|

市場調查報告書

商品編碼

1684034

亞太地區MLCC:市場佔有率分析、產業趨勢與成長預測(2025-2030年)Asia-Pacific MLCC - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

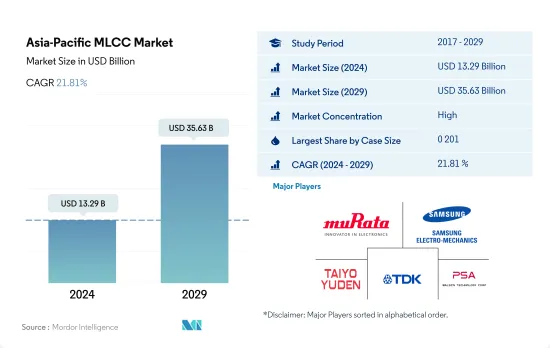

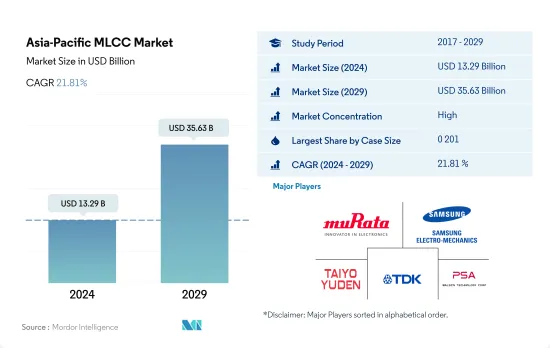

亞太地區 MLCC 市場規模預計在 2024 年為 132.9 億美元,預計到 2029 年將達到 356.3 億美元,預測期內(2024-2029 年)的複合年成長率為 21.81%。

0201 MLCC 的需求受到該地區家用電子電器和醫療設備需求不斷成長的推動。

- 0201 已成為領跑者,在 2022 年佔據了 46.85% 的最大市場佔有率,緊隨其後的是 1005,佔 16.20%,0402 佔 12.01%。

- 歸類為 1 類的電介質分為 C0G、X8G 和 U2J。具有低至中等電容的 C0G MLCC 越來越受歡迎,尤其是在家用電子電器產業,例如智慧型手機和智慧型手錶,因為人們越來越傾向於小型化以實現更時尚的設計。

- 2 類電介質 MLCC 分為 X7R、X5R 和 Y5V。這些電介質能夠承受高壓條件,這使其成為汽車應用的理想選擇,因為自動駕駛輔助系統 (ADAS)、資訊娛樂系統和改進的電池儲存能力等功能得到了進步。

獎勵和折扣正在推動電動車需求的成長,而擴增實境(AR)和虛擬實境(VR)等消費性電子產品的發展也推動了對 MLCC 的需求。

- 2022年,中國將成為領跑者,佔最大的市場佔有率24.79%,緊隨其後的是韓國(20.31%)和日本(12.27% )。

- 中國的消費性電子製造業是全球最突出的產業之一。隨著5G網路的引進、智慧家庭、擴增實境(AR)和虛擬實境(VR)技術的普及,以及家電產品功能的不斷完善和升級,預計未來中國家電市場將迎來快速成長。因此,預計對電容小於 100uF 且外殼尺寸為 0201 的表面黏著技術積層陶瓷電容(MLCC) 的需求將相應增加。獎勵和折扣推動了電動車需求的成長,而擴增實境和虛擬實境等家用電子電器的發展則推動了 MLCC 的需求。

- 汽車產業正經歷技術快速發展時期,這導致對 MLCC 的需求增加。通常,不具備自動駕駛功能的內燃機汽車需要大約 3,000 個 MLCC,而電動車則需要 8,000 到 10,000 個 MLCC。汽車產業是印度經濟成長的主要貢獻者,可以被視為當前情勢的標竿。此外,印度政府法規、獎勵、折扣以及有關電動車的意識正在鼓勵消費者購買電動車,從而推動對 MLCC 的需求。

亞太MLCC市場趨勢

電子商務產業的發展有望推動市場

- 輕型商用車產量預計將從2019年的525萬輛增加到2022年的523萬輛。

- 線上商務和物流行業將支撐輕型商用車市場。行動電話和網路的普及帶動了網路零售和電子商務的成長。預計商用車銷售量將會增加,以便及時向客戶交付貨物。

- 受新冠疫情線上銷售的影響,全球電商市場的用戶群和收入大幅擴張。 2020 年個人網路購物的最大增幅是由於疫情迫使個人網路購物。不過,由於地方政府對電子商務和旅遊實施的嚴格限制,2020年亞太地區輕型商用車產量與前一年同期比較減11.17%。

- 隨著世界各國政府帶頭推動輕型商用車電氣化,輕型商用車產量正穩步復甦。該地區的主要企業正在合作開發和製造電動卡車。

預計電動車的普及將推動需求成長。

- 預計乘用車產量將從 2019 年的 4,065 萬輛成長至 2022 年的 4,232 萬輛,在此期間的複合年成長率為 1.35%。

- 2020年乘用車產量與前一年同期比較下降11.88%。疫情和俄烏戰爭對全球供應鏈造成重大衝擊,導致乘用車生產放緩,並迫使製造商暫時關閉生產線。由於人們推遲購買汽車等大件物品,通貨膨脹等經濟挑戰影響了需求。不過,市場正在緩慢但穩定地復甦,2022年的產量與前一年同期比較增10.83%。

- 由於政府有關二氧化碳排放政策的變化,對燃料乘用車的需求逐漸減少。該地區各國政府致力於2030年減少溫室氣體排放,並在2050年實現淨零排放。為了滿足這一需求,上市公司和政府正在推動混合動力汽車和電動車的引進,既透過公共設施直接推廣,也透過補貼家庭和職場的私人充電站間接推廣。與西方國家相比,亞太國家的電動車銷售成長更快。過去十年,該地區的純電動車銷量大幅成長。

- 上述因素和發展導致乘用車生產中擴大採用預測技術,預計這一積極趨勢將在預測期內推動這些車輛中使用的 MLCC 的成長。

亞太MLCC產業概況

亞太地區MLCC市場格局較為統一,前五大廠商的市佔率達72.07%。市場的主要企業有:村田製作所、三星電機、太陽誘電、TDK株式會社和華新科技株式會社(按字母順序排列)。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章執行摘要和主要發現

第2章 報告要約

第3章 引言

- 研究假設和市場定義

- 研究範圍

- 調查方法

第4章 產業主要趨勢

- 家電銷售

- 空調銷售

- 桌上型電腦銷量

- 遊戲機銷售

- 筆記型電腦銷量

- 冰箱銷售

- 智慧型手機銷量

- 倉儲設備銷售

- 平板電腦銷量

- 電視銷售

- 汽車製造

- 客車生產

- 重型卡車生產

- 輕型商用車生產

- 乘用車生產

- 汽車製造

- 工業自動化銷售

- 工業機器人銷售

- 服務機器人銷售

- 法律規範

- 價值鍊和通路分析

第5章市場區隔

- 介電類型

- 1級

- 2級

- 錶殼尺寸

- 0 201

- 0 402

- 0 603

- 1 005

- 1 210

- 其他

- 電壓

- 500V~1000V

- 小於500V

- 1000V以上

- 電容

- 100uF~1,000uF

- 小於100uF

- 超過1000uF

- Mlcc安裝類型

- 金屬蓋

- 徑向引線

- 表面黏著技術

- 最終用戶

- 航太和國防

- 車

- 家用電子電器

- 工業設備

- 醫療設備

- 電力和公共產業

- 通訊設備

- 其他

- 國家

- 中國

- 印度

- 日本

- 韓國

- 其他

第6章 競爭格局

- 關鍵策略趨勢

- 市場佔有率分析

- 業務狀況

- 公司簡介

- Kyocera AVX Components Corporation(Kyocera Corporation)

- Maruwa Co ltd

- Murata Manufacturing Co., Ltd

- Nippon Chemi-Con Corporation

- Samsung Electro-Mechanics

- Samwha Capacitor Group

- Taiyo Yuden Co., Ltd

- TDK Corporation

- Vishay Intertechnology Inc.

- Walsin Technology Corporation

- Wurth Elektronik GmbH & Co. KG

- Yageo Corporation

第 7 章 CEO 的關鍵策略問題CEO 的關鍵策略問題

第 8 章 附錄

- 世界概況

- 概述

- 五力分析框架

- 全球價值鏈分析

- 市場動態(DRO)

- 資訊來源及延伸閱讀

- 圖片列表

- 關鍵見解

- 資料包

- 詞彙表

簡介目錄

Product Code: 50001976

The Asia-Pacific MLCC Market size is estimated at 13.29 billion USD in 2024, and is expected to reach 35.63 billion USD by 2029, growing at a CAGR of 21.81% during the forecast period (2024-2029).

The demand for 0 201 MLCCs is driven by the growing demand for consumer electronics and medical equipment in the region

- 0 201 emerged as the frontrunner, capturing the largest market share of 46.85%, followed closely by 1 005 with 16.20% and 0 402 with 12.01% in terms of volume in 2022.

- Dielectrics classified as Class 1 can be divided into C0G, X8G, and U2J. The C0G MLCCs with low-mid range capacitance are becoming increasingly popular in the consumer electronic electronics industry, particularly in smartphones, smartwatches, and other devices, due to the increasing trend toward miniaturization in order to achieve sleeker designs.

- Class 2 dielectric MLCCs are classified into X7R, X5R, and Y5V. These dielectrics are an ideal choice for automotive applications due to their ability to withstand high-voltage conditions and the advancement of features such as Automatic Driver Assistance Systems (ADAS), infotainment systems, and improved battery storage capabilities.

Incentives and discounts are driving the increasing demand for electric vehicles, along with the development of consumer electronics such as augmented reality and virtual reality, which is propelling MLCC demand

- In 2022, China emerged as the frontrunner, capturing the largest market share of 24.79%, followed closely by South Korea with 20.31% and Japan with 12.27% in terms of value.

- The Chinese consumer electronics manufacturing industry is one of the most prominent globally. It is anticipated that the Chinese consumer electronics market will experience rapid growth in the future, driven by the introduction of 5G networks, the proliferation of smart homes, augmented and virtual reality technologies, and the continuous evolution of consumer electronic devices with improved features. As a result, the need for installed multi-layer ceramic capacitors MLCCs of surface mount type with 0201 case sizes with low capacitance of less than 100uF is expected to increase accordingly. Incentives and discounts drive the increasing demand for electric vehicles, and the development of consumer electronics such as augmented reality and virtual reality is propelling the MLCC demand.

- The automotive industry is undergoing a period of rapid technological development, which is leading to an increase in the demand for MLCCs. Generally, an engine-driven vehicle without an automated driving feature requires approximately 3,000 MLCCs, while an electric vehicle requires between 8,000 and 10,000 MLCCs. The automotive sector is a major contributor to India's economic growth and can be seen as a benchmark for the current situation. Additionally, Indian government regulations, incentives, discounts, and awareness about e-mobility are driving consumers toward the purchase of electric vehicles, driving the demand for MLCCs.

Asia-Pacific MLCC Market Trends

Development of the E-commerce industry is expected to propel the market

- The light commercial vehicle production was expected to grow from 5.25 million units in 2019 to 5.23 million units in 2022.

- The online commerce and logistics sectors support the market for light commercial vehicles. Owing to increased access to mobile phones and the Internet, there has been an increase in online retail sales and e-commerce. Commercial vehicle sales are expected to increase to improve the timely delivery of goods to clients.

- As a result of COVID-19 online sales, the user base and income of the global e-commerce market greatly expanded. The highest increase in online shopping by individuals in 2020 was caused by the pandemic, which forced individuals to shop online. However, the Asia-Pacific light commercial vehicles witnessed a YoY drop of 11.17% in production in 2020 because of stringent restrictions on e-commerce and travel imposed by the local authorities.

- The production of light commercial vehicles is recovering steadily as governments are taking the initiative to electrify these vehicles. Major regional players are collaborating to develop and manufacture electric trucks.

The rising adoption of electric vehicles is expected to enhance the demand

- The passenger vehicle production was expected to grow from 40.65 million units in 2019 to 42.32 million units in 2022, registering a CAGR of 1.35% during the period.

- The passenger car sector witnessed a drop of 11.88% YoY production in 2020. The pandemic and the Russia-Ukraine war heavily impacted supply chains across the globe, slowing down the production of passenger cars and forcing manufacturers to close production lines temporarily. Economic challenges such as inflation affected demand, as people are postponing large purchases such as cars. However, the market witnessed a slow but steady recovery, with a YoY production growth of 10.83% in 2022.

- The demand for fuel-based passenger vehicles is slowly reducing due to changing government policies concerning CO2 emissions. Governments across the regions are focusing on reducing greenhouse gas emissions by 2030 and achieving net-zero emissions by 2050. To meet this demand, companies and governments are focusing on introducing hybrid or electric cars and installing charging infrastructures directly at public outlets or indirectly through subsidies for private car charging stations in homes and workplaces. Asia-Pacific countries are exhibiting higher growth in the sales of electric vehicles compared to their Western competitors. In the last decade, there has been a significant increase in BEV sales in this region.

- Owing to the aforementioned factors and developments, the adoption of predictive technologies is increasing in the production of passenger vehicles, and such positive trends are expected to enhance the growth of the MLCCs used in these vehicles during the forecast period.

Asia-Pacific MLCC Industry Overview

The Asia-Pacific MLCC Market is fairly consolidated, with the top five companies occupying 72.07%. The major players in this market are Murata Manufacturing Co., Ltd, Samsung Electro-Mechanics, Taiyo Yuden Co., Ltd, TDK Corporation and Walsin Technology Corporation (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Consumer Electronics Sales

- 4.1.1 Air Conditioner Sales

- 4.1.2 Desktop PC's Sales

- 4.1.3 Gaming Console Sales

- 4.1.4 Laptops Sales

- 4.1.5 Refrigerator Sales

- 4.1.6 Smartphones Sales

- 4.1.7 Storage Unit Sales

- 4.1.8 Tablets Sales

- 4.1.9 Television Sales

- 4.2 Automotive Production

- 4.2.1 Buses and Coaches Production

- 4.2.2 Heavy Trucks Production

- 4.2.3 Light Commercial Vehicles Production

- 4.2.4 Passenger Vehicles Production

- 4.2.5 Total Motor Production

- 4.3 Industrial Automation Sales

- 4.3.1 Industrial Robots Sales

- 4.3.2 Service Robots Sales

- 4.4 Regulatory Framework

- 4.5 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2029 and analysis of growth prospects)

- 5.1 Dielectric Type

- 5.1.1 Class 1

- 5.1.2 Class 2

- 5.2 Case Size

- 5.2.1 0 201

- 5.2.2 0 402

- 5.2.3 0 603

- 5.2.4 1 005

- 5.2.5 1 210

- 5.2.6 Others

- 5.3 Voltage

- 5.3.1 500V to 1000V

- 5.3.2 Less than 500V

- 5.3.3 More than 1000V

- 5.4 Capacitance

- 5.4.1 100µF to 1000µF

- 5.4.2 Less than 100µF

- 5.4.3 More than 1000µF

- 5.5 Mlcc Mounting Type

- 5.5.1 Metal Cap

- 5.5.2 Radial Lead

- 5.5.3 Surface Mount

- 5.6 End User

- 5.6.1 Aerospace and Defence

- 5.6.2 Automotive

- 5.6.3 Consumer Electronics

- 5.6.4 Industrial

- 5.6.5 Medical Devices

- 5.6.6 Power and Utilities

- 5.6.7 Telecommunication

- 5.6.8 Others

- 5.7 Country

- 5.7.1 China

- 5.7.2 India

- 5.7.3 Japan

- 5.7.4 South Korea

- 5.7.5 Others

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 Kyocera AVX Components Corporation (Kyocera Corporation)

- 6.4.2 Maruwa Co ltd

- 6.4.3 Murata Manufacturing Co., Ltd

- 6.4.4 Nippon Chemi-Con Corporation

- 6.4.5 Samsung Electro-Mechanics

- 6.4.6 Samwha Capacitor Group

- 6.4.7 Taiyo Yuden Co., Ltd

- 6.4.8 TDK Corporation

- 6.4.9 Vishay Intertechnology Inc.

- 6.4.10 Walsin Technology Corporation

- 6.4.11 Wurth Elektronik GmbH & Co. KG

- 6.4.12 Yageo Corporation

7 KEY STRATEGIC QUESTIONS FOR MLCC CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

02-2729-4219

+886-2-2729-4219