|

市場調查報告書

商品編碼

1693383

印尼黏合劑:市場佔有率分析、行業趨勢和成長預測(2025-2030 年)Indonesia Adhesives - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

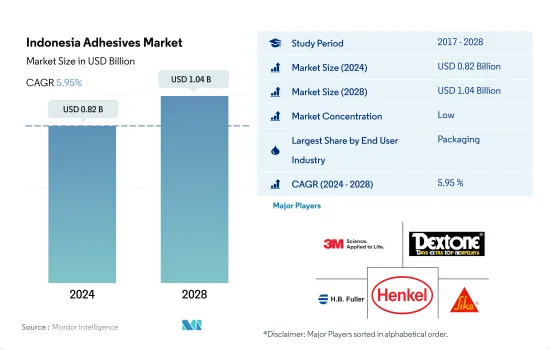

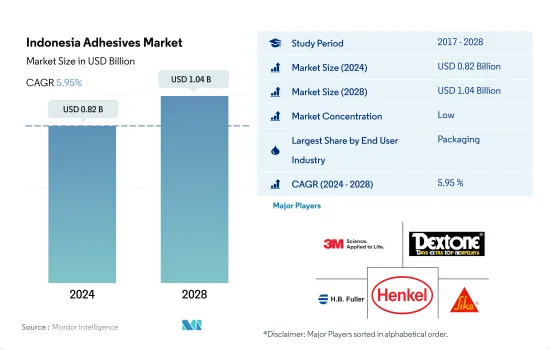

印尼黏合劑市場規模預計在 2024 年為 8.2 億美元,預計到 2028 年將達到 10.4 億美元,預測期內(2024-2028 年)的複合年成長率為 5.95%。

國內大量正在實施和計劃實施的基礎設施計劃將對膠合劑需求的成長發揮關鍵作用。

- 受新冠疫情影響,2020年印尼膠黏劑消費量呈下降趨勢。與 2019 年相比,當年的消費量下降了約 13%。該國的封鎖是造成該國黏合劑短缺的主要原因。此外,由於生產設施停工和供應鏈中斷,這些黏合劑的需求受到了嚴重影響。

- 印尼的包裝產業在各行各業中發揮著至關重要的作用。因此,包裝工業的發展與民族工業的發展密不可分。事實上,包裝已成為該國工業產品的競爭因素之一。近年來,包裝業與前一年同期比較增6%-7%,2021年營收達104,728億印尼盾。實際上,即使新冠疫情開始蔓延,包裝業務也沒有受到太大影響。預計包裝產業將以每年 6% 至 8% 的速度成長,與食品和飲料、製藥和零售等主要支援產業的成長保持一致。

- 另一方面,工業界目前正在投資大型基礎設施計劃以加速國家的發展。例如,印尼計劃投資超過400億美元擴建雅加達地鐵網路,預計此舉將促進該國建築業的發展。印尼還計劃在未來幾年內實施價值超過 4000 億美元的雄心勃勃的建設計劃,包括建造 25 個機場和新發電廠。所有這些變數都會影響對黏合劑的需求。

印尼膠黏劑市場趨勢

政府推廣紙和紙板包裝的措施將推動產業

- 包裝主要用於保護、容納、資訊、實用和促銷。這使得包裝成為大多數行業的重要組成部分。預計不斷成長的印尼市場將推動包裝使用量,預測期內複合年成長率將達到 4.33%。 2017年,包裝使用量達1.4346億噸,包括紙、紙板和塑膠。受新冠疫情影響,供應鏈中斷、包裝材料短缺、貨物進出口限制、工廠產能低等因素導致2020年市場出現-5.77%的負成長。

- 2021年,市場將達到4.28%的正成長,各類包裝材料的使用量將達到1.5341億噸。由於近年來電子商務行業的興起,包裝行業預計將在未來繼續成長,這對包裝行業來說是一個巨大的推動,因為運輸貨物需要專門的包裝。

- 印尼是繼中國之後第二大海洋塑膠廢棄物排放,這也是印尼政府採取措施禁止使用塑膠的原因。印尼政府實施的生產者延伸責任(EPR)法規要求生產商和零售商重新設計產品包裝,以包含更高比例的可回收材料。這將鼓勵製造商使用紙和紙板作為包裝基材,增加包裝過程中使用的黏合劑的數量。

- 在當今競爭激烈的消費品市場中,企業採用有吸引力的包裝來在競爭中脫穎而出並在市場上保持其品牌價值已成為必然。

汽車零件出口強勁成長帶動產業成長

- 印尼的汽車產業仍然是一個有前景的產業,為該國的經濟發展做出了重大貢獻。印尼共和國產業部長阿古斯古米旺卡塔薩斯米塔表示,2021年印尼汽車產業呈現驚人成長,成長率達到17.82%的兩位數。 2019年,印尼汽車產量約1,286,848輛,但受新冠疫情影響,2020年產量大幅下滑至690,176輛,降幅約46%。受此影響,2019年至2021年生產的汽車數量變化約為-13%,而2020年至2021年的變化約為63%。

- 2019年至2021年,印尼汽車業貿易連續多年保持順差。 2020年,全球疫情導致進出口雙雙下滑,限制和擾亂了經濟活動,擾亂了全球供應鏈,打擊了整體生產。然而,2021年生產強勁,導致出口和進口均大幅成長,貿易差額達19.3億美元。雖然 2021 年的商業活動水準是近十年來最高的,但貿易順差與 2019 年和 2020 年相比卻是最低的,當時的順差分別為 20 億美元和 19.5 億美元。

- 在全球範圍內,電動車的發展標誌著印尼交通運輸部門方式的根本轉變。鑑於該國的鎳蘊藏量,印尼完全有能力成為全球電動車供應鏈的主要企業。為了成為該地區電動車未來的一部分,印尼需要投資技術、人才、可再生能源和基礎設施。

印尼膠黏劑產業概況

印尼膠合劑市場較為分散,前五大企業市佔率合計為15.91%。市場的主要企業有:3M、DEXTONE INDONESIA、HB Fuller Company、Henkel AG & Co. KGaA 和 Sika AG。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章執行摘要和主要發現

第2章 報告要約

第3章 引言

- 研究假設和市場定義

- 研究範圍

- 調查方法

第4章 產業主要趨勢

- 最終用戶趨勢

- 航太

- 車

- 建築與施工

- 鞋類皮革

- 包裝

- 木製品和配件

- 法律規範

- 印尼

- 價值鍊和通路分析

第5章市場區隔

- 最終用戶產業

- 航太

- 車

- 建築與施工

- 鞋類和皮革

- 醫療保健

- 包裝

- 木製品和配件

- 其他

- 科技

- 熱熔膠

- 反應性

- 溶劑型

- 紫外線固化膠合劑

- 水性

- 樹脂

- 丙烯酸纖維

- 氰基丙烯酸酯

- 環氧樹脂

- 聚氨酯

- 矽膠

- VAE,EVA

- 其他

第6章 競爭格局

- 關鍵策略趨勢

- 市場佔有率分析

- 商業狀況

- 公司簡介

- 3M

- ALTECO co., ltd.

- DEXTONE INDONESIA

- HB Fuller Company

- Henkel AG & Co. KGaA

- Huntsman International LLC

- MAPEI SpA

- Pidilite Industries Ltd.

- PT. Pamolite Adhesive Industry

- Sika AG

第7章:CEO面臨的關鍵策略問題

第 8 章 附錄

- 全球黏合劑和密封劑產業概況

- 概述

- 五力分析框架(產業吸引力分析)

- 全球價值鏈分析

- 促進因素、限制因素和機會

- 資訊來源及延伸閱讀

- 圖片列表

- 關鍵見解

- 數據包

- 詞彙表

簡介目錄

Product Code: 92438

The Indonesia Adhesives Market size is estimated at 0.82 billion USD in 2024, and is expected to reach 1.04 billion USD by 2028, growing at a CAGR of 5.95% during the forecast period (2024-2028).

The numerous ongoing and planned infrastructure projects in the country to have a key role in the growth of adhesive demand

- The consumption of adhesives in Indonesia has shown a downward trend in 2020 due to the impact of COVID-19. The consumption was reduced by about 13% in terms of volume in the same year compared to 2019. The lockdown in the country has largely become the major reason for the shortage of adhesives in the country. Moreover, due to the shutdown of production facilities and supply chain disruption, the demand for these adhesives is largely being impacted.

- The Indonesian packaging industry plays an important role in all industries and businesses. Therefore, the development of the packaging industry cannot be separated from the development of the national industry. In fact, packaging has become one of the determining factors for the competitiveness of national industrial products. In recent years, the packaging sector has grown by 6%-7% year-on-year, with a realized value of IDR 104,728 billion in 2021. In reality, as the COVID-19 epidemic began to spread, the packing business did not suffer considerably. The packaging industry is expected to increase at a 6%-8% annual rate, in conjunction with the growth of the major supporting sectors, such as food and beverage (Mamin), pharmaceutical, and retail.

- On the other side, the industry is now investing in massive infrastructure projects to accelerate the country's growth. For example, Indonesia is planning to invest over USD 40 billion to expand Jakarta's metro network, which is expected to strengthen the country's construction industry. Indonesia is also planning ambitious construction projects worth more than USD 400 billion in the future years, including the construction of 25 airports and new power plants. All of these variables influence the demand for adhesives.

Indonesia Adhesives Market Trends

The government initiatives to promote paper and paperboard packaging will escalate the industry size

- The packaging is mainly used for protection, containment, information, utility of use, and promotion. This makes packaging an integral part of most industries. The growing Indonesian market is expected to boost packaging usage and register a CAGR of 4.33% during the forecast period. In 2017, packaging usage accounted for 143.46 million tons of packaging, including paper and paperboard and plastic. Due to COVID-19, in 2020, the market registered a negative growth of -5.77%, and this was due to disruption in the supply chain, shortage of packaging material, restrictions on the import and export of goods, and factories operating at low capacity.

- In 2021, the market registered a positive growth of 4.28%, with 153.41 million tons of packaging material used for various purposes. It is expected that the packaging industry will keep growing as there has been a rise in the e-commerce sector which has given a significant boost to the packaging industry in the past few years as special packaging is required for shipping goods.

- The government of Indonesia has taken steps toward the use of plastic, as Indonesia is the second-largest contributor of plastic waste in the ocean after China. The extended producer responsibility (EPR) regulation imposed by the Indonesian government will oblige producers and retailers to redesign their product packaging to have a higher proportion of recyclable material. This will encourage manufacturers to use paper and paperboard as the base material for the packaging, which will increase the volume of adhesives used in the packaging process.

- In today's competitive market of consumer products, it has become inevitable for companies to use attractive packaging to stand out from their competitors and maintain their brand value in the market.

Considerable growth of export values for automotive parts & components will proliferate the industry growth

- The automotive industry in Indonesia remains a promising sector that contributes significantly to the country's economic progress. According to Agus Gumiwang Kartasasmita, Minister of Sector Republic of Indonesia, the automobile industry in Indonesia witnessed tremendous growth in 2021, with a double-digit growth rate of 17.82%. In 2019, the country produced about 12,86,848 units of vehicles which drastically reduced to 6,90,176 units in 2020, accounting for a decline of about 46% owing to the COVID-19 pandemic. Due to this reason, the variation in automotive production between 2019 and 2021 resulted in about -13%, whereas between 2020 and 2021, the variation was about 63%.

- The trade in the automotive sector in Indonesia showed a surplus in all years from 2019 to 2021. Both exports and imports fell in 2020 as a result of the global pandemic, which generated limitations and disruptions in economic activities, so impeding the global supply chain and hurting total production. However, in line with the robust output in 2021, both export and import values increased significantly, with a trade balance of USD 1.93 billion. Although 2021 had the highest level of commercial activity in the prior ten years, the trade balance surplus was the lowest in comparison to 2019 and 2020, which had balance values of USD 2 billion and USD 1.95 billion, respectively.

- Globally, the development of EVs signaled a fundamental shift in the Indonesian transportation sector's policies. Given the country's nickel reserves, Indonesia is well-placed to become a major player in the global EV supply chain. To be a part of the region's EV future, Indonesia needs to invest in technology, talent resources, renewable energy, and infrastructure.

Indonesia Adhesives Industry Overview

The Indonesia Adhesives Market is fragmented, with the top five companies occupying 15.91%. The major players in this market are 3M, DEXTONE INDONESIA, H.B. Fuller Company, Henkel AG & Co. KGaA and Sika AG (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 End User Trends

- 4.1.1 Aerospace

- 4.1.2 Automotive

- 4.1.3 Building and Construction

- 4.1.4 Footwear and Leather

- 4.1.5 Packaging

- 4.1.6 Woodworking and Joinery

- 4.2 Regulatory Framework

- 4.2.1 Indonesia

- 4.3 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2028 and analysis of growth prospects)

- 5.1 End User Industry

- 5.1.1 Aerospace

- 5.1.2 Automotive

- 5.1.3 Building and Construction

- 5.1.4 Footwear and Leather

- 5.1.5 Healthcare

- 5.1.6 Packaging

- 5.1.7 Woodworking and Joinery

- 5.1.8 Other End-user Industries

- 5.2 Technology

- 5.2.1 Hot Melt

- 5.2.2 Reactive

- 5.2.3 Solvent-borne

- 5.2.4 UV Cured Adhesives

- 5.2.5 Water-borne

- 5.3 Resin

- 5.3.1 Acrylic

- 5.3.2 Cyanoacrylate

- 5.3.3 Epoxy

- 5.3.4 Polyurethane

- 5.3.5 Silicone

- 5.3.6 VAE/EVA

- 5.3.7 Other Resins

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and Analysis of Recent Developments).

- 6.4.1 3M

- 6.4.2 ALTECO co., ltd.

- 6.4.3 DEXTONE INDONESIA

- 6.4.4 H.B. Fuller Company

- 6.4.5 Henkel AG & Co. KGaA

- 6.4.6 Huntsman International LLC

- 6.4.7 MAPEI S.p.A.

- 6.4.8 Pidilite Industries Ltd.

- 6.4.9 PT. Pamolite Adhesive Industry

- 6.4.10 Sika AG

7 KEY STRATEGIC QUESTIONS FOR ADHESIVES AND SEALANTS CEOS

8 APPENDIX

- 8.1 Global Adhesives and Sealants Industry Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework (Industry Attractiveness Analysis)

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Drivers, Restraints, and Opportunities

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

02-2729-4219

+886-2-2729-4219