|

市場調查報告書

商品編碼

1692576

亞太地區 EVA 黏合劑:市場佔有率分析、產業趨勢和成長預測(2025-2030 年)Asia-Pacific EVA Adhesives - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

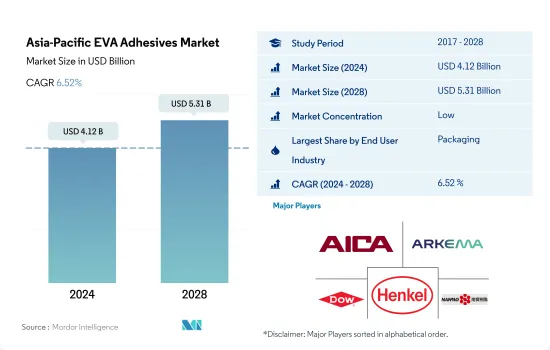

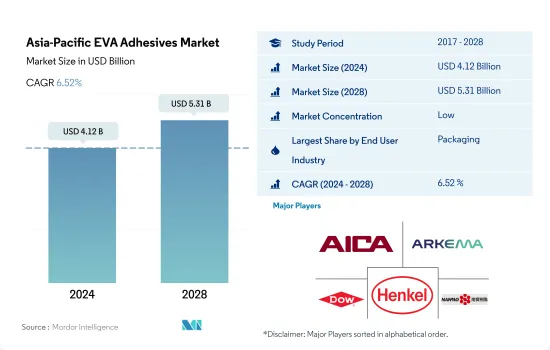

亞太地區 EVA 黏合劑市場規模預計在 2024 年為 41.2 億美元,預計到 2028 年將達到 53.1 億美元,預測期內(2024-2028 年)的複合年成長率為 6.52%。

包裝仍然是成長最快的最終用戶,並保持其領先地位。

- EVA 黏合劑應用於各種終端用戶行業,包括包裝、汽車、木工和細木工以及建築和施工。這些黏合劑能夠黏合紙張、木材、塑膠、橡膠、金屬和皮革等基材。 EVA 黏合劑的主要應用包括紙/紙板盒、包裝和標籤、紙箱密封、組裝、汽車內裝和紙張加工。

- 2017年至2019年,EVA膠黏劑的需求大幅成長。韓國鞋革產業在亞太地區EVA膠合劑市場中成長率最高(27.62%)。

- 2020 年,由於營運和貿易限制、供應鏈限制以及 COVID-19 疫情造成的勞動力短缺等各種因素,所有終端用戶行業對 EVA 黏合劑的需求均下降。鞋類皮革產業需求受創最為嚴重,較去年同期下降14.22%。由於2020年全球鞋類消費量與前一年同期比較下降22%,集中在亞太地區的鞋類製造商被迫減少產量。這對該行業對EVA膠粘劑的需求產生了負面影響。

- 預計該行業成長趨勢將在預測期內持續下去。就數量而言,預計 2022-2028 年預測期間所有終端用戶產業對 EVA 黏合劑的需求複合年成長率將達到 5.09%。包裝行業由於其快速固化特性而更青睞 EVA 黏合劑,佔據了需求的最大佔有率,預計在 2022-2028 年預測期內仍將是最大的終端用戶產業。

亞太地區強大的生產能力有助於確保 EVA 黏合劑的最高需求

- 2017年至2021年,亞太地區EVA膠黏劑市場需求量在所有地區中最高。由於所有終端用戶行業的生產能力都很高,該地區的黏合劑需求佔有率一直佔全球需求的 46-47%。採用熱熔技術的 EVA 樹脂基黏合劑滿足了該地區大部分的需求。

- 2017年至2019年期間,該地區對黏合劑的需求複合年成長率不到1%。 EVA樹脂黏合劑成長放緩是由於該地區建設活動和汽車產量下降。 2018 年和 2019 年,這些終端用戶產業的需求分別以 -2.4% 和 -2.25% 的複合年成長率下降。

- 2020年,營運、勞動力、原料、供應鏈等方面的限制導致該地區所有終端用戶產業的需求減少。在該地區的所有行業中,澳洲製鞋業受到的打擊最為嚴重,2020與前一年同期比較49.53%。國內需求下降是由於經濟衰退導致的購買力下降,疫情期間該行業受到了嚴重影響。

- 2021 年,隨著限制措施的放鬆,EVA 樹脂基黏合劑的需求迅速恢復到疫情前的水平。印度市場銷量增幅最高,與前一年同期比較去年同期成長8.55%。預計亞太地區的需求將會成長,預測期內複合年成長率為 4.46%。預計預測期內,該地區的建築、包裝和汽車行業將推動需求成長。

亞太地區EVA膠黏劑市場趨勢

開發中國家電子商務產業快速成長帶動產業擴張

- 包裝主要用於保護、容納、資訊、實用和促銷。這使得包裝成為大多數行業的重要組成部分。 2017年,包括紙、紙板和塑膠包裝在內的包裝使用量達25億噸。 2020年,受新冠疫情影響,供應鏈中斷、包裝材料短缺、貨物進出口限制、工廠開工率低等因素影響,市場出現7.4%的負成長率。

- 中國和印尼分別是第一和第二大海洋塑膠廢棄物排放,亞洲各國政府正採取措施減少塑膠的使用。中國公佈了有關過度包裝的新規定,要求所有食品和化妝品製造商遵守具體的指導方針,根據產品比例確定允許的包裝量。印尼政府的生產者延伸責任(EPR)法規要求生產者和零售商重新設計產品包裝,以增加可回收材料的比例。

- 2021年,市場實現了8%的正成長,各類包裝材料的使用量達到27億噸。由於中等收入階層的不斷壯大、供應鏈的改善以及電子商務活動的活性化,包裝行業預計將繼續成長,這些因素需要專門的包裝來運輸貨物,這在過去幾年中為包裝行業提供了巨大的推動力。預計不斷成長的亞洲市場將推動包裝的使用,使其在預測期內(2022-2028 年)的複合年成長率達到 5.7%。

電動車的普及正在推動該產業

- 由於汽車銷售強勁成長,亞太地區的汽車產業是市場領先產業之一。在所有國家中,中國是最大的汽車生產國,佔該地區汽車產量的57%左右,其次是日本(17%)、印度(10%)和韓國(8%)。

- 該地區的汽車銷售和產量均大幅下降,影響了黏合劑的使用。 2017- 與前一年同期比較變動為-1.8%,而2018-19年度則進一步下降-6.4%。 2019-20年度,受新冠疫情影響,該地區產量再次受到負面影響,較去年同期與前一年同期比較10.2%。由於製造工廠停工和供應鏈中斷,汽車零件短缺,生產水準受到限制。然而,預計汽車需求將在 2021 年再次增加並持續成長,從而導致預測期內全部區域的黏合劑使用量增加。

- 亞太電動車市場為黏合劑市場帶來了另一個成長機會。電動和混合動力汽車的產量和採用率的不斷提高,推動了汽車電子組裝中黏合劑的使用量。中國是世界上最大的電動車生產國,也是全部區域最大的電動車生產國。 2016年至2021年間,商用電動車數量從562,603輛增加到1,116,382輛,成長率約98%。預計這些因素將增加對黏合劑的需求,從而在預測期內提高市場成長率。

亞太地區EVA膠黏劑產業概況

亞太地區EVA膠黏劑市場較為分散,前五大公司佔9.91%的市佔率。該市場的主要企業包括愛克工業、阿科瑪集團、陶氏化學、漢高股份公司、南寶樹脂化學集團等。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章執行摘要和主要發現

第2章 報告要約

第3章 引言

- 研究假設和市場定義

- 研究範圍

- 調查方法

第4章 產業主要趨勢

- 最終用戶趨勢

- 航太

- 車

- 建築與施工

- 鞋類皮革

- 包裝

- 木製品和配件

- 法律規範

- 澳洲

- 中國

- 印度

- 印尼

- 日本

- 馬來西亞

- 新加坡

- 韓國

- 泰國

- 價值鍊和通路分析

第5章市場區隔

- 最終用戶產業

- 航太

- 車

- 建築與施工

- 鞋類和皮革

- 醫療保健

- 包裝

- 木製品和配件

- 其他

- 科技

- 熱熔膠

- 溶劑型

- 水性

- 國家

- 澳洲

- 中國

- 印度

- 印尼

- 日本

- 馬來西亞

- 新加坡

- 韓國

- 泰國

- 其他亞太地區

第6章競爭格局

- 關鍵策略趨勢

- 市場佔有率分析

- 商業狀況

- 公司簡介

- Aica Kogyo Co..Ltd.

- Arkema Group

- CEMEDINE Co.,Ltd.

- Dow

- HB Fuller Company

- Henkel AG & Co. KGaA

- NANPAO RESINS CHEMICAL GROUP

- OKONG Corp.

- Paramelt BV

- Selic Corp Public Company Limited.

第7章:CEO面臨的關鍵策略問題

第 8 章 附錄

- 全球黏合劑和密封劑產業概況

- 概述

- 五力分析框架(產業吸引力分析)

- 全球價值鏈分析

- 促進因素、限制因素和機會

- 資訊來源及延伸閱讀

- 圖片列表

- 關鍵見解

- 數據包

- 詞彙表

簡介目錄

Product Code: 92413

The Asia-Pacific EVA Adhesives Market size is estimated at 4.12 billion USD in 2024, and is expected to reach 5.31 billion USD by 2028, growing at a CAGR of 6.52% during the forecast period (2024-2028).

Packaging is the fastest-growing end-user and remains as pole position

- EVA adhesives find applications in various end-user industries, including packaging, automotive, woodworking and joinery, and building and construction. These adhesives can bond substrates like paper, wood, plastics, rubbers, metals, and leather. Some major applications of these adhesives are paper/card stock boxes, package labeling, carton sealing, assembly, vehicle interiors, and paper conversion, among others.

- The demand for EVA adhesives has grown significantly from 2017 to 2019. The footwear and leather industry in South Korea witnessed the highest growth (of 27.62%) in the Asia-Pacific EVA adhesives market.

- In 2020, the demand for EVA adhesives declined from all end-user industries because of various factors such as operational and trade restrictions, supply chain constraints, and labor shortages due to the COVID-19 pandemic. The demand from the footwear and leather industry suffered the most, declining by 14.22% y-o-y. As global footwear consumption decreased by 22% y-o-y in 2020, footwear manufacturers concentrated in the Asia-Pacific region had to reduce their production. This negatively affected the demand for EVA adhesives in this industry.

- The industry's growth trend is expected to continue during the forecast period. In volume terms, the demand for EVA adhesives from all end-user industries combined is expected to record a CAGR of 5.09% during the forecast period 2022-2028. The packaging industry favors EVA adhesives over others because of their fast-curing properties and, thus, accounts for the largest share of the demand and is expected to remain the largest end-user industry during the forecast period 2022-2028.

The large manufacturing capacities of the Asia-Pacific region helped to secure the highest demand for EVA adhesives

- From 2017 to 2021, the demand for the EVA adhesives market generated from Asia-Pacific was the highest among all regions. This region's share of adhesive demand has consistently accounted for 46-47% of the global demand because of the region's high manufacturing capacity in all end-user industries. EVA resin-based adhesives with hot-melt technologies generate most of the demand in the area.

- From 2017 to 2019, the demand for adhesives from this region recorded a CAGR of less than 1%. The slow growth in EVA resin-based adhesives was due to a decrease in construction activities and automotive production in the region. The demand from these end-user industries declined at CAGRs of -2.4% and -2.25% in 2018 and 2019, respectively.

- In 2020, the demand from all end-user industries across the region declined due to constraints in operations, labor, raw material, supply chain, and other aspects. Among all industries in the region, the Australian footwear industry took the worst hit, declining by 49.53% Y-o-Y in volume terms in 2020. The decrease in domestic demand was due to the low purchasing power resulting from a weak economy, severely affecting this industry during the pandemic.

- In 2021, the demand for EVA resin-based adhesives quickly rebounded to the pre-pandemic volumes as restrictions eased. The Indian market witnessed the highest Y-o-Y growth of 8.55% in volume terms. The overall demand from the Asia-Pacific region is expected to grow, recording a CAGR of 4.46%, during the forecast period. This demand growth is expected to be driven by the region's construction, packaging, and automotive industries during the forecast period.

Asia-Pacific EVA Adhesives Market Trends

Fast paced growth of e-commerce industry in developing nations to augment the industry

- Packaging is mainly used for protection, containment, information, utility, and promotion. This makes packaging an integral part of most industries. In 2017, packaging usage accounted for 2.5 billion ton of packaging, including paper and paperboard and plastic packaging. In 2020, due to the COVID-19 pandemic, the market registered a negative growth rate of 7.4% due to disruptions in the supply chain, shortage of packaging material, restrictions on the import and export of goods, and factories operating at low capacity.

- Governments of different Asian countries have taken steps to reduce the use of plastic, as China and Indonesia are the first and second-largest contributors to plastic waste in the ocean. China has announced new restrictions on excessive packaging, requiring all food and cosmetics producers to adhere to specific guidelines determining the volume of packaging allowed in proportion to a product. The extended producer responsibility (EPR) regulation imposed by the Indonesian government will oblige producers and retailers to redesign their product packaging to include a higher proportion of recyclable material.

- In 2021, the market registered a positive growth of 8%, with 2.7 billion ton of packaging material used for various purposes. The packaging industry is expected to keep growing due to the rising middle-income population, improvement of supply chains, and rising e-commerce activities, which have significantly boosted the packaging industry in the past few years as special packaging is required for shipping goods. The growing Asian market is expected to boost packaging usage, enabling it to register a CAGR of 5.7% during the forecast period (2022-2028).

Increasing adoption of electric vehicles to drive the industry

- The Asia-Pacific automotive industry is one of the leading industries in the market, as the sales of automotive vehicles are largely increasing. Among all the countries, China is the largest automotive producer, accounting for about 57% of the regional production, followed by Japan with 17%, India with 10%, and South Korea with 8%.

- Vehicle sales in the region have majorly declined along with production, owing to which the utilization of adhesives has been impacted. While the Y-o-Y variation in 2017-18 was -1.8%, it fell further by -6.4% in 2018-19. In 2019-20, regional production was again impacted negatively and recorded a -10.2% decline from the previous year due to the COVID-19 pandemic. The shutdown of manufacturing facilities and the shortage of vehicle components due to disruptions in the supply chain constrained the production level. However, in 2021, the demand for automobiles rose again and is expected to continue, thereby increasing the utilization of adhesives across the region over the forecast period.

- The EV market in Asia-Pacific offers another opportunity for the adhesives market to grow. The rising production and adoption of EVs and hybrid vehicles are boosting the usage of adhesives for electronic component assembly in vehicles. China is the largest producer of EVs globally as well as across the region. From 2016 to 2021, the volume of commercial electric vehicles increased from 562,603 to 1,116,382 units, recording a growth rate of about 98%. These factors are expected to increase the demand for adhesives and result in the higher market growth over the forecast period.

Asia-Pacific EVA Adhesives Industry Overview

The Asia-Pacific EVA Adhesives Market is fragmented, with the top five companies occupying 9.91%. The major players in this market are Aica Kogyo Co..Ltd., Arkema Group, Dow, Henkel AG & Co. KGaA and NANPAO RESINS CHEMICAL GROUP (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 End User Trends

- 4.1.1 Aerospace

- 4.1.2 Automotive

- 4.1.3 Building and Construction

- 4.1.4 Footwear and Leather

- 4.1.5 Packaging

- 4.1.6 Woodworking and Joinery

- 4.2 Regulatory Framework

- 4.2.1 Australia

- 4.2.2 China

- 4.2.3 India

- 4.2.4 Indonesia

- 4.2.5 Japan

- 4.2.6 Malaysia

- 4.2.7 Singapore

- 4.2.8 South Korea

- 4.2.9 Thailand

- 4.3 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2028 and analysis of growth prospects)

- 5.1 End User Industry

- 5.1.1 Aerospace

- 5.1.2 Automotive

- 5.1.3 Building and Construction

- 5.1.4 Footwear and Leather

- 5.1.5 Healthcare

- 5.1.6 Packaging

- 5.1.7 Woodworking and Joinery

- 5.1.8 Other End-user Industries

- 5.2 Technology

- 5.2.1 Hot Melt

- 5.2.2 Solvent-borne

- 5.2.3 Water-borne

- 5.3 Country

- 5.3.1 Australia

- 5.3.2 China

- 5.3.3 India

- 5.3.4 Indonesia

- 5.3.5 Japan

- 5.3.6 Malaysia

- 5.3.7 Singapore

- 5.3.8 South Korea

- 5.3.9 Thailand

- 5.3.10 Rest of Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and Analysis of Recent Developments).

- 6.4.1 Aica Kogyo Co..Ltd.

- 6.4.2 Arkema Group

- 6.4.3 CEMEDINE Co.,Ltd.

- 6.4.4 Dow

- 6.4.5 H.B. Fuller Company

- 6.4.6 Henkel AG & Co. KGaA

- 6.4.7 NANPAO RESINS CHEMICAL GROUP

- 6.4.8 OKONG Corp.

- 6.4.9 Paramelt B.V.

- 6.4.10 Selic Corp Public Company Limited.

7 KEY STRATEGIC QUESTIONS FOR ADHESIVES AND SEALANTS CEOS

8 APPENDIX

- 8.1 Global Adhesives and Sealants Industry Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework (Industry Attractiveness Analysis)

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Drivers, Restraints, and Opportunities

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

02-2729-4219

+886-2-2729-4219