|

市場調查報告書

商品編碼

1910826

歐洲施工機械市場:市場佔有率分析、產業趨勢與統計、成長預測(2026-2031年)Europe Construction Equipment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

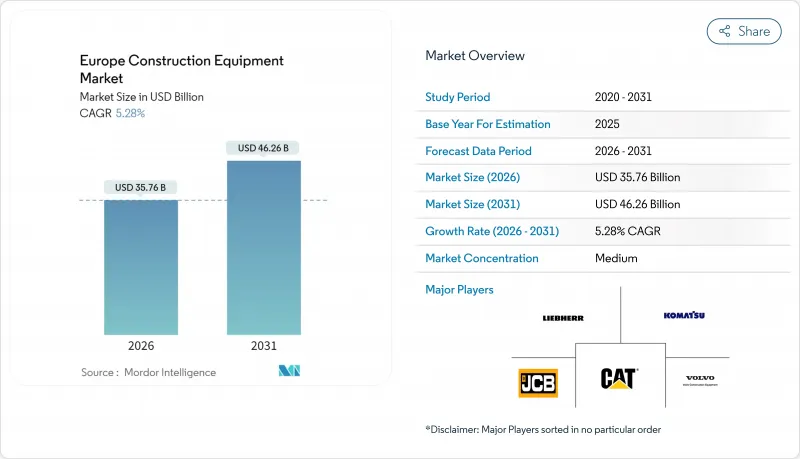

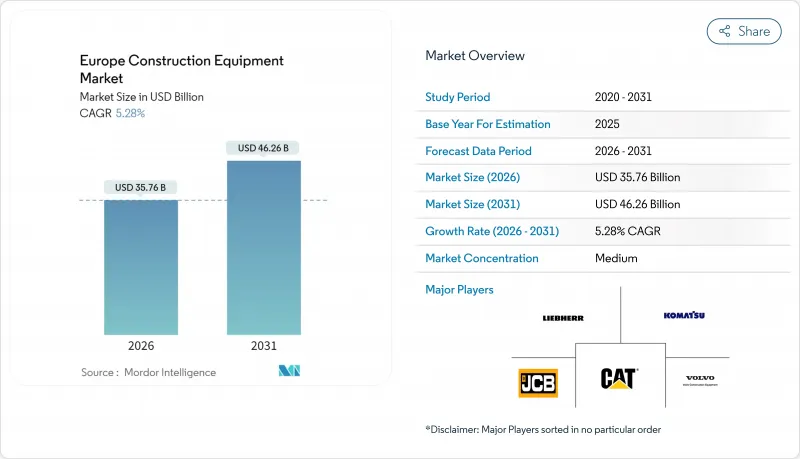

2025年歐洲施工機械市場價值為339.7億美元,預計到2031年將達到462.6億美元,高於2026年的357.6億美元。

預計在預測期(2026-2031 年)內,複合年成長率將達到 5.28%。

與歐盟綠色交易相關的公共工程支出增加、歐洲央行2025年的降息週期以及第五階段排放氣體法規的持續實施,是影響需求的關鍵因素。儘管城市計劃越來越傾向於使用純電動車型,但柴油機械在重型基礎設施建設中仍然不可或缺。中國原始設備製造商(OEM)正利用直接融資和本地支援中心來縮小與西方老牌企業的競爭差距。同時,租賃車隊的過剩壓低了平均售價,並加速了向以服務為中心的收入模式和基於訂閱的遠端資訊處理服務包的轉型。

歐洲施工機械市場趨勢與分析

與歐盟綠色交易相關的公共工程項目

成員國正以前所未有的力道向氣候適應型基礎設施投入資金,將採購週期從18-24個月縮短至最短12個月。德國的預算外資金預計在2024年略微減少後,於2025年略微增加建築支出。支出增加將推高對可再生能源設施所需的挖土機、平地平土機和小型機械的需求。為了獲得綠色交易的競標,建築商越來越傾向於選擇符合第五階段排放標準和電動車型,即使這意味著超過10%的價格溢價。因此,供應商面臨維持更高庫存緩衝的壓力,以適應加快的計劃進度。

隨著歐洲央行降息週期的開始(2025-2026年),住宅將回升。

2025年第一季,住宅投資略有回升,這是自2022年以來的首次復甦。德國的核准房屋抵押貸款核准和建築貸款需求尤其強勁,此前高利率時期積壓的住宅需求得到了刺激。小型挖土機、小型裝載機和加長型堆高機受益最大,因為都市區改造計劃是新建住宅的主要類型。貸款條件的放寬也使得小規模承包商能夠重返設備融資市場,從而擴大了入門動力機械的基本客群。

租賃車隊供應過剩壓低了新車的平均售價。

2021年至2022年間,車隊規模的積極擴張導致租賃運轉率年減,預計2024年將僅63.4%。租賃需求疲軟迫使企業減少車隊投資,造成通路庫存過剩6至9個月。製造商正透過延長融資期限和提供服務抵扣來應對,但這些措施正在擠壓利潤空間並縮減創新預算。

細分市場分析

預計到2025年,挖土機將佔據歐洲施工機械市場44.78%的佔有率,到2031年將以5.32%的複合年成長率成長,超過歐洲施工機械市場的整體成長速度。伸縮臂堆高機緊跟在後,增速顯著提升,主要得益於倉庫自動化計劃對高空精準定位的需求。起重機銷售量維持穩定,但受到低成本進口產品的利潤壓力;而平地平土機受惠於運輸走廊的投資。

電氣化正在重塑各細分領域的競爭格局。利勃海爾L 507 E輪式裝載機運作長達16小時,其功能可與柴油動力機械媲美。裝載機和後鏟市場面臨中國製造商的激烈價格競爭,而專用隧道鑽掘機由於複雜的安全認證,准入門檻仍然很高。承包商越來越傾向於選擇多功能附件,這些配件可以將挖土機改裝成拆除、回收和整平工具,從而推高了單機平均售價,並將買家鎖定在專有的液壓介面上。

截至2025年,內燃機仍將佔據歐洲施工機械市場80.66%的佔有率,其中純電動工程機械的成長速度最快,複合年成長率為5.39%。在充電基礎設施有限的地區,混合動力系統可以彌補這一不足,但對於高運轉率的工地而言,純電動工程機械由於其總體擁有成本優勢顯著。挪威和荷蘭的地方政府已限制在公共工程項目中使用柴油設備,導致當地訂單激增,超過了工廠的前置作業時間。

儘管電動機械的初始投資成本比柴油機械高出五分之一,但對於每年運作1500小時的建築商而言,透過節省燃料和維護成本,不到四年即可收回額外的投資。氫燃料電池目前仍處於小眾市場,但利勃海爾的氫燃料電池挖掘機試點計畫已引發了人們對其在電力供應不穩定的偏遠風電場應用的關注。製造商目前需要同時管理柴油和電動兩種產品平台,這迫使他們必須增加研發預算並調整供應鏈。鋰和稀土元素價格的波動使電池採購更加複雜,並推高了零件成本。這些限制因素導致歐洲施工機械市場的預測複合年成長率下降了0.5個百分點。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 歐盟綠色交易公共工程項目

- 隨著歐洲央行降息週期的開始(2025-2026年),住宅將回升。

- 加速車隊電氣化進程,以滿足第五/六階段二氧化碳和氮氧化物排放法規的要求。

- 都市區改造區域對小型設備的需求不斷成長

- OEM主導的訂閱式車用資訊服務方案提升售後市場收入

- 倉庫自動化領域對電池驅動加長型堆高機高機的需求激增

- 市場限制

- 租賃車隊供應過剩壓低了新車的平均售價。

- 缺乏合格的操作人員會延長計劃工期。

- 鋰和稀土元素價格的波動將影響電動車設備的物料清單成本。

- 中國進口商品CE標誌/型式認證核准延遲的情況仍在持續。

- 價值/供應鏈分析

- 監管環境

- 技術展望

- 波特五力模型

- 新進入者的威脅

- 買方的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場規模與成長預測

- 按機器類型

- 起重機

- 伸縮臂堆高機

- 挖土機

- 裝載機和後鏟

- 平土機機

- 其他

- 透過電源

- 內燃機

- 混合

- 電池式電動車

- 氫燃料電池

- 按最終用戶行業分類

- 基礎設施和建築

- 採礦和採石

- 石油和天然氣

- 製造/倉儲業

- 農業/林業

- 公共產業和可再生能源

- 透過使用

- 土木工程施工

- 起重和物料輸送

- 挖掘和拆除

- 道路建設和鋪路

- 隧道建設

- 回收和廢棄物管理

- 按國家/地區

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 荷蘭

- 比利時

- 波蘭

- 其他歐洲地區

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Caterpillar Inc.

- AB Volvo(Volvo CE)

- Liebherr Group

- CNH Industrial NV

- Komatsu Ltd.

- JCB Ltd.

- Hitachi Construction Machinery

- Deere & Company

- Sandvik AB

- Manitou Group

- Atlas Copco AB

- XCMG Europe

- Sany Europe GmbH

- Doosan Bobcat EMEA

- Wirtgen Group

- Kubota Corp.

- Terex Corp.

- Bomag GmbH

- Wacker Neuson SE

- Hyundai Construction Equipment Europe

第7章 市場機會與未來展望

The Europe Construction Equipment Market was valued at USD 33.97 billion in 2025 and estimated to grow from USD 35.76 billion in 2026 to reach USD 46.26 billion by 2031, at a CAGR of 5.28% during the forecast period (2026-2031).

Rising public-works spending linked to the EU Green Deal, the European Central Bank's 2025 rate-cut cycle, and the ongoing rollout of Stage V emissions rules are the primary forces shaping demand. Equipment buyers are tilting toward battery-electric models for urban projects, while diesel machines remain essential on heavy infrastructure sites. Chinese original-equipment manufacturers (OEMs) are using direct financing and local support centers to narrow competitive gaps with incumbent Western brands. Simultaneously, rental-fleet oversupply is suppressing average selling prices, accelerating the pivot to service-centric revenue streams and subscription telematics bundles.

Europe Construction Equipment Market Trends and Insights

EU Green Deal-Linked Public-Works Pipeline

Member states are channeling unprecedented capital into climate-resilient infrastructure, compressing procurement cycles from 18-24 months to as few as 12 months. Germany's off-budget fund is already lifting real construction outlays by minimal in 2025 after a slight contraction in 2024. This spending wave boosts demand for excavators, motor graders, and compact machines needed for renewable-energy installations. Contractors increasingly favor Stage V-compliant or electric models, even when premiums exceed more than one-tenth, to secure eligibility for Green Deal tenders. Suppliers therefore face mounting pressure to maintain higher inventory buffers that match accelerated project timelines.

Recovery Of Residential Starts As Ecb Rate-Cut Cycle Begins (2025-26)

Housing investment turned positive slightly in Q1 2025, the first upturn since 2022. Mortgage approvals and construction loan demand have strengthened, especially in Germany, where pent-up housing needs accumulated during the high-rate period. Compact excavators, mini loaders, and telehandlers benefit the most because urban infill projects dominate new housing activity. Easier credit is also pulling small contractors back into the equipment-financing market, widening the customer base for entry-level electric machines.

Rental-Fleet Oversupply Suppressing New-Unit ASPs

Aggressive fleet expansion during 2021-2022 left rental utilization at only 63.4% in 2024, pushing rental rates down on year over year. Sluggish rental growth has forced companies to cut fleet spending by minimal, creating channel inventory bulges of six to nine months. Manufacturers respond with longer financing terms and service credits, but these steps erode margins and slow innovation budgets.

Other drivers and restraints analyzed in the detailed report include:

- Accelerated Fleet Electrification To Meet Stage V/Vi Co2 & Nox Caps

- Growing Demand For Compact Equipment On Urban Infill Sites

- Scarcity of Certified Operators Inflating Project Timelines

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Excavators captured 44.78% of the Europe construction equipment market share in 2025 and are projected to grow at a 5.32% CAGR to 2031, outpacing the overall Europe construction equipment market. Telescopic handlers follow closely in growth, fuelled by warehouse automation projects that demand precision placement at height. Cranes maintain steady volume but see margin pressure from lower-priced imports, while motor graders gain from transport-corridor spending.

Electrification reshapes competitive dynamics within each subcategory. Liebherr's L 507 E wheel loader delivers 16-hour run-time, showing functional parity with diesel units. Loader and backhoe segments face intense price competition from Chinese OEMs, whereas specialized tunneling equipment retains higher entry barriers thanks to complex safety certifications. Contractors increasingly prefer multi-functional attachments that turn excavators into demolition, recycling, or grading tools, boosting average selling price per unit and locking buyers into proprietary hydraulic interfaces.

Internal combustion engines still hold 80.66% of the Europe construction equipment market size in 2025, but battery-electric units are climbing fastest at a 5.39% CAGR. Hybrid drive-trains bridge constraints where charging infrastructure is lacking, yet total cost of ownership advantages favor full electrics on high-utilization sites. Provincial mandates in Norway and the Netherlands restrict diesel equipment on public projects, triggering regional spikes in electric orders that outstrip factory lead times.

Capital costs for electric machines are one-fifth higher, but contractors running 1,500 hours annually recoup premiums in under four years through fuel and maintenance savings. Hydrogen fuel cells remain niche, but Liebherr's pilot hydrogen excavator has sparked interest for use in remote wind farms where grid supply is thin. Manufacturers must now manage dual product platforms-diesel and electric-stretching R&D budgets and supply chains. Battery sourcing is complicated by lithium and rare-earth price swings that raise bills of material, a restraint subtracting 0.5 percentage points from Europe construction equipment market CAGR projections.

The Europe Construction Equipment Market Report is Segmented by Machinery Type (Cranes, Telescopic Handler, and More), Power Source (Internal-Combustion, Hybrid, and More), End-User Industry (Infrastructure & Construction, Mining & Quarrying, and More), Application (Earthmoving, Lifting & Material Handling, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD) and Volume (Units).

List of Companies Covered in this Report:

- Caterpillar Inc.

- AB Volvo (Volvo CE)

- Liebherr Group

- CNH Industrial N.V.

- Komatsu Ltd.

- JCB Ltd.

- Hitachi Construction Machinery

- Deere & Company

- Sandvik AB

- Manitou Group

- Atlas Copco AB

- XCMG Europe

- Sany Europe GmbH

- Doosan Bobcat EMEA

- Wirtgen Group

- Kubota Corp.

- Terex Corp.

- Bomag GmbH

- Wacker Neuson SE

- Hyundai Construction Equipment Europe

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 EU Green Deal-Linked Public-Works Pipeline

- 4.2.2 Recovery Of Residential Starts As Ecb Rate-Cut Cycle Begins (2025-26)

- 4.2.3 Accelerated Fleet Electrification To Meet Stage V/Vi Co2 & Nox Caps

- 4.2.4 Growing Demand For Compact Equipment On Urban Infill Sites

- 4.2.5 OEM-Led Subscription & Telematics Bundles Boosting Aftermarket Revenue

- 4.2.6 Surge In Battery-Electric Telehandlers For Warehouse-Automation Build-Outs

- 4.3 Market Restraints

- 4.3.1 Rental-Fleet Oversupply Suppressing New-Unit Asps

- 4.3.2 Scarcity Of Certified Operators Inflating Project Timelines

- 4.3.3 Lithium & Rare-Earth Price Volatility Hitting Ev-Equipment Bom Costs

- 4.3.4 Persistent Ce-Mark/Homologation Delays For Chinese Imports

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value (USD) and Volume (Units))

- 5.1 By Machinery Type

- 5.1.1 Cranes

- 5.1.2 Telescopic Handler

- 5.1.3 Excavator

- 5.1.4 Loader and Backhoe

- 5.1.5 Motor Graders

- 5.1.6 Others

- 5.2 By Power Source

- 5.2.1 Internal-Combustion

- 5.2.2 Hybrid

- 5.2.3 Battery-Electric

- 5.2.4 Hydrogen Fuel-Cell

- 5.3 By End-user Industry

- 5.3.1 Infrastructure & Construction

- 5.3.2 Mining & Quarrying

- 5.3.3 Oil & Gas

- 5.3.4 Manufacturing & Warehousing

- 5.3.5 Agriculture & Forestry

- 5.3.6 Utilities & Renewable Energy

- 5.4 By Application

- 5.4.1 Earthmoving

- 5.4.2 Lifting & Material Handling

- 5.4.3 Excavation & Demolition

- 5.4.4 Road Building & Paving

- 5.4.5 Tunnelling

- 5.4.6 Recycling & Waste Management

- 5.5 By Country

- 5.5.1 Germany

- 5.5.2 United Kingdom

- 5.5.3 France

- 5.5.4 Italy

- 5.5.5 Spain

- 5.5.6 Russia

- 5.5.7 Netherlands

- 5.5.8 Belgium

- 5.5.9 Poland

- 5.5.10 Rest of Europe

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (Includes Global Level Overview, Market Level Overview, Core Segments, Financials as Available, Strategic Information, Market Rank/Share for Key Companies, Products and Services, SWOT Analysis, and Recent Developments)

- 6.4.1 Caterpillar Inc.

- 6.4.2 AB Volvo (Volvo CE)

- 6.4.3 Liebherr Group

- 6.4.4 CNH Industrial N.V.

- 6.4.5 Komatsu Ltd.

- 6.4.6 JCB Ltd.

- 6.4.7 Hitachi Construction Machinery

- 6.4.8 Deere & Company

- 6.4.9 Sandvik AB

- 6.4.10 Manitou Group

- 6.4.11 Atlas Copco AB

- 6.4.12 XCMG Europe

- 6.4.13 Sany Europe GmbH

- 6.4.14 Doosan Bobcat EMEA

- 6.4.15 Wirtgen Group

- 6.4.16 Kubota Corp.

- 6.4.17 Terex Corp.

- 6.4.18 Bomag GmbH

- 6.4.19 Wacker Neuson SE

- 6.4.20 Hyundai Construction Equipment Europe

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment