|

市場調查報告書

商品編碼

1911472

馬來西亞二手車市場:市場佔有率分析、產業趨勢與統計、成長預測(2026-2031)Malaysia Used Car - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

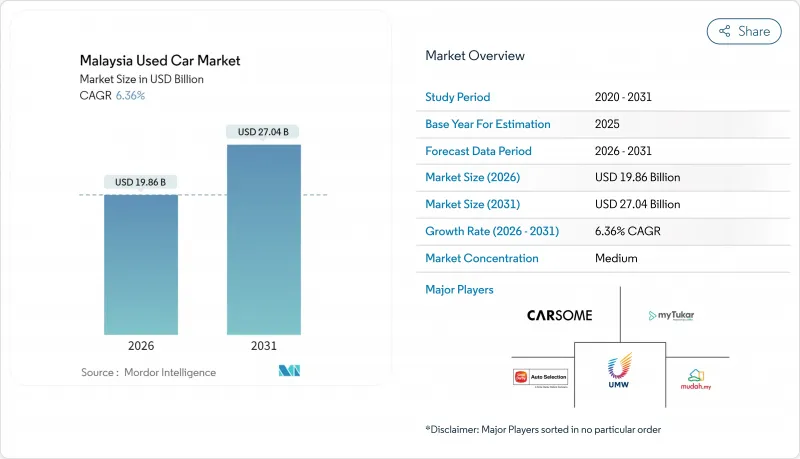

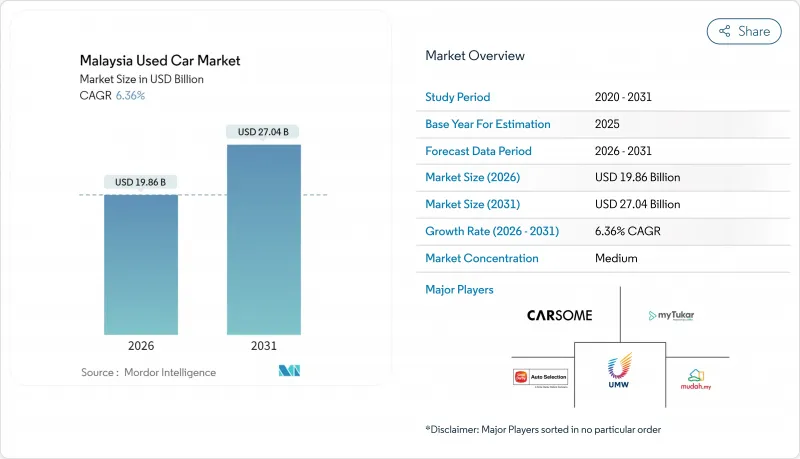

2025年馬來西亞二手車市場價值為186.7億美元,預計從2026年的198.6億美元成長到2031年的270.4億美元,在預測期(2026-2031年)內複合年成長率為6.36%。

強勁的家庭支出、策略性的消費稅減免以及國家汽車政策下逐步放寬的進口管制,都在支撐二手車需求,並進一步推動二手車供應的未來成長。隨著越來越多的消費者尋求更適合混合交通和季節性洪澇災害的駕駛位置,SUV的需求正在加速成長;同時,由於充電基礎設施的不斷完善,純電動車也越來越受歡迎。

馬來西亞二手車市場趨勢及分析

新車價格上漲

預計2024年新車標價將上漲,2026年銷售稅改革實施後進一步上漲8%至20%。這很可能促使許多中等收入家庭轉向5,000至9,999美元的二手車市場,目前已佔38.74%的佔有率。持續的通貨膨脹和疲軟的馬幣推高了進口成本,導致價格差距不斷擴大。這一價格差距有利於Perodua和Proton等本土品牌保持穩定的存貨周轉,這些品牌擁有充足的供應和價格合理的零件。

拓展數位零售平台

CARSOME每年利用其175項人工智慧檢測系統處理超過10萬輛汽車,創造約10億美元的收入,並樹立了新的品質標準。它與Google雲端的合作實現了即時定價和最佳化的客戶體驗,而實體經銷商則正在採用虛擬展示室來維持市場佔有率。線上通路6.73%的複合年成長率表明,馬來西亞消費者擴大透過行動搜尋開始購車流程,儘管許多消費者仍然重視在最後階段進行實地驗車。

假車/非法進口車

馬來西亞取消開放式核准許可製度,並對新加坡註冊車輛入境處以馬幣的車輛入境許可罰款,凸顯了邊境管制的收緊。雖然此舉短期內會增加合規成本,但最終將保護授權經銷商的利益,並鼓勵消費者選擇檢驗、文件齊全的正規經銷商。

細分市場分析

儘管轎車在2025年仍將以37.68%的市場佔有率繼續佔據馬來西亞二手車市場最大佔有率,但SUV預計將以7.03%的複合年成長率超越其他車型。 SUV的成長趨勢歸功於其更高的駕駛座椅位置、更優異的防水性能以及Proton X70租賃到期車輛的供應。 CARSOME報告顯示,SUV的平均售價更高,即使銷量尚未趕上轎車,也能提高單車盈利。

預計到2031年,SUV在馬來西亞二手車市場將快速成長。同時,由於運行成本低,掀背車仍將是頗受歡迎的入門車型。多功能車(MPV)將繼續滿足大家庭和重視靈活座椅佈局的叫車營運商的需求。隨著基礎設施計劃預計將延長都市區通勤時間,庫存豐富的SUV車型經銷商將佔據有利地位,領先市場需求成長。

儘管非正規二手車經銷商仍佔馬來西亞二手車市場的62.54%,但正規經營者正以6.47%的複合年成長率快速擴張,這主要得益於保固和數位化服務的推動。消費者願意為經過認證的車輛偵測支付適度的溢價,因為這有助於降低風險,並提供安心的售後服務。

隨著 CARSOME 擴大檢測中心規模,以及 Carro 推出即時線上估價服務,馬來西亞正規二手車市場規模不斷擴大。森那美收購 UMW Holdings,將豐田和 Perodua 的二手車業務合併為一個品牌,預示著未來市場將進一步整合。

到2025年,汽油車將佔交易總量的75.92%,而純電動車在獎勵和充電基礎設施不斷完善的推動下,成長速度最快,達到7.15%。柴油車仍將是物流車隊的主流,而混合動力汽車則為那些專注於續航里程的駕駛者提供了過渡選擇。

隨著充電樁數量增加到 10,000 個,以及稅收優惠政策持續到 2025 年,馬來西亞 xEV(電動和混合動力汽車)二手車市場規模預計將在 2026 年至 2031 年間成長三倍。經銷商已開始培訓高壓技術人員,以便在第一批大眾市場電動車進入二手市場時抓住殘值機會。

馬來西亞二手車市場報告按車輛類型(例如,掀背車)、供應商類型(有組織/無組織)、燃料類型(例如,汽油、柴油)、車齡(例如,0-2 年、3-5 年)、價格範圍(例如,低於 5,000 美元)、銷售管道(線路上、線下)、所有權類型(首次銷售數量、多組數)以及市場規模、數位和數量(市場規模、數位)以及市場規模(首次銷售數量)以及市場規模和市場規模(首次細分市場數量)以及市場規模(首次數量)以及市場規模和市場數量(首次銷售數量)以及市場規模和市場數量(首次市場規模和數量)。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 新車價格上漲

- 拓展數位零售平台

- 多種型號可供選擇

- 綜合金融和保險

- OEM贊助的CPO項目

- 透過遠端資訊處理確保透明度

- 市場限制

- 假車/非法進口車

- 電動車殘值存在不確定性

- 測試標準碎片化

- 有限售後保固

- 價值/供應鏈分析

- 監管環境

- 技術展望

- 波特五力模型

- 新進入者的威脅

- 買方和消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場規模及成長預測(價值(美元))

- 按車輛類型

- 掀背車車

- 轎車

- 運動型多用途車(SUV)

- 多用途汽車(MPV)

- 其他(敞篷車、小轎車、跨界車、跑車)

- 依供應商類型

- 組織

- 雜亂無章

- 按燃料類型

- 汽油車

- 柴油引擎

- 混合動力汽車(HEV 和 PHEV)

- 電池式電動車(BEV)

- 液化石油氣/壓縮天然氣/其他

- 按車輛年份

- 0-2歲

- 3-5年

- 6-8歲

- 9-12歲

- 已經過去12年多了。

- 按價格範圍

- 不到5000美元

- 5,000 美元至 9,999 美元

- 10,000 美元至 14,999 美元

- 15,000 美元至 19,999 美元

- 20,000美元至29,999美元

- 超過3萬美元

- 按銷售管道

- 線上

- 數位分類廣告入口網站

- 純粹的電子零售商

- OEM授權網路商店

- 離線

- OEM特許經銷商

- 多品牌獨立零售商

- 實體競標行

- 線上

- 依所有權類型

- 原車主轉售

- 多位業主

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- CARSOME Sdn Bhd

- myTukar Sdn Bhd

- Sime Darby Auto Selection

- UMW Toyota Motor Sdn Bhd(TOPMARK)

- Mercedes-Benz Malaysia(CPO)

- Mudah.my Sdn Bhd

- Carlist.my

- Caricarz Sdn Bhd

- BMW Malaysia(Premium Selection)

- Perodua Pre-Owned Vehicles

- Proton Certified Pre-Owned

- Bermaz Auto Pre-Owned

- TC Euro Cars(Renault)

- GoCar Subs/GoEV Marketplace

- EasyCars

- MUV Marketplace

- Big Three Auto

- Motor Trader Malaysia

- eBid Motors

- Carsome Certified Lab

第7章 市場機會與未來展望

The Malaysia Used Car Market was valued at USD 18.67 billion in 2025 and estimated to grow from USD 19.86 billion in 2026 to reach USD 27.04 billion by 2031, at a CAGR of 6.36% during the forecast period (2026-2031).

Robust household spending, strategic sales-tax exemptions and the National Automotive Policy's gradual import liberalization underpin demand further enlarged the future supply of pre-owned vehicles. SUV demand is accelerating as buyers look for elevated driving positions suited to mixed traffic and seasonal flooding, while battery-electric models gain traction on the back of expanding charging infrastructure.

Malaysia Used Car Market Trends and Insights

Escalating New-Car Prices

New-vehicle sticker prices climbed during 2024 and are expected to rise another 8-20% once excise duty reforms are activated in 2026, pushing many middle-income families toward the USD 5,000-9,999 used segment that already commands 38.74% share. Persistent inflation and a weak ringgit inflate import costs, keeping the price gap wide. The differential supports steady inventory turnover for local brands such as Perodua and Proton that provide ample supply and affordable parts.

Digital Retail Platform Expansion

CARSOME processes more than 100,000 vehicles a year through its AI-driven 175-point inspection regime, delivering roughly USD 1 billion in revenue and setting new quality benchmarks. Partnerships with Google Cloud allow real-time pricing and customer-experience optimization, while traditional lots now add virtual showrooms to defend market share. The online channel's 6.73% CAGR shows that Malaysian shoppers increasingly begin their journey with a mobile search even though many still insist on a last-mile physical inspection.

Counterfeit / Illegally Imported Vehicles

The end of the Open Approved Permit model and fresh Vehicle Entry Permit fines of RM300 for Singapore-registered cars entering Malaysia underscore tighter border controls. The crackdown lifts compliance costs in the short run but ultimately shields legitimate dealers, encouraging customers to gravitate toward organised lots with verifiable documentation.

Other drivers and restraints analyzed in the detailed report include:

- Diverse Selection Among Models

- Integrated Financing & Insurance

- Fragmented Inspection Standards

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Sedans maintained the largest 37.68% slice of the Malaysia used car market in 2025, though SUVs are forecast to post a 7.03% CAGR, outpacing every other body style. The SUV uptrend stems from elevated driving positions, better flood clearance and fresh supply from Proton X70 lease returns. CARSOME reports that SUV transactions command higher average selling prices, boosting per-unit profitability even while unit volumes are still catching sedans.

The Malaysia used car market size for SUVs is projected to grow exponentially by 2031, while hatchbacks retain strong entry-level resonance because of low running costs. Multi-Purpose Vehicles continue serving large families and ride-hailing operators that value flexible seating. Dealers stocking diversified SUV trims position themselves ahead of the demand curve as infrastructure projects lengthen urban commutes.

Unorganised yards still control 62.54% of the Malaysia used car market share, but organised operators are growing faster at 6.47% CAGR due to warranty coverage and digital service layers. Consumers are willing to pay modest premiums for certified inspections that reduce risk and provide after-sales peace of mind.

The Malaysia used car market size attributable to organised vendors as CARSOME expands to increase its inspection centres and Carro introduces instant online valuations. Sime Darby's purchase of UMW Holdings integrates Toyota and Perodua pre-owned programs under a single banner, signalling deeper consolidation ahead.

Petrol cars commanded 75.92% of 2025 transactions, yet battery-electric units are charting the fastest 7.15% trajectory on incentives and charging rollouts. Diesel remains the province of logistics fleets, whereas hybrids deliver a transitional option for drivers worried about range.

Malaysia used car market size for xEVs is projected to triple between 2026 and 2031 as charging points climb to 10,000 and tax holidays stay intact through 2025. Dealers are beginning to train technicians in high-voltage servicing to capture the residual-value opportunity once the first wave of mass-market EVs enters secondary circulation.

The Malaysia Used Car Market Report is Segmented by Vehicle Type (Hatchbacks and More), Vendor Type (Organized and Unorganized), Fuel Type (Petrol, Diesel, and More), Vehicle Age (0 - 2 Years, 3 - 5 Years, and More), Price Segment (Less Than USD 5 000, and More), Sales Channel (Online and Offline), and Ownership (First-Owner Resale and Multi-Owner). Market Size & Growth Forecasts (Value (USD) and Volume (Units)).

List of Companies Covered in this Report:

- CARSOME Sdn Bhd

- myTukar Sdn Bhd

- Sime Darby Auto Selection

- UMW Toyota Motor Sdn Bhd (TOPMARK)

- Mercedes-Benz Malaysia (CPO)

- Mudah.my Sdn Bhd

- Carlist.my

- Caricarz Sdn Bhd

- BMW Malaysia (Premium Selection)

- Perodua Pre-Owned Vehicles

- Proton Certified Pre-Owned

- Bermaz Auto Pre-Owned

- TC Euro Cars (Renault)

- GoCar Subs / GoEV Marketplace

- EasyCars

- MUV Marketplace

- Big Three Auto

- Motor Trader Malaysia

- eBid Motors

- Carsome Certified Lab

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Escalating new-car prices

- 4.2.2 Digital retail platform expansion

- 4.2.3 Diverse selection among models

- 4.2.4 Integrated financing & insurance

- 4.2.5 OEM-backed CPO programs

- 4.2.6 Telematics-enabled transparency

- 4.3 Market Restraints

- 4.3.1 Counterfeit / illegally imported vehicles

- 4.3.2 EV residual-value uncertainty

- 4.3.3 Fragmented inspection standards

- 4.3.4 Limited aftermarket warranty

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers/Consumers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value (USD))

- 5.1 By Vehicle Type

- 5.1.1 Hatchbacks

- 5.1.2 Sedans

- 5.1.3 Sport-Utility Vehicles (SUVs)

- 5.1.4 Multi-Purpose Vehicles (MPVs)

- 5.1.5 Others (convertibles, coupes, crossovers, sports cars)

- 5.2 By Vendor Type

- 5.2.1 Organised

- 5.2.2 Unorganised

- 5.3 By Fuel Type

- 5.3.1 Petrol

- 5.3.2 Diesel

- 5.3.3 Hybrid (HEV & PHEV)

- 5.3.4 Battery-Electric (BEV)

- 5.3.5 LPG / CNG / Others

- 5.4 By Vehicle Age

- 5.4.1 0 - 2 Years

- 5.4.2 3 - 5 Years

- 5.4.3 6 - 8 Years

- 5.4.4 9 - 12 Years

- 5.4.5 More than 12 Years

- 5.5 By Price Segment

- 5.5.1 Less than USD 5 000

- 5.5.2 USD 5 000 - USD 9 999

- 5.5.3 USD 10 000 - USD 14 999

- 5.5.4 USD 15 000 - USD 19 999

- 5.5.5 USD 20 000 - USD 29 999

- 5.5.6 More than or equal to USD 30 000

- 5.6 By Sales Channel

- 5.6.1 Online

- 5.6.1.1 Digital Classified Portals

- 5.6.1.2 Pure-play e-Retailers

- 5.6.1.3 OEM-Certified Online Stores

- 5.6.2 Offline

- 5.6.2.1 OEM-Franchised Dealers

- 5.6.2.2 Multi-brand Independent Dealers

- 5.6.2.3 Physical Auction Houses

- 5.6.1 Online

- 5.7 By Ownership

- 5.7.1 First-owner Resale

- 5.7.2 Multi-owner

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (Includes Global Level Overview, Market Level Overview, Core Segments, Financials as Available, Strategic Information, Market Rank/Share for Key Companies, Products and Services, SWOT Analysis, and Recent Developments)

- 6.4.1 CARSOME Sdn Bhd

- 6.4.2 myTukar Sdn Bhd

- 6.4.3 Sime Darby Auto Selection

- 6.4.4 UMW Toyota Motor Sdn Bhd (TOPMARK)

- 6.4.5 Mercedes-Benz Malaysia (CPO)

- 6.4.6 Mudah.my Sdn Bhd

- 6.4.7 Carlist.my

- 6.4.8 Caricarz Sdn Bhd

- 6.4.9 BMW Malaysia (Premium Selection)

- 6.4.10 Perodua Pre-Owned Vehicles

- 6.4.11 Proton Certified Pre-Owned

- 6.4.12 Bermaz Auto Pre-Owned

- 6.4.13 TC Euro Cars (Renault)

- 6.4.14 GoCar Subs / GoEV Marketplace

- 6.4.15 EasyCars

- 6.4.16 MUV Marketplace

- 6.4.17 Big Three Auto

- 6.4.18 Motor Trader Malaysia

- 6.4.19 eBid Motors

- 6.4.20 Carsome Certified Lab

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment