|

市場調查報告書

商品編碼

1911455

印尼二手車市場:市場佔有率分析、產業趨勢與統計、成長預測(2026-2031)Indonesia Used Car - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

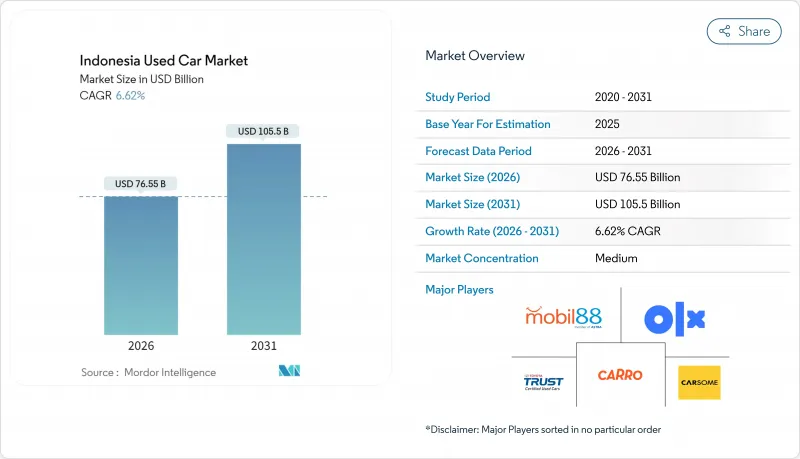

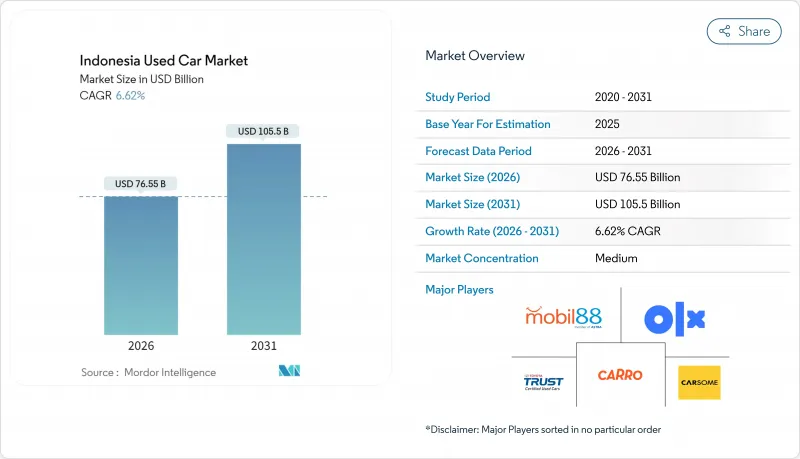

預計印尼二手車市場規模將從 2025 年的 718 億美元成長到 2026 年的 765.5 億美元,到 2031 年將達到 1,055 億美元,2026 年至 2031 年的複合年成長率為 6.62%。

需求韌性反映出市場結構向二手車轉變,信貸環境收緊和購買力下降迫使家庭在不推遲出行目標的前提下精打細算。二手車融資額將在2024年首次超過新車融資額,這標誌著消費行為正在持續調整。線上廣告已成為資訊搜尋的主要方式,而新興的人工智慧評估工具透過提供客觀的車輛狀況評分,正在縮小價格差距。主要銀行貸款策略的轉變提高了貸款的可及性和盈利能力,同時,叫車業者的車隊更新也為經銷商庫存創造了源源不絕的優質二手車。

印尼二手車市場趨勢及洞察

拓展線上廣告與電子商務活動

數位平台讓消費者在聯繫賣家之前比較價格、里程和照片,從而簡化交易流程。平台營運商整合了驗車、融資和文書工作,減輕了經銷商密度低的農村地區消費者的搜尋負擔。 SEVA在2024年實現了17,500輛汽車的銷量和8.2兆印尼幣的總交易額,證明了這種模式的有效性,並刺激了資本流入和獨角獸企業的誕生。傳統企業集團也積極回應:Astra收購OLX後,將其內部融資、驗車中心和物流整合到單一平台上。 OJK對平台內數位貸款的監管支援進一步完善了無縫體驗,推動印尼二手車市場向更深層的線上滲透。

銀行轉向二手的二手車貸款產品

印尼中亞銀行(BCA)等領先銀行預計,到2024年,其汽車貸款餘額將達到65.3兆印尼幣(約41億美元)。隨著貸款機構尋求更高收益,二手車的市場佔有率正在不斷成長。我們獨特的評分系統經過改進,納入了包括里程數、詳細檢測等級和預計轉售價值在內的多種關鍵因素,不再只關注借款人的收入。這種創新方法使得線上市場能夠實現即時預核准,顯著縮短了核准時間,僅需幾個小時。因此,這項精簡的流程不僅提高了轉換率,也刺激了印尼二手車市場的流動性,為買賣雙方創造了更多機會。

虛報里程數和事故記錄的現象仍然十分普遍。

地方政府的車輛登記(STNK)和所有權證書(BPKB)系統各自獨立運行,使得不法分子能夠篡改里程或掩蓋車輛跨州運輸過程中的水損情況。首次購車者和線上購車者受影響最大,他們往往要為問題車輛支付過高的價格。這種信任缺失推高了貸款風險溢價,並將阻礙印尼二手車市場的流動性,直到人工智慧檢測和集中式數據普及。

細分市場分析

截至2025年,SUV將佔印尼二手車市場37.62%的佔有率,這主要得益於其較高的離地間隙和在擁擠道路上的安全性能。 MPV的複合年成長率(CAGR)為7.05%,受到重視側滑門和靈活座椅佈局的多代家庭的青睞。轎車的目標客戶是注重燃油效率的通勤者,而掀背車是針對能夠應對狹窄停車位的首次購車者。預計在車隊更新換代帶來的強勁供應推動下,SUV在印尼二手車市場的佔有率將持續成長。然而,由於學生通勤需求的增加,MPV在爪哇島郊區的銷售量正在下降。中國汽車製造商正憑藉具有競爭力的混合模式進軍這兩個細分市場,而老牌日本汽車製造商也更頻繁地更新其產品陣容。

在雅加達和泗水,新能源SUV深受追求品質生活的消費者青睞。而在路況較為複雜的外島地區,緊湊型MPV則佔主導地位。數位平台利用演算法向叫車用戶推薦SUV,向成長型家庭推薦MPV,進而提高配對效率。認證二手車專案也更傾向於SUV和MPV,因為與轎車相比,這些車型的保固提升銷售盈利更高。

截至2025年,汽油動力汽車仍將佔印尼二手車市場63.10%的佔有率,但混合動力汽車汽車和電動車正以12.34%的複合年成長率快速成長,這主要得益於消費稅減免和奢侈品稅豁免政策。由於政府正在討論削減補貼和實施更嚴格的排放氣體法規,柴油汽車的市佔率正在萎縮。雖然二手電動車市場規模仍然小規模,但快速充電樁的普及性和政府的藍圖預計將促進未來二手車的流通。從2024年起,雅加達競標會上混合動力汽車的殘值預計將比汽油動力汽車高出6-8%,這表明購車者的購車標準正在改變。

電池劣化的不不確定性限制了電動車的普及。經銷商對未經製造商檢驗的老款電動車持謹慎態度。銀行正在縮短仍在保固期內的電動車的貸款期限並降低抵押品估值。同時,在充電基礎設施不發達的農村市場,汽油動力汽車仍具有流動性優勢。

到2025年,價格區間在11,000美元至21,999美元之間的二手車將佔印尼二手車市場收入的39.05%,年複合成長率達7.33%,這與家庭中等收入水準和銀行信貸額度的成長趨勢相符。售價低於5,500美元的入門級車型吸引了省會城市的現金買家,而售價高於22,000美元的高階車型則迎合了追求豪華品牌的富裕都市人群的需求。印尼二手價位二手車市場佔有率的成長得益於旺盛的置換需求以及提供一年保固的認證二手車項目。

線上分期付款模擬工具正在幫助提升消費者對中價位車型的認知度,在各大門戶網站上搜尋最高的方案是首付20%、分48個月支付的1.5萬美元Avanza車型。高階車型市場的成長主要得益於外籍人士的車輛更新換代和企業車隊的處置,但與以性價比為導向的核心市場相比,它仍然是一個小眾市場。

其他福利:

- Excel格式的市場預測(ME)表

- 分析師支持(3個月)

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 拓展線上廣告與電子商務活動

- 銀行轉向推出專門針對二手車的貸款產品

- 在爪哇島以外地區拓展有組織的經銷商網路

- 叫車車輛更新週期(Grab 和 Gojek)

- 原廠回購計畫提升殘值

- 人工智慧驅動的狀況評估平台縮小了價格差距

- 市場限制

- 里程表和事故記錄造假現象依然普遍存在。

- 分散式州登記資料庫

- 島際物流成本高昂阻礙了爪哇島以外的貿易。

- 二手電動汽車電池健康檢查的認證實施有限

- 監管環境

- 技術展望

- 波特五力模型

- 新進入者的威脅

- 買方的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場規模與成長預測

- 按車輛類型

- 掀背車

- 轎車

- SUV

- MPV

- 按燃料類型

- 汽油

- 柴油引擎

- 混合動力汽車和電動車

- 其他(液化石油氣、壓縮天然氣等)

- 按價格範圍

- 低於5500美元

- 5,500 美元至 10,999 美元

- 11,000 美元至 21,999 美元

- 超過22,000美元

- 按銷售管道

- 線上數位分類門戶

- 純粹的電子零售商

- 經銷商/OEM線上平台

- 實體加盟店

- 獨立二手車經銷商

- 競標行(線上線下混合式)

- 私人銷售

- 依供應商類型

- 組織

- 雜亂無章

- 車齡

- 0-2歲

- 3-5年

- 6-8歲

- 8年以上

- 貸款提供者

- 汽車製造商(OEM)

- 銀行

- 非銀行金融公司

- 按州

- 西爪哇

- 東爪哇

- 中爪哇

- 北蘇門答臘

- 萬登

- 雅加達

- 其他州

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Mobil88(PT Serasi Auto Raya(SERA))

- Toyota Astra Motor(Toyota Trust)

- PT Tunas Ridean Tbk.

- PT Inchcape Indomobil Distribution Indonesia(IIDI)(Mercedes Certified)

- BMW Premium Selection(BME Eurokars)

- OLX Indonesia

- Carro Indonesia(Trusty Cars Ltd)

- Carsome Indonesia

- Broom.id

- Carmudi Indonesia

- Moladin

- Mobil123

第7章 市場機會與未來展望

The Indonesia used car market is expected to grow from USD 71.80 billion in 2025 to USD 76.55 billion in 2026 and is forecast to reach USD 105.5 billion by 2031 at 6.62% CAGR over 2026-2031.

Demand resilience reflects a structural tilt toward pre-owned vehicles as tighter credit conditions and waning purchasing power push households to stretch budgets without postponing mobility goals. Used-car financing outpaced new-car loans for the first time in 2024, signalling a lasting recalibration of consumer behavior. Online classifieds now dominate discovery journeys, and emerging AI-grading tools narrow price dispersion by giving buyers objective condition scores. Financing pivots by major banks boost accessibility and margins, while ride-hailing fleet renewals inject a steady stream of high-quality cars into dealer inventories.

Indonesia Used Car Market Trends and Insights

Growing Online Classified and E-retail Activity

Digital portals empower consumers to compare prices, mileage, and photos, streamlining their transactions before reaching out to sellers. Platform operators integrate inspection, financing, and documentation, reducing search friction in secondary cities where dealer density is low. SEVA's 17,500-unit throughput and IDR 8.2 trillion gross transaction value in 2024 validated the model, encouraging capital inflows and unicorn creation . Traditional conglomerates have reacted: Astra's OLX acquisition aligned captive financing, inspection centers, and logistics into a single stack. Regulatory support from OJK for in-platform digital lending completes a frictionless experience, propelling the Indonesian used car market toward deeper online penetration.

Banks' Pivot to Used-car Specific Loan Products

Major banks such as BCA expanded vehicle loan books to IDR 65.3 trillion (USD 4.1 billion) in 2024, with used cars forming an increasing share as lenders chase higher yields . Proprietary scorecards have evolved to incorporate a range of crucial factors, including mileage bands, detailed inspection grades, and projected resale values, moving beyond the traditional focus on borrower income. This innovative approach allows for instant pre-approval within online marketplaces, significantly reducing approval times to just a few hours. As a result, this streamlined process not only enhances conversion rates but also invigorates liquidity in the Indonesian used car market, creating dynamic opportunities for both buyers and sellers.

Odometer and Accident-history Fraud Remains Pervasive

Provincial STNK and BPKB systems operate in silos, letting bad actors reset mileage or hide flood damage when vehicles cross borders. First-time buyers and online shoppers bear the brunt, paying inflated prices for compromised cars. Trust deficits raise financing risk premiums, dampening the Indonesia used car market velocity until AI inspection and centralized data become mainstream.

Other drivers and restraints analyzed in the detailed report include:

- Expanding Organized Dealer Networks Outside Java

- Ride-hailing Fleet Renewal Cycles (Grab and Gojek)

- Fragmented Provincial Registration Databases

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

SUVs owned 37.62% of the Indonesia used car market share in 2025, buoyed by high ground clearance and perceived safety in congested streets. MPVs, climbing at 7.05% CAGR, appeal to multi-generational households that prize sliding doors and flexible seating. Sedans cater to commuters seeking fuel efficiency, and hatchbacks target first-time owners navigating tight parking norms. The Indonesia used car market size for SUVs is projected to keep pace with robust supply from fleet replacements, yet MPVs fetch quicker days-to-sale in suburban Java as school-run demand rises. Chinese OEMs have entered both segments with competitive hybrid trims, pushing Japanese incumbents to refresh line-ups more frequently.

New-energy SUVs feed aspirational buyers in Jakarta and Surabaya, while compact MPVs dominate outer-island lanes where road quality varies. Digital platforms algorithmically recommend SUVs to ride-hailing prospects and MPVs to growing families, increasing match efficiency. Certified programs overweight SUVs and MPVs because warranty upsells monetize better than sedans.

Petrol models still command 63.10% of the Indonesia used car market size in 2025, yet hybrids and electric models exhibit a 12.34% CAGR, propelled by VAT cuts and zero luxury tax. The diesel share erodes amid rising subsidy talk and emissions scrutiny. The Indonesia used car market size for electric models remains small, but fast-charger rollouts and government roadmaps catalyze future secondary sales. Residual values of hybrids have outperformed petrol peers in Jakarta auctions by 6-8% since 2024, hinting at shifting buyer calculus.

Battery degradation uncertainty curbs wider uptake. Dealers hesitate to stock older BEVs without OEM testing. Banks apply shorter tenures and higher collateral haircuts for BEVs pending battery warranties. Petrol cars, however, keep liquidity advantages in rural exchanges where charging remains scarce.

Units priced USD 11,000-21,999 held 39.05% of the Indonesia used car market revenue in 2025 and expanded at 7.33% CAGR, aligning with median household affordability and bank lending brackets. Entry models under USD 5,500 attract cash buyers in tier-3 cities, while premium brackets above USD 22,000 serve affluent urbanites eyeing luxury badges. The Indonesia used car market share of mid-range vehicles benefits from abundant trade-ins and certified programs bundling one-year warranties.

Online calculators showcasing installment scenarios boost mid-range visibility: a USD 15,000 Avanza with a 20% down payment and a 48-month tenor remains the most-searched combination on leading portals. Growth in premium slices rides on expatriate turnovers and corporate fleet disposals, but remains niche relative to value-centric core segments.

The Indonesia Used Car Market Report is Segmented by Vehicle Type (Hatchbacks, Sedans, and More), Fuel Type (Petrol, Diesel, and More), Price Segment (Below USD 5, 500, USD 5, 500-10, 999, and More), Sales Channel (Online Digital Classified Portals, Pure-Play E-Retailers, and More), Vendor Type (Organized and Unorganized), Vehicle Age, Financing Providers, and Province. The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Mobil88 (PT Serasi Auto Raya (SERA))

- Toyota Astra Motor (Toyota Trust)

- PT Tunas Ridean Tbk.

- PT Inchcape Indomobil Distribution Indonesia (IIDI) (Mercedes Certified)

- BMW Premium Selection (BME Eurokars)

- OLX Indonesia

- Carro Indonesia (Trusty Cars Ltd )

- Carsome Indonesia

- Broom.id

- Carmudi Indonesia

- Moladin

- Mobil123

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing Online Classified and E-retail Activity

- 4.2.2 Banks' Pivot to Used-car Specific Loan Products

- 4.2.3 Expanding Organized Dealer Networks Outside Java

- 4.2.4 Ride-hailing Fleet Renewal Cycles (Grab and Gojek)

- 4.2.5 OEM Buy-back Schemes Boosting Residual Values

- 4.2.6 AI-led Condition Grading Platforms Reducing Price Dispersion

- 4.3 Market Restraints

- 4.3.1 Odometer and Accident-history Fraud Remains Pervasive

- 4.3.2 Fragmented Provincial Registration Databases

- 4.3.3 High Inter-island Logistics Cost Discourages Non-Java Trade

- 4.3.4 Limited Certified-battery Health Checks for Used EVs

- 4.4 Regulatory Landscape

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Vehicle Type

- 5.1.1 Hatchbacks

- 5.1.2 Sedans

- 5.1.3 SUVs

- 5.1.4 MPVs

- 5.2 By Fuel Type

- 5.2.1 Petrol

- 5.2.2 Diesel

- 5.2.3 Hybrid and Electric

- 5.2.4 Others (LPG, CNG, etc.)

- 5.3 By Price Segment

- 5.3.1 Below USD 5,500

- 5.3.2 USD 5,500 - 10,999

- 5.3.3 USD 11,000 - 21,999

- 5.3.4 >= USD 22,000

- 5.4 By Sales Channel

- 5.4.1 Online Digital Classified Portals

- 5.4.2 Pure-play e-Retailers

- 5.4.3 Dealer/OEM Online Platforms

- 5.4.4 Physical Franchise Dealerships

- 5.4.5 Independent Used-Car Lots

- 5.4.6 Auction Houses (Physical and Online Hybrid)

- 5.4.7 Peer-to-Peer (Private) Sales

- 5.5 By Vendor Type

- 5.5.1 Organized

- 5.5.2 Unorganized

- 5.6 By Vehicle Age

- 5.6.1 0 - 2 Years

- 5.6.2 3 - 5 Years

- 5.6.3 6 - 8 Years

- 5.6.4 Above 8 Years

- 5.7 By Financing Providers

- 5.7.1 Original Equipment Manufacturers (OEMs)

- 5.7.2 Banks

- 5.7.3 Non-Banking Financial Companies

- 5.8 By Province

- 5.8.1 West Java

- 5.8.2 East Java

- 5.8.3 Central Java

- 5.8.4 North Sumatra

- 5.8.5 Banten

- 5.8.6 Jakarta

- 5.8.7 Other Provinces

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (Includes Global Level Overview, Market Level Overview, Core Segments, Financials as Available, Strategic Information, Market Rank/Share for Key Companies, Products and Services, SWOT Analysis, and Recent Developments)

- 6.4.1 Mobil88 (PT Serasi Auto Raya (SERA))

- 6.4.2 Toyota Astra Motor (Toyota Trust)

- 6.4.3 PT Tunas Ridean Tbk.

- 6.4.4 PT Inchcape Indomobil Distribution Indonesia (IIDI) (Mercedes Certified)

- 6.4.5 BMW Premium Selection (BME Eurokars)

- 6.4.6 OLX Indonesia

- 6.4.7 Carro Indonesia (Trusty Cars Ltd )

- 6.4.8 Carsome Indonesia

- 6.4.9 Broom.id

- 6.4.10 Carmudi Indonesia

- 6.4.11 Moladin

- 6.4.12 Mobil123

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment