|

市場調查報告書

商品編碼

1740872

替代蛋白質生產設備市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Alternative Protein Production Equipment Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

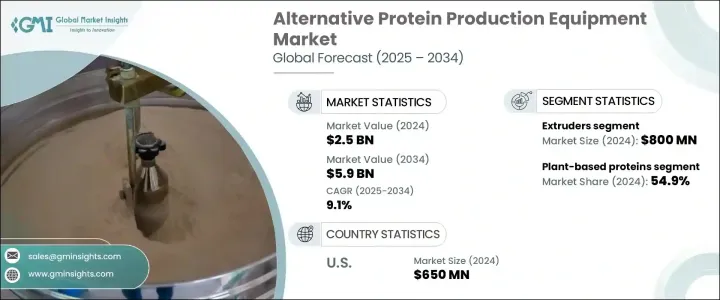

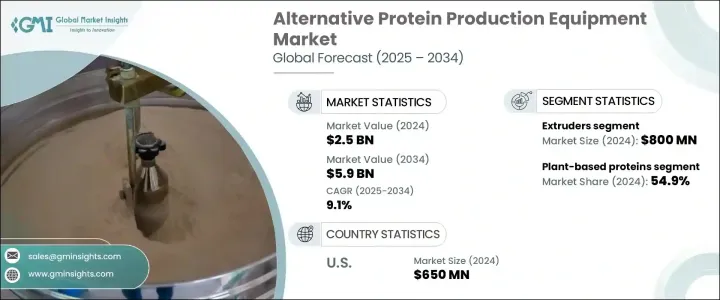

2024年,全球替代蛋白質生產設備市場價值為25億美元,預計到2034年將以9.1%的複合年成長率成長,達到59億美元。這一成長主要源於全球飲食習慣的重大轉變,消費者擴大尋求符合健康、永續性和道德消費等現代價值觀的食品替代品。隨著人口成長加速和主要市場收入水準的提高,對可擴展、可靠且清潔的食品生產技術的需求日益成長。傳統食品體系面臨壓力,促使該產業投資支持替代蛋白質的先進加工設備。這些解決方案對於改變食品生產方式至關重要,它們在不影響營養和口味的情況下,為傳統肉類提供可行的替代品。

健康生活意識的不斷增強,是推動非傳統蛋白質生產設備需求成長的另一個驅動力。現今的消費者對飲食更加挑剔,主動避免食用與慢性疾病相關的食物,同時選擇那些能夠促進更健康生活方式的食品。這種思維模式的轉變正促使食品製造商探索更精簡、富含纖維且不含激素或抗生素等添加劑的蛋白質替代品。因此,生產商面臨越來越大的壓力,需要投資於能夠高效生產這些高需求蛋白質產品的先進設備。這正在重塑產業格局,並為食品生產和設備設計樹立新的標準。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 25億美元 |

| 預測值 | 59億美元 |

| 複合年成長率 | 9.1% |

就設備類型而言,擠壓機引領市場,2024年創造了8億美元的收入。預計到2034年,該細分市場的複合年成長率將達到約9.4%。這些機器對於將蛋白質成分塑造成吸引尋求傳統肉類替代品的消費者的口感至關重要。尤其是高水分擠壓技術,它被用來複煞車物組織中的纖維結構,提升植物蛋白消費者的食用體驗,並有助於推動替代食品的更廣泛普及。

從應用角度來看,植物蛋白在2024年佔據了總市場佔有率的54.9%,預計在預測期內的複合年成長率約為9.6%。由於其成本優勢、市場成熟度和消費者接受度,該領域早期就吸引了市場的注意。各種植物來源的產品在食品雜貨貨架和餐飲服務菜單中佔據了重要地位,吸引了越來越多注重健康的消費者和對更永續食品系統感興趣的消費者。對加工能力提升的追求促使人們在分離機、攪拌機、乾燥機和擠出機等設備上進行新的投資,這些設備專門用於處理植物來源的原料並最佳化產出品質。

就最終用途而言,食品業繼續佔據市場主導地位,在2024年佔據最大佔有率,預計到2034年仍將保持這一領先地位。隨著企業競相迎合不斷變化的消費者偏好,它們正在大力投資精密工程設備,以支持替代蛋白質產品的大規模生產。無論是老牌食品品牌或新興企業,都在投入資金升級生產線,以保持競爭力。由於滿足品質標準和生產可擴展性的需求,對發酵槽、料斗、生物反應器和大容量擠出機的需求正在成長。零售興趣的增強以及消費者對健康和環保產品的支出增加,進一步加速了這一趨勢。

從區域來看,美國以2024年6.5億美元的估值領先北美市場,預計2034年複合年成長率將達到9.5%。人們對永續飲食習慣和植物性飲食的關注,正促使製造商建立或擴大用於替代蛋白質生產的設施。消費者偏好的轉變推動了對創新食品加工技術的需求,並強化了先進自動化機械在該領域的重要性。需求的成長為設備製造商創造了新的機遇,使其能夠提供更專業的解決方案,以滿足食品生產商的需求。

積極影響替代蛋白質生產設備市場的關鍵參與者包括安德里茨股份公司 (ANDRITZ AG)、阿法拉伐公司 (Alfa Laval AB)、比克食品設備公司 (BAK Food Equipment)、布勒股份公司 (Buhler AG)、FAM STUMABO、畢派克斯國際有限公司 (Bepex International LLC)、基伊埃比 (BTGEA)、Mengers International Corporation、JerGEA. Marel 公司、莫迪維克 (MULTIVAC Sepp Haggenmuller SE & Co. KG)、羅伯特·賴澤公司 (Robert Reiser & Co., Inc.)、羅克韋爾自動化公司 (Rockwell Automation)、保羅·穆勒公司 (Paul Mueller Company)、Scansteel Foodtech A/S 和斯必克流體技術公司 (SPX FLOW)。這些公司在設計和交付先進機械系統方面處於領先地位,以滿足現代蛋白質生產不斷變化的需求。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 影響價值鏈的因素

- 利潤率分析

- 中斷

- 未來展望

- 製造商

- 經銷商

- 川普政府關稅分析

- 對貿易的影響

- 貿易量中斷

- 報復措施

- 對產業的影響

- 供應方影響(原料)

- 主要材料價格波動

- 供應鏈重組

- 生產成本影響

- 需求面影響(銷售價格)

- 價格傳導至終端市場

- 市佔率動態

- 消費者反應模式

- 受影響的主要公司

- 策略產業反應

- 供應鏈重組

- 定價和產品策略

- 政策參與

- 展望與未來考慮

- 對貿易的影響

- 供應商格局

- 交易分析

- 利潤率分析

- 技術概述

- 重要新聞和舉措

- 監管格局

- 衝擊力

- 成長動力

- 全球人口快速成長

- 越來越重視健康和保健

- 消費者對永續蛋白質的需求不斷成長

- 擴大植物蛋白生產

- 產業陷阱與挑戰

- 初始資本投入高

- 與現有系統整合的複雜性

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:市場估計與預測:依設備類型,2021 - 2034 年

- 主要趨勢

- 擠出機

- 均質機

- 攪拌機

- 烘乾機

- 過濾裝置

第6章:市場估計與預測:依營運模式,2021 年至 2034 年

- 主要趨勢

- 半自動

- 自動的

第7章:市場估計與預測:按應用,2021 - 2034 年

- 主要趨勢

- 植物蛋白

- 培養肉

- 昆蟲蛋白

- 蛋替代品

第8章:市場估計與預測:依最終用途,2021 - 2034 年

- 主要趨勢

- 食品工業

- 動物飼料

- 營養保健品

- 其他

第9章:市場估計與預測:按加工技術,2021 - 2034 年

- 主要趨勢

- 紋理化

- 發酵

- 乳化

- 噴霧乾燥

第10章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- MEA

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第 11 章:公司簡介

- Alfa Laval AB

- ANDRITZ AG

- BAK Food Equipment

- Bepex International LLC

- Buhler AG

- FAM STUMABO

- GEA Group Aktiengesellschaft

- JBT Marel Corporation

- Middleby Corporation

- MULTIVAC Sepp Haggenmuller SE & Co. KG

- Paul Mueller Company

- Robert Reiser & Co., Inc.

- Rockwell Automation

- Scansteel Foodtech A/S.

- SPX FLOW

The Global Alternative Protein Production Equipment Market was valued at USD 2.5 billion in 2024 and is estimated to grow at a CAGR of 9.1% to reach USD 5.9 billion by 2034. This growth is largely driven by a major shift in global eating habits as consumers increasingly seek food alternatives that align with modern values around health, sustainability, and ethical consumption. With population growth accelerating and income levels rising across key markets, the demand for scalable, reliable, and clean food production technologies is gaining momentum. Traditional food systems are under pressure, prompting the industry to invest in advanced processing equipment that supports alternative proteins. These solutions are becoming critical in transforming how food is produced, offering a viable substitute to conventional meat without compromising on nutrition or taste.

The growing awareness around healthy living is another driving force behind the rise in demand for equipment capable of producing non-traditional protein sources. Consumers today are far more selective about what they eat, actively avoiding foods linked to chronic diseases while embracing options that fuel a more energetic lifestyle. This shift in mindset is encouraging food manufacturers to explore protein alternatives that are leaner, richer in fiber, and free from additives like hormones or antibiotics. As a result, there is increased pressure on producers to invest in advanced machinery capable of efficiently manufacturing these high-demand protein formats. This is reshaping the industry landscape and establishing new standards in food production and equipment design.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.5 Billion |

| Forecast Value | $5.9 Billion |

| CAGR | 9.1% |

In terms of equipment types, extruders led the market by generating USD 800 million in revenue in 2024. This segment is expected to grow at a CAGR of approximately 9.4% through 2034. These machines are essential for shaping protein ingredients into textures that appeal to consumers seeking substitutes for conventional meat. High-moisture extrusion technology, in particular, is being used to replicate the fibrous structure found in animal tissue, enhancing the eating experience for plant-based protein consumers and helping to drive broader adoption of alternative food products.

Application-wise, plant-based proteins accounted for 54.9% of the total market share in 2024 and are projected to grow at a CAGR of about 9.6% during the forecast period. This segment has captured early market attention thanks to its cost advantages, market readiness, and consumer acceptance. Products derived from various plant sources are finding a strong foothold in grocery aisles and foodservice menus, appealing to a growing group of health-conscious consumers and those interested in more sustainable food systems. The push for improved processing capabilities has led to new investments in equipment such as separators, mixers, dryers, and extruders, tailored to handle plant-derived inputs and optimize output quality.

The food industry continues to dominate the market in terms of end use, holding the largest share in 2024, and is expected to maintain this lead through 2034. As companies race to cater to evolving consumer preferences, they are investing heavily in precision-engineered equipment that supports large-scale production of alternative protein products. Both established food brands and emerging companies are directing capital toward upgrading their manufacturing lines to stay competitive. Demand for fermenters, hoppers, bioreactors, and high-volume extruders is rising, driven by the need to meet quality standards and production scalability. Enhanced retail interest and increased consumer spending on health-driven and environmentally friendly products are further accelerating this trend.

Regionally, the United States led the North American market with a valuation of USD 650 million in 2024 and is set to grow at a CAGR of 9.5% through 2034. Interest in sustainable eating practices and plant-forward diets is encouraging manufacturers to set up or expand facilities geared toward alternative protein production. The shift in consumer preferences is pushing demand for innovative food processing technologies and reinforcing the importance of advanced, automated machinery in this space. This rise in demand has created new opportunities for equipment manufacturers to offer more specialized solutions tailored to the needs of food producers.

Key players actively shaping the alternative protein production equipment market include ANDRITZ AG, Alfa Laval AB, BAK Food Equipment, Buhler AG, FAM STUMABO, Bepex International LLC, GEA Group Aktiengesellschaft, Middleby Corporation, JBT Marel Corporation, MULTIVAC Sepp Haggenmuller SE & Co. KG, Robert Reiser & Co., Inc., Rockwell Automation, Paul Mueller Company, Scansteel Foodtech A/S, and SPX FLOW. These companies are at the forefront of designing and delivering advanced machinery systems that meet the evolving needs of modern protein production.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Trump administration tariffs analysis

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-Side impact (Raw Materials)

- 3.2.2.2 Price volatility in key materials

- 3.2.2.3 Supply chain restructuring

- 3.2.2.4 Production cost implications

- 3.2.2.5 Demand-Side impact (Selling Price)

- 3.2.2.6 Price transmission to end markets

- 3.2.2.7 Market share dynamics

- 3.2.2.8 Consumer response patterns

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Supplier landscape

- 3.4 Trade analysis

- 3.5 Profit margin analysis

- 3.6 Technological overview

- 3.7 Key news & initiatives

- 3.8 Regulatory landscape

- 3.9 Impact forces

- 3.9.1 Growth drivers

- 3.9.1.1 Rapidly growing global population

- 3.9.1.2 Growing emphasis on health and wellness

- 3.9.1.3 Rising consumer demand for sustainable proteins

- 3.9.1.4 Expansion of plant-based protein production

- 3.9.2 Industry pitfalls & challenges

- 3.9.2.1 High initial capital investment

- 3.9.2.2 Complexity of integration with existing systems

- 3.9.1 Growth drivers

- 3.10 Growth potential analysis

- 3.11 Porter's analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Equipment Type, 2021 - 2034 (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Extruders

- 5.3 Homogenizers

- 5.4 Mixers

- 5.5 Dryers

- 5.6 Filtration units

Chapter 6 Market Estimates & Forecast, By Mode of Operation, 2021 - 2034 (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Semi-automatic

- 6.3 Automatic

Chapter 7 Market Estimates & Forecast, By Application, 2021 - 2034 (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Plant-Based proteins

- 7.3 Cultured meat

- 7.4 Insect proteins

- 7.5 Egg replacements

Chapter 8 Market Estimates & Forecast, By End Use, 2021 - 2034 (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Food industry

- 8.3 Animal feed

- 8.4 Nutraceuticals

- 8.5 Others

Chapter 9 Market Estimates & Forecast, By Processing Technology, 2021 - 2034 (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 Texturization

- 9.3 Fermentation

- 9.4 Emulsification

- 9.5 Spray drying

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 (USD Billion) (Thousand Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 Australia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Alfa Laval AB

- 11.2 ANDRITZ AG

- 11.3 BAK Food Equipment

- 11.4 Bepex International LLC

- 11.5 Buhler AG

- 11.6 FAM STUMABO

- 11.7 GEA Group Aktiengesellschaft

- 11.8 JBT Marel Corporation

- 11.9 Middleby Corporation

- 11.10 MULTIVAC Sepp Haggenmuller SE & Co. KG

- 11.11 Paul Mueller Company

- 11.12 Robert Reiser & Co., Inc.

- 11.13 Rockwell Automation

- 11.14 Scansteel Foodtech A/S.

- 11.15 SPX FLOW