|

市場調查報告書

商品編碼

1911471

菲律賓二手車市場:市場佔有率分析、產業趨勢與統計、成長預測(2026-2031)Philippines Used Car - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

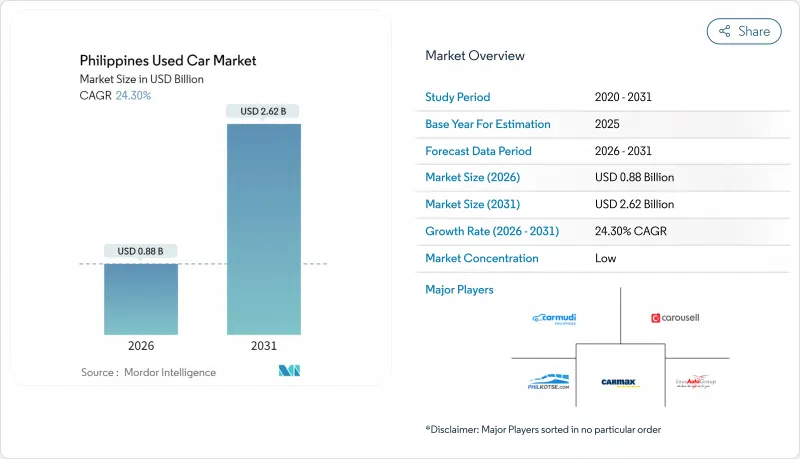

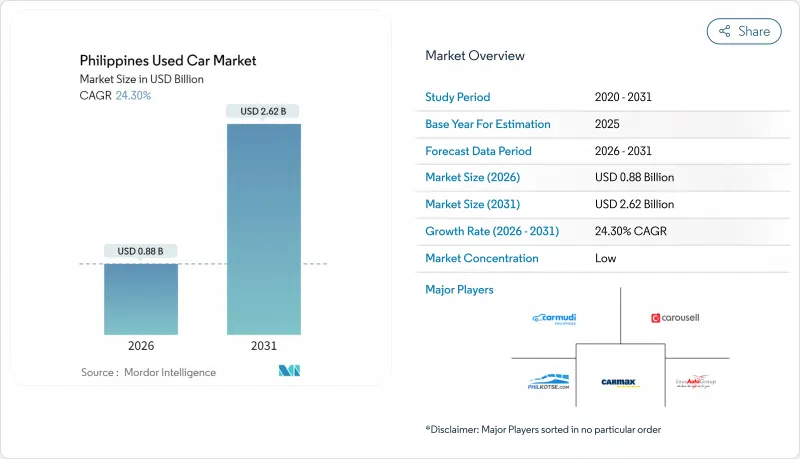

預計菲律賓二手車市場將從 2025 年的 7.1 億美元成長到 2026 年的 8.8 億美元,到 2031 年達到 26.2 億美元,2026 年至 2031 年的複合年成長率為 24.30%。

這一令人矚目的成長展現了市場在經濟挑戰下的韌性。新車價格上漲和中產階級日益成長的出行需求正促使更多菲律賓人選擇二手車。數位平台在促進市場擴張、提高透明度和簡化交易流程方面發揮關鍵作用。預計這些線上通路在2025年至2030年間將迎來強勁成長。監管政策的調整,例如陸路交通管理局(LTO)暫停徵收車輛過戶罰款,正在推動二手車交易流程。此外,汽車金融滲透率的快速提升,以及銀行與數位汽車交易平台之間的合作,預計將在未來幾年推動交易量的成長。

菲律賓二手車市場趨勢與分析

透過線上廣告和電子商務實現二手車交易數位化

菲律賓二手車市場的數位轉型正在從根本上改變交易結構,如今85%的銷售線索都來自線上,尤其是Facebook等社群媒體平台。這種轉變將傳統的購車週期從數週縮短至數天,消費者利用數位工具比較不同選項、查詢車輛歷史記錄並在前往經銷商之前獲得融資。數位平台的功能也日益超越簡單的資訊發布,提供端到端的交易服務,包括線上支付、電子文件和虛擬驗車。這種轉變在網路普及率超過72%的大馬尼拉地區最為明顯,隨著智慧型手機的普及,這種趨勢正迅速擴展到其他地區城市。

馬尼拉大都會不斷壯大的中產階級推動了對經濟實惠交通工具的需求。

馬尼拉大都會區不斷壯大的中產階級對經濟實惠的出行解決方案的需求空前高漲,二手車市場正成為首次購車者的主要途徑。這項人口結構的變化體現在25至35歲的年輕專業身上,他們更重視車輛的保值性和實用性,而非新車身分。推動這一趨勢的經濟務實性體現在他們對價格在50萬至100萬披索比索之間的車輛的偏好上,這類車輛在質量和價格之間取得了最佳平衡,能夠滿足月收入在5萬至10萬披索之間的中等收入家庭的需求。這種影響不僅限於車輛所有權本身,也延伸到車輛選擇標準,燃油效率和維護成本逐漸取代品牌形象,成為首要考量。

車輛歷史記錄缺乏透明度會削弱買家信心。

菲律賓二手車市場仍面臨車輛歷史資訊不透明和文件管理不規範等挑戰,尤其是在非正規市場,這持續侵蝕消費者的信任。資訊缺失導致購車過程出現許多摩擦,迫使買家依賴表面化的檢查和第三方技工,而非已開發市場普遍採用的全面車輛歷史報告。這種信任缺失在農村地區尤其嚴重,因為這些地區車輛檢驗服務有限,造成市場效率和價格上的區域差異。

細分市場分析

由於營運成本低且擅長建立人際關係,非正規經銷商,尤其是在大都會區以外的地區,預計到2025年將佔據71.65%的銷售額。他們吸引那些尋求折扣的顧客,但由於文件資料不足,也面臨一些挑戰,這可能會讓買家望而卻步。非正規經銷商憑藉對超當地語系化市場的深入了解和人際關係銷售技巧,尤其是在遍遠地區,得以維持市場地位,因為在這些地區,人脈關係往往比正式的資格認證更為重要。他們的經營模式通常以營運成本低、手續簡便為特點,這使得他們能夠提供具有競爭力的價格,但也帶來了透明度方面的挑戰,這對於日益成熟的消費者來說往往是一個問題。

以Carmudi和Automart.PH主導的成熟二手車市場正以25.05%的複合年成長率快速擴張,透過提供車輛檢驗證書、預先核准貸款和7天退貨保證等服務,有效緩解了消費者的購車焦慮。線上平台覆蓋全國,而位於馬尼拉大都會區、宿霧和達沃的實體店則提供試駕和售後服務。隨著消費者對車輛歷史記錄的要求日益提高,菲律賓二手車市場正逐步向這些透明化的平台轉型。

到2025年,轎車將佔汽車交易總量的36.10%,並將繼續成為追求低運行成本的通勤者的首選。同時,SUV和MPV將以24.72%的複合年成長率成長,這主要得益於家庭用戶對高離地間隙的需求,以應對洪水和坑洞路面。豐田威馳和本田鋒範等緊湊型日系車型在該類別中佔據主導地位,憑藉其可靠的性能和充足的零件供應,為用戶提供了低廉的用車成本。掀背車是預算有限的消費者的入門車型,而廂型車則服務於商業用戶和需要最大載客量的大家庭。皮卡在農村地區保持穩定的需求,因為越野實用性和耐用性是這些地區用戶考慮的關鍵因素。

豐田Fortuna和三菱Montero Sport等中型SUV正在推動這一快速成長,它們配備了最新的駕駛輔助系統,並可容納七名乘客。掀背車和廂型車保持著穩定的細分市場,而皮卡則迎合了需要兼顧貨物運輸和崎嶇路況的農村買家的需求。預計到2030年,SUV在菲律賓二手車市場與轎車的銷售差距將顯著縮小。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 透過線上廣告和電子商務實現二手車交易數位化

- 馬尼拉大都會不斷壯大的中產階級將推動對經濟實惠的交通工具的需求。

- 透過積極的OEM置換和融資計劃縮短車輛擁有周期

- 受海外務工人員匯款支持的區域成長中心採購趨勢

- 蘇比克灣和自由港地區進口配額放寬,促進了供應。

- 燃油成本上漲正促使人們轉向二手更節能的二手車。

- 市場限制

- 車輛歷史記錄缺乏透明度會降低買家信心。

- 颱風季過後,洪水災害風險會降低殘值。

- 都市區來自共乘和微出行的競爭

- 高利率限制了消費者獲得金融產品的機會。

- 技術展望

- 波特五力模型

- 新進入者的威脅

- 買方和消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場規模及成長預測(價值(美元)及銷售量(單位))

- 依供應商類型

- 有組織的

- 雜亂無章

- 按車輛類型

- 掀背車

- 轎車

- SUV 和 MPV

- 皮卡車

- 貨車

- 按燃料類型

- 汽油

- 柴油引擎

- 混合動力汽車和電動車

- 其他(壓縮天然氣、液化石油氣)

- 按銷售管道

- 線上

- 離線

- 按車輛型號年份

- 0-3歲

- 4-6年

- 7-10歲

- 超過10年

- 按價格範圍(菲律賓比索)

- 不到50萬披索

- 披索至100萬披索

- 超過100萬

- 按地區

- 呂宋島

- 維薩揚群島

- 棉蘭老島

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Carmudi

- Carousell

- Carmax

- LausGroup

- Toyota Motor Philippines

- Automart.PH

- Philkotse.com

- ZigWheels

- Tsikot.com

- Car Empire

- OLX Philippines

- AutoDeal.com.ph

- Hyundai HARI CPO

- Volkswagen PH

- Ford Philippines

- PGA Cars Premium Used

- Mitsubishi Diamond CPO

- Nissan Intelligent Choice PH

- Suzuki Certified Used Cars

- Isuzu PH Used Truck Centers

- Grab AutoExchange

- BPI Repossessed Cars Marketplace

第7章 市場機會與未來展望

The Philippines Used Car Market is expected to grow from USD 0.71 billion in 2025 to USD 0.88 billion in 2026 and is forecast to reach USD 2.62 billion by 2031 at 24.30% CAGR over 2026-2031.

This impressive growth underscores the market's resilience in economic challenges. As new car prices climb and the middle class seeks mobility, more Filipinos turn to pre-owned vehicles. Digital platforms are playing a pivotal role, boosting market expansion, enhancing transparency, and streamlining transactions. These online channels are anticipated to grow robustly from 2025 to 2030. Regulatory changes, like the LTO's temporary halt on ownership transfer penalties, are smoothing out the resale process. Furthermore, a surge in auto loan penetration, coupled with collaborations between banks and digital auto marketplaces, is set to amplify transaction volumes in the coming years.

Philippines Used Car Market Trends and Insights

Digitalization of Used-Car Transactions via Online Classifieds and E-commerce

The digital transformation of the Philippines used car market is fundamentally altering transaction dynamics, with 85% of leads now originating from online sources, particularly social media platforms like Facebook. This shift has compressed the traditional buying cycle from weeks to days as consumers leverage digital tools to compare options, check vehicle histories, and secure financing before visiting dealerships. Digital platforms are not merely listing services but increasingly offer end-to-end transaction capabilities, including online payment processing, digital documentation, and virtual inspections.The transition is most pronounced in Metro Manila, where internet penetration exceeds 72%, but is rapidly extending to provincial cities as smartphone adoption increases

Middle-Class Expansion in Metro Manila Boosting Affordable Mobility Demand

The expanding middle class in Metro Manila is creating unprecedented demand for affordable mobility solutions, with the used car market serving as the primary entry point for first-time vehicle owners. This demographic shift is characterized by young professionals aged 25-35 who prioritize value retention and practical features over new-car prestige. The economic pragmatism driving this trend is evident in the preference for vehicles in the PHP 500k-1 million range, which offers the optimal balance between quality and affordability for middle-income households earning PHP 50,000-100,000 monthly. The impact extends beyond simple ownership to influence vehicle selection criteria, with fuel efficiency and maintenance costs becoming primary considerations over brand prestige.

Limited Vehicle-History Transparency Undermining Buyer Trust

The persistent challenge of limited vehicle history transparency continues to undermine consumer confidence in the Philippines used car market, particularly in the dominant unorganized segment where documentation practices remain inconsistent. This information asymmetry creates significant friction in the purchasing process, with buyers forced to rely on superficial inspections or third-party mechanics rather than comprehensive vehicle history reports that are standard in more developed markets. The trust deficit is most acute in provincial areas where access to vehicle verification services is limited, creating geographic disparities in market efficiency and pricing.

Other drivers and restraints analyzed in the detailed report include:

- OEM Trade-in and Financing Programs Shortening Ownership Cycles

- OFW Remittance-Driven Purchases in Provincial Growth Centers

- Competition from Ride-hailing and Micro-mobility in Urban Hubs

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Unorganized dealers controlled 71.65% of 2025 sales thanks to lower overheads and relationship-based negotiations, particularly outside major cities. They appeal to bargain hunters but struggle with limited documentation, which fuels buyer hesitation. Unorganized dealers maintain their foothold through hyperlocal market knowledge and relationship-based selling, particularly in provincial areas where personal connections often outweigh formal guarantees. Their business model typically involves lower overhead costs and minimal documentation, allowing for competitive pricing but creating transparency challenges that increasingly sophisticated consumers find problematic.

Organized players, led by Carmudi and Automart.PH is scaling at 25.05% CAGR by bundling inspection certificates, financing pre-approval, and seven-day return windows that reduce purchase anxiety. Their digital storefronts reach a national audience, while physical hubs in Metro Manila, Cebu, and Davao anchor test drives and after-sales service. As consumer expectations for verifiable histories grow, the Philippines' used car market gradually shifts toward these transparent marketplaces.

Sedans captured 36.10% of transactions in 2025 and remain the entry point for commuters seeking low running costs. Yet SUVs and MPVs are charting a 24.72% CAGR, buoyed by families looking for higher ground clearance against floods and potholes. The category is dominated by compact Japanese models like the Toyota Vios and Honda City, which benefit from established reliability reputations and abundant parts availability that reduce ownership costs. Hatchbacks serve as entry-level options for budget-conscious consumers, while vans cater to commercial users and large families requiring maximum passenger capacity. Pickup trucks maintain steady demand in provincial areas where utility and durability on unpaved roads are primary considerations.

Mid-sized contenders such as the Toyota Fortuner and Mitsubishi Montero Sport headline this surge, offering modern driver-assistance suites and seven-seat capacity. Hatchbacks and vans maintain steady niche roles, while pickups cater to provincial buyers balancing cargo needs and rugged roads. The Philippines used car market size for SUVs is forecast to close much of the volume gap with sedans by 2030.

Philippines Used Car Market Report is Segmented by Vendor Type (Organized and Unorganized), Vehicle Type (Hatchbacks, Sedans, and More), Fuel Type (Petrol, Diesel, and More), Sales Channel (Online and Offline), Vehicle Age (0 To 3 Years, 4 To 6 Years, and More), Price Band (Less Than PHP 500K, PHP 500K To 1 Million, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD) and Volume (Units).

List of Companies Covered in this Report:

- Carmudi

- Carousell

- Carmax

- LausGroup

- Toyota Motor Philippines

- Automart.PH

- Philkotse.com

- ZigWheels

- Tsikot.com

- Car Empire

- OLX Philippines

- AutoDeal.com.ph

- Hyundai HARI CPO

- Volkswagen PH

- Ford Philippines

- PGA Cars Premium Used

- Mitsubishi Diamond CPO

- Nissan Intelligent Choice PH

- Suzuki Certified Used Cars

- Isuzu PH Used Truck Centers

- Grab AutoExchange

- BPI Repossessed Cars Marketplace

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Digitalization of Used-Car Transactions via Online Classifieds and E-commerce

- 4.2.2 Middle-Class Expansion in Metro Manila Boosting Affordable Mobility Demand

- 4.2.3 Aggressive OEM Trade-in and Financing Programs Shortening Ownership Cycles

- 4.2.4 OFW Remittance-Driven Purchases in Provincial Growth Centers

- 4.2.5 Relaxed Import Quotas in Subic and Freeport Zones Spurring Supply

- 4.2.6 Rising Fuel Costs Driving Shift to More Efficient Used Vehicles

- 4.3 Market Restraints

- 4.3.1 Limited Vehicle-History Transparency Undermining Buyer Trust

- 4.3.2 Flood-Damage Risk Post-Typhoon Season Depressing Residual Values

- 4.3.3 Competition from Ride-hailing and Micro-mobility in Urban Hubs

- 4.3.4 High Interest Rates Constraining Consumer Financing Access

- 4.4 Technological Outlook

- 4.5 Porter's Five Forces

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

5 Market Size and Growth Forecasts (Value (USD) and Volume (Units))

- 5.1 By Vendor Type

- 5.1.1 Organized

- 5.1.2 Unorganized

- 5.2 By Vehicle Type

- 5.2.1 Hatchbacks

- 5.2.2 Sedans

- 5.2.3 SUVs and MPVs

- 5.2.4 Pickup Trucks

- 5.2.5 Vans

- 5.3 By Fuel Type

- 5.3.1 Petrol

- 5.3.2 Diesel

- 5.3.3 Hybrid and Electric

- 5.3.4 Others (CNG, LPG)

- 5.4 By Sales Channel

- 5.4.1 Online

- 5.4.2 Offline

- 5.5 By Vehicle Age

- 5.5.1 0 to 3 Years

- 5.5.2 4 to 6 Years

- 5.5.3 7 to 10 Years

- 5.5.4 More than 10 Years

- 5.6 By Price Band (PHP)

- 5.6.1 Less than 500 k

- 5.6.2 500k to 1 million

- 5.6.3 More than 1 million

- 5.7 By Geography

- 5.7.1 Luzon

- 5.7.2 Visayas

- 5.7.3 Mindanao

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (Includes Global Level Overview, Market Level Overview, Core Segments, Financials as Available, Strategic Information, Market Rank/Share for Key Companies, Products and Services, SWOT Analysis, and Recent Developments)

- 6.4.1 Carmudi

- 6.4.2 Carousell

- 6.4.3 Carmax

- 6.4.4 LausGroup

- 6.4.5 Toyota Motor Philippines

- 6.4.6 Automart.PH

- 6.4.7 Philkotse.com

- 6.4.8 ZigWheels

- 6.4.9 Tsikot.com

- 6.4.10 Car Empire

- 6.4.11 OLX Philippines

- 6.4.12 AutoDeal.com.ph

- 6.4.13 Hyundai HARI CPO

- 6.4.14 Volkswagen PH

- 6.4.15 Ford Philippines

- 6.4.16 PGA Cars Premium Used

- 6.4.17 Mitsubishi Diamond CPO

- 6.4.18 Nissan Intelligent Choice PH

- 6.4.19 Suzuki Certified Used Cars

- 6.4.20 Isuzu PH Used Truck Centers

- 6.4.21 Grab AutoExchange

- 6.4.22 BPI Repossessed Cars Marketplace

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment