|

市場調查報告書

商品編碼

1684050

通訊用 MLCC -市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Telecommunication MLCC - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

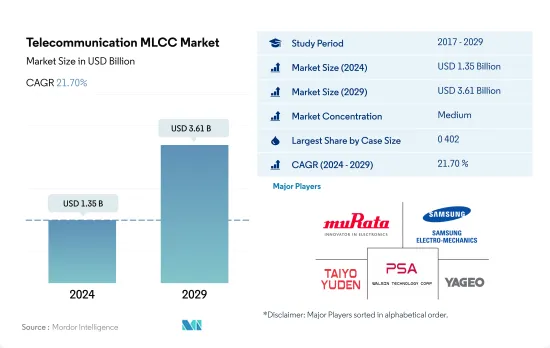

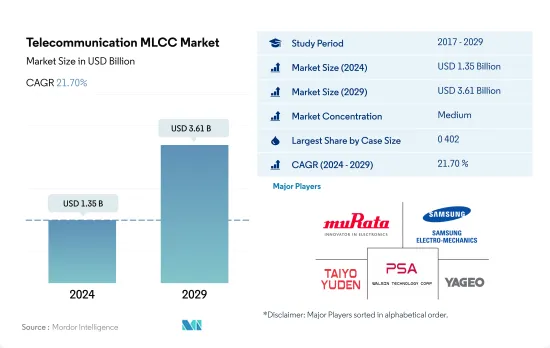

預計2024年通訊MLCC市場規模為13.5億美元,到2029年將達到36.1億美元,預測期內(2024-2029年)的複合年成長率為21.70%。

各種外殼尺寸推動通訊MLCC的演進

- 由於技術進步和對小型高效能電子元件的需求,通訊MLCC 市場正在經歷重大變革時期期。在「按錶殼尺寸」部分,主要有五個類別:0 201、0 402、0 603、1 005 和 1 210。每種錶殼尺寸在塑造產業發展方面都發揮關鍵作用。

- 0201 錶殼尺寸對於滿足產業不斷變化的需求仍然至關重要。該細分市場累計強勁成長勢頭,2022 年銷售額達 1.4529 億美元。其緊湊的外形規格滿足了機上盒 (STB) 等設備的空間最佳化需求,這對於實現 4K HDR 和杜比全景聲 (Dolby Atmos) 支援等高級功能至關重要。

- 錶殼尺寸0603象徵日益成長的合作和技術創新。其緊湊的外形規格與中國電信和中國聯通的5G網路共用計劃的戰略合作相輔相成。 1005 機殼尺寸可適應這些創新,從而實現個人化服務和高效的頻寬利用。 ADB 和 KAONMEDIA 等夥伴關係利用這種機殼尺寸來引入最尖端科技並提高設備性能。

- 1210型機箱在通訊基礎設施中發揮著至關重要的作用。它能夠實現基地台內的高效能訊號處理、功率轉換和射頻電路。 Ubiik 的 freeRANTM 和 Qualcomm 的緊湊型宏 5G RAN 平台等創新表明了對高效能元件的需求。

- 從先進機上盒的小型但功能強大的組件到基地台的高效訊號處理,我們為整個通訊市場提供了各種尺寸的產品,兼顧了尺寸限制和技術能力,從而推動了行業的發展。

全球通訊基礎設施對MLCC的需求不斷成長

- 由於 5G 網路的快速部署以及對高速連接和先進通訊服務的需求不斷成長,全球通訊業正在經歷動態成長。

- 亞太地區正處於通訊業快速成長的前沿,智慧型手機、資料通訊服務和數位內容的廣泛應用就是明證。中國等國家正率先推出 5G 技術,目前已有數百萬個 5G基地台運作。該地區對 MLCC 的需求很大,主要是因為需要能夠承受高溫並保持訊號完整性的高效通訊基地台。隨著該地區在通訊不斷創新和領先,對 MLCC 的需求依然強勁。

- 美國是全球通訊領域的重要參與者,在建立5G網路方面取得了長足進步。隨著AT&T、Verizon、T-Mobile等科技巨頭大力投資5G技術,通訊基地台對MLCC的需求不斷上升。

- 歐洲行動應用和服務的快速成長推動了加強通訊基礎設施的需求。英國、德國、法國和西班牙等國家推出5G網路,增加了對基地台的需求。 MLCC 在實現 5G 先進功能(例如更高的資料傳輸速度和更低的延遲)方面發揮關鍵作用。

- 隨著5G網路的快速部署,中東和非洲正在經歷重大變革時期。隨著商用 5G 服務在全部區域推出,世界其他地區對 MLCC 的需求正在激增。

全球通訊用MLCC市場動向

5G網路部署不斷增加推動MLCC需求

- 5G技術的到來為通訊業帶來了重大進步,徹底改變了更快的無線連線。其中,5G/mmWave基地台已成為部署5G網路的必不可少的組成部分,尤其是在資料需求量大的都市區。這些基地台使用毫米波頻率來發送和接收無線電訊號,從而實現 5G 技術的優勢。 5G/mmWave 基地台中 MLCC 的整合在支援功能方面發揮著至關重要的作用,並對通訊MLCC 市場具有影響力。

- 5G/mmWave基地台旨在利用 24 GHz 至 100 GHz 範圍內的 mmWave 頻率的獨特特性來提供超快速且可靠的無線連接。 5G/mmWave基地台的部署對於充分發揮自動駕駛汽車和物聯網等新興應用的潛力至關重要。

- 從過往分析來看,通訊MLCC市場5G/mmWave基地台的成長模式及預測已經顯現。這些基地台的數量在早期非常少,隨著時間的推移逐漸成長。 2018 年該數量將達到 9 萬台,2019 年將增至 12 萬台。儘管面臨新冠疫情帶來的挑戰,5G/mmWave基地台部署仍保持韌性,2020 年將進一步成長至 13 萬台,2022 年將增至 22 萬台。預測顯示該數量將繼續擴大,到 2026 年將達到 50 萬台。這一上升趨勢反映出對利用 mmWave 頻率來改善無線效能的 5G 網路的需求不斷成長,尤其是在人口稠密的都市區。

引領通訊MLCC市場的成長

- 通訊市場正在經歷 5G 固定無線存取 (FWA) 連線的大幅成長。預計從 2020 年到 2026 年,該市場將以 68% 的複合年成長率呈指數級成長。這一成長將導致銷量大幅增加,預計 2020 年 5G FWA 連接數為 200 萬,到 2026 年將達到 6,500 萬。這對 MLCC 製造商來說是一個巨大的機遇,因為 FWA 設備嚴重依賴 MLCC 來實現高效能。客戶端設備 (CPE)、基地台和網路設備等 FWA 設備正在推動對 MLCC 的需求。隨著 5G FWA 的採用不斷擴大,對這些電容器的需求將會增加。為了滿足5G FWA設備的特定要求和預期性能,對於MLCC製造商來說,持續的技術創新和生產供給能力的調整至關重要。

- 認知到 4G 和其他技術在通訊市場中持續的重要性至關重要。 MLCC 在智慧型手機、路由器和物聯網設備等設備中發揮至關重要的作用,有助於電源管理、訊號濾波和雜訊抑制。隨著 4G 和其他技術的連接數量的增加,這些設備對 MLCC 的需求也在增加。儘管如此,5G FWA連接的快速成長為MLCC製造商創造了誘人的市場機會。但同樣重要的是要認知到對 4G 和其他技術的持續需求。透過創新和夥伴關係滿足這兩個行業的獨特需求,MLCC 製造商可以推動成長並充分發揮通訊MLCC 市場的潛力。

通訊MLCC產業概況

通訊MLCC市場適度整合,前五大企業佔比44.61%。市場的主要企業有:村田製作所、三星電機、太陽誘電、華新科技和國巨集團(按字母順序排列)。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章執行摘要和主要發現

第2章 報告要約

第3章 引言

- 研究假設和市場定義

- 研究範圍

- 調查方法

第4章 產業主要趨勢

- 基地台銷售

- 5G/毫米波基地台

- 宏4G基地台

- 宏5G/Sub-6GHz基地台

- 小型4G基地台

- 緊湊型5G基地台

- 機上盒銷售

- 全球機上盒銷量

- FWA連接

- 全球範圍內的 FWA 連接

- 法律規範

- 價值鍊和通路分析

第5章市場區隔

- 設備類型

- 基地台

- 機上盒

- 其他

- 錶殼尺寸

- 0 201

- 0 402

- 0 603

- 1 005

- 1 210

- 其他

- 電壓

- 50V~200V

- 小於50V

- 200V以上

- 電容

- 10μF至100μF

- 小於10μF

- 100μF 以上

- 介電類型

- 1級

- 2級

- 地區

- 亞太地區

- 歐洲

- 北美洲

- 世界其他地區

第6章競爭格局

- 關鍵策略趨勢

- 市場佔有率分析

- 商業狀況

- 公司簡介

- Kyocera AVX Components Corporation(Kyocera Corporation)

- Maruwa Co ltd

- Murata Manufacturing Co., Ltd

- Nippon Chemi-Con Corporation

- Samsung Electro-Mechanics

- Samwha Capacitor Group

- Taiyo Yuden Co., Ltd

- TDK Corporation

- Vishay Intertechnology Inc.

- Walsin Technology Corporation

- Wurth Elektronik GmbH & Co. KG

- Yageo Corporation

第 7 章 CEO 的關鍵策略問題CEO 的關鍵策略問題

第 8 章 附錄

- 世界概況

- 概述

- 五力分析框架

- 全球價值鏈分析

- 市場動態(DRO)

- 資訊來源及延伸閱讀

- 圖片列表

- 關鍵見解

- 資料包

- 詞彙表

簡介目錄

Product Code: 50001995

The Telecommunication MLCC Market size is estimated at 1.35 billion USD in 2024, and is expected to reach 3.61 billion USD by 2029, growing at a CAGR of 21.70% during the forecast period (2024-2029).

Different case sizes are fueling the evolution of telecommunication MLCCs

- The telecommunication MLCC market is undergoing a profound transformation, driven by technological advancements and the demand for compact yet high-performance electronic components. Within the "by case size" segment, five key categories stand out: 0 201, 0 402, 0 603, 1 005, and 1 210. Each case size plays a pivotal role in shaping the industry's evolution.

- The 0 201 case size is central to meeting evolving industry demands. Demonstrating strong growth, this segment generated USD 145.29 million in revenue in 2022. Its compact form factor aligns with the need for space optimization in devices like set-top boxes (STBs), which is crucial for enabling advanced features such as 4K HDR and Dolby Atmos support.

- The 0 603 case size represents collaborative progress and technological innovation. Its compact form factor complements strategic collaborations, exemplified by China Telecom and China Unicom's 5G network sharing initiative. Case Size 1 005 accommodates these innovations, allowing personalized services and efficient bandwidth utilization. Partnerships like ADB and KAONMEDIA leverage this case size to introduce cutting-edge technologies, enhancing device performance.

- The 1 210 case size plays a significant role in telecom infrastructure. It enables efficient signal processing, power conversion, and RF circuitry within base stations. Innovations like Ubiik's freeRANTM and Qualcomm's Compact Macro 5G RAN Platform exemplify the demand for high-performance components.

- Case sizes of all types in the telecommunication market with compact yet powerful components for advanced STBs to efficiently signal processing in base stations contribute to the industry's progress, offering a balance between size constraints and technological capabilities.

The demand for MLCCs is growing in the global telecommunication infrastructure

- The global telecommunication sector is experiencing dynamic growth, driven by the rapid deployment of 5G networks and the increasing demand for high-speed connectivity and advanced communication services.

- Asia-Pacific is at the forefront of the telecommunications industry's surge, marked by the widespread adoption of smartphones, data services, and digital content. Countries such as China are pioneering the deployment of 5G technology, with millions of operational 5G base stations. The demand for MLCCs in the region is substantial, driven by the need for efficient communication base stations that can withstand high temperatures and maintain signal integrity. As the region continues to innovate and lead in telecommunications, the demand for MLCCs remains strong.

- The United States is a key player in the global telecommunication sector, making significant strides in establishing the national 5G network. With tech giants like AT&T, Verizon, and T-Mobile investing heavily in 5G technology, the demand for MLCCs in communication base stations is on the rise.

- Europe has witnessed a surge in mobile applications and services, driving the need for enhanced telecommunications infrastructure. The deployment of 5G networks across countries like the United Kingdom, Germany, France, and Spain has led to an increased demand for base stations. MLCCs are playing a critical role in enabling the advanced functionalities of 5G, such as higher data rates and reduced latency.

- Middle East & Africa is undergoing a significant transformation with the rapid deployment of 5G networks. As commercial 5G services are introduced across the region, the demand for MLCCs in the Rest of the World has surged.

Global Telecommunication MLCC Market Trends

The rising adoption of 5G networks is propelling the MLCC demand

- The emergence of 5G technology has brought significant advancements to the telecommunications industry, revolutionizing wireless connectivity with faster speeds. In this context, 5G/mmWave base stations have become crucial components for deploying 5G networks, particularly in urban areas with high data demand. These base stations use mmWave frequencies to transmit and receive wireless signals, enabling the benefits of 5G technology. The integration of MLCCs within 5G/mmWave base stations plays a pivotal role in supporting functionality and presents implications for the telecom MLCC market.

- 5G/mmWave base stations are designed to deliver ultra-fast and reliable wireless connectivity by leveraging the unique characteristics of mmWave frequencies, ranging from 24 GHz to 100 GHz. The deployment of 5G/mmWave base stations is crucial for achieving the full potential of emerging applications such as autonomous vehicles and IoT.

- Upon historical analysis, a clear growth pattern and projections emerge for 5G/mmWave base stations within the telecom MLCC market. The volume of these base stations started from negligible figures in the early years and experienced gradual growth over time. In 2018, the volume reached 0.09 million units, increasing to 0.12 million units in 2019. Despite the challenges posed by the global COVID-19 pandemic, the deployment of 5G/mmWave base stations remained resilient, with a further increase to 0.13 million units in 2020 and 0.22 million units in 2022. The projected figures indicate a continued expansion, with the volume expected to reach 0.5 million units by 2026. This upward trend reflects the growing demand for 5G networks to leverage mmWave frequencies for enhanced wireless performance, particularly in densely populated urban areas.

Navigating growth in the telecommunications MLCC market

- The telecommunication market is witnessing a remarkable surge in 5G fixed wireless access (FWA) connections. It is projected to expand exponentially at a CAGR of 68% from 2020 to 2026. This growth translates to a substantial increase in volume, with 2 million 5G FWA connections in 2020, which is expected to reach 65 million by 2026. This presents a significant opportunity for MLCC manufacturers, as FWA devices heavily rely on MLCCs for efficient performance. FWA devices, including customer premises equipment (CPE), base stations, and network equipment, are driving the demand for MLCCs. As the adoption of 5G FWA continues to grow, the need for these capacitors will be amplified. To meet the specific requirements and performance expectations of 5G FWA devices, ongoing innovation and alignment of production and supply capabilities are paramount for MLCC manufacturers.

- It is crucial to recognize the continued significance of 4G and other technologies in the telecommunication market. MLCCs play a vital role in these devices, such as smartphones, routers, and IoT devices, facilitating power management, signal filtering, and noise suppression. As the number of 4G and other technology connections increases, so does the demand for MLCCs in these devices. Nevertheless, the rapid growth of 5G FWA connections presents a compelling market opportunity for MLCC manufacturers. However, it is essential to recognize the continued demand for 4G and other technologies. By addressing the unique needs of both segments through innovation and partnerships, MLCC manufacturers can drive growth and capture the full potential of the telecommunications MLCC market.

Telecommunication MLCC Industry Overview

The Telecommunication MLCC Market is moderately consolidated, with the top five companies occupying 44.61%. The major players in this market are Murata Manufacturing Co., Ltd, Samsung Electro-Mechanics, Taiyo Yuden Co., Ltd, Walsin Technology Corporation and Yageo Corporation (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Base Station Sales

- 4.1.1 5G/mmWave Base Station

- 4.1.2 Macro 4G Base Station

- 4.1.3 Macro-5G/sub6GHz Base Station

- 4.1.4 Small 4G Base Station

- 4.1.5 Small 5G Base Station

- 4.2 Set Top Boxes Sales

- 4.2.1 Global Set Top Boxes Sales

- 4.3 Fwa Connections

- 4.3.1 Global FWA connections

- 4.4 Regulatory Framework

- 4.5 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2029 and analysis of growth prospects)

- 5.1 Device Type

- 5.1.1 Base Stations

- 5.1.2 Set Top Boxes

- 5.1.3 Others

- 5.2 Case Size

- 5.2.1 0 201

- 5.2.2 0 402

- 5.2.3 0 603

- 5.2.4 1 005

- 5.2.5 1 210

- 5.2.6 Others

- 5.3 Voltage

- 5.3.1 50V to 200V

- 5.3.2 Less than 50V

- 5.3.3 More than 200V

- 5.4 Capacitance

- 5.4.1 10 μF to 100 μF

- 5.4.2 Less than 10 μF

- 5.4.3 More than 100 μF

- 5.5 Dielectric Type

- 5.5.1 Class 1

- 5.5.2 Class 2

- 5.6 Region

- 5.6.1 Asia-Pacific

- 5.6.2 Europe

- 5.6.3 North America

- 5.6.4 Rest of the World

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 Kyocera AVX Components Corporation (Kyocera Corporation)

- 6.4.2 Maruwa Co ltd

- 6.4.3 Murata Manufacturing Co., Ltd

- 6.4.4 Nippon Chemi-Con Corporation

- 6.4.5 Samsung Electro-Mechanics

- 6.4.6 Samwha Capacitor Group

- 6.4.7 Taiyo Yuden Co., Ltd

- 6.4.8 TDK Corporation

- 6.4.9 Vishay Intertechnology Inc.

- 6.4.10 Walsin Technology Corporation

- 6.4.11 Wurth Elektronik GmbH & Co. KG

- 6.4.12 Yageo Corporation

7 KEY STRATEGIC QUESTIONS FOR MLCC CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

02-2729-4219

+886-2-2729-4219