|

市場調查報告書

商品編碼

1684043

工業MLCC:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)Industrial MLCC - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

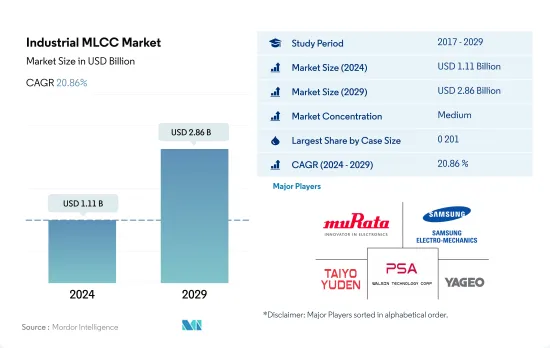

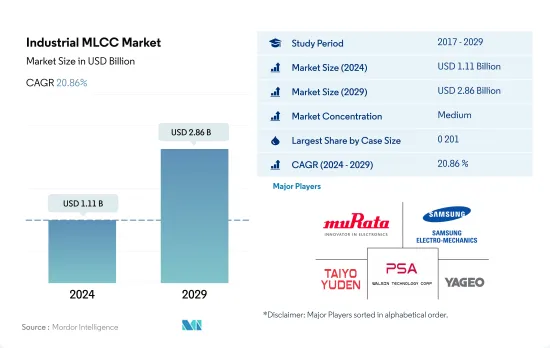

工業 MLCC 市場規模預計在 2024 年為 11.1 億美元,預計到 2029 年將達到 28.6 億美元,預測期內(2024-2029 年)的複合年成長率為 20.86%。

先進的電子元件和工業應用之間存在著動態的相互作用。

- 工業 MLCC 市場按外殼尺寸細分,呈現以先進電子元件和工業應用之間的相互作用為特徵的動態格局。其中,0 201、0 402、0 603、1 210 和 1 005 等特定外殼尺寸體現了 MLCC 在確保各種應用的最佳性能和可靠性方面發揮的重要作用。

- 外殼尺寸 0 201 在交流伺服馬達中很重要,對於機器人、半導體設備和飛機系統等精密驅動應用至關重要。這些 MLCC 提高了效率、可靠性和降噪效果,對於在不同工業環境中實現無縫運作至關重要。

- 0402 外殼尺寸類別在追求節能解決方案中發揮核心作用,並符合減少排放和實現永續工業實踐的全球措施。此類 MLCC 可促進高效配電和訊號完整性,支援採用節能技術。協作機器人和自動化正在推動 1210 MLCC 的需求,確保密閉空間內的穩定性。這些 MLCC 與OMRON的 TM20 和 Doosan Robotics 的 E-SERIES 協作機器人相容。

- 隨著工業自動化的發展,對 0603 MLCC 的需求也不斷成長。全球工業生產的成長正在加強市場並滿足對緊湊和可靠的 MLCC 的需求。 1005 MLCC與精密機械相容,符合自動化趨勢,特別體現在中國協作機器人安裝趨勢。隨著功率半導體和電子產品滿足電動車需求和能源效率計劃,0 805、1 812、2 220、1 218 和 1 813 等外殼尺寸的 MLCC 將推動 MLCC 和半導體市場的成長。

技術進步和經濟動態正在塑造市場格局並推動全球工業 MLCC 市場的發展

- 在快速的技術進步和不斷變化的經濟狀況的共同推動下,全球工業 MLCC 市場正處於關鍵的十字路口。在北美,自動化和對製造卓越的不懈追求正在推動 MLCC 的採用。強勁的工業機器人市場,尤其是美國和加拿大的市場,正在催化需求的穩定成長。本部分不僅強調了 MLCC 在工業機器人中的日益普及,還強調了 MLCC 在服務機器人中的作用不斷擴大,以適應該地區的醫療保健和老化挑戰。

- 以日本和中國主導的亞太地區正在崛起成為科技強國。自動化、機器人、人工智慧和物聯網解決方案的蓬勃發展正在推動該地區向前發展。本分析深入探討了 MLCC 如何實現日本複雜機器人的穩定性以及如何推動中國 5G工業IoT(IIoT) 設備的崛起。該地區的技術先驅將塑造 MLCC 需求的未來。

- 在歐洲,工業 4.0 的曙光正在徹底改變製造業和機器人技術。探索了工業機器人和 MLCC 之間的複雜相互作用,強調了 MLCC 在電源管理和穩健性能方面的關鍵作用。隨著歐洲機器人的快速普及,MLCC的需求日益受到關注,因為它可以提高業務效率,並有望成為變革性成長的舞台。

- 包括拉丁美洲、中東和非洲在內的世界其他地區則呈現多樣化的經濟轉變和技術期望。

全球工業MLCC市場趨勢

為了滿足自動化應用不斷變化的需求,不斷進步,對控制 PLC 的銷售需求也在增加。

- MLCC 是 PLC 的重要組成部分,與處理器、電源和輸入/輸出 (I/O) 單元一樣。 MLCC在PLC中的關鍵作用是確保微處理器和積體電路等敏感元件的穩定電源供應和濾除雜訊。

- 透過提供可靠的去耦或旁路功能,MLCC 可提高 PLC 效能、降低故障或資料損壞的可能性,並確保在工業環境中的無縫運作。因此,由於工業自動化需要強大且可靠的電源管理解決方案,PLC 市場對 MLCC 的需求持續成長。

- 工業可程式邏輯控制器 (PLC) 的需求受到持續進步的推動,以滿足自動化應用不斷變化的需求。 PLC 現在提供增強的程式功能,從而實現更大的靈活性、擴充性和易用性。 PLC 提供更大的記憶體容量、緊湊的尺寸,並允許整合高速(Gigabit)乙太網路連接和內建無線功能。此功能有助於高效監控和控制分散式伺服器/多用戶應用程式。具有高電容值的小型 MLCC 的出現使 PLC 製造商能夠設計緊湊但功能強大的系統,有助於滿足對節省空間、高性能 PLC 解決方案的需求。

智慧工廠的出現推動了對MLCC的需求

- 工業機器人產量將從2021年的41萬台增加到2022年的43萬台。工業機器人在製造業的工業自動化中發揮著至關重要的作用,工業中的許多核心業務都由機器人管理。在工業機器人中,MLCC主要用於濾波和去耦用途。 MLCC 有助於穩定和調節電源,確保機器人電子元件平穩可靠地運作。工業機器人對 MLCC 的要求取決於機器人的尺寸和複雜性、功率需求以及所需的精度和可靠性等級等因素。

- 工業機器人市場細分為關節機器人、線性機器人、圓柱形機器人、並聯機器人和SCARA機器人,用於汽車、化學和製造、建築、電氣和電子、食品和飲料、機械和金屬、製藥等各種終端用戶行業。汽車產業整體產量從 2021 年的 1.332 億輛成長到 2022 年的 1.3987 億輛。汽車需求的成長需要增加產量,這導致工業機器人在汽車製造過程中的使用增加以及人工智慧數位化的參與。

- 在新冠疫情期間,對機器人的需求增加,因為它們被用來幫助遏制感染疾病的傳播。機器人的引入使得醫療專業人員能夠以最高的精度進行手術。

工業MLCC產業概況

工業MLCC市場適度整合,前五大企業佔57.14%。該市場的主要企業有:村田製作所、三星電機、太陽誘電、華新科技和國巨集團(按字母順序排列)。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章執行摘要和主要發現

第2章 報告要約

第3章 引言

- 研究假設和市場定義

- 研究範圍

- 調查方法

第4章 產業主要趨勢

- 工業自動化全球銷售

- 控制PLC的全球銷售

- 全球工業機器人銷售

- 服務機器人全球銷售

- 伺服馬達全球銷售

- 太陽能逆變器和最佳化器的全球銷售

- 法律規範

- 價值鍊和通路分析

第5章市場區隔

- 錶殼尺寸

- 0 201

- 0 402

- 0 603

- 1 005

- 1 210

- 其他

- 電壓

- 600V~1100V

- 小於600V

- 1100V以上

- 電容

- 10μF至100μF

- 小於10μF

- 100μF 以上

- 介電類型

- 1級

- 2級

- 地區

- 亞太地區

- 歐洲

- 北美洲

- 世界其他地區

第6章競爭格局

- 關鍵策略趨勢

- 市場佔有率分析

- 商業狀況

- 公司簡介

- Kyocera AVX Components Corporation(Kyocera Corporation)

- Maruwa Co ltd

- Murata Manufacturing Co., Ltd

- Nippon Chemi-Con Corporation

- Samsung Electro-Mechanics

- Samwha Capacitor Group

- Taiyo Yuden Co., Ltd

- TDK Corporation

- Vishay Intertechnology Inc.

- Walsin Technology Corporation

- Wurth Elektronik GmbH & Co. KG

- Yageo Corporation

第 7 章 CEO 的關鍵策略問題CEO 的關鍵策略問題

第 8 章 附錄

- 世界概況

- 概述

- 五力分析框架

- 全球價值鏈分析

- 市場動態(DRO)

- 資訊來源及延伸閱讀

- 圖片列表

- 關鍵見解

- 資料包

- 詞彙表

簡介目錄

Product Code: 50001986

The Industrial MLCC Market size is estimated at 1.11 billion USD in 2024, and is expected to reach 2.86 billion USD by 2029, growing at a CAGR of 20.86% during the forecast period (2024-2029).

There is a dynamic interplay between advanced electronic components and industrial applications in the market

- The industrial MLCC market, categorized by case size, showcases a dynamic landscape characterized by the interplay between advanced electronic components and industrial applications. Within this context, the specific case sizes 0 201, 0 402, 0 603, 1 210, 1 005, and others exemplify the pivotal role of MLCCs in ensuring optimal performance and reliability across various sectors.

- The 0 201 case size is critical in AC servo motors and is essential for precision-driven applications like robotics, semiconductor equipment, and aircraft systems. These MLCCs enhance efficiency, reliability, and noise reduction, which is vital for seamless operation in diverse industrial settings.

- The 0 402 case size category takes center stage in the pursuit of energy-efficient solutions, aligning with global initiatives to reduce emissions and achieve sustainable industrial practices. MLCCs in this category facilitate efficient power distribution and signal integrity, supporting the adoption of energy-efficient technologies. Cobots and automation drive the demand for 1 210 MLCCs, ensuring stability in confined spaces. These MLCCs align with OMRON's TM20 and Doosan Robotics' E-SERIES cobots.

- The demand for 0 603 MLCCs is growing with industrial automation. Global industrial production growth strengthens the market, aligning with compact, reliable MLCC requirements. The 1 005 MLCCs cater to precision machinery and align with automation trends, mirroring cobot installations, especially in China. MLCCs in case sizes like 0 805, 1 812, 2 220, 1 218, and 1 813 power semiconductors and electronics meet EV demands and energy efficiency initiatives, thus driving the growth of the MLCC and semiconductor market.

Technological advancements and economic dynamics are shaping the landscape, propelling the global industrial MLCC market

- The global industrial MLCC market stands at a critical juncture, propelled by the confluence of rapid technological advancements and the ever-evolving economic landscape. In North America, a relentless pursuit of automation and manufacturing excellence drives the adoption of MLCCs. Robust industrial robotics markets, particularly in the United States and Canada, are catalysts for the steady rise in demand. This segment not only explores the increasing integration of MLCCs in industrial robots but also uncovers the expanding role of these components in service robots, aligning with the region's healthcare and aging population challenges.

- Asia-Pacific is emerging as a technological powerhouse, with Japan and China leading the charge. A vibrant landscape of automation, robotics, AI, and IoT solutions propels the region forward. This analysis dives deep into how MLCCs enable stability in Japan's intricate robotics while facilitating the rise of 5G-powered industrial IoT (IIoT) devices in China. The region's technological pioneers are poised to shape the future of MLCC demand.

- In Europe, the dawn of Industry 4.0 revolutionized manufacturing and robotics. The intricate interplay between industrial robots and MLCCs is explored, emphasizing their pivotal role in power management and robust performance. As Europe experiences a surge in robotic installations, the demand for MLCCs is expected to enhance operational efficiency and gain prominence, setting the stage for transformative growth.

- The Rest of the World, encompassing Latin America and Middle East & Africa, unveils a tapestry of diverse economic shifts and technological aspirations.

Global Industrial MLCC Market Trends

Continuous advancements to meet the evolving requirements of automation applications are increasing the demand for control PLC sales

- MLCCs are essential components in PLCs, alongside the processor, power supply, and input/output (I/O) section. An important role of MLCCs in PLCs is to ensure a stable power supply and filter out noise for sensitive components like microprocessors and integrated circuits.

- By providing reliable decoupling or bypassing capabilities, MLCCs enhance the performance of PLCs, reducing the potential for malfunctions and data corruption, thus ensuring seamless operation in industrial environments. As a result, the demand for MLCCs in the PLC market continues to grow, driven by the need for robust and reliable power management solutions in industrial automation.

- The demand for industrial programmable logic controllers (PLCs) is fueled by their continuous advancements to meet the evolving requirements of automation applications. PLCs now offer enhanced programming capabilities, enabling greater flexibility, scalability, and ease of use. They are equipped with larger memory capacities and compact sizes, allowing for the integration of high-speed (gigabit) Ethernet connectivity and built-in wireless features. This feature facilitates efficient monitoring and control of distributed server/multi-user applications. The availability of compact MLCCs with high capacitance values enables PLC manufacturers to design smaller yet highly functional systems, meeting the demand for space-efficient and high-performance PLC solutions.

The emergence of smart factories is propelling the demand for MLCCs

- The industrial robots' production volume increased from 0.41 million units in 2021 to 0.43 million units in 2022. Industrial robots play a crucial role in manufacturing industrial automation, with many core operations in industries being managed by robots. In industrial robots, MLCCs are primarily used for filtering and decoupling purposes. They help stabilize and regulate the power supply, ensuring smooth and reliable operation of the robot's electronic components. MLCC requirements in industrial robots can vary depending on factors such as the size and complexity of the robot, the power requirements, and the level of precision and reliability needed.

- The industrial robotics market is segmented into articulated robots, linear robots, cylindrical robots, parallel robots, and SCARA robots, which can be used in various end-user industries such as automotive, chemical and manufacturing, construction, electrical and electronics, food and beverage, machinery and metal, and pharmaceutical. The overall automotive industry witnessed growth in terms of production volume, from 133.20 million units in 2021 to 139.87 million units in 2022. The rising demand for automobiles necessitates increased production, resulting in the increased use of industrial robots in the automotive manufacturing process and the involvement of AI and digitalization.

- During the COVID-19 pandemic, there was an increase in demand for robots since they could be used to curb the spread of infectious diseases. With the introduction of robots, healthcare professionals were able to perform surgery with maximum precision.

Industrial MLCC Industry Overview

The Industrial MLCC Market is moderately consolidated, with the top five companies occupying 57.14%. The major players in this market are Murata Manufacturing Co., Ltd, Samsung Electro-Mechanics, Taiyo Yuden Co., Ltd, Walsin Technology Corporation and Yageo Corporation (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Global Industrial Automation Sales

- 4.1.1 Global Control PLC Sales

- 4.1.2 Global Industrial Robots Sales

- 4.1.3 Global Service Robots Sales

- 4.1.4 Global Servo Motor Sales

- 4.1.5 Global Solar PV Inverters and Optimizers Sales

- 4.2 Regulatory Framework

- 4.3 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2029 and analysis of growth prospects)

- 5.1 Case Size

- 5.1.1 0 201

- 5.1.2 0 402

- 5.1.3 0 603

- 5.1.4 1 005

- 5.1.5 1 210

- 5.1.6 Others

- 5.2 Voltage

- 5.2.1 600V to 1100V

- 5.2.2 Less than 600V

- 5.2.3 More than 1100V

- 5.3 Capacitance

- 5.3.1 10 μF to 100 μF

- 5.3.2 Less than 10 μF

- 5.3.3 More than 100 μF

- 5.4 Dielectric Type

- 5.4.1 Class 1

- 5.4.2 Class 2

- 5.5 Region

- 5.5.1 Asia-Pacific

- 5.5.2 Europe

- 5.5.3 North America

- 5.5.4 Rest of the World

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 Kyocera AVX Components Corporation (Kyocera Corporation)

- 6.4.2 Maruwa Co ltd

- 6.4.3 Murata Manufacturing Co., Ltd

- 6.4.4 Nippon Chemi-Con Corporation

- 6.4.5 Samsung Electro-Mechanics

- 6.4.6 Samwha Capacitor Group

- 6.4.7 Taiyo Yuden Co., Ltd

- 6.4.8 TDK Corporation

- 6.4.9 Vishay Intertechnology Inc.

- 6.4.10 Walsin Technology Corporation

- 6.4.11 Wurth Elektronik GmbH & Co. KG

- 6.4.12 Yageo Corporation

7 KEY STRATEGIC QUESTIONS FOR MLCC CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

02-2729-4219

+886-2-2729-4219