|

市場調查報告書

商品編碼

1871187

基於DNA的客製化維生素配方市場機會、成長促進因素、產業趨勢分析及預測(2025-2034年)DNA-Based Customized Vitamin Formulations Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

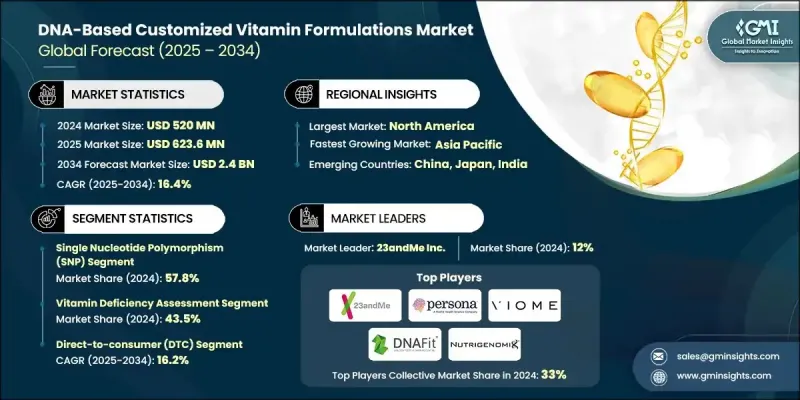

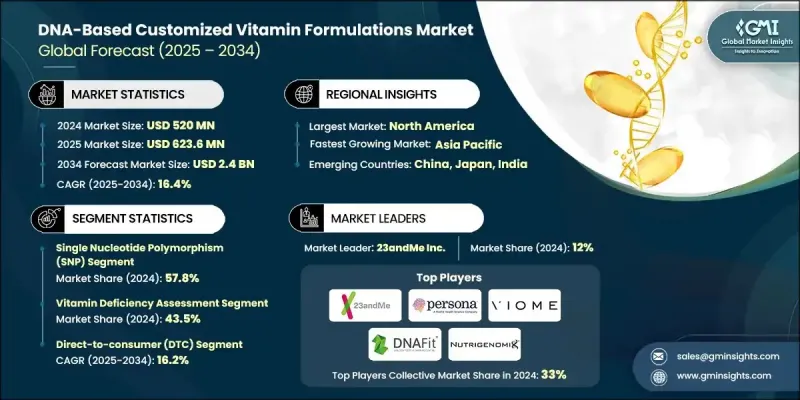

2024 年全球 DNA 客製化維生素配方市場價值為 5.2 億美元,預計到 2034 年將以 16.4% 的複合年成長率成長至 24 億美元。

基因檢測技術的進步和消費者對個人化健康意識的日益增強推動了這一市場的成長,而慢性病的高發也使得量身定做的營養方案成為可能。儘管目前仍屬於小眾領域,但它正與更廣泛的個人化營養市場同步擴張。價格親民且易於取得的基因檢測吸引了新的消費者,而新興地區數位健康基礎設施的快速發展也蘊藏著巨大的潛力。從基因檢測到營養補充劑配送和健康追蹤,端到端的個人化營養平台創造了高階產品和服務,並帶來了交叉銷售的機會。全球數百萬成年人都在服用膳食補充劑,在將基因資訊融入預防保健策略、營養規劃和整體生活方式最佳化的健康生態系統的支持下,該市場仍有巨大的成長空間。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 5.2億美元 |

| 預測值 | 24億美元 |

| 複合年成長率 | 16.4% |

單核苷酸多態性 (SNP) 檢測市場佔有率為 57.8%,預計到 2034 年將以 14.9% 的複合年成長率成長。 SNP 分析具有成本效益高、臨床驗證有效且能高度精確地將遺傳變異與營養代謝聯繫起來等優點。隨著技術的成熟、變異譜的不斷擴展以及解讀方法的改進,基於 SNP 的方法在以消費者為中心的營養市場中持續獲得青睞。

2024年,維生素缺乏評估市場佔43.5%的佔有率,預計2025年至2034年將以16.1%的複合年成長率成長。維生素缺乏評估能夠深入了解個體在營養吸收和利用方面的遺傳傾向,是預防性健康方案的基礎。消費者和醫療保健提供者對影響維生素水平的遺傳因素的認知不斷提高,推動了預測性和精準營養規劃的普及。

預計到2024年,北美基於DNA的客製化維生素配方市佔率將達到44.2%。該地區受益於先進的醫療保健基礎設施、較高的消費者意識以及有利的監管環境。消費者對直接基因檢測的接受度推動了該類產品的普及,預防性健康方法也日益融入臨床實踐。此外,個人化營養新創公司獲得的大量風險投資進一步加速了市場成長。

全球DNA客製化維生素配方市場的主要公司包括Persona Nutrition、Rootine、Viome Life Sciences、GenoPalate、Habit(金寶湯公司)、Nutrigenomix Inc.、23andMe Inc.、Care/of、Season Health、InsideTracker、DNAfit(Prenetics)、Bioniq、Map/of、Season Health、InsideTracker、DNAfit(Prenetics)、Bioniq、Mapmygenome、XC。這些公司致力於拓展產品線、整合先進的基因檢測技術並利用人工智慧驅動的營養洞察。與醫療保健機構、健身平台和健康生態系統的合作有助於提升信譽度和客戶覆蓋率。直銷模式和數位化平台則增強了使用者參與度和便利性。行銷重點強調個人化、預防性健康益處以及經科學驗證的建議,以建立信任。

目錄

第1章:方法論與範圍

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 供應商格局

- 利潤率

- 每個階段的價值增加

- 影響價值鏈的因素

- 中斷

- 產業影響因素

- 成長促進因素

- 慢性病盛行率上升

- 消費者健康意識的增強

- 技術進步與成本降低

- 產業陷阱與挑戰

- 監管複雜性和合規要求

- 有限的臨床驗證

- 市場機遇

- 人工智慧與機器學習整合

- 穿戴式裝置融合

- 成長促進因素

- 成長潛力分析

- 監管環境

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 波特的分析

- PESTEL 分析

- 價格趨勢

- 按地區

- 依技術類型

- 未來市場趨勢

- 技術與創新格局

- 當前技術趨勢

- 新興技術

- 專利格局

- 貿易統計(HS編碼)(註:僅提供重點國家的貿易統計資料)

- 主要進口國

- 主要出口國

- 永續性和環境方面

- 永續實踐

- 減少廢棄物策略

- 生產中的能源效率

- 環保舉措

- 碳足跡考量

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- MEA

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 合作夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估算與預測:依技術類型分類,2021-2034年

- 主要趨勢

- 單核苷酸多態性(SNP)

- 下一代定序(NGS)

- 微陣列技術

- 即時PCR

第6章:市場估算與預測:依應用領域分類,2021-2034年

- 主要趨勢

- 維生素缺乏評估

- 代謝健康最佳化

- 運動表現提升

- 抗老與長壽支持

第7章:市場估計與預測:依配銷通路分類,2021-2034年

- 主要趨勢

- 直接面對消費者(DTC)

- 醫療保健提供者

- 零售藥局

- 專業營養品店

第8章:市場估算與預測:依地區分類,2021-2034年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 歐洲其他地區

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 亞太其他地區

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

- 中東和非洲其他地區

第9章:公司簡介

- 23andMe Inc.

- Persona Nutrition

- Viome Life Sciences

- DNAfit (Prenetics)

- Nutrigenomix Inc.

- Rootine

- InsideTracker

- GenoPalate

- Care/of

- Habit (Campbell Soup Company)

- Season Health

- Bioniq

- Xcode Life

- Mapmygenome

- Avesthagen

The Global DNA-Based Customized Vitamin Formulations Market was valued at USD 520 million in 2024 and is estimated to grow at a CAGR of 16.4% to reach USD 2.4 Billion by 2034.

The growth is fueled by advancements in genetic testing technologies and rising consumer awareness of personalized health, driven in part by the prevalence of chronic diseases that benefit from tailored nutritional approaches. Although still a niche sector, it is expanding alongside the broader personalized nutrition market. Affordable and accessible genetic testing has attracted new consumers, while digital health infrastructure growth in emerging regions offers untapped potential. End-to-end personalized nutrition platforms, from genetic testing to supplement delivery and health tracking, create premium offerings and cross-selling opportunities. With millions of adults consuming dietary supplements globally, the market has considerable room for expansion, supported by wellness ecosystems that integrate genetic insights into preventive health strategies, nutrition planning, and overall lifestyle optimization.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $520 Million |

| Forecast Value | $2.4 Billion |

| CAGR | 16.4% |

The single-nucleotide polymorphism (SNP) testing segment held a 57.8% share and is projected to grow at a CAGR of 14.9% through 2034. SNP analysis is cost-effective, clinically validated, and highly precise in linking genetic variants to nutrient metabolism. With mature technology, growing variant panels, and improved interpretation methods, SNP-based approaches continue to gain traction in consumer-focused nutrition markets.

The vitamin deficiency assessment segment held 43.5% share in 2024 and is expected to grow at a CAGR of 16.1% from 2025 to 2034. Assessing vitamin deficiencies provides critical insights into an individual's genetic predisposition for nutrient absorption and utilization, forming the backbone of preventive health protocols. Rising awareness of the genetic factors influencing vitamin status drives adoption among consumers and healthcare providers seeking predictive and accurate nutrition planning.

North America DNA-Based Customized Vitamin Formulations Market held a 44.2% share in 2024. The region benefits from advanced healthcare infrastructure, high consumer awareness, and a supportive regulatory environment. Acceptance of direct-to-consumer genetic testing has driven adoption, and preventive health approaches are increasingly integrated into clinical practice. Strong venture capital funding for personalized nutrition startups further accelerates market growth.

Key companies in the Global DNA-Based Customized Vitamin Formulations Market include Persona Nutrition, Rootine, Viome Life Sciences, GenoPalate, Habit (Campbell Soup Company), Nutrigenomix Inc., 23andMe Inc., Care/of, Season Health, InsideTracker, DNAfit (Prenetics), Bioniq, Mapmygenome, Xcode Life, and Avesthagen. Companies in the DNA-Based Customized Vitamin Formulations Market focus on expanding product offerings, integrating advanced genetic testing, and leveraging AI-driven nutrition insights. Partnerships with healthcare providers, fitness platforms, and wellness ecosystems improve credibility and customer access. Direct-to-consumer sales models and digital platforms enhance user engagement and convenience. Marketing efforts emphasize personalization, preventive health benefits, and scientifically validated recommendations to build trust.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Technology type

- 2.2.3 Application

- 2.2.4 Distribution channel

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising chronic disease prevalence

- 3.2.1.2 Consumer health consciousness growth

- 3.2.1.3 Technology advancement & cost reduction

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Regulatory complexity & compliance requirements

- 3.2.2.2 Limited clinical validation

- 3.2.3 Market opportunities

- 3.2.3.1 AI & machine learning integration

- 3.2.3.2 Wearable device convergence

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By technology type

- 3.8 Future market trends

- 3.9 Technology and Innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code) ( Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint consideration

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates and Forecast, By Technology Type, 2021-2034 (USD Million) (Kilo Tons)

- 5.1 Key trends

- 5.2 Single nucleotide polymorphism (SNP)

- 5.3 Next-generation sequencing (NGS)

- 5.4 Microarray technology

- 5.5 Real-time PCR

Chapter 6 Market Estimates and Forecast, By Application, 2021-2034 (USD Million) (Kilo Tons)

- 6.1 Key trends

- 6.2 Vitamin deficiency assessment

- 6.3 Metabolic health optimization

- 6.4 Athletic performance enhancement

- 6.5 Aging & longevity support

Chapter 7 Market Estimates and Forecast, By Distribution Channel, 2021-2034 (USD Million) (Kilo Tons)

- 7.1 Key trends

- 7.2 Direct-to-consumer (DTC)

- 7.3 Healthcare providers

- 7.4 Retail pharmacies

- 7.5 Specialty nutrition stores

Chapter 8 Market Estimates and Forecast, By Region, 2021-2034 (USD Million) (Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Rest of Europe

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Rest of Asia Pacific

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.5.4 Rest of Latin America

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

- 8.6.4 Rest of Middle East and Africa

Chapter 9 Company Profiles

- 9.1 23andMe Inc.

- 9.2 Persona Nutrition

- 9.3 Viome Life Sciences

- 9.4 DNAfit (Prenetics)

- 9.5 Nutrigenomix Inc.

- 9.6 Rootine

- 9.7 InsideTracker

- 9.8 GenoPalate

- 9.9 Care/of

- 9.10 Habit (Campbell Soup Company)

- 9.11 Season Health

- 9.12 Bioniq

- 9.13 Xcode Life

- 9.14 Mapmygenome

- 9.15 Avesthagen