|

市場調查報告書

商品編碼

1849911

北美數位電子看板:市場佔有率分析、行業趨勢、統計數據和成長預測(2025-2030 年)North America Digital Signage - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

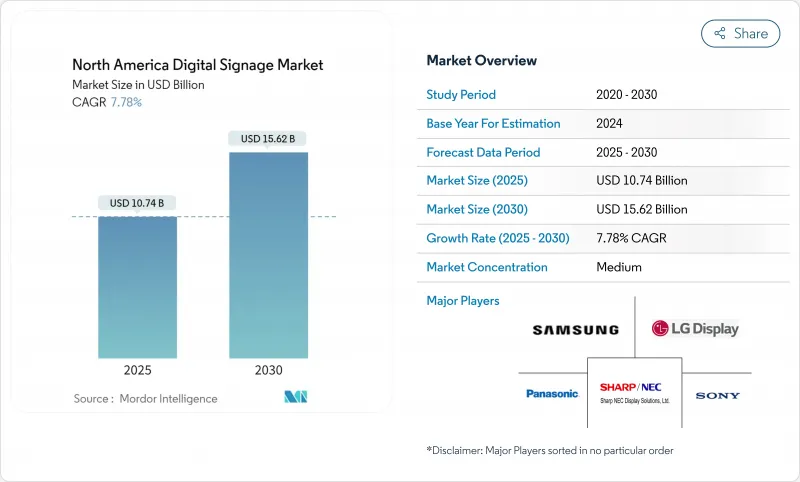

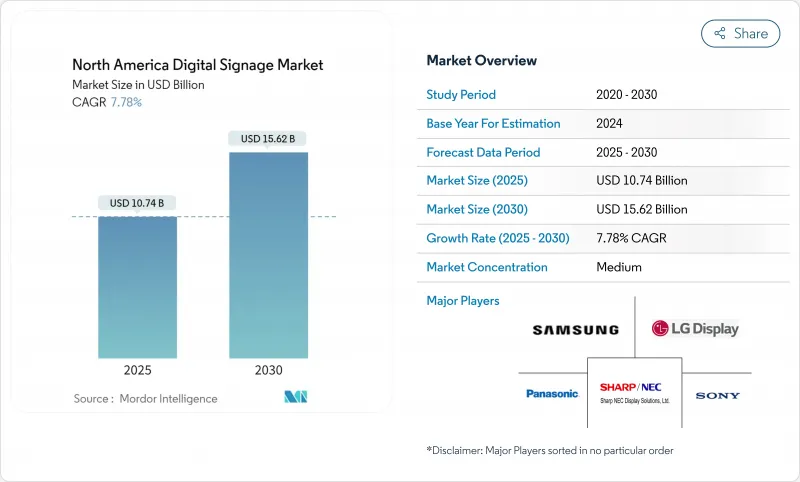

預計2025年北美數位電子看板市場規模將達到107.4億美元,到2030年將達到156.2億美元。

零售商店、交通樞紐和企業園區不再將螢幕視為被動的廣告牌,而是將其視為數據豐富的客戶參與工具。互動式格式、透明LED建築幕牆和程式化採購正在改變收益的計算方式,而液晶面板成本的下降和「硬體+軟體」捆綁優惠正吸引中小企業進入升級週期。關稅變化、能源效率法規和在地化正在重塑供應商格局,但多門市品牌的持續資本投資使需求曲線保持上升趨勢。

北美數位電子看板看板市場趨勢與洞察

承包解決方案的進步加速了美國零售連鎖店的部署

自2023年以來,整合螢幕、媒體播放機、軟體、內容模板和遠端監控的捆綁產品在全國範圍內的推廣速度加快了37%。零售集團目前正在數百家門市實現體驗標準化,同時根據當地存量基準進行促銷活動。採用這種模式的驅動力是訂閱定價而非資本支出:60%尚未部署數位電子看板的企業計劃在兩年內加入。採用這種模式的連鎖店報告稱,參與度提升了22%,平均購物金額提升了18%,證實了其正從成本中心轉變為收益驅動力。

利用行動數據的情境感知廣告可提高加拿大廣告商的投資報酬率

匿名行動電話訊號為內容調度人員提供即時受眾預測。加拿大的一項試驗研究表明,與傳統戶外廣告相比,戶外廣告的投資報酬率提高了41%,零售商的參與度提高了27%,轉換率提高了19%。地理圍欄技術使品牌能夠重新定位透過行動電話接觸到的路人,將實體印象和數位後續行動整合在一起,而無需儲存個人識別資訊。

基於位置的定位和臉部分析的隱私問題

美國的州級法案和加拿大的《數位憲章》正在強化知情同意規則,並迫使商家從臉部辨識轉向匿名人口統計。調查顯示,68%的加拿大年輕人反對在商業活動中進行人臉分析,迫使零售商在聲譽風險和個人化服務效益之間做出權衡。

細分分析

2024年,硬體將佔據北美數位電子看板市場佔有率的56.9%,其中以資本密集螢幕和媒體播放機為主。儘管硬體佔據領先地位,但隨著雲端儀表板、人工智慧調度引擎和受眾分析將買家的關注點從一次性安裝轉向終身價值,軟體市場佔有率的複合年成長率仍達8.8%。訂閱套餐目前佔平台收益的43%,將供應商獎勵與持續的內容最佳化相結合。硬體製造商預先提供許可證和託管服務,實現無縫採購,使零售商無需與多家供應商捆綁。

由於終端用戶缺乏內部頻寬來更新龐大場館內的宣傳活動,規劃、佈線、校準、現場維護和創新設計等服務層級正在穩步擴展。提供端到端網路管理的整合商正在贏得多年期契約,確保年金可預測,同時將故障率保持在服務水準閾值以下。最新媒體播放器內建的邊緣人工智慧功能可降低頻寬成本並實現局部決策,例如在安靜時段靜音或標記故障 LED 以便主動維修。

到2024年,LCD和傳統LED將保持46.8%的市場佔有率,憑藉成本效益和成熟的供應鏈,為主流計劃提供支援。目前,透明LED顯示器可以在不遮擋視線的情況下打開店面櫥窗,透明度超過80%,客流量也因此增加了兩位數。然而,透明LED顯示器以其超過80%的透光率重新定義了建築,使零售商能夠在不遮擋視線的情況下,為店面櫥窗注入活力。這種形式的複合年成長率預計為11.2%,是北美數位電子看板市場成長最快的形式,尤其是在高階零售商、汽車展示室和體驗式快閃店領域。

OLED 正在進入高階市場,其近乎無限的對比度和離軸清晰度使其高昂的價格物有所值。窄像素間距 LED 用於控制室和廣播場景的手持觀看,而堅固耐用的投影機則用於不規則的建築幕牆和臨時活動。媒體播放機正在從被動播放盒發展為具有設備內分析功能的小型邊緣伺服器,可以緩衝連接中斷並保持播放完整性。

北美數位電子看板位看板市場報告按組件(硬體、軟體、服務)、硬體(LCD/LED 顯示器、OLED 顯示器等)、安裝位置(室內、室外)、顯示器尺寸(32 吋以下、32-52 吋等)、安裝位置(店內、店內/路邊)、終端用戶市場(零售、運輸等)和國家/地區細分。市場預測以美元計算。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場狀況

- 市場概況

- 市場促進因素

- 承包解決方案的進步加速了美國零售連鎖店的採用

- 利用行動數據的情境感知廣告為加拿大廣告主帶來投資報酬率

- 4K/8K電視牆整合增強了美國主要機場的體驗

- 墨西哥智慧城市計畫在市中心推廣戶外數位電子看板

- 液晶面板價格下降導致北美公司採用率上升

- 程序化 DOOH 平台可提高廣告主支出和螢幕使用率

- 市場限制

- 關於基於位置的定位和臉部分析的隱私問題

- 大型顯示器的能源效率法規更加嚴格

- 高亮度LED元件供應鏈不穩定

- 本地獨立速食店的資本投資障礙

- 產業生態系統分析

- 分銷通路分析

- 監管環境—資料隱私和環境標籤標準

- 技術簡介

- 美國數位電子看板解決方案的演變

- 關鍵科技趨勢—電視牆、4K/8K、POS、社群媒體整合

- 波特五力分析

- 新進入者的威脅

- 買方的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

第5章市場規模與成長預測(價值)

- 按組件

- 硬體

- 軟體

- 服務

- 依硬體類型

- LCD/LED顯示器

- OLED顯示器

- 媒體播放機

- 投影機/投影螢幕

- 透明LED顯示器

- 其他硬體

- 按位置

- 室內的

- 戶外

- 按顯示尺寸

- 32英吋或更小

- 32至52英寸

- 52吋或以上

- 按安裝位置

- 商店內部

- 商店外/街上

- 按最終用戶

- 零售

- 運輸

- 飯店業

- 公司

- 教育

- 衛生保健

- 政府

- 體育和娛樂場所

- 其他最終用戶

- 按國家

- 美國

- 加拿大

- 墨西哥

第6章 競爭態勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Samsung Electronics Co., Ltd.

- LG Display Co., Ltd.

- SHARP NEC Display Solutions, Ltd.

- Sony Group Corporation

- Panasonic Corporation

- Cisco Systems, Inc.

- Planar Systems, Inc.(Leyard)

- Barco NV

- Daktronics, Inc.

- BrightSign LLC

- STRATACACHE Inc.(Scala)

- Broadsign International, LLC

- Christie Digital Systems USA, Inc.

- AOPEN Inc.

- Goodview Electronics

- Hitachi, Ltd.

- Peerless-AV

- Elo Touch Solutions, Inc.

- Mvix Digital Signage

- Four Winds Interactive

第7章 市場機會與未來展望

The North America digital signage market is valued at USD 10.74 billion in 2025 and is forecast to climb to USD 15.62 billion by 2030, reflecting a steady 7.78% CAGR.

Growth comes from retailers, transportation hubs and corporate campuses that now treat screens as data-rich customer-engagement tools rather than passive billboards. Hardware still anchors most projects, yet cloud software and analytics subscriptions are expanding margins for vendors and easing roll-outs for end-users.Interactive formats, transparent LED facades and programmatic buying are reshaping return-on-investment calculations, while declining LCD panel costs and bundled "hardware-plus-software" offers are pulling small businesses into the upgrade cycle. Tariff shifts, energy-efficiency rules and localized manufacturing are redrawing supplier maps, but sustained capital spending by multi-site brands keeps the demand curve intact.

North America Digital Signage Market Trends and Insights

Evolution of Turnkey Solutions Accelerating Deployment Across U.S. Retail Chains

Bundled offerings that merge screens, media players, software, content templates and remote monitoring have shortened national roll-outs by 37% since 2023. Retail groups now standardize experiences across hundreds of stores while tailoring promotions to local inventory levels. Subscription pricing, rather than capital outlay, encourages adoption: 60% of enterprises without digital signage intend to subscribe within two years. Chains adopting this model report 22% higher engagement and 18% uplift in average basket value, confirming the pivot from cost center to revenue driver.

Context-Aware Advertising Leveraging Mobile Data Enhances ROI for Canadian Advertisers

Anonymized cellphone signals now feed real-time audience estimates into content schedulers. Canadian pilots show ROI gains of 41% over traditional out-of-home buying, plus 27% higher engagement and 19% conversion lifts in retail settings. Geofencing lets brands retarget exposed passers-by on their phones, knitting together physical impressions and digital follow-ups without storing personal identifiers.

Privacy Concerns Regarding Location-Based Targeting & Facial Analytics

State-level U.S. bills and Canada's Digital Charter are tightening consent rules, forcing vendors to shift from face recognition to anonymous demographic counts. Surveys indicate 68% of Canadian youth oppose facial analysis in commerce, prompting retailers to weigh reputational risk against personalization benefits.

Other drivers and restraints analyzed in the detailed report include:

- Integration of 4K/8K Video Walls Powers Experiential Venues in Major U.S. Airports

- Smart-City Initiatives Driving Outdoor Digital Signage Roll-outs in Mexican Urban Centers

- Rising Energy-Efficiency Regulations for Large-Format Displays

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Hardware captured 56.9% of North America digital signage market share in 2024, anchored by capital-intensive screens and media players. Despite this lead, the software slice is advancing at an 8.8% CAGR as cloud dashboards, AI scheduling engines and audience analytics shift buyer focus from one-time installs to lifetime value. Subscription bundles now comprise 43% of platform revenue, aligning vendor incentives with continuous content optimisation. Hardware makers increasingly pre-load licenses and managed services, creating seamless procurement and freeing retailers from juggling multiple suppliers.

The services tier-covering planning, cabling, calibration, on-site maintenance and creative design-expands steadily because end-users lack in-house bandwidth to refresh campaigns across sprawling estates. Integrators that manage networks end-to-end win multi-year contracts, locking in predictable annuities while keeping failure rates below service-level thresholds. Edge-AI features embedded in modern media players reduce bandwidth costs and enable localised decisions-such as muting audio during quiet hours or flagging malfunctioning LEDs for proactive repairs.

LCD and conventional LED kept 46.8% share in 2024, anchoring mainstream projects thanks to cost efficiency and mature supply chains. Transparent LED now unlocks storefront windows without blocking sightlines, delivering more than 80% transparency and lifting foot traffic by double-digit percentages.Their dominance secures bulk-procurement economies and simplified spares inventory. Transparent LED sheets, however, are rewriting architectural norms with over 80% light transmission, allowing retailers to animate shop windows without blocking sight-lines. Forecast 11.2% CAGR positions the format as the fastest-growing slice of North America digital signage market, particularly in luxury retail, automotive showrooms and experiential pop-ups.

OLED enters premium arenas where near-infinite contrast ratios and off-axis clarity justify higher ticket prices. Narrow pixel-pitch LEDs fill control rooms and broadcast sets that view screens at arm's length, while ruggedised projectors still serve irregular facades and temporary events. Media players graduate from passive playback boxes to miniature edge servers capable of on-device analytics, buffering against connectivity outages and preserving playback integrity.

The North America Digital Signage Market Report is Segmented by Component (Hardware, Software, Services), Hardware (LCD/LED Display, OLED Display, and More), Location (Indoor, and Outdoor), Display Size (Sub 32 Inches, 32 - 52 Inches, and More), Installation Location (In-Store, and Out-of-Store/Roadside), End-User Vertical (Retail, Transportation, and More), and Country. The Market Forecasts are Provided in Terms of Value in (USD).

List of Companies Covered in this Report:

- Samsung Electronics Co., Ltd.

- LG Display Co., Ltd.

- SHARP NEC Display Solutions, Ltd.

- Sony Group Corporation

- Panasonic Corporation

- Cisco Systems, Inc.

- Planar Systems, Inc. (Leyard)

- Barco NV

- Daktronics, Inc.

- BrightSign LLC

- STRATACACHE Inc. (Scala)

- Broadsign International, LLC

- Christie Digital Systems USA, Inc.

- AOPEN Inc.

- Goodview Electronics

- Hitachi, Ltd.

- Peerless-AV

- Elo Touch Solutions, Inc.

- Mvix Digital Signage

- Four Winds Interactive

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Evolution of Turnkey Solutions Accelerating Deployment Across United States Retail Chains

- 4.2.2 Context-Aware Advertising Leveraging Mobile Data Enhances ROI for Canadian Advertisers

- 4.2.3 Integration of 4K/8K Video Walls Powers Experiential Venues in Major United States Airports

- 4.2.4 Smart-City Initiatives Driving Outdoor Digital Signage Roll-outs in Mexican Urban Centers

- 4.2.5 Decline in LCD Panel Prices Expands Adoption Among SMBs Across North America

- 4.2.6 Programmatic DOOH Platforms Increasing Advertiser Spend and Screen Utilisation

- 4.3 Market Restraints

- 4.3.1 Privacy Concerns Regarding Location-Based Targeting and Facial Analytics

- 4.3.2 Rising Energy-Efficiency Regulations for Large-Format Displays

- 4.3.3 Supply-Chain Volatility for High-Brightness LED Components

- 4.3.4 Capex Barriers for Independent QSRs in Rural Areas

- 4.4 Industry Ecosystem Analysis

- 4.5 Distribution Channel Analysis

- 4.6 Regulatory Landscape - Data-Privacy and Environmental Display Standards

- 4.7 Technology Snapshot

- 4.7.1 Evolution of Digital Signage Solutions in the United States

- 4.7.2 Key Technological Trends - Video Walls, 4K/8K, POS and Social Media Integration

- 4.8 Porter's Five Forces Analysis

- 4.8.1 Threat of New Entrants

- 4.8.2 Bargaining Power of Buyers

- 4.8.3 Bargaining Power of Suppliers

- 4.8.4 Threat of Substitutes

- 4.8.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUES)

- 5.1 By Component

- 5.1.1 Hardware

- 5.1.2 Software

- 5.1.3 Services

- 5.2 By Hardware Type

- 5.2.1 LCD/LED Display

- 5.2.2 OLED Display

- 5.2.3 Media Players

- 5.2.4 Projectors/Projection Screens

- 5.2.5 Transparent LED Displays

- 5.2.6 Other Hardware

- 5.3 By Location

- 5.3.1 Indoor

- 5.3.2 Outdoor

- 5.4 By Display Size

- 5.4.1 Below 32 Inches

- 5.4.2 32 - 52 Inches

- 5.4.3 Above 52 Inches

- 5.5 By Installation Location

- 5.5.1 In-Store

- 5.5.2 Out-of-Store/Roadside

- 5.6 By End-user Vertical

- 5.6.1 Retail

- 5.6.2 Transportation

- 5.6.3 Hospitality

- 5.6.4 Corporate

- 5.6.5 Education

- 5.6.6 Healthcare

- 5.6.7 Government

- 5.6.8 Sports and Entertainment Venues

- 5.6.9 Other End-users

- 5.7 By Country

- 5.7.1 United States

- 5.7.2 Canada

- 5.7.3 Mexico

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Samsung Electronics Co., Ltd.

- 6.4.2 LG Display Co., Ltd.

- 6.4.3 SHARP NEC Display Solutions, Ltd.

- 6.4.4 Sony Group Corporation

- 6.4.5 Panasonic Corporation

- 6.4.6 Cisco Systems, Inc.

- 6.4.7 Planar Systems, Inc. (Leyard)

- 6.4.8 Barco NV

- 6.4.9 Daktronics, Inc.

- 6.4.10 BrightSign LLC

- 6.4.11 STRATACACHE Inc. (Scala)

- 6.4.12 Broadsign International, LLC

- 6.4.13 Christie Digital Systems USA, Inc.

- 6.4.14 AOPEN Inc.

- 6.4.15 Goodview Electronics

- 6.4.16 Hitachi, Ltd.

- 6.4.17 Peerless-AV

- 6.4.18 Elo Touch Solutions, Inc.

- 6.4.19 Mvix Digital Signage

- 6.4.20 Four Winds Interactive

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment