|

市場調查報告書

商品編碼

1851353

數位電子看板:市場佔有率分析、產業趨勢、統計數據和成長預測(2025-2030 年)Digital Signage - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

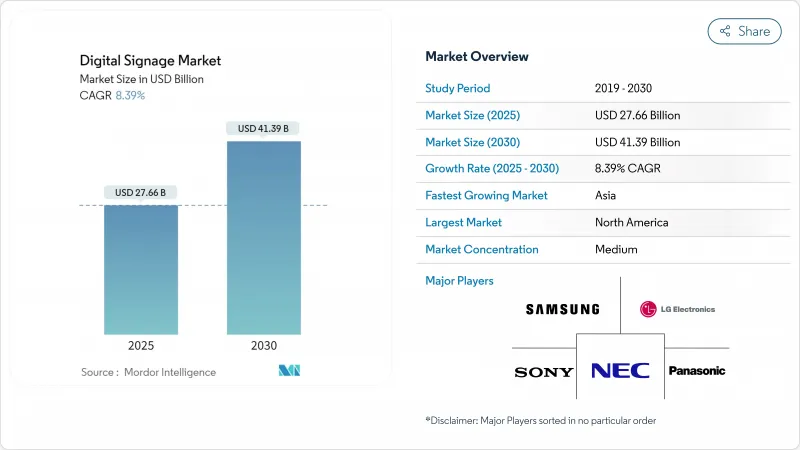

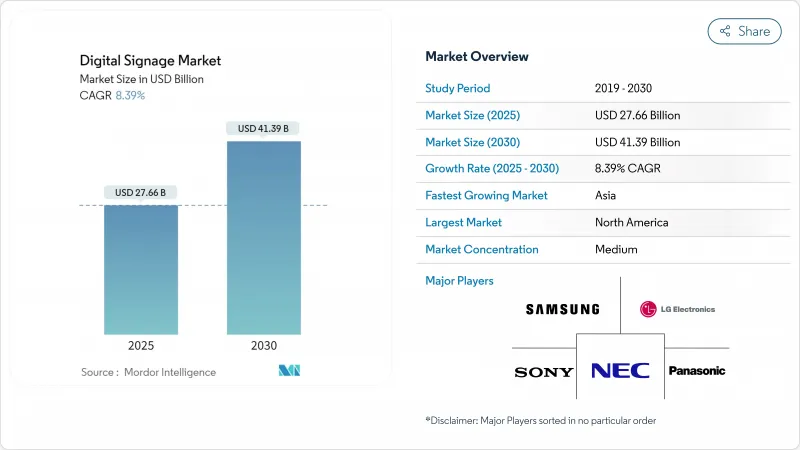

數位電子看板市場預計到 2025 年將達到 276.6 億美元,到 2030 年將達到 413.9 億美元,年複合成長率為 8.39%。

這項擴張得益於人工智慧主導的內容引擎、5G邊緣網路和節能型MicroLED螢幕的持續普及。大型企業正在利用互聯顯示器統一混合職場中的通訊,而市政府則將互動式電子白板融入智慧城市基礎設施,以簡化交通出行和公共舉措。零售商正在加大投資,因為受眾分析平台正將店內螢幕轉化為能夠創造收益的零售媒體資產。同時,交通營運商正在部署即時乘客資訊系統,以提升服務品質。

全球數位電子看板市場趨勢與洞察

人工智慧驅動的受眾分析協助動態內容個人化

零售商如今正以人工智慧引擎取代千篇一律的廣告循環,這些引擎能夠根據消費者的接近即時調整通訊。電腦視覺模組可以測量顧客的年齡、性別和互動時長,從而觸發創新變體,將轉換率提升高達 30%。美國、英國、德國和法國的連鎖店正在將這些洞察與會員應用程式資料結合,以豐富全通路宣傳活動。代理商願意為這種精準曝光支付高額的 CPM,將他們的門市網路轉變為高利潤的媒體管道。雖然 GDPR 合規性正在影響歐洲的部署速度,但供應商正在採用「隱私設計」工作流程,在分析之前對視訊幀進行本地匿名化處理。這些因素正在推動數位電子看板市場在中期內保持強勁的成長勢頭。

5G + 邊緣運算輔助實現即時戶外串流播放

東京、首爾、新加坡和雪梨的交通部門正在利用毫米波5G骨幹網,將超低延遲的視訊和緊急警報推送至戶外LED顯示器。裝置上的邊緣伺服器預先快取高解析度影片片段,從而降低資料傳輸成本,並允許在人流量高峰期立即啟動宣傳活動。亞洲交通樞紐的研究表明,當5G取代傳統光纖時,生產力可提高52%至245%,成本最多可降低90%。隨著更多城市運作獨立的5G核心網,數位電子看板市場將迎來快速成長。

內容管理系統標準的分散化使多供應商互通性變得複雜。

全球零售商使用多種品牌的螢幕,但目前尚未找到通用的調度或分析通訊協定。通訊警告稱,缺乏互通性將減緩技術普及並增加整體擁有成本。因此,許多公司被迫選擇單一供應商的生態系統,限制了競爭性競標。產業聯盟正在製定應用程式介面(API),但由於各供應商的藍圖不同,進展緩慢。這種情況限制了數位電子看板市場在短期內的擴充性。

細分市場分析

到 2024 年,電視牆將佔銷售額的 28.1%。數位電子看板市場仍受到品牌劇院和企業全體員工大會的青睞,而速食店對數位海報的需求也保持穩定。

然而,隨著自助結帳、路線指引和會員註冊等功能充分利用響應式觸控屏,自助服務終端預計將在2030年之前以9.2%的複合年成長率快速成長。數位電子看板市場的零售商正在部署人工智慧模組,以便在結帳時推薦附加元件並調整小票金額。透明液晶顯示器透過將產品展示與數據疊加相結合,在奢侈品商店和汽車展示室中開闢了一片新天地。製造商目前正在嘗試將多面板電視牆與自助服務終端互動結合的混合設備,用於交通樞紐。

硬體組件仍將是數位電子看板市場的基礎,涵蓋 LED 顯示器、媒體播放機和安裝套件,預計到 2024 年將佔收入的 60.7%。像素成本的下降使得資本支出更容易控制,每四到五年即可完成一次更新換代。

隨著企業發現內容編配與分析能夠提升投資報酬率,軟體收入正以10.5%的複合年成長率(兩位數)快速成長。雲端儀錶板透過遠距離診斷確保車輛運作,而人工智慧調度器則提高了宣傳活動的針對性。供應商正在整合播放證明帳本,使廣告商審核其廣告曝光情況,從而增強數位電子看板市場的信任度。

區域分析

2024年,北美將佔全球營收的33.4%,這主要得益於美國企業大廳整修中所體現的數位化優先理念。加拿大零售商加快了結帳流程的現代化,穩定了該地區的需求。該地區數位電子看板市場的發展也得益於日趨成熟的雲端基礎設施,降低了部署難度。

亞太地區預計將實現8.5%的複合年成長率,這主要得益於中國的城市叢集計劃、日本的技術出口促進、印度的購物中心蓬勃發展以及東南亞旅遊業的復甦。面板和積體電路的一體化供應鏈正在降低單位成本,為該地區的買家提供更豐富的價格選擇,並提升數位電子看板市場的滲透率。

在環保設計政策和強勁購買力的支撐下,歐洲市場維持穩定成長。儘管歷史街區的標誌數量限制使得合規難度加大,但德國和北歐企業仍採用了A級能效顯示螢幕,彌補了旅遊區關閉帶來的影響。東歐機場競相利用身臨其境型資訊顯示器爭奪樞紐地位,數位電子看板市場向東擴張。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 人工智慧驅動的受眾分析技術,協助北美及歐洲零售商店及交通樞紐實現動態內容個人化。

- 5G+邊緣運算助力亞洲及大洋洲主要交通樞紐實現即時戶外串流播放

- 歐盟企業永續性指令加速節能型微型LED和電子紙牌的普及

- 美國後疫情時代的混合辦公模式推廣雲端基礎的企業溝通儀錶板

- 中東各地正在興建多個智慧大型企劃(如NEOM和杜拜2040),這些計畫都將大型數位廣告看板融入其中。

- 零售媒體商業化戰略推動拉丁美洲大型連鎖店部署電視牆

- 市場限制

- 內容管理系統(CMS)標準分散化,使全球零售商的多供應商互通性變得複雜。

- 歐洲歷史城區戶外LED建築幕牆面臨高昂的資本支出與授權障礙

- 美國交通運輸顯示器勒索軟體暴露網路安全漏洞

- 用於大型面板的專用驅動積體電路的供應鏈價格正在上漲。

- 生態系分析

- 技術展望

- 波特五力分析

- 新進入者的威脅

- 買方的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場規模與成長預測

- 按類型

- 電視牆

- 視訊螢幕

- 亭

- 透明液晶螢幕

- 數位海報

- 廣告看板

- 其他類型

- 按組件

- 硬體

- LCD/LED顯示器

- OLED顯示器

- 微型LED顯示器

- 媒體播放機

- 控制器

- 投影機/投影幕

- 其他硬體

- 軟體

- 服務

- 安裝與整合

- 託管服務

- 支援與維護

- 硬體

- 透過部署

- 本地部署

- 雲端基礎的

- 混合

- 按螢幕尺寸

- 32英吋或更小

- 32英寸至52英寸

- 52吋或以上

- 超大尺寸,100吋或更大

- 按位置

- 店內/室內

- 戶外的

- 按最終用途行業分類

- 零售

- 運輸

- 飯店業

- 公司的

- 教育

- 衛生保健

- 政府機構

- 體育娛樂

- 銀行和金融服務

- 製造工廠

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 北歐國家

- 其他歐洲地區

- 南美洲

- 巴西

- 其他南美洲

- 亞太地區

- 中國

- 日本

- 印度

- 東南亞

- 亞太其他地區

- 中東和非洲

- 中東

- GCC

- 土耳其

- 其他中東地區

- 非洲

- 南非

- 其他非洲地區

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- NEC Display Solutions Ltd.

- LG Display Co. Ltd.

- Samsung Electronics Co. Ltd.

- Panasonic Corporation

- Sony Group Corporation

- Stratacache

- Planar Systems Inc.

- Hitachi Ltd.

- Barco NV

- Goodview

- Cisco Systems Inc.

- Scala Inc.

- Broadsign International LLC

- Appspace Inc.

- BrightSign LLC

- Mvix Inc.

- Christie Digital Systems USA Inc.

- Daktronics Inc.

- Leyard Optoelectronic Co. Ltd.

- Unilumin Group Co. Ltd.

- JCDecaux SA

- E Ink Holdings Inc.

- Clear Channel Outdoor Holdings Inc.

- Sharp Corporation

第7章 市場機會與未來展望

The digital signage market size stands at USD 27.66 billion in 2025 and is forecast to reach USD 41.39 billion by 2030, reflecting an 8.39% CAGR.

Consistent uptake of AI-driven content engines, 5G-enabled edge networks and energy-frugal MicroLED screens underpins this expansion. Large enterprises are using connected displays to unify communications across hybrid workplaces, while city authorities weave interactive boards into smart-city infrastructure to streamline mobility and public safety initiatives. Retailers intensify investment as audience-analytics platforms transform in-store screens into revenue-generating retail-media assets. At the same time, transportation operators deploy real-time passenger information systems that raise service quality.

Global Digital Signage Market Trends and Insights

AI-powered audience analytics boosting dynamic content personalisation

Retailers now replace one-size-fits-all loops with AI engines that adjust messaging in real time when shoppers approach. Computer-vision modules gauge age bracket, gender and engagement length, then trigger creative variants that can lift conversion by as much as 30%. Chains in the United States, United Kingdom, Germany and France link these insights with loyalty-app data to enrich omnichannel campaigns. Agencies pay premium CPMs for such precise exposure, turning store networks into high-margin media channels. Compliance with GDPR shapes rollout pace in Europe, yet vendors embed privacy-by-design workflows that anonymise video frames locally before analysis. These factors keep the digital signage market on a solid medium-term growth path.

5G + edge computing enabling real-time outdoor streaming

Transit authorities in Tokyo, Seoul, Singapore and Sydney use millimetre-wave 5G backbones to push ultra-low-latency video and emergency alerts to outdoor LED boards. On-device edge servers pre-cache high-resolution clips, cutting data transit cost and letting campaigns switch instantly when foot-traffic sensors spike. Studies for Asian transport hubs show productivity gains from 52% to 245% and cost savings up to 90% when 5G replaces legacy fibre. As more metros activate standalone 5G cores, the digital signage market receives an immediate uplift.

Fragmented CMS standards complicating multi-vendor interoperability

Global retailers often juggle screens from several brands yet find no common protocol for scheduling or analytics. The International Telecommunication Union warns that the lack of interoperability slows deployments and raises total ownership cost. Many firms therefore lock into single-vendor ecosystems, limiting competitive bids. Industry alliances are drafting APIs, but diverging roadmaps among vendors keep progress slow. This reality curbs near-term scalability for the digital signage market.

Other drivers and restraints analyzed in the detailed report include:

- EU corporate sustainability mandates accelerating energy-efficient displays

- Post-pandemic hybrid work models driving cloud dashboards

- Cyber-security vulnerabilities spotlighted by ransomware on transit displays

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Video walls dominated 2024 revenue with 28.1% share due to their immersive impact in control rooms and flagship retail settings. The digital signage market continues to favour their scale for brand theatre and corporate town-hall events. Demand also stays steady for digital posters in quick-serve restaurants because franchisees value simple content swaps.

Kiosks, however, offer the fastest 9.2% CAGR to 2030 as shoppers embrace self-checkout, wayfinding and loyalty enrollment on responsive touchscreens. Retailers in the digital signage market deploy AI modules that recommend add-ons at check-out, nudging ticket size. Transparent LCD enclosures carve a niche in luxury stores and automotive showrooms, merging product visibility with data overlays. Manufacturers now experiment with hybrid rigs that fuse multi-panel video walls and kiosk interaction for transit concourses.

Hardware parts generated 60.7% of 2024 turnover and remain foundational to the digital signage market, covering LED tiles, media players and mounting kits. Falling pixel costs keep capex manageable for refresh cycles every four-to-five years.

Software revenue is growing at a double-digit 10.5% CAGR as companies discover that content orchestration and analytics drive ROI. Cloud dashboards secure fleet uptime through remote diagnostics, while AI schedulers improve campaign relevance. Vendors integrate proof-of-play ledgers so advertisers can audit exposures, raising confidence in the digital signage market.

The Digital Signage Market Report is Segmented by Type (Video Wall, Video Screen, Kiosk, and More), Component (Hardware, Software, and Services), Deployment (On-Premise, Cloud-Based, and Hybrid), Screen Size (Below 32", 32"-52", and More), Location (In-store/Indoor, and Outdoor), End-Use Industry (Retail, Transportation, Hospitality, Corporate, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America held 33.4% 2024 income, anchored by United States corporate refurbishments that turned lobbies into digital-first showcases. Canadian retailers accelerate checkout modernisation, keeping regional demand steady. The digital signage market here benefits from mature cloud infrastructure that reduces deployment friction.

Asia-Pacific is on an 8.5% CAGR trajectory, propelled by China's city cluster projects, Japan's technology export push, India's mall boom and Southeast Asia's tourism recovery. An integrated supply chain for panels and ICs lowers unit costs, giving regional buyers price latitude that boosts the digital signage market's penetration.

Europe records stable gains supported by ecodesign mandates and high purchasing power. Historic-district signage caps add compliance effort, yet German and Nordic corporates adopt energy-class A displays, offsetting tourist-zone pauses. Eastern European airports compete for hub status through immersive wayfinding walls, expanding the digital signage market eastward.

- NEC Display Solutions Ltd.

- LG Display Co. Ltd.

- Samsung Electronics Co. Ltd.

- Panasonic Corporation

- Sony Group Corporation

- Stratacache

- Planar Systems Inc.

- Hitachi Ltd.

- Barco NV

- Goodview

- Cisco Systems Inc.

- Scala Inc.

- Broadsign International LLC

- Appspace Inc.

- BrightSign LLC

- Mvix Inc.

- Christie Digital Systems USA Inc.

- Daktronics Inc.

- Leyard Optoelectronic Co. Ltd.

- Unilumin Group Co. Ltd.

- JCDecaux SA

- E Ink Holdings Inc.

- Clear Channel Outdoor Holdings Inc.

- Sharp Corporation

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 AI-powered audience analytics boosting dynamic content personalisation in North American and European retail and transit corridors

- 4.2.2 5G + edge computing enabling real-time outdoor streaming across major Asian and Oceanian transport hubs

- 4.2.3 EU corporate sustainability mandates accelerating adoption of energy-efficient MicroLED and e-paper signage

- 4.2.4 Post-pandemic hybrid work models driving cloud-based corporate communication dashboards in the USA

- 4.2.5 Smart-city mega-projects (NEOM, Dubai 2040) integrating large-format digital billboards across the Middle East

- 4.2.6 Retail-media monetisation strategies fuelling video-wall roll-outs by Latin-American big-box chains

- 4.3 Market Restraints

- 4.3.1 Fragmented CMS standards complicating multi-vendor interoperability for global retailers

- 4.3.2 High CAPEX and permitting hurdles for outdoor LED facades in historical European city centres

- 4.3.3 Cyber-security vulnerabilities spotlighted by ransomware on United States transit displays

- 4.3.4 Supply-chain price spikes in specialty driver-ICs for large panels

- 4.4 Industry Ecosystem Analysis

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUES)

- 5.1 By Type

- 5.1.1 Video Wall

- 5.1.2 Video Screen

- 5.1.3 Kiosk

- 5.1.4 Transparent LCD Screen

- 5.1.5 Digital Poster

- 5.1.6 Billboard

- 5.1.7 Other Types

- 5.2 By Component

- 5.2.1 Hardware

- 5.2.1.1 LCD/LED Display

- 5.2.1.2 OLED Display

- 5.2.1.3 MicroLED Display

- 5.2.1.4 Media Players

- 5.2.1.5 Controllers

- 5.2.1.6 Projector/Projection Screens

- 5.2.1.7 Other Hardware

- 5.2.2 Software

- 5.2.3 Services

- 5.2.3.1 Installation and Integration

- 5.2.3.2 Managed Services

- 5.2.3.3 Support and Maintenance

- 5.2.1 Hardware

- 5.3 By Deployment

- 5.3.1 On-premise

- 5.3.2 Cloud-based

- 5.3.3 Hybrid

- 5.4 By Screen Size

- 5.4.1 Below 32"

- 5.4.2 32"-52"

- 5.4.3 Above 52"

- 5.4.4 Ultra-large Above 100"

- 5.5 By Location

- 5.5.1 In-store/Indoor

- 5.5.2 Outdoor

- 5.6 By End-use Industry

- 5.6.1 Retail

- 5.6.2 Transportation

- 5.6.3 Hospitality

- 5.6.4 Corporate

- 5.6.5 Education

- 5.6.6 Healthcare

- 5.6.7 Government

- 5.6.8 Sports and Entertainment

- 5.6.9 Banking and Financial Services

- 5.6.10 Manufacturing Facilities

- 5.7 By Geography

- 5.7.1 North America

- 5.7.1.1 United States

- 5.7.1.2 Canada

- 5.7.1.3 Mexico

- 5.7.2 Europe

- 5.7.2.1 Germany

- 5.7.2.2 United Kingdom

- 5.7.2.3 France

- 5.7.2.4 Nordics

- 5.7.2.5 Rest of Europe

- 5.7.3 South America

- 5.7.3.1 Brazil

- 5.7.3.2 Rest of South America

- 5.7.4 Asia-Pacific

- 5.7.4.1 China

- 5.7.4.2 Japan

- 5.7.4.3 India

- 5.7.4.4 South-East Asia

- 5.7.4.5 Rest of Asia-Pacific

- 5.7.5 Middle East and Africa

- 5.7.5.1 Middle East

- 5.7.5.1.1 Gulf Cooperation Council Countries

- 5.7.5.1.2 Turkey

- 5.7.5.1.3 Rest of Middle East

- 5.7.5.2 Africa

- 5.7.5.2.1 South Africa

- 5.7.5.2.2 Rest of Africa

- 5.7.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 NEC Display Solutions Ltd.

- 6.4.2 LG Display Co. Ltd.

- 6.4.3 Samsung Electronics Co. Ltd.

- 6.4.4 Panasonic Corporation

- 6.4.5 Sony Group Corporation

- 6.4.6 Stratacache

- 6.4.7 Planar Systems Inc.

- 6.4.8 Hitachi Ltd.

- 6.4.9 Barco NV

- 6.4.10 Goodview

- 6.4.11 Cisco Systems Inc.

- 6.4.12 Scala Inc.

- 6.4.13 Broadsign International LLC

- 6.4.14 Appspace Inc.

- 6.4.15 BrightSign LLC

- 6.4.16 Mvix Inc.

- 6.4.17 Christie Digital Systems USA Inc.

- 6.4.18 Daktronics Inc.

- 6.4.19 Leyard Optoelectronic Co. Ltd.

- 6.4.20 Unilumin Group Co. Ltd.

- 6.4.21 JCDecaux SA

- 6.4.22 E Ink Holdings Inc.

- 6.4.23 Clear Channel Outdoor Holdings Inc.

- 6.4.24 Sharp Corporation

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment