|

市場調查報告書

商品編碼

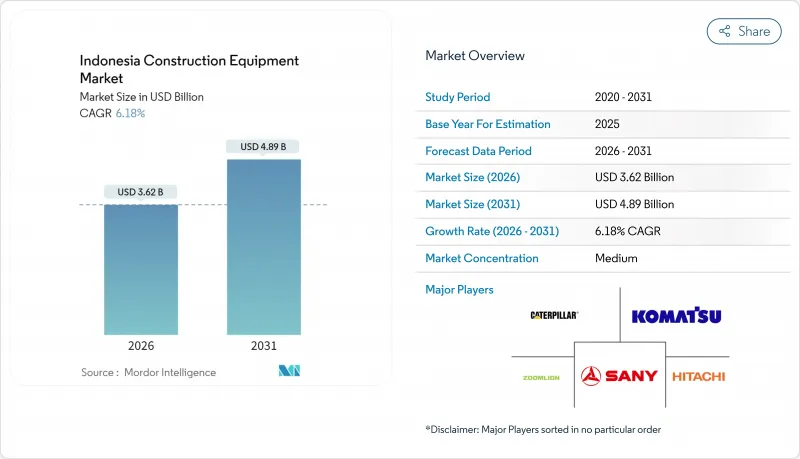

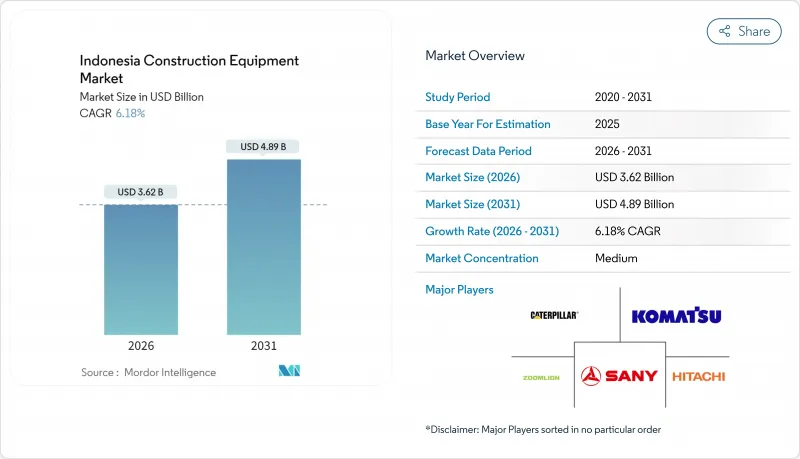

1906279

印尼施工機械市場:市場佔有率分析、產業趨勢、統計數據和成長預測(2026-2031年)Indonesia Construction Equipment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

2025年印尼施工機械市場價值為34.1億美元,預計從2026年的36.2億美元成長到2031年的48.9億美元,在預測期(2026-2031年)內複合年成長率為6.18%。

國家戰略計劃(PSN)的持續推進、350億美元的新首都(IKN)計劃以及強勁的礦業投資,都支撐著土木機械、物料輸送和專用機械等各類設備的需求。能夠提供本地組裝、靈活資金籌措和遠端資訊處理服務的供應商,最有利於最大限度地運轉率以雅加達為中心的龐大車隊。

印尼施工機械市場趨勢與洞察

印尼2030年基礎建設計畫公共部門支出激增

印尼41個已進入最後階段的PSN工程要求在收費公路、水壩、港口和工業園區等地不間斷地部署設備。每投入印尼幣用於基礎建設,就能產生1.9印尼幣的經濟價值,進而增加承包商和租賃公司的採購預算。這種乘數效應在經濟特區和電力計劃中最為顯著,推動了需求高峰從傳統的爪哇島集中型轉變為全國性。北蘇門答臘和南蘇拉威西的生產成長最為顯著,使這兩個省份成為區域租賃需求中心。計劃的長期性使得供應商能夠制定長達五至七年的維護契約,從而確保在設備的整個生命週期內獲得零件和業務收益。

城市鐵路和收費公路的快速發展促進了土木工程車輛的更新換代。

計畫於2024年完工的芝芒吉斯-芝比通收費公路象徵高強度的土木工程建設,施工高峰期將部署大量挖土機和自動卸貨卡車。卡朗若安-卡良高3A段的數位化現場監控顯著減少了設備停機時間,提高了設備運轉率,凸顯了遠端資訊處理整合的重要性日益凸顯。採用精準導航系統的建設公司在燃油效率和施工速度方面均取得了顯著提升。目前,北蘇門答臘省帕拉帕特等基礎設施走廊的省級政府正在推廣這些舉措,表明技術主導的升級改造正在爪哇島以外的地區普及。隨著更嚴格的排放氣體法規對老舊的二級排放標準設備提出了更高的要求,建設公司正在加速向更清潔、運作強度更低的三級排放標準和混合動力設備轉型。

印尼幣匯率波動推高進口設備價格和資金籌措成本。

資本財進口在印尼貿易結構中佔比很大,這使得建築公司極易受到外匯波動的影響,匯率波動可能在幾週內導致採購預算減少0.25%。信用證可以提供成本緩衝,但在地採購要求使得選擇全球品牌的規格變得複雜。 8/2024號貿易條例簡化了港口清關流程,但匯率風險仍存在,迫使設備貸款機構收緊對中小企業的貸款價值比(LTV)。經銷商擴大將以美元計價的零件合約與以印尼幣計價的機械貸款捆綁在一起,雖然減少了錯配,但也增加了文件負擔。在巴淡島和芝卡朗進行本地組裝有助於降低風險,但Tier 4F引擎的進口價格仍以美元計價。

細分市場分析

2025年,印尼施工機械市場中土木機械的銷售額將超過10億美元,佔市場佔有率的48.12%,這主要得益於公共網路服務(PSN)和礦業基礎建設的蓬勃發展。平地平土機、履帶挖土機和鉸接式自動卸貨卡車是收費公路和水壩建設計劃的核心設備,而混凝土攪拌站和破碎設備則為大規模EPC(工程、採購和施工)計劃提供配套支援。先進的遠端資訊處理技術能夠追蹤怠速油耗和底盤磨損情況,促使承包商在排放法規生效前更換老舊的Tier 2車型。

受倉庫自動化和港口現代化的推動,物料輸送設備市場正以7.32%的複合年成長率成長,並佔據了較大的市場佔有率。鋰離子電池驅動的堆高機無需更換電池即可實現三班倒作業,從而減少了25%的停機時間。丹戎不碌港的遙控岸橋提高了泊位作業效率,並促使丹戎霹靂港和吉京港追加訂單。

到2025年,液壓平台將佔銷售額的84.55%,這主要得益於其成本績效優勢以及印尼業者的親和性。供應商改進了滑閥調校和能源回收迴路,在不改變作業習慣的情況下,降低了8%的燃油消費量。遠端鑽探計劃優先考慮液壓系統的可靠性而非電氣系統的複雜性,從而維持了半徑超過100公里礦場的液壓設備更換需求。

目前,電動和混合動力車的租賃量僅為4,200輛,但其複合年成長率(CAGR)卻達到了6.45%,這主要得益於排碳權激勵措施以及在地採購電動車可享10%的增值稅折扣。一項針對20噸挖土機的試點改造表明,每立方米土方的營運成本降低了30個基點。使用混合動力機械的承包商在符合碳捕獲與封存/碳捕獲、利用與封存(CCS/CCUS)法規的公共競標中往往能獲得優先評估。資金籌措方案中包含綠色標籤的資產支持證券,與傳統融資相比,其票儲存差較小。這將鼓勵從2027年起,混合動力機械在主流競標中得到更廣泛的應用。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 印尼2030年基礎建設計畫公共部門支出激增

- 城市鐵路和收費公路的快速發展促進了土木工程車輛的更新換代。

- 電子商務倉儲的蓬勃發展推動了對物料輸送設備的需求。

- 大宗商品超級週期提振加里曼丹礦業領域的資本投資

- 排碳權獎勵鼓勵建築公司採用電動/混合動力汽車

- 泛東協供應鏈重返印尼,擴大建設項目規模

- 市場限制

- 印尼幣匯率波動導致進口設備價格上漲和資金籌措成本增加。

- 由於土地徵用程序繁瑣,計劃延期

- 分散的租賃生態系統限制了全國範圍內的車隊可用性。

- 高級機器控制操作方面持續存在的技能差距

- 價值/供應鏈分析

- 技術展望

- 監管環境

- 波特五力模型

- 新進入者的威脅

- 買方的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場規模和成長預測(價值和數量)

- 透過裝置

- 土木工程施工機械

- 挖土機

- 後鏟式裝載機

- 平土機機

- 推土機

- 道路施工機械

- 壓路機

- 瀝青鋪築機

- 物料輸送設備

- 起重機

- 堆高機和伸縮臂堆高機

- 曲臂式升降機

- 其他施工機械

- 土木工程施工機械

- 按驅動類型

- 油壓

- 電動/混合動力

- 按輸出功率(千瓦)

- 小於100千瓦

- 101~200 kW

- 201~400 kW

- 超過400千瓦

- 最終用戶

- 基礎設施和房地產建築公司

- 採礦和採石公司

- 製造和工業設施

- 農業和人工林

- 透過使用

- 住宅

- 商業建築

- 工業建築

- 交通運輸和基礎設施計劃

- 能源和公共產業計劃

- 按地區

- Java

- 蘇門答臘

- 加里曼丹

- 蘇拉威西

- 巴布亞馬魯古群島

- 印尼其他地區

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Caterpillar Inc.

- Komatsu Ltd.

- Hitachi Construction Machinery Co., Ltd.

- JC Bamford Excavators Ltd.(JCB)

- HD Hyundai Construction Equipment

- SANY Heavy Industry Co., Ltd.

- Xuzhou Construction Machinery Group(XCMG)

- Zoomlion Heavy Industry Sci & Tech

- Liebherr Group

- Kubota Corporation

- Yanmar Co., Ltd.

- Takeuchi Mfg. Co., Ltd.

- Kobelco Construction Machinery

- Manitou Group

- Toyota Material Handling

- Volvo Construction Equipment

- Doosan Bobcat

- Sumitomo Construction Machinery

- CNH Industrial(CASE Construction)

- Shantui Construction Machinery Co., Ltd.

第7章 市場機會與未來展望

The Indonesia Construction Equipment Market was valued at USD 3.41 billion in 2025 and estimated to grow from USD 3.62 billion in 2026 to reach USD 4.89 billion by 2031, at a CAGR of 6.18% during the forecast period (2026-2031).

Continued implementation of the Proyek Strategis Nasional (PSN) pipeline, the USD 35 billion New Capital City (IKN) program, and resilient mining investment jointly anchors demand across earth-moving, material-handling, and specialized machinery categories. Suppliers that blend local assembly, flexible financing, and telematics services are best positioned to capitalize on utilization rates in Jakarta-centric fleets.

Indonesia Construction Equipment Market Trends and Insights

Surging Public-Sector Spend on Indonesia's 2030 Infrastructure Vision

Indonesia's 41 final-stage PSN schemes require uninterrupted equipment deployment across toll roads, dams, ports, and industrial parks. Every rupiah spent on infrastructure has generated 1.9 rupiah in economic value, reinforcing procurement budgets for contractors and rental houses. The multiplier appears strongest in economic zones and power projects, prompting nationwide demand peaks rather than the historical Java concentration. North Sumatra and South Sulawesi have posted the sharpest output lifts, turning each province into a regional rental hotspot. Longer project pipelines permit suppliers to structure five- to seven-year maintenance contracts, locking in parts and service revenue throughout machine life cycles.

Rapid Urban Rail & Toll-Road Build-Outs Driving Earth-Moving Fleet Renewal

Completed in 2024, the Cimanggis-Cibitung Toll Road exemplifies high earth-moving intensity, with significant deployment of excavators and dump trucks during peak construction. On-site digital monitoring at the Karangjoang-Kariangau Section 3A helped reduce equipment idle time significantly while improving utilization rates-highlighting the growing importance of telematics integration. Contractors adopting precision guidance systems are seeing notable gains in fuel efficiency and operational speed. These practices are now being extended by provincial authorities to infrastructure corridors like Parapat in North Sumatra, indicating that technology-driven upgrades are expanding beyond Java. With stricter emission norms tightening around aging Tier 2 equipment, contractors are increasingly turning to cleaner, low-hour Tier 3 and hybrid machines.

Volatile Rupiah Elevating Imported Equipment Prices & Financing Costs

Capital-goods imports form a significant share of Indonesia's trade basket, exposing contractors to foreign-exchange swings that erode purchasing budgets by quarter-points in weeks. Letters of credit add cost buffers, while local content mandates complicate specification choices for global brands. Trade Ministerial Regulation No. 8/2024 streamlines port clearance, yet currency risk persists, prompting equipment financiers to tighten loan-to-value ratios for smaller firms. Dealers increasingly bundle dollar-indexed parts contracts with rupiah-denominated machine loans, reducing mismatch but raising documentation overheads. Local assembly in Batam and Cikarang mitigates exposure, though Tier 4F engine imports remain priced in USD.

Other drivers and restraints analyzed in the detailed report include:

- E-Commerce Warehousing Boom Lifting Demand for Material-Handling Equipment

- Commodity Super-Cycle Fueling Mining-Sector Capex in Kalimantan

- Project Execution Delays Tied to Land-Acquisition Bureaucracy

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Earth-moving machinery generated more than a billion USD within the Indonesian construction equipment market in 2025, translating into a 48.12% share amid a surge of PSN and mining groundwork. Motor graders, crawler excavators, and articulated haulers form the backbone of toll-road and dam packages, while batching plants and crushing units round out larger EPC scopes. Advanced telematics now track idle fuel-burn and undercarriage wear, nudging contractors to upgrade older Tier 2 models ahead of emission mandates.

Material-handling equipment contributed significant share and is expanding at a 7.32% CAGR, propelled by warehouse automation and port modernization. Forklifts with lithium-ion packs enable triple-shift operations without battery swaps, cutting downtime by 25%. At Tanjung Priok, remote-operated quay cranes improve berth productivity, driving follow-on orders from Tanjung Perak and Kijing.

Hydraulic platforms captured 84.55% revenue in 2025, underpinned by cost-performance equilibrium and familiarity among Indonesian operators. Suppliers refine spool-valve tuning and energy-recovery circuits to cut fuel consumption by 8% without shifting working habits. Remote drilling projects value hydraulic robustness over electrical complexity, sustaining replacement demand in 100 km-plus radius mines.

Electric and hybrid variants, although only 4,200 units on rent today, post a 6.45% CAGR backed by carbon-credit incentives and 10% VAT discounts on locally contented EVs. Pilot retrofits on 20-tonne excavators show operating-cost drops of 30 basis points per cubic meter moved. Contractors adopting hybrids often secure preferential scoring in public tenders aligned with CCS/CCUS compliance. Financing bundles include green-label asset-backed securities, trimming coupon spreads versus conventional loans, and nudging adoption into mainstream bids for 2027 onward.

The Indonesia Construction Equipment Market Report is Segmented by Equipment Type (Earth-Moving Equipment, Road Construction Equipment, and More), Drive Type (Hydraulic and Electric/Hybrid), Power Output (Less Than 100 KW and More), End-User (Infrastructure & Real-Estate Contractors and More), Application (Residential Construction and More), and Region. The Market Forecasts are Provided in Terms of Value (USD) and Volume (Units).

List of Companies Covered in this Report:

- Caterpillar Inc.

- Komatsu Ltd.

- Hitachi Construction Machinery Co., Ltd.

- J.C. Bamford Excavators Ltd. (JCB)

- HD Hyundai Construction Equipment

- SANY Heavy Industry Co., Ltd.

- Xuzhou Construction Machinery Group (XCMG)

- Zoomlion Heavy Industry Sci & Tech

- Liebherr Group

- Kubota Corporation

- Yanmar Co., Ltd.

- Takeuchi Mfg. Co., Ltd.

- Kobelco Construction Machinery

- Manitou Group

- Toyota Material Handling

- Volvo Construction Equipment

- Doosan Bobcat

- Sumitomo Construction Machinery

- CNH Industrial (CASE Construction)

- Shantui Construction Machinery Co., Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surging Public-Sector Spend on Indonesia's 2030 Infrastructure Vision

- 4.2.2 Rapid Urban Rail & Toll-Road Build-Outs Driving Earth-Moving Fleet Renewal

- 4.2.3 E-Commerce Warehousing Boom Lifting Demand for Material-Handling Equipment

- 4.2.4 Commodity Super-Cycle Fueling Mining-Sector Capex in Kalimantan

- 4.2.5 Carbon-Credit Incentives Pushing Contractors Toward Electric/Hybrid Fleets

- 4.2.6 ASEAN-Wide Supply-Chain Re-Shoring into Indonesia Expanding Construction Pipelines

- 4.3 Market Restraints

- 4.3.1 Volatile Rupiah Elevating Imported Equipment Prices & Financing Costs

- 4.3.2 Project Execution Delays Tied to Land-Acquisition Bureaucracy

- 4.3.3 Fragmented Rental Ecosystem Limiting Nationwide Fleet Utilisation

- 4.3.4 Persistent Skills Gap in Advanced Machine-Control Operation

- 4.4 Value / Supply-Chain Analysis

- 4.5 Technological Outlook

- 4.6 Regulatory Landscape

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value & Volume)

- 5.1 By Equipment Type

- 5.1.1 Earth-moving Equipment

- 5.1.1.1 Excavators

- 5.1.1.2 Backhoe Loaders

- 5.1.1.3 Motor Graders

- 5.1.1.4 Bulldozers

- 5.1.2 Road Construction Equipment

- 5.1.2.1 Road Rollers

- 5.1.2.2 Asphalt Pavers

- 5.1.3 Material-Handling Equipment

- 5.1.3.1 Cranes

- 5.1.3.2 Forklifts & Telescopic Handlers

- 5.1.3.3 Articulated Boom Lifts

- 5.1.4 Other Construction Equipment

- 5.1.1 Earth-moving Equipment

- 5.2 By Drive Type

- 5.2.1 Hydraulic

- 5.2.2 Electric / Hybrid

- 5.3 By Power Output (kW)

- 5.3.1 Less than 100 kW

- 5.3.2 101 to 200 kW

- 5.3.3 201 to 400 kW

- 5.3.4 More than 400 kW

- 5.4 By End-user

- 5.4.1 Infrastructure & Real-estate Contractors

- 5.4.2 Mining & Quarrying Companies

- 5.4.3 Manufacturing & Industrial Facilities

- 5.4.4 Agriculture & Plantation Sector

- 5.5 By Application

- 5.5.1 Residential Construction

- 5.5.2 Commercial Construction

- 5.5.3 Industrial Construction

- 5.5.4 Transportation & Infrastructure Projects

- 5.5.5 Energy & Utilities Projects

- 5.6 By Region

- 5.6.1 Java

- 5.6.2 Sumatra

- 5.6.3 Kalimantan

- 5.6.4 Sulawesi

- 5.6.5 Papua & Maluku

- 5.6.6 Rest of Indonesia

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, Recent Developments)

- 6.4.1 Caterpillar Inc.

- 6.4.2 Komatsu Ltd.

- 6.4.3 Hitachi Construction Machinery Co., Ltd.

- 6.4.4 J.C. Bamford Excavators Ltd. (JCB)

- 6.4.5 HD Hyundai Construction Equipment

- 6.4.6 SANY Heavy Industry Co., Ltd.

- 6.4.7 Xuzhou Construction Machinery Group (XCMG)

- 6.4.8 Zoomlion Heavy Industry Sci & Tech

- 6.4.9 Liebherr Group

- 6.4.10 Kubota Corporation

- 6.4.11 Yanmar Co., Ltd.

- 6.4.12 Takeuchi Mfg. Co., Ltd.

- 6.4.13 Kobelco Construction Machinery

- 6.4.14 Manitou Group

- 6.4.15 Toyota Material Handling

- 6.4.16 Volvo Construction Equipment

- 6.4.17 Doosan Bobcat

- 6.4.18 Sumitomo Construction Machinery

- 6.4.19 CNH Industrial (CASE Construction)

- 6.4.20 Shantui Construction Machinery Co., Ltd.

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment