|

市場調查報告書

商品編碼

1911421

北美跨境公路貨運:市佔率分析、產業趨勢與統計、成長預測(2026-2031 年)North America Cross Border Road Freight Transport - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

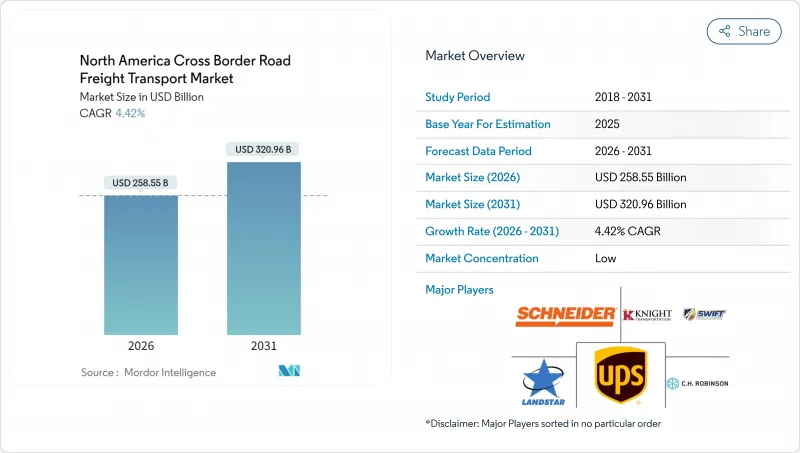

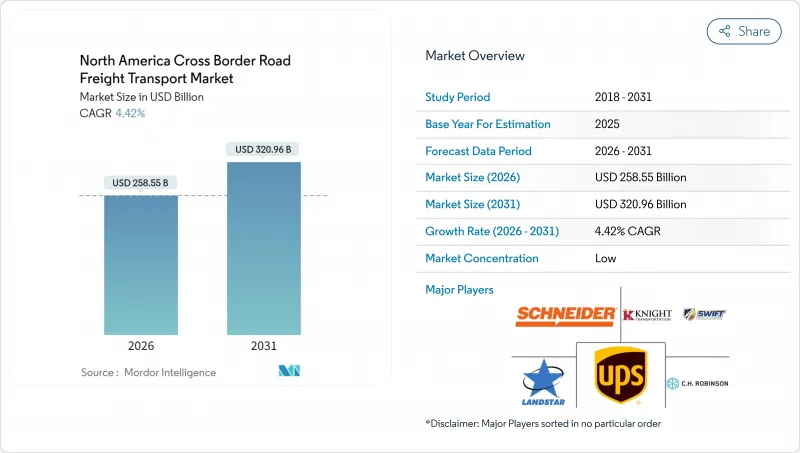

預計北美跨境公路貨運市場規模將從 2025 年的 2,476 億美元成長到 2026 年的 2,585.5 億美元,到 2031 年將達到 3,209.6 億美元,2026 年至 2031 年的複合年成長率為 4.42%。

美國-墨西哥-加拿大協定(USMCA)下的貿易整合以及墨西哥近岸外包的加速發展正在重塑貨運走廊,將貨運量從跨太平洋路線轉移到深入美國和加拿大消費區的陸路跨境路線。強大的製造業合作、電子商務的快速普及以及大規模公共基礎設施項目共同推動了北美跨境公路貨運市場的發展,擴大了負載容量機會並縮短了訂單到交貨的周期。將自動化海關程序、即時視覺化工具和預測分析融入邊境營運的承運商的表現優於傳統承運商。然而,網路安全準備和司機可用性仍然是顯著的能力差距。對兆瓦級充電走廊和數位化「Complemento Carta Porte」(邊境通行證補充)合規平台的投資進一步鞏固了智慧邊境標準,並凸顯了競爭格局中的技術差距。

北美跨境公路貨運市場趨勢與洞察

近岸外包的快速發展正在重塑北美貨運走廊格局

製造業從亞洲向墨西哥的轉移,推動墨西哥對美國的出口在2024年成長23%,並使I-35和I-10州際公路沿線的重型貨運交通得以集中,繞過太平洋門戶。如今,專業承運商已在這些走廊部署專用車輛,以最佳化墨西哥工廠和美國配送中心之間的往返運輸利用率。北向運輸的穩定性促使拉雷多、埃爾帕索和聖地牙哥等跨境口岸的基礎設施投資增加。同時,美國中西部地區的轉運樞紐也迎來了組裝中間零件運輸量的成長。同時,南向原料運輸的增加,使路線密度更加均衡,並提高了資產回報率。這些結構性變化正在鞏固永久性貿易路線,並為北美跨境公路貨運市場的長期擴張奠定基礎。

電子商務加速發展促進跨境小包裹運輸

預計到2024年,跨境電子商務支出將達到261億加幣(192億美元),其中31%來自美國零售商向加拿大的出貨。小包裹運輸的快速成長推動了邊境地區附近收貨點的需求。擁有自動化分類系統、仲介代理服務和費率最佳化引擎的零擔貨運公司,如今正以高價提供兩日達的跨境配送服務。全通路模式的興起進一步連結了零售門市的補貨和供應商的退貨環節,提高了回程傳輸貨運的密度。因此,北美跨境公路貨運市場正迅速向高頻次、輕型貨物運輸轉型,而這些運輸需要詳細的海關數據和動態調度。

長期CDL司機和技術人員短缺

到2025年,該行業將面臨超過8萬名司機的缺口,而跨境的特殊要求更使招聘工作變得困難。貨運公司被迫為持有跨境運輸資格證書的司機提供18%至22%的工資溢價,但由於司機為了避免文件延誤而轉向國內路線,導致員工離職率超過95%。技術人員短缺導致的維護週期延長,增加了設備停機時間,並降低了資產運轉率。高昂的更換成本迫使小規模的車隊營運商考慮合併或退出,加速了北美跨境公路貨運市場的整合。

細分市場分析

到2025年,製造業將佔北美跨境公路貨運市場的31.68%,凸顯了涵蓋汽車、電子和工業機械的三方生產網路的深度。該領域依賴零件在最終組裝前多次跨境運輸,從而確保了穩定的運輸路線和較高的拖車運轉率。隨著原始設備製造商(OEM)繼續在美國和加拿大採購零件,同時擴大在墨西哥的最終組裝規模,預計北美跨境公路貨運市場的製造業貨運量將進一步成長。擁有保稅堆場、堆場管理系統和經認證的安全車隊通訊協定的承運商,在OEM實施嚴格的供應商評分系統後,正贏得大規模的合約。

批發和零售業將達到最高成長率,2026年至2031年的複合年成長率將達到5.07%,這主要得益於電子商務平台的普及,這些平台能夠統一三個國家的產品目錄。位於主要入境口岸20英里範圍內的轉運中心將簡化當日拼箱貨物的分割流程,從而幫助零售商實現準時交貨。北美跨境公路貨運市場日益分散,商品種類日益豐富,推動了對用於運輸食品雜貨的溫控貨車和用於運輸家具的高箱拖車的需求。農業、石油天然氣和建築等其他行業也在擴大貨物種類,為車隊營運商提供了調整設備配置的機會,以適應季節性週期和大型計劃進度。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 按經濟活動分類的GDP分配

- 按經濟活動分類的GDP成長

- 經濟表現及概況

- 電子商務產業的趨勢

- 製造業的發展趨勢

- 運輸和倉儲業GDP

- 物流績效

- 道路長度

- 出口趨勢

- 進口趨勢

- 燃油價格趨勢

- 卡車運輸營運成本

- 卡車運輸車隊規模(按類型)

- 主要卡車供應商

- 公路貨運量趨勢

- 公路貨運價格趨勢

- 透過交通方式分享

- 通貨膨脹

- 法律規範

- 價值鍊和通路分析

- 市場促進因素

- 近岸外包的快速發展正在重塑北美貨運走廊格局

- 電子商務加速發展促進跨境小包裹運輸

- 聯邦和州公路再投資(IIJA、IFC 等)

- 數位化Complemento Carta Porte(貨物運輸單據)合規性正在推動智慧邊境技術的應用。

- 兆瓦級充電走廊使電動長途卡車運輸成為現實

- 經由中國運輸的跨墨西哥航運可以抵消環太平洋地區的波動。

- 市場限制

- 長期缺乏持有商業駕駛執照 (CDL) 的司機和技術人員

- 柴油價格和通行費的波動對利潤率帶來壓力。

- 由於安保人員數量波動,檢查站停留時間難以預測。

- TMS網路安全漏洞損害了貨物運輸的可視性

- 市場創新

- 波特五力分析

- 新進入者的威脅

- 買方的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場規模與成長預測

- 終端用戶產業

- 農業、漁業、林業

- 建設業

- 製造業

- 石油天然氣、採礦和採石

- 批發和零售

- 其他

- 按國家/地區

- 美國

- 加拿大

- 墨西哥

- 北美其他地區

第6章 競爭情勢

- 市場集中度

- 關鍵策略舉措

- 市佔率分析

- 公司簡介

- Bison Transport

- CH Robinson

- Cowtown Logistics Freight Management

- CSA Transportation

- DHL Group

- EP Logistics

- Fastfrate Inc.

- Hub Group, Inc.

- Integrity Express Logistics, LLC

- JB Hunt Transport, Inc.

- Knight-Swift Transportation Holdings Inc.

- Landstar System Inc.

- Midland

- Ryder System, Inc.

- Schneider National, Inc.

- Trans International Trucking, Inc.

- Trans-Pro Logistics

- United Parcel Service of America, Inc.(UPS)

- Werner Enterprises Inc.

- XPO, Inc.

第7章 市場機會與未來展望

The North America cross border road freight transport market is expected to grow from USD 247.6 billion in 2025 to USD 258.55 billion in 2026 and is forecast to reach USD 320.96 billion by 2031 at 4.42% CAGR over 2026-2031.

Trade integration under the United States-Mexico-Canada Agreement (USMCA) and the acceleration of nearshoring into Mexico are recalibrating freight corridors, shifting volumes from trans-Pacific lanes toward over-the-road cross-border routes that extend deep into U.S. and Canadian consumer zones. Strong manufacturing linkages, rapid e-commerce adoption, and large-scale public infrastructure programs together bolster the North America cross border road freight transport market by enlarging payload opportunities and shortening order-to-delivery cycles. Carriers that automate customs, deploy real-time visibility tools, and embed predictive analytics into border-crossing routines are outpacing conventional operators, while cybersecurity preparedness and driver recruitment remain critical capability gaps. Investments in megawatt-class charging corridors and digital Complemento Carta Porte compliance platforms further cement smart-border standards, sharpening the technology divide across the competitive field.

North America Cross Border Road Freight Transport Market Trends and Insights

Near-Shoring Boom Reshapes North America Freight Corridors

Manufacturing migration from Asia to Mexico lifted Mexican exports to the United States by 23% in 2024, anchoring heavy freight flows along I-35 and I-10 that bypass Pacific gateways. Specialized carriers now deploy dedicated fleets on these corridors, optimizing round-trip utilization between Mexican plants and U.S. distribution nodes. Northbound stability encourages infrastructure investments at Laredo, El Paso, and San Diego crossings, while U.S. Midwestern hubs receive higher volumes of intermediate components for assembly lines. In parallel, southbound shipments of raw materials create balanced lane density that fortifies asset returns. These structural shifts are embedding permanent trade lanes that underpin long-run expansion of the North America cross border road freight transport market.

E-commerce Acceleration Lifts Cross-Border LTL Volumes

Cross-border e-commerce spending reached CAD 26.1 billion (USD 19.2 billion) in 2024, with 31% tied to U.S. retailers shipping into Canada. The proliferation of small-parcel flows fuels demand for consolidation gateways close to border zones. LTL carriers equipped with automated sortation, broker-of-record services, and tariff optimization engines now capture premium premiums for two-day cross-border delivery. Growth of omnichannel models further links retail storefront replenishment with return-to-vendor loops, adding backhaul cargo density. Consequently, the North America cross border road freight transport market is experiencing rapid segmentation toward higher-frequency, lower-weight consignments that require granular customs data and dynamic scheduling.

Chronic CDL Driver and Technician Gap

The industry entered 2025 with an 80,000+ driver shortfall, and specialized cross-border requirements compound recruitment difficulty. Carriers must offer 18-22% wage premiums for border-certified drivers, yet turnover exceeds 95% as workers chase domestic lanes that avoid documentation delays. Equipment downtime rises as technician shortages lengthen maintenance cycles, squeezing asset availability. High replacement costs drive smaller fleets to consider mergers or exit, accelerating consolidation within the North America cross border road freight transport market.

Other drivers and restraints analyzed in the detailed report include:

- Federal and Provincial Highway Reinvestment

- Digitized Complemento Carta Porte Compliance Drives Adoption of Smart-border Tech

- Diesel-Price and Toll Volatility Compress Margins

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Manufacturing captured 31.68% of the North America cross border road freight transport market in 2025, underlining the depth of trilateral production networks spanning automotive, electronics, and industrial machinery. This segment benefits from components that cross borders multiple times before final assembly, stabilizing lane volumes and enabling high trailer utilization. The North America cross border road freight transport market size for manufacturing shipments is set to expand as OEMs ramp up Mexico-based final assembly while retaining U.S. and Canadian component sourcing. Carriers with bonded yards, yard-management systems, and certified secure fleet protocols win larger contracts as OEMs enforce stringent vendor scorecards.

Wholesale and retail trade posts the fastest growth at a 5.07% CAGR between 2026-2031, fueled by e-commerce platforms harmonizing catalog offerings across the three countries. Cross-dock facilities positioned within 20 miles of primary ports of entry streamline same-day deconsolidation, enabling retailers to hit promise-date metrics. The North America cross border road freight transport market continues to fragment across SKU profiles, heightening demand for temperature-controlled vans for grocery and high-cube trailers for home-furnishings. Additional segments such as agriculture, oil and gas, and construction also broaden cargo diversity, giving fleets opportunities to calibrate equipment mixes against seasonal cycles and mega-project timelines.

The North America Cross Border Road Freight Transport Market Report is Segmented by End User Industry (Agriculture, Fishing, and Forestry, Construction, Manufacturing, Oil and Gas, Mining and Quarrying, Wholesale and Retail Trade, and Others), and Country (Canada, Mexico, United States, Rest of North America). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Bison Transport

- C.H. Robinson

- Cowtown Logistics Freight Management

- CSA Transportation

- DHL Group

- EP Logistics

- Fastfrate Inc.

- Hub Group, Inc.

- Integrity Express Logistics, LLC

- J.B. Hunt Transport, Inc.

- Knight-Swift Transportation Holdings Inc.

- Landstar System Inc.

- Midland

- Ryder System, Inc.

- Schneider National, Inc.

- Trans International Trucking, Inc.

- Trans-Pro Logistics

- United Parcel Service of America, Inc. (UPS)

- Werner Enterprises Inc.

- XPO, Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 GDP Distribution by Economic Activity

- 4.3 GDP Growth by Economic Activity

- 4.4 Economic Performance and Profile

- 4.4.1 Trends in E-Commerce Industry

- 4.4.2 Trends in Manufacturing Industry

- 4.5 Transport and Storage Sector GDP

- 4.6 Logistics Performance

- 4.7 Length of Roads

- 4.8 Export Trends

- 4.9 Import Trends

- 4.10 Fuel Pricing Trends

- 4.11 Trucking Operational Costs

- 4.12 Trucking Fleet Size by Type

- 4.13 Major Truck Suppliers

- 4.14 Road Freight Tonnage Trends

- 4.15 Road Freight Pricing Trends

- 4.16 Modal Share

- 4.17 Inflation

- 4.18 Regulatory Framework

- 4.19 Value Chain and Distribution Channel Analysis

- 4.20 Market Drivers

- 4.20.1 Near-Shoring Boom Reshapes N-America Freight Corridors

- 4.20.2 E-Commerce Acceleration Lifts Cross-Border LTL Volumes

- 4.20.3 Federal and Provincial Highway Reinvestment (IIJA, IFC, etc.)

- 4.20.4 Digitised Complemento Carta Porte Compliance Drives Adoption of Smart-Border Tech

- 4.20.5 Megawatt Charging Corridors Unlock Electric Long-Haul Trucking

- 4.20.6 China-via-Mexico Trans-Shipment Offsets Trans-Pacific Volatility

- 4.21 Market Restraints

- 4.21.1 Chronic CDL Driver and Technician Gap

- 4.21.2 Diesel-Price and Toll Volatility Compress Margins

- 4.21.3 Security Staffing Waves Create Unpredictable Checkpoint Dwell

- 4.21.4 TMS Cybersecurity Breaches Interrupt Load Visibility

- 4.22 Technology Innovations in the Market

- 4.23 Porter's Five Forces Analysis

- 4.23.1 Threat of New Entrants

- 4.23.2 Bargaining Power of Buyers

- 4.23.3 Bargaining Power of Suppliers

- 4.23.4 Threat of Substitutes

- 4.23.5 Competitive Rivalry

5 Market Size and Growth Forecasts (Value, USD)

- 5.1 End User Industry

- 5.1.1 Agriculture, Fishing, and Forestry

- 5.1.2 Construction

- 5.1.3 Manufacturing

- 5.1.4 Oil and Gas, Mining and Quarrying

- 5.1.5 Wholesale and Retail Trade

- 5.1.6 Others

- 5.2 Country

- 5.2.1 United States

- 5.2.2 Canada

- 5.2.3 Mexico

- 5.2.4 Rest of North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Key Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (Includes Global Level Overview, Market Level Overview, Core Segments, Financials as Available, Strategic Information, Market Rank/Share for Key Companies, Products and Services, and Recent Developments)

- 6.4.1 Bison Transport

- 6.4.2 C.H. Robinson

- 6.4.3 Cowtown Logistics Freight Management

- 6.4.4 CSA Transportation

- 6.4.5 DHL Group

- 6.4.6 EP Logistics

- 6.4.7 Fastfrate Inc.

- 6.4.8 Hub Group, Inc.

- 6.4.9 Integrity Express Logistics, LLC

- 6.4.10 J.B. Hunt Transport, Inc.

- 6.4.11 Knight-Swift Transportation Holdings Inc.

- 6.4.12 Landstar System Inc.

- 6.4.13 Midland

- 6.4.14 Ryder System, Inc.

- 6.4.15 Schneider National, Inc.

- 6.4.16 Trans International Trucking, Inc.

- 6.4.17 Trans-Pro Logistics

- 6.4.18 United Parcel Service of America, Inc. (UPS)

- 6.4.19 Werner Enterprises Inc.

- 6.4.20 XPO, Inc.

7 Market Opportunities and Future Outlook

- 7.1 White-Space and Unmet-Need Assessment