|

市場調查報告書

商品編碼

1911423

歐洲二手車市場:市場佔有率分析、產業趨勢與統計、成長預測(2026-2031)Europe Used Car - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

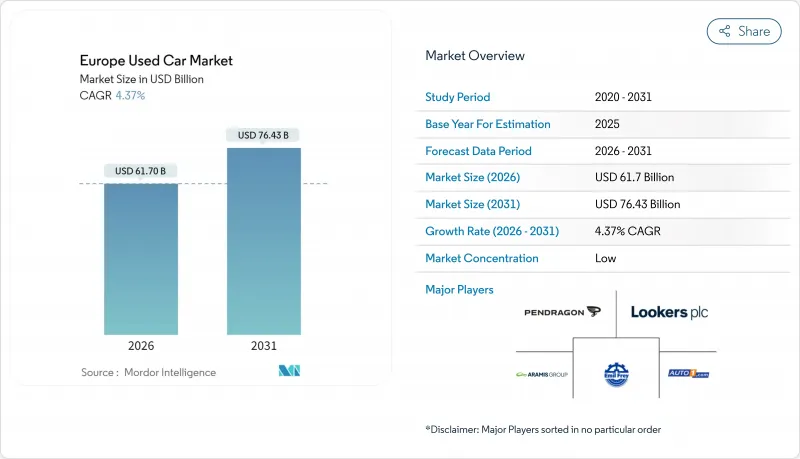

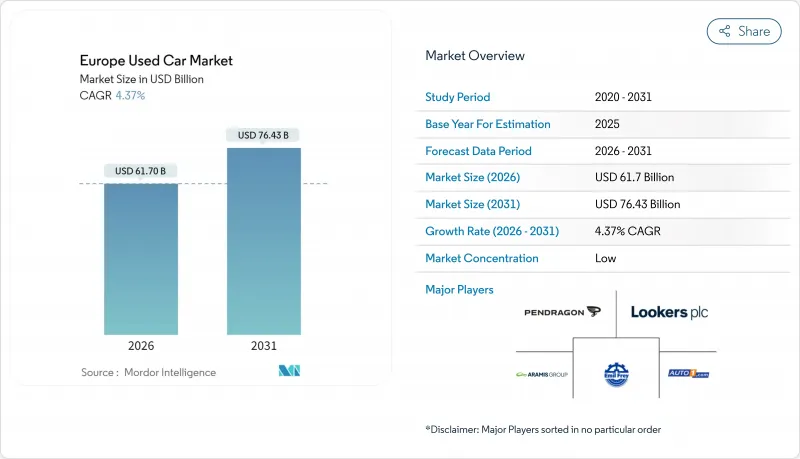

歐洲二手車市場預計將從 2025 年的 591.2 億美元成長到 2026 年的 617 億美元,到 2031 年達到 764.3 億美元,2026 年至 2031 年的複合年成長率為 4.37%。

數位化市場、OEM支援的認證二手(CPO)專案以及嵌入式融資解決方案正在融合,透過提高價格透明度、可靠性和可負擔性來加速需求成長。隨著西歐逐步淘汰柴油車的政策將車輛重新分配到中歐和東歐,跨境庫存流動正在創造增量銷售。大量車齡3-5年的二手租賃車輛供應正在緩解新車庫存持續短缺的問題。同時,儘管估值不確定性,電池式電動車(BEV)仍代表著一個快速成長的高階細分市場。隨著傳統經銷商、數位顛覆者和OEM直銷通路都在尋求融合線上研究、展示室和交付流程的全通路模式,日益激烈的競爭正在重塑利潤率和客戶擁有週期。

歐洲二手車市場趨勢與洞察

原廠配套認證二手車(CPO)專案的激增

原廠認證二手車 (CPO) 計劃將廠商保固、保養標準和數位化預約工具引入二手車銷售流程,使準新車成為新車的可靠替代品。高殘值和更高的單車盈利促使各大品牌將 CPO 納入其核心策略;然而,消費者對 CPO 的認知度仍然較低。德國和英國的經銷商協會正在持續進行教育活動,旨在將技術保固資訊轉化為更清晰的價值訊息。有效的 CPO 計劃能夠引導車主使用授權服務,並在整個車主生命週期內增強配件和保養方面的收入來源。

由於強制性車隊電氣化,租賃期滿(3-5年車齡)的車輛供應量增加。

大量租賃到期車輛,尤其是車齡3-5年的車輛,正在改變歐洲各地的庫存格局,為市場參與企業帶來挑戰和機會。車隊電氣化強制令加速了這一趨勢,企業車隊為了實現永續性目標並利用不斷發展的技術,正在加快車輛的更新換代速度。在德國和荷蘭等租賃滲透率較高的市場,這種供應激增尤其明顯,在這些市場,租賃仍是電池式電動車(BEV)的主要購買方式。

里程表造假問題削弱了買家信心

里程表造假問題持續困擾著歐洲二手車市場,削弱了消費者信心,並導致受影響細分市場的車輛價格下跌。這種人為降低車輛里程數以提高售價的做法,每年對歐洲消費者造成數十億歐元的損失,並且對跨境交易的影響尤其嚴重,因為跨境交易的檢驗難度更高。東歐、義大利和西班牙的情況尤其嚴峻,這些地區的監管力道參差不齊。基於區塊鏈的車輛歷史記錄等數位化解決方案展現出一定的潛力,但其在歐洲的應用仍十分分散。

細分市場分析

到2025年,SUV/MUV車型將佔歐洲二手車市場33.78%的佔有率,這反映出即使在油價達到峰值後,消費者仍然渴望擁有多功能性和舒適的乘坐體驗。越來越多的純電動SUV租約到期,也支撐了9.67%的複合年成長率預測。由於都市區堵塞費使車身較長的轎車處於不利地位,轎車市場將持續下滑。掀背車在人口密集的城市中心,仍受到價格敏感型首次購車者的青睞。

在法國和西班牙,高殘值促使特許經銷商預留展位空間展示中階跨界車,而中小型服務型企業對輕型商用車的需求依然穩定。符合歐盟6排放標準的廂型車在低排放氣體區售價高出12%,凸顯了合規車輛和不合規車輛之間的市場兩極化。南歐市場對SUV的需求日益成長,葡萄牙對標緻2008等小型跨界車的需求實現了兩位數成長。

到2025年,柴油車在歐洲二手車市場的佔有率將佔41.52%,低於歷史最高水平,這主要歸因於空氣品質措施的加強。儘管目前規模仍然較小,但純電動車(BEV)正以17.95%的複合年成長率快速成長,早期採用者發布的示範車輛有助於緩解人們對技術的擔憂。在充電基礎設施不發達的國家,汽油車仍然十分重要,而混合動力汽車(HEV)和插電式混合動力汽車(PHEV)則彌合了法規遵循和續航里程之間的差距。

跨境套利正推動柴油車從法國和德國流向保加利亞和羅馬尼亞,延長車輛的生命週期回報期;同時,隨著荷蘭二手車補貼的減少,純電動車交易正在興起。電池健康狀況的透明度仍然是一個障礙,但隨著檢驗工具包的廣泛普及,預計在歐盟7標準實施後,市場流動性將進一步提升。

點對點交易、個人廣告和小規模經銷商仍佔交易量的54.60%,但在投資者的支持下,數據豐富的市場平台正以6.18%的複合年成長率快速擴張。排名前五的零售商僅佔B2C交易量的6%,顯示市場整合空間龐大。由製造商支援的認證二手車(CPO)經銷商提供更嚴格的庫存管理、捆綁式服務計劃和融資方案,這些都吸引了風險規避型消費者。

歐洲二手車市場由平台主導,這些平台提供集中庫存、自動化維護和產權保障等服務。在波蘭,結合運輸和稅務服務,有組織的經銷商能夠在跨境交易中擊敗分散的競爭對手,從而建立信任並促進重複購買。

其他福利:

- Excel格式的市場預測(ME)表

- 分析師支持(3個月)

目錄

第1章 引言

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場促進因素

- 原廠配套認證二手車(CPO)專案的激增

- 由於強制性車隊電氣化,二手租賃車輛(3-5年車齡)供應量增加。

- 純線上市場的成長和數位滲透率的不斷提高

- 由於符合WLTP/歐7排放標準,新車價格上漲,與二手車的價格差距擴大。

- 加速柴油車淘汰政策將促進跨境貿易流動

- 透過嵌入式金融/先買後付解決方案提升首次購屋者的購屋能力

- 市場限制

- 里程表造假行為持續存在,削弱了買家的信心。

- 稅收制度和登記規則的碎片化阻礙了二級分配的順利進行。

- 電動車電池健康狀態標準化工作的延誤導致二手電動車的殘值下降。

- 老舊車輛的品質和可靠性問題

- 價值/價值鏈分析

- 監理展望

- Euro 7 歐盟電池法規增值稅利潤率方法修訂

- 技術展望

- 人工智慧驅動的車輛評估* 用於轉售的數位雙胞胎* OTA保固分析

- 波特五力模型

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場規模及成長預測(價值(美元)及銷售量(單位))

- 按車輛類型

- 轎車

- SUV/MUV

- 掀背車

- 按燃料類型

- 汽油車

- 柴油車

- 電池式電動車(BEV)

- 混合動力汽車和插電式混合動力汽車(HEV/PHEV)

- 其他(液化石油氣、壓縮天然氣、生質燃料)

- 依供應商類型

- 有組織的

- 雜亂無章

- 按銷售管道

- 離線

- 線上

- 按車輛型號年份

- 0-2歲

- 3-5年

- 6-8歲

- 超過9年

- 以所有者數量計算

- 單一車主車輛

- 多車主車輛

- 價格範圍(美元)

- 低於 10,000 美元

- 10,000 美元至 20,000 美元

- 20,000美元至30,000美元

- 超過3萬美元

- 透過融資方式

- 貸款購買

- 現金購買

- 按國家/地區

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 荷蘭

- 瑞典

- 波蘭

- 其他歐洲地區

第6章 競爭情勢

- 策略性舉措(併購、資金籌措、船隊合作)

- 市佔率分析

- 公司簡介

- Auto1 Group SE

- Emil Frey AG

- BCA Marketplace(Constellation Automotive)

- Pendragon PLC

- Aramis Group SA

- Lookers PLC

- Autorola A/S

- Arnold Clark Automobiles Ltd

- Sytner Group Ltd

- Cazoo Group Ltd

- CarNext BV

- Inchcape PLC

- Hedin Mobility Group

- Heycar(Mobility Trader GmbH)

- Penske Automotive Group/CarShop

- ALD Automotive and LeasePlan

- Groupe Renault Retail Group

- Bilia AB

- Motorpoint Group PLC

- Vertu Motors PLC

第7章 市場機會與未來展望

The Europe used car market is expected to grow from USD 59.12 billion in 2025 to USD 61.7 billion in 2026 and is forecast to reach USD 76.43 billion by 2031 at 4.37% CAGR over 2026-2031.

Digital marketplaces, OEM-backed certified pre-owned (CPO) programs, and embedded finance solutions together accelerate demand by improving price transparency, trust, and affordability. Cross-border inventory flows unlock incremental volume as diesel phase-out policies in Western Europe redirect vehicles to Central and Eastern Europe. The mid-age supply wave of 3 to 5-year-old ex-lease cars balances out persistent shortages of younger stock, while battery-electric vehicles (BEVs) add a fast-growing premium layer despite valuation uncertainty. Competitive intensity is rising as traditional dealers, digital disruptors, and OEM captive channels pursue omnichannel models that blend online research with showroom or delivery hand-offs, reshaping margins and customer ownership cycles.

Europe Used Car Market Trends and Insights

Surge in OEM-Backed Certified Pre-Owned (CPO) Programs

OEM CPO schemes inject manufacturer warranties, refurbishment standards, and digital booking tools into the resale journey, positioning near-new cars as credible substitutes for new models. Strong residuals and higher per-unit profitability motivate brands to mainstream CPO in core planning. Consumer awareness, however, remains muted; ongoing education initiatives by dealer councils in Germany and the UK aim to translate technical coverage into clearer value messaging. Effective programs also loop owners back into authorized service lanes, reinforcing accessory and maintenance revenue streams across the ownership lifecycle.

Rising Supply of Ex-Lease Vehicles (3-5-Year Bracket) Driven by Fleet Electrification Mandates

The influx of off-lease vehicles, particularly in the 3-5 year bracket, is reshaping inventory dynamics across Europe, creating both challenges and opportunities for market participants. Fleet electrification mandates are accelerating this trend, with corporate fleets cycling through vehicles more rapidly to meet sustainability targets and take advantage of evolving technology. This supply surge is particularly pronounced in markets with strong leasing penetration, such as Germany and the Netherlands, where leasing remains a key acquisition method for battery electric vehicles (BEVs).

Persisting Odometer Fraud Undermining Buyer Trust

Odometer fraud continues to plague the European used car market, eroding consumer confidence and depressing values across affected segments. This practice, where vehicle mileage is artificially reduced to increase selling prices, costs European consumers billions annually and disproportionately impacts cross-border transactions where verification is more challenging.The problem is particularly acute in Eastern Europe, Italy, and Spain, where regulatory enforcement varies significantly. While digital solutions like blockchain-based vehicle history records show promise, implementation remains fragmented across the continent.

Other drivers and restraints analyzed in the detailed report include:

- Growth of Pure-Play Online Marketplaces Increasing Digital Penetration

- Elevated New-Car Prices from WLTP/Euro-7 Compliance Widening Price Gap to Used

- Slow EV Battery-Health Standardisation Depressing Residual Values of Used BEVs

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

SUV/MUV models commanded 33.78% of the Europe used car market size in 2025, reflecting consumer appetite for versatility and higher seating positions even after fuel-cost pressures peaked. BEV-compatible SUVs now exit lease pools in greater numbers, which underpins a 9.67% CAGR outlook. Sedans continue to slide as urban congestion charges penalise longer body formats. Hatchbacks retain loyalty inside dense city cores among price-sensitive first-time buyers.

Dynamic residuals encourage franchised dealers in France and Spain to dedicate rooftop space to mid-spec crossovers, while LCV uptake remains steady in service-oriented SMEs. Euro 6-compliant vans trade at 12% premiums inside low-emission zones, highlighting a bifurcation between compliant and non-compliant workhorses. Southern Europe leans even harder into SUVs; Portugal's demand for sub-compact crossovers such as the Peugeot 2008 grows by double digits.

Diesel vehicles captured 41.52% of the Europe used car market share in 2025, down from previous highs as clean-air measures rise. Though starting small, battery electric vehicles are advancing at 17.95% CAGR as early adopter fleets de-risk technology fears by releasing documented vehicles. Petrol maintains relevance in countries with nascent charging grids, while HEV and PHEV bridge compliance and range concerns.

Cross-border arbitrage channels diesel cars from France and Germany into Bulgaria and Romania, prolonging lifecycle yields. Meanwhile, BEV bargains appear in the Netherlands, where resale subsidies tighten. Transparency around battery state of health remains a gating factor, yet growth in verification kits is expected to unlock further liquidity after Euro 7 implementation.

Independent traders, private classifieds, and micro-dealerships still account for 54.60% of the volume, but organized players scale quicker at 6.18% CAGR as investors back data-rich marketplaces. The top five retailers account for only 6% of B2C transactions, signalling ample consolidation headroom. OEM-sponsored CPO outlets add inventory discipline, bundled service plans, and financing that resonate with risk-averse shoppers.

The Europe used car market rewards platforms able to syndicate stock, automate reconditioning, and guarantee title. In Poland, bundled transport and taxation services enable organised sellers to undercut fragmented rivals on cross-border purchases, boosting trust and repeat business.

The Europe Used Car Market Report is Segmented by Vehicle Type (Hatchback, Sedan, and More), Fuel Type (Gasoline, Diesel, and More), Vendor Type (Organized and Unorganized), Sales Channel (Offline and Online), Vehicle Age (0 To 2 Years, 3 To 5 Years, and More), Ownership Count (Single-Owner Vehicles and More), Price Band, Financing Type, and Country. The Market Forecasts are Provided in Terms of Value (USD) and Volume (Units).

List of Companies Covered in this Report:

- Auto1 Group SE

- Emil Frey AG

- BCA Marketplace (Constellation Automotive)

- Pendragon PLC

- Aramis Group SA

- Lookers PLC

- Autorola A/S

- Arnold Clark Automobiles Ltd

- Sytner Group Ltd

- Cazoo Group Ltd

- CarNext B.V.

- Inchcape PLC

- Hedin Mobility Group

- Heycar (Mobility Trader GmbH)

- Penske Automotive Group/CarShop

- ALD Automotive and LeasePlan

- Groupe Renault Retail Group

- Bilia AB

- Motorpoint Group PLC

- Vertu Motors PLC

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Drivers

- 4.1.1 Surge in OEM-Backed Certified Pre-Owned (CPO) Programs

- 4.1.2 Rising Supply of Ex-Lease Vehicles (3-5-Year Bracket) Driven by Fleet Electrification Mandates

- 4.1.3 Growth of Pure-Play Online Marketplaces Increasing Digital Penetration

- 4.1.4 Elevated New-Car Prices from WLTP/Euro-7 Compliance Widening Price Gap to Used

- 4.1.5 Accelerated Diesel Phase-Out Policies Boosting Cross-Border Trade Flows

- 4.1.6 Embedded Finance/BNPL Solutions Improving Affordability for First-Time Buyers

- 4.2 Market Restraints

- 4.2.1 Persisting Odometer Fraud Undermining Buyer Trust

- 4.2.2 Fragmented Tax and Registration Rules Hampering Seamless Secondary Trade

- 4.2.3 Slow EV Battery-Health Standardisation Depressing Residual Values of Used BEVs

- 4.2.4 Quality and Reliability Concerns in Older-Age Vehicles

- 4.3 Value/Supply-Chain Analysis

- 4.4 Regulatory Outlook

- 4.4.1 Euro-7 EU Battery Regulation VAT margin scheme revisions

- 4.5 Technological Outlook

- 4.5.1 AI-driven vehicle grading * Digital twins for re-marketing * OTA warranty analytics

- 4.6 Porter's Five Forces

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

5 Market Size and Growth Forecasts (Value (USD) and Volume (Units))

- 5.1 By Vehicle Type

- 5.1.1 Sedan

- 5.1.2 SUV/MUV

- 5.1.3 Hatchback

- 5.2 By Fuel Type

- 5.2.1 Gasoline

- 5.2.2 Diesel

- 5.2.3 Battery Electric Vehicle (BEV)

- 5.2.4 Hybrid and Plug-in Hybrid (HEV/PHEV)

- 5.2.5 Others (LPG, CNG, Bio-fuel)

- 5.3 By Vendor Type

- 5.3.1 Organized

- 5.3.2 Unorganized

- 5.4 By Sales Channel

- 5.4.1 Offline

- 5.4.2 Online

- 5.5 By Vehicle Age

- 5.5.1 0 to 2 Years

- 5.5.2 3 to 5 Years

- 5.5.3 6 to 8 Years

- 5.5.4 More Than 9 Years

- 5.6 By Ownership Count

- 5.6.1 Single-Owner Vehicles

- 5.6.2 Multi-Owner Vehicles

- 5.7 By Price Band (USD)

- 5.7.1 Less than 10k

- 5.7.2 10k to 20k

- 5.7.3 20k to 30k

- 5.7.4 More than 30k

- 5.8 By Financing Type

- 5.8.1 Financed Purchase

- 5.8.2 Outright Purchase

- 5.9 By Country

- 5.9.1 Germany

- 5.9.2 United Kingdom

- 5.9.3 France

- 5.9.4 Italy

- 5.9.5 Spain

- 5.9.6 Russia

- 5.9.7 Netherlands

- 5.9.8 Sweden

- 5.9.9 Poland

- 5.9.10 Rest of Europe

6 Competitive Landscape

- 6.1 Strategic Moves (M&A, Fund-Raises, Fleet Partnerships)

- 6.2 Market Share Analysis

- 6.3 Company Profiles (Includes Global Level Overview, Market Level Overview, Core Segments, Financials as Available, Strategic Information, Market Rank/Share for Key Companies, Products and Services, SWOT Analysis, and Recent Developments)

- 6.3.1 Auto1 Group SE

- 6.3.2 Emil Frey AG

- 6.3.3 BCA Marketplace (Constellation Automotive)

- 6.3.4 Pendragon PLC

- 6.3.5 Aramis Group SA

- 6.3.6 Lookers PLC

- 6.3.7 Autorola A/S

- 6.3.8 Arnold Clark Automobiles Ltd

- 6.3.9 Sytner Group Ltd

- 6.3.10 Cazoo Group Ltd

- 6.3.11 CarNext B.V.

- 6.3.12 Inchcape PLC

- 6.3.13 Hedin Mobility Group

- 6.3.14 Heycar (Mobility Trader GmbH)

- 6.3.15 Penske Automotive Group/CarShop

- 6.3.16 ALD Automotive and LeasePlan

- 6.3.17 Groupe Renault Retail Group

- 6.3.18 Bilia AB

- 6.3.19 Motorpoint Group PLC

- 6.3.20 Vertu Motors PLC