|

市場調查報告書

商品編碼

1684035

中國MLCC市場佔有率分析、產業趨勢與統計、成長預測(2025-2030年)China MLCC - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

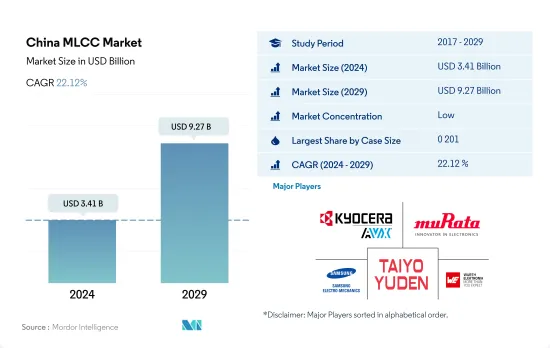

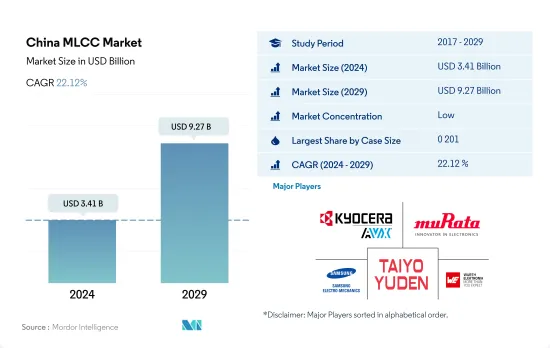

預計 2024 年中國 MLCC 市場規模將達到 34.1 億美元,到 2029 年將達到 92.7 億美元,預測期內(2024-2029 年)的複合年成長率為 22.12%。

中國MLCC市場蓬勃發展,尺寸動態及市場成長預測

- 在中國充滿活力的 MLCC 市場中,預計 0201 外殼尺寸部分將在 2022 年佔據 41.33% 的市場佔有率,到 2029 年將創造 35.1 億美元的收益。這些微型 MLCC 是關鍵元件,廣泛應用於穿戴式裝置、醫療設備設備和物聯網設備等小型電子設備。其在密集 PCB 佈局中的出色性能確保了無縫整合,同時不影響效率。隨著中國準備主導全球 5G 市場,預計 0 201 MLCC 的需求將激增,尤其是對於支援 5G 的智慧型手機而言,緊湊的外形規格是關鍵。

- 預計 2022 年 0.402 尺寸外殼將佔據市場佔有率的 23.82%(按數量計算),到 2029 年預計將帶來 20.6 億美元的市場規模。這種緊湊型部件長 0.040 英寸,寬 0.020 英寸,用於智慧型手機、平板電腦、筆記型電腦和遊戲機等消費性電子產品。

- 中國 0603 外殼尺寸細分市場預計將在 2022 年佔據 18.78% 的市場佔有率,到 2029 年銷售額將達到 17.1 億美元。這些 MLCC 長 0.06 英寸,寬 0.03 英寸,具有手持方便、易於識別和手工焊接的優點。

- 1 210 外殼尺寸部分將在 2022 年佔據 16.07% 的市場佔有率,預計到 2029 年將達到 9.566 億美元。中國電動車市場的成長和先進的智慧型手機技術正在推動對這些 MLCC 的需求,以確保可靠的性能並支援最新的功能。

中國MLCC市場趨勢

電子商務產業的發展預計將推動輕型商用車的需求

- 隨著越來越多的政府放寬對皮卡使用的限制,作為中國市場上的小型輕型汽車細分市場,皮卡預計將出現強勁成長。 2019年,輕型商用車累計產量達200萬輛,輕型卡車國內銷售量達190萬輛,持續成長。

- 近兩年輕型卡車銷量穩定成長。隨著國家取消低速貨車產品類別以及國內電商快遞物流、低溫運輸運輸的快速發展,輕卡市場需求持續成長, 與前一年同期比較率達7.44%。中國輕卡廠商也相應設計了相關產品,以因應複雜的使用環境。

- 2022年,中國將在電動輕型商用車整體銷量中佔據領先地位,銷量將超過1.3億輛,其中近15%的輕型商用車銷量將是電動車。近年來,雖然對純電動卡車、燃料電池卡車以及商用車(包括輕型商用車)的補貼有所減少,但自2020年以來,儘管每輛車的補貼減少,但零排放商用卡車的銷量卻有所成長,這表明電動卡車的商業競爭力正在增強。隨著國內快捷郵件物流業的持續發展,預計中長期內小型貨車整體銷售需求仍將維持成長趨勢。

快速的都市化和先進的汽車技術預計將增加對乘用車的需求

- 中國是全球汽車工業成長最快的國家之一,並且是全球主要的目的地設備製造商 ( OEM )。乘用車是中國汽車產業的主要細分市場,2019 年產量為 2,138 萬輛。可支配收入的增加、都市化的加快、二、三線城市對新車的需求以及汽車成本的下降是推動中國乘用車成長的一些因素。

- 2021年中國電動車銷量(330萬輛)超過了2020年全球銷量(300萬輛)。 2021 年,中國電動車持有仍位居世界第一,達到 780 萬輛,是新冠疫情爆發前 2019 年保有量的兩倍多。 2021年中國純電動車銷量超過270萬輛,佔新電動車銷量的82%。

- 2021年,電動車在國內車銷售的佔比從2020年的5%上升至16%,2021年12月的月佔比達到20%。這一令人印象深刻的成長與政府在「十四五」規劃(2021-2025年)中加速脫碳的努力相吻合,延續了過去幾個「十五」規劃期間逐步加強對電動車市場的政策支持的趨勢。目前的五年規劃包括針對交通運輸業的中期目標,例如到2025年將電動車的年平均銷售佔有率提高到20%。

- 受嚴格的排放法規、波動的燃料價格以及客戶對環保交通日益成長的需求的推動,預計2022年乘用車產量將與前一年同期比較成長11.15%,並且預計成長趨勢還將持續。

中國MLCC行業概況

中國MLCC市場分散,前五大企業佔0%。該市場的主要企業有:京瓷AVX元件株式會社(京瓷株式會社)、村田製作所、三星電機、太陽誘電和伍爾特電子有限公司(按字母順序排列)。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章執行摘要和主要發現

第2章 報告要約

第3章 引言

- 研究假設和市場定義

- 研究範圍

- 調查方法

第4章 產業主要趨勢

- 價格趨勢

- 銅價走勢

- 鎳價趨勢

- 白銀價格趨勢

- 家電銷量

- 空調銷售

- 桌上型電腦銷量

- 遊戲機銷售

- 筆記型電腦銷售

- 冰箱銷售

- 智慧型手機銷量

- 倉儲設備銷售

- 平板電腦銷量

- 電視銷售

- 汽車製造

- 客車生產

- 重型卡車生產

- 輕型商用車生產

- 乘用車生產

- 汽車產量

- 電動汽車生產

- BEV(純電動車)生產

- PHEV(插電式混合動力汽車)產量

- 工業自動化銷售

- 工業機器人銷售

- 服務機器人銷售

- 法律規範

- 價值鍊和通路分析

第5章市場區隔

- 介電類型

- 1級

- 2級

- 錶殼尺寸

- 0 201

- 0 402

- 0 603

- 1 005

- 1 210

- 其他

- 電壓

- 500V~1000V

- 小於500V

- 1000V以上

- 電容

- 100uF~1000uF

- 小於100uF

- 超過 1,000uF

- Mlcc安裝類型

- 金屬蓋

- 徑向引線

- 表面黏著技術

- 最終用戶

- 航太和國防

- 車

- 家用電子電器

- 工業設備

- 醫療設備

- 電力和公共產業

- 通訊設備

- 其他

第6章競爭格局

- 關鍵策略趨勢

- 市場佔有率分析

- 業務狀況

- 公司簡介

- Kyocera AVX Components Corporation(Kyocera Corporation)

- Maruwa Co. Ltd

- Murata Manufacturing Co. Ltd

- Nippon Chemi-Con Corporation

- Samsung Electro-Mechanics

- Samwha Capacitor Group

- Taiyo Yuden Co. Ltd

- TDK Corporation

- Vishay Intertechnology Inc.

- Walsin Technology Corporation

- Wurth Elektronik GmbH & Co. KG

- Yageo Corporation

第 7 章 CEO 的關鍵策略問題CEO 的關鍵策略問題

第 8 章 附錄

- 世界概況

- 概述

- 五力分析框架

- 全球價值鏈分析

- 市場動態(DRO)

- 資訊來源及延伸閱讀

- 圖片列表

- 關鍵見解

- 資料包

- 詞彙表

簡介目錄

Product Code: 50001977

The China MLCC Market size is estimated at 3.41 billion USD in 2024, and is expected to reach 9.27 billion USD by 2029, growing at a CAGR of 22.12% during the forecast period (2024-2029).

China's thriving MLCC market through case size dynamics and market growth projections

- In China's dynamic MLCC market, the 0 201 case size segment held a substantial 41.33% of the volume market share in 2022, and it's poised to generate a revenue of USD 3.51 billion by 2029. These miniature MLCCs are pivotal components, finding extensive use in small electronic devices like wearables, medical equipment, and IoT devices. Their remarkable performance within densely populated PCB layouts ensures seamless integration without compromising efficiency. As China gears up to dominate the global 5G market, the demand for 0 201 MLCCs is expected to soar, especially in 5G-enabled smartphones, where compact form factors are crucial.

- The 0 402 case size segment, representing 23.82% of the market share by volume in 2022, is projected to yield USD 2.06 billion by 2029. These compact components, measuring 0.040 inches in length and 0.020 inches in width, are the go-to for consumer electronics, including smartphones, tablets, laptops, and gaming consoles.

- China's 0 603 case size segment, with a 18.78% share of the volume market in 2022, is expected to generate USD 1.71 billion by 2029. These MLCCs, measuring 0.06 inches in length and 0.03 inches in width, are convenient to work with manually, providing advantages in ease of identification and hand soldering.

- The 1 210 case size segment, accounting for 16.07% of the volume market share in 2022 and projecting USD 956.60 million by 2029, offers precise measurements that are crucial for optimal integration on circuit boards and electronic devices. The growth in China's electric vehicle market and advanced smartphone technologies are driving the need for these MLCCs, ensuring dependable performance and supporting modern functionalities.

China MLCC Market Trends

The development of the e-commerce industry is expected to propel the demand for light commercial vehicles

- Pickups, a small light-vehicle segment in the Chinese market, are poised for robust growth as more governments relax rules over their use. The total production of light commercial vehicles in 2019 was 2 million units, and the sales volume of light trucks in the country reached 1.9 million units, achieving continuous growth.

- The sales of light trucks have grown steadily in the past two years. Due to the country canceling the product category of low-speed trucks and the rapid development of domestic e-commerce express logistics and cold chain transportation, the market demand for light trucks continued to increase, with a Y-o-Y growth of 7.44% in 2020. Chinese light truck manufacturers designed their related products accordingly to cope with the complex usage environment.

- In 2022, China led in terms of overall electric LCV sales, with over 130 million units sold and nearly 15% of LCVs sold being electric. Subsidies for battery electric and fuel cell trucks and vocational vehicles (including LCVs) have decreased in recent years, but zero-emission commercial truck sales have been growing since 2020, even as subsidies per vehicle have declined, indicating the increasing commercial competitiveness of electric trucks. With the continuous development of the country's express delivery and logistics industry, the overall light truck sales demand is expected to maintain a growth trend in the medium and long term.

Rapid urbanization and advanced vehicle technology are expected to increase the demand for passenger vehicles

- China has one of the fastest-growing auto industries and accounts for a major presence of original equipment manufacturers (OEMs) globally. Passenger cars were a key segment of the Chinese automotive industry, producing 21.38 million units in 2019. Factors such as increasing disposable income, rapid urbanization, demand for new cars from lower-tier cities, and low vehicle costs are driving the growth of passenger vehicles in China.

- More electric cars were sold in China in 2021 (3.3 million) than in the world in 2020 (3.0 million). China's fleet of electric cars remained the world's largest at 7.8 million in 2021, which was more than double the stock of 2019 before the COVID-19 pandemic. Over 2.7 million BEVs were sold in China in 2021, accounting for 82% of new electric car sales.

- Electric cars accounted for 16% of domestic car sales in 2021, up from 5% in 2020, and reached a monthly share of 20% in December 2021, reflecting a much quicker recovery of the EV market relative to conventional cars. This impressive growth came alongside government efforts to accelerate decarbonization in the new 14th Five-Year Plan (FYP) (2021-2025), continuing the trend of progressively strengthening policy support for EV markets in the past few FYP periods. The current FYP includes medium-term objectives in transport, such as reaching an annual average of 20% market share for electric car sales in 2025.

- Stringent emission norms, fluctuating fuel prices, and the growing demand from customers for eco-friendly transportation caused the production of passenger vehicles to witness a Y-o-Y growth of 11.15% in 2022, and this growth is expected to continue in the future.

China MLCC Industry Overview

The China MLCC Market is fragmented, with the top five companies occupying 0%. The major players in this market are Kyocera AVX Components Corporation (Kyocera Corporation), Murata Manufacturing Co. Ltd, Samsung Electro-Mechanics, Taiyo Yuden Co. Ltd and Wurth Elektronik GmbH & Co. KG (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Price Trend

- 4.1.1 Copper Price Trend

- 4.1.2 Nickel Price Trend

- 4.1.3 Silver Price Trend

- 4.2 Consumer Electronics Sales

- 4.2.1 Air Conditioner Sales

- 4.2.2 Desktop PC's Sales

- 4.2.3 Gaming Console Sales

- 4.2.4 Laptops Sales

- 4.2.5 Refrigerator Sales

- 4.2.6 Smartphones Sales

- 4.2.7 Storage Unit Sales

- 4.2.8 Tablets Sales

- 4.2.9 Television Sales

- 4.3 Automotive Production

- 4.3.1 Buses and Coaches Production

- 4.3.2 Heavy Trucks Production

- 4.3.3 Light Commercial Vehicles Production

- 4.3.4 Passenger Vehicles Production

- 4.3.5 Total Motor Production

- 4.4 EV Production

- 4.4.1 BEV (Battery Electric Vehicle) Production

- 4.4.2 PHEV (Plug-in Hybrid Electric Vehicle) Production

- 4.5 Industrial Automation Sales

- 4.5.1 Industrial Robots Sales

- 4.5.2 Service Robots Sales

- 4.6 Regulatory Framework

- 4.7 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2029 and analysis of growth prospects)

- 5.1 Dielectric Type

- 5.1.1 Class 1

- 5.1.2 Class 2

- 5.2 Case Size

- 5.2.1 0 201

- 5.2.2 0 402

- 5.2.3 0 603

- 5.2.4 1 005

- 5.2.5 1 210

- 5.2.6 Others

- 5.3 Voltage

- 5.3.1 500V to 1000V

- 5.3.2 Less than 500V

- 5.3.3 More than 1000V

- 5.4 Capacitance

- 5.4.1 100µF to 1000µF

- 5.4.2 Less than 100µF

- 5.4.3 More than 1000µF

- 5.5 Mlcc Mounting Type

- 5.5.1 Metal Cap

- 5.5.2 Radial Lead

- 5.5.3 Surface Mount

- 5.6 End User

- 5.6.1 Aerospace and Defence

- 5.6.2 Automotive

- 5.6.3 Consumer Electronics

- 5.6.4 Industrial

- 5.6.5 Medical Devices

- 5.6.6 Power and Utilities

- 5.6.7 Telecommunication

- 5.6.8 Others

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 Kyocera AVX Components Corporation (Kyocera Corporation)

- 6.4.2 Maruwa Co. Ltd

- 6.4.3 Murata Manufacturing Co. Ltd

- 6.4.4 Nippon Chemi-Con Corporation

- 6.4.5 Samsung Electro-Mechanics

- 6.4.6 Samwha Capacitor Group

- 6.4.7 Taiyo Yuden Co. Ltd

- 6.4.8 TDK Corporation

- 6.4.9 Vishay Intertechnology Inc.

- 6.4.10 Walsin Technology Corporation

- 6.4.11 Wurth Elektronik GmbH & Co. KG

- 6.4.12 Yageo Corporation

7 KEY STRATEGIC QUESTIONS FOR MLCC CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

02-2729-4219

+886-2-2729-4219