|

市場調查報告書

商品編碼

1684042

高壓MLCC:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)High Voltage MLCC - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

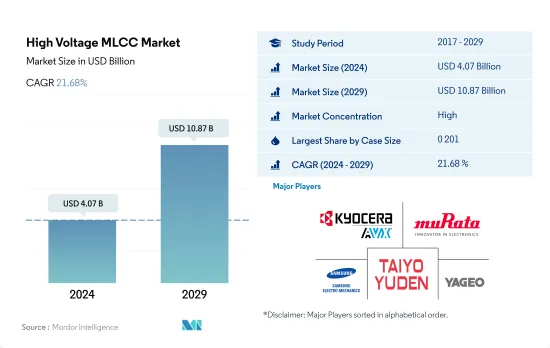

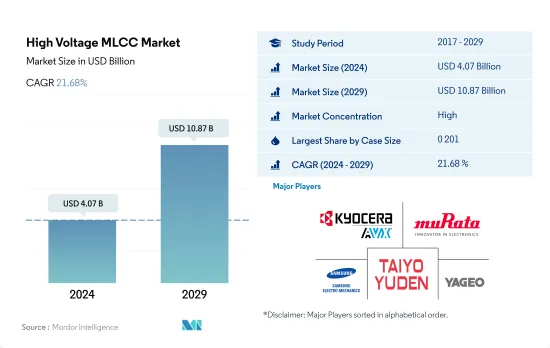

高壓 MLCC 市場規模估計和預測在 2024 年為 40.7 億美元,預計到 2029 年將達到 108.7 億美元,在市場估計和預測期(2024-2029 年)內以 21.68% 的複合年成長率成長。

攜帶式和連網型設備的日益普及推動了在不犧牲效能的情況下實現緊湊型設計的發展。

- 就數量而言,到 2022 年,0 201 錶殼尺寸部分將佔據最大的市場佔有率,為 24.04%,其次是 0 402 錶殼尺寸部分,佔 15.81%,1 206 錶殼尺寸部分佔 15.66%。

- 持續的小型化趨勢加上對更高組件密度的需求正在推動對這些組件的需求。可攜式和連網型設備的日益普及也推動了對 0 201 MLCC 元件的需求。

- 0 1005 MLCC用途十分廣泛。航太和國防領域對 MLCC 的需求正在上升,尤其是軍用飛機和無人機的電子戰防禦系統等應用。國家安全問題和日益嚴重的邊境威脅正在推動國防領域對載人和無人機的需求。全國各政府已採取多項措施促進國內製造業和整體工業成長。

- 緊湊的 0402 外殼尺寸是表面黏著技術陶瓷電容器的流行外形規格。在汽車產業,0402MLCC 用於各種應用,包括引擎控制單元、資訊娛樂系統、ADAS 和照明控制。這些電容器在惡劣的汽車環境中提供可靠的性能。德國電動車的數量正在增加,充電基礎設施的擴張可能會刺激電動車充電站對 MLCC 等關鍵零件的需求。隨著充電站數量的增加,確保充電基礎設施平穩運作和可靠性的 MLCC 的需求可能會相應增加。

亞太地區價格實惠、節能的機器人數量正在激增。

- 2022 年,亞太地區將佔據最大的市場佔有率,為 43.00%,其次是北美,為 23.57%,歐洲為 22.80%。

- 亞太地區正處於技術快速應用和數位轉型的前沿。中國是世界上最大的工業機器人市場,這在很大程度上得益於政府推動製造業現代化的政策。政策舉措包括國家高科技研究發展計畫、中國製造2025和機器人產業發展規劃,這些計畫呼籲加大對自動化和機器人技術的投資。

- 就基礎設施和製造業活動而言,美國航太和國防部門是最大的部門之一。該市場主要受到航太和國防領域投資的推動,並受到商業和軍事終端用戶對這些產品日益成長的需求的支持。隨著發射成本的下降和技術的進步,太空探勘預計將會不斷發展和壯大。預計這些因素將在預測期內增強 MLCC 的前景。

全球高壓MLCC市場趨勢

汽車技術的不斷進步預計將推動乘用車

- 乘用車是已開發國家最常見的交通途徑之一。 MLCC是汽車各種電氣和電子電路正常、穩定運作的重要元件。使用的元件很多,即使是典型的不具有自動駕駛功能的引擎驅動車輛也會使用大約 3,000 個 MLCC。 MLCC 用於乘用車的安全氣囊、防鎖死煞車系統、輪胎壓力、光感測器、燈/LED 驅動器、汽車警報器、儀表板系統、燃油泵、水泵、變速箱感測器、溫度感測器等。

- 預計乘用車出貨量將從 2022 年的 6,159 萬輛增至 2030 年的 1.105 億輛,預測期(2023-2030 年)的複合年成長率為 7.58%。

- 新興國家生活水準的提高和中等收入階層的迅速擴大正在推動汽車銷售的成長。由於有經濟實惠的選擇,消費者也傾向購買乘用車。技術進步、ADAS 和聯網汽車的興起正在推動乘用車的銷售。由於政府有關二氧化碳排放政策的變化,對燃料乘用車的需求逐漸減少。該地區各國政府承諾在 2030 年減少溫室氣體 (GHG)排放,到 2050 年實現淨零排放。為了滿足這項需求,各公司正專注於推出混合動力汽車和電動車。

電動機車意識的提高預計將推動 MLCC 需求激增

- MLCC在摩托車中的主要應用之一是電力濾波和去耦。 MLCC 也用於抑制摩托車中的 EMI(電磁干擾)。它被放置在靠近電子電路的位置,以防止火星塞和交流發電機等其他電子元件的干擾。總體而言,MLCC在確保摩托車電子系統正常運作方面發揮著至關重要的作用,其使用對於車輛的可靠且高效運作至關重要。

- 預計二輪車出貨量將從 2022 年的 5,485 萬輛成長到 2030 年的 8,105 萬輛,預測期間(2023-2030 年)的複合年成長率為 5%。新冠疫情一波波導致市場停擺。然而,2021年休閒摩托車的需求增加,顯示出了韌性。在低收入和中等收入地區,由於負擔能力是關鍵,摩托車的市場佔有率高於四輪車。

- 技術發展、車輛安全性的提高、摩托車 ADAS(高級駕駛輔助系統)的引入以及零售和電子商務領域物流的增加都在推動摩托車生產和銷售方面發揮關鍵作用。世界各國政府正在採取舉措提高人們對電動機車的認知,因為它們有助於減少碳足跡。例如,2021年,印度將其FAME II政策延長至2024年,以刺激主要電動車需求。它還增加了對電動二輪車的補貼,並累計了電池更換政策以及電動車製造和電池供給能力發展的預算。

高壓MLCC產業概況

高壓MLCC市場格局較為統一,前五大廠商的市佔率合計為66.12%。市場的主要企業有:京瓷AVX元件株式會社(京瓷株式會社)、村田製作所、三星電機、太陽誘電和國巨株式會社(按字母順序排列)。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章執行摘要和主要發現

第2章 報告要約

第3章 引言

- 研究假設和市場定義

- 研究範圍

- 調查方法

第4章 產業主要趨勢

- 價格趨勢

- 銅價走勢

- 鎳價趨勢

- 油價趨勢

- 鈀金價格趨勢

- 白銀價格趨勢

- 鋅價趨勢

- MLCC前置作業時間

- 01005 MLCC

- 0201 MLCC

- 0201/0402 MLCC-HI CV

- 0402 MLCC

- 0603 MLCC

- 0603 MLCC-高CV

- 0603 MLCC-高壓

- 0805 MLCC

- 0805 MLCC-高CV

- 0805 MLCC-高壓

- 1206 MLCC

- 1206 MLCC-高壓

- 1206 MLCC-高壓

- 1210~1825-高真空

- 1210~1825 MLCC

- 1210+MLCC-高壓

- 2220+MLCC

- 2220+MLCC-高壓

- 汽車銷售

- 全球BEV(純電動車)產量

- 全球電動車銷量

- 全球燃料電池電動車(FCEV)產量

- 全球HEV(混合動力電動車)產量

- 全球重型商用車銷售

- 全球ICEV(內燃機汽車)產量

- 全球輕型商用車銷售

- 非電動車的全球銷量

- 全球插電式混合動力汽車(PHEV)產量

- 全球乘用車銷量

- 全球摩托車銷售

- 家電銷量

- 空調銷售

- 桌上型電腦銷量

- 遊戲機銷售

- HDD 和 SSD 銷售

- 筆記型電腦銷售

- 印表機銷售

- 冰箱銷售

- 智慧型手機銷量

- 智慧型手錶

- 平板電腦銷量

- 電視銷售

- 電動汽車銷售

- 全球BEV(純電動車)產量

- 全球FCEV(燃料電池電動車)產量

- 全球HEV(混合動力電動車)產量

- 全球ICEV(內燃機汽車)產量

- 全球插電式混合動力電動車(PHEV)產量

- 其他

- 法律規範

- 價值鍊和通路分析

第5章市場區隔

- 介電類型

- 1級

- 2級

- 錶殼尺寸

- 0 201

- 0 402

- 0 603

- 0 805

- 1 206

- 其他

- 電容

- 高頻電容

- 低頻電容

- 中檔電容

- Mlcc安裝類型

- 金屬蓋

- 徑向引線

- 表面黏著技術

- 最終用戶

- 航太和國防

- 車

- 家用電子電器

- 工業設備

- 醫療設備

- 電力和公共產業

- 通訊設備

- 其他

- 地區

- 亞太地區

- 歐洲

- 北美洲

- 世界其他地區

第6章競爭格局

- 關鍵策略趨勢

- 市場佔有率分析

- 商業狀況

- 公司簡介

- Kyocera AVX Components Corporation(Kyocera Corporation)

- Maruwa Co ltd

- Murata Manufacturing Co., Ltd

- Nippon Chemi-Con Corporation

- Samsung Electro-Mechanics

- Samwha Capacitor Group

- Taiyo Yuden Co., Ltd

- TDK Corporation

- Vishay Intertechnology Inc.

- Walsin Technology Corporation

- Wurth Elektronik GmbH & Co. KG

- Yageo Corporation

第 7 章 CEO 的關鍵策略問題CEO 的關鍵策略問題

第 8 章 附錄

- 世界概況

- 概述

- 五力分析框架

- 全球價值鏈分析

- 市場動態(DRO)

- 資訊來源及延伸閱讀

- 圖片列表

- 關鍵見解

- 資料包

- 詞彙表

簡介目錄

Product Code: 50001985

The High Voltage MLCC Market size is estimated at 4.07 billion USD in 2024, and is expected to reach 10.87 billion USD by 2029, growing at a CAGR of 21.68% during the forecast period (2024-2029).

The increasing popularity of portable and connected devices is contributing to achieving compact designs without compromising on performance

- The 0 201 case size segment emerged as the frontrunner, capturing the largest market share of 24.04%, followed by the 0 402 case size segment with 15.81% and the 1 206 case size segment with 15.66% in terms of volume in 2022.

- The ongoing trend of miniaturization, coupled with the need for higher component density, drives the demand for these components. The increasing popularity of portable and connected devices further contributes to the demand for 0 201 MLCC components, as they enable manufacturers to achieve compact designs without compromising on performance.

- The usage of 0 1005 MLCCs spans diverse applications. The demand for MLCCs is on the rise in the aerospace and defense sectors, especially for applications such as military aircraft and electronic warfare defense systems like UAVs. The increasing national security concerns and border threats are driving the demand for manned and unmanned aerial vehicles in the defense sector. Governments are taking several measures to boost domestic manufacturing and growth across industries.

- The compact 0 402 case size is widely adopted as a form factor for surface-mount ceramic capacitors. The automotive industry relies on 0 402 MLCCs for various applications, including engine control units, infotainment systems, ADAS, and lighting control. These capacitors provide reliable performance in harsh automotive environments. The number of electric vehicles in Germany and this expansion in the charging infrastructure may drive the demand for key components like MLCCs in EV charging stations. As the number of charging stations increases, there will likely be a proportional surge in the demand for MLCCs to ensure the smooth operation and reliability of the charging infrastructure.

Availability of affordable and energy-efficient robots is surging in Asia-Pacific

- Asia-Pacific captured the largest market share of 43.00%, followed by North America, with 23.57%, and Europe, with 22.80%, in terms of volume in 2022.

- Asia-Pacific is at the forefront of rapid technology adoption and digital transformation efforts. China is the world's largest market for industrial robots, largely due to government policies promoting the modernization of the country's manufacturing sector. Policy initiatives include the National High-Tech R&D program, Made in China 2025, and the Robotic Industry Development Program, which require more investments in automation and robotics.

- The US aerospace and defense sector is one of the largest in terms of infrastructure and manufacturing activities. The market is primarily driven by investments in the aerospace and defense sector and supported by the rising demand for the sector's products by commercial and military end users. Space exploration is expected to evolve and grow due to declining launch costs and technological advancements. Such factors are expected to bolster the prospects of the MLCCs during the forecast period.

Global High Voltage MLCC Market Trends

Rise in technological advancements in vehicles is expected to boost passenger vehicles

- Passenger cars are among the most common modes of transportation in developed countries. MLCCs are essential components for the proper and stable operation of the various electrical and electronic circuits utilized in cars. A large number of components are used, and even the typical engine-driven vehicle that does not have an automated driving feature uses approximately 3,000 MLCCs. MLCCs are used in passenger vehicles for airbags, anti-lock brake systems, tire pressures, light sensors, lamp/LED drivers, car alarms, dashboard systems, fuel pumps, water pumps, gearbox sensors, temperature sensors, etc.

- Passenger vehicle shipments are expected to grow from 61.59 million units in 2022 to 110.5 million units in 2030, registering a CAGR of 7.58% during the forecast period (2023-2030).

- Passenger vehicle sales are increasing due to the rising standard of living in emerging countries and the surge in the middle-income group population. Consumers are also inclined toward these vehicles owing to the availability of economic options in these vehicles. The rise in technological advancements, ADAS, and connected vehicles is propelling the sales of passenger vehicles. The demand for fuel-based passenger vehicles is slowly reducing as a result of changing government policies concerning CO2 emissions. Governments across the regions are focusing on reducing greenhouse gas (GHG) emissions by 2030 and achieving net-zero emissions by 2050. Companies are focusing on introducing hybrid and electric cars to cater to such demands.

Increasing awareness of electric bikes is expected to surge the demand for MLCCs

- One of the primary applications of MLCC in two-wheeler vehicles is power filtering and decoupling. MLCCs are also used to suppress EMI (electromagnetic interference) in two-wheeler vehicles. They are placed near the electronic circuits to prevent interference from other electronic components, such as spark plugs and alternators. Overall, MLCCs play a crucial role in ensuring the proper functioning of electronic systems in two-wheeler vehicles, and their use is essential for the reliable and efficient operation of the vehicle.

- The two-wheeler vehicle shipments are expected to grow from 54.85 million units in 2022 to 81.05 million units in 2030, registering a CAGR of 5% during the forecast period (2023-2030). The COVID-19 pandemic halted the market through a series of waves. However, the demand for two-wheelers increased in 2021 for recreational purposes and proved more resilient. With affordability being key in low- and medium-income regions, two-wheelers have a better market share in terms of numbers than four-wheelers.

- Technology developments, vehicle safety advancements, the introduction of driver-assist systems in motorcycles, and rising logistics in the retail and e-commerce sectors have all played a vital role in propelling the production and sales of two-wheelers. Governments of various countries are taking initiatives to increase awareness of electric bikes, which helps reduce the carbon footprint. For instance, in 2021, India extended its primary EV demand stimulating FAME II policy to 2024. It also increased subsidies for electric two-wheelers and made budgetary commitments for battery swapping policies and developing EV manufacturing and battery supply capacity.

High Voltage MLCC Industry Overview

The High Voltage MLCC Market is fairly consolidated, with the top five companies occupying 66.12%. The major players in this market are Kyocera AVX Components Corporation (Kyocera Corporation), Murata Manufacturing Co., Ltd, Samsung Electro-Mechanics, Taiyo Yuden Co., Ltd and Yageo Corporation (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Price Trend

- 4.1.1 Copper Price Trend

- 4.1.2 Nickel Price Trend

- 4.1.3 Oil Price Trend

- 4.1.4 Palladium Price Trend

- 4.1.5 Silver Price Trend

- 4.1.6 Zinc Price Trend

- 4.2 Mlcc Lead Times

- 4.2.1 01005 MLCC

- 4.2.2 0201 MLCC

- 4.2.3 0201/0402 MLCC-HI CV

- 4.2.4 0402 MLCC

- 4.2.5 0603 MLCC

- 4.2.6 0603 MLCC - HI CV

- 4.2.7 0603 MLCC - HI VOLT

- 4.2.8 0805 MLCC

- 4.2.9 0805 MLCC - HI CV

- 4.2.10 0805 MLCC - HI VOLT

- 4.2.11 1206 MLCC

- 4.2.12 1206 MLCC - HI CV

- 4.2.13 1206 MLCC - HI VOLT

- 4.2.14 1210 TO 1825 - HI CV

- 4.2.15 1210 TO 1825 MLCC

- 4.2.16 1210+ MLCC - HI VOLT

- 4.2.17 2220+ MLCC

- 4.2.18 2220+ MLCC - HI CV

- 4.3 Automotive Sales

- 4.3.1 Global BEV (Battery Electric Vehicle) Production

- 4.3.2 Global Electric Vehicles Sales

- 4.3.3 Global FCEV (Fuel Cell Electric Vehicle) Production

- 4.3.4 Global HEV (Hybrid Electric Vehicle) Production

- 4.3.5 Global Heavy Commercial Vehicles Sales

- 4.3.6 Global ICEV (Internal Combustion Engine Vehicle) Production

- 4.3.7 Global Light Commercial Vehicles Sales

- 4.3.8 Global Non-Electric Vehicle Sales

- 4.3.9 Global PHEV (Plug-in Hybrid Electric Vehicle) Production

- 4.3.10 Global Passenger Vehicles Sales

- 4.3.11 Global Two-Wheeler Sales

- 4.4 Consumer Electronics Sales

- 4.4.1 Air Conditioner Sales

- 4.4.2 Desktop PC's Sales

- 4.4.3 Gaming Console Sales

- 4.4.4 HDDs and SSDs Sales

- 4.4.5 Laptops Sales

- 4.4.6 Printers Sales

- 4.4.7 Refrigerator Sales

- 4.4.8 Smartphones Sales

- 4.4.9 Smartwatches Sales

- 4.4.10 Tablets Sales

- 4.4.11 Television Sales

- 4.5 Ev Sales

- 4.5.1 Global BEV (Battery Electric Vehicle) Production

- 4.5.2 Global FCEV (Fuel Cell Electric Vehicle) Production

- 4.5.3 Global HEV (Hybrid Electric Vehicle) Production

- 4.5.4 Global ICEV (Internal Combustion Engine Vehicle) Production

- 4.5.5 Global PHEV (Plug-in Hybrid Electric Vehicle) Production

- 4.5.6 Others

- 4.6 Regulatory Framework

- 4.7 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2029 and analysis of growth prospects)

- 5.1 Dielectric Type

- 5.1.1 Class 1

- 5.1.2 Class 2

- 5.2 Case Size

- 5.2.1 0 201

- 5.2.2 0 402

- 5.2.3 0 603

- 5.2.4 0 805

- 5.2.5 1 206

- 5.2.6 Others

- 5.3 Capacitance

- 5.3.1 High-Range Capacitance

- 5.3.2 Low-Range Capacitance

- 5.3.3 Mid-Range Capacitance

- 5.4 Mlcc Mounting Type

- 5.4.1 Metal Cap

- 5.4.2 Radial Lead

- 5.4.3 Surface Mount

- 5.5 End User

- 5.5.1 Aerospace and Defence

- 5.5.2 Automotive

- 5.5.3 Consumer Electronics

- 5.5.4 Industrial

- 5.5.5 Medical Devices

- 5.5.6 Power and Utilities

- 5.5.7 Telecommunication

- 5.5.8 Others

- 5.6 Region

- 5.6.1 Asia-Pacific

- 5.6.2 Europe

- 5.6.3 North America

- 5.6.4 Rest of the World

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 Kyocera AVX Components Corporation (Kyocera Corporation)

- 6.4.2 Maruwa Co ltd

- 6.4.3 Murata Manufacturing Co., Ltd

- 6.4.4 Nippon Chemi-Con Corporation

- 6.4.5 Samsung Electro-Mechanics

- 6.4.6 Samwha Capacitor Group

- 6.4.7 Taiyo Yuden Co., Ltd

- 6.4.8 TDK Corporation

- 6.4.9 Vishay Intertechnology Inc.

- 6.4.10 Walsin Technology Corporation

- 6.4.11 Wurth Elektronik GmbH & Co. KG

- 6.4.12 Yageo Corporation

7 KEY STRATEGIC QUESTIONS FOR MLCC CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

02-2729-4219

+886-2-2729-4219