|

市場調查報告書

商品編碼

1858831

個人化營養人工智慧平台市場機會、成長促進因素、產業趨勢分析及預測(2025-2034年)Personalized Nutrition AI Platforms Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

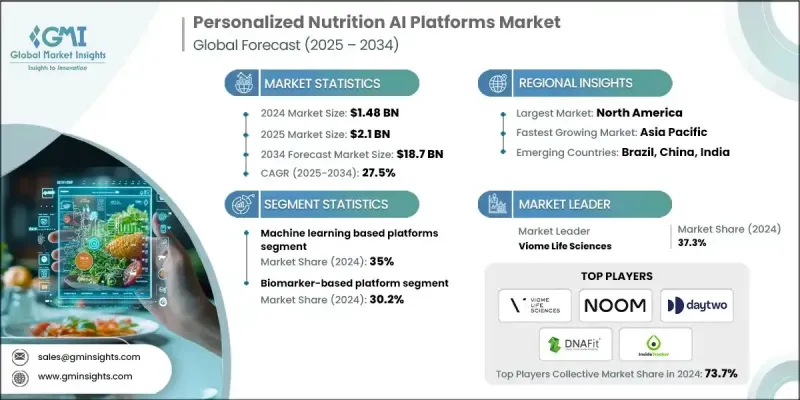

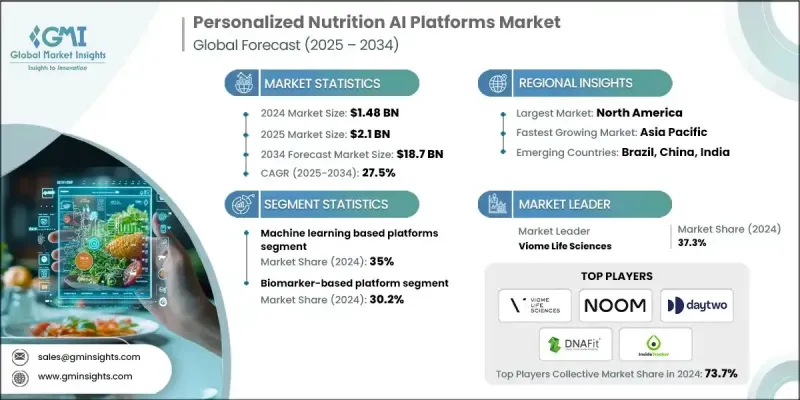

2024 年全球個人化營養 AI 平台市值為 14.8 億美元,預計到 2034 年將以 27.5% 的複合年成長率成長至 187 億美元。

市場成長的驅動力在於消費者對個人化健康解決方案的需求日益成長,這種解決方案超越了傳統的「一刀切」模式。隨著人們健康意識的增強和預防保健的日益普及,能夠根據每位使用者的生物特徵、生活方式和健康目標量身定做營養指導的人工智慧平台正迅速崛起。消費者現在更傾向於高度個人化的飲食計劃和營養補充服務,這些服務會考慮過敏史、飲食目標和既往病史等因素。活躍人群對運動表現最佳化和健身飲食的日益關注也進一步推動了市場的發展。這些平台擴大整合了基因組學、蛋白質組學和微生物組分析等複雜的生物資料,從而提供與每個人獨特生理特徵相契合的營養建議。透過利用這些資料,個人化的人工智慧平台能夠提供高度精準的建議,使其成為一般用戶和健康專業人士信賴的工具。這些工具的便利性、精準性和即時適應性正在幫助消費者重塑他們的營養策略。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 14.8億美元 |

| 預測值 | 187億美元 |

| 複合年成長率 | 27.5% |

到2024年,基於機器學習的平台將佔據35%的市場。這些平台依賴結構化資料集,例如穿戴式裝置輸出、醫療檢測結果和飲食日記。隨著資料集的擴展和標註的準確性不斷提高,機器學習演算法也在不斷發展,提供越來越精準、更具實用性的營養建議。增強型學習模型正在推動數位營養生態系統的創新,使用戶能夠獲得隨著時間推移而不斷改進並適應行為、環境或健康狀況變化的見解。

2024年,基於生物標記的細分市場佔據了30.2%的市場佔有率,預計到2034年將以27.5%的複合年成長率成長。這些平台專注於將血液檢測和臨床標記資料轉化為個人化建議,旨在改善心血管和代謝健康等領域。它們能夠透過可測量的健康資料追蹤使用者對介入措施的反應,贏得了醫療專業人員和終端用戶的信任,進一步鞏固了其在醫療保健和健康領域的地位。

預計到2024年,美國個人化營養人工智慧平台市場規模將達5.138億美元,領先北美地區。這一成長主要得益於美國完善的醫療保健生態系統、不斷成長的數位健康投資以及市場對人工智慧營養平台的廣泛接受。監管機構對醫療器材軟體(SaMD)和臨床決策支援(CDS)系統等數位健康工具的支持,以及基於感測器的穿戴式設備和持續血糖監測設備的普及,正在拓展即時個人化指導的潛力。

全球個人化營養人工智慧平台市場的主要參與者包括 Viome Life Sciences、Baze、Noom Inc.、ZOE Limited、Nutrigenomix Inc.、Rootine、DNAfit (Prenetics)、InsideTracker、DayTwo Ltd. 和 Season Health。為了鞏固市場地位,各公司正專注於開發由人工智慧和機器學習驅動的數據豐富的個人化引擎。他們與基因組學和診斷實驗室建立合作關係,以增強多組學整合並開發專有的推薦演算法。這些平台還優先考慮透過行動優先介面和穿戴式裝置實現無縫的用戶體驗。各公司在監管合規和臨床驗證方面投入巨資,以贏得消費者和醫療保健提供者的信任。此外,許多品牌正瞄準運動員、糖尿病患者和老年人群等細分消費群體,以客製化滿足其特定需求的產品和服務。訂閱式服務模式的採用旨在確保客戶留存率和持續的收入來源。有些公司甚至整合了遠距醫療和營養指導功能,從而建立端到端的個人化健康生態系統。

目錄

第1章:方法論與範圍

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 供應商格局

- 利潤率

- 每個階段的價值增加

- 影響價值鏈的因素

- 中斷

- 產業影響因素

- 成長促進因素

- 慢性病盛行率不斷上升

- 對個人化健康和保健解決方案的需求日益成長

- 人工智慧和機器學習的進步

- 產業陷阱與挑戰

- 監理複雜性和合規成本

- 資料隱私和安全問題

- 市場機遇

- 消費者對客製化健康解決方案的需求日益成長

- 與穿戴式設備和健康設備整合

- 成長促進因素

- 成長潛力分析

- 監管環境

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 波特的分析

- PESTEL 分析

- 價格趨勢

- 按地區

- 依技術類型

- 未來市場趨勢

- 專利格局

- 貿易統計(HS編碼)(註:僅提供重點國家的貿易統計資料)

- 主要進口國

- 主要出口國

- 永續性和環境方面

- 永續實踐

- 減少廢棄物策略

- 生產中的能源效率

- 環保舉措

- 碳足跡考量

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- MEA

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 合作夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估算與預測:依技術類型分類,2021-2034年

- 主要趨勢

- 基於機器學習的平台

- 多組學人工智慧系統

- 預測分析平台

- 大型語言模式系統

第6章:市場估算與預測:依資料輸入類型分類,2021-2034年

- 主要趨勢

- 基於生物標記的平台

- 微生物組分析系統

- 穿戴式裝置整合

- 自我報告資料平台

第7章:市場估計與預測:依地區分類,2021-2034年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 歐洲其他地區

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 亞太其他地區

- 拉丁美洲

- 巴西

- 墨西哥

- 拉丁美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

- 中東和非洲其他地區

第8章:公司簡介

- Baze

- DayTwo Ltd.

- DNAfit (Prenetics)

- InsideTracker

- Noom Inc.

- Nutrigenomix Inc.

- Rootine

- Season Health

- Viome Life Sciences

The Global Personalized Nutrition AI Platforms Market was valued at USD 1.48 billion in 2024 and is estimated to grow at a CAGR of 27.5% to reach USD 18.7 billion by 2034.

Market growth is fueled by increasing consumer demand for personalized health and wellness solutions that move beyond the conventional one-size-fits-all model. As people grow more health-conscious and seek preventive care, AI-powered platforms offering nutrition guidance tailored to each user's biological profile, lifestyle, and health goals are seeing a rapid rise in popularity. Consumers now prefer hyper-personalized meal planning and supplement services that factor in allergies, dietary goals, and medical history. The growing interest in performance optimization and fitness-focused diets among active individuals further contributes to market momentum. These platforms are increasingly integrated with complex biological data like genomics, proteomics, and microbiome analysis to deliver nutrition advice that's aligned with each individual's unique physiological traits. By harnessing this data, personalized AI-driven platforms offer a high degree of accuracy in recommendations, making them a trusted tool for both everyday users and health professionals. The convenience, precision, and real-time adaptability of these tools are helping reshape the way consumers approach their nutrition strategies.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.48 Billion |

| Forecast Value | $18.7 Billion |

| CAGR | 27.5% |

The machine learning-based platforms segment held a 35% share in 2024. These platforms thrive on structured datasets such as wearable device outputs, medical test results, and food diaries. As datasets expand and become more accurately labeled, machine learning algorithms continue to evolve, offering increasingly precise, actionable nutrition advice. Enhanced learning models are driving innovation across digital nutrition ecosystems, enabling users to receive insights that improve over time and adapt to changes in behavior, environment, or health.

The biomarker-based segment accounted for a 30.2% share in 2024 and is forecast to grow at a CAGR of 27.5% through 2034. These platforms specialize in converting blood work and clinical marker data into individualized recommendations aimed at improving areas such as cardiovascular and metabolic health. Their ability to track how a user responds to interventions through measurable health data has earned trust from both medical professionals and end users, further solidifying their role in the healthcare and wellness landscape.

United States Personalized Nutrition AI Platforms Market generated USD 513.8 million in 2024, leading the North American region. Growth here is driven by a well-established healthcare ecosystem, increasing digital health investments, and strong market acceptance of AI-based nutrition platforms. Regulatory support for digital health tools like software as a medical device (SaMD) and clinical decision support (CDS) systems, along with the widespread use of sensor-based wearables and continuous glucose monitoring devices, is expanding the potential of personalized coaching in real time.

Key players dominating the Global Personalized Nutrition AI Platforms Market include Viome Life Sciences, Baze, Noom Inc., ZOE Limited, Nutrigenomix Inc., Rootine, DNAfit (Prenetics), InsideTracker, DayTwo Ltd., and Season Health. To solidify their position, companies are focusing on data-rich personalization engines powered by AI and machine learning. Firms are forming partnerships with genomic and diagnostic labs to enhance multi-omic integration and develop proprietary recommendation algorithms. These platforms also prioritize seamless user experience through mobile-first interfaces and connected wearables. Companies are investing heavily in regulatory compliance and clinical validations to gain credibility with both consumers and healthcare providers. Additionally, many brands are targeting niche consumer segments such as athletes, diabetics, and aging populations to tailor offerings for specific needs. Subscription-based service models are being adopted to ensure customer retention and sustained revenue streams. Some are even integrating telehealth and nutrition coaching features, creating end-to-end personalized health ecosystems.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Technology type

- 2.2.3 Data input type

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing prevalence of chronic diseases

- 3.2.1.2 Rising demand for personalized health and wellness solutions

- 3.2.1.3 Advancements in AI and machine learning

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Regulatory complexity & compliance costs

- 3.2.2.2 Data privacy & security concerns

- 3.2.3 Market opportunities

- 3.2.3.1 Growing consumer demand for tailored health solutions

- 3.2.3.2 Integration with wearables and health devices

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.6.1 Technology and Innovation Landscape

- 3.6.2 Current technological trends

- 3.6.3 Emerging technologies

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By technology type

- 3.8 Future market trends

- 3.9 Patent Landscape

- 3.10 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only)

- 3.10.1 Major importing countries

- 3.10.2 Major exporting countries

- 3.11 Sustainability and environmental aspects

- 3.11.1 Sustainable practices

- 3.11.2 Waste reduction strategies

- 3.11.3 Energy efficiency in production

- 3.11.4 Eco-friendly initiatives

- 3.12 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Technology Type, 2021 - 2034 (USD Million)

- 5.1 Key trends

- 5.2 Machine learning-based platforms

- 5.3 Multi-omics AI systems

- 5.4 Predictive analytics platforms

- 5.5 Large language model-based systems

Chapter 6 Market Estimates and Forecast, By Data Input Type, 2021 - 2034 (USD Million)

- 6.1 Key trends

- 6.2 Biomarker-based platforms

- 6.3 Microbiome analysis systems

- 6.4 Wearable device integration

- 6.5 Self-reported data platforms

Chapter 7 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Million)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 UK

- 7.3.3 France

- 7.3.4 Spain

- 7.3.5 Italy

- 7.3.6 Rest of Europe

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 India

- 7.4.3 Japan

- 7.4.4 Australia

- 7.4.5 South Korea

- 7.4.6 Rest of Asia Pacific

- 7.5 Latin America

- 7.5.1 Brazil

- 7.5.2 Mexico

- 7.5.3 Rest of Latin America

- 7.6 Middle East and Africa

- 7.6.1 Saudi Arabia

- 7.6.2 South Africa

- 7.6.3 UAE

- 7.6.4 Rest of Middle East and Africa

Chapter 8 Company Profiles

- 8.1 Baze

- 8.2 DayTwo Ltd.

- 8.3 DNAfit (Prenetics)

- 8.4 InsideTracker

- 8.5 Noom Inc.

- 8.6 Nutrigenomix Inc.

- 8.7 Rootine

- 8.8 Season Health

- 8.9 Viome Life Sciences