|

市場調查報告書

商品編碼

1906081

中東和非洲施工機械:市場佔有率分析、行業趨勢、統計數據和成長預測(2026-2031 年)Middle East And Africa Construction Equipment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

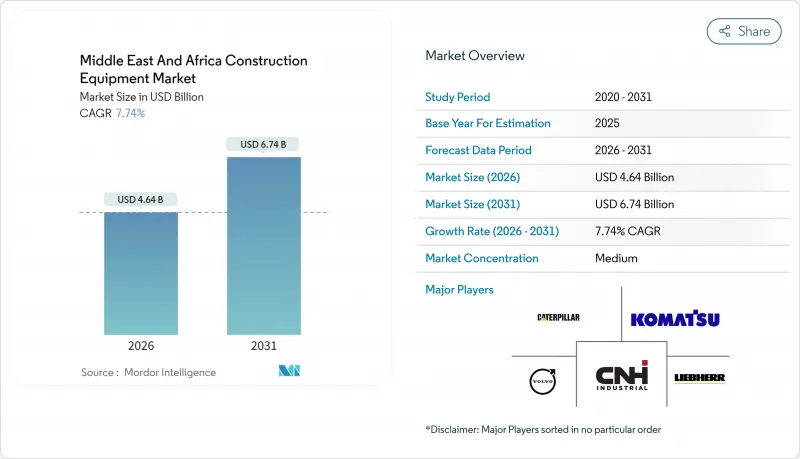

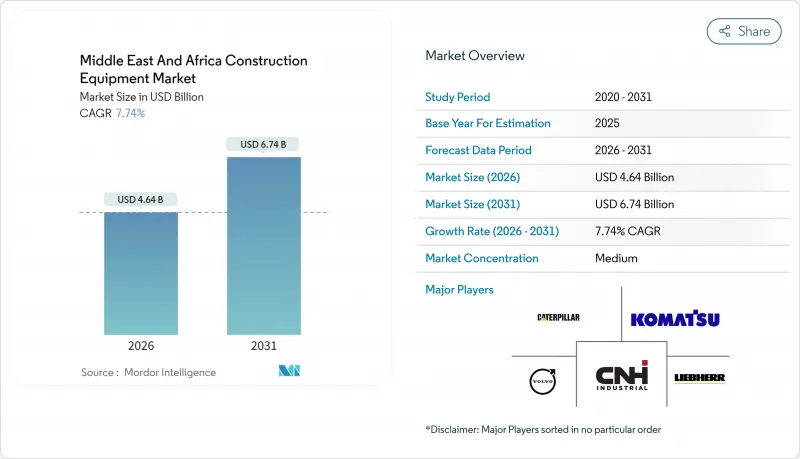

預計到 2026 年,中東和非洲施工機械市場規模將達到 46.4 億美元,高於 2025 年的 43.1 億美元,預計到 2031 年將達到 67.4 億美元,2026 年至 2031 年的複合年成長率為 7.74%。

波灣合作理事會(GCC)正經歷創紀錄的2兆美元基礎設施發展計劃,施工機械市場成長遠高於全球平均水準。沙烏地阿拉伯正透過其「2030願景」大型企劃推動投資,而卡達則在世界盃後的投資熱潮中保持成長勢頭,並繼續推進其「2030國家願景」多元化發展計畫。承包商充足的訂單、向數位化車隊最佳化方向的明顯轉變以及不斷擴大的電池礦物開採活動,共同增強了市場需求的韌性。同時,儘管混合動力和純電子機械的普及速度加快,但柴油動力車隊仍然保持著主導地位,因為承包商需要在可靠性和新的永續性要求之間尋求平衡。

中東及非洲施工機械市場趨勢及分析

海灣合作理事會大型企劃計畫推動資本需求

沙烏地阿拉伯的「2030願景」計畫累計1兆美元用於基礎建設,其中包括需要塔式起重機的NEOM新城開發計劃。為此,沃爾夫克蘭和扎米爾集團在該地區建立了首個塔式起重機製造廠。在阿拉伯聯合大公國,超過6500億美元的在建和訂單計劃推動著建築業的發展,而卡達耗資250億美元的國家鐵路項目也為建築業提供了持續的動力。像NEOM與三星物產簽訂的價值13億沙烏地里亞爾的機器人合約這樣的合資項目,將減少80%的人工鋼筋作業,進一步刺激了對自動化設備的需求。長期前景和政府資金的支持幫助施工機械市場抵禦了全球經濟放緩的影響,保持了原始設備製造商和經銷商訂單的穩定性。

全部區域的所有權模式正從所有權模式轉向租賃模式

為了因應設備購置成本上漲(自2020年以來已上漲20%),承包商正轉向租賃模式。聯合租賃公司(United Rentals)報告稱,由於其中東客戶擴大了包含遠端資訊處理服務操作員培訓的短期契約,該公司2024年的收入將有所成長。哈克租賃公司(Hark Rentals)也預計,在類似綜合服務產品的推動下,2025年該地區將實現成長。沙烏地阿拉伯的租賃市場正以兩位數的複合年成長率成長,這主要得益於在高利率環境下最佳化現金流。這種模式有助於提高產能運轉率,並符合永續性目標,使用戶無需大量前期投資即可使用新一代電動挖土機,從而推動施工機械市場的發展。

原油價格波動會延後資本投資決策。

原油價格飆升導致承包商重新談判成本加成契約,並縮減可自由支配的船隊預算,因為他們預計資金籌措。 2020年,海上油氣產業大幅削減了資本支出,推遲了需要專用起重機和派餅的平台擴建項目。奈及利亞的情況凸顯了這種影響的嚴重性。布蘭特原油價格上漲導致建築材料成本飆升,儘管GDP成長,但信貸緊縮,新設備訂單卻放緩。然而,海灣合作理事會(GCC)國家經濟多元化,政府擔保的公共工程項目穩定了採購進度,有助於緩衝市場波動,並限制施工機械市場的下行風險。

細分市場分析

至2025年,挖土機將佔中東和非洲施工機械市場35.75%的佔有率,凸顯其在公共大型企劃、採礦和住宅開發中的核心角色。預計到2031年,挖土機相關施工機械市場規模將以7.79%的複合年成長率成長,主要受卡達國家鐵路計畫大規模溝槽挖掘和埃及水泥廠石灰石表土清除需求的推動。配備自動坡度控制設備和高空拆除臂的挖土機可將工作效率提高五分之一,促使大型建設公司重複訂購。

剛果民主共和國的電池礦物開採需求也反映了這一趨勢,該國深層鈷礦需要配備加固底盤的90噸級挖土機。嚴格的建築安全標準促使人們更傾向於配備360度攝影機和遠端資訊處理系統的挖土機,從而使其運轉率提高了五倍。輪式裝載機和履帶起重機等配套設備用於骨材運輸和高層建築吊裝,但其成長勢頭落後於挖土機。在沙烏地阿拉伯,模組化住宅工廠對伸縮臂叉裝機的需求不斷成長,而後鏟式裝載機則被用於挖掘城市多式聯運道路上的公共工程溝渠。

到2025年,柴油和內燃機(ICE)車型將佔中東和非洲施工機械市場72.63%的佔有率,證實了非洲沙漠地區和偏遠地區對傳統動力傳動系統的持續依賴。耐高溫引擎結合多級過濾器,即使在高達50°C的溫度下也能確保運作。然而,隨著海灣合作理事會(GCC)的脫碳政策推動範圍1排放目標的實現,電動和混合動力車型預計將以7.75%的複合年成長率成長。

Caterpillar320電動挖土機單次充電即可運作8小時,並可直接連接至車隊遠端資訊處理系統,方便在混合動力車隊中部署。零排放設備正擴大被指定用於杜拜地鐵隧道項目,礦業營運商也正利用地下通風成本降低的優勢。儘管電池因高溫而劣化以及充電基礎設施不足等挑戰減緩了都市區的普及速度,但租賃公司正透過將行動充電器納入其設備服務包來加速推廣。

其他福利:

- Excel格式的市場預測(ME)表

- 分析師支持(3個月)

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 海灣合作理事會大型企劃管道專案推動設備需求成長

- 全部區域的所有權模式正從所有權模式轉向租賃模式

- 非洲各地快速城市住宅計劃

- 在地採購法規推動了整車製造商和本地合資企業的組裝發展。

- 遠端資訊處理即服務在偏遠沙漠地區車隊最佳化的應用

- 電池礦物開採(鋰、錳)需要大型裝載機

- 市場限制

- 原油價格週期性波動會延後資本投資決策。

- 政治和安全熱點問題阻礙了計劃實施

- 港口擁塞導致關鍵備件分發延誤

- 新一代電子機械工程師短缺

- 價值/供應鏈分析

- 監管環境

- 技術展望

- 波特五力模型

- 新進入者的威脅

- 買方的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場規模及成長預測(價值(美元))

- 按機器類型

- 挖土機

- 輪式裝載機

- 履帶起重機

- 伸縮臂堆高機

- 後鏟式裝載機

- 滑移裝載機和小型履帶裝載機

- 平土機機

- 推土機和推土鏟

- 瀝青鋪築機和壓路機

- 鉸接式自動卸貨卡車

- 挖溝工人和其他人

- 按驅動類型

- 柴油/內燃機

- 電動和混合動力

- 油壓

- 透過輸出

- 100馬力或以下

- 101-200馬力

- 201-400馬力

- 超過400馬力

- 透過使用

- 基礎設施和交通運輸

- 石油和天然氣

- 採礦和採石

- 商業建築

- 住宅

- 工業/製造業

- 最終用戶

- 承包商

- 設備租賃公司

- 政府/市政當局

- 礦業公司

- 按國家/地區

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 卡達

- 阿曼

- 科威特

- 巴林

- 南非

- 其他中東和非洲地區

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Caterpillar Inc.

- Komatsu Ltd.

- Volvo AB

- Hitachi Construction Machinery

- Liebherr Group

- CNH Industrial(Case CE)

- JCB Ltd.

- Doosan Corporation

- Kobelco Construction Machinery

- Tadano Ltd.

- Manitowoc Company Inc.

- Sumitomo Construction Machinery

- Mitsubishi Corporation

- XCMG

- SANY Heavy Industry

- Hyundai Genuine

- Deere & Company(Wirtgen)

- Bobcat Company

- Zoomlion Heavy Industry

- Terex Corporation

第7章 市場機會與未來展望

The Middle East And Africa Construction Equipment Market size in 2026 is estimated at USD 4.64 billion, growing from 2025 value of USD 4.31 billion with 2031 projections showing USD 6.74 billion, growing at 7.74% CAGR over 2026-2031.

The construction equipment market benefits from an unprecedented USD 2 trillion infrastructure pipeline across the Gulf Cooperation Council (GCC), positioning regional growth far ahead of the global average. Saudi Arabia drives spending through Vision 2030 mega-projects, while Qatar sustains momentum with post-World-Cup investments and continues to implement National Vision 2030 diversification programs. Robust contractor backlogs, a clear pivot toward digital fleet optimization, and expanding mining activity for battery minerals collectively reinforce demand resilience. Meanwhile, the diesel-powered fleet maintains dominance despite accelerating adoption of hybrid and fully electric machines as contractors balance reliability with emerging sustainability requirements.

Middle East And Africa Construction Equipment Market Trends and Insights

GCC Mega-Projects Pipeline Accelerates Equipment Demand

Saudi Arabia's Vision 2030 agenda earmarks USD 1 trillion for infrastructure, including NEOM development that requires tower cranes, prompting Wolffkran and Zamil Group to establish the region's first tower-crane manufacturing facility. The UAE supports momentum with more than USD 650 billion in active or awarded projects, while Qatar's USD 25 billion National Rail Scheme sustains construction work. Joint ventures such as NEOM's SAR 1.3 billion robotics deal with Samsung C&T cut manual rebar labor by 80% yet intensify demand for automated equipment fleets. Long-term visibility and sovereign funding insulate the construction equipment market from global slowdowns, ensuring steady machine order books for OEMs and dealers.

Region-Wide Shift From Ownership To Rental Models

Contractors are pivoting toward rental to combat the two-fifth surge in equipment purchase prices since 2020. United Rentals reported a revenue uptick in 2024 as Middle East customers expand short-term contracts covering telematics, service, and operator training. Herc Rentals projects regional growth in 2025 on similar bundled offerings. Saudi Arabia's rental niche is tracking a double-digit CAGR, driven by cash-flow optimization during a high-interest environment. The model improves fleet utilization and opens access to next-generation electric excavators without large upfront capital, keeping the construction equipment market aligned with evolving sustainability targets.

Oil-Price Cyclicality Defers Capex Decisions

Sharp upward shifts in crude prices reduce discretionary fleet budgets because contractors anticipate cost-plus contract renegotiations and financing constraints. The offshore sector slashed in CAPEX in 2020, postponing platform expansions that otherwise require specialized cranes and pipelayers. Nigeria showcases the sensitivity: construction input costs spike when Brent exceeds tightening lending and dampening new equipment orders despite GDP growth. Nonetheless, diversified GCC economies cushion volatility via sovereign-backed public works that hold procurement schedules steady, limiting downside risk for the construction equipment market.

Other drivers and restraints analyzed in the detailed report include:

- Rapid Urban Housing Programmes Across Africa

- Local-Content Rules Driving Oem-Local Jv Assembly Lines

- Political & Security Hotspots Curb Project Execution

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Excavators accounted for 35.75% of Middle East and Africa construction equipment market in 2025, underscoring their pivotal role across public mega-projects, mining, and housing developments. The construction equipment market size attached to excavators is on track to rise at a 7.79% CAGR through 2031 in response to heavy trenching needs on Qatar's National Rail Scheme and limestone overburden removal at Egyptian cement sites. Excavators equipped with grade-control automatics and high-reach demolition booms deliver one-fifth efficiency gains, prompting repeat orders from Tier 1 contractors.

Demand also reflects battery-mineral extraction in the DRC, where deep-pit cobalt mines require 90-ton units with reinforced undercarriages. Stringent construction safety codes boost preference for excavators with 360-degree cameras and telematics, enabling one-fifth utilization improvements. Complementary categories including wheel loaders and crawler cranes, support aggregate transfer and high-rise lifts yet trail excavators in growth momentum. Telescopic handlers grow within modular housing plants in Saudi Arabia, while backhoe loaders supply utility trenching across mixed-traffic urban roads.

Diesel and ICE models represented 72.63% of Middle East and Africa construction equipment market in 2025, validating continued reliance on conventional powertrains in desert and off-grid African sites. High thermal-tolerance engines paired with multi-stage filtration safeguard uptime against 50 °C ambient conditions. Nevertheless, the electric and hybrid cohort is advancing at a 7.75% CAGR as GCC decarbonization policies push clients toward lower Scope 1 emissions targets.

Caterpillar's 320 Electric excavator delivers an eight-hour shift on a single charge and slots directly into fleet telematics dashboards, simplifying adoption within mixed-power fleets. Urban metro tunneling in Dubai increasingly specifies zero-tailpipe machines, while mining operators exploit reduced ventilation costs underground. Persistent constraints-battery degradation under heat and limited charging infrastructure-slow penetration outside metropolitan hubs, yet rental firms accelerate exposure by bundling mobile chargers into equipment-as-a-service packages.

The Middle East and Africa Construction Equipment Market Report is Segmented by Machinery Type (Excavators, Wheel Loaders, and More), Drive Type (Diesel/ICE and More), Power Output (Less Than or Equal To 100 HP and More), Application (Infrastructure & Transport, Oil & Gas, and More), End-User (Contractors, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD) and Volume (Units).

List of Companies Covered in this Report:

- Caterpillar Inc.

- Komatsu Ltd.

- Volvo AB

- Hitachi Construction Machinery

- Liebherr Group

- CNH Industrial (Case CE)

- JCB Ltd.

- Doosan Corporation

- Kobelco Construction Machinery

- Tadano Ltd.

- Manitowoc Company Inc.

- Sumitomo Construction Machinery

- Mitsubishi Corporation

- XCMG

- SANY Heavy Industry

- Hyundai Genuine

- Deere & Company (Wirtgen)

- Bobcat Company

- Zoomlion Heavy Industry

- Terex Corporation

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 GCC Mega-Projects Pipeline Accelerates Equipment Demand

- 4.2.2 Region-Wide Shift From Ownership To Rental Models

- 4.2.3 Rapid Urban Housing Programmes Across Africa

- 4.2.4 Local-Content Rules Driving Oem-Local Jv Assembly Lines

- 4.2.5 Telematics-As-A-Service For Remote Desert Fleet Optimisation

- 4.2.6 Battery-Mineral Mining (Lithium, Manganese) Needs Heavy Loaders

- 4.3 Market Restraints

- 4.3.1 Oil-Price Cyclicality Defers Capex Decisions

- 4.3.2 Political & Security Hotspots Curb Project Execution

- 4.3.3 Port Congestion Delays Critical Spare-Parts Flow

- 4.3.4 Shortage Of Technicians For Next-Gen Electric Machines

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value (USD))

- 5.1 By Machinery Type

- 5.1.1 Excavators

- 5.1.2 Wheel Loaders

- 5.1.3 Crawler Cranes

- 5.1.4 Telescopic Handlers

- 5.1.5 Backhoe Loaders

- 5.1.6 Skid-Steer & Compact Track Loaders

- 5.1.7 Motor Graders

- 5.1.8 Bulldozers & Dozers

- 5.1.9 Asphalt Pavers & Road Rollers

- 5.1.10 Articulated Dump Trucks

- 5.1.11 Trenchers & Misc.

- 5.2 By Drive Type

- 5.2.1 Diesel / ICE

- 5.2.2 Electric & Hybrid

- 5.2.3 Hydraulic

- 5.3 By Power Output

- 5.3.1 Less than or equal to 100 HP

- 5.3.2 101-200 HP

- 5.3.3 201-400 HP

- 5.3.4 More than 400 HP

- 5.4 By Application

- 5.4.1 Infrastructure & Transport

- 5.4.2 Oil & Gas

- 5.4.3 Mining & Quarrying

- 5.4.4 Commercial Buildings

- 5.4.5 Residential

- 5.4.6 Industrial / Manufacturing

- 5.5 By End-User

- 5.5.1 Contractors

- 5.5.2 Equipment Rental Companies

- 5.5.3 Government & Municipalities

- 5.5.4 Mining Firms

- 5.6 By Country

- 5.6.1 Saudi Arabia

- 5.6.2 United Arab Emirates

- 5.6.3 Qatar

- 5.6.4 Oman

- 5.6.5 Kuwait

- 5.6.6 Bahrain

- 5.6.7 South Africa

- 5.6.8 Rest of Middle East and Africa

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Segments, Financials as Available, Strategic Information, Market Rank/Share for Key Companies, Products and Services, SWOT Analysis, and Recent Developments)

- 6.4.1 Caterpillar Inc.

- 6.4.2 Komatsu Ltd.

- 6.4.3 Volvo AB

- 6.4.4 Hitachi Construction Machinery

- 6.4.5 Liebherr Group

- 6.4.6 CNH Industrial (Case CE)

- 6.4.7 JCB Ltd.

- 6.4.8 Doosan Corporation

- 6.4.9 Kobelco Construction Machinery

- 6.4.10 Tadano Ltd.

- 6.4.11 Manitowoc Company Inc.

- 6.4.12 Sumitomo Construction Machinery

- 6.4.13 Mitsubishi Corporation

- 6.4.14 XCMG

- 6.4.15 SANY Heavy Industry

- 6.4.16 Hyundai Genuine

- 6.4.17 Deere & Company (Wirtgen)

- 6.4.18 Bobcat Company

- 6.4.19 Zoomlion Heavy Industry

- 6.4.20 Terex Corporation

7 Market Opportunities & Future Outlook

- 7.1 White-Space & Unmet-Need Assessment