|

市場調查報告書

商品編碼

1684052

北美MLCC:市場佔有率分析、產業趨勢與成長預測(2025-2030年)North America MLCC - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

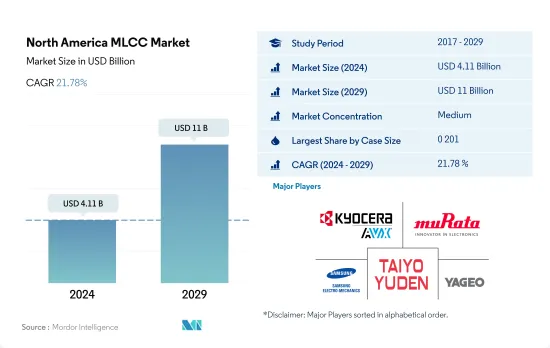

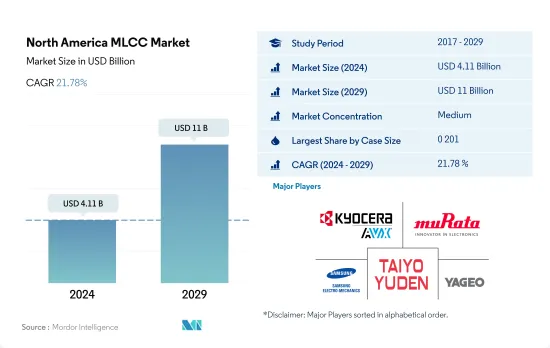

北美 MLCC 市場規模預計在 2024 年為 41.1 億美元,預計到 2029 年將達到 110 億美元,預測期內(2024-2029 年)的複合年成長率為 21.78%。

消費者對新技術的認知不斷提高是 0 201 MLCC 成長的主要刺激因素之一。

- 就銷量而言,0 201 型機殼佔據了最大的市場佔有率,為 32.73%,2022 年的收益為 6.449 億美元。 0 603 型機殼是成長最快的細分市場,複合年成長率為 29.10%(2022-2029 年)。

- 持續的小型化趨勢加上對更高組件密度的需求正在推動對這些組件的需求。可攜式和連網裝置的日益普及也推動了對 0.201 MLCC 元件的需求。北美是多家筆記型電腦製造商和跨國公司的所在地,在市場上佔有重要地位。對視訊會議、虛擬協作工具和線上教育日益成長的需求正在刺激筆記型電腦的銷售。

- 0 1005 MLCC 具有廣泛的應用,尤其是在智慧型手機、穿戴式裝置和物聯網設備等小型電子設備中,使製造商能夠在不影響效能的情況下創造出時尚、緊湊的設計。隨著消費者在裝置上的支出增加(包括升級現有行動電話),加拿大的智慧型手機用戶數量逐年增加。

- 外殼尺寸 0 402 是表面黏著技術陶瓷電容器廣泛採用的外形規格。在汽車產業,0402MLCC 用於各種應用,包括引擎控制單元、資訊娛樂系統和 ADAS。這些電容器在惡劣的汽車環境中提供可靠的性能。在北美,由於人們越來越關注車輛安全、對車輛舒適性的需求不斷成長,以及車主越來越希望在發生事故時減少人為錯誤,自動駕駛汽車的需求正在成長。

預計政府獎勵措施和補貼將提振美國電動車需求

- 2022年,美國將佔據最大的市場佔有率,達到56.69%,緊隨其後的是其他國家,市場佔有率為43.31%。

- 美國是MLCC最重要的市場之一。該國是先進汽車,尤其是電動車和自動駕駛技術的先驅之一。 MLCC 終端使用者應用領域的主要企業大多位於美國,這使得美國成為 MLCC 製造商的主要目標。隨著大多數公司不斷改進其產品供應,MLCC 的部署數量也不斷增加。因此,預計美國將成為預測期內MLCC的主要市場之一。

- 加拿大應對環境問題的願景是發展電動車和能源儲存系統市場的主要驅動力,為所研究市場中的供應商創造了更多機會。加拿大已加入新的國際聯盟,致力於轉向電動車。由於數位技術的廣泛採用,該國還為高階電子設備提供了巨大的市場。據加拿大娛樂軟體協會(ESAC)稱,加拿大的遊戲產業正在蓬勃發展,高階設備越來越普及。這些關鍵因素推動了對 MLCC 的需求:

北美MLCC市場趨勢

電子商務產業發展可望推動輕型商用車

- 疫情導致封鎖和其他限制措施,為輕型商用車產業帶來了前所未有的供應鏈問題。疫情導致世界各地實施了前所未有的程度和類型的行動和旅行限制。基礎設施、運輸和物流等運輸貨物的最終用戶產業完全陷入停滯,為製造業和貨運業帶來了新的挑戰。輕型商用車(LCV)市場受到北美電子商務和物流行業成長的推動。隨著能夠使用網路和智慧型手機的人數不斷增加,線上零售商的數量也在不斷成長。預計這將導致輕型商用車的需求增加,從而有利於及時向客戶交付貨物。

- 在加拿大,乘用車和輕型卡車溫室氣體排放法規為新型輕型車輛設定了溫室氣體排放上限。預計物流和電子商務行業的擴張將增加對輕型商用車的需求。在都市化進程的推動下,輕型商用車(LCV)市場正在隨著需要高效物流的新零售和電子商務平台的發展而不斷擴大。純電動車的日益普及、新型電動車的推出以及充電基礎設施的發展是推動市場成長的主要因素。

駕駛員輔助系統意識的提升創造了需求

- 北美乘用車市場經歷了巨大的成長,2019年產量達到297萬輛。美國是全球第三大電動車生產國。由於政府推出措施鼓勵電動車的發展,電動車的普及速度仍在持續。

- 由於全球供應鏈崩壞,COVID-19 疫情擾亂了汽車生產,阻礙了市場成長。然而,隨著人們對電動車對環境的正面影響的認知不斷提高,以及世界各國政府採取的各種舉措,預計預測期內市場將出現顯著成長。

- 一些OEM已經開始有意提高其生產能力,以滿足日益成長的電動車需求。政府禁止內燃機汽車的政策也促進了電動車的銷售。由於各種原因,全球汽油和柴油價格上漲,使得電動車製造商更容易增加銷售量。全球第三大市場美國的電動車銷售量預計將在2022年成長55%,銷售佔有率達8%。

- 2019 年 5 月,聯邦政府啟動了零排放汽車(iZEV)獎勵計畫。這項獎勵舉措旨在幫助加拿大人和加拿大企業購買或租賃零排放汽車。 2022年,加拿大聯邦政府宣布將強制銷售零排放汽車。目標是到 2026 年,加拿大銷售的新車中至少有 20% 為零排放汽車。到 2030 年,這一比例將增至 60%,到 2035 年將躍升至 100%。

北美MLCC產業概況

北美MLCC市場格局適度整合,前五大廠商市佔率合計為41.61%。市場的主要企業有:京瓷AVX元件株式會社(京瓷株式會社)、村田製作所、三星電機、太陽誘電和國巨株式會社(按字母順序排列)。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章執行摘要和主要發現

第2章 報告要約

第3章 引言

- 研究假設和市場定義

- 研究範圍

- 調查方法

第4章 產業主要趨勢

- 價格趨勢

- 白銀價格趨勢

- 鋅價走勢

- 家電銷量

- 空調銷售

- 桌上型電腦銷量

- 遊戲機銷售

- 筆記型電腦銷售

- 冰箱銷售

- 智慧型手機銷量

- 倉儲設備銷售

- 平板電腦銷量

- 電視銷售

- 汽車製造

- 重型卡車生產

- 輕型商用車生產

- 乘用車生產

- 馬達生產

- 工業自動化銷售

- 工業機器人銷售

- 服務機器人銷售

- 法律規範

- 價值鍊和通路分析

第5章市場區隔

- 介電類型

- 1級

- 2級

- 錶殼尺寸

- 0 201

- 0 402

- 0 603

- 1 005

- 1 210

- 其他

- 電壓

- 500V~1000V

- 小於500V

- 1000V以上

- 電容

- 100uF~1,000uF

- 小於100uF

- 超過 1,000uF

- Mlcc安裝類型

- 金屬蓋

- 徑向引線

- 表面黏著技術

- 最終用戶

- 航太和國防

- 車

- 家用電子電器

- 工業設備

- 醫療設備

- 電力和公共產業

- 通訊設備

- 其他

- 國家

- 美國

- 其他

第6章競爭格局

- 關鍵策略趨勢

- 市場佔有率分析

- 商業狀況

- 公司簡介

- Kyocera AVX Components Corporation(Kyocera Corporation)

- Maruwa Co ltd

- Murata Manufacturing Co., Ltd

- Nippon Chemi-Con Corporation

- Samsung Electro-Mechanics

- Samwha Capacitor Group

- Taiyo Yuden Co., Ltd

- TDK Corporation

- Vishay Intertechnology Inc.

- Walsin Technology Corporation

- Wurth Elektronik GmbH & Co. KG

- Yageo Corporation

第 7 章 CEO 的關鍵策略問題CEO 的關鍵策略問題

第 8 章 附錄

- 世界概況

- 概述

- 五力分析框架

- 全球價值鏈分析

- 市場動態(DRO)

- 資訊來源及延伸閱讀

- 圖片列表

- 關鍵見解

- 資料包

- 詞彙表

簡介目錄

Product Code: 50001998

The North America MLCC Market size is estimated at 4.11 billion USD in 2024, and is expected to reach 11 billion USD by 2029, growing at a CAGR of 21.78% during the forecast period (2024-2029).

Increasing awareness among consumers about the emergence of novel technologies is among the primary growth stimulants of 0 201 MLCCs

- Case size 0 201 holds the largest market share of 32.73% in terms of volume and generated a revenue of USD 644.90 million in 2022. The case size 0 603 is the fastest-growing segment, with a CAGR of 29.10% (2022-2029).

- The ongoing trend of miniaturization, coupled with the need for higher component density, drives the demand for these components. The increasing popularity of portable and connected devices further contributes to the demand for 0 201 MLCC components, as they enable manufacturers to achieve compact designs without compromising on performance. North America is home to several laptop manufacturers and multinational companies that have a significant presence in the market. The increased need for video conferencing, virtual collaboration tools, and online education has accelerated laptop sales.

- The usage of 0 1005 MLCCs spans diverse applications, particularly in compact electronic devices such as smartphones, wearables, and IoT devices, enabling manufacturers to achieve sleek and compact designs without compromising performance. The number of smartphone users in Canada is increasing every year as consumers spend more money on devices, including upgrades to their existing phones.

- The 0 402 case size is widely adopted as a form factor for surface-mount ceramic capacitors. The automotive industry relies on 0 402 MLCCs for various applications, including engine control units, infotainment systems, and ADAS. These capacitors provide reliable performance in harsh automotive environments. The demand for autonomous vehicles is rising in North America due to the increased focus on automotive safety, the rise in demand for comfort features in a vehicle, and a growing desire of vehicle owners to reduce the amount of human error in case of accidents.

Favorable government incentives and subsidies are expected to increase the demand for EVs in the United States

- The United States captured the largest market share of 56.69%, followed closely by others with 43.31% in terms of volume in 2022.

- The United States is one of the most significant markets for MLCC. The country is one of the pioneers of advanced automotive, especially electric vehicles and autonomous technology. Most major companies in end-user applications of MLCCs are based in the United States, making the country a major target for MLCC manufacturers. As most of these companies are advancing their product offerings, the deployment of the number of MLCCs is increasing. This is likely to make the United States one of the significant markets for MLCC over the forecast period.

- Canada's vision to combat environmental concerns is a major factor in the development of the electric vehicles and energy storage systems market, which is further creating an opportunity for the vendors in the market studied. Canada signed a new international alliance to switch to electric cars. The country also offers a massive market for high-end electronic devices, mainly due to the high adoption rate of digital technologies. According to the Entertainment Software Association of Canada (ESAC), the gaming industry in Canada is booming, increasing the penetration of high-end devices in the country. These key factors are fueling the demand for MLCCs.

North America MLCC Market Trends

The development of the e-commerce industry is expected to propel light commercial vehicles

- The pandemic resulted in lockdowns and other restrictions that caused supply chain issues in the light commercial vehicle industry that had never been seen before. The pandemic caused unprecedented levels and types of mobility and travel limitations worldwide. The end-user industries that transport goods, such as infrastructure, transportation, and logistics, have completely shut down, posing new challenges for the manufacturing and freight industries. The light commercial vehicle (LCV) market is driven by the growth of North America's e-commerce sector and logistics. As the number of people with internet access and access to smartphones increases, so does the number of online retail outlets. As a result, the demand for light commercial vehicles is expected to increase, facilitating the timely delivery of products to customers.

- Canada established GHG emission caps for new light-duty vehicles by Passenger Automobile and Light Truck Greenhouse Gas Emission Regulations. The expansion of the logistics and e-commerce sectors is expected to increase the demand for LCVs. Due to rising urbanization, the market for light commercial vehicles (LCVs) is expanding with the development of new retail and e-commerce platforms that require effective logistics. The rising popularity of BEVs, the introduction of new EV models, and the development of charging infrastructure are the primary factors driving the market's growth.

The growing awareness of driver assistance systems is creating demand

- The passenger car market in North America experienced tremendous growth, with a production of 2.97 million units in 2019. The United States is the third-largest producer of electric vehicles in the world. The shift to EVs has continued at its current rate, owing to government initiatives to promote EV growth.

- The COVID-19 pandemic hindered the growth of the market, as there was a disruption in the production of vehicles due to the collapse of supply chains across the world. However, the market is expected to witness significant growth during the forecast period due to increasing awareness about the positive environmental impacts of electric vehicles and various initiatives by governments of different countries.

- Several OEMs became interested in increasing their production capacity to meet the growing demand for electric vehicles. The government policy banning ICE engines helped boost the sales of electric vehicles. The increase in the price of gasoline and diesel due to various global reasons has made it easy for EV companies to boost their sales. Electric car sales in the United States, the third largest market, increased by 55% in 2022, reaching a sales share of 8%.

- In May 2019, the federal government launched the Incentives for Zero-Emission Vehicles (iZEV) Program. The incentive-based initiative aims to help Canadians and Canadian businesses purchase or lease zero-emission vehicles. In 2022, the Canadian federal government announced a sales mandate for zero-emission vehicles. With the aim that at least 20% of new passenger vehicles sold in Canada must be zero-emission vehicles by 2026. That will increase to 60% by 2030 and jump to 100% by 2035.

North America MLCC Industry Overview

The North America MLCC Market is moderately consolidated, with the top five companies occupying 41.61%. The major players in this market are Kyocera AVX Components Corporation (Kyocera Corporation), Murata Manufacturing Co., Ltd, Samsung Electro-Mechanics, Taiyo Yuden Co., Ltd and Yageo Corporation (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Price Trend

- 4.1.1 Silver Price Trend

- 4.1.2 Zinc Price Trend

- 4.2 Consumer Electronics Sales

- 4.2.1 Air Conditioner Sales

- 4.2.2 Desktop PC's Sales

- 4.2.3 Gaming Console Sales

- 4.2.4 Laptops Sales

- 4.2.5 Refrigerator Sales

- 4.2.6 Smartphones Sales

- 4.2.7 Storage Unit Sales

- 4.2.8 Tablets Sales

- 4.2.9 Television Sales

- 4.3 Automotive Production

- 4.3.1 Heavy Trucks Production

- 4.3.2 Light Commercial Vehicles Production

- 4.3.3 Passenger Vehicles Production

- 4.3.4 Total Motor Production

- 4.4 Industrial Automation Sales

- 4.4.1 Industrial Robots Sales

- 4.4.2 Service Robots Sales

- 4.5 Regulatory Framework

- 4.6 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2029 and analysis of growth prospects)

- 5.1 Dielectric Type

- 5.1.1 Class 1

- 5.1.2 Class 2

- 5.2 Case Size

- 5.2.1 0 201

- 5.2.2 0 402

- 5.2.3 0 603

- 5.2.4 1 005

- 5.2.5 1 210

- 5.2.6 Others

- 5.3 Voltage

- 5.3.1 500V to 1000V

- 5.3.2 Less than 500V

- 5.3.3 More than 1000V

- 5.4 Capacitance

- 5.4.1 100µF to 1000µF

- 5.4.2 Less than 100µF

- 5.4.3 More than 1000µF

- 5.5 Mlcc Mounting Type

- 5.5.1 Metal Cap

- 5.5.2 Radial Lead

- 5.5.3 Surface Mount

- 5.6 End User

- 5.6.1 Aerospace and Defence

- 5.6.2 Automotive

- 5.6.3 Consumer Electronics

- 5.6.4 Industrial

- 5.6.5 Medical Devices

- 5.6.6 Power and Utilities

- 5.6.7 Telecommunication

- 5.6.8 Others

- 5.7 Country

- 5.7.1 United States

- 5.7.2 Others

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 Kyocera AVX Components Corporation (Kyocera Corporation)

- 6.4.2 Maruwa Co ltd

- 6.4.3 Murata Manufacturing Co., Ltd

- 6.4.4 Nippon Chemi-Con Corporation

- 6.4.5 Samsung Electro-Mechanics

- 6.4.6 Samwha Capacitor Group

- 6.4.7 Taiyo Yuden Co., Ltd

- 6.4.8 TDK Corporation

- 6.4.9 Vishay Intertechnology Inc.

- 6.4.10 Walsin Technology Corporation

- 6.4.11 Wurth Elektronik GmbH & Co. KG

- 6.4.12 Yageo Corporation

7 KEY STRATEGIC QUESTIONS FOR MLCC CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

02-2729-4219

+886-2-2729-4219