|

市場調查報告書

商品編碼

1693393

義大利密封劑:市場佔有率分析、行業趨勢和統計數據、成長預測(2025-2030 年)Italy Sealants - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

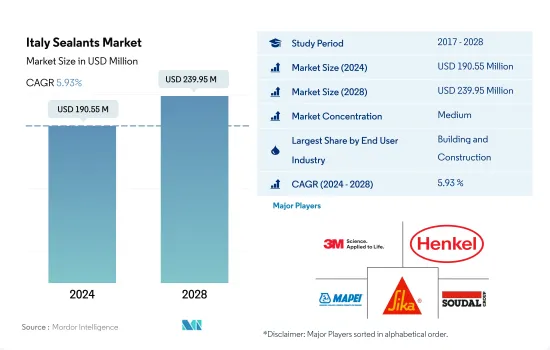

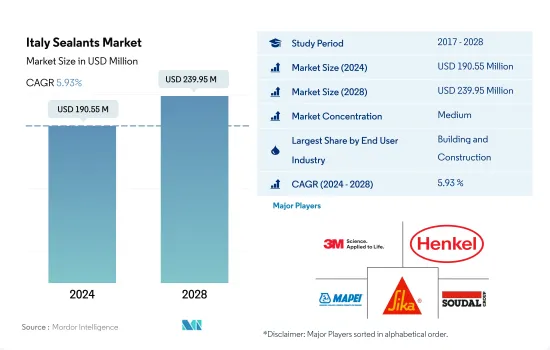

義大利密封劑市場規模預計在 2024 年為 1.9055 億美元,預計到 2028 年將達到 2.3995 億美元,預測期內(2024-2028 年)的複合年成長率為 5.93%。

新建和舊建築維修推動密封膠需求

- 義大利密封劑市場主要由建設產業推動,其次是其他最終用戶行業部門,因為密封劑在建築和建設活動中的應用範圍很廣,例如防水、防風雨密封、裂縫密封和接縫密封。義大利的建築業佔該國GDP的近8%。 2018年,義大利有超過49萬家註冊建築及相關工程公司。受新冠疫情負面影響,2020年義大利建設產業成長下降10.1%。

- 各種密封劑廣泛應用於電子和電氣設備製造的灌封和保護應用。義大利電子產品市場錄得強勁成長,主要原因是對主要家電、家用電子產品和語音通訊的需求旺盛。預計這將推動其他終端用戶工業領域對密封劑的需求。預計到 2028 年,機車和 DIY 行業中密封劑的各種應用將推動對密封劑的需求。

- 密封劑在醫療保健產業有著廣泛的應用,義大利幾十年來在醫療設備製造方面取得了長足的發展。密封劑用於醫療保健應用,例如組裝和密封醫療設備零件。該國醫療設備和技術市場擁有近4,323家公司。義大利政府也宣布計劃在 2024 年底前投資 11.8 億歐元升級 3,133 台設備。由於這些趨勢,預計未來幾年對醫用密封劑的需求將會增加。

義大利密封膠市場趨勢

政府政策和基礎設施投資增加將推動建設產業

- 義大利推出了2017年預算法,旨在促進公共和私人對公共基礎設施領域的投資。此外,該國也為2017年至2032年期間的政府基礎建設撥款530億美元。 2019 年,佛羅倫薩市還核准了用於開發新體育場的土地,這是更大的城市重建計畫的一部分。體育場可容納 40,000 名觀眾,預計於 2023 年完工。

- 然而,2020年,義大利是受新冠疫情影響最嚴重的國家之一,其建築市場萎縮了23%。 2021年,義大利建築市場創下16.59%的最高成長率。根據歐盟委員會介紹,義大利政府已宣布多項舉措以提振住宅市場。根據2021年預算法,義大利將110%超級獎金扣除期限延長至2022年6月30日。義大利政府正在部分城市推行建設補貼,每套住宅最低投資額為2萬美元,並透過提供居留擔保的方式促進城市人口成長。義大利的建築成本明顯低於歐洲其他許多地區,尤其是度假屋,預計將促進未來的住宅。

- 預計義大利建築市場在預測期內(2022-2028 年)的複合年成長率將達到 3.2%。隨著政府致力於改善全國的商業基礎設施和其他土木工程活動,政府有關外國直接投資和扣除額的變化預計將推動該國的建設產業,進而推動市場的發展。

電動車需求的不斷成長可能會推動汽車產量

- 義大利是歐洲主要汽車製造國之一。與2017年相比,2018年該國汽車產量萎縮了9.26%,2019年則萎縮了22.2%。 2018年和2019年,美國脫歐的影響、更複雜的環保法規的實施以及中美緊張關係等因素對義大利汽車市場產生了負面影響。

- 2020年汽車產量與2019年同期相比下降了20%。新冠疫情擾亂了汽車製造業,對整個供應鏈產生了負面影響。許多供應商也面臨原料成本(如鋼鐵、塑膠和樹脂)和能源價格上漲的困擾,這些因素正在影響該國的汽車市場。

- 2020年電動車的成長將進一步加速。 2020年上半年純電動車註冊量與2019年相比成長了86%。 2020年截至6月底,純電動車銷量約3.1萬輛。所有插電式汽車的總銷量增加至50,500輛。 Pure EV的平均市場佔有率也大幅提升,領先於該國的黏合劑和密封劑市場。

- 同樣,2021 年,義大利電動車市場持續成長。近年來,電動車銷量在短短三年內成長了六倍。同樣,電動車的市場佔有率也在2021年增加到4.6%。因此,該國的黏合劑和密封劑市場預計將有所改善。

義大利密封劑產業概況

義大利密封劑市場適度整合,前五大公司佔63.07%的市場。該市場的主要企業有:3M、漢高股份公司、馬貝集團、西卡股份公司和Soudal Holding NV(按字母順序排列)

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章執行摘要和主要發現

第2章 報告要約

第3章 引言

- 研究假設和市場定義

- 研究範圍

- 調查方法

第4章 產業主要趨勢

- 最終用戶趨勢

- 航太

- 車

- 建築與施工

- 法律規範

- 義大利

- 價值鍊和通路分析

第5章市場區隔

- 最終用戶產業

- 航太

- 車

- 建築與施工

- 衛生保健

- 其他最終用戶產業

- 樹脂

- 丙烯酸纖維

- 環氧樹脂

- 聚氨酯

- 矽膠

- 其他樹脂

第6章 競爭格局

- 關鍵策略趨勢

- 市場佔有率分析

- 商業狀況

- 公司簡介.

- 3M

- Dow

- Henkel AG & Co. KGaA

- MAPEI SpA

- NPT Srl

- RPM International Inc.

- Sika AG

- Soudal Holding NV

- Torggler Srl

- Wacker Chemie AG

第7章:CEO面臨的關鍵策略問題

第 8 章 附錄

- 全球黏合劑和密封劑產業概況

- 概述

- 五力分析框架(產業吸引力分析)

- 全球價值鏈分析

- 促進因素、阻礙因素和機會

- 資訊來源及延伸閱讀

- 圖片列表

- 關鍵見解

- 資料包

- 詞彙表

簡介目錄

Product Code: 92449

The Italy Sealants Market size is estimated at 190.55 million USD in 2024, and is expected to reach 239.95 million USD by 2028, growing at a CAGR of 5.93% during the forecast period (2024-2028).

With new construction and renovation of old buildings demand for sealants will rise

- The Italian sealants market is majorly driven by the construction industry, followed by the other end-user industries segment due to the diverse applications of sealants in building and construction activities, such as waterproofing, weather-sealing, cracks-sealing, and joint-sealing. The Italian construction industry accounted for nearly 8% of the country's GDP. In 2018, Italy registered more than 490,000 companies in construction and related works. Due to the adverse impacts of the COVID-19 pandemic, the Italian construction industry's growth declined by 10.1% in 2020.

- A variety of sealants are widely used in electronics and electrical equipment manufacturing for potting and protecting applications. The Italian electronics market registered significant growth mostly due to the high demand for large household appliances, consumer electronics, and telephony. This is expected to foster the demand for sealants from the other end-user industries segment. A range of applications of sealants in the locomotive and DIY industries is expected to boost the demand for sealants by 2028.

- Sealants have diverse applications in the healthcare industry, and Italy has achieved significant development in the manufacturing of medical equipment over the decades. Sealants are used for healthcare applications such as assembling and sealing medical device parts. The country counted nearly 4,323 companies in the medical device and technology market. The Italian government also announced plans to invest EUR 1.18 billion to upgrade 3,133 devices at the end of 2024. Thus, such a trend is expected to augment the demand for medical-grade sealants over the coming years.

Italy Sealants Market Trends

Increasing government policies and investments in the infrastructure sector to propel the construction industry

- In Italy, the Budget Law 2017 was introduced to boost public and private investments in the public infrastructure sectors. A budget of USD 53 billion was also allotted for the development of government infrastructure in the country for the period 2017-2032. In 2019, the Municipality of Florence also approved land to develop a new stadium as part of the larger urban redevelopment plan. The stadium is likely to hold a capacity of 40,000 seats; it is expected to be completed by 2023.

- However, in 2020, the Italian construction market contracted by 23%, as Italy was one of the worst-hit nations during the COVID-19 pandemic. In 2021, the Italian construction market registered the highest growth rate of 16.59%. According to the European Commission, the Italian government announced several initiatives to promote the residential/housing market. Under its 2021 Budget Law, Italy extended the timeline for the super bonus, 110% deduction up to June 30, 2022. The Italian government has been promoting construction subsidies to invest a minimum of USD 20,000 per house in some cities to promote the population of the city by providing sponsorship for stay. This is expected to boost house construction in the future, as construction in Italy is significantly cheaper than in many other parts of Europe, especially for vacation homes.

- The Italian construction market is expected to register a CAGR of 3.2% during the forecast period (2022-2028). As the government focuses on improving commercial infrastructure and other civil engineering activities across the country, changes in government policies for foreign direct investments and tax deductions are expected to drive the construction industry in the country, which, in turn, is expected to drive the market.

Rising electric vehicles demand is likely to boost automotive production

- Italy is one of the major automotive manufacturers in Europe. Compared to 2017, automotive vehicle production in the country contracted by 9.26% in 2018 and 22.2% in 2019, as in 2018 and 2019, factors like the fallout from Brexit, the implementation of more complex environmental regulations, and the tensions between the United States and China negatively affected the market for automotive vehicles in Italy.

- The automotive vehicle production volume contracted by 20% in 2020 compared to the same period in 2019. The COVID-19 pandemic resulted in disruptions in car manufacturing and had a negative impact on the whole supply chain. Many suppliers additionally suffer from increased raw material costs (e.g., for steel, plastics, and resin) and higher energy prices, affecting the automotive market in the country.

- In 2020, the country's electric vehicle growth further increased. Registrations for pure EVs in the first six months of 2020 were up by 86% compared to 2019. Almost 31,000 pure EVs were sold in 2020 till the end of June. Total sales of all plug-in vehicles rose to 50,500 units. The average pure-electric market share also increased significantly, driving the market for adhesives and sealants in the country.

- Similarly, the year 2021 witnessed continued growth in the Italian EV market. In recent years, electric vehicle sales increased by six-fold in just three years. Similarly, the market share of electric vehicles increased to 4.6% in 2021. Thus, it is expected to improve the market for adhesives and sealants in the country.

Italy Sealants Industry Overview

The Italy Sealants Market is moderately consolidated, with the top five companies occupying 63.07%. The major players in this market are 3M, Henkel AG & Co. KGaA, MAPEI S.p.A., Sika AG and Soudal Holding N.V. (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 End User Trends

- 4.1.1 Aerospace

- 4.1.2 Automotive

- 4.1.3 Building and Construction

- 4.2 Regulatory Framework

- 4.2.1 Italy

- 4.3 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2028 and analysis of growth prospects)

- 5.1 End User Industry

- 5.1.1 Aerospace

- 5.1.2 Automotive

- 5.1.3 Building and Construction

- 5.1.4 Healthcare

- 5.1.5 Other End-user Industries

- 5.2 Resin

- 5.2.1 Acrylic

- 5.2.2 Epoxy

- 5.2.3 Polyurethane

- 5.2.4 Silicone

- 5.2.5 Other Resins

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and Analysis of Recent Developments).

- 6.4.1 3M

- 6.4.2 Dow

- 6.4.3 Henkel AG & Co. KGaA

- 6.4.4 MAPEI S.p.A.

- 6.4.5 NPT Srl

- 6.4.6 RPM International Inc.

- 6.4.7 Sika AG

- 6.4.8 Soudal Holding N.V.

- 6.4.9 Torggler S.r.l.

- 6.4.10 Wacker Chemie AG

7 KEY STRATEGIC QUESTIONS FOR ADHESIVES AND SEALANTS CEOS

8 APPENDIX

- 8.1 Global Adhesives and Sealants Industry Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework (Industry Attractiveness Analysis)

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Drivers, Restraints, and Opportunities

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

02-2729-4219

+886-2-2729-4219