|

市場調查報告書

商品編碼

1693384

泰國黏合劑:市場佔有率分析、行業趨勢和成長預測(2025-2030 年)Thailand Adhesives - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

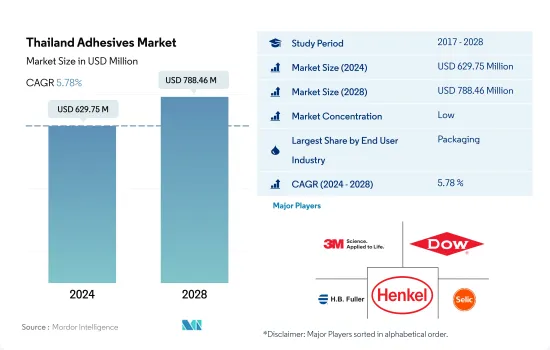

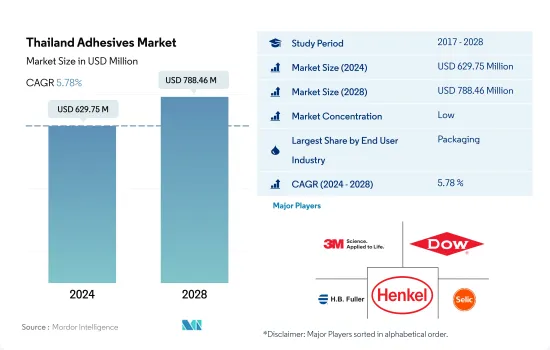

泰國黏合劑市場規模預計在 2024 年為 6.2975 億美元,預計到 2028 年將達到 7.8846 億美元,預測期內(2024-2028 年)的複合年成長率為 5.78%。

泰國的汽車工業在該國黏合劑需求的整體成長中發揮關鍵作用。

- 受新冠疫情影響,2020 年黏合劑消費量較 2019 年下降約 11.6%。疫情導致製造地關閉、需求減少,嚴重影響了泰國的黏合劑消費量。泰國的停工持續了近三個月,擾亂了供應鏈並導致勞動力短缺。但由於製造業需求穩定,2021年消費量達到10%左右的正成長。

- 黏合劑主要用於國內包裝產業,因為它們在包裝應用中黏合塑膠、金屬、紙張和紙板方面發揮著至關重要的作用。由於成本低、黏合強度高,這些應用需要使用水性黏合劑,並且該行業大量使用水性黏合劑。 2021 年,泰國包裝產業消耗了約 26,000 噸水性黏合劑。溶劑型黏合劑是包裝產業成長最快的技術,預計 2022 年至 2028 年該領域的複合年成長率為 2.37%。

- 汽車業是泰國第二大黏合劑消費產業。該國汽車產能達168萬輛,與前一年同期比較增18%,帶動2021年汽車膠合劑市場成長16.62%。預計國際市場對泰國汽車出口需求的成長將推動未來幾年對汽車膠合劑的需求。 2021年汽車出口額將達414.3億美元。

泰國黏合劑市場趨勢

食品、化妝品等產業對塑膠包裝的需求不斷增加,推動包裝產業

- 預計2022年泰國人均GDP將達7,450美元,與前一年同期比較增3.3%。包裝產業對該國GDP的貢獻約為1.91%。貿易外匯、就業、人事費用、政府政策支持等都會影響泰國的包裝產業。

- 2020年,受新冠疫情影響,泰國經濟放緩。當年的產量與 2019 年相比下降了 4.74%。這是由於供應鏈中斷、勞動力短缺以及近三個月的全國封鎖造成的。然而,2021年國際邊界開放後國內經濟復甦,導致生產所需原料供應正常,2021年增加了7,900噸。

- 泰國是全球塑膠包裝市場領先的製造國之一。塑膠包裝產業每年的價值為 50 億美元,是所有類型包裝中最高的。該國約有28%的塑膠產量用於塑膠包裝產品。這種包裝主要用於食品、醫療、化妝品和許多其他類型的產品。

- 泰國包裝產業對生質塑膠的使用正在增加。政府也透過《塑膠廢棄物管理藍圖(2018-2030)》等措施優先發展生質塑膠產業。 GC 和嘉吉是跨國生物聚合物公司,已宣布計劃投資 200 億美元在泰國建造新的生質塑膠工廠。

泰國汽車工業預計將佔據東南亞國協汽車產量的近50.1%,處於領先地位。

- 過去50年來,泰國汽車工業經歷了令人矚目的成長。該國正在不斷向下一代汽車產業邁進,該產業遵循S曲線,具有更高的附加價值生產,並致力於使其汽車產業政策與環境保護政策保持一致。泰國是東協地區最大的汽車生產國。 2020年產量為1,427,074輛,佔東協總產量的50.1%。其次是印尼(691,150輛,約24.2%)和馬來西亞(485,186輛,約17.0%)。

- 2019年汽車產量約2,013,710輛,但2020年受新冠疫情影響,產量驟降至1,427,074輛,下降約29%。因此,2019年至2021年汽車產量波動幅度約為-16%,2020年至2021年汽車產量波動幅度約為-1%。

- 泰國是世界第11大汽車生產國,也是東協第一大汽車生產國,憑藉著成熟的價值鏈,有望成為東協的電動車中心。為滿足當地需求,泰國的電動車庫存正穩定成長。更重要的是,幾家泰國知名公司正在積極投資該國的電動車充電基礎設施,顯示對未來需求成長的信心日益增強。政府和私人機構為增加充電站等電動車基礎設施所做的努力表明泰國的電動車生態系統正在快速發展。

泰國膠黏劑產業概況

泰國膠合劑市場較為分散,前五大企業佔29.77%的市佔率。該市場的主要企業包括 3M、陶氏、HB Fuller Company、漢高股份公司、Selic Corp Public Company Limited 等。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章執行摘要和主要發現

第2章 報告要約

第3章 引言

- 研究假設和市場定義

- 研究範圍

- 調查方法

第4章 產業主要趨勢

- 最終用戶趨勢

- 航太

- 車

- 建築與施工

- 鞋類皮革

- 包裝

- 木製品和配件

- 法律規範

- 泰國

- 價值鍊和通路分析

第5章市場區隔

- 最終用戶產業

- 航太

- 車

- 建築與施工

- 鞋類和皮革

- 醫療保健

- 包裝

- 木製品和配件

- 其他

- 科技

- 熱熔膠

- 反應性

- 溶劑型

- 紫外線固化膠合劑

- 水性

- 樹脂

- 丙烯酸纖維

- 氰基丙烯酸酯

- 環氧樹脂

- 聚氨酯

- 矽膠

- VAE,EVA

- 其他

第6章競爭格局

- 關鍵策略趨勢

- 市場佔有率分析

- 商業狀況

- 公司簡介

- 3M

- Arkema Group

- Dow

- DUNLOP ADHESIVES(THAILAND)CO., LTD.

- HB Fuller Company

- Henkel AG & Co. KGaA

- Huntsman International LLC

- Selic Corp Public Company Limited.

- Sika AG

- Star Bond (Thailand) Company Limited

第7章:CEO面臨的關鍵策略問題

第 8 章 附錄

- 全球黏合劑和密封劑產業概況

- 概述

- 五力分析框架(產業吸引力分析)

- 全球價值鏈分析

- 促進因素、限制因素和機會

- 資訊來源及延伸閱讀

- 圖片列表

- 關鍵見解

- 數據包

- 詞彙表

簡介目錄

Product Code: 92439

The Thailand Adhesives Market size is estimated at 629.75 million USD in 2024, and is expected to reach 788.46 million USD by 2028, growing at a CAGR of 5.78% during the forecast period (2024-2028).

Thailand's Automotive industry having a significant role in the overall growth of adhesive's demand in the country

- The consumption of adhesives declined in 2020 by about 11.6% compared to 2019 due to the COVID-19 pandemic, which severely affected the consumption of adhesives in Thailand owing to the closedown of the manufacturing sites and reduction in demand. The lockdown in the country for nearly three months resulted in supply chain disruptions and labor shortages. However, consumption registered growth in 2021 with a positive growth rate of about 10% due to steady demand from the manufacturing sector.

- Adhesives are majorly consumed in the packaging industry in the country owing to their importance in bonding plastics, metals, and paper and cardboard packaging applications. Water-borne adhesives are highly consumed in the industry because of their cheaper cost and high bonding strength, which is required in these applications. Nearly 26 thousand tons of water-borne adhesives were consumed in the Thai packaging industry in 2021. Solvent-borne adhesives are the fastest-growing technology in the packaging industry, and the segment is expected to register a CAGR of 2.37% from 2022 to 2028.

- The automotive industry is the second-largest consumer of adhesives in Thailand. The automotive adhesives market grew by 16.62% in 2021, as the country's total vehicle manufacturing capacity reached 1.68 million units, up by 18% from the previous year. The rising demand for Thailand's automotive exports in the international market is expected to drive the demand for automotive adhesives over the coming years. The automotive export value reached USD 41.43 billion in 2021.

Thailand Adhesives Market Trends

Growing demand for plastic packaging in food, cosmetics, and other industries will propel the packaging industry

- Thailand registered a GDP of USD 7,450 per capita with a growth rate of 3.3% Y-O-Y in 2022. The packaging industry contributes a share of around 1.91 of the country's GDP. Trade exchange, employment, labor charges, government policy support, etc., affect the Thai packaging industry.

- The country observed an economic slowdown in 2020 because of the COVID-19 pandemic. Production volume declined by 4.74% in the same year compared to 2019. This happened due to supply chain disruptions, labor shortages, and a lockdown in the country for nearly three months. However, because of economic recovery in the country in line with international borders being opened in 2021, the regular supply of raw materials began for production, which increased by 7,900 ton in 2021.

- Thailand is one of the major manufacturing countries in the global plastic packaging market. The plastic packaging industry reaches USD 5 billion annually, the highest among other types of packaging. Around 28% of the country's plastic production is used in plastic packaging products. This packaging is majorly used in food, healthcare, cosmetics, and many other types of products in Thailand.

- The usage of bioplastics in the packaging industry of Thailand is increasing. The government has also prioritized the bioplastic industry's development through policies such as the Plastic Waste Management Roadmap (2018-2030). GC and Cargill are two multinational biopolymer companies that have announced plans to invest USD 20 billion in establishing new bioplastic plants in Thailand.

Nearly 50.1% share of the overall automotive production among the ASEAN countries is likely to drive the industry in Thailand

- The Thai automobile sector has grown tremendously over the last 50 years. The country is constantly advancing its next-generation automotive industry to follow the S-Curve promotion with better value-added production, and it also aims for the automotive industrial policy to be aligned with the environmental protection policy. Thailand is the largest auto producer in the ASEAN region. In 2020, production totaled 1,427,074 units, accounting for 50.1% of total ASEAN production. This was followed by Indonesia (690,150 units, or approximately 24.2%) and Malaysia (485,186 units, or approximately 17.0%).

- In 2019, the country recorded about 20.13,710 units of vehicles produced, which drastically reduced to 14,27,074 units in 2020, accounting for a decline of about 29% owing to the COVID-19 pandemic. As a result, the variation in automotive production between 2019 and 2021 amounted to about -16%, whereas between 2020 and 2021, the variation was recorded at about -1%.

- Thailand, ranked as the 11th largest automotive producer in the world and the first in ASEAN, is poised to become ASEAN's EV center, owing to its well-established value chain, which provides the industry with top-notch quality products at a competitive price. Thailand's EV stock has been steadily increasing in response to local demand. More importantly, several well-known Thai corporations have been actively investing in EV charging infrastructure around the country, indicating rising confidence in future demand increases. Efforts by governmental and private sector institutions to increase EV infrastructure, such as charging stations, suggest that Thailand's EV ecosystem is developing rapidly.

Thailand Adhesives Industry Overview

The Thailand Adhesives Market is fragmented, with the top five companies occupying 29.77%. The major players in this market are 3M, Dow, H.B. Fuller Company, Henkel AG & Co. KGaA and Selic Corp Public Company Limited. (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 End User Trends

- 4.1.1 Aerospace

- 4.1.2 Automotive

- 4.1.3 Building and Construction

- 4.1.4 Footwear and Leather

- 4.1.5 Packaging

- 4.1.6 Woodworking and Joinery

- 4.2 Regulatory Framework

- 4.2.1 Thailand

- 4.3 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2028 and analysis of growth prospects)

- 5.1 End User Industry

- 5.1.1 Aerospace

- 5.1.2 Automotive

- 5.1.3 Building and Construction

- 5.1.4 Footwear and Leather

- 5.1.5 Healthcare

- 5.1.6 Packaging

- 5.1.7 Woodworking and Joinery

- 5.1.8 Other End-user Industries

- 5.2 Technology

- 5.2.1 Hot Melt

- 5.2.2 Reactive

- 5.2.3 Solvent-borne

- 5.2.4 UV Cured Adhesives

- 5.2.5 Water-borne

- 5.3 Resin

- 5.3.1 Acrylic

- 5.3.2 Cyanoacrylate

- 5.3.3 Epoxy

- 5.3.4 Polyurethane

- 5.3.5 Silicone

- 5.3.6 VAE/EVA

- 5.3.7 Other Resins

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and Analysis of Recent Developments).

- 6.4.1 3M

- 6.4.2 Arkema Group

- 6.4.3 Dow

- 6.4.4 DUNLOP ADHESIVES (THAILAND) CO., LTD.

- 6.4.5 H.B. Fuller Company

- 6.4.6 Henkel AG & Co. KGaA

- 6.4.7 Huntsman International LLC

- 6.4.8 Selic Corp Public Company Limited.

- 6.4.9 Sika AG

- 6.4.10 Star Bond (Thailand) Company Limited

7 KEY STRATEGIC QUESTIONS FOR ADHESIVES AND SEALANTS CEOS

8 APPENDIX

- 8.1 Global Adhesives and Sealants Industry Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework (Industry Attractiveness Analysis)

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Drivers, Restraints, and Opportunities

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

02-2729-4219

+886-2-2729-4219