production of electric vehicles in years up to 2028. The increase in the number of electric vehicles being sold in India increased by 108% in 2021 compared to 2020.

India Sealants Industry Overview

The India Sealants Market is fragmented, with the top five companies occupying 21.68%. The major players in this market are 3M, Henkel AG & Co. KGaA, Pidilite Industries Ltd., Sika AG and Soudal Holding N.V. (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 End User Trends

- 4.1.1 Aerospace

- 4.1.2 Automotive

- 4.1.3 Building and Construction

- 4.2 Regulatory Framework

- 4.2.1 India

- 4.3 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2028 and analysis of growth prospects)

- 5.1 End User Industry

- 5.1.1 Aerospace

- 5.1.2 Automotive

- 5.1.3 Building and Construction

- 5.1.4 Healthcare

- 5.1.5 Other End-user Industries

- 5.2 Resin

- 5.2.1 Acrylic

- 5.2.2 Epoxy

- 5.2.3 Polyurethane

- 5.2.4 Silicone

- 5.2.5 Other Resins

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and Analysis of Recent Developments).

- 6.4.1 3M

- 6.4.2 Arkema Group

- 6.4.3 ASTRAL ADHESIVES

- 6.4.4 Dow

- 6.4.5 Henkel AG & Co. KGaA

- 6.4.6 Jubilant Industries Ltd.

- 6.4.7 Pidilite Industries Ltd.

- 6.4.8 Sika AG

- 6.4.9 Soudal Holding N.V.

- 6.4.10 Wacker Chemie AG

7 KEY STRATEGIC QUESTIONS FOR ADHESIVES AND SEALANTS CEOS

8 APPENDIX

- 8.1 Global Adhesives and Sealants Industry Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework (Industry Attractiveness Analysis)

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Drivers, Restraints, and Opportunities

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

02-2729-4219

+886-2-2729-4219