|

市場調查報告書

商品編碼

1911804

歐洲宅配、速遞和小包裹(CEP) 市場:市場佔有率分析、行業趨勢和統計數據、成長預測 (2026-2031)Europe Courier, Express, And Parcel (CEP) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

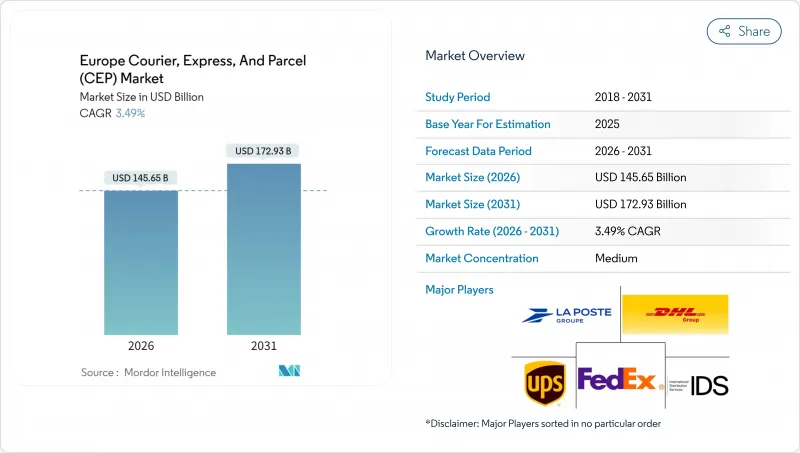

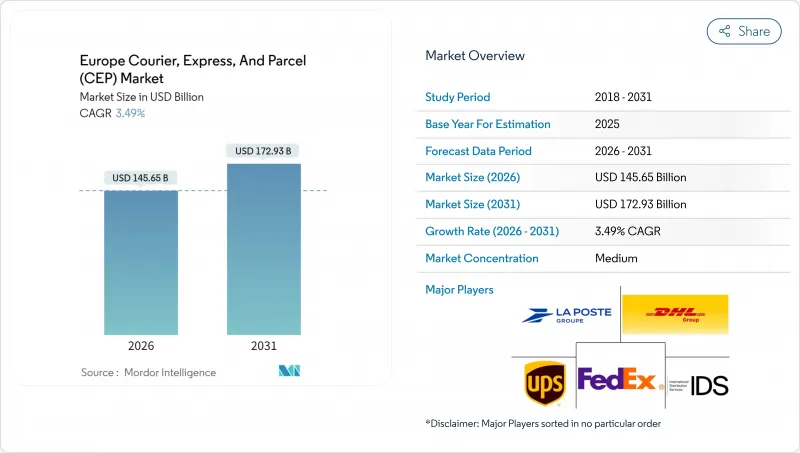

預計到 2026 年,歐洲宅配、速遞和小包裹(CEP) 市場規模將達到 1,456.5 億美元。

這意味著從 2025 年的 1,407.4 億美元成長到 2031 年的 1,729.3 億美元,2026 年至 2031 年的複合年成長率為 3.49%。

這種溫和的成長軌跡掩蓋了更深層的結構性變化,電子商務的擴張、監管的協調以及技術的應用正在重塑整個歐洲大陸的「最後一公里」配送網路。零售商正優先考慮差異化的配送體驗。由於81%的歐洲消費者如果無法選擇自己偏好的配送方式就會放棄購買,競爭的焦點正從價格轉向服務品質。歐盟層級的增值稅改革-數位時代增值稅改革(ViDA)將於2035年前分階段實施,屆時將規範跨境資料流,並有利於擁有先進合規系統的大型營運商。同時,超過50萬的司機缺口正在加速自動化投資,導致營運商面臨勞動力短缺的問題。日益嚴格的永續性要求以及在市中心(尤其是在荷蘭)引入零排放區,正在推動擴大電動車隊和宅配櫃密度,並促進有能力投資綠色資產的運輸業者之間的整合。

歐洲宅配、速遞與小包裹(CEP) 市場趨勢與洞察

爆炸性成長的電子商務和全通路零售的快速發展

社交電商的興起正推動小包裹配送擺脫傳統的季節性模式,轉向難以預測、受趨勢主導的高峰模式,這使得歐洲宅配、速遞和小包裹(CEP) 市場亟需靈活的運力規劃。預計到 2025 年,德國電商包裝材料支出將達到 39.9 億美元,並在 2034 年前保持 14.03% 的年複合成長率(CAGR),凸顯了包裝材料對這一成長的重要性。由於 79% 的買家表示,如果退貨流程繁瑣,他們會取消訂單,因此,先進的逆向物流正從附加服務轉變為核心競爭力。醫療保健領域的小包裹遞送也正乘著這股全通路浪潮的東風。 DHL 斥資 20 億歐元(約 22 億美元)的醫療保健物流業務正在資助專業的低溫運輸服務,以滿足日益成長的網路藥局需求。網紅推廣活動帶來的包裹量集中化,迫使物流公司設計動態路線演算法來應對流量激增,同時維持服務水準。

歐盟內部跨境貿易自由化與增值稅改革

ViDA電子帳單令將於2030年7月生效,屆時歐盟內部所有形式的B2B貿易將統一採用EN16931標準,從而減少人工文書工作並加快清關速度。一站式服務中心將於2028年7月擴展,屆時成員國之間將可使用單一增值稅號,這對每天處理數百萬個跨境小包裹的歐洲宅配、速遞和小包裹(CEP)市場而言是一項重大利好。強制性的10天課稅期要求企業對IT系統維修,這將使已擁有整合資料湖的營運商獲得優勢。同時,進口管制系統2(ICS2)要求在歐盟邊境通行前提交詳細的進口總表,這將加強安全性,並為擁有詳細產品級資料管道的承運商提供競爭優勢。這些措施將降低擴張壁壘,同時提高數位化合規標準,並促進向國際一體化的長期轉型。

價格競爭和體積重量系統帶來的利潤率壓力

疫情後產能過剩導致業者重新推出折扣以捍衛市場佔有率,儘管貨運量有所成長,但歐洲宅配、速遞和小包裹(CEP) 市場的盈利卻在下降。按體積計費的運費本應反映實際消耗量,但營運商通常會為策略客戶免除此項費用,這比提高成本效益更快地擠壓了利潤空間。 Impost 收購 YoDell Inc. 和 Sending Inc. 凸顯了營運商轉向透過非內生性擴張來降低固定成本的趨勢。承運商增加了尖峰時段費用和燃油額外費用,而托運人則利用多承運商軟體來提高價格邊際收益,以此進行反擊。這種拉鋸戰限制了短期內的價格復甦,同時也進一步推動了產業的整合。

細分市場分析

到 2025 年,電子商務領域的佔有率將保持在 34.45%,其中醫療小包裹預計將以 3.79% 的複合年成長率在 2026 年至 2031 年間實現最快成長。人口老化和網路藥局的興起使得溫控最後一公里配送成為優先事項。

DHL 的 20 億歐元(22 億美元)計畫旨在推動對符合 GDP 標準的設施、冷鏈包裝和專用控制塔的投資。製造商需要專用的零件運輸路線,而金融服務文件則催生了一個對安全快遞服務的特定市場。在零售淡季,貨運公司會交叉銷售當日送達的生物醫學產品運輸服務,以彌補車隊運轉率的下降。

2025年,國際小包裹配送將佔歐洲宅配、速遞和小包裹(CEP)市場收入的34.28%,國內服務則佔據剩餘的市場佔有率。預計2026年至2031年間,國際貨運的複合年成長率將達到3.73%,超過國內貨運的成長速度,主要得益於簡化的增值稅支付方式和經銷商履約。

隨著配送時間與國內標準接軌,歐洲消費者擴大從鄰國購買商品。 InPost 的網路於 2024 年 11 月在歐盟八個國家推出,採用自助取件櫃配送模式,避免了人工分類和海關延誤。 ICS2 資料要求初期會延長跨境貨物的前置作業時間,但會減少歐盟內部運輸的摩擦點。服務可預測性的提高吸引了更多中小型出口商,促使現有郵政業者改善追蹤系統並擴大高階跨境服務。

其他福利

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 人口統計數據

- 按經濟活動分類的GDP分配

- 按經濟活動分類的GDP成長

- 通貨膨脹

- 經濟表現及概況

- 電子商務產業的趨勢

- 製造業趨勢

- 運輸和倉儲業的GDP

- 出口趨勢

- 進口趨勢

- 燃油價格

- 物流績效

- 基礎設施

- 法律規範

- 中歐和東歐

- 法國

- 德國

- 義大利

- 荷蘭

- 北歐國家

- 俄羅斯

- 西班牙

- 瑞士

- 英國

- 價值鍊和通路分析

- 市場促進因素

- 爆炸性成長的電子商務和全通路零售的快速發展

- 歐盟內部跨境貿易自由化與增值稅改革

- 擴大宅配櫃和PUDO網路

- 透過自動化和人工智慧提高營運效率

- 透過碳成本內部化實現綠色CEP車隊優勢

- 多承運商小包裹管理平台的興起

- 市場限制

- 價格競爭和按尺寸收費系統對利潤率造成壓力。

- 促進要素和倉庫工人嚴重短缺

- 宅配工人國家最低工資法

- 網路安全和資料主權合規成本不斷上升

- 市場創新

- 波特五力分析

- 新進入者的威脅

- 買方的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場規模與成長預測

- 目的地

- 國內的

- 國際的

- 運輸速度

- 表達

- 非快遞

- 模型

- B2B

- 企業對消費者 (B2C)

- 消費者對消費者 (C2C)

- 運輸重量

- 重型貨物

- 輕型貨物

- 中等重量貨物

- 交通工具

- 航空

- 路

- 其他

- 終端用戶產業

- 電子商務

- 金融服務(BFSI)

- 衛生保健

- 製造業

- 一級產業

- 批發零售(線下)

- 其他

- 國家

- 阿爾巴尼亞

- 保加利亞

- 克羅埃西亞

- 捷克共和國

- 丹麥

- 愛沙尼亞

- 芬蘭

- 法國

- 德國

- 匈牙利

- 冰島

- 義大利

- 拉脫維亞

- 立陶宛

- 荷蘭

- 挪威

- 波蘭

- 羅馬尼亞

- 俄羅斯

- 斯洛伐克共和國

- 斯洛維尼亞

- 西班牙

- 瑞典

- 瑞士

- 英國

- 其他歐洲

第6章 競爭情勢

- 市場集中度

- 關鍵策略措施 競爭格局:市場集中度/關鍵策略趨勢/市場佔有率分析/公司簡介/DHL集團/

- 市佔率分析

- 公司簡介

- DHL Group

- FedEx

- GEODIS

- International Distributions Services(including GLS)

- La Poste Group

- Logista

- Otto GmbH & Co. KG

- Post NL

- Poste Italiane

- Sterne Group

- United Parcel Service(UPS)

第7章 市場機會與未來展望

The Europe courier, express, and parcel (CEP) market size in 2026 is estimated at USD 145.65 billion, growing from 2025 value of USD 140.74 billion with 2031 projections showing USD 172.93 billion, growing at 3.49% CAGR over 2026-2031.

This moderate trajectory masks deeper structural shifts as e-commerce expansion, regulatory harmonization, and technology adoption reshape last-mile networks across the continent. Retailers are prioritizing delivery-experience differentiation because 81% of European shoppers abandon baskets when preferred options are unavailable, tilting competitive focus from price to service quality. EU-level VAT in the Digital Age (ViDA) reforms, phased through 2035, are standardizing cross-border data flows, favoring scale players with advanced compliance systems. Meanwhile, a driver shortfall exceeding 500,000 openings has accelerated automation investment as operators grapple with labor scarcity. Heightened sustainability mandates and city-center zero-emission zones, notably in the Netherlands, add urgency for electric fleets and parcel-locker density, reinforcing consolidation among carriers that can fund green assets.

Europe Courier, Express, And Parcel (CEP) Market Trends and Insights

Explosive E-Commerce and Omnichannel Retail Boom

Social-commerce momentum is steering parcel flows toward unpredictable, trend-driven peaks rather than traditional seasonality, requiring flexible capacity planning across the Europe courier, express, and parcel (CEP) market. German e-commerce packaging spend reached USD 3.99 billion in 2025, reflecting 14.03% CAGR (2025-2030) expectations through 2034, underlining the packaging intensity of this growth. Reverse-logistics sophistication is turning from add-on to core capability, as 79% of shoppers cancel purchases when returns appear difficult. Healthcare parcels are piggybacking on this omnichannel wave; DHL's EUR 2 billion (USD 2.20 billion) health-logistics rollout funds specialized cold-chain services aligned with rising e-pharmacy penetration. Volume concentration around influencer promotions compels carriers to design dynamic routing algorithms to absorb traffic surges without impairing service-level compliance.

Liberalized Intra-EU Cross-Border Trade and VAT Reforms

ViDA's e-invoicing mandate arriving in July 2030 will standardize EN16931 formats for all intra-EU B2B trades, shrinking manual paperwork and accelerating customs clearances. The July 2028 expansion of the One-Stop Shop lets merchants maintain a single VAT ID across member states, a boon for the Europe courier, express, and parcel (CEP) market handling millions of cross-border parcels daily. Advanced IT retrofits are required because declarations must be filed within 10 days of chargeable events, favoring operators that already run integrated data lakes. Concurrently, Import Control System 2 obliges detailed entry summaries before crossing EU borders, tightening security and tilting the playing field to carriers with rich product-level data pipelines. Together, these measures reduce friction in sales expansion while raising digital-compliance thresholds, shaping a long-run shift toward international consolidation.

Margin Squeeze from Price Wars and Dimension-Based Tariffs

Post-pandemic overcapacity has resurrected discounting as operators defend share, eroding yields despite volume growth in the Europe courier, express, and parcel (CEP) market. Dimensional-weight pricing, meant to reflect cubic consumption, often gets waived for strategic accounts, compressing margins faster than cost-line efficiencies. InPost's acquisitions of Yodel and Sending highlight the pivot toward inorganic density to dilute fixed overhead. Carriers add peak or fuel surcharges but shippers push back, leveraging multicarrier software to arbitrage rates. The tug-of-war limits near-term price recovery while stoking further consolidation.

Other drivers and restraints analyzed in the detailed report include:

- Expansion of Parcel Lockers and PUDO Networks

- Automation and AI-Driven Operational Efficiency

- Acute Driver and Warehouse-Labor Shortages

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

E-commerce retained a 34.45% share in 2025, yet healthcare parcels are set to rise fastest at 3.79% CAGR between 2026-2031. Aging populations and e-pharmacy expansion make temperature-controlled last-mile a priority.

DHL's EUR 2 billion (USD 2.20 billion) program funds GDP-compliant facilities, cool-chain packaging, and dedicated control towers. Manufacturers require part-express lanes, and financial-services documents sustain secure-courier niches. Carriers cross-sell same-day biomedical pickup to monetize vehicle downtime during retail off-peak cycles.

Cross-border parcel flows accounted for 34.28% of revenues in 2025 as domestic services retained the remainder of Europe courier, express, and parcel (CEP) market share. International consignments are forecast to climb at a 3.73% CAGR between 2026-2031, outpacing domestic growth as ViDA simplifies VAT settlement and merchants centralize fulfillment.

European shoppers increasingly purchase from neighboring states once delivery times align with domestic benchmarks. InPost's November 2024 network activation across eight EU countries uses a locker-to-locker model that bypasses manual sorting and customs delays. ICS2 data prerequisites initially elongate lead-times for goods sourced outside the bloc, but EU-internal routes face fewer friction points. Improved service predictability attracts SME exporters, prompting postal incumbents to upgrade track-and-trace and push into premium cross-border offerings.

The Europe Courier, Express, and Parcel (CEP) Market Report is Segmented by End User Industry (E-Commerce and More), Destination (Domestic and International), Speed of Delivery (Express and Non-Express), Shipment Weight (Heavy Weight Shipments, and More), Mode of Transport (Air, Road, and Others), and Model (Business-To-Business, and More). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- DHL Group

- FedEx

- GEODIS

- International Distributions Services (including GLS)

- La Poste Group

- Logista

- Otto GmbH & Co. KG

- Post NL

- Poste Italiane

- Sterne Group

- United Parcel Service (UPS)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Demographics

- 4.3 GDP Distribution by Economic Activity

- 4.4 GDP Growth by Economic Activity

- 4.5 Inflation

- 4.6 Economic Performance and Profile

- 4.6.1 Trends in E-Commerce Industry

- 4.6.2 Trends in Manufacturing Industry

- 4.7 Transport and Storage Sector GDP

- 4.8 Export Trends

- 4.9 Import Trends

- 4.10 Fuel Price

- 4.11 Logistics Performance

- 4.12 Infrastructure

- 4.13 Regulatory Framework

- 4.13.1 Central and Eastern Europe (CEE)

- 4.13.2 France

- 4.13.3 Germany

- 4.13.4 Italy

- 4.13.5 Netherlands

- 4.13.6 Nordics

- 4.13.7 Russia

- 4.13.8 Spain

- 4.13.9 Switzerland

- 4.13.10 United Kingdom

- 4.14 Value Chain and Distribution Channel Analysis

- 4.15 Market Drivers

- 4.15.1 Explosive E-Commerce and Omnichannel Retail Boom

- 4.15.2 Liberalized Intra-EU Cross-Border Trade and VAT Reforms

- 4.15.3 Expansion of Parcel Lockers and PUDO Networks

- 4.15.4 Automation and AI-Driven Operational Efficiency

- 4.15.5 Carbon-Cost Internalization Favouring Green CEP Fleets

- 4.15.6 Rise of Multicarrier Parcel-Management Platforms

- 4.16 Market Restraints

- 4.16.1 Margin Squeeze from Price Wars and Dimension-Based Tariffs

- 4.16.2 Acute Driver and Warehouse-Labor Shortages

- 4.16.3 Country-Level Courier Wage-Floor Legislation

- 4.16.4 Rising Cyber-Security and Data-Sovereignty Compliance Costs

- 4.17 Technology Innovations in the Market

- 4.18 Porter's Five Forces Analysis

- 4.18.1 Threat of New Entrants

- 4.18.2 Bargaining Power of Buyers

- 4.18.3 Bargaining Power of Suppliers

- 4.18.4 Threat of Substitutes

- 4.18.5 Competitive Rivalry

5 Market Size and Growth Forecasts (Value, USD)

- 5.1 Destination

- 5.1.1 Domestic

- 5.1.2 International

- 5.2 Speed of Delivery

- 5.2.1 Express

- 5.2.2 Non-Express

- 5.3 Model

- 5.3.1 Business-to-Business (B2B)

- 5.3.2 Business-to-Consumer (B2C)

- 5.3.3 Consumer-to-Consumer (C2C)

- 5.4 Shipment Weight

- 5.4.1 Heavy Weight Shipments

- 5.4.2 Light Weight Shipments

- 5.4.3 Medium Weight Shipments

- 5.5 Mode of Transport

- 5.5.1 Air

- 5.5.2 Road

- 5.5.3 Others

- 5.6 End User Industry

- 5.6.1 E-Commerce

- 5.6.2 Financial Services (BFSI)

- 5.6.3 Healthcare

- 5.6.4 Manufacturing

- 5.6.5 Primary Industry

- 5.6.6 Wholesale and Retail Trade (Offline)

- 5.6.7 Others

- 5.7 Country

- 5.7.1 Albania

- 5.7.2 Bulgaria

- 5.7.3 Croatia

- 5.7.4 Czech Republic

- 5.7.5 Denmark

- 5.7.6 Estonia

- 5.7.7 Finland

- 5.7.8 France

- 5.7.9 Germany

- 5.7.10 Hungary

- 5.7.11 Iceland

- 5.7.12 Italy

- 5.7.13 Latvia

- 5.7.14 Lithuania

- 5.7.15 Netherlands

- 5.7.16 Norway

- 5.7.17 Poland

- 5.7.18 Romania

- 5.7.19 Russia

- 5.7.20 Slovak Republic

- 5.7.21 Slovenia

- 5.7.22 Spain

- 5.7.23 Sweden

- 5.7.24 Switzerland

- 5.7.25 United Kingdom

- 5.7.26 Rest of Europe

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Key Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (Includes Global Level Overview, Market Level Overview, Core Segments, Financials as Available, Strategic Information, Market Rank/Share for Key Companies, Products and Services, and Recent Developments)

- 6.4.1 DHL Group

- 6.4.2 FedEx

- 6.4.3 GEODIS

- 6.4.4 International Distributions Services (including GLS)

- 6.4.5 La Poste Group

- 6.4.6 Logista

- 6.4.7 Otto GmbH & Co. KG

- 6.4.8 Post NL

- 6.4.9 Poste Italiane

- 6.4.10 Sterne Group

- 6.4.11 United Parcel Service (UPS)

7 Market Opportunities and Future Outlook

- 7.1 White-Space and Unmet-Need Assessment