|

市場調查報告書

商品編碼

1911759

義大利資料中心:市場佔有率分析、產業趨勢與統計、成長預測(2026-2031 年)Italy Data Center - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

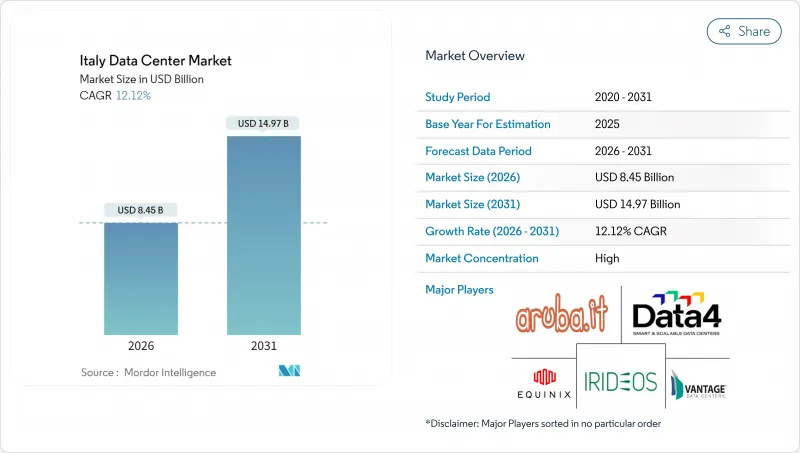

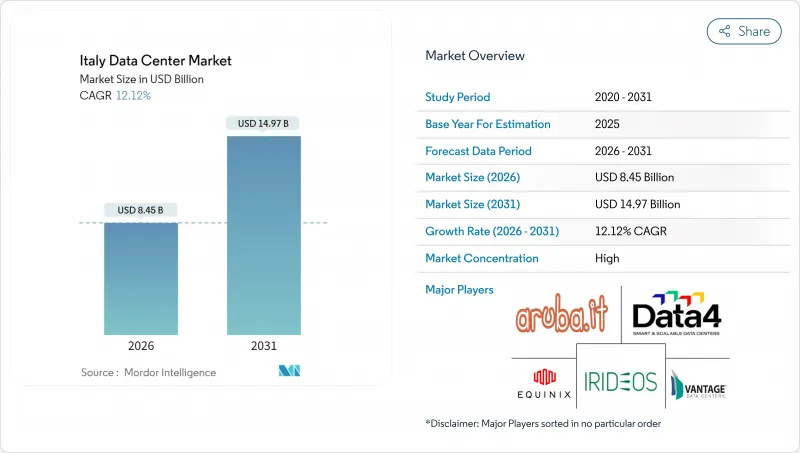

預計義大利資料中心市場將從 2025 年的 75.4 億美元成長到 2026 年的 84.5 億美元,到 2031 年達到 149.7 億美元,2026 年至 2031 年的複合年成長率為 12.12%。

就IT負載容量而言,市場預計將從2025年的1080兆瓦成長到2030年的4090兆瓦,在預測期(2025-2030年)內複合年成長率(CAGR)為30.49%。市場佔有率和估計值均以兆瓦(MW)為單位計算和報告。需求成長的促進因素包括超大規模雲端運算的擴張、公共部門積極的數位化計畫以及對人工智慧驅動運算日益成長的需求。米蘭憑藉其靠近跨歐洲光纖線路、電力採購的改善以及不斷增加的海底電纜鋪設計劃,仍然是高密度建設的理想位置。與法蘭克福、倫敦、阿姆斯特丹、巴黎和都柏林相比,義大利的土地和電力供應更容易取得,因此也更受國際投資者青睞。併購活動的活性化表明,隨著規模經濟成為決定性因素,市場可能正在進入整合階段。

義大利資料中心市場趨勢與分析

超大規模資料中心業者加速雲端擴張

如今,義大利已成為全球雲端服務供應商的首選目的地,他們希望將資源從擁擠的北歐樞紐轉移出去。微軟正在Lombardia投資43億歐元(約46億美元)興建新設施,並計畫在2027年前投入多個可用區運作。谷歌雲正在米蘭和都靈開設橫跨六棟建築的雙區域,以滿足本地數據居住需求。亞馬遜網路服務(AWS)正在評估一些前義大利國家電力公司(Enel)的發電廠舊址,例如蒙塔爾托·迪·卡斯特羅,這將縮短核准時間並充分利用現有電網。外資的湧入正在幫助提升建築標準,促進液冷技術的應用,並促成與國家電網營運商Terna簽訂重要的電力合約。

基於PNRR的公共部門雲端遷移

義大利耗資1915億歐元的「復甦與韌性計畫」(PNRR)加速了全國的數位轉型。 2024年,國家戰略中心(Polo Strategico Nazionale)授予了價值5.2億歐元的契約,用於將各部會的工作負載遷移到主權雲,比上一年成長了73%。該舉措要求資料儲存在國內,優先選擇具備量子級加密和99.995%運轉率的Tier 4級資料中心。義大利電信(TIM)正在投資1.3億歐元(約1.41億美元)在羅馬附近建造一座25兆瓦的資料中心,預計2026年底完工。此資料中心專為GPU叢集而設計。隨著各市政當局也積極回應,公立醫院、學校和其他場所對小規模邊緣節點的需求也不斷成長。

電力成本上漲和電網限制

預計到2024年,義大利批發電力價格平均將達到133歐元/兆瓦時(144美元/兆瓦時),比法國高出30%,比西班牙高出40%,這將對營運利潤率構成壓力。截至2025年3月,義大利國家電網公司(Terna)已接受42吉瓦的併網申請,遠超過目前的發電儲備容量,並暴露出供給能力短缺的問題。可再生能源審核速度緩慢,2022年全部區域提交的太陽能申請中僅有1%獲得批准。義大利資料中心市場要求營運商簽訂多年期可再生能源購電協議(PPA),投資興建現場儲能電池,並根據變電站升級改造分階段進行建置。

細分市場分析

大型資料中心將引領義大利資料中心市場的發展,預計到2025年將佔總營收的46.45%。 Digital Realty和Aruba等供應商正將這些設施用作批發託管套件和多租戶雲端節點的叢集。同時,隨著超大規模雲端服務供應商將人工智慧訓練工作負載轉移到內部,預計到2031年,大型園區(超過60兆瓦)將以29.10%的複合年成長率成長。米蘭東環路周邊地區的建設熱潮尤為明顯,該地區三個總合裝置容量達350兆瓦的計劃已於2025年破土動工。公用事業規模的用地面積需要專用的150千伏特電網連接和現場變電站來降低輸電費用的波動。隨著工廠和電信中心機房的模組化擴建能夠滿足邊緣運算的需求,小規模資料中心正在穩步減少。

加速向更大規模發展將降低整體擁有成本。將電力基礎設施分佈在更多機架上,可使每千瓦的資本支出降低高達 25%,而集中式熱回收迴路為貝加莫等城市的區域供熱系統提供熱能,則可提高電源使用效率 (PUE)。同時,地方政府正在推廣綜合分區規劃,以最大限度地減少土地利用衝突。因此,向更大規模園區發展的趨勢強化了長期土地購買策略,尤其是在Lombardia和Piemonte地區,這些地區已具備高速公路和暗纖線路。在此背景下,預計未來五年義大利資料中心市場(就大型計劃而言)將成長約四倍,其新建設資本配置將超過中型資料中心。

預計到2025年,四級設施將佔總收入的55.05%,年複合成長率達30.20%,這反映了企業對可同時維護的基礎設施的需求。金融機構、通訊業者和公共部門機構都需要採用2N+1架構,配備雙132kV電源、72小時柴油日用儲槽和完全彈性的冷卻迴路。三級設施的建造成本比四級設施低15%,但僅限於災害復原應用和第三方託管非關鍵工作負載。一級和二級設施則針對本地內容快取和工廠資料轉儲等特定邊緣場景。

預計2026年推出的監管改革可能會將公共雲端提供者與政府簽訂合約的運作要求寫入法律,實際上強制要求獲得Tier 4認證。這一前景預計將進一步推動投資向最高層級傾斜,到2027年,Tier 4在義大利資料中心市場的佔有率將達到約60%。由於大多數關鍵任務型應用無法容忍每年超過五分鐘的停機時間,因此需求仍然缺乏彈性。因此,專注於Tier 4架構的供應商將獲得定價權,而Tier 3供應商則需要增加收入來源,例如資安管理服務,才能保持競爭力。

義大利資料中心市場報告按資料中心規模(大型、超大型、中型、巨型、小規模)、等級(Tier 1-2、Tier 3、Tier 4)、資料中心類型(超大規模/自建、企業/邊緣、託管)、最終用戶(銀行、金融服務和保險 (BFSI)、IT 和 ITES、電子商務、政府、製造業、媒體和娛樂、電信等)以及熱點進行細分。市場預測以 IT 負載容量(兆瓦,MW)為單位。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 超大規模資料中心業者加速雲端擴張

- 基於PNRR的公共部門雲端遷移

- 人工智慧驅動的高密度運算需求

- 戰略性海底到陸地連接升級

- 區域供熱製冷中餘熱回收的現狀

- 現有設施(棕地)和地下場地的再利用

- 市場限制

- 電力成本上漲和電網限制

- 監管方面的不確定性和核准程序的延誤

- 保障水資源安全與限制冷卻

- 國內用於大規模建設的資金有限

- 市場展望

- IT負載能力

- 高架樓層面積

- 託管收入

- 預裝機架

- 機架空間利用率

- 海底電纜

- 主要行業趨勢

- 智慧型手機用戶數量

- 每部智慧型手機的數據流量

- 行動資料通訊速度

- 寬頻資料通訊速度

- 光纖連接網路

- 法律規範

- 價值鍊和通路分析

- 波特五力分析

- 新進入者的威脅

- 買方的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場規模及成長預測(兆瓦)

- 按資料中心規模

- 大規模

- 大規模

- 中號

- 百萬

- 小規模

- 依層級類型

- 一級和二級

- 三級

- 第四級

- 依資料中心類型

- 超大規模/內部建設

- 企業/邊緣運算

- 搭配

- 未使用的

- 運作中

- 零售共址

- 批發託管

- 最終用戶

- BFSI

- 資訊科技與資訊科技服務

- 電子商務

- 政府機構

- 製造業

- 媒體與娛樂

- 溝通

- 其他最終用戶

- 透過熱點

- 米蘭

- 熱那亞

- 義大利其他地區

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Telecom Italia SpA

- IBM Corporation

- Data4 Group SAS

- Google LLC

- Microsoft Corporation

- Retelit SpA

- STACK Infrastructure, Inc.

- CloudHQ, LLC

- Vantage Data Centers, LLC

- ReeVo SpA

- Equinix, Inc.

- Aruba SpA

- Cloudflare, Inc.

- Eni SpA

- Oracle Corporation

- Digital Realty Trust, Inc.

- Amazon Web Services, Inc.

- CyrusOne LLC

- Iron Mountain Inc.

- Irideos SpA

第7章 市場機會與未來展望

The Italy Data Center market is expected to grow from USD 7.54 billion in 2025 to USD 8.45 billion in 2026 and is forecast to reach USD 14.97 billion by 2031 at 12.12% CAGR over 2026-2031.

In terms of IT load capacity, the market is expected to grow from 1.08 thousand megawatt in 2025 to 4.09 thousand megawatt by 2030, at a CAGR of 30.49% during the forecast period (2025-2030). The market segment shares and estimates are calculated and reported in terms of MW. Hyperscale cloud expansion, aggressive public sector digitalization programs, and rising AI-driven computing needs fuel demand. Milan's proximity to trans-European fiber routes, improvements in power procurement, and a growing pipeline of submarine cables keep the country attractive for high-density builds. International investors also favor Italy because land and power are still easier to secure than in Frankfurt, London, Amsterdam, Paris and Dublin. Heightened merger activity suggests the market could enter a consolidation phase as scale economies become decisive.

Italy Data Center Market Trends and Insights

Accelerated Hyperscaler Cloud Expansion

Italy is now a top-tier destination for global cloud providers that need capacity relief from congested Northern European hubs. Microsoft earmarked EUR 4.3 billion (USD 4.6 billion) for new Lombardy facilities that will bring multiple availability zones online by 2027. Google Cloud opened twin regions in Milan and Turin, spanning six buildings to meet local data-residency requirements. Amazon Web Services is evaluating former Enel power-plant sites such as Montalto di Castro to condense permitting timelines and leverage existing transmission links. The influx of foreign capital lifts construction standards, accelerates adoption of liquid cooling, and pushes bulk-power engagement with Terna, the national grid operator.

Public Sector Cloud Migration Under PNRR

Italy's EUR 191.5 billion Recovery and Resilience Plan accelerated nationwide digital transformation. The National Strategic Hub (Polo Strategico Nazionale) awarded contracts worth EUR 520 million in 2024, representing a 73% year-over-year increase, to migrate ministerial workloads to sovereign clouds. The initiative obliges data to remain on domestic soil, favoring Tier 4 sites with quantum-safe encryption and 99.995% uptime. TIM committed EUR 130 million (USD 141 million) for a 25 MW facility near Rome, scheduled for completion in late 2026, specifically designed for GPU clusters. As municipalities seek compliance, demand is emerging for smaller edge nodes across public hospitals and schools.

High Electricity Costs and Grid Constraints

Italian wholesale power averaged EUR 133/MWh (USD 144/MWh) in 2024, 30% higher than France and 40% above Spain, eroding operating margins. Terna received 42 GW of connection requests by March 2025, dwarfing current generation reserves and exposing capacity shortfalls. Renewable approvals are sluggish: regions cleared only 1% of solar applications filed in 2022. For the Italy data center market, operators must therefore sign multi-year renewable PPAs, invest in on-site batteries, and phase construction to match sub-station upgrades.

Other drivers and restraints analyzed in the detailed report include:

- AI-Driven High-Density Compute Demand

- Strategic Submarine and Terrestrial Connectivity Upgrades

- Regulatory Uncertainty and Permitting Delays

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The large-facility tier led the Italy data center market with 46.45% revenue in 2025. Operators such as Digital Realty and Aruba use these sites to cluster wholesale colocation suites and multi-tenant cloud nodes. Meanwhile, massive campuses above 60 MW are set to post a 29.10% CAGR through 2031 as hyperscale clouds migrate AI training workloads in-house. The resulting construction swing is visible around Milan's eastern ring road, where three projects totaling 350 MW broke ground in 2025. Utility-scale footprints justify private 150 kV grid connections and on-site substations that mitigate volatile transmission tariffs. Small facilities decline steadily because edge use cases can be served from modular annexes attached to factories or telecom central offices.

Acceleration toward larger footprints compresses the total cost of ownership. Spreading power infrastructure over more racks lowers capex per kW by up to 25% and improves PUE through centralized heat-recovery loops that feed district heating in towns like Bergamo. At the same time, local municipalities favor consolidated zoning to minimize land-use conflicts. The momentum toward massive campuses, therefore, reinforces long-term land banking strategies, especially in Lombardy and Piedmont, where motorway access and dark fiber routes already exist. Within this context, the Italy data center market size for massive projects is positioned to expand almost fourfold over five years, eclipsing medium-tier deployments in new-build capex.

Tier 4 facilities held 55.05% of 2025 revenue and are forecast for a 30.20% CAGR, reflecting enterprise appetite for concurrent-maintainable infrastructure. Financial institutions, telecom operators, and public-sector entities all specify 2N+1 architectures with dual 132 kV feeds, diesel day-tanks sized for 72 hours, and fully fault-tolerant cooling loops. Tier 3 sites, though cheaper by 15% in build cost, remain relegated to disaster-recovery roles or third-party hosting of non-critical workloads. Tier 1-2 installations fill niche edge scenarios such as local content caches or factory data dumps.

Regulatory reforms anticipated for 2026 may codify uptime requirements for public cloud providers serving government contracts, effectively mandating Tier 4 certification. This prospect further tilts investment toward the highest tier and is expected to push the Italy data center market share of Tier 4 to approximately 60% by 2027. Demand elasticity is low because most mission-critical applications cannot tolerate more than five minutes of annual downtime. Accordingly, vendors focusing on Tier 4 builds gain pricing power, while Tier 3 operators need to add revenue streams such as managed security services to stay competitive.

The Italy Data Center Market Report is Segmented by Data Center Size (Large, Massive, Medium, Mega, and Small), Tier Type (Tier 1 and 2, Tier 3, and Tier 4), Data Center Type (Hyperscale/Self-built, Enterprise/Edge, and Colocation), End User (BFSI, IT and ITES, E-Commerce, Government, Manufacturing, Media and Entertainment, Telecom, and More), and Hotspot. The Market Forecasts are Provided in Terms of IT Load Capacity (MW).

List of Companies Covered in this Report:

- Telecom Italia S.p.A.

- IBM Corporation

- Data4 Group S.A.S.

- Google LLC

- Microsoft Corporation

- Retelit S.p.A.

- STACK Infrastructure, Inc.

- CloudHQ, LLC

- Vantage Data Centers, LLC

- ReeVo S.p.A.

- Equinix, Inc.

- Aruba S.p.A.

- Cloudflare, Inc.

- Eni S.p.A.

- Oracle Corporation

- Digital Realty Trust, Inc.

- Amazon Web Services, Inc.

- CyrusOne LLC

- Iron Mountain Inc.

- Irideos S.p.A.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Accelerated hyperscaler cloud expansion

- 4.2.2 Public sector cloud migration under PNRR

- 4.2.3 AI-driven high-density compute demand

- 4.2.4 Strategic submarine and terrestrial connectivity upgrades

- 4.2.5 District heating waste-heat recovery adoption

- 4.2.6 Brownfield and underground site repurposing

- 4.3 Market Restraints

- 4.3.1 High electricity costs and grid constraints

- 4.3.2 Regulatory uncertainty and permitting delays

- 4.3.3 Water availability and cooling restrictions

- 4.3.4 Limited domestic capital for large-scale builds

- 4.4 Market Outlook

- 4.4.1 IT Load Capacity

- 4.4.2 Raised Floor Space

- 4.4.3 Colocation Revenue

- 4.4.4 Installed Racks

- 4.4.5 Rack Space Utilization

- 4.4.6 Submarine Cable

- 4.5 Key Industry Trends

- 4.5.1 Smartphone Users

- 4.5.2 Data Traffic Per Smartphone

- 4.5.3 Mobile Data Speed

- 4.5.4 Broadband Data Speed

- 4.5.5 Fiber Connectivity Network

- 4.5.6 Regulatory Framework

- 4.6 Value Chain and Distribution Channel Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (MEGAWATT)

- 5.1 By Data Center Size

- 5.1.1 Large

- 5.1.2 Massive

- 5.1.3 Medium

- 5.1.4 Mega

- 5.1.5 Small

- 5.2 By Tier Type

- 5.2.1 Tier 1 and 2

- 5.2.2 Tier 3

- 5.2.3 Tier 4

- 5.3 By Data Center Type

- 5.3.1 Hyperscale / Self-built

- 5.3.2 Enterprise / Edge

- 5.3.3 Colocation

- 5.3.3.1 Non-Utilized

- 5.3.3.2 Utilized

- 5.3.3.2.1 Retail Colocation

- 5.3.3.2.2 Wholesale Colocation

- 5.4 By End User

- 5.4.1 BFSI

- 5.4.2 IT and ITES

- 5.4.3 E-Commerce

- 5.4.4 Government

- 5.4.5 Manufacturing

- 5.4.6 Media and Entertainment

- 5.4.7 Telecom

- 5.4.8 Other End Users

- 5.5 By Hotspot

- 5.5.1 Milan

- 5.5.2 Genova

- 5.5.3 Rest of Italy

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Telecom Italia S.p.A.

- 6.4.2 IBM Corporation

- 6.4.3 Data4 Group S.A.S.

- 6.4.4 Google LLC

- 6.4.5 Microsoft Corporation

- 6.4.6 Retelit S.p.A.

- 6.4.7 STACK Infrastructure, Inc.

- 6.4.8 CloudHQ, LLC

- 6.4.9 Vantage Data Centers, LLC

- 6.4.10 ReeVo S.p.A.

- 6.4.11 Equinix, Inc.

- 6.4.12 Aruba S.p.A.

- 6.4.13 Cloudflare, Inc.

- 6.4.14 Eni S.p.A.

- 6.4.15 Oracle Corporation

- 6.4.16 Digital Realty Trust, Inc.

- 6.4.17 Amazon Web Services, Inc.

- 6.4.18 CyrusOne LLC

- 6.4.19 Iron Mountain Inc.

- 6.4.20 Irideos S.p.A.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and unmet-need assessment