|

市場調查報告書

商品編碼

1690092

中東和北非的數位戶外媒體:市場佔有率分析、產業趨勢和成長預測(2025-2030 年)Middle East And North Africa DOOH - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

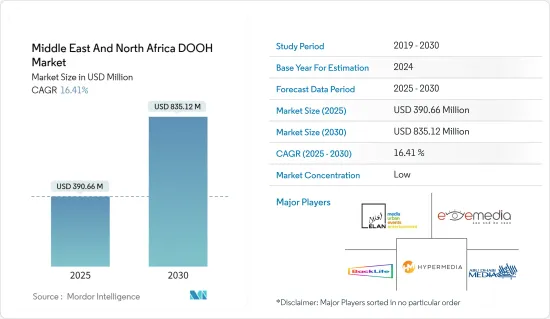

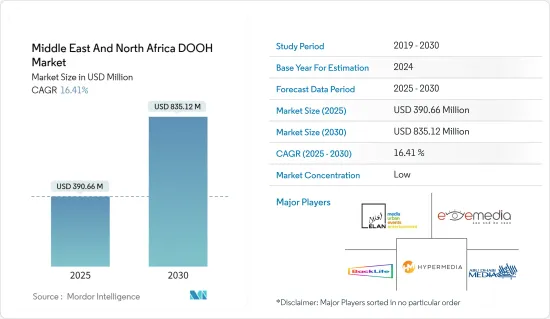

中東和北非 DOOH 市場規模預計在 2025 年為 3.9066 億美元,預計到 2030 年將達到 8.3512 億美元,預測期內(2025-2030 年)的複合年成長率為 16.41%。

網路廣告日益複雜,加上廣告攔截器、行銷和廣告的高昂收費,導致企業尋求替代解決方案來傳達他們的廣告和訊息。這可能會為 DOOH 市場帶來豐厚的機會,並在預測期內提升其滲透率。

關鍵亮點

- 數位戶外 (DOOH) 行銷對中東和北非市場產生了重大影響,該行業領域的公司經歷了顯著成長。大量廣告商進入這個市場以提高其品牌和產品的知名度,他們透過全新的方式吸引目標受眾來實現這一目標。如今,僅僅出現在小螢幕上已經不夠了,廣泛傳播訊息比以往任何時候都更加重要。為此,您需要建立具有「IRL」(現實生活)存在的 360 度廣告。

- 沙烏地阿拉伯市場有機會透過適應新技術並在新的環境中引入新技術,按照沙烏地阿拉伯王國的 2030 願景來推進這項行銷方面。這意味著為了保護環境,要從印刷標牌轉向數位看板。由此,現有產業將演變成充滿活力的媒體產業,更自然融入城市和社會,更環保,也更能吸引觀眾的美感。

- 自動化和程式化平台的興起減少了宣傳活動購買的摩擦,從而推動了戶外廣告錢包佔有率的成長。這些取代了 RFP、人工談判和手動訂購等低效率的採購程序。未來,基於人工智慧的演算法有望實現“智慧廣告”,這種廣告可以隨著時間的推移進行調整和改進,以適應目標受眾的偏好。數位螢幕還將追蹤購買行為,利用感測器技術檢測路人的人口統計特徵並追蹤臉部表情,並將這些資訊來源作為人工智慧廣告的輸入。

- 在所有不同的交通環境中,機場已被證明是理想的廣告環境,尤其是對於知名品牌和奢侈品牌而言。機場被迫想辦法增加收益。透過將海報等靜態展示轉變為數位展示,機場可以利用相同的空間並將其出售給多個廣告商,而不僅僅是一個。這將成倍地增加您的收益。機場還可以引入廣告合作夥伴來幫助分擔升級到新廣告技術的成本。 Airport Ads 投入大量資金開發 DOOH 解決方案和體驗,將創新理念與執行力結合,應用於沙迦機場(阿拉伯聯合大公國)和肯尼思卡翁達機場(尚比亞)等多個國際機場。

- 兩家公司正在共同努力擴大其區域影響力並增強產品系列。例如,2022年5月,在高加索、北非、西非和黎凡特地區提供戶外廣告(OOH)的Pikasso與義大利主要企業的數位戶外(DOOH)程式化公司Pladway達成了商業和技術合作。

- 突然之間,組織和數位行銷公司被迫跟上數位趨勢。這為數位行銷公司提供了更多的空間來為客戶測試他們的想法。例如,疫情改變了公司的工作方式。越來越多的企業正在採用數位化工作機制。儘管環境不容樂觀,數位行銷企業仍擁有營運所需的優勢。此次停擺讓各機構有機會在沒有實體辦公室的情況下審查和重新考慮其各種數位化業務。

中東和北非數位戶外媒體市場趨勢

公車廣告蓬勃發展

- 交通廣告是在任何形式的交通工具上或內部發布的廣告,例如公車、計程車、火車和路面電車。

- 在該地區,交通廣告主要用於公共運輸(計程車、公車、地鐵等)、機場、汽車站、火車站、公車候車亭等。隨著居民擴大使用公共運輸,市場相關人員正在尋求將數位戶外廣告交通納入被確定為重要安裝地點的交通區域。

- 例如,道路交通管理局(RTA)報告稱,到 2022 年,杜拜使用公共運輸、共用出行和計程車的乘客人數將達到約 6.214 億人次,與前一年同期比較成長 35%。公共運輸、共乘和計程車的日均用戶數從 2021 年的 130 萬增加到 2022 年的 170 萬。公共運輸使用量和乘客量的大幅增加可能會為在各種公共運輸平台上安裝數位廣告螢幕的交通 DOOH 公司帶來顯著利益,從而推動市場成長潛力。

- 此外,各公司都意識到了交通數位戶外廣告解決方案的顯著優勢,從而大大推動了市場的成長。例如,有機會從在車輛頂部展示的可攜式數位廣告中獲益,其中的內容可供駕駛人、乘客和行人等用戶閱讀。 Override 是一家位於沙烏地阿拉伯的數位廣告看板公司,它透過提供更重要的功能來挖掘這一潛力:資料和超目標地理圍欄廣告。

- 此外,各種政府措施也大力推動了公共運輸上數位看板的安裝,從而為市場成長做出了重大貢獻。例如,隨著 RTA 推出新功能,杜拜的計程車預計將於 2022 年 10 月數位化。據 RTA 的杜拜計程車公司稱,此次推出的舉措是為了跟上最新技術並解決計程車行業的包裝和舉措舉措問題。計程車廣告更進了一步。傳統的車貼將被數位廣告取代。數位看板可能會安裝在車輛的後擋風玻璃上,以便在路上經過的通勤者能夠看到。

- 總體而言,過去一年來,市場已顯著成長,投資數位顯示器的公司獲得了豐厚的收益。此外,預計配備傳統顯示器的車輛將被數位顯示器取代,以加強品牌推廣。

沙烏地阿拉伯佔主要市場佔有率

- 儘管有電視和網路等替代媒體,但沙烏地阿拉伯的戶外廣告業仍然是廣告公司和組織宣傳其產品的最重要和領先的行業之一。當其他管道或影片無法播放商業廣告時,戶外廣告仍然是最重要的媒介。此外,戶外廣告是市場上的理想和首選,因為與其他廣告媒體相比,它能夠在更短的時間內接觸到大量受眾,並為大眾提供一套成熟的互動式數位解決方案。 2030願景正在為各地帶來巨大變化,包括沙烏地阿拉伯,該國正經歷經濟和社會的繁榮。

- 根據世界銀行的報告,預計到2022年,沙烏地阿拉伯將有3,036萬人居住在都市區,其中大部分城鎮居民集中在利雅德、達曼、麥加、吉達等沙烏地阿拉伯主要城市。根據聯合國開發計畫署和聯合國經濟和社會事務部預測,到 2030 年,利雅德和吉達兩市的人口預計將分別達到 790 萬和 500 萬。

- 此外,2022年沙烏地阿拉伯的人均收入為27,941美元,而2021年為23,186美元。隨著都市區和人均GDP的成長,全國各地的購物中心和商場也不斷增加。因為都市區更喜歡在商業區、娛樂中心、電影院和國際餐廳購物和消磨休閒。這項因素為廣告公司在數位廣告看板和街道家具上推廣其產品和服務創造了機會。此外,在沙烏地阿拉伯領先的戶外廣告供應商沙烏地阿拉伯標誌媒體 (SSM) 等組織的幫助下,沙烏地阿拉伯的戶外廣告媒體市場目前正在發展並處於強勢地位。

- 沙烏地阿拉伯強勁的經濟為私營部門的崛起鋪平了道路,引入了新公司並加劇了競爭。公共機構的溝通也大力推動。與前幾年相比,戶外支出的增加也可以歸因於人們對新的、令人興奮的社交活動、社區活動和目的地旅遊的認知和推廣的提高。

- 格式的數位化及其優勢在硬體方面至關重要。它的規模、位置、網路分佈以及對觀眾的曝光度使其很難被忽視。它們也給人留下了持久、實用的印象,需求量很大。

- 沙烏地阿拉伯的戶外廣告產業及其多種形式為廣告商帶來了豐厚的利潤。例如,純網路參與企業(國內和國際)正在大力投資戶外廣告,因為他們看到了戶外廣告能為其業務帶來的好處。它強調了戶外廣告對於提高知名度和銷售的持續重要性。

中東和北非地區數位戶外媒體產業概況

中東和北非數位戶外 (DOOH) 市場主要參與者包括 ELAN Group、EyeMedia、HyperMedia FZ LLC、Backlite Media 和 Abu Dhabi Media。該市場的參與企業正在採取合作和收購等策略來加強其產品供應並獲得永續的競爭優勢。

2023 年 4 月,Backlite Media 與 Al Qana 合作,獲得了位於阿布達比市中心這座獨特且享有盛譽的海濱場所的獨家廣告權。我們與 Al Qana 的經營團隊合作,創建了阿布達比最大、最具影響力的數位螢幕之一“The Curve”,以慶祝這一戰略關係。

2022 年 7 月,德高集團宣布與 Displayce 簽署策略夥伴關係關係,Displayce 是 DSP(需求方平台)領域的行業參與企業,專門從事數位戶外 (DOOH) 廣告的採購和最佳化。與德高集團達成的協議旨在顯著加速 Displayce 的發展,使其成為戶外廣告市場行業標準的 DSP,同時繼續為廣告商和出版商提供對所有 DOOH 媒體的全面和直接訪問。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概覽

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代產品的威脅

- 競爭對手之間的競爭強度

- 產業價值鏈分析

- COVID-19 市場影響評估

第5章市場動態

- 市場促進因素

- 向數位廣告的轉變仍在繼續

- 增加公共運輸基礎設施

- 採用程序化廣告等全球策略

- 市場限制

- 中東的嚴格監管為供應商帶來挑戰

- 傳統廣告形式在某些國家仍占主導地位

第6章市場區隔

- 按位置

- 室內的

- 戶外的

- 按應用

- 廣告看板

- 過境

- 街道家具

- 其他

- 按最終用戶

- 商業設施

- 設施

- 基礎設施

- 按國家

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 科威特

- 卡達

- 摩洛哥

- 埃及

- 其他中東和非洲地區

第7章競爭格局

- 公司簡介

- ELAN Group

- EyeMedia

- HyperMedia FZ LLC

- Backlite Media

- Abu Dhabi Media

- Dooha Media(Madaeen Al Doha Group)

- Lemma Technologies Ltd

- JCDecaux Group

- Company Ranking

第8章投資分析

第9章:市場的未來

The Middle East And North Africa DOOH Market size is estimated at USD 390.66 million in 2025, and is expected to reach USD 835.12 million by 2030, at a CAGR of 16.41% during the forecast period (2025-2030).

With the increasing complexity of online advertising, coupled with the premium pricing charged for ad blockers, marketing, and advertising, companies are looking for alternative solutions that will enable them to display their advertisements or messages. This presents the DOOH market with a lucrative opportunity, which may boost its adoption over the forecast period.

Key Highlights

- Digital out-of-home (DOOH) marketing hugely impacts the Middle East and Africa markets, and companies are experiencing considerable growth in this industry sector. Numerous advertisers are entering this market to increase awareness of their brands and products, and they are doing it by enticing their target audience in brand-new ways. Being present on a little screen is insufficient today; spreading messages far and wide is more crucial than ever. It entails creating 360-degree ads featuring a presence "IRL" ( in real life).

- The Saudi market has the chance to advance this facet of marketing in line with the kingdom's 2030 Vision by keeping up with emerging technologies and implementing them in new settings. This entails switching out print-based billboards for digital ones to protect the environment. As a result, the existing industry will develop into a vibrant media sector that blends in naturally with cities and society, is more ecologically friendly, and appeals to the audience's sense of aesthetics.

- One of the top market trends is the rise of automation and programmatic platforms since they drive growth in OOH wallet share by reducing campaign purchasing friction. They replace the inefficient buying procedure of RFPs, human negotiation, and manual orders. In the future, artificial intelligence-based algorithms are expected to enable "smart advertisements," which can adapt and improve according to the preferences of target audiences over time. Also, digital screens will track purchase behavior and leverage sensor technology to detect passersby demographic features and track facial expressions and use these sources as inputs for artificially intelligent advertisements.

- Among various transit environments, airports have proven to be an ideal environment for advertising, particularly for top-tier and luxury brands. Airports are under pressure to figure out ways to generate more and more revenue. Converting static displays like posters to digital displays allow airports to utilize the same space to sell to multiple advertisers instead of just one. That multiplies the amount of revenue exponentially. Also, airports can share the cost burden of upgrading to new advertising technologies by bringing in advertising partners. Airport Ads has significantly invested in various international airports, including Sharjah (UAE) and Kenneth Kaunda (Zambia), in developing DOOH solutions and experiences that integrate innovative ideas and executions.

- To expand their presence in the different regions and enhance their product portfolio, the companies are collaborating. For instance, in May 2022, Commercial and technological cooperation was established between Pikasso, the provider of out-of-home advertising (OOH) in the Caucasus, North and West Africa, and the Levant, and Pladway, the top digital out-of-home (DOOH) programmatic company in Italy.

- Organizations and digital marketing companies were forced to follow the digital trend suddenly. This has given digital marketing companies more room to test customer ideas. The pandemic, for example, has changed the way firms work. More and more businesses are adopting a digital work structure. Despite the bleak environment, digital marketing businesses have the required edge to function. The lockout has given agencies the chance to identify and rethink their various digital job tasks in the absence of a physical office.

Middle East And North Africa DOOH Market Trends

Transit to be Fastest Growing Application

- Transit advertising, often known as "advertising on transportation," is the placement of commercials on or within any form of transportation, including buses, taxis, trains, trams, etc.

- The region mostly finds its transit applications across public transportation vehicles (such as taxis, buses, and underground trains), airports, bus stops, train stations, and bus stops. The citizens' growing utilization of public transit drives the market players to incorporate DooH transit along the transit areas identified as essential installation sites.

- For instance, the Roads and Transport Authority (RTA) reported that in Dubai, ridership of public transportation, shared mobility, and taxis recorded around 621.4 million in 2022, a 35% rise year-on-year. The average daily ridership of public transportation, shared mobility, and taxis was 1.7 million in 2022, up from 1.3 million in 2021. Such considerable growth in utilization and ridership in public transit may significantly benefit transit DOOH firms installing digital advertising screens across various public transit modes, thereby gaining potential market growth.

- Moreover, various firms recognize the significant benefits of transit DOOH solutions, substantially driving market growth. For instance, there is a chance to profit from portable digital advertisements displayed on the top of cars, where users, including drivers, passengers, and pedestrians, can read the content. Override, a KSA-based digital billboard business, is taking the plunge into this possibility by offering an even more important feature: data and hyper-targeted geofenced ads.

- Moreover, various government initiatives are significantly supporting the installation of digital billboards on public transport, thereby considerably contributing to market growth. For instance, in October 2022, Dubai cabs were expected to be digitalized as the RTA introduced new features. According to Dubai Taxi Corporation in RTA, the recent rollout would be part of keeping up with the latest technology and tackling the issues of the taxi sector's introduction of package initiatives. Taxi advertisements will be a step forward. Traditional automobile stickers will be replaced with digital advertisements. A digital billboard will likely be mounted on the vehicle's back windshield, which will be visible to commuters on the road.

- Overall, the market had considerable adoption rates during the year, with firms invested in digital displays significantly generating profitable earnings. Further, vehicles with traditional displays are anticipated to be replaced by digital displays to enhance brand promotion.

Saudi Arabia to Hold Significant Market Share

- Despite the existence of alternative media, such as TV, the Internet, etc., the outdoor advertising sector in Saudi Arabia is one of the most significant and primary sectors for advertising firms and organizations looking to advertise their products. When commercials cannot be made on other channels or videos, outdoor advertisements remain the most significant medium. Moreover, outdoor advertising is the ideal and first choice in the market, as it delivers a full-fledged set of interactive digital solutions to the public, ensuring access to a vast number of viewers in a much shorter period compared to other advertising mediums. A significant shift has occurred everywhere due to Vision 2030, and Saudi Arabia, which is booming economically and socially, has made significant changes.

- According to a report by the World Bank, in 2022, 30.36 million people were expected to live in urban areas. Most urban settlers settled in prominent Saudi Arabian cities like Riyadh, Dammam, Mecca, and Jeddah. According to the UNDP and UN DESA, by 2030, the cities of Riyadh and Jeddah are expected to be populated by 7.9 million and 5 million people, respectively.

- Further, in 2022, Saudi Arabia recorded a per capita income of USD 27,941, which was USD 23,186 in 2021. With the rise in urban population and GDP per capita, shopping complexes and malls across the country are also rising steadily, as urban people prefer to shop and spend leisure time in business zones, entertainment centers, cinemas, and international dining experiences. This factor creates opportunities for advertising agencies to market their products and services on digital billboards and street furniture. Further, due to organizations like Saudi Signs Media (SSM), one of the leading OOH providers in Saudi Arabia, the OOH media market in the country is currently in a strong position as it continues to develop.

- With the introduction of new companies and increased competition, Saudi Arabia's robust economy has paved the way for the rise of the private sector. The nation has also seen an active forward movement in communication from official agencies. The increase in outdoor spending compared to prior years has also been attributed to increased awareness of and promotion of new and exciting social activities, regional events, and destination tourism, among other factors.

- The digitalization of formats and their advantages have been crucial in terms of hardware. They are difficult to ignore because of their dimensions, positioning, network distribution, and line-of-sight exposure to audiences. They also leave a lasting, actionable impression that is in high demand.

- The Saudi Arabian OOH industry and the numerous formats are quite advantageous for advertisers. For instance, companies like pure online players (both local and foreign) heavily invest in the media since they have seen its advantages for their businesses. There is no shortage of interest and repeat queries, highlighting that OOH continues to be crucial for raising awareness and boosting sales.

Middle East And North Africa DOOH Industry Overview

The Middle East and North Africa digital out-of-home (DOOH) market is fragmented, with the presence of major players like ELAN Group, EyeMedia, HyperMedia FZ LLC, Backlite Media, and Abu Dhabi Media. Players in the market are adopting strategies such as partnerships and acquisitions to enhance their product offerings and gain a sustainable competitive advantage.

In April 2023, Backlite Media partnered with Al Qana to gain exclusive advertising rights to this unique and renowned waterfront venue in the heart of Abu Dhabi. In collaboration with Al Qana's management, the company built "The Curve," one of Abu Dhabi's largest and most impactful digital screens, to commemorate this strategic relationship.

In July 2022, JCDecaux SA announced the signing of a strategic partnership with Displayce, the industry player in DSP (Demand Side Platform), which specializes in procuring and optimizing digital outdoor advertising (DOOH). The agreement with JCDecaux aimed to considerably speed up Displayce's development so that it became the industry standard DSP in the outdoor advertising market while continuing to provide full and direct access for advertisers and media agencies to all DOOH media.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products and Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Ongoing Shift Toward Digital Advertising

- 5.1.2 Increase in Public Transit Infrastructure

- 5.1.3 Adoption of Global Cues such as Programmatic Advertising

- 5.2 Market Restraints

- 5.2.1 Stringent Regulations in the Middle East Have Been a Challenge for Vendors

- 5.2.2 Traditional Forms of Advertising Continue to Dominate in a Few Countries

6 MARKET SEGMENTATION

- 6.1 By Location

- 6.1.1 Indoor

- 6.1.2 Outdoor

- 6.2 By Application

- 6.2.1 Billboard

- 6.2.2 Transit

- 6.2.3 Street Furniture

- 6.2.4 Other Applications

- 6.3 By End-User

- 6.3.1 Commercial

- 6.3.2 Institutional

- 6.3.3 Infrastructural

- 6.4 By Country

- 6.4.1 Saudi Arabia

- 6.4.2 United Arab Emirates

- 6.4.3 Kuwait

- 6.4.4 Qatar

- 6.4.5 Morocco

- 6.4.6 Egypt

- 6.4.7 Rest of Middle East and North Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 ELAN Group

- 7.1.2 EyeMedia

- 7.1.3 HyperMedia FZ LLC

- 7.1.4 Backlite Media

- 7.1.5 Abu Dhabi Media

- 7.1.6 Dooha Media (Madaeen Al Doha Group)

- 7.1.7 Lemma Technologies Ltd

- 7.1.8 JCDecaux Group

- 7.2 Company Ranking