|

市場調查報告書

商品編碼

1910907

印尼資料中心市場佔有率分析、產業趨勢與統計、成長預測(2026-2031)Indonesia Data Center - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

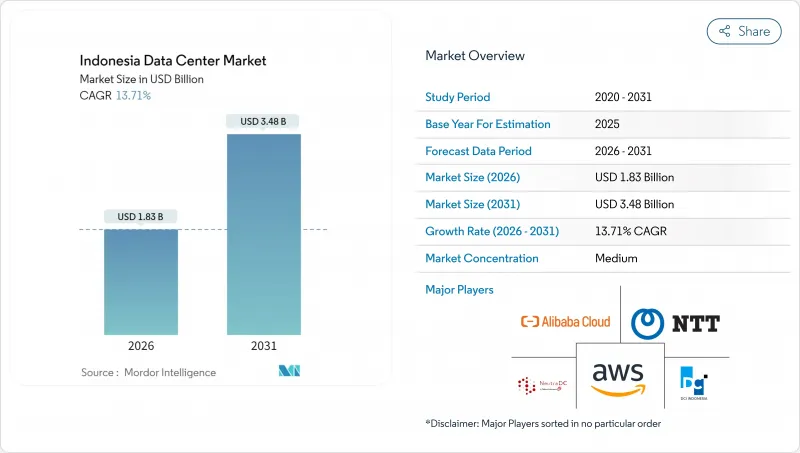

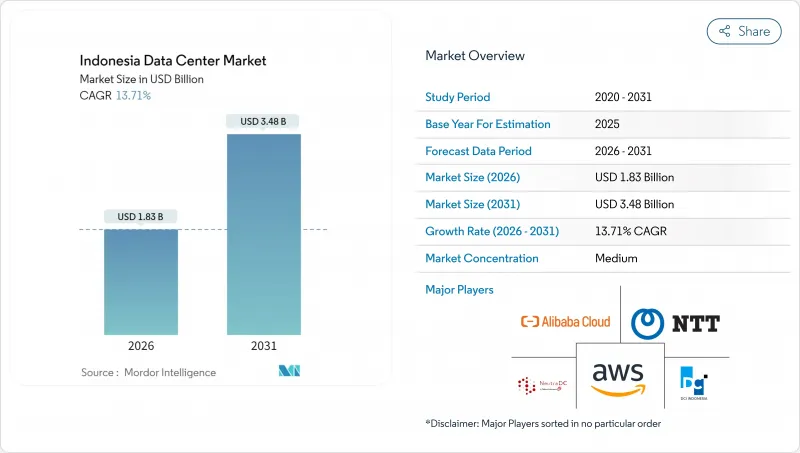

2025年印尼資料中心市場價值16.1億美元,預計到2031年將達到34.8億美元,高於2026年的18.3億美元。

預計在預測期(2026-2031 年)內,複合年成長率將達到 13.71%。

就IT負載容量而言,預計市場將從2025年的1440兆瓦成長到2030年的3560兆瓦,在預測期(2025-2030年)內複合年成長率(CAGR)為19.89%。市場佔有率和估計值均以兆瓦(MW)為超大規模資料中心業者計算和報告。超大規模資料中心的快速部署、允許外資在經濟特區100%持股的稅收優惠政策,以及印尼2.72億居民呈指數級成長的數位消費,使印尼的資料中心市場成為東南亞最具活力的數位基礎設施前沿之一。雅加達憑藉其密集的光纖網路和海底光纜登陸點,主導容量部署;而巴淡島由於接近性新加坡,正在吸引溢出需求並加速新建設。雖然託管服務仍然佔據部署的大部分佔有率,但隨著全球雲端服務供應商將其平台在地化以遵守嚴格的資料居住法,超大規模投資正以每年超過21%的速度成長。三級架構已成為預設架構,反映了企業在避免四級架構高成本的同時,對可維護性的需求。與印尼國家電力公司 (PLN) 簽訂的長期購電協議也使得兆瓦級可再生能源能夠為人工智慧配置提供動力。

印尼資料中心市場趨勢與洞察

超大規模資料中心業者加速雲端區域部署

AWS、Google雲端和微軟正在推出或宣布多可用區(multi-AZ)區域,以確保國內運作的延遲低於20毫秒。雅加達和巴淡島正在籌備超過250兆瓦的大規模託管交易。 Indosat-NVIDIA投資2.5億美元的AI工廠將於2024年10月投入運作,目前已為20多家印尼企業提供服務,併計劃在18個月內將GPU從H100升級到Blackwell GB200,以滿足生成式AI推理的需求。超大規模資料中心業者嚴格的可再生能源採購政策促成了與印尼國家電力公司(PLN)簽訂包含可再生能源認證的長期電力契約,幫助營運商實現其永續性目標。本地通訊業者受益於最後一公里連接和託管服務的結合,隨著核心系統遷移到雲端,這正在推動企業市場的客戶留存。這些發展使印尼成為全球流量路由的關鍵組成部分,重新分配了先前在新加坡和吉隆坡終止的工作負載。由此產生的資本投資週期推高了建築業薪資,導致技術純熟勞工短缺,並加速了供應商與理工學院之間簽訂勞動力技能培訓協議的必要性。

政府稅收優惠及放寬外資所有權限制

印尼允許外資100%控股其經濟特區內的資料中心計劃,並對數位基礎設施投資實行加速折舊政策,將新建設計劃的實際內部收益率(IRR)門檻降低了250-300個基點。芝卡朗和巴淡島經濟特區對進口設備增值稅(VAT),使初始資本支出減少了約11%。簡化的線上單一申請(OSS)系統將符合資格的計劃核准時間從24週縮短至最短10週。這些優惠政策吸引了韓國投資夥伴公司(Korea Investment Partners)和金光集團(Sinar Masland)、以及數位房地產公司(Digital Realty)和米特拉·阿迪塔瑪公司(Mitra Adithama)等合資企業,這些企業承諾從2024年起總合投資超過7.5億美元。政策制定者已將數位基礎設施定位為實現印尼到2025年數位經濟規模達到1,300億美元目標的基礎,並確保即使在政府更迭的情況下,稅收優惠政策也能繼續有效。雖然關稅豁免降低了壁壘,但開發商仍必須滿足建築材料嚴格的在地採購要求,這鼓勵他們與印尼EPC承包商合作。

電網碳排放強度增加會推高合規成本。

煤炭仍佔印尼發電結構的40.5%,使得營運商面臨範圍2排放,且與跨國客戶的淨零排放義務不符。印尼國家電力公司(PLN)依賴123兆印尼幣(約80億美元)的補貼,限制了可再生能源的快速發展,迫使資料中心開發商採購離網太陽能+儲能系統和生質能混燒契約,以滿足其碳預算。由於供應落後於需求,可再生能源證書(REC)交易價格居高不下,導致電力成本增加約6美元/兆瓦時。超大規模超大規模資料中心業者正在協商虛擬購電協議(PPA),但在PLN完成併網權分離之前,他們仍面臨交易對手風險。更複雜的是,印尼銀行的資料中心認證清單現在要求披露生命週期碳排放資訊,這增加了銀行、金融服務和保險(BFSI)客戶的審核負擔。在 2030 年代巴布亞大規模水力發電投入使用之前,印尼的資料中心產業將不得不權衡其成長雄心與高昂的脫碳成本之間的關係。

細分市場分析

截至2025年,大型資料中心將佔印尼資料中心市場的46.12%。這反映出企業傾向於選擇單園區解決方案,此類方案可提供穩定的電力供應、營運商中立的連接以及低於1.5的園區PUE值。隨著Telkom在芝卡朗(Cikarang)的擴建項目(預計到2025年園區容量將增至60MW)以及EdgeConnex在勿加泗(Bekasi)分階段開發(每個階段30MW)項目的推進,印尼的大型資料中心市場預計將進一步擴張。同時,中型資料中心正以21.18%的複合年成長率(CAGR)推動市場成長,這主要得益於分散式企業傾向將邊緣節點部署在更靠近使用者的區域。 NeutraDC等營運商已在二線城市以「neuCentrIX」品牌經營19個微型邊緣站點,凸顯了區域市場對小規模資料中心的需求促進因素。超大型資料中心也正在湧現,例如印尼衛星公司(Indosat)和英偉達(NVIDIA)的AI Factory已預訂80兆瓦的容量用於未來擴展。這印證了GPU叢集推動高功率密度設計(每個機架80千瓦)的趨勢。小型模組化資料中心仍然是小眾市場,主要支援政府邊緣工作負載和離島的農村連接試點計畫。總體而言,營運商正在使其建設模式多樣化,以平衡雅加達兆瓦級設施與島嶼的分散式延遲需求,從而透過規模化滿足並行需求。

預計到2027年,隨著印尼國家電力公司(PLN)在泗水和萬隆的變電站升級改造完成,釋放出150兆伏安的備用容量,中型資料中心的擴容速度將加快。在這些大都市部署4-6兆瓦資料中心單元的開發商,可以充分利用金融科技公司和電商平台對低於5毫秒延遲支付處理的需求。同時,超大規模資料超大規模資料中心業者繼續預租超過10兆瓦的整個資料中心機房,為大規模的場地擴建奠定基礎。因此,企劃案融資模式擴大結合多元化的收入來源(批發主力租戶和零售邊緣機房),以最佳化資本支出回收,並充分利用印尼的十年免稅期。這些混合經營模式凸顯了印尼資料中心市場如何鼓勵靈活的容量規劃,以實現規模和覆蓋範圍的雙重成長。

預計到2025年,三級資料中心將佔印尼資料中心市場的83.90%,並繼續保持行業標準,在滿足銀行、金融和保險(BFSI)以及電信行業的服務水平協議(SLA)要求的同時,提供可維護性,且無需承擔四級資料中心建設35%的額外成本。四級資料中心容量僅限於大型園區內的特定機房,這些機房通常用於滿足遊戲發行商和高頻交易者對容錯正常運作的需求。巴厘巴板和日惹的物聯網和智慧城市試點計畫的邊緣部署仍然採用一級或二級面積,因為生命週期經濟效益高於冗餘性。 《個人資訊保護法》下的監管清單要求使用雙電源和N+1冷卻系統,這實際上為新建設中心設定了准入門檻。 Neutra資料中心的芝卡朗資料中心已獲得三級和四級執行時間認證,並採用模組化電力撬裝系統,可在不同等級之間實現無縫過渡。這項功能無需重新安置機架,對於希望逐步擴展業務的公司來說很有吸引力。

未來的分級設計將納入諸如WUE(用水效率)等永續性指標,將使傳統的分類系統看起來不夠整體性。營運商已經開始安裝屋頂太陽能發電系統,以滿足其5%的年度用電量,預計一旦印尼國家電力公司(PLN)最終確定淨計量電價政策,這一比例將翻倍。此外,高密度GPU機房需要液冷迴路,將冷卻冗餘從機房級別轉移到機架級別,進一步增加了分級的複雜性。儘管存在這些變化,Tier 3仍將是印尼資料中心市場成長的核心,因為它在成本、合規性和可靠的運作之間取得了良好的平衡,並且可以滿足90%的企業工作負載需求。

印尼資料中心市場報告按資料中心規模(大型、超大型、中型、巨型、小規模)、等級(Tier 1-2、Tier 3、Tier 4)、資料中心類型(超大規模/自建、企業/邊緣、託管)、最終用戶(銀行、金融服務和保險 (BFSI)、IT 和 ITES、電子商務、政府、製造業)、媒體和娛樂等)以及熱點進行細分。市場預測以 IT 負載容量(兆瓦)為單位。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 超大規模資料中心業者加速雲端區域的部署(AWS、微軟、Google)

- 政府為數位基礎設施提供稅收優惠並放寬外商投資限制

- 印尼年輕人的網路和行動數據消費量呈指數級成長

- 到2030年,三級/四級產能供不應求將無法滿足預計的1吉瓦需求。

- 確保與波蘭國家電力公司 (PLN) 簽訂長期購電協議 (PPA),以提供人工智慧賦能的兆瓦級電力供應

- 巴淡島經濟特區成為新加坡的限電中心

- 市場限制

- 電網碳排放強度不斷增加以及對煤炭的依賴程度不斷提高,正在推高永續性合規成本。

- 關鍵IT設備和冷卻設備的高關稅和非關稅壁壘

- 多機構核准過程中複雜的許可程序和土地徵用障礙

- GPU密集型工作機會國內熟練勞工短缺,推動薪資上漲

- 市場展望

- IT負載能力

- 高架地板面積

- 託管收入

- 預裝機架

- 機架空間利用率

- 海底電纜

- 主要行業趨勢

- 智慧型手機用戶數量

- 每部智慧型手機的數據流量

- 行動資料通訊速度

- 寬頻資料通訊速度

- 光纖連接網路

- 法律規範

- 價值鍊和通路分析

- 波特五力分析

- 新進入者的威脅

- 買方的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場規模及成長預測(兆瓦)

- 按資料中心規模

- 大規模

- 超大規模

- 中號

- 百萬

- 小規模

- 按層級標準

- 一級和二級

- 三級

- 第四級

- 依資料中心類型

- 超大規模/內部建設

- 企業/邊緣運算

- 搭配

- 運作

- 運作

- 零售共址

- 批發託管

- 按最終用戶行業分類

- BFSI

- 資訊科技與資訊科技服務

- 電子商務

- 政府

- 製造業

- 媒體與娛樂

- 溝通

- 其他最終用戶

- 透過熱點

- 雅加達

- 巴淡島

- 其他印尼

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- PT. Telkom Data Ekosistem(NeutraDC)

- PT DCI Indonesia

- Amazon Web Services, Inc.

- Alibaba Cloud

- K2 Data Centers-Sinar Mas Land

- Indosat Tbk PT(Big Data Exchange(BDx))

- Biznet Data Center

- Space DC Pte Ltd

- Bersama Digital Data Centres(BDDC)

- Princeton Digital Group

- Tencent Cloud

- Digital Edge(Singapore)Holdings Pte. Ltd.(Indonet)

- Google LLC

- MettaDC

- NTT Ltd.

第7章 市場機會與未來展望

The Indonesia Data Center Market was valued at USD 1.61 billion in 2025 and estimated to grow from USD 1.83 billion in 2026 to reach USD 3.48 billion by 2031, at a CAGR of 13.71% during the forecast period (2026-2031).

In terms of IT load capacity, the market is expected to grow from 1.44 thousand megawatt in 2025 to 3.56 thousand megawatt by 2030, at a CAGR of 19.89% during the forecast period (2025-2030). The market segment shares and estimates are calculated and reported in terms of MW. Rapid hyperscaler roll-outs, tax exemptions that allow 100% foreign ownership in Special Economic Zones, and a sharp rise in digital consumption among 272 million residents position the Indonesia data center market as one of Southeast Asia's most dynamic digital infrastructure frontiers. Jakarta dominates capacity deployment due to its dense fiber network and submarine cable landing points, while Batam's proximity to Singapore attracts spillover demand, accelerating greenfield builds. Colocation still commands most deployments, yet hyperscale investments are advancing more than 21% a year as global cloud providers localize platforms to comply with strict data-residency laws. Tier 3 designs remain the default architecture, reflecting enterprises' need for concurrent maintainability without the premium of Tier 4, and long-term PLN power-purchase agreements unlock renewable megawatt blocks that support AI-ready configurations.

Indonesia Data Center Market Trends and Insights

Accelerating Hyperscaler Cloud Region Roll-outs

AWS, Google Cloud, and Microsoft have each activated or announced multi-AZ regions, guaranteeing sub-20 ms latency for domestic workloads and driving a pipeline of wholesale colocation deals exceeding 250 MW in Jakarta and Batam. The Indosat-NVIDIA USD 250 million AI factory that went live in October 2024 already serves more than 20 Indonesian enterprises and plans to migrate from H100 to Blackwell GB200 GPUs within 18 months to satisfy generative-AI inferencing demand. Hyperscalers' strict renewable-energy procurement policies catalyze long-term power contracts with PLN that bundle renewable certificates, helping operators meet sustainability targets. Local carriers benefit by bundling last-mile connectivity and managed services, which embeds stickiness in an enterprise market still migrating core systems to the cloud. These deployments anchor Indonesia in global traffic routes, redirecting workloads that would otherwise terminate in Singapore or Kuala Lumpur. The resulting capex cycle raises construction wages and tightens the skilled-labor pool, hastening the need for workforce upskilling agreements between providers and polytechnic institutes.

Government Tax Incentives and Eased Foreign Ownership

Indonesia allows 100% foreign ownership in data-center projects located within Special Economic Zones and grants accelerated depreciation on digital-infrastructure investments, lowering effective project IRR thresholds by 250-300 basis points for greenfield builds. Cikarang and Batam SEZs each offer 0% VAT on imported equipment, shaving up-front capex by around 11%. The streamlined Online Single Submission (OSS) system compresses approval timelines from 24 to as little as 10 weeks for compliant projects. These incentives have attracted joint ventures such as Korea Investment Partners-Sinar Mas Land and Digital Realty-Mitra Aditama, which collectively announced more than USD 750 million in commitments since 2024. Policymakers view digital infrastructure as a cornerstone for the USD 130 billion digital economy target by 2025, ensuring continuity of fiscal privileges even under changing administrations. While tariff holidays lower barriers, developers must still meet stringent local content requirements for construction materials, prompting partnerships with Indonesian EPC contractors.

Grid Carbon Intensity Increases Compliance Costs

Coal still accounts for 40.5% of the national generation mix, exposing operators to Scope 2 emissions that conflict with the net-zero mandates of multinational clients. PLN's financial reliance on IDR 123 trillion (USD 8 billion) in subsidies constrains the rapid build-out of renewable energy, forcing data-center developers to source off-grid solar-plus-storage or biomass co-firing contracts to meet their carbon budgets. Renewable energy certificates (RECs) sell at premium prices because supply lags behind demand, adding roughly USD 6 per MWh to power costs. Hyperscalers negotiate virtual PPAs but face counterparty risk until PLN finalizes unbundling of grid-injection rights. Further complicating matters, Bank Indonesia's data center accreditation checklist now requires life-cycle carbon disclosures, increasing audit overhead for BFSI clients. Until large-scale hydropower from Papua is delivered in the 2030s, the Indonesian data center industry must balance growth aspirations with steep decarbonization expenses.

Other drivers and restraints analyzed in the detailed report include:

- Rapid Internet and Mobile Data Consumption

- Undersupply of Tier 3/4 Capacity

- High Import Tariffs on Critical Equipment

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Large facilities held 46.12% of the Indonesia data center market share in 2025, reflecting enterprises' preference for single-campus solutions that offer resilient power, carrier-neutral connectivity, and campus-wide PUE below 1.5. The Indonesia data center market size for large builds is predicted to widen further as Telkom's Cikarang expansion raises its campus capacity to 60 MW by 2025, and EdgeConneX commits to multi-phase developments of 30 MW each in Bekasi. Medium-sized facilities, however, are pacing the field with a 21.18% CAGR because distributed enterprises deploy edge nodes closer to users. Operators such as NeutraDC already run 19 micro-edge sites branded neuCentrIX across tier-2 cities, highlighting how geography drives smaller footprints. Mega and massive categories are emerging, exemplified by the Indosat-NVIDIA AI factory that reserves 80 MW for future phases, underlining how GPU clusters skew power density design toward 80 kW per rack. Small modular data centers remain niche, mainly supporting government edge workloads and rural connectivity pilots on outer islands. Overall, operators are diversifying build templates to strike a balance between Jakarta megawatts and the islands' distributed latency needs, thus sustaining parallel demand across size cohorts.

Medium-size capacity gains are likely to accelerate once PLN's substation upgrades in Surabaya and Bandung unlock 150 MVA of spare load by 2027. Developers deploying 4 - 6 MW pods in those metros can monetize demand from fintechs and e-commerce platforms that require sub-5 ms latency for payment processing. Meanwhile, hyperscalers continue to sign pre-lease agreements for entire data halls exceeding 10 MW each, anchoring large-site expansions. As a result, project financing models increasingly bundle diversified revenue streams, wholesale anchor tenants plus retail edge cages, to optimize capex payback under Indonesia's 10-year tax-holiday horizon. The resulting hybrid business models underscore how the Indonesia data center market incentivizes flexible capacity planning to capture both scale and reach.

Tier 3 facilities captured 83.90% of the Indonesia data center market share in 2025 and will remain the de facto standard owing to concurrent maintainability that satisfies BFSI and telecom SLAs without the 35% cost premium of Tier 4 builds. Tier 4 supply is restricted to a handful of suites within major campuses where gaming publishers and high-frequency traders demand fault-tolerant uptime. Tier 1-2 footprints persist in edge deployments serving IoT and smart-city pilots in Balikpapan and Yogyakarta, where lifecycle economics trump redundancy. Regulatory checklists issued under the Personal Data Protection Law require dual-power feeds and N + 1 cooling, effectively making Tier 3 the entry barrier for new builds. NeutraDC's Cikarang complex holds both Uptime Tier III and Tier IV certifications and utilizes modular electrical skids to facilitate seamless transitions between tiers, eliminating the need to migrate racks, a feature that appeals to enterprises scaling over time.

Future tier designs will incorporate sustainability metrics such as WUE and render traditional classifications less comprehensive. Operators are already integrating rooftop solar that supplies 5% of annual consumption, a figure expected to double once PLN finalizes net-metering rules. In addition, GPU-dense halls demand liquid-cooling loops that complicate tier labels because cooling redundancy becomes rack-level rather than hall-level. Despite such shifts, Tier 3 will retain dominance because it balances cost, compliance, and reliable uptime for 90% of enterprise workloads, thereby remaining integral to Indonesia's data center market growth.

The Indonesia Data Center Market Report is Segmented by Data Center Size (Large, Massive, Medium, Mega, and Small), Tier Type (Tier 1 and 2, Tier 3, and Tier 4), Data Center Type (Hyperscale/Self-Built, Enterprise/Edge, and Colocation), End User (BFSI, IT and ITES, E-Commerce, Government, Manufacturing, Media and Entertainment, and More), and Hotspot. The Market Forecasts are Provided in Terms of IT Load Capacity (MW).

List of Companies Covered in this Report:

- PT. Telkom Data Ekosistem (NeutraDC)

- PT DCI Indonesia

- Amazon Web Services, Inc.

- Alibaba Cloud

- K2 Data Centers-Sinar Mas Land

- Indosat Tbk PT (Big Data Exchange (BDx))

- Biznet Data Center

- Space DC Pte Ltd

- Bersama Digital Data Centres (BDDC)

- Princeton Digital Group

- Tencent Cloud

- Digital Edge (Singapore) Holdings Pte. Ltd. (Indonet)

- Google LLC

- MettaDC

- NTT Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Accelerating hyperscaler cloud region roll-outs (AWS, Microsoft, Google)

- 4.2.2 Government tax incentives and eased foreign ownership for digital infrastructure

- 4.2.3 Rapidly rising internet and mobile data consumption among Indonesia's young population

- 4.2.4 Undersupply of Tier-3/4 capacity versus estimated 1 GW demand by 2030

- 4.2.5 Secured long-term PLN PPAs enabling AI-ready megawatt blocks

- 4.2.6 Batam SEZ emerging as spill-over hub for Singapore load balancing

- 4.3 Market Restraints

- 4.3.1 Grid carbon intensity and coal reliance increasing sustainability compliance costs

- 4.3.2 High import tariffs and non-tariff barriers on critical IT and cooling equipment

- 4.3.3 Permitting complexity and land-acquisition hurdles across multi-agency approvals

- 4.3.4 Limited domestic skilled workforce for GPU-dense operations driving wage inflation

- 4.4 Market Outlook

- 4.4.1 IT Load Capacity

- 4.4.2 Raised Floor Space

- 4.4.3 Colocation Revenue

- 4.4.4 Installed Racks

- 4.4.5 Rack Space Utilization

- 4.4.6 Submarine Cable

- 4.5 Key Industry Trends

- 4.5.1 Smartphone Users

- 4.5.2 Data Traffic Per Smartphone

- 4.5.3 Mobile Data Speed

- 4.5.4 Broadband Data Speed

- 4.5.5 Fiber Connectivity Network

- 4.5.6 Regulatory Framework

- 4.6 Value Chain and Distribution Channel Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (MEGAWATT)

- 5.1 By Data Center Size

- 5.1.1 Large

- 5.1.2 Massive

- 5.1.3 Medium

- 5.1.4 Mega

- 5.1.5 Small

- 5.2 By Tier Standard

- 5.2.1 Tier 1 and 2

- 5.2.2 Tier 3

- 5.2.3 Tier 4

- 5.3 By Data Center Type

- 5.3.1 Hyperscale / Self-Built

- 5.3.2 Enterprise / Edge

- 5.3.3 Colocation

- 5.3.3.1 Non-Utilized

- 5.3.3.2 Utilized

- 5.3.3.2.1 Retail Colocation

- 5.3.3.2.2 Wholesale Colocation

- 5.4 By End User Industry

- 5.4.1 BFSI

- 5.4.2 IT and ITES

- 5.4.3 E-Commerce

- 5.4.4 Government

- 5.4.5 Manufacturing

- 5.4.6 Media and Entertainment

- 5.4.7 Telecom

- 5.4.8 Other End Users

- 5.5 By Hotspot

- 5.5.1 Jakarta

- 5.5.2 Batam

- 5.5.3 Rest of Indonesia

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)}

- 6.4.1 PT. Telkom Data Ekosistem (NeutraDC)

- 6.4.2 PT DCI Indonesia

- 6.4.3 Amazon Web Services, Inc.

- 6.4.4 Alibaba Cloud

- 6.4.5 K2 Data Centers-Sinar Mas Land

- 6.4.6 Indosat Tbk PT (Big Data Exchange (BDx))

- 6.4.7 Biznet Data Center

- 6.4.8 Space DC Pte Ltd

- 6.4.9 Bersama Digital Data Centres (BDDC)

- 6.4.10 Princeton Digital Group

- 6.4.11 Tencent Cloud

- 6.4.12 Digital Edge (Singapore) Holdings Pte. Ltd. (Indonet)

- 6.4.13 Google LLC

- 6.4.14 MettaDC

- 6.4.15 NTT Ltd.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment