|

市場調查報告書

商品編碼

1684048

智慧型手機用MLCC:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)Smartphone MLCC - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

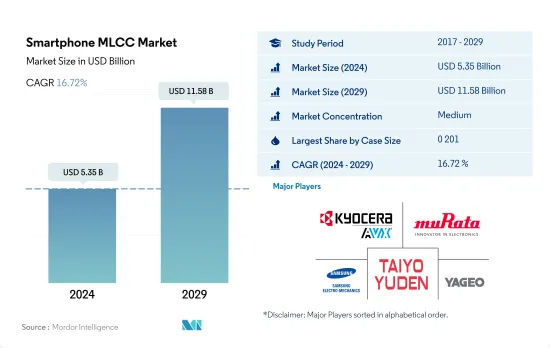

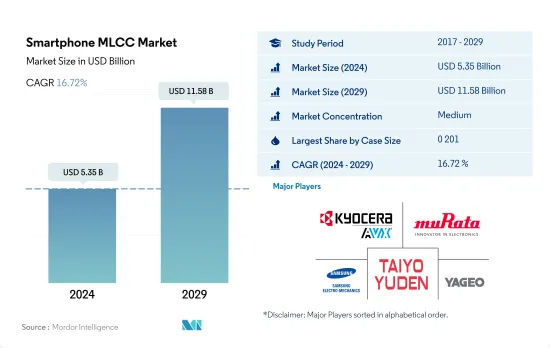

預計 2024 年智慧型手機 MLCC 市場規模為 53.5 億美元,到 2029 年將達到 115.8 億美元,預測期內(2024-2029 年)的複合年成長率為 16.72%。

智慧型手機 MLCC 市場由各種外殼尺寸提供的緊湊型解決方案驅動。

- 微型 MLCC 的使用在策略上針對的是空間受限的智慧型手機的複雜設計。採用緊湊型 0.201 MLCC 專門用於解決空間受限的智慧型手機的複雜設計挑戰。

- 從筆記型電腦到專用工業工具,5G 設備的普及對 MLCC 的需求產生了直接且重大的影響。特別是1201MLCC,因其緊湊的外形規格和與微型電子設備的兼容性而聞名,預計需求將激增。隨著 5G 技術超越智慧型手機,筆記型電腦、無人機和其他尖端設備製造商將需要可靠且高效的 MLCC 組件。

- 0.402 MLCC 比 0.201 MLCC 稍大,從而實現了尺寸和電容的最佳平衡。 0603 MLCC 非常適合需要中等電容的應用,從而實現了多功能性。

- 智慧型手機MLCC市場對0402外殼尺寸的需求正在激增。這種激增是由於5G技術的興起,這將刺激對電容器的需求。

- 隨著消費者熱情地採用無線家庭寬頻接入,對5G路由器和相關設備的需求將飆升,從而導致對這些關鍵MLCC的需求增加。

影響智慧型手機MLCC市場的區域動態

- 預計智慧型手機 MLCC 市場將在各個地區出現顯著成長,反映出推動需求的變革趨勢和技術進步。

- 在亞太地區,快速的技術進步和日益成長的數位連接正在推動智慧型手機 MLCC 市場發生重大變化。預計到 2030 年智慧型手機連線數將超過 30 億,普及率將達到 94%,因此對 MLCC 的需求龐大。 5G技術和物聯網的擴展將推動需求成長,使該地區成為全球技術領域的關鍵參與者。

- 隨著5G技術的興起,歐洲智慧型手機市場正在發生變化,對MLCC的需求產生了影響。預計到2025年5G網路覆蓋率將達到70%,這將增加對先進組件的需求。物聯網的成長和整個市場智慧型手機滲透率的變化為 MLCC 製造商提供了多方面的機會,凸顯了 MLCC 在業務擴展中的作用。

- 在5G快速演進的推動下,北美智慧型手機MLCC市場正經歷變革時期。美國和加拿大雄心勃勃的 5G 部署計劃正在推動對增強連接和訊號處理的需求,從而推動對 MLCC 的需求。行動技術對該地區 GDP 的重大貢獻凸顯了 MLCC 在技術進步中的關鍵作用。

- 包括中東、北非和撒哈拉以南非洲在內的世界其他地區的智慧型手機 MLCC 市場前景光明。在中東和北非地區,行動技術正在推動經濟成長和對 MLCC 的需求,而在撒哈拉以南非洲地區,行動革命正在刺激智慧型手機的普及,從而影響 MLCC 需求。儘管面臨挑戰,該地區的技術採用將推動智慧型手機 MLCC 市場持續成長。

全球智慧型手機MLCC市場趨勢

5G智慧型手機需求預計將導致4G智慧型手機銷售下降

- MLCC 對智慧型手機的電子元件非常重要,因為它們可以過濾和穩定處理器和記憶體等多個組件的電力輸送,從而降低噪音和干擾並提高訊號品質。高階智慧型手機可能包含 800-1,000 個 MLCC,而中階設備可能需要 300-600 個。

- 2020年4G智慧型手機銷量與前一年同期比較去年同期下降36.37%。智慧型手機市場的供需失衡受到了新冠疫情的影響。智慧型手機製造業受到下一代產品開發疲軟和現有產品出貨延遲的打擊。在中國當地,隨著智慧型手機的普及和4G的推出,行動網際網路使用量激增,幫助中國提升了在數位社會價值鏈中的地位。銷量從 2021 年的 7.9024 億台進一步下降 12% 至 2022 年的 6.9195 億台。隨著 5G 技術的推出,消費者希望升級他們的智慧型手機,以獲得更高的效能和更快的速度。

- 4G智慧型手機雖然不如5G設備先進,但仍需要能夠滿足高速資料傳輸和多媒體應用需求的MLCC。雖然對MLCC的要求可能比5G智慧型手機略低,但MLCC對於4G設備中的電源管理、訊號調節和降噪仍然至關重要。

AR 和 VR 技術的日益融合預計將推動 5G 智慧型手機的銷售

- 5G 智慧型手機處於技術進步的前沿,提供更快的資料速度、更低的延遲和增強的網路容量。這些智慧型手機需要具有更高電容的 MLCC,以滿足與 5G 連接相關的增加的資料吞吐量和功率需求。

- MLCC的整合可實現高效的電力傳輸、雜訊抑制和電壓穩定,從而確保5G智慧型手機的最佳性能。從2019年到2022年,每部5G智慧型手機將包含約600至1,400個MLCC。 MLCC的小型化正在幫助製造商開發理想尺寸的高性能、多功能且易於使用的5G智慧型手機。

- 5G智慧型手機銷量從2021年的6.0463億部成長25%至2022年的7.575億支。隨著消費者轉換並升級到配備最新技術的智慧型手機,對5G智慧型手機的需求預計會增加。 5G 設備越來越受歡迎,晶片製造商鼓勵智慧型手機製造商在其新產品中加入 5G 晶片。

- 5G技術的出現將使智慧型手機製造商能夠提升用戶體驗。 5G 具有低延遲和快速的網路速度,將實現虛擬實境 (VR) 和擴增實境(AR) 等新的可能性,從而增強遊戲體驗。隨著智慧型手機搭載功能的增多,預計MLCC的搭載數量也將隨之增加。

智慧型手機MLCC產業概況

智慧型手機MLCC市場適度整合,前五大公司佔59.43%的市場。市場的主要企業有:京瓷AVX元件株式會社(京瓷株式會社)、村田製作所、三星電機、太陽誘電和國巨株式會社(按字母順序排列)。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章執行摘要和主要發現

第2章 報告要約

第3章 引言

- 研究假設和市場定義

- 研究範圍

- 調查方法

第4章 產業主要趨勢

- 智慧型手機銷量

- 4G智慧型手機銷量

- 5G智慧型手機銷量

- Android智慧型手機銷量

- iOS智慧型手機銷售

- 智慧型手機價格分析

- 智慧型手機平均售價

- 每人智慧型手機數量

- 每人智慧型手機數量

- 5G連線數

- 全球5G行動連線數量

- 法律規範

- 價值鍊和通路分析

第5章市場區隔

- 科技

- 4G智慧型手機

- 5G智慧型手機

- 其他

- 作業系統

- 安卓

- iOS

- 錶殼尺寸

- 0 201

- 0 402

- 0 603

- 0 805

- 1 210

- 其他

- 電壓

- 10V~20V

- 20V以上

- 小於10V

- 電容

- 10μF至100μF

- 小於10μF

- 100μF 以上

- 介電類型

- 1級

- 2級

- 價格分佈

- 廉價智慧型手機(300 美元以下)

- 中階智慧型手機(300-700 美元)

- 高階智慧型手機(700 美元以上)

- 地區

- 亞太地區

- 歐洲

- 北美洲

- 世界其他地區

第6章競爭格局

- 關鍵策略趨勢

- 市場佔有率分析

- 商業狀況

- 公司簡介

- Kyocera AVX Components Corporation(Kyocera Corporation)

- Maruwa Co ltd

- Murata Manufacturing Co., Ltd

- Nippon Chemi-Con Corporation

- Samsung Electro-Mechanics

- Samwha Capacitor Group

- Taiyo Yuden Co., Ltd

- TDK Corporation

- Vishay Intertechnology Inc.

- Walsin Technology Corporation

- Wurth Elektronik GmbH & Co. KG

- Yageo Corporation

第 7 章 CEO 的關鍵策略問題CEO 的關鍵策略問題

第 8 章 附錄

- 世界概況

- 概述

- 五力分析框架

- 全球價值鏈分析

- 市場動態(DRO)

- 資訊來源及延伸閱讀

- 圖片列表

- 關鍵見解

- 資料包

- 詞彙表

簡介目錄

Product Code: 50001993

The Smartphone MLCC Market size is estimated at 5.35 billion USD in 2024, and is expected to reach 11.58 billion USD by 2029, growing at a CAGR of 16.72% during the forecast period (2024-2029).

The smartphone MLCC market is being propelled by compact solutions provided by various case sizes

- The utilization of compact MLCCs is strategically targeted toward the intricate designs of space-constrained smartphones. The incorporation of compact 0 201 MLCCs is specifically tailored to address the intricate design challenges presented by space-constrained smartphones.

- The proliferation of 5G-enabled devices, ranging from laptops to specialized industry tools, has a direct and consequential impact on the demand for MLCCs. Notably, 1 201 MLCCs, renowned for their compact form factor and compatibility with diminutive electronic devices, are projected to record a surge in demand. As 5G technology transcends the realm of smartphones, manufacturers engaging in the production of laptops, drones, and an array of other cutting-edge gadgets seek reliable and efficient MLCC components.

- Building upon this continuum, the 0 402 MLCCs, slightly larger than their 0 201 counterparts, effectively strike an optimal balance between dimensions and capacitance. The 0 603 MLCCs introduce a facet of versatility by catering adeptly to applications necessitating moderate levels of capacitance.

- An underlying trend of notable significance lies within the realm of the smartphone MLCC market, i.e., the meteoric rise in the demand for the 0 402 case size. This surge is attributed to the rise of 5G technology, which fuels the demand for these capacitors.

- As consumers enthusiastically adopt wireless home broadband access, the requisition for 5G routers and associated devices experiences a corresponding surge, thereby augmenting the demand landscape for these critical MLCCs.

Regional dynamics are shaping the smartphone MLCC market

- The smartphone MLCC market is poised for substantial growth across various regions, reflecting the transformative trends and technological advancements driving the demand.

- Asia-Pacific is witnessing significant changes in the smartphone MLCC market due to rapid technological advancements and digital connectivity growth. With over 3 billion projected smartphone connections by 2030 and a 94% adoption rate, the demand for MLCCs is substantial. 5G technology and IoT expansion drive the rising demand, positioning the region as a key player in the global tech landscape.

- Europe's smartphone market is evolving with the rise of 5G technology, impacting MLCC demand. A 70% 5G network coverage by 2025 is anticipated to drive the need for advanced components. IoT growth and changing smartphone adoption rates across markets offer diverse opportunities for MLCC manufacturers, emphasizing their role in expansion.

- Driven by rapid 5G evolution, the North American smartphone MLCC market is in a transformative phase. Ambitious 5G deployment plans in the United States and Canada boost the demand for enhanced connectivity and signal processing, fueling MLCC demand. The region's strong mobile technology contribution to GDP underscores the critical role of MLCCs in technological advancement.

- The Rest of the World, including the Middle East, North Africa, and Sub-Saharan Africa, presents a dynamic landscape for the smartphone MLCC market. Mobile technologies drive economic growth and demand for MLCCs in MENA, while Sub-Saharan Africa's mobile revolution spurs smartphone adoption, impacting MLCC requirements. Despite challenges, the region's adoption of technology positions it for sustained growth in the smartphone MLCC market.

Global Smartphone MLCC Market Trends

The demand for 5G smartphones is expected to decrease the sales of 4G smartphones

- MLCCs are important for electronic components in smartphones as they filter and stabilize power supply to several components, such as processors and memory, reduce noise and interference, and improve signal quality. A high-end smartphone uses 800-1,000 MLCCs, while low or mid-range devices require 300-600 per unit.

- The sales of 4G smartphones witnessed a Y-o-Y drop of 36.37% in 2020. The supply and demand imbalance in the smartphone market was affected by the COVID-19 pandemic. Weakened development of next-generation products and delayed shipments of existing products have adversely hit the smartphone manufacturing sector since China is the global manufacturing center for most of these components and devices. The surge in mobile internet usage in mainland China, driven by the increasing adoption of smartphones and the widespread availability of 4G, has propelled the country's advancement up the digital-society value chain. The sales witnessed a further decline of 12% in 2022, from 790.24 million units in 2021 to 691.95 million units in 2022. The introduction of 5G technology is driving consumers to upgrade their smartphones so they can benefit from enhanced performance and quicker speeds.

- 4G smartphones, although not as advanced as 5G devices, still require MLCCs that can handle the demands of high-speed data transmission and multimedia applications. MLCC requirements may be slightly lower compared to 5G smartphones, but MLCCs remain critical for power management, signal conditioning, and noise reduction in 4G devices.

The growing integration of AR and VR technology is expected to propel the sales of 5G smartphones

- 5G smartphones are at the forefront of technological advancements, offering faster data speeds, lower latency, and enhanced network capacity. These smartphones require MLCCs with higher capacitance to support the increased data throughput and power demands associated with 5G connectivity.

- The integration of MLCCs enables efficient power delivery, noise suppression, and voltage stabilization, ensuring optimal performance of 5G smartphones. Approximately 600-1,400 MLCCs were used in each 5G smartphone during 2019-2022. The miniaturization of MLCCs is helping manufacturers in developing a high-performing, multipurpose, and easy-to-use 5G smartphone with the ideal size.

- The sales of 5G smartphones rose by 25% in 2022, from 604.63 million units in 2021 to 757.50 million units in 2022. The demand for 5G smartphones is expected to increase as consumers switch and upgrade to smartphones with the latest technology. The popularity of 5G devices is on the rise, prompting chipmakers to encourage smartphone manufacturers to integrate 5G chips into their new product range.

- The advent of 5G technology allows smartphone manufacturers to improve the user experience. With lower latency and faster network speeds, 5G enables new possibilities, such as virtual reality (VR) and augmented reality (AR), for enhanced gaming experiences. As the number of functions installed in a smartphone increases, the number of installed MLCCs is also expected to increase proportionally.

Smartphone MLCC Industry Overview

The Smartphone MLCC Market is moderately consolidated, with the top five companies occupying 59.43%. The major players in this market are Kyocera AVX Components Corporation (Kyocera Corporation), Murata Manufacturing Co., Ltd, Samsung Electro-Mechanics, Taiyo Yuden Co., Ltd and Yageo Corporation (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Smartphones Sales

- 4.1.1 4G Smartphone Sales

- 4.1.2 5G Smartphone Sales

- 4.1.3 Android Smartphone Sales

- 4.1.4 iOS Smartphone Sales

- 4.2 Smartphone Price Analysis

- 4.2.1 Average Selling Price of Smartphones

- 4.3 Smartphone Per Capita

- 4.3.1 Smartphone Volume Per Capita

- 4.4 5g Connections

- 4.4.1 Global 5G Mobile Connections

- 4.5 Regulatory Framework

- 4.6 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2029 and analysis of growth prospects)

- 5.1 Technology

- 5.1.1 4G Smartphones

- 5.1.2 5G Smartphones

- 5.1.3 Others

- 5.2 Operating System

- 5.2.1 Android

- 5.2.2 iOS

- 5.3 Case Size

- 5.3.1 0 201

- 5.3.2 0 402

- 5.3.3 0 603

- 5.3.4 0 805

- 5.3.5 1 210

- 5.3.6 Others

- 5.4 Voltage

- 5.4.1 10V to 20V

- 5.4.2 Above 20V

- 5.4.3 Less than 10V

- 5.5 Capacitance

- 5.5.1 10 μF to 100 μF

- 5.5.2 Less than 10 μF

- 5.5.3 More than 100 μF

- 5.6 Dielectric Type

- 5.6.1 Class 1

- 5.6.2 Class 2

- 5.7 Price Range

- 5.7.1 Budget smartphones (Less than USD 300)

- 5.7.2 Mid-range smartphones (USD 300 - USD 700)

- 5.7.3 Premium smartphones (More than USD 700)

- 5.8 Region

- 5.8.1 Asia-Pacific

- 5.8.2 Europe

- 5.8.3 North America

- 5.8.4 Rest of the World

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 Kyocera AVX Components Corporation (Kyocera Corporation)

- 6.4.2 Maruwa Co ltd

- 6.4.3 Murata Manufacturing Co., Ltd

- 6.4.4 Nippon Chemi-Con Corporation

- 6.4.5 Samsung Electro-Mechanics

- 6.4.6 Samwha Capacitor Group

- 6.4.7 Taiyo Yuden Co., Ltd

- 6.4.8 TDK Corporation

- 6.4.9 Vishay Intertechnology Inc.

- 6.4.10 Walsin Technology Corporation

- 6.4.11 Wurth Elektronik GmbH & Co. KG

- 6.4.12 Yageo Corporation

7 KEY STRATEGIC QUESTIONS FOR MLCC CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

02-2729-4219

+886-2-2729-4219