|

市場調查報告書

商品編碼

1684045

個人電腦和筆記型電腦用 MLCC——市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)PCs and Laptops MLCC - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

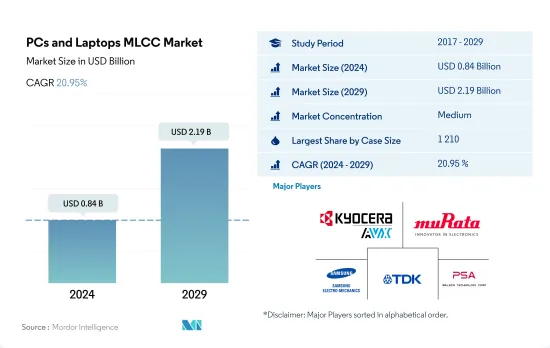

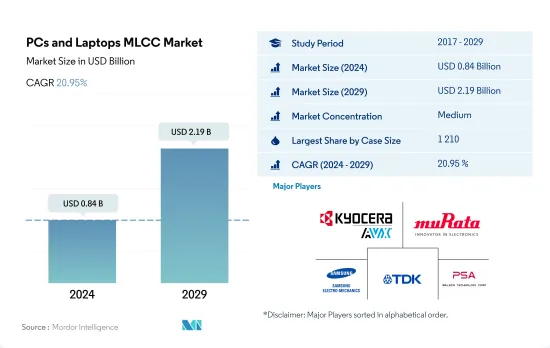

預計 2024 年 PC 和筆記型電腦 MLCC 市場規模將達到 8.4 億美元,到 2029 年將達到 21.9 億美元,預測期內(2024-2029 年)的複合年成長率為 20.95%。

預計全球個人電腦和筆記型電腦用MLCC市場將在各種外殼尺寸方面取得進展。

- 全球個人電腦和筆記型電腦用 MLCC 市場的外殼尺寸部分是電子設備進步的關鍵方面。有多種機箱尺寸可供選擇,每種尺寸都與塑造電腦世界的不斷發展的趨勢有著錯綜複雜的聯繫。 0603 尺寸外殼與 PC 市場的起伏產生共鳴,反映了遠距工作激增和預算限制對 MLCC 需求的影響。

- 在個人電腦銷量激增、供應鏈挑戰影響適應策略以及向電子和遊戲領域擴張的背景下,0-805 尺寸機箱表現出多樣化的成長。 0.806尺寸上,蘋果的足跡與此呼應,科技巨頭的影響力與MLCC的需求趨勢交織在一起。

- 1,206 的機箱尺寸代表 PC 銷售在變化中的穩定性,反映了供應、需求動態和穩定成長之間的相互作用。 1.210 外殼尺寸的 MLCC 在提高性能和穩定性方面發揮著至關重要的作用,這與蘋果對 PC 的影響相吻合,並凸顯了對增強多媒體和堅定功能的需求。 1,210 個外殼尺寸的 MLCC 支援穩定性,體現行業領導者的影響力並響應不斷變化的 PC 市場動態。穩定的成長體現了對增強多媒體體驗和堅定系統穩定性的需求。

- 「其他」外殼尺寸形成多樣化的電容解決方案,支援先進的顯示技術和人工智慧主導的最佳化。先進顯示技術與電容器解決方案之間的這種結合凸顯了計算生態系統多個方面的持續創新。

亞太、歐洲、北美及世界其他地區對全球PC及筆記型電腦MLCC市場的影響

- 亞太地區、歐洲、北美和太平洋其他地區呈現出影響全球 PC 和筆記型電腦 MLCC 市場的獨特動態。不斷變化的 PC 需求、技術進步以及消費行為正在塑造這些地區的 MLCC 格局。

- 由於經濟和技術進步的不同,亞太地區的市場動態也呈現多樣化。儘管整體個人電腦市場放緩且生產中斷,但中國、日本、韓國和台灣等主要科技中心仍是全球科技生態系統的重要參與者。這些地區正在刺激對包括 MLCC 在內的先進組件的需求,從而創造服務各個細分市場的機會。

- 歐洲對品質和精確度的重視,加上對高效能 MLCC 的承諾,推動了蓬勃發展的個人電腦和筆記型電腦產業的需求成長。儘管面臨挑戰,但個人電腦的持續普及,尤其是在遠端工作和混合環境中,徵兆著對 MLCC 的持續需求。

- 北美由美國、墨西哥和加拿大組成,歷來主導個人電腦和筆記型電腦市場。儘管一直保持強勁的市場地位,但 2022 年的經濟不確定性導致 PC 出貨量下降,進而影響了 MLCC 的需求。消費者支出的變化和電子設備需求的減少將對 MLCC 組件產生直接影響。

- 在全球其他地區,個人電腦設備市場在2023年第一季大幅下滑,年減13.0%。經濟挑戰和不斷變化的消費者偏好(尤其是在中東和非洲地區)正在影響全球 PC 和筆記型電腦 MLCC 市場,影響對 MLCC 的需求數量和規格。

PC及筆記型電腦用MLCC市場的全球動向

教育機構擴大採用筆記型電腦推動市場

- 由於 MLCC 在提供高頻去耦和濾波以實現高效、綠能傳輸方面發揮關鍵作用,因此筆記型電腦對 MLCC 的需求顯著成長。這至關重要,因為筆記型電腦依靠精確的電壓和電流水平來確保其各個組件的最佳運作。

- 筆記型電腦成長強勁,出貨量從 2020 年的 2.225 億台成長 19.6% 至 2021 年的 2.768 億台。筆記型電腦需求激增最初歸因於 COVID-19 疫情期間遠端工作和虛擬通訊的廣泛採用。這增加了這些設備對 MLCC 的需求。然而,隨著員工逐漸返回實體辦公空間,對筆記型電腦的需求有所下降。智慧型手機和平板電腦功能的不斷增強,加上行動應用程式和雲端基礎服務的進步,使得這些設備更適合執行特定任務,從而減少了對筆記型電腦的整體需求。此外,對多功能筆記型電腦的需求日益成長以及高速網際網路的普及也影響了對筆記型電腦的需求。預計這一發展將受到多種因素的推動,包括消費者購買力的提高以及對遊戲筆記型電腦日益成長的偏好,尤其是千禧世代。

- 由於新冠疫情的持續影響,許多人在家學習,對筆記型電腦的需求持續增加。這種持續的需求直接轉化為筆記型電腦製造對 MLCC 的持續需求。 MLCC 在確保筆記型電腦可靠、高效的效能方面發揮關鍵作用,並且已成為滿足這些設備持續市場需求的重要組件。

筆記型電腦需求增加導致市場放緩

- MLCC的電極可作為個人電腦等電子設備的穩定電力源。為了順應筆記型電腦效能提升、尺寸縮小、設計更緊湊的市場趨勢,也為了製造能夠適應產業需求變化的產品,MLCC製造商將耐高溫、高容量MLCC視為首要任務。

- 個人電腦出貨量將從 2021 年的 3.4173 億台下降 16% 至 2022 年的 2.862 億台。由於電池線路中產生不良聲學噪聲,尤其是在 DC-DC 轉換器的初級側,個人電腦對 MLCC 的需求正在下降。在 PC 附近策略性地放置電容式回饋會對使用者體驗產生負面影響並留下負面印象。消費者正在積極尋求能夠提供更安靜、更舒適的使用者體驗的個人電腦。人們對無噪音設備的日益偏好導致筆記型電腦對 MLCC 的需求下降,因為筆記型電腦容易受到干擾性回饋噪音的影響。

- PC 用 MLCC 需求下降的主要原因是,疫情期間購買的相對較新的 PC 被廣泛擁有,導致它們不再負擔得起,從而降低了消費者投資購買新 PC 的意願。由於企業採取成本控制策略來削減個人電腦預算,嚴峻的經濟狀況導致歐洲、中東和非洲地區的企業個人電腦支出下降。這導致PC需求大幅下降,達到數年來的最低水準。因此,個人電腦製造必不可少的零件MLCC的需求受到影響,導致個人電腦用MLCC銷售下降。

PC/筆記型電腦MLCC產業概況

PC和筆記型電腦MLCC市場適度整合,前五大公司佔51.77%的市場。市場的主要企業有:京瓷AVX元件株式會社(京瓷株式會社)、村田製作所、三星電機、TDK株式會社和華新科技株式會社。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章執行摘要和主要發現

第2章 報告要約

第3章 引言

- 研究假設和市場定義

- 研究範圍

- 調查方法

第4章 產業主要趨勢

- 個人電腦和筆記型電腦銷售

- 全球筆記型電腦銷量

- 全球個人電腦銷售

- 法律規範

- 價值鍊和通路分析

第5章市場區隔

- 錶殼尺寸

- 0 603

- 0 805

- 0 806

- 1 206

- 1 210

- 其他

- 電壓

- 10V~20V

- 20V以上

- 小於10V

- 電容

- 10μF至100μF

- 小於10μF

- 100μF 以上

- 介電類型

- 1級

- 2級

- 地區

- 亞太地區

- 歐洲

- 北美洲

- 世界其他地區

第6章競爭格局

- 關鍵策略趨勢

- 市場佔有率分析

- 商業狀況

- 公司簡介

- Kyocera AVX Components Corporation(Kyocera Corporation)

- Maruwa Co ltd

- Murata Manufacturing Co., Ltd

- Nippon Chemi-Con Corporation

- Samsung Electro-Mechanics

- Samwha Capacitor Group

- Taiyo Yuden Co., Ltd

- TDK Corporation

- Vishay Intertechnology Inc.

- Walsin Technology Corporation

- Wurth Elektronik GmbH & Co. KG

- Yageo Corporation

第 7 章 CEO 的關鍵策略問題CEO 的關鍵策略問題

第 8 章 附錄

- 世界概況

- 概述

- 五力分析框架

- 全球價值鏈分析

- 市場動態(DRO)

- 資訊來源及延伸閱讀

- 圖片列表

- 關鍵見解

- 資料包

- 詞彙表

The PCs and Laptops MLCC Market size is estimated at 0.84 billion USD in 2024, and is expected to reach 2.19 billion USD by 2029, growing at a CAGR of 20.95% during the forecast period (2024-2029).

Fueling advancements expected across varied case sizes in the global PCs and laptops MLCC market

- The case size segment within the global PCs and laptops MLCC market constitutes a vital dimension of electronic device advancement. It encompasses a spectrum of case sizes, each intricately interwoven with the evolving trends shaping the computing world. The 0 603 case size resonates with the PC market's ups and downs, mirroring remote work's surge and budget constraints' impact on MLCC demand.

- The 0 805 case size demonstrates versatile growth amidst PC sales surges, as supply chain challenges influence adaptive strategies and extend to electronic devices and gaming. Apple's footprint reverberates in the 0 806 case size, intertwining tech giants' influence with MLCC demand trends.

- The 1 206 case size showcases stability amid shifting PC sales, reflecting the interplay of supply, demand dynamics, and steady growth. The essential role of 1 210 case size MLCCs in powering performance and stability aligns with Apple's PC influence, accentuating the demand for enhanced multimedia and unwavering functionality. Anchoring stability, the 1 210 case size MLCCs respond to shifts in PC market dynamics, reflecting the influence of industry giants. The steady growth narrates the demand for enhanced multimedia experiences and unwavering system stability.

- The "others" case sizes form a versatile domain of capacitance solutions, responding to advanced display tech and AI-driven optimizations. This alignment between advanced display technologies and capacitor solutions underscores the cohesive innovation occurring across various facets of the computing ecosystem.

The impact of Asia-Pacific, Europe, North America, and Rest of the World on the global PCs and laptops MLCC market

- The Asia-Pacific, Europe, North America, and the Rest of the World present unique dynamics that impact the global PCs and laptops MLCC market. Shifts in PC demand, technological advancements, and evolving consumer behaviors collectively shape the MLCC landscape across these regions.

- The Asia-Pacific region showcases diverse market dynamics driven by various economies and technological advancements. Despite a broader PC market slowdown and production disruptions, key technology hubs like China, Japan, South Korea, and Taiwan remain pivotal players in the global tech ecosystem. These hubs fuel the demand for advanced components, including MLCCs, creating opportunities for catering to different market segments.

- Europe's strong emphasis on quality and precision aligns with its commitment to high-performance MLCCs, driving increased demand from the thriving PCs and laptops sector. Despite challenges, the enduring adoption of PCs, especially in remote work and hybrid settings, bodes well for sustained MLCC demand.

- North America, comprising the United States, Mexico, and Canada, historically dominates the PCs and laptops market. While consistently maintaining a strong presence, a decline in PC shipments in 2022 due to economic uncertainties affected the demand for MLCCs. Consumer spending shifts and decreased demand for electronic devices have direct implications for MLCC components.

- The Rest of the World witnessed a significant 13.0% Y-o-Y decline in the personal computing devices market in Q1 2023. Economic challenges and evolving consumer preferences, specifically in the MEA region, influence the global PCs and laptops MLCC market, affecting the required quantity and specifications of MLCCs.

Global PCs and Laptops MLCC Market Trends

Rise in adoption of laptops in educational institutions is propelling the market

- The demand for MLCCs in laptops has witnessed significant growth due to their essential role in providing high-frequency decoupling and filtering for efficient and clean power supply. This is crucial as laptops rely on precise voltage and current levels to ensure optimal operation of various components.

- The laptops experienced a substantial increase, with shipments rising by 19.6% from 222.5 million units in 2020 to 276.8 million units in 2021. The surge in laptop demand was initially driven by the widespread adoption of remote work and virtual communication during the COVID-19 pandemic. This has led to an increased need for MLCCs in these devices. However, as employees gradually transition back to physical office spaces, the demand for laptops has somewhat subsided. The evolving capabilities of smartphones and tablets, coupled with advancements in mobile applications and cloud-based services, have made these devices more suitable for specific tasks, diminishing the overall necessity for laptops. Furthermore, the demand for laptops is being influenced by the growing need for versatile laptops and the widespread availability of high-speed internet. This development is anticipated to occur due to various factors, including the rise in consumer purchasing power and the increasing preference for gaming laptops, especially among the millennial demographic.

- The demand for laptops persists due to the enduring effects of the COVID-19 pandemic, with many individuals learning from home. This sustained demand directly translates into an ongoing requirement for MLCCs in laptop manufacturing. MLCCs play a vital role in guaranteeing the dependable and efficient performance of laptops, making them an indispensable component in meeting the ongoing market demand for these devices.

Increasing demand for laptops stagnates the market

- The electrodes in an MLCC serve as a stable source of electricity for electronics like PCs. To keep up with the market's current trend for improved performance, miniaturization, and compact laptop PC designs and manufacture products that can withstand the industry's changing demands, MLCC manufacturers are making high-temperature and high-capacitance MLCC the utmost importance.

- PC's shipments declined by 16%, from 341.73 million units in 2021 to 286.2 million in 2022. The demand for MLCCs in PCs has declined due to the unfavorable acoustic noise they produce within the battery lines, specifically on the primary side of DC-DC converters. The presence of capacitive howling strategically placed close to PCs adversely affects the user experience, creating a negative impact. Consumers are actively seeking PCs that offer a quieter and more pleasant user experience. This growing preference for noise-free devices has contributed to the decreasing demand for MLCCs in laptops affected by disruptive howling noises.

- The decline in MLCC demand for PCs is primarily due to the prevalent ownership of relatively new PCs purchased during the pandemic, resulting in a lack of affordability and reduced consumer motivation to invest in new PC purchases. The challenging economic climate has resulted in reduced business PC spending in the EMEA region as companies adopt cost management strategies by cutting down on PC budgets. This factor has led to a significant drop in PC demand, reaching its lowest level in years, consequently impacting the demand for MLCCs as a vital component in PC manufacturing and resulting in a decline in MLCC sales for PC applications.

PCs and Laptops MLCC Industry Overview

The PCs and Laptops MLCC Market is moderately consolidated, with the top five companies occupying 51.77%. The major players in this market are Kyocera AVX Components Corporation (Kyocera Corporation), Murata Manufacturing Co., Ltd, Samsung Electro-Mechanics, TDK Corporation and Walsin Technology Corporation (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Pc And Laptops Sales

- 4.1.1 Global Laptop Sales

- 4.1.2 Global PC Sales

- 4.2 Regulatory Framework

- 4.3 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2029 and analysis of growth prospects)

- 5.1 Case Size

- 5.1.1 0 603

- 5.1.2 0 805

- 5.1.3 0 806

- 5.1.4 1 206

- 5.1.5 1 210

- 5.1.6 Others

- 5.2 Voltage

- 5.2.1 10V to 20V

- 5.2.2 Above 20V

- 5.2.3 Less than 10V

- 5.3 Capacitance

- 5.3.1 10 μF to 100 μF

- 5.3.2 Less than 10 μF

- 5.3.3 More than 100 μF

- 5.4 Dielectric Type

- 5.4.1 Class 1

- 5.4.2 Class 2

- 5.5 Region

- 5.5.1 Asia-Pacific

- 5.5.2 Europe

- 5.5.3 North America

- 5.5.4 Rest of the World

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 Kyocera AVX Components Corporation (Kyocera Corporation)

- 6.4.2 Maruwa Co ltd

- 6.4.3 Murata Manufacturing Co., Ltd

- 6.4.4 Nippon Chemi-Con Corporation

- 6.4.5 Samsung Electro-Mechanics

- 6.4.6 Samwha Capacitor Group

- 6.4.7 Taiyo Yuden Co., Ltd

- 6.4.8 TDK Corporation

- 6.4.9 Vishay Intertechnology Inc.

- 6.4.10 Walsin Technology Corporation

- 6.4.11 Wurth Elektronik GmbH & Co. KG

- 6.4.12 Yageo Corporation

7 KEY STRATEGIC QUESTIONS FOR MLCC CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms