|

市場調查報告書

商品編碼

1910906

中東資料中心:市場佔有率分析、產業趨勢與統計、成長預測(2026-2031)Middle East Data Center - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

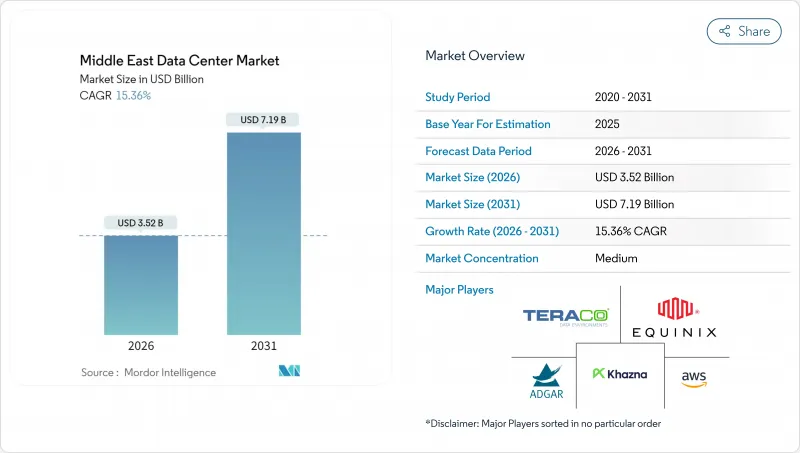

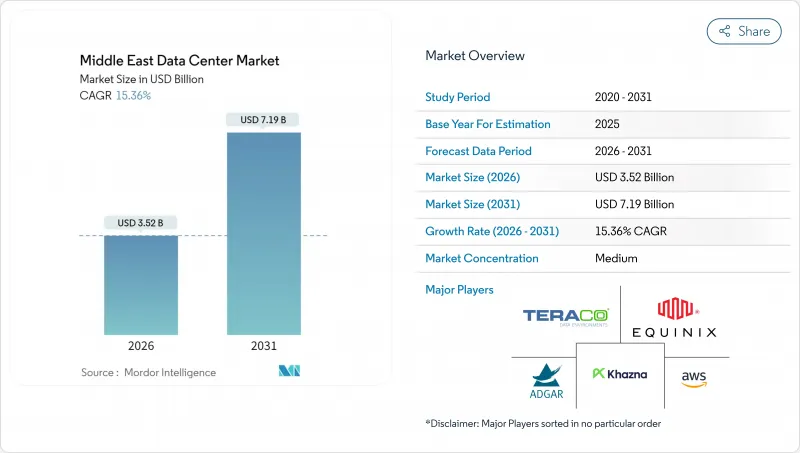

預計中東資料中心市場將從 2025 年的 30.5 億美元成長到 2026 年的 35.2 億美元,到 2031 年將達到 71.9 億美元,2026 年至 2031 年的複合年成長率為 15.36%。

就裝置容量而言,預計市場將從2025年的1820兆瓦成長到2030年的2840兆瓦,預測期間(2025-2030年)複合年成長率(CAGR)為9.23%。市場佔有率和估計值均以兆瓦(MW)為單位計算和報告。強力的政府資金支持、超大規模容量強制性要求、高密度海底電纜登陸點以及支持性的雲端優先法規,正在吸引資本和人才湧入該地區,縮短傳統建設週期並提高運轉率。沙烏地阿拉伯的「人類智慧」(HUMAIN)計畫和阿拉伯聯合大公國-法國人工智慧協議等國家級項目,正在為整合GPU的機房創造穩固的需求基礎;而油田廢水發電試點項目表明,能源成本結構性降低,這有望擴大該地區相對於歐洲和亞洲的成本優勢。將土地和電力供應管理與液冷技術專長相結合的運營商,正在贏得超大規模資料中心業者企業的長期契約,這些企業希望避免在其他地區出現容量短缺。隨著國內主要企業、全球託管品牌和能源巨頭競相爭奪利雅德、阿布達比和特拉維夫的位置,競爭壓力日益增大,推高了土地價格,同時加快了園區區間光纖的建設,從而改善了跨境工作負載的流動性。

中東資料中心市場趨勢與洞察

沙烏地阿拉伯和阿拉伯聯合大公國迅速採納國家雲端優先政策

具約束力的「雲端優先」政策要求各部會和國營企業按照不同於傳統成本最佳化的時間表遷移工作負載,從而有效增強需求彈性,保護開發人員免受週期性衰退的影響。這些政策還包含嚴格的資料主權條款,旨在建立具有高定價的主權雲端區域。公共部門合約授予必須遵守這些政策,迫使外國雲端服務提供者與獲得許可的當地產業營運商合作,從而提高國內價值獲取,並加速向本地勞動力轉移技能。

政府支持的超大規模資料中心容量目標預計到2030年將超過1.3吉瓦。

沙烏地電信的「Center 3」等旗艦專案以1GW的藍圖為目標,確保了主要租戶的入駐,並通常捆綁購電特權,從而降低了風險溢價,並將開發週期縮短至18-24個月。政府主導的資金籌措避免了以往購電協議競標的局面,並允許同時推出多個園區,而這在純粹的商業市場中難以資金籌措。早期供應過剩進一步降低了尋求在歐洲和亞洲之間實現低延遲冗餘的國際超大規模資料中心業者的進入門檻。

氣候變遷導致冷氣運轉成本增加

與溫帶地區相比,沙漠地區的環境溫度會使年均PUE值增加3-5%,迫使業者資金籌措大規模冷水機組或採用液冷技術,以確保GPU機架符合規範要求。人工智慧叢集進一步加劇了熱負荷,而水資源短缺法規限制了蒸發冷卻系統的應用,導致營運商更加依賴電力驅動的冷水機組,並在新進業者不斷增加價格壓力之際,推高了營運成本。

細分市場分析

大型資料中心佔總裝置容量的39.62%,主要得益於企業的持續使用和已完全折舊的資產。然而,隨著新一代園區投入運作,預計這一比例將會下降。同時,受國家主導的人工智慧專案和需要超過50兆瓦連續電力供應的超大規模資料中心超大規模資料中心業者的推動,大型園區在該細分市場中實現了最高的成長率(年複合成長率16.69%)。預計在2026年至2031年間,由於這些大型建設項目,中東資料中心市場規模將成長一倍以上。目前,擁有數百兆瓦併網容量的業者享有優先採購權。

這種轉變有利於像DataVolt這樣的開發商,其位於NEOM的1.5GW淨零能耗人工智慧工廠展示了政府主導的規劃如何摒棄傳統的漸進式擴展的託管邏輯。對於需要全國性資料中心但又無法大規模資料中心經濟效益的區域性雲端服務而言,超大型和中型資料中心仍然至關重要。小規模邊緣節點將繼續滿足低延遲應用場景和監管居住條款的要求,從而確保形成一種類似啞鈴的結構,將超大規模和微型配置整合在同一區域生態系統中。

到2025年,三級資料中心將佔中東資料中心市場的67.05%,鞏固其作為多租戶應用可靠性和成本效益最佳解決方案的地位。然而,隨著人工智慧訓練、數位支付清算和國家安全工作負載對資料中心彈性的要求不斷提高,四級資料中心將繼續以16.55%的複合年成長率成長。預計到本十年末,中東四級資料中心的市場規模將成長兩倍,這主要得益於關鍵基礎設施計劃國家核准流程的加速。

區域運營商希望部署四級儲能系統以證明其長期可靠性。諸如阿拉伯聯合大公國電信(Etisalat)獲得的三級金牌運營永續性認證等來自執行時間 Institute的認證,展現了成熟的品質文化,從而降低了地緣政治風險的擔憂。然而,三級和四級儲能系統每兆瓦的資本支出差異仍然是區域城市(尤其是那些對價格敏感的租戶占主導地位的城市)的一大障礙。開發人員必須根據當地需求彈性調整冗餘水平,這通常會導致同一站點內混合使用三級和四級儲能系統。

中東資料中心市場報告按資料中心規模(大型、超大型、中型、巨型、小規模)、等級標準(Tier 1-2、Tier 3、Tier 4)、資料中心類型(超大規模/自建、企業/邊緣、託管)、終端用戶產業(銀行、金融服務和保險 (BFSI)、IT 及 ITES、電子商務、政府、媒體和娛樂等)以及地區進行市場區隔。市場預測以 IT 負載容量(兆瓦)為單位。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 沙烏地阿拉伯和阿拉伯聯合大公國迅速採納國家雲端優先政策

- 政府支持的超大規模資料中心容量目標預計到 2030 年將超過 1.3 吉瓦。

- 國家主導的人工智慧資金籌措激增(例如,1000億美元的HUMAIN計畫)

- 增加海底電纜密度將促進區域互聯互通。

- 將未使用的油田廢氣再利用為資料中心提供能源

- 以色列向海灣合作理事會營運商出口人工智慧最佳化型液冷系統

- 市場限制

- 氣候變遷導致冷氣運轉成本增加

- 資料中心認證技術人員短缺

- 與液化天然氣相關的電力價格波動

- 地緣政治網路風險保險溢價

- 技術展望

- 市場展望

- IT負載能力

- 高架樓層面積

- 託管收入

- 預裝機架

- 機架空間利用率

- 海底電纜

- 主要行業趨勢

- 智慧型手機用戶數量

- 每部智慧型手機的數據流量

- 行動資料通訊速度

- 寬頻資料通訊速度

- 光纖連接網路

- 法律規範

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 以色列

- 價值鍊和通路分析

- 五力分析

- 買方的議價能力

- 供應商的議價能力

- 新進入者的威脅

- 替代品的威脅

- 產業間競爭

第5章 市場規模與成長預測

- 按資料中心規模

- 大規模

- 巨大的

- 中號

- 百萬

- 小規模

- 按層級標準

- 一級和二級

- 三級

- 第四級

- 依資料中心類型

- 超大規模或內部構建

- 企業或邊緣

- 搭配

- 運作

- 運作

- 零售共址

- 批發託管

- 按最終用戶行業分類

- BFSI

- 資訊科技與資訊科技服務

- 電子商務

- 政府

- 製造業

- 媒體與娛樂

- 溝通

- 其他終端用戶產業

- 按國家/地區

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 以色列

- 其他中東地區

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Khazna Data Centers LLC

- Digital Realty Trust Inc.

- Teraco Data Environments Proprietary Limited

- Adgar Investments and Development Ltd.

- MedOne Data Centers Ltd.

- Africa Data Centres Ltd.

- Electronia Company Limited

- Gulf Data Hub LLC

- Amazon Web Services Inc.

- Paratus Group Holdings Ltd.

- Etihad Etisalat Company

- Center3 Company

- Emirates Integrated Telecommunications Company PJSC

- Data Hub Integrated Solutions Moro LLC(Moro Hub)

- Equinix Inc.

第7章 市場機會與未來展望

The Middle East Data Center Market is expected to grow from USD 3.05 billion in 2025 to USD 3.52 billion in 2026 and is forecast to reach USD 7.19 billion by 2031 at 15.36% CAGR over 2026-2031.

In terms of the installed base, the market is expected to grow from 1.82 thousand megawatts in 2025 to 2.84 thousand megawatts by 2030, at a CAGR of 9.23% during the forecast period from 2025 to 2030. The market segment shares and estimates are calculated and reported in terms of MW. Solid sovereign funding, hyperscale capacity mandates, dense subsea cable landings, and supportive cloud-first regulations combine to attract capital and talent to the region at a pace that shortens traditional build cycles and boosts utilization rates. Sovereign programs such as Saudi Arabia's HUMAIN and the UAE-France AI pact create guaranteed anchor demand for GPU-dense halls, while oil-field waste-gas-to-power pilots hint at structurally lower energy costs that could widen regional cost advantages over Europe and parts of Asia. Operators that pair land and power control with liquid-cooling know-how are securing long-term commitments from hyperscalers eager to hedge against capacity shortages elsewhere. Competitive pressure is mounting as domestic champions, global colocation brands, and energy majors jostle for sites in Riyadh, Abu Dhabi, and Tel Aviv, driving up land prices but also accelerating inter-campus fiber builds that improve cross-border workload mobility.

Middle East Data Center Market Trends and Insights

Rapid Adoption of National Cloud-First Policies in Saudi Arabia and the UAE

Binding cloud-first mandates oblige ministries and state-owned firms to migrate workloads on timelines that ignore typical cost optimization, effectively creating a demand floor that cushions developers against cyclical slowdowns. These directives also embed strict data-sovereignty clauses, encouraging sovereign-cloud zones that fetch premium pricing. Because compliance is required to win public-sector contracts, foreign cloud providers must partner with licensed local operators, reinforcing domestic value capture and accelerating skill transfer to the local workforce.

Government-Backed Hyperscale Capacity Targets Exceeding 1.3 GW by 2030

Flagship programs such as Saudi Telecom Company's center3 target a 1 GW roadmap, guarantee anchor tenancy, and often bundle power-purchase concessions, dropping risk premiums and compressing development timelines to 18-24 months. Sovereign financing removes the typical scramble for off-take agreements, enabling simultaneous multi-campus launches that would be hard to fund in purely commercial markets. The oversupply that results in early years further reduces entry barriers for international hyperscalers seeking low-latency redundancy between Europe and Asia.

Climate-Driven Cooling OPEX Escalation

Desert ambient temperatures push annual PUE up by 3-5% over temperate sites and force operators to finance large chilled-water plants or adopt liquid-cooling in order to keep GPU racks within spec. AI clusters exacerbate the heat profile, and water-scarcity regulations restrict evaporative systems, increasing dependence on electrically driven chillers that inflate operating costs just when price pressure from new entrants intensifies.

Other drivers and restraints analyzed in the detailed report include:

- Surge in Sovereign AI Funding

- Sub-Sea Cable Densification Boosting Regional Inter-Connectivit

- Scarcity of Certified Data-Center Engineers

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Large facilities accounted for 39.62% of deployed capacity, thanks to enterprise loyalty and fully depreciated assets. However, as new-generation campuses come online, this share is set to decline. Meanwhile, massive campuses, driven by sovereign AI programs and hyperscalers requiring contiguous power blocks exceeding 50 MW, recorded the highest growth in the segment with a 16.69% CAGR. Between 2026 and 2031, the Middle East data center market is expected to more than double in size due to these massive builds. Operators securing multi-hundred-megawatt grid connections are currently enjoying a status of preferential procurement.

The shift favors developers like DataVolt, whose 1.5 GW net-zero AI factory in NEOM underlines how sovereign planning circumvents the incremental build logic of traditional colocation. Mega and medium formats remain relevant for regional cloud services that require country-specific presence yet cannot absorb the economics of massive footprints. Small edge nodes continue to address latency-critical use cases and regulatory residency clauses, ensuring a barbell-sized structure that blends both hyperscale and micro deployments within the same regional ecosystem.

Tier 3 facilities accounted for 67.05% of the Middle East data center market share in 2025, confirming their status as the cost-effective sweet spot for reliability in multi-tenant applications. Tier 4, however, is advancing at 16.55% CAGR as AI training, digital payments clearing, and national security workloads raise the bar on fault tolerance. The Middle East data center market size allocated to Tier 4 is expected to triple by the end of the decade, driven by expedited sovereign permitting for critical infrastructure projects.

Regional operators showcase Tier 4 ambitions to signal long-term reliability. Uptime Institute certifications, such as Etisalat's Tier III Gold for Operational Sustainability, illustrate a maturing quality culture that reduces perceived geopolitical risk. Yet the CAPEX per MW differential between Tier 3 and Tier 4 remains a hurdle for second-tier cities where price-sensitive tenants dominate. Developers must therefore calibrate redundancy levels to local demand elasticity, often blending Tier 3 and Tier 4 halls on the same site.

The Middle East Data Center Market Report is Segmented by Data Center Size (Large, Massive, Medium, Mega, and Small), Tier Standard (Tier 1 and 2, Tier 3, and Tier 4), Data Center Type (Hyperscale/Self-Built, Enterprise/Edge, and Colocation), End User Industry (BFSI, IT and ITES, E-Commerce, Government, Media and Entertainment, and More), and Geography. The Market Forecasts are Provided in Terms of IT Load Capacity (MW).

List of Companies Covered in this Report:

- Khazna Data Centers LLC

- Digital Realty Trust Inc.

- Teraco Data Environments Proprietary Limited

- Adgar Investments and Development Ltd.

- MedOne Data Centers Ltd.

- Africa Data Centres Ltd.

- Electronia Company Limited

- Gulf Data Hub LLC

- Amazon Web Services Inc.

- Paratus Group Holdings Ltd.

- Etihad Etisalat Company

- Center3 Company

- Emirates Integrated Telecommunications Company PJSC

- Data Hub Integrated Solutions Moro L.L.C (Moro Hub)

- Equinix Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapid adoption of national cloud-first policies in Saudi Arabia and UAE

- 4.2.2 Government backed hyperscale capacity targets exceeding 1.3 GW by 2030

- 4.2.3 Surge in sovereign AI funding (e.g., USD 100 B HUMAIN program)

- 4.2.4 Sub-sea cable densification boosting regional inter-connectivity

- 4.2.5 Under-utilised oil-field waste-gas repurposed for data-center power

- 4.2.6 AI-optimised liquid cooling exports from Israel to GCC operators

- 4.3 Market Restraints

- 4.3.1 Climate-driven cooling OPEX escalation

- 4.3.2 Scarcity of certified data-center engineers

- 4.3.3 LNG-indexed electricity tariff volatility

- 4.3.4 Geopolitical cyber-risk premium on insurance

- 4.4 Technological Outlook

- 4.5 Market Outlook

- 4.5.1 IT Load Capacity

- 4.5.2 Raised Floor Space

- 4.5.3 Colocation Revenue

- 4.5.4 Installed Racks

- 4.5.5 Rack Space Utilization

- 4.5.6 Submarine Cable

- 4.6 Key Industry Trends

- 4.6.1 Smartphone Users

- 4.6.2 Data Traffic Per Smartphone

- 4.6.3 Mobile Data Speed

- 4.6.4 Broadband Data Speed

- 4.6.5 Fiber Connectivity Network

- 4.6.6 Regulatory Framework

- 4.6.6.1 Saudi Arabia

- 4.6.6.2 United Arab Emirates

- 4.6.6.3 Israel

- 4.6.7 Value Chain and Distribution Channel Analysis

- 4.6.8 Poter's Five Forces Analysis

- 4.6.8.1 Bargaining Power of Buyers

- 4.6.8.2 Bargaining Power of Suppliers

- 4.6.8.3 Threat of New Entrants

- 4.6.8.4 Threat of Substitutes

- 4.6.8.5 Industry Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Data Center Size

- 5.1.1 Large

- 5.1.2 Massive

- 5.1.3 Medium

- 5.1.4 Mega

- 5.1.5 Small

- 5.2 By Tier Standard

- 5.2.1 Tier 1 and 2

- 5.2.2 Tier 3

- 5.2.3 Tier 4

- 5.3 By Data Center Type

- 5.3.1 Hyperscale or Self-built

- 5.3.2 Enterprise or Edge

- 5.3.3 Colocation

- 5.3.3.1 Non Utilized

- 5.3.3.2 Utilized

- 5.3.3.2.1 Retail Colocation

- 5.3.3.2.2 Wholesale Colocation

- 5.4 By End User Industry

- 5.4.1 BFSI

- 5.4.2 IT and ITES

- 5.4.3 E-Commerce

- 5.4.4 Government

- 5.4.5 Manufacturing

- 5.4.6 Media and Entertainment

- 5.4.7 Telecom

- 5.4.8 Other End User Industries

- 5.5 By Country

- 5.5.1 Saudi Arabia

- 5.5.2 United Arab Emirates

- 5.5.3 Israel

- 5.5.4 Rest of Middle East

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Khazna Data Centers LLC

- 6.4.2 Digital Realty Trust Inc.

- 6.4.3 Teraco Data Environments Proprietary Limited

- 6.4.4 Adgar Investments and Development Ltd.

- 6.4.5 MedOne Data Centers Ltd.

- 6.4.6 Africa Data Centres Ltd.

- 6.4.7 Electronia Company Limited

- 6.4.8 Gulf Data Hub LLC

- 6.4.9 Amazon Web Services Inc.

- 6.4.10 Paratus Group Holdings Ltd.

- 6.4.11 Etihad Etisalat Company

- 6.4.12 Center3 Company

- 6.4.13 Emirates Integrated Telecommunications Company PJSC

- 6.4.14 Data Hub Integrated Solutions Moro L.L.C (Moro Hub)

- 6.4.15 Equinix Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White space and Unmet need Assessment