|

市場調查報告書

商品編碼

1684051

日本MLCC:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030年)Japan MLCC - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

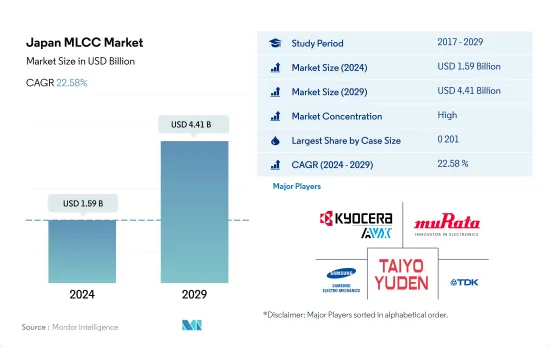

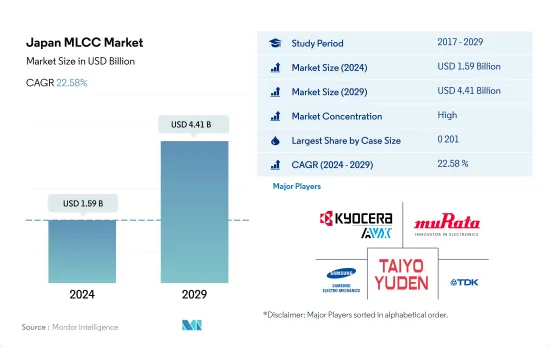

預計日本MLCC市場規模將在2024年達到15.9億美元,2029年達到44.1億美元,預測期間(2024-2029年)的複合年成長率為22.58%。

ADAS 和其他產品需求的成長預計將推動表面黏著技術MLCC 的需求

- 預計 2022 年 0 201 型機殼將佔據最大的市場佔有率,按出貨量計算為 35.01%,到 2029 年將產生 5,343 萬美元的收益。 1,005 型機殼是成長最快的細分市場,預計複合年成長率為 24.35%(2022-2029 年)。

- 持續的小型化趨勢加上對更高組件密度的需求正在推動對這些組件的需求。可攜式和連網裝置的日益普及進一步促進了對 0 201 MLCC 元件的需求,使製造商能夠在不影響效能的情況下實現小型化設計。

- 0 1005 MLCC 具有廣泛的應用,尤其是在智慧型手機、穿戴式裝置和物聯網設備等小型電子設備中,使製造商能夠在不影響效能的情況下創造出時尚、緊湊的設計。隨著海外公司尋求加強其在不斷擴大的市場中的影響力,日本的智慧型手錶產業正在不斷發展。

- 緊湊的 0402 外殼尺寸是表面黏著技術陶瓷電容器的流行外形規格。在汽車產業,0402MLCC 用於各種應用,包括引擎控制單元、資訊娛樂系統、ADAS(高級駕駛輔助系統)和照明控制。這些電容器在惡劣的汽車環境中提供可靠的性能。駕駛輔助功能的需求不斷成長,提高了技術在日本汽車製造業中的作用。例如,日產汽車公司與日立汽車系統公司合作,為日產汽車提供ADAS ECU和地圖定位單元,開拓日本MLCC市場的發展機會。

日本MLCC市場動向

電子商務的興起、都市區的擴大和基礎設施的發展推動了輕型商用車的需求。

- 日本輕型卡車市場在經歷了近年來的不穩定表現後,目前呈現溫和成長。 2019年,該國生產了83,950輛輕型商用車。這些卡車用於農業、建築和其他業務。受新冠疫情及俄烏戰爭影響,輕型商用車市場產量與前一年同期比較下降16.93%。此外,由於採用了結合石化燃料和電力的最新技術,混合動力輕型商用車(LCV)成為日本市場上成長最快的細分市場。

- 汽車工業仍然是日本經濟的重要組成部分,豐田、本田、日產和三菱等公司享有全球聲譽。這種主導地位延伸至商用車領域,五十鈴、日野和扶桑是該領域的產業領導者。日本以其技術專長而聞名,推動了燃油效率、車輛安全性的進步以及混合動力和電力系統作為替代能源的出現。

- 礦產和能源資源對於工業至關重要,而自主性則提供了將人們從危險中解救出來並提高安全性的機會。儘管面臨持續的勞動力短缺挑戰,自動駕駛輕型車輛 (ALV) 除了能夠採購關鍵礦物外,還為操作多台設備的礦場提供了額外的安全措施,以減少人為錯誤造成的事故。 2023 年 5 月,日本日本小松公司公司和豐田汽車公司宣布,他們將啟動一個聯合計劃,開發基於日本小松公司自動運輸系統 (AHS) 運行的自動輕型車輛 (ALV)。

電動車補貼計畫不斷增加,刺激乘用車需求

- 日本擁有向世界提供產品和服務的汽車製造商。豐田、鈴木、大發、日產是日本本土乘用車品牌。日本2019年生產了832萬輛乘用車。

- 受疫情和日本全國經濟衰退影響,日本汽車產量大幅下降,與前一年同期比較下降16.43%,4月日本乘用車出口量減半,降至約16.8萬輛的歷史最低水準。 2021年日本經濟開始復甦,電動車銷量較2020年大幅成長,年平均成長超過50%。

- 日本綠色成長策略的目標是到2035年實現汽車銷量100%為電動車。 《合理使用能源法》(2023年)將加速實現此策略目標,並支持日本電動車市場的成長。由於政府以獎勵和回扣形式提供的支持,日本對電動車的需求正在成長。政府已承諾將購買電動車的補貼和獎勵增加兩倍。到 2022 年,日本將把電動車補貼計畫的資金增加到 5.3 億美元,對純電動車 (BEV) 購買的支持金額增加一倍至最高 6,500 美元,對插電式混合動力車 (PHEV) 購買的支持金額最高至 4,200 美元。

- 為了擴大該國的電動車銷量,許多公司正在開發和推出新產品。在日本,2022年5月,豐田推出了新款電動SUV Bz4x,電池容量為71.4kWh。向電動車的轉變已經改變了貿易平衡,並且未來這種趨勢可能還會繼續。日本是電動車、馬達和鋰離子電池的淨出口國。日本已準備好從日益成長的電動車市場中獲益,2022 年日本的乘用車產量為 656 萬輛,預計未來還將進一步成長。

日本MLCC產業概況

日本MLCC市場格局較為集中,前五大廠商的市佔率合計達76.37%。市場的主要企業有:京瓷AVX元件株式會社(京瓷株式會社)、村田製作所、三星馬達、太陽誘電和TDK株式會社(依字母順序排列)。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章執行摘要和主要發現

第2章 報告要約

第3章 引言

- 研究假設和市場定義

- 研究範圍

- 調查方法

第4章 產業主要趨勢

- 價格趨勢

- 原油價格趨勢

- 白銀價格趨勢

- 家電銷量

- 空調銷售

- 桌上型電腦銷量

- 遊戲機銷售

- 筆記型電腦銷售

- 冰箱銷售

- 智慧型手機銷量

- 倉儲設備銷售

- 平板電腦銷量

- 電視銷售

- 汽車製造

- 客車生產

- 重型卡車生產

- 輕型商用車生產

- 乘用車生產

- 汽車製造

- 電動汽車生產

- BEV(純電動車)生產

- PHEV(插電式混合動力汽車)產量

- 工業自動化銷售

- 工業機器人銷售

- 服務機器人銷售

- 法律規範

- 價值鍊和通路分析

第5章市場區隔

- 介電類型

- 1級

- 2級

- 錶殼尺寸

- 0 201

- 0 402

- 0 603

- 1 005

- 1 210

- 其他

- 電壓

- 500V~1000V

- 小於500V

- 1000V以上

- 電容

- 100uF~1,000uF

- 小於100uF

- 超過 1,000uF

- Mlcc安裝類型

- 金屬蓋

- 徑向引線

- 表面黏著技術

- 最終用戶

- 航太和國防

- 車

- 家用電子電器

- 工業設備

- 醫療設備

- 電力和公共產業

- 通訊設備

- 其他

第6章競爭格局

- 關鍵策略趨勢

- 市場佔有率分析

- 商業狀況

- 公司簡介

- Kyocera AVX Components Corporation(Kyocera Corporation)

- Maruwa Co ltd

- Murata Manufacturing Co., Ltd

- Nippon Chemi-Con Corporation

- Samsung Electro-Mechanics

- Taiyo Yuden Co., Ltd

- TDK Corporation

- Vishay Intertechnology Inc.

- Walsin Technology Corporation

- Wurth Elektronik GmbH & Co. KG

- Yageo Corporation

第 7 章 CEO 的關鍵策略問題CEO 的關鍵策略問題

第 8 章 附錄

- 世界概況

- 概述

- 五力分析框架

- 全球價值鏈分析

- 市場動態(DRO)

- 資訊來源及延伸閱讀

- 圖片列表

- 關鍵見解

- 資料包

- 詞彙表

簡介目錄

Product Code: 50001997

The Japan MLCC Market size is estimated at 1.59 billion USD in 2024, and is expected to reach 4.41 billion USD by 2029, growing at a CAGR of 22.58% during the forecast period (2024-2029).

Rising demand for ADAS and other technologies is expected to increase demand for surface-mount MLCCs

- Case size 0 201 held the largest market share of 35.01% in terms of volume in 2022 and is expected to generate a revenue of USD 53.43 million in 2029. Case size 1 005 is the fastest-growing segment with an expected CAGR of 24.35% (2022-2029).

- The ongoing trend of miniaturization, coupled with the need for higher component density, drives the demand for these components. The increasing popularity of portable and connected devices further contributes to the demand for 0 201 MLCC components, enabling manufacturers to achieve compact designs without compromising performance.

- The usage of 0 1005 MLCCs spans diverse applications, particularly in compact electronic devices such as smartphones, wearables, and IoT devices, enabling manufacturers to achieve sleek and compact designs without compromising performance. Japan's smartwatch industry is growing as foreign companies are looking to strengthen their presence in the expanding market.

- The compact 0 402 case size is widely adopted as a form factor for surface-mount ceramic capacitors. The automotive industry relies on 0 402 MLCCs for various applications, including engine control units, infotainment systems, advanced driver-assistance systems (ADAS), and lighting control. These capacitors provide reliable performance in harsh automotive environments. The rising demand for driver-assist functions has raised the role of technology in the Japanese auto manufacturing sector. For instance, Nissan and Hitachi Automotive Systems have partnered to provide Nissan vehicles with ADAS ECU and map position units, developing an opportunity for the MLCC market in the country.

Japan MLCC Market Trends

The demand for light commercial vehicles is fueled by the increase in e-commerce, the expansion of urban areas, and the development of infrastructure

- The Japanese light truck market is witnessing moderate growth, following volatile performance in recent years. The country produced 83.95 thousand light commercial vehicles in 2019. These trucks are used in operations such as agriculture and construction. Due to the COVID-19 pandemic and the Russia-Ukraine war, the light commercial vehicle market witnessed a Y-o-Y drop of 16.93% in production. Moreover, Hybrid light commercial vehicles (LCV) are experiencing the most rapid growth in the Japanese market as a result of the combination of fossil fuel and electricity in modern technology.

- The automotive industry remains a crucial component of Japan's economy, and companies like Toyota, Honda, Nissan, and Mitsubishi have gained worldwide recognition. This dominance extends to the commercial vehicle sector, with Isuzu, Hino, and Fuso being industry leaders. Japan is renowned for its technological expertise, leading to developments in fuel efficiency, vehicle safety, and the emergence of hybrid and electric systems as alternative energy sources.

- While minerals and energy resources are essential for industries, autonomy offers the opportunity to remove people from harm's way and enhance safety. Along with sourcing critical minerals despite the ongoing challenge of labor shortages, autonomous light vehicles (ALV) provide additional safety measures at mine sites on which multiple pieces of equipment are operated to reduce accidents due to human error. In May 2023, Japan's Komatsu Ltd and Toyota Motor Corporation announced the launch of a joint project to develop an autonomous light vehicle (ALV) that will run on Komatsu's Autonomous Haulage System (AHS).

Increasing EV subsidy schemes are increasing the demand for passenger vehicles

- Japan is home to automotive manufacturers that supply their products and services globally. Toyota, Suzuki, Daihatsu, and Nissan are the domestic passenger vehicle brands in Japan. The country produced 8.32 million passenger vehicles in 2019.

- Following the pandemic and a nationwide recession in Japan, production slumped and witnessed a Y-o-Y decline of 16.43%, while exports of Japanese-made cars halved in April and reached a low of about 168,000. In 2021, the economy of the nation began to recover, and sales of electric automobiles increased significantly by more than 50% annually in 2021 compared to 2020.

- Japan's Green Growth Strategy aims to reach 100% electric car sales by 2035. The 2023 Act on the Rational Use of Energy tracks accelerates the targets set under the Strategy, helping the Japanese electric vehicle market grow. The country's demand for electric cars is increasing because of government support in the form of incentives and refunds. The government declared that it would treble the grants and incentives for buying electric automobiles. In 2022, Japan increased its EV subsidy scheme to fund USD 530 million, doubling the support for BEV purchases up to USD 6,500 and USD 4,200 for PHEVs.

- To expand the number of electric vehicles sold in the nation, numerous companies are developing and releasing new products. In Japan, in May 2022, Toyota launched its new electric SUV, Bz4x, which has a battery capacity of 71.4 kWh. The transition to e-mobility is shifting and will continue to shift trade balances. Japan is a net exporter of electric cars, electric motors, and Li-ion batteries. The country is well-positioned to benefit from a growing electric car market, which produced 6.56 million passenger cars in 2022; it is expected to grow further in the future.

Japan MLCC Industry Overview

The Japan MLCC Market is fairly consolidated, with the top five companies occupying 76.37%. The major players in this market are Kyocera AVX Components Corporation (Kyocera Corporation), Murata Manufacturing Co., Ltd, Samsung Electro-Mechanics, Taiyo Yuden Co., Ltd and TDK Corporation (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Price Trend

- 4.1.1 Oil Price Trend

- 4.1.2 Silver Price Trend

- 4.2 Consumer Electronics Sales

- 4.2.1 Air Conditioner Sales

- 4.2.2 Desktop PC's Sales

- 4.2.3 Gaming Console Sales

- 4.2.4 Laptops Sales

- 4.2.5 Refrigerator Sales

- 4.2.6 Smartphones Sales

- 4.2.7 Storage Unit Sales

- 4.2.8 Tablets Sales

- 4.2.9 Television Sales

- 4.3 Automotive Production

- 4.3.1 Buses and Coaches Production

- 4.3.2 Heavy Trucks Production

- 4.3.3 Light Commercial Vehicles Production

- 4.3.4 Passenger Vehicles Production

- 4.3.5 Total Motor Production

- 4.4 Ev Production

- 4.4.1 BEV (Battery Electric Vehicle) Production

- 4.4.2 PHEV (Plug-in Hybrid Electric Vehicle) Production

- 4.5 Industrial Automation Sales

- 4.5.1 Industrial Robots Sales

- 4.5.2 Service Robots Sales

- 4.6 Regulatory Framework

- 4.7 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2029 and analysis of growth prospects)

- 5.1 Dielectric Type

- 5.1.1 Class 1

- 5.1.2 Class 2

- 5.2 Case Size

- 5.2.1 0 201

- 5.2.2 0 402

- 5.2.3 0 603

- 5.2.4 1 005

- 5.2.5 1 210

- 5.2.6 Others

- 5.3 Voltage

- 5.3.1 500V to 1000V

- 5.3.2 Less than 500V

- 5.3.3 More than 1000V

- 5.4 Capacitance

- 5.4.1 100µF to 1000µF

- 5.4.2 Less than 100µF

- 5.4.3 More than 1000µF

- 5.5 Mlcc Mounting Type

- 5.5.1 Metal Cap

- 5.5.2 Radial Lead

- 5.5.3 Surface Mount

- 5.6 End User

- 5.6.1 Aerospace and Defence

- 5.6.2 Automotive

- 5.6.3 Consumer Electronics

- 5.6.4 Industrial

- 5.6.5 Medical Devices

- 5.6.6 Power and Utilities

- 5.6.7 Telecommunication

- 5.6.8 Others

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 Kyocera AVX Components Corporation (Kyocera Corporation)

- 6.4.2 Maruwa Co ltd

- 6.4.3 Murata Manufacturing Co., Ltd

- 6.4.4 Nippon Chemi-Con Corporation

- 6.4.5 Samsung Electro-Mechanics

- 6.4.6 Taiyo Yuden Co., Ltd

- 6.4.7 TDK Corporation

- 6.4.8 Vishay Intertechnology Inc.

- 6.4.9 Walsin Technology Corporation

- 6.4.10 Wurth Elektronik GmbH & Co. KG

- 6.4.11 Yageo Corporation

7 KEY STRATEGIC QUESTIONS FOR MLCC CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

02-2729-4219

+886-2-2729-4219