|

市場調查報告書

商品編碼

1858869

品牌食品主食市場機會、成長促進因素、產業趨勢分析及預測(2025-2034年)Branded Food Staple Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

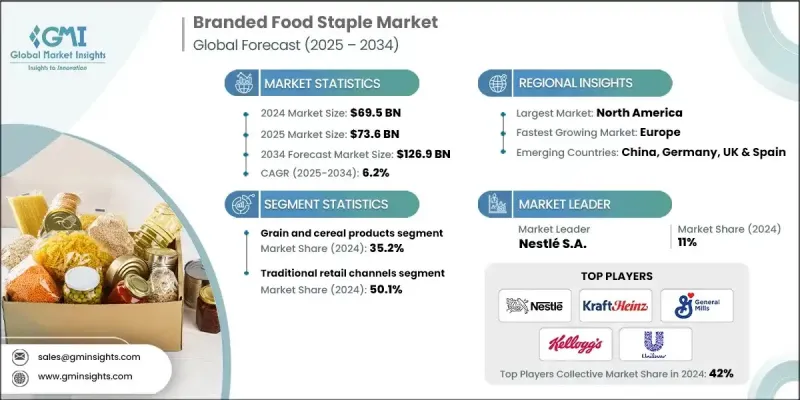

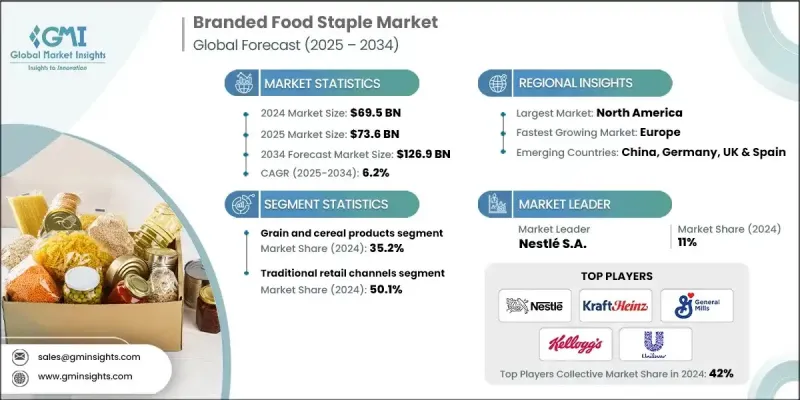

2024 年全球品牌食品主食市場價值為 695 億美元,預計到 2034 年將以 6.2% 的複合年成長率成長至 1269 億美元。

這個市場涵蓋了米、麵粉、糖、食用油和豆類等廣泛消費的包裝必需食品,這些食品均以品質穩定和值得信賴的品牌而聞名。隨著全球城市化進程的加速和消費者習慣的不斷變化,人們明顯傾向於選擇包裝好的主食,以確保食品安全、可追溯性和明確的營養價值。消費者對清潔標籤、強化食品和無添加劑食品的需求日益成長,這與更廣泛的健康意識趨勢相契合,進一步推動了品牌主食的消費。目前,消費者更青睞透明度、品質保證和便利性,而非散裝或無包裝產品。品牌主食在成熟市場和新興市場都獲得了顯著的市場佔有率,尤其是當人們生活節奏加快、尋求日常飲食中值得信賴的品牌時。收入水準的提高、食品安全意識的增強以及生活方式的改變正在塑造全球消費趨勢。市場也正在適應對永續實踐和環保包裝的需求,這反映了消費者日益增強的環保意識,並影響著不同地區的消費者產品選擇。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 695億美元 |

| 預測值 | 1269億美元 |

| 複合年成長率 | 6.2% |

穀物及穀類產品市佔率佔比達35.2%,預計到2034年將以6.5%的複合年成長率成長。該細分市場的成長主要得益於城市化程度的提高、消費者對包裝穀物營養成分認知的增強以及對健康食品選擇的日益關注。食用油和脂肪的需求依然旺盛,這主要得益於消費者對植物性、有益心臟健康的食品日益成長的興趣。目前,品牌產品中已包含富含omega-3的食用油以及椰子油、亞麻籽油和牛油果油等多種品種,這些都促進了該產品類別的整體擴張。

2024年,傳統零售業市佔率為50.1%,預計到2034年將以6.3%的複合年成長率成長。超市、本地雜貨店和小商店仍然是全球消費者購買主食的主要管道。隨著零售業態的現代化,店內升級,例如品牌展示區、營養成分錶和試吃站,正在提升消費者參與度,並在銷售點增強品牌偏好。

2024年,北美品牌主食市佔率將達到30.3%,主要得益於消費者對有機、清潔標章和健康食品日益成長的偏好。區域趨勢顯示,消費者對永續採購和環保包裝的興趣日益濃厚,這正在影響產品設計和購買行為。隨著消費者健康意識和環保意識的不斷增強,該地區的品牌正在調整策略,以滿足這些不斷變化的需求,並確保長期成長。

積極塑造全球品牌主食市場格局的關鍵企業包括可口可樂公司、雀巢公司、億滋國際公司、百事公司、好時公司、味好美公司、達能公司、瑪氏公司、通用磨坊公司、家樂氏公司、卡夫亨氏公司、聯合英國食品公司(ABF)和聯合利華。為了鞏固其在全球品牌主食市場的地位,領導企業正在實施以產品創新、永續發展和供應鏈效率為重點的策略性舉措。一項重要優先事項是拓展產品組合,提供更多健康食品選擇,例如有機食品、強化食品或植物性主食,以滿足不斷變化的消費者需求。各品牌也正在投資環保包裝解決方案和負責任的採購,以符合其環境目標。這些公司正利用數位化通路和全通路零售策略,擴大其直接面對消費者的覆蓋範圍。

目錄

第1章:方法論與範圍

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 供應商格局

- 利潤率

- 每個階段的價值增加

- 影響價值鏈的因素

- 中斷

- 產業影響因素

- 成長促進因素

- 消費者生活方式與飲食偏好的改變

- 品牌認知度與信任度

- 提高健康和保健意識

- 包裝和生產的技術進步

- 產業陷阱與挑戰

- 原物料價格波動

- 來自自有品牌的激烈競爭

- 市場機遇

- 以健康為導向的產品創新

- 自有品牌合作關係

- 永續包裝解決方案

- 新興市場滲透率

- 成長促進因素

- 成長潛力分析

- 監管環境

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 波特的分析

- PESTEL 分析

- 價格趨勢

- 按地區

- 按產品類別

- 未來市場趨勢

- 技術與創新格局

- 當前技術趨勢

- 新興技術

- 專利格局

- 貿易統計(HS編碼)(註:僅提供重點國家的貿易統計資料)

- 主要進口國

- 主要出口國

- 永續性和環境方面

- 永續實踐

- 減少廢棄物策略

- 生產中的能源效率

- 環保舉措

- 碳足跡考量

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- MEA

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 合作夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估算與預測:依產品類別分類,2021-2034年

- 主要趨勢

- 穀物和穀類產品

- 米及米製品

- 小麥及小麥製品

- 燕麥及燕麥製品

- 特色穀物和古老穀物

- 食用油和脂肪

- 植物油

- 橄欖油和優質食用油

- 特種油和功能性油

- 奶油和人造奶油產品

- 糖和甜味劑

- 精製糖製品

- 天然和人造甜味劑

- 蜂蜜和楓糖製品

- 人工甜味劑系統

- 鹽和調味料

- 食鹽和特殊鹽

- 香料和調味料混合物

- 香草和天然調味料

- 民族和國際調味料

- 罐裝和醃製食品

- 罐裝蔬菜和水果

- 醃製肉類和海鮮

- 醃製和發酵產品

- 義大利麵和麵條產品

- 傳統義大利麵製品

- 特色手麵

- 替代型和無麩質意麵

第6章:市場估算與預測:依配銷通路分類,2021-2034年

- 主要趨勢

- 傳統零售通路

- 超市和大型超市

- 便利商店

- 特色食品店

- 現代零售業態

- 折扣零售商

- 有機和天然食品店

- 美食和高階零售商

- 電子商務與數位管道

- 線上雜貨平台

- 直接面對消費者的銷售

- 訂閱服務

第7章:市場估計與預測:依地區分類,2021-2034年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 歐洲其他地區

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 亞太其他地區

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

- 中東和非洲其他地區

第8章:公司簡介

- Associated British Foods plc (ABF)

- Danone SA

- General Mills Inc.

- Kraft Heinz Company

- Mars Incorporated

- McCormick & Company, Inc.

- Mondelez International Inc.

- Nestle SA

- PepsiCo Inc.

- The Coca-Cola Company

- The Hershey Company

- The Kellogg's Company

- Unilever

The Global Branded Food Staple Market was valued at USD 69.5 billion in 2024 and is estimated to grow at a CAGR of 6.2% to reach USD 126.9 billion by 2034.

This market comprises widely consumed, packaged essential food items such as rice, flour, sugar, cooking oils, and pulses, each offering consistent quality and the reliability of trusted brands. As global urbanization accelerates and consumer habits evolve, there's a clear shift toward packaged staples that guarantee food safety, traceability, and defined nutritional value. The rising demand for clean-label, fortified, and additive-free options aligns with the broader health-conscious movement, further amplifying branded staple consumption. Currently, consumers are favoring transparency, quality assurance, and convenience over bulk or unpackaged alternatives. Branded staples are gaining significant traction in both mature and emerging markets, especially as people adopt busier lifestyles and seek trusted names in their everyday diets. Improved income levels, awareness around food safety, and lifestyle changes are shaping consumption trends globally. Markets are also adapting to the demand for sustainable practices and eco-friendly packaging, which reflects growing environmental consciousness among consumers and influences product choices across regions.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $69.5 Billion |

| Forecast Value | $126.9 Billion |

| CAGR | 6.2% |

The grain and cereal products segment held a 35.2% share and is projected to grow at a CAGR of 6.5% through 2034. This segment's stronghold is driven by greater urban penetration, rising awareness of nutritional content in packaged grains, and increasing focus on health-based food selections. Demand for cooking oils and fats remains high, supported by growing interest in plant-based, heart-healthy options. Branded offerings now include oils enriched with omega-3 and varieties such as coconut, flaxseed, and avocado, contributing to the overall expansion of this product category.

The traditional retail segment held a 50.1% share in 2024 and is forecast to grow at a CAGR of 6.3% by 2034. Supermarkets, local grocery stores, and small-scale shops continue to be the primary buying points for staple food items worldwide. With the modernization of retail formats, in-store upgrades like branded display zones, nutrition counters, and sampling stations are elevating consumer engagement and driving brand preference at point-of-sale locations.

North America Branded Food Staple Market held 30.3% share in 2024, driven by the rising preference for organic, clean-label, and health-focused food products. Regional trends show growing interest in sustainable sourcing and eco-friendly packaging, which is influencing both product design and purchasing behavior. As consumers become increasingly health-aware and environmentally conscious, brands in this region are adjusting their strategies to cater to these evolving expectations and ensure long-term growth.

Key players actively shaping the Global Branded Food Staple Market include The Coca-Cola Company, Nestle S.A., Mondelez International Inc., PepsiCo Inc., The Hershey Company, McCormick & Company, Inc., Danone S.A., Mars Incorporated, General Mills Inc., The Kellogg's Company, Kraft Heinz Company, Associated British Foods plc (ABF), and Unilever. To strengthen their foothold in the Global Branded Food Staple Market, leading companies are implementing strategic actions focused on product innovation, sustainability, and supply chain efficiency. A major priority is expanding portfolios with health-forward options such as organic, fortified, or plant-based staples that meet evolving consumer demands. Brands are also investing in eco-friendly packaging solutions and responsible sourcing to align with environmental goals. Leveraging digital channels and omnichannel retail strategies, these companies are enhancing direct-to-consumer reach.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product category

- 2.2.3 Distribution Channel

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Changing Consumer Lifestyles and Dietary Preferences

- 3.2.1.2 Brand Recognition and Trust

- 3.2.1.3 Increasing Health and Wellness Awareness

- 3.2.1.4 Technological Advancements in Packaging and Production

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Price Volatility of Raw Materials

- 3.2.2.2 Intense Competition from Private Labels

- 3.2.3 Market opportunities

- 3.2.3.1 Health-oriented Product Innovation

- 3.2.3.2 Private Label Partnerships

- 3.2.3.3 Sustainable Packaging Solutions

- 3.2.3.4 Emerging Market Penetration

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By product category

- 3.8 Future market trends

- 3.9 Technology and Innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code) ( Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint consideration

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates and Forecast, By Product Category, 2021-2034 (USD Million & Units)

- 5.1 Key trends

- 5.2 Grain and cereal products

- 5.2.1 Rice and rice products

- 5.2.2 Wheat and wheat-based products

- 5.2.3 Oats and oat-based products

- 5.2.4 Specialty and ancient grains

- 5.3 Cooking oils and fats

- 5.3.1 Vegetable oils

- 5.3.2 Olive oil and premium oils

- 5.3.3 Specialty and functional oils

- 5.3.4 Butter and margarine products

- 5.4 Sugar and sweeteners

- 5.4.1 Refined sugar products

- 5.4.2 Natural and alternative sweeteners

- 5.4.3 Honey and maple products

- 5.4.4 Artificial sweetener systems

- 5.5 Salt and seasonings

- 5.5.1 Table salt and specialty salts

- 5.5.2 Spice and seasoning blends

- 5.5.3 Herbs and natural seasonings

- 5.5.4 Ethnic and international seasonings

- 5.6 Canned and preserved foods

- 5.6.1 Canned vegetables and fruits

- 5.6.2 Preserved meat and seafood

- 5.6.3 Pickled and fermented products

- 5.7 Pasta and noodle products

- 5.7.1 Traditional pasta products

- 5.7.2 Specialty and artisanal pasta

- 5.7.3 Alternative and gluten-free pasta

Chapter 6 Market Estimates and Forecast, By Distribution Channel, 2021-2034 (USD Million & Units)

- 6.1 Key trends

- 6.2 Traditional retail channels

- 6.2.1 Supermarkets and hypermarkets

- 6.2.2 Convenience stores

- 6.2.3 Specialty food stores

- 6.3 Modern retail formats

- 6.3.1 Discount retailers

- 6.3.2 Organic and natural food stores

- 6.3.3 Gourmet and premium retailers

- 6.4 E-commerce and digital channels

- 6.4.1 Online grocery platforms

- 6.4.2 Direct-to-consumer sales

- 6.4.3 Subscription services

Chapter 7 Market Estimates and Forecast, By Region, 2021-2034 (USD Million & Units)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 UK

- 7.3.3 France

- 7.3.4 Spain

- 7.3.5 Italy

- 7.3.6 Rest of Europe

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 India

- 7.4.3 Japan

- 7.4.4 Australia

- 7.4.5 South Korea

- 7.4.6 Rest of Asia Pacific

- 7.5 Latin America

- 7.5.1 Brazil

- 7.5.2 Mexico

- 7.5.3 Argentina

- 7.5.4 Rest of Latin America

- 7.6 Middle East and Africa

- 7.6.1 Saudi Arabia

- 7.6.2 South Africa

- 7.6.3 UAE

- 7.6.4 Rest of Middle East and Africa

Chapter 8 Company Profiles

- 8.1 Associated British Foods plc (ABF)

- 8.2 Danone S.A.

- 8.3 General Mills Inc.

- 8.4 Kraft Heinz Company

- 8.5 Mars Incorporated

- 8.6 McCormick & Company, Inc.

- 8.7 Mondelez International Inc.

- 8.8 Nestle S.A.

- 8.9 PepsiCo Inc.

- 8.10 The Coca-Cola Company

- 8.11 The Hershey Company

- 8.12 The Kellogg's Company

- 8.13 Unilever