|

市場調查報告書

商品編碼

1693399

日本密封劑:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Japan Sealants - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

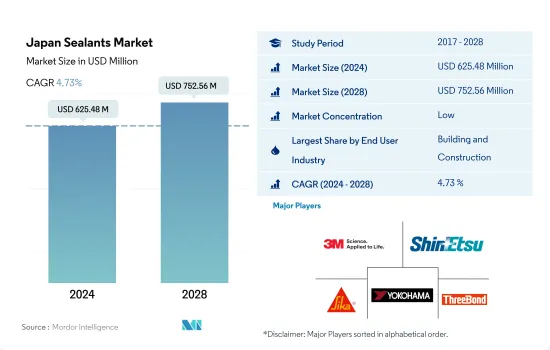

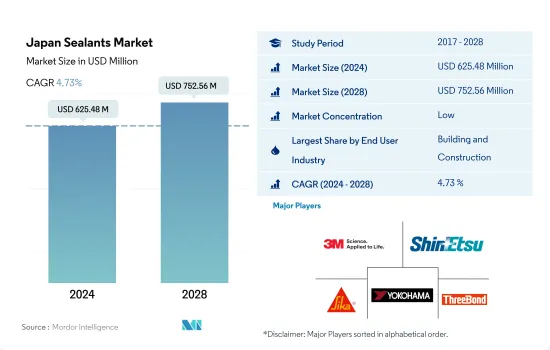

日本密封劑市場規模預計在 2024 年為 6.2548 億美元,預計到 2028 年將達到 7.5256 億美元,預測期內(2024-2028 年)的複合年成長率為 4.73%。

汽車市場和建築業的蓬勃發展預計將推動日本密封膠的消費

- 在日本的密封劑市場中,建築業佔據主要佔有率,其次是其他終端用戶行業,因為密封劑在建築和建設活動中的應用多種多樣,例如防水、防風雨密封、裂縫密封和接縫密封。此外,建築密封劑的使用壽命很長,且易於應用於各種基材。 2019年,日本建築業約佔國內生產總值)的5.3%,未來幾年可能會大幅成長。日本政府對建築品質的重視和對永續發展的推動可能會導致預測期內對密封劑的需求激增。

- 電氣設備製造中使用各種密封劑進行灌封和保護應用。它們用於密封感測器和電纜。日本電子產品市場預計在 2021 年實現近 6% 的銷售佔有率,並且由於高所得收入和中等收入群體迅速採用家用電子電器產品,未來幾年將出現可觀的成長。這將推動其他終端用戶領域對密封劑的需求。此外,日本在世界各地擁有完善的機車引擎生產設施,這將推動到 2028 年對急需的密封劑的需求。

- 密封劑在汽車工業中有多種用途,主要用於引擎和汽車墊圈,並為各種基材提供廣泛的黏合性。多年來,日本一直被視為汽車行業的主要生產國之一,這得益於其廣泛的生產設施和主要汽車製造商的強大影響力,這可能會在未來幾年產生對密封劑的需求。

日本密封膠市場趨勢

商業和基礎設施計劃的增加推動建築業

- 受公共和私人基礎設施及商業計劃投資增加的推動,日本建築業預計在未來五年內將溫和成長。預計在 2022 年至 2028 年的預測期內,日本建築膠黏劑和密封劑市場銷售的複合年成長率約為 2.89%,價值的複合年成長率約為 5.35%。

- 日本是高層建築和高層建築領域的領先地區和重要消費市場。日本擁有各種各樣的高層建築(近 290 座),其中東京是此類建築的主要中心。短期內,此類建築在日本的規劃和建設正在呈現良好的成長動能。一些建設計劃包括東京車站的兩座高層塔樓、一座 37 層、230 公尺高的辦公大樓和一座 61 層、390 公尺高的辦公大樓,預計將於 2027 年竣工。最重要的重建計劃是八重洲重建計劃,預計將於 2023 年竣工,該項目將用新的辦公、酒店、住宅、零售和教育設施取代舊建築。

- 在日本,清水建設公司、鹿島建設公司、大林組公司、大成建設公司、大和房屋等大型建設公司都已暫停施工。隨著各國政府開始放寬新冠肺炎疫情防治措施,很難預測工作將在多大程度上恢復正常。近年來,在新冠疫情爆發之前,日本的基礎建設計劃數量和規模一直在增加。隨著日本從疫情中復甦,建築基礎設施計劃也應該會恢復。預計這些因素將增加對黏合劑和密封劑的需求。

除了是豐田、本田和日產等知名汽車製造商的所在地之外,對電動車的需求也推動了汽車產業的發展。

- 日本是豐田、本田、日產等世界最大汽車製造商的所在地,其中豐田是全球市值第二大公司。豐田截至2022年3月的會計年度銷量較上年同期成長15%,顯示日本汽車市場呈現成長趨勢。預計到2027年日本乘用車銷量將達到3,951,710輛。

- 受新冠疫情影響,全國的封鎖、整體經濟放緩、出口下降以及供應鏈中斷,導致汽車銷售大幅下降。受這些因素影響,乘用車銷量從2019年的399.7萬輛下降至2020年的384.1萬輛,導致2020年汽車銷量下滑。

- 在日本,由於人們環保意識的增強以及日本都市區公共運輸使用量的增加,2021 年汽車市場銷售量與 2020 年相比有所下降。政府也透過提高公共運輸的效率來支持這項事業。鐵路佔日本公共運輸的近72%。

- 2017年,受吸引消費者的新型插電式混合動力汽車的推出推動,日本的電動車銷售量達到頂峰。預計 2022 年至 2027 年期間汽車產業的電動車領域的複合年成長率將達到 24.39%。預計到2027年,日本的電動車銷量將達到165,500輛。這將為整個日本汽車產業帶來收益的成長。

日本密封膠產業概況

日本密封膠市場細分化,前五大公司佔26.31%的市佔率。該市場的主要企業包括 3M、信越化學、西卡股份公司、橫濱橡膠和 ThreeBond Holdings。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章執行摘要和主要發現

第2章 報告要約

第3章 引言

- 研究假設和市場定義

- 研究範圍

- 調查方法

第4章 產業主要趨勢

- 最終用戶趨勢

- 航太

- 車

- 建築與施工

- 法律規範

- 日本

- 價值鍊和通路分析

第5章市場區隔

- 最終用戶產業

- 航太

- 車

- 建築與施工

- 醫療保健

- 其他

- 樹脂

- 丙烯酸纖維

- 環氧樹脂

- 聚氨酯

- 矽膠

- 其他

第6章競爭格局

- 關鍵策略趨勢

- 市場佔有率分析

- 商業狀況

- 公司簡介

- 3M

- Arkema Group

- CEMEDINE Co.,Ltd.

- Henkel AG & Co. KGaA

- SEKISUI FULLER

- SHARP CHEMICAL IND. CO.,LTD.

- Shin-Etsu Chemical Co., Ltd.

- Sika AG

- THE YOKOHAMA RUBBER CO., LTD.

- ThreeBond Holdings Co., Ltd.

第7章 CEO 的關鍵策略問題

第 8 章 附錄

- 全球黏合劑和密封劑產業概況

- 概述

- 五力分析框架(產業吸引力分析)

- 全球價值鏈分析

- 促進因素、限制因素和機會

- 資訊來源及延伸閱讀

- 圖片列表

- 關鍵見解

- 數據包

- 詞彙表

簡介目錄

Product Code: 92455

The Japan Sealants Market size is estimated at 625.48 million USD in 2024, and is expected to reach 752.56 million USD by 2028, growing at a CAGR of 4.73% during the forecast period (2024-2028).

Emerging automotive market and building & construction industry are expected to boost the consumption of sealants in Japan

- The construction industry holds the major share in the Japanese sealants market, followed by other end-user industries due to diverse applications of sealants in building and construction activities such as waterproofing, weather-sealing, cracks-sealing, and joint-sealing. Moreover, construction sealants are designed for longevity and ease of application on different substrates. The Japanese construction sector achieved about 5.3% of the nation's GDP in 2019 and is likely to register considerable growth in the upcoming years. The Japanese government focuses on the quality of buildings and promotes sustainable development, which will likely proliferate sealants demand over the forecast period.

- A variety of sealants are used in electrical equipment manufacturing for potting and protecting applications. They are used for sealing sensors and cables. The Japanese electronics market registered nearly 6% of revenue share in 2021 and is likely to have promising growth in the upcoming years owing to the rapid adoption of consumer electronics among the high and middle-income groups. This, in terms, will foster the demand for sealants in the other end-user segment. Moreover, Japan has well-established facilities to produce locomotive engines around the world will drive the demand for required sealants by 2028.

- Sealants are used in diverse applications in the automotive industry, mostly used for engines and car gaskets, and exhibit extensive bonding to various substrates. Japan has been marked as one of the leading producers in the automotive industry over the years due to extensive production facilities and the strong presence of major carmakers, which is likely to create demand for sealants in the coming years.

Japan Sealants Market Trends

Rising commercial and infrastructure projects to lead the construction industry

- The construction sector in the country is expected to record moderate growth over the next five years, owing to the increasing investments in public and private infrastructure and commercial projects. The Japanese construction adhesives and sealants market is projected to record a CAGR of about 2.89% in volume and 5.35% in value during the forecast period 2022 to 2028.

- Japan is a major area in the field of skyscrapers and high-rise buildings, making it a significant market for consumption. The country hosts various high-rise buildings (nearly 290), with Tokyo being a major hub for such buildings. The planning and construction of such buildings are witnessing decent growth in Japan in the short term. Some construction projects include two high-rise towers for Tokyo Stations, a 37-story and 230 m tall office tower, and a 61-story and 390 m tall office tower, due for completion in 2027. One of the most significant redevelopment projects includes the Yaesu redevelopments project for old buildings to new offices, hotels, residential, retail, and educational facilities, which are due to be completed by 2023.

- In Japan, major construction companies, such as Shimizu, Kajima, Obayashi, Taisei, and Daiwa House, suspended construction work. Although the government has begun to ease its measures to combat the COVID-19 pandemic, it is difficult to predict to what extent work will return to normal. In recent years, before the COVID-19 pandemic, the number and volume of construction and infrastructure projects in Japan had been increasing. As Japan recovers from the pandemic, construction and infrastructure projects should also re-commence. These factors are expected to lead to an increase in the demand for adhesives and sealants.

In addition to being home to renowned automotive manufacturers including Toyota, Honda, and Nissan, the demand for EVs is rising the automotive industry

- Japan is home to the world's largest automotive companies, such as Toyota, Honda, and Nissan, of which Toyota is the world's second-largest company in terms of market capitalization. Toyota's sales revenue showed a 15% Y-o-Y growth in the fiscal year ending March 2022, suggesting an increasing trend of automotive market growth in Japan. Passenger vehicle sales in Japan are expected to reach 3951.71 thousand units by 2027.

- Due to the impact of the COVID-19 pandemic, the sales of automobiles reduced drastically because of nationwide lockdowns, overall economic slowdown, decreased exports, supply chain disruptions, etc. These factors led to a decrease in the sales volume of automobiles in 2020 as passenger car sales fell from 3997 thousand in 2019 to 3841 thousand in 2020.

- Japan witnessed a decrease in automotive market revenue in 2021 compared to 2020 because of the increasing awareness of environmental concerns and increased use of public transport in the cities of Japan. The government is also supporting the cause by making public transport more efficient than before. The railways cover nearly 72% of the public transportation system in Japan.

- Japan witnessed peak sales of electric vehicles in 2017 because of the launch of new plug-in hybrid vehicles, which appealed to consumers. The electric vehicles segment of the automotive industry is expected to record a CAGR of 24.39% in 2022-2027. The number of electric vehicles sold in Japan is expected to be 165.5 thousand by 2027. This will lead to an increase in the overall revenue of the automotive industry in Japan.

Japan Sealants Industry Overview

The Japan Sealants Market is fragmented, with the top five companies occupying 26.31%. The major players in this market are 3M, Shin-Etsu Chemical Co., Ltd., Sika AG, THE YOKOHAMA RUBBER CO., LTD. and ThreeBond Holdings Co., Ltd. (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 End User Trends

- 4.1.1 Aerospace

- 4.1.2 Automotive

- 4.1.3 Building and Construction

- 4.2 Regulatory Framework

- 4.2.1 Japan

- 4.3 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2028 and analysis of growth prospects)

- 5.1 End User Industry

- 5.1.1 Aerospace

- 5.1.2 Automotive

- 5.1.3 Building and Construction

- 5.1.4 Healthcare

- 5.1.5 Other End-user Industries

- 5.2 Resin

- 5.2.1 Acrylic

- 5.2.2 Epoxy

- 5.2.3 Polyurethane

- 5.2.4 Silicone

- 5.2.5 Other Resins

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and Analysis of Recent Developments).

- 6.4.1 3M

- 6.4.2 Arkema Group

- 6.4.3 CEMEDINE Co.,Ltd.

- 6.4.4 Henkel AG & Co. KGaA

- 6.4.5 SEKISUI FULLER

- 6.4.6 SHARP CHEMICAL IND. CO.,LTD.

- 6.4.7 Shin-Etsu Chemical Co., Ltd.

- 6.4.8 Sika AG

- 6.4.9 THE YOKOHAMA RUBBER CO., LTD.

- 6.4.10 ThreeBond Holdings Co., Ltd.

7 KEY STRATEGIC QUESTIONS FOR ADHESIVES AND SEALANTS CEOS

8 APPENDIX

- 8.1 Global Adhesives and Sealants Industry Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework (Industry Attractiveness Analysis)

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Drivers, Restraints, and Opportunities

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

02-2729-4219

+886-2-2729-4219