|

市場調查報告書

商品編碼

1910840

印度資料中心市場:市場佔有率分析、產業趨勢與統計、成長預測(2026-2031)India Data Center - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

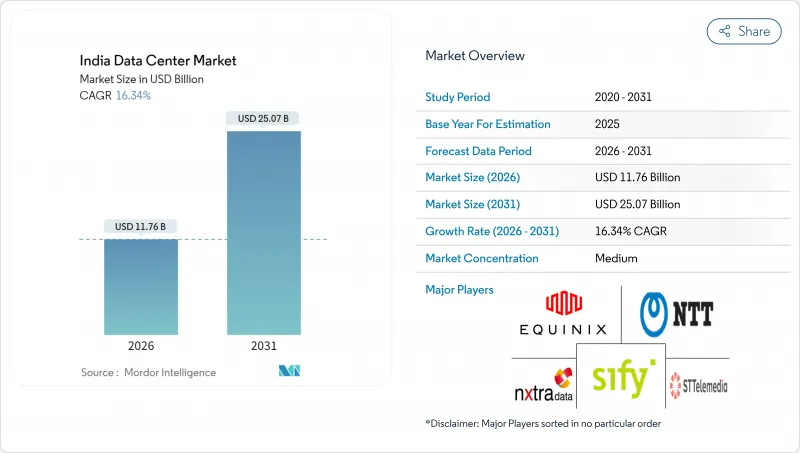

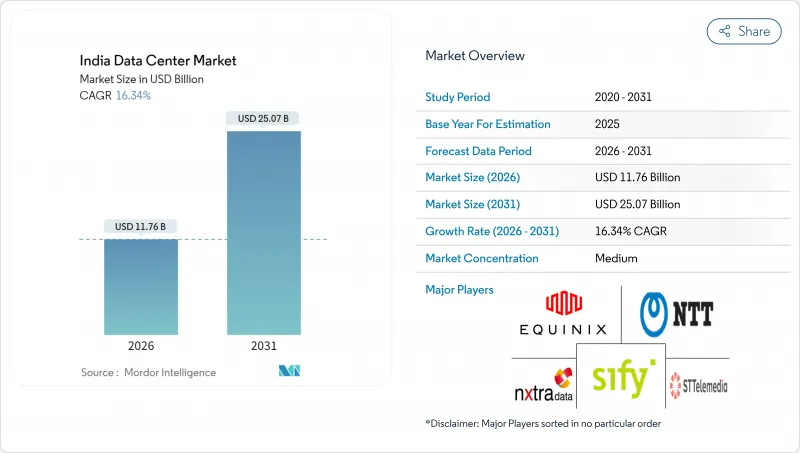

據估計,印度資料中心市場在 2026 年的價值將達到 117.6 億美元,高於 2025 年的 101.1 億美元,預計到 2031 年將達到 250.7 億美元。

預計2026年至2031年年複合成長率(CAGR)為16.34%。

就IT負載容量而言,預計市場將從2025年的4,480兆瓦成長到2030年的12,470兆瓦,在預測期(2025-2030年)內以22.72%的複合年成長率成長。市場佔有率和估計值均以兆瓦為單位計算和報告。這一快速成長歸因於六大因素:印度數位計畫推動了超大規模雲端投資;爆炸性成長的OTT流量推動邊緣節點向區域城市轉移;強制性數據本地化法規;購電協議(PPA)降低了可再生能源採購風險;海底電纜容量使國際頻寬提升了四倍四倍;以及蓬勃發展的AI工作負載將機架密度推高至50千瓦以上。雲端服務供應商正計劃建造一系列價值數十億美元的園區,而國內營運商則專注於GPU賦能的設計並擴大可再生能源容量。孟買和清奈國際連接的加強正在降低跨境流量延遲,並提升印度資料中心市場作為亞太地區互聯樞紐的吸引力。同時,印度儲備銀行(RBI)和電子資訊科技部(MeitY)的資料在地化強制令正在銀行、金融服務和保險(BFSI)以及公共部門使用者中催生出不可或缺的需求,為長期運轉率奠定了基礎。在此背景下,在可再生能源、高密度冷卻技術和沿海所擁有土地擁有優勢的營運商正在獲得戰略優勢。

印度資料中心市場趨勢與洞察

印度數位計畫後,超大規模雲端部署呈現爆炸性成長。

信實工業宣佈在賈姆訥格爾投資300億美元建設一座3GW的AI園區,這是印度迄今最大的單筆資料中心投資。亞馬遜雲端服務(AWS)、微軟和谷歌已承諾在孟買、清奈和海得拉巴周邊投資超過150億美元用於新增容量,並受益於基礎設施激勵措施和一站式核准流程。印度人工智慧使命撥款1037.1億盧比(約12.5億美元)用於部署1萬個GPU,凸顯了政策的持續支持。這些措施正在重塑資料中心的設計,使其朝著50-120kW機架、液冷和現場可再生能源的方向發展,從而推動從通用託管模式向專用超大規模園區進行競爭性轉型。

國內OTT影片流量的快速成長推動了對邊緣節點的需求。

OTT訂閱用戶持續以兩位數的速度成長,將對延遲高度敏感的快取擴展到浦那、齋浦爾和科欽等二線城市。到2024年,阿薩姆邦、比哈爾邦和北方邦東部的農村寬頻覆蓋率將超過都市區,凸顯了分散式基礎設施的必要性。 5-20兆瓦的邊緣站點有助於服務供應商實現低於50毫秒的延遲,降低回程傳輸成本,並改善使用者體驗。專注於緊湊型面積的區域運營商正在抓住這一轉變,並利用全球CDN運營商部署區域接入點(PoP)以提供本地化高清內容的舉措。

州際電力價格差異削弱了成本競爭力

工業用電價格從安得拉邦的每千瓦時4.50盧比到馬哈拉斯特拉邦的每千瓦時8.00盧比不等,相差40%至50%,而且在20年的資產使用壽命內,這種差異還會進一步擴大。人工智慧機架的耗電量是傳統伺服器的15至20倍,因此對這種價格差異的感受最為強烈。目前正在就開放式電力採購政策進行討論,預計這將緩解這種價格差異,但具體時間尚不確定。這促使營運商尋求自建太陽能-風能混合發電設施以及跨邦可再生能源購電協議,例如Google與古吉拉突邦30吉瓦卡夫達計劃的合作。

細分市場分析

大型資料中心將佔2025年收入的22.08%,鞏固其作為超大規模租戶基礎設施的地位。共用基礎設施和50至200兆瓦的規模提供了營運優勢和交叉連接深度。同時,中型資料中心將實現19.22%的複合年成長率,這主要得益於二線城市邊緣節點的部署,旨在降低OTT(Over-The-Top)延遲並支援物聯網應用。這種分散式網路使服務供應商能夠將運算資源部署在更靠近終端用戶的位置,從而補充而非取代大型園區。隨著人工智慧模型的成熟,市場需求正在出現兩極化,一方是千兆瓦級的大型園區,另一方則是許多中型資料中心。

營運商正在調整其擴張計劃,以平衡土地成本、電網接入和延遲目標。大型資料中心開發商傾向於選擇沿海地區和電力資源豐富的內陸走廊,這些地區擁有多條海底光纜和可再生能源叢集,能夠提供長期穩定的網路彈性。中型資料中心建造者則尋求擁有強大光纖骨幹網路的現有設施(棕地),並優先考慮在 12 至 18 個月內運作。對於競相滿足使用者體驗閾值的OTT 和遊戲平台而言,這個時間節點至關重要。永續性要求也在影響規模決策,因為諸如節水冷卻和現場太陽能發電等組件使得以 20-50 兆瓦為增量進行擴張更加可預測。這些因素強化了一種雙層建設策略:在樞紐位置利用印度資料中心市場的規模優勢,同時向消費區域輻射小規模的節點。

三級資料中心是基礎級資料中心,透過 N+1 冗餘實現 99.982% 的運轉率,從而平衡資本投資,預計到 2025 年將保持 49.05% 的市場佔有率。同時,四級資料中心正以 20.25% 的複合年成長率快速成長,以滿足銀行、金融和保險 (BFSI)、醫療保健和即時交易平台對 99.995%運轉率的要求。能夠採用 2N 電源配置實現可維護性和容錯性的營運商正在贏得高價值工作負載。一級/二級資料中心將繼續用於開發和測試環境以及對成本敏感的應用場景,但隨著其重要性的提升,其市場佔有率預計將逐漸下降。

監管機構和保險公司正日益將服務等級協定 (SLA) 與 Tier 4 標準接軌,迫使企業將關鍵任務系統升級到更高等級。模組化設計允許企業逐步投資,並從一開始就獲得 Tier 4 認證,從而降低資本成本。同時,混合雲端架構師正在推廣在備用站點採用標準化的 Tier 3 架構,簡化災害復原計劃,而無需承擔完整的 Tier 4 成本。最終形成了一種分級正常運轉率結構,其中卓越的彈性與實用的冗餘級別並存,使能夠提供清晰服務級別差異化的運營商能夠在印度資料中心市場獲得市場佔有率。

印度資料中心市場報告按資料中心規模(大型、超大型、中型、巨型、小規模)、層級(Tier 1 & 2、Tier 3、Tier 4)、資料中心類型(超大規模/自建、企業/邊緣、託管)、最終用戶(銀行、金融服務和保險 (BFSI)、IT 和 ITES、電子商務、政府、電信製造業、媒體和娛樂、娛樂、電信製造業)以及熱點等。市場預測以 IT 負載容量(兆瓦)為單位。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 印度數位時代後,超大規模雲端採用率爆炸性成長。

- 國內OTT影片流量的快速成長推動了對邊緣節點的需求。

- 根據印度儲備銀行(RBI)和資訊科技部(MeitY)的政策,資料在地化是強制性要求。

- 公司專屬使用的混合太陽能和風能發電的購電協議(數量掛鉤協議)

- 擴大海底電纜登陸站將提升國際頻寬供應

- 日益繁重的AI/ML工作負載需要高密度GPU機架。

- 市場限制

- 各州之間電力價格差異導致成本競爭力下降

- 高需求海岸樞紐土地徵用延誤

- 城市中心柴油緊急發電機的核准程序延誤

- 專業資料中心建設勞動力短缺

- 市場展望

- IT負載能力

- 高架地板面積

- 託管收入

- 預裝機架

- 機架空間利用率

- 海底電纜

- 主要行業趨勢

- 智慧型手機用戶數量

- 每部智慧型手機的數據流量

- 行動資料通訊速度

- 寬頻資料通訊速度

- 光纖連接網路

- 法律規範

- 價值鍊和通路分析

- 波特五力分析

- 新進入者的威脅

- 買方的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場規模及成長預測(兆瓦)

- 按資料中心規模

- 大規模

- 巨大的

- 中號

- 百萬

- 小規模

- 依層級類型

- 一級/二級

- 三級

- 第四級

- 依資料中心類型

- 超大規模/內部建設

- 企業/邊緣運算

- 搭配

- 未使用的

- 目前正在使用

- 零售共址

- 批發託管

- 最終用戶

- BFSI

- 資訊科技/資訊科技服務

- 電子商務

- 政府機構

- 製造業

- 媒體與娛樂

- 溝通

- 其他最終用戶

- 透過熱點

- 班加羅爾

- 清奈

- 海得拉巴

- 孟買

- 新德里

- 其他地區

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- NTT Ltd

- CtrlS Datacenters Ltd

- AdaniConneX Private Limited

- STT Telemedia Global Data Centres India Private Limited

- Amazon Web Services Inc

- Princeton Digital Group Limited

- Sify Technologies Limited

- Colt Data Centre Services Holdings Limited

- Nxtra Data Limited

- SAP SE

- Yotta Infrastructure Solutions LLP

- RackBank Datacenters Private Limited

- MilesWeb Internet Services Pvt Ltd

- Pi DATACENTERS Pvt Ltd

- Reliance Communications Limited

- Equinix Inc

- Digital Realty Trust Inc

- Web Werks India Pvt Ltd

- Tata Communications Limited

- Bridge Data Centres India Private Limited

第7章 市場機會與未來展望

India Data Center Market size in 2026 is estimated at USD 11.76 billion, growing from 2025 value of USD 10.11 billion with 2031 projections showing USD 25.07 billion, growing at 16.34% CAGR over 2026-2031.

In terms of IT load capacity, the market is expected to grow from 4.48 thousand megawatt in 2025 to 12.47 thousand megawatt by 2030, at a CAGR of 22.72% during the forecast period (2025-2030). The market segment shares and estimates are calculated and reported in terms of MW. This sharp expansion stems from six forces: hyperscale cloud investments unlocked by Digital India incentives, explosive OTT traffic that pulls edge nodes into tier-2 cities, mandatory data localization rules, power purchase agreements that derisk renewable sourcing, submarine cable capacity that quadruples international bandwidth, and surging AI workloads that push rack densities above 50 kW. Cloud providers have lined up multi-billion-USD campuses, while domestic operators are pivoting to GPU-ready designs and renewable capacity additions. International connectivity upgrades at Mumbai and Chennai reduce latency for cross-border traffic, enhancing the attractiveness of the India data center market to Asia-Pacific interconnection hubs. Simultaneously, RBI and MeitY localization mandates create non-discretionary demand from BFSI and public-sector users, anchoring long-term utilization. Against this backdrop, operators with renewable power, high-density cooling, and coastal land banks are securing strategic advantages.

India Data Center Market Trends and Insights

Explosive Growth in Hyperscale Cloud Deployments Post-Digital India Incentives

Reliance Industries unveiled a USD 30 billion, 3 GW AI campus in Jamnagar, marking the largest single data center investment in India. AWS, Microsoft, and Google have together pledged more than USD 15 billion for new capacity around Mumbai, Chennai, and Hyderabad, facilitated by infrastructure status benefits and single-window clearances. The India AI Mission earmarked INR 10,371 crore (USD 1.25 billion) for 10,000 GPUs, validating sustained policy support. These moves are reshaping facility design toward 50-120 kW racks, liquid cooling, and on-site renewables, shifting competition from generic colocation toward purpose-built hyperscale campuses.

Escalating Domestic OTT Video Traffic Driving Edge Node Demand

OTT subscriptions keep rising in double digits, driving latency-sensitive caches into tier-2 cities such as Pune, Jaipur and Kochi. Rural broadband lines in Assam, Bihar and Uttar Pradesh East surpassed urban connections in 2024, underlining the need for distributed infrastructure. Edge sites of 5-20 MW help providers meet sub-50 ms latency, trim backhaul costs and improve user experience. Regional operators specializing in compact footprints are capitalizing on this shift as global CDNs deploy regional PoPs to localize high-definition content.

Inter-State Power Tariff Differentials Eroding Cost Competitiveness

Industrial tariffs vary from INR 4.50 in Andhra Pradesh to INR 8.00 in Maharashtra, a 40-50% spread that magnifies over a 20-year asset life. AI racks that draw 15-20 times the power of legacy servers feel this disparity most keenly. Pending policy talks on open-access procurement could ease the gap, yet timelines remain undefined. Operators therefore pursue captive solar-wind hybrids and multi-state renewable PPAs, illustrated by Google's tie-up with the 30 GW Khavda project in Gujarat.

Other drivers and restraints analyzed in the detailed report include:

- Mandated Data Localization Under RBI and MeitY Policies

- Rising AI-ML Workload Intensity Requiring GPU-Dense Racks

- Land Acquisition Delays in Coastal High-Demand Hubs

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Large facilities represented 22.08% of 2025 revenue, cementing their role as anchor hubs for hyperscale tenants. Shared infrastructure and 50-200 MW scale deliver operating leverage and cross-connect depth. Medium sites, however, will clock a 19.22% CAGR, propelled by edge-node rollouts in tier-2 cities that lower OTT latency and support IoT applications. This distributed mesh allows providers to place compute closer to end users, complementing megacampuses rather than replacing them. As AI models mature, demand is bifurcating between a few giga-watt campuses and numerous mid-sized outposts.

Operators are calibrating expansion plans to balance land costs, grid access, and latency targets. Large-campus developers favor coastal or power-rich inland corridors where multiple subsea cables or renewable clusters offer long-term resilience. Medium-site builders seek brownfield buildings with robust fiber backbones that can be brought online within 12-18 months, a timeline crucial for OTT and gaming platforms racing to meet user-experience thresholds. Sustainability mandates also influence sizing decisions because water-efficient cooling and on-site solar form factors scale more predictably in 20-50 MW blocks. These variables reinforce a two-tier build strategy that anchors the India data center market size at hub locations while radiating smaller nodes into consumption zones.

Tier 3 remains the baseline, retaining a 49.05% 2025 share thanks to N+1 redundancy, which balances capex and achieves 99.982% availability. Yet Tier 4 is accelerating at 20.25% CAGR as BFSI, healthcare, and real-time trading platforms demand 99.995% uptime. Operators that can deliver concurrently maintainable, fault-tolerant layouts with 2N power trains are capturing high-value workloads. Tier 1 and Tier 2 rooms persist for development and testing, as well as cost-sensitive use cases, but face gradual erosion as criticality increases.

Regulators and insurers are increasingly aligning service-level agreements with Tier 4 benchmarks, nudging enterprises to migrate their mission-critical stacks upward. Capital costs are mitigated by modular designs that allow operators to phase in investment while achieving Tier 4 credentials from day one. In parallel, hybrid-cloud architects push for standardized Tier 3 footprints at secondary sites to simplify disaster-recovery blueprints without incurring the full expense of a Tier 4 footprint. The net result is a stratified uptime landscape where premium fault tolerance coexists with pragmatic redundancy tiers, collectively broadening the India data center market share for operators that offer clear service-level differentiation.

The India Data Center Market Report is Segmented by Data Center Size (Large, Massive, Medium, Mega, and Small), Tier Type (Tier 1 and 2, Tier 3, and Tier 4), Data Center Type (Hyperscale/Self-built, Enterprise/Edge, and Colocation), End User (BFSI, IT and ITES, E-Commerce, Government, Manufacturing, Media and Entertainment, Telecom, and More), and Hotspot. The Market Forecasts are Provided in Terms of IT Load Capacity (MW).

List of Companies Covered in this Report:

- NTT Ltd

- CtrlS Datacenters Ltd

- AdaniConneX Private Limited

- STT Telemedia Global Data Centres India Private Limited

- Amazon Web Services Inc

- Princeton Digital Group Limited

- Sify Technologies Limited

- Colt Data Centre Services Holdings Limited

- Nxtra Data Limited

- SAP SE

- Yotta Infrastructure Solutions LLP

- RackBank Datacenters Private Limited

- MilesWeb Internet Services Pvt Ltd

- Pi DATACENTERS Pvt Ltd

- Reliance Communications Limited

- Equinix Inc

- Digital Realty Trust Inc

- Web Werks India Pvt Ltd

- Tata Communications Limited

- Bridge Data Centres India Private Limited

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Explosive growth in hyperscale cloud deployments post-Digital India incentives

- 4.2.2 Escalating domestic OTT video traffic driving edge node demand

- 4.2.3 Mandated data localisation under RBI and MeitY policies

- 4.2.4 Availability-linked power-purchase agreements for captive solar-wind hybrid energy

- 4.2.5 Submarine cable landing expansions boosting international bandwidth supply

- 4.2.6 Rising AI-ML workload intensity requiring GPU-dense racks

- 4.3 Market Restraints

- 4.3.1 Inter-state power tariff differentials eroding cost competitiveness

- 4.3.2 Land acquisition delays in coastal high-demand hubs

- 4.3.3 Slow clearances for diesel-based backup generators in urban cores

- 4.3.4 Shortage of specialised data center construction labour

- 4.4 Market Outlook

- 4.4.1 IT Load Capacity

- 4.4.2 Raised Floor Space

- 4.4.3 Colocation Revenue

- 4.4.4 Installed Racks

- 4.4.5 Rack Space Utilization

- 4.4.6 Submarine Cable

- 4.5 Key Industry Trends

- 4.5.1 Smartphone Users

- 4.5.2 Data Traffic Per Smartphone

- 4.5.3 Mobile Data Speed

- 4.5.4 Broadband Data Speed

- 4.5.5 Fiber Connectivity Network

- 4.5.6 Regulatory Framework

- 4.6 Value Chain and Distribution Channel Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (MEGAWATT)

- 5.1 By Data Center Size

- 5.1.1 Large

- 5.1.2 Massive

- 5.1.3 Medium

- 5.1.4 Mega

- 5.1.5 Small

- 5.2 By Tier Type

- 5.2.1 Tier 1 and 2

- 5.2.2 Tier 3

- 5.2.3 Tier 4

- 5.3 By Data Center Type

- 5.3.1 Hyperscale / Self-built

- 5.3.2 Enterprise / Edge

- 5.3.3 Colocation

- 5.3.3.1 Non-Utilized

- 5.3.3.2 Utilized

- 5.3.3.2.1 Retail Colocation

- 5.3.3.2.2 Wholesale Colocation

- 5.4 By End User

- 5.4.1 BFSI

- 5.4.2 IT and ITES

- 5.4.3 E-Commerce

- 5.4.4 Government

- 5.4.5 Manufacturing

- 5.4.6 Media and Entertainment

- 5.4.7 Telecom

- 5.4.8 Other End Users

- 5.5 By Hotspot

- 5.5.1 Bengaluru

- 5.5.2 Chennai

- 5.5.3 Hyderabad

- 5.5.4 Mumbai

- 5.5.5 Delhi-NCR

- 5.5.6 Rest of India

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 NTT Ltd

- 6.4.2 CtrlS Datacenters Ltd

- 6.4.3 AdaniConneX Private Limited

- 6.4.4 STT Telemedia Global Data Centres India Private Limited

- 6.4.5 Amazon Web Services Inc

- 6.4.6 Princeton Digital Group Limited

- 6.4.7 Sify Technologies Limited

- 6.4.8 Colt Data Centre Services Holdings Limited

- 6.4.9 Nxtra Data Limited

- 6.4.10 SAP SE

- 6.4.11 Yotta Infrastructure Solutions LLP

- 6.4.12 RackBank Datacenters Private Limited

- 6.4.13 MilesWeb Internet Services Pvt Ltd

- 6.4.14 Pi DATACENTERS Pvt Ltd

- 6.4.15 Reliance Communications Limited

- 6.4.16 Equinix Inc

- 6.4.17 Digital Realty Trust Inc

- 6.4.18 Web Werks India Pvt Ltd

- 6.4.19 Tata Communications Limited

- 6.4.20 Bridge Data Centres India Private Limited

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and unmet-need assessment