|

市場調查報告書

商品編碼

1910901

日本資料中心市場-佔有率分析、產業趨勢、統計和成長預測(2026-2031)Japan Data Center - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

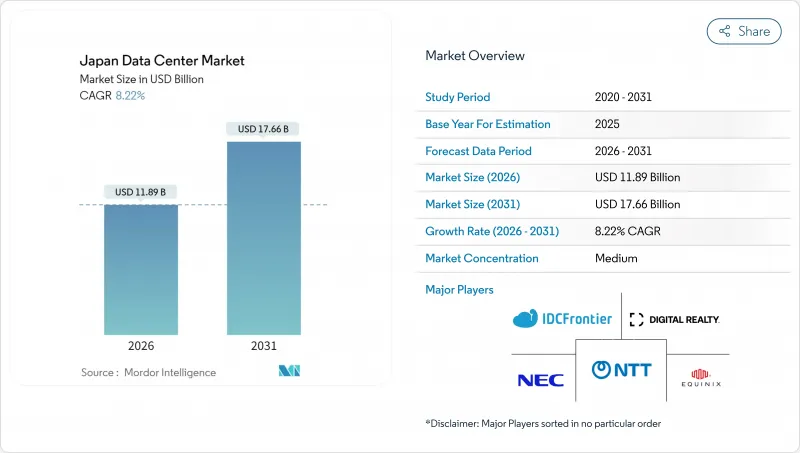

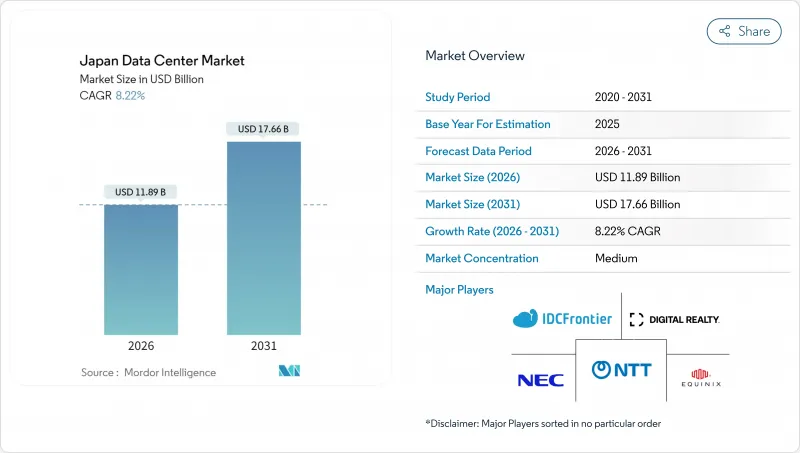

日本資料中心市場預計將從 2025 年的 109.9 億美元成長到 2026 年的 118.9 億美元,到 2031 年達到 176.6 億美元,2026 年至 2031 年的複合年成長率為 8.22%。

就IT負載容量而言,市場預計將從2025年的3,340兆瓦成長到2030年的6,460兆瓦,在預測期(2025-2030年)內複合年成長率(CAGR)為14.12%。市場佔有率和估計值均以兆瓦(MW)為單位計算和報告。在公共部門雲端政策、超大規模資本支出以及人工智慧工作負載激增的推動下,叢集(目前已是亞太地區最大的集群)預計將鞏固主導地位。國內營運商正受益於優先發展自主雲端的政策,而全球雲端供應商則正在將容量本地化以滿足資料居住法規的要求。 5G的持續部署和物聯網(IoT)的日益普及正在推動邊緣運算的需求,促使中等規模的配置靠近人口中心和製造地。同時,土地短缺、電價上漲和抗震設計成本迫使開發商最佳化設施選址、創新冷卻技術並向郊區走廊多元化發展,以維持日本資料中心市場的成長動能。

日本資料中心市場趨勢與洞察

政府數位轉型計畫加速雲端遷移

日本數位局已設定目標,計劃在2025年前將中央政府的工作負載全面遷移到雲端平台,並有望成為國內新增資料中心容量的主要租戶,以維護資料主權。為滿足這項激增的需求,亞馬遜雲端服務(AWS)計劃在2027年前投資2.26兆日圓(約152.4億美元)擴建其位於東京和大阪的資料中心。地方政府和國有企業類似的現代化趨勢也推動了對地方政府需求的成長,確保了新建設計劃的早期預訂率。國內供應商在公共採購中享有優先權,而全球超大規模資料中心業者正在加快合資策略,以滿足採購法規的要求。最終,政府工作負載源源不絕地湧入,為日本資料中心市場未來多年的運轉率提供了支撐。

超大規模投資激增,以應對人工智慧和OTT流量成長。

人工智慧模型的訓練已將每個機架的功率密度提升至30kW以上,微軟承諾投資29億美元,為日本客戶打造配備豐富GPU的資料中心園區。谷歌斥資10億美元建造的「Proa」和「Taihei」海底光纜正在提升跨太平洋的傳輸能力,並將東京和大阪定位為重要的整合中心。日本國內主要企業Softbank Corporation與英偉達合作,共同打造一座人工智慧最佳化型資料中心,這進一步印證了高密度運算已成為一項策略資產。這些舉措縮短了供需週期,加快了核准速度,並加劇了對有限兆瓦級配額的競爭,所有這些都在推動日本資料中心市場的擴張。

主要熱點地區土地稀缺且高成本

預計到2024年,東京市中心地價將上漲69%,將推高資料中心開發預算,並擠壓內部報酬率。江東區居民的反對凸顯了社會接受度方面的障礙,迫使業者將業務拓展至印西市等郊區,這些地區擁有更廣闊的土地資源,且地方政府的激勵措施能夠改善計劃的計劃。雖然搬遷可以降低土地成本,但需要同時投資建造暗纖和冗餘變電站,這將延長專案建設週期,並限制日本資料中心市場的短期供應。

細分市場分析

預計到2031年,容量在5兆瓦至20兆瓦之間的中型資料中心將以12.02%的複合年成長率成長,超過日本整體資料中心市場的成長速度。這種規模的資料中心既能實現冷卻和保全方面的規模經濟效益,又能保持位置的柔軟性,從而避免大型資料中心園區面臨的土地和電力限制。大型資料中心仍佔據38.10%的市場佔有率,因為像亞馬遜網路服務(AWS)這樣的超大規模資料中心業者營運商會購置連片土地來建造100兆瓦以上的叢集。然而,這些計劃面臨的監管和社區障礙會延長開發週期,使中型資料中心在上市速度上更具優勢。由經濟產業省支持的福島人工智慧資料中心項目,就體現了政府對可在不同地區複製的15兆瓦分散式資料中心的支持政策。

開發人員傾向於採用模組化設計,以便逐步啟動,從而使資本投資與合約授予保持一致,同時最大限度地減少閒置容量。對於考慮遷移傳統設備的公司而言,中型資料中心是整合多個本地部署地點的理想選擇。此外,支援 5G 和物聯網的邊緣運算節點通常也適用於此規模範圍,從而增強運轉率的彈性。因此,即使超大規模資料中心正在興起,預計中型機房仍將主導日本資料中心市場未來的成長。

截至2025年,三級資料中心將佔日本資料中心市場的66.05%,年複合成長率達15.28%。其99.982%的運轉率滿足大多數審核標準和災害復原要求,無需像四級資料中心那樣配備雙電源或並行維護冗餘。營運商整合隔震軸承、阻尼器和加固框架,以確保這些設施能夠承受7級地震並維持服務水準。這種方法強調風險與成本的平衡。一級和二級資料中心用於開發和測試環境以及非關鍵儲存應用場景,特別適用於電力預算緊張的農村地區。四級資料中心由於資本投入高昂,僅限於延遲要求極低的交易平台和核心營運商交換器。

標準化正在加速三級資料中心的發展。預製電氣和機械撬裝設備減少了現場施工,將工期從24個月縮短至18個月。此外,由於已有預先已通過核准的抗震和節能計算模板,此模式也簡化了監理申報流程。因此,三級資料中心可望進一步擴大其優勢,並推動日本資料中心市場架構的演進。

日本資料中心市場報告按資料中心規模(大型、超大型、中型、巨型、小規模)、等級(Tier 1、Tier 2、Tier 3、Tier 4)、資料中心類型(超大規模/自建、企業/邊緣、託管)、最終用戶(銀行、金融服務和保險 (BFSI)、IT 及 ITES、電子商務、政府、製造業、媒體和電信市場預測以 IT 負載容量(兆瓦,MW)為單位。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場促進因素

- 政府數位轉型計畫加速雲端遷移

- 超大規模投資激增,以適應人工智慧和OTT流量成長

- 5G賦能的物聯網的普及將推動邊緣配置。

- 數據本地化規則將鼓勵國內產能擴張

- 老舊企業辦公室的退役推動了託管需求。

- 大阪和東京城市餘熱回收獎勵措施。

- 市場限制

- 主要熱點地區土地稀缺且高成本

- 與其他本地公司相比,電費較高

- 地震和災害抵禦能力成本溢價

- 併網核准流程前置作業時間較長

- 市場展望

- IT負載能力

- 高架地板面積

- 託管收入

- 預裝機架

- 機架空間利用率

- 海底電纜

- 主要行業趨勢

- 智慧型手機用戶數量

- 每部智慧型手機的數據流量

- 行動資料通訊速度

- 寬頻資料傳輸速度

- 光纖連接網路

- 法律規範

- 價值鍊和通路分析

- 波特五力分析

- 新進入者的威脅

- 買方的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場規模與成長預測

- 按資料中心規模

- 大規模

- 巨大的

- 中號

- 百萬

- 小規模

- 依層級類型

- 一級和二級

- 三級

- 第四級

- 依資料中心類型

- 超大規模/內部建設

- 企業/邊緣運算

- 搭配

- 未使用的

- 運作中

- 零售共址

- 批發託管

- 最終用戶

- BFSI

- 資訊科技/資訊科技服務

- 電子商務

- 政府機構

- 製造業

- 媒體與娛樂

- 溝通

- 其他最終用戶

- 透過熱點

- 大阪市

- 高松

- 東京

- 其他地區

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Equinix Inc.

- MC Digital Realty(Digital Realty Trust Inc. and Mitsubishi Corporation JV)

- AT TOKYO Corporation

- Amazon Web Services Inc.

- NTT Global Data Centers(NTT Ltd.)

- netXDC(SCSK Corporation)

- IDC Frontier Inc.(Yahoo Japan subsidiary)

- AirTrunk Operating Pty Ltd.

- NEC Corporation

- IBM Japan Ltd.

- Colt Data Centre Services Holdings Ltd.

- Alibaba Cloud(Alibaba Group Holding Ltd.)

- Microsoft Corporation

- Telehouse(KDDI Corporation)

- Additional regional and niche operators

第7章 市場機會與未來展望

The Japan Data Center Market is expected to grow from USD 10.99 billion in 2025 to USD 11.89 billion in 2026 and is forecast to reach USD 17.66 billion by 2031 at 8.22% CAGR over 2026-2031.

In terms of IT load capacity, the market is expected to grow from 3.34 thousand megawatt in 2025 to 6.46 thousand megawatt by 2030, at a CAGR of 14.12% during the forecast period (2025-2030). The market segment shares and estimates are calculated and reported in terms of MW. Fueled by public-sector cloud mandates, hyperscale capital outlays, and proliferating artificial-intelligence workloads, the cluster is already the largest in Asia-Pacific and is on course to consolidate regional primacy. Domestic operators benefit from policy preferences for sovereign cloud while global cloud providers localize capacity to satisfy data-residency rules. Sustained 5G rollout and Internet-of-Things (IoT) adoption intensify edge-computing needs, encouraging medium-scale deployments near population and manufacturing centers. Simultaneously, land scarcity, electricity tariffs and seismic engineering premiums compel developers to optimize facility footprints, innovate in cooling and diversify toward suburban corridors to keep the Japan data center market growth momentum intact.

Japan Data Center Market Trends and Insights

Government Digital Transformation Programs Accelerating Cloud Migration

The Digital Agency targets complete migration of central-government workloads to cloud platforms by 2025, creating an anchor tenant for new capacity located inside Japan to preserve data sovereignty. Amazon Web Services has earmarked JPY 2.26 trillion (USD 15.24 billion) through 2027 to scale facilities in Tokyo and Osaka to meet this surge. Similar modernization waves in municipalities and state-owned corporations extend demand into regional prefectures, ensuring that new builds achieve rapid pre-commit rates. Domestic providers gain selection preference in public tenders, while global hyperscalers accelerate joint-venture strategies to satisfy procurement rules. The outcome is a steady pipeline of government workloads that underpins multi-year utilization visibility for the Japan data center market.

Surge in Hyperscale Investments to Meet AI and OTT Traffic Growth

Artificial-intelligence model training pushes power density above 30 kW per rack, prompting Microsoft to pledge USD 2.9 billion for GPU-rich campuses serving Japanese customers. Google's USD 1 billion Proa and Taihei subsea cables improve trans-Pacific throughput, positioning Tokyo and Osaka as primary aggregation nodes. Domestic champion SoftBank collaborates with NVIDIA on AI-optimized halls, reinforcing that high-density compute has become a strategic asset. These commitments shorten supply-demand cycles, compress permitting windows, and intensify competition for scarce megawatt allocations, all of which add tailwinds to Japan data center market expansion.

Scarcity and High Cost of Land in Prime Hotspots

Average land prices in central Tokyo rose 69% during 2024, inflating facility-development budgets and squeezing internal rates of return. Community pushback in Koto ward underscores social-license barriers, forcing operators to scout suburban areas such as Inzai, where larger parcels exist and municipal incentives improve project economics. While relocation mitigates land cost, it demands parallel investment in dark-fiber routes and redundant sub-stations, elongating project timelines and tempering near-term Japan data center market supply.

Other drivers and restraints analyzed in the detailed report include:

- 5G-Enabled IoT Proliferation Driving Edge Deployments

- Decommissioning of Ageing Enterprise Sites Boosting Colocation Demand

- Long Grid-Connection Approval Lead Times

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Medium-sized halls between 5 MW and 20 MW are on track for a 12.02% CAGR to 2031, outpacing the overall Japan data center market. These footprints deliver economies of scale in cooling and security while retaining siting flexibility that circumvents the land and power constraints dogging mega-campuses. Large-scale sites retain 38.10% share because hyperscalers like Amazon Web Services reserve contiguous land for clusters exceeding 100 MW. Yet the regulatory and community hurdles tied to such projects prolong gestation periods, giving medium builds a speed-to-market edge. The Fukushima AI facility, backed by the Ministry of Economy and Trade illustrates policy support for distributed 15-MW blocks that can be replicated across regions.

Developers favor modular designs that allow phased power rollouts, letting them match capital deployment to contract wins while limiting stranded capacity. Enterprises migrating legacy rooms find the medium footprint ideal for consolidating multiple on-premise sites under one roof. Moreover, edge-compute nodes supporting 5G and IoT often scale within this band, enhancing utilization resilience. Consequently, medium halls are expected to become the volume engine for future Japan data center market size additions, even as hyperscale complexes command headlines.

Tier 3 facilities hold 66.05% share of Japan data center market size in 2025 and are expanding at 15.28% CAGR. Their 99.982% uptime rating meets most audit and disaster-recovery thresholds without incurring the dual utility feeds and concurrent-maintenance redundancy of Tier 4. Operators integrate base-isolation bearings, dampers, and reinforced frames so these halls withstand magnitude-7 quakes while maintaining service levels, a design approach that balances risk and cost. Tier 1 and Tier 2 footprints serve dev-test and non-critical storage use cases, especially in regional sites where power budgets are tighter. Tier 4 remains confined to latency-sensitive trading platforms and core switching sites for telecom carriers due to capex intensity.

Standardization accelerates Tier 3 development. Prefabricated electrical and mechanical skids reduce field labor, compressing build schedules from 24 to 18 months. The model also simplifies regulatory submissions because templates have pre-approved seismic and energy-efficiency calculations. Accordingly, Tier 3 is likely to deepen its lead, anchoring how the Japan data center market architecturally evolves.

The Japan Data Center Market Report is Segmented by Data Center Size (Large, Massive, Medium, Mega, and Small), Tier Type (Tier 1 and 2, Tier 3, and Tier 4), Data Center Type (Hyperscale/Self-built, Enterprise/Edge, and Colocation), End User (BFSI, IT and ITES, E-Commerce, Government, Manufacturing, Media and Entertainment, Telecom, and More), and Hotspot. The Market Forecasts are Provided in Terms of IT Load Capacity (MW).

List of Companies Covered in this Report:

- Equinix Inc.

- MC Digital Realty (Digital Realty Trust Inc. and Mitsubishi Corporation JV)

- AT TOKYO Corporation

- Amazon Web Services Inc.

- NTT Global Data Centers (NTT Ltd.)

- netXDC (SCSK Corporation)

- IDC Frontier Inc. (Yahoo Japan subsidiary)

- AirTrunk Operating Pty Ltd.

- NEC Corporation

- IBM Japan Ltd.

- Colt Data Centre Services Holdings Ltd.

- Alibaba Cloud (Alibaba Group Holding Ltd.)

- Microsoft Corporation

- Telehouse (KDDI Corporation)

- Additional regional and niche operators

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Drivers

- 4.1.1 Government digital transformation programs accelerating cloud migration

- 4.1.2 Surge in hyperscale investments to meet AI and OTT traffic growth

- 4.1.3 5G-enabled IoT proliferation driving edge deployments

- 4.1.4 Data localisation rules favour domestic capacity additions

- 4.1.5 Decommissioning of ageing enterprise sites boosting colocation demand

- 4.1.6 Municipal waste-heat reuse incentives in Osaka and Tokyo

- 4.2 Market Restraints

- 4.2.1 Scarcity and high cost of land in prime hotspots

- 4.2.2 Elevated electricity tariffs versus regional peers

- 4.2.3 Earthquake and disaster-resilience cost premium

- 4.2.4 Long grid-connection approval lead times

- 4.3 Market Outlook

- 4.3.1 IT Load Capacity

- 4.3.2 Raised Floor Space

- 4.3.3 Colocation Revenue

- 4.3.4 Installed Racks

- 4.3.5 Rack Space Utilization

- 4.3.6 Submarine Cable

- 4.4 Key Industry Trends

- 4.4.1 Smartphone Users

- 4.4.2 Data Traffic Per Smartphone

- 4.4.3 Mobile Data Speed

- 4.4.4 Broadband Data Speed

- 4.4.5 Fiber Connectivity Network

- 4.4.6 Regulatory Framework

- 4.5 Value Chain and Distribution Channel Analysis

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitutes

- 4.6.5 Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (MEGAWATT)

- 5.1 By Data Center Size

- 5.1.1 Large

- 5.1.2 Massive

- 5.1.3 Medium

- 5.1.4 Mega

- 5.1.5 Small

- 5.2 By Tier Type

- 5.2.1 Tier 1 and 2

- 5.2.2 Tier 3

- 5.2.3 Tier 4

- 5.3 By Data Center Type

- 5.3.1 Hyperscale / Self-built

- 5.3.2 Enterprise / Edge

- 5.3.3 Colocation

- 5.3.3.1 Non-Utilized

- 5.3.3.2 Utilized

- 5.3.3.2.1 Retail Colocation

- 5.3.3.2.2 Wholesale Colocation

- 5.4 By End User

- 5.4.1 BFSI

- 5.4.2 IT and ITES

- 5.4.3 E-Commerce

- 5.4.4 Government

- 5.4.5 Manufacturing

- 5.4.6 Media and Entertainment

- 5.4.7 Telecom

- 5.4.8 Other End Users

- 5.5 By Hotspot

- 5.5.1 Osaka City

- 5.5.2 Takamatsu

- 5.5.3 Tokyo

- 5.5.4 Rest of Japan

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Equinix Inc.

- 6.4.2 MC Digital Realty (Digital Realty Trust Inc. and Mitsubishi Corporation JV)

- 6.4.3 AT TOKYO Corporation

- 6.4.4 Amazon Web Services Inc.

- 6.4.5 NTT Global Data Centers (NTT Ltd.)

- 6.4.6 netXDC (SCSK Corporation)

- 6.4.7 IDC Frontier Inc. (Yahoo Japan subsidiary)

- 6.4.8 AirTrunk Operating Pty Ltd.

- 6.4.9 NEC Corporation

- 6.4.10 IBM Japan Ltd.

- 6.4.11 Colt Data Centre Services Holdings Ltd.

- 6.4.12 Alibaba Cloud (Alibaba Group Holding Ltd.)

- 6.4.13 Microsoft Corporation

- 6.4.14 Telehouse (KDDI Corporation)

- 6.4.15 Additional regional and niche operators

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and unmet-need assessment