|

市場調查報告書

商品編碼

1910873

菲律賓宅配、速遞和小包裹(CEP) 市場:佔有率分析、產業趨勢、統計數據和成長預測 (2026-2031)Philippines Courier, Express, And Parcel (CEP) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

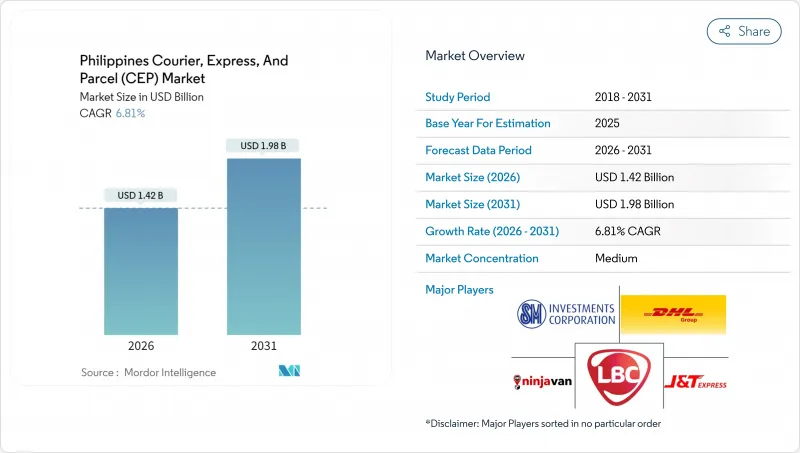

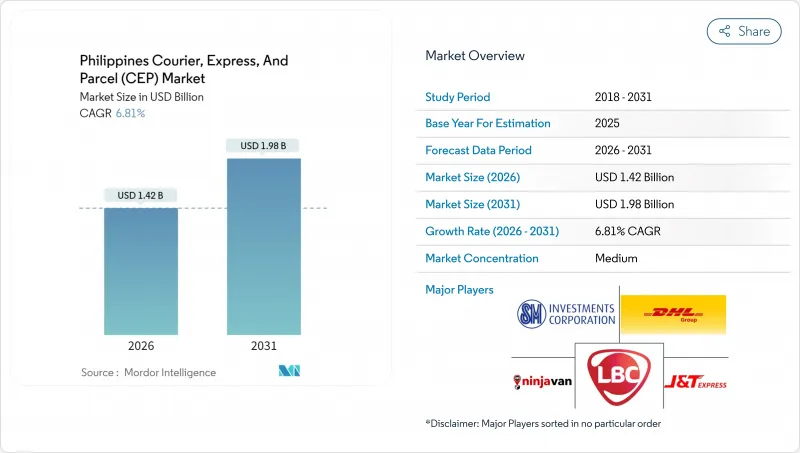

預計菲律賓宅配、速遞和小包裹(CEP) 市場將從 2025 年的 13.3 億美元成長到 2026 年的 14.2 億美元,預計到 2031 年將達到 19.8 億美元,2026 年至 2031 年的複合年成長率為 6.81%。

這一成長主要得益於電子商務交易量的激增、持續的基礎設施投資以及菲律賓群島的地理環境,這些因素共同造就了島際配送解決方案的巨大潛在市場。日益激烈的競爭、不斷更新的監管法規以及消費者對即時可見性的日益成長的需求,正促使營運商升級其技術基礎設施並重新設計其中心輻射模式。燃油價格的波動和資產密集型網路需求給小規模業者帶來了壓力,而大型業者則利用自動化技術來保障利潤率,這進一步加劇了產業整合的趨勢。因此,菲律賓的宅配、快捷郵件和小包裹市場正從以交易量為主導的模式向以技術主導、服務差異化為導向的市場轉型,更加注重速度、可靠性和地理覆蓋範圍。

菲律賓宅配、速遞與小包裹(CEP) 市場趨勢與洞察

電子商務訂單量爆炸性成長

預計到2025年,貿易額將佔國內生產總值)的5.5%,這意味著每位消費者的平均小包裹遞送頻率將成長三倍,現有分揀能力面臨巨大壓力。營運商正在利用協調高效的自動化系統和動態路線規劃工具,改造全國7,641個島嶼上的多種運輸方式。模組化樞紐、可擴展的軟體和數據驅動的運力規劃,使菲律賓宅配、速遞和小包裹(CEP)市場能夠在不相應增加成本的情況下,應對小型、高頻次遞送的激增。以電子產品和時尚為主導的零售類別,在提升包裹總量的同時,壓縮了平均小包裹收入,這有利於那些實現路線密集化的承運商。電子商務平台越來越重視保證送達時間,並將其作為競標的關鍵因素,這推動了承運商對預測分析和即時可見性的運用。在菲律賓的宅配、速遞和小包裹(CEP) 產業,投資機器人分揀機和應用程式介面 (API) 整合正成為保持競爭力的先決條件。

馬尼拉大都會地區對當日/即時送達的需求

馬尼拉大都會區居住1,300萬居民,交通網路密集,交通壅塞反而讓更靈活的摩托車配送網路比貨車配送網路更具優勢。隨著當日達服務從加值服務轉變為基本需求,快遞公司正在都會區部署微型倉配中心。這些中心縮短了配送距離,降低了漏送風險,並實現了嚴格的兩小時送達窗口。即時追蹤、自動送達證明和主動通知客戶已成為主流平台的標準功能。未能達到可見性標準的快遞公司可能會面臨客戶流失的風險,因為那些基於應用程式的競爭對手憑藉透明的、支援GPS定位的服務搶佔了市場佔有率。為了解決當日達服務資本密集的問題,各大快遞公司正嘗試輕資產的特許經營模式。這種模式將公司自有的配送中心與群眾外包配送團隊結合,提高了網路密度,從而支持菲律賓宅配、速遞和小包裹(CEP)市場的快速成長。

港口擁擠及島際交通瓶頸

馬尼拉港和宿霧港在旺季期間的運作通常超出設計吞吐能力40%至50%,導致平均延誤兩天,影響下游貨物的交付。泊位有限和人工裝卸貨櫃延長了船舶週轉時間,而滾裝船(RORO)服務因天氣原因取消也會擾亂輕庫存模式下至關重要的運營節奏。在港口自動化和泊位擴建計劃完成之前,菲律賓宅配、速遞和小包裹(CEP)市場的承運商必須保持緩衝庫存,確保跨多個港口的替代路線,並製定客戶溝通通訊協定以維持服務水準。

細分市場分析

到2025年,電子商務將佔據42.10%的市場佔有率,其中線上市場、D2C品牌和社群賣家將推動每日出貨量激增。倉儲、退貨管理和全通路整合服務的結合正在增強大型平台的客戶留存率。 2026年至2031年,醫療物流將維持7.10%的強勁複合年成長率,因為遠端醫療、疫苗分發和郵購配藥項目需要溫控、監管鏈合規和快速交付。符合GDP認證的倉庫、檢驗的包裝和符合監管規定的文件將成為菲律賓宅配、速遞和小包裹(CEP)行業的關鍵差異化因素。

金融服務領域(信用卡帳單、法律文件等)正穩步向數位化管道轉型,但某些監管流程仍需要安全的實體交付。製造業和批發業的貨物運輸涉及大量庫存單位(SKU)和重複的大宗訂單模式。包括農業和採礦業在內的一級產業依賴宅配網路運輸時效性強的樣品、備件和合規文件,這印證了該領域對國民經濟現代化進程的廣泛重要性。

到2025年,國內物流收入將佔總收入的64.40%,反映出馬尼拉-宿霧-達沃三角地區的貿易集中度較高,該地區的網路密度降低了小包裹成本。業者利用固定路線的卡車運輸和模組化微型倉庫,在呂宋島70%的始發地-目的地之間實現48小時內送達。菲律賓國內宅配、快捷郵件和小包裹市場規模預計將穩定成長,但隨著基於應用程式的競爭對手不斷加大折扣力度,利潤率將面臨下降。國際小包裹雖然絕對數量較小,但預計在2026年至2031年間將以7.05%的複合年成長率成長,這主要得益於跨境電子商務購物、“balaikbayan boxes”(寄給海外微企業的小包裹)以及中小微企業對海外買家的出口。海關清關、空運空間和監管合規的高額定價有助於提高單位經濟效益,使跨境業務成為菲律賓宅配、速遞和小包裹(CEP) 市場利潤的穩定因素。

雙邊貿易協定的拓展和電子清關平台的引入,使清關時間縮短了多達48小時,縮小了與區域競爭對手的服務品質差距。克拉克機場和宿霧機場綜合貨運站的落成,有助於實現南北韓之間貨物運輸的多元化,並緩解了馬尼拉樞紐的壓力。這加快了生鮮產品和高價值電子產品的運輸速度。市場領導目前提供的服務將國際遞送與本地退貨安排相結合,充分利用了海外僑民的匯款購物需求,並拓展了菲律賓宅配、速遞和小包裹(CEP)行業的全球互聯互通。

其他福利

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 人口統計數據

- 按經濟活動分類的GDP分配

- 按經濟活動分類的GDP成長

- 通貨膨脹

- 經濟表現及概覽

- 電子商務產業的趨勢

- 製造業趨勢

- 運輸和倉儲業的GDP

- 出口趨勢

- 進口趨勢

- 燃油價格

- 物流績效

- 基礎設施

- 法律規範

- 價值鍊和通路分析

- 市場促進因素

- 電子商務訂單量爆炸性成長

- 馬尼拉大都會地區對當日送達和即時送達的需求

- 首都區以外中小微企業數位化銷售蓬勃發展

- 政府發展「更好、更多」的物流走廊

- 透過加強對叫車服務使用者的安全監管來改善勞動力供應

- 在島國測試無人機和自動配送

- 市場限制

- 港口擁擠及島際交通瓶頸

- 燃油額外費用上漲對最後一公里配送利潤率帶來壓力

- 將地址系統分類到地方社區

- 基於應用程式的企業之間價格競爭日益激烈

- 市場創新

- 波特五力分析

- 新進入者的威脅

- 買方的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場規模與成長預測

- 收件地址

- 國內的

- 國際的

- 配送速度

- 表達

- 非快遞

- 模型

- B2B

- B2C

- C2C

- 運輸重量

- 重型貨物

- 輕型貨物

- 中等重量貨物

- 交通工具

- 航空郵件

- 陸上

- 其他

- 終端用戶產業

- 電子商務

- 金融服務(BFSI)

- 衛生保健

- 製造業

- 一級產業

- 批發零售(線下)

- 其他

第6章 競爭情勢

- 市場集中度

- 關鍵策略措施 競爭格局:市場集中 / 關鍵策略舉措 / 市場佔有率分析 / 公司簡介 / 阿亞拉集團

- 市佔率分析

- 公司簡介

- Ayala Corporation

- DHL Group

- FedEx

- J& T Express

- Lalamove

- LBC Express Holdings, Inc.

- Ninja Van

- Philippine Postal Corporation(PHLPost)

- SM Investments Corporation(including 2GO)

- United Parcel Service(UPS)

- Ximex Delivery Express Logistics Inc.(XDE)

第7章 市場機會與未來展望

The Philippines courier, express, and parcel market is expected to grow from USD 1.33 billion in 2025 to USD 1.42 billion in 2026 and is forecast to reach USD 1.98 billion by 2031 at 6.81% CAGR over 2026-2031.

This growth is propelled by surging e-commerce volumes, sustained infrastructure investment, and the country's archipelagic geography, which together create a large addressable base for island-to-island delivery solutions. Intensifying competition, regulatory modernization, and rising consumer expectations for real-time visibility are prompting operators to upgrade technology stacks and redesign hub-and-spoke models. Consolidation pressure is growing as fuel price volatility and asset-heavy network requirements strain smaller fleets, while scale players leverage automation to protect margins. As a result, the Philippines courier, express, and parcel market is evolving from a volume-oriented model toward a technology-enabled, service-differentiated landscape that prizes speed, reliability, and geographic reach.

Philippines Courier, Express, And Parcel (CEP) Market Trends and Insights

Explosive E-Commerce Order Volumes

Transaction values are expected to represent 5.5% of national GDP in 2025, tripling the average parcel frequency per consumer and stretching existing sortation capacity. Operators are pivoting to high-throughput automation and dynamic routing tools that can orchestrate multiple transport modes across 7,641 islands. Modular hubs, scalable software, and data-driven capacity planning are enabling the Philippines courier, express, and parcel market to absorb a wave of small, frequent shipments without proportionate cost increases. Retail categories led by consumer electronics and fashion are compressing average parcel revenue yet boosting overall volume, rewarding carriers that achieve densification at the route level. E-commerce platforms increasingly condition tender awards on guaranteed delivery windows, pushing carriers toward predictive analytics and real-time visibility. Investments in robotic sorters and application-programming-interface integrations are becoming table stakes for relevance in the Philippines courier, express, and parcel industry.

Same-Day / Instant Delivery Preference in Metro Manila

Metro Manila houses 13 million residents within a dense road network where traffic congestion paradoxically favors nimble motorcycle fleets over vans. Same-day arrival has shifted from premium to baseline expectation, prompting couriers to roll out micro-fulfillment nodes inside the metropolis. These nodes shorten stem mileage, lower failed-delivery risk, and enable tighter two-hour delivery windows. Real-time tracking, automated proof-of-delivery, and proactive customer notifications are now standard features across leading platforms. Carriers that fail to meet visibility benchmarks risk customer churn as app-based challengers capture share with transparent, GPS-enabled service. To meet the capital intensity of same-day service, larger players are experimenting with asset-light franchise models that blend company-owned hubs with crowd-sourced rider supply, reinforcing the network density that underpins express profitability within the Philippines courier, express, and parcel market.

Port Congestion and Inter-Island Shipping Bottlenecks

Manila and Cebu ports routinely operate at 40-50% above designed throughput during peak periods, creating two-day average dwell overruns that ripple into downstream delivery commitments. Limited berthing slots and manual container handling extend vessel turnaround, while weather-driven RORO cancellations disrupt the sailing cadence vital for inventory-light models. Until port automation and berth expansion projects reach completion, carriers must maintain buffer inventory, multi-port contingency routes, and customer communication protocols to protect service levels in the Philippines courier, express, and parcel market.

Other drivers and restraints analyzed in the detailed report include:

- MSME Digital-Selling Boom Outside NCR

- Government "Build Better More" Logistics Corridors

- Rising Fuel Surcharges Pressuring Last-Mile Margins

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

E-commerce commanded 42.10% share in 2025 as online marketplaces, direct-to-consumer brands, and social sellers collectively fueled daily shipment spikes. Bundled warehousing, returns management, and omnichannel integration services enhance retention of large platform accounts. Healthcare logistics posts a robust 7.10% CAGR between 2026-2031 as telemedicine, vaccine distribution, and prescription-by-mail programs demand temperature integrity, chain-of-custody compliance, and rapid fulfillment. GDP-certified warehouses, validated packaging, and regulatory-aligned documentation become critical differentiators in the Philippines courier, express, and parcel industry.

Financial-services parcels credit-card statements, legal documents-continue a measured migration to digital channels but still require secure physical handover in certain regulatory workflows. Manufacturing and wholesale shipments incorporate heavier SKUs and scheduled bulk-order patterns. Primary industries including agriculture and mining rely on courier networks for time-sensitive samples, spare parts, and compliance paperwork, underscoring the sector's broad-based relevance to national economic modernization.

Domestic flow anchored 64.40% of 2025 revenue, reflecting concentrated trade along the Manila-Cebu-Davao triangle where network density lowers per-parcel cost. Operators leverage fixed-route trucking and modular micro-depots to hit sub-48-hour delivery for 70% of intra-Luzon origin-destination pairs. The Philippines courier, express, and parcel market size for domestic services is projected to grow steadily yet face thinning margins as app-based competitors intensify discounting. International parcels, although smaller in absolute volume, register a 7.05% CAGR between 2026-2031, driven by cross-border e-commerce purchases, balikbayan boxes, and export shipments from MSMEs tapping overseas buyers. Premium pricing for customs clearance, airfreight space, and regulatory compliance underpins higher unit economics, making cross-border a profit stabilizer within the wider Philippines courier, express, and parcel market.

Expanding bilateral trade agreements and electronic customs platforms are shaving up to 48 hours off clearance times, narrowing service-quality gaps with regional peers. As Clark and Cebu airports add integrated cargo terminals, north-south diversion reduces Manila hub pressure, enabling faster transit for perishables and high-value electronics. Market leaders now bundle international shipping with localized returns orchestration, capitalizing on the diaspora's remittance-linked purchases and expanding the Philippines courier, express, and parcel industry's global connectivity.

The Philippines Courier, Express, and Parcel Market Report is Segmented by End User Industry (E-Commerce and More), Destination (Domestic and International), Speed of Delivery (Express and More), Shipment Weight (Heavy Weight Shipments and More), Mode of Transport (Air, Road, and Others), and Model (Business-To-Business, Business-To-Consumer, and Consumer-To-Consumer). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Ayala Corporation

- DHL Group

- FedEx

- J&T Express

- Lalamove

- LBC Express Holdings, Inc.

- Ninja Van

- Philippine Postal Corporation (PHLPost)

- SM Investments Corporation (including 2GO)

- United Parcel Service (UPS)

- Ximex Delivery Express Logistics Inc. (XDE)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Demographics

- 4.3 GDP Distribution by Economic Activity

- 4.4 GDP Growth by Economic Activity

- 4.5 Inflation

- 4.6 Economic Performance and Profile

- 4.6.1 Trends in E-Commerce Industry

- 4.6.2 Trends in Manufacturing Industry

- 4.7 Transport and Storage Sector GDP

- 4.8 Export Trends

- 4.9 Import Trends

- 4.10 Fuel Price

- 4.11 Logistics Performance

- 4.12 Infrastructure

- 4.13 Regulatory Framework

- 4.14 Value Chain and Distribution Channel Analysis

- 4.15 Market Drivers

- 4.15.1 Explosive E-Commerce Order Volumes

- 4.15.2 Same-Day/Instant Delivery Preference in Metro Manila

- 4.15.3 MSME Digital-Selling Boom Outside NCR

- 4.15.4 Government "Build Better More" Logistics Corridors

- 4.15.5 Rider-Security Regulations Improving Workforce Supply

- 4.15.6 Drone and Autonomous Delivery Pilots in Island Provinces

- 4.16 Market Restraints

- 4.16.1 Port Congestion and Inter-Island Shipping Bottlenecks

- 4.16.2 Rising Fuel Surcharges Pressuring Last-Mile Margins

- 4.16.3 Fragmented Address System in Rural Barangays

- 4.16.4 Intensifying Price Wars Among App-Based Players

- 4.17 Technology Innovations in the Market

- 4.18 Porter's Five Forces Analysis

- 4.18.1 Threat of New Entrants

- 4.18.2 Bargaining Power of Buyers

- 4.18.3 Bargaining Power of Suppliers

- 4.18.4 Threat of Substitutes

- 4.18.5 Competitive Rivalry

5 Market Size and Growth Forecasts (Value, USD)

- 5.1 Destination

- 5.1.1 Domestic

- 5.1.2 International

- 5.2 Speed of Delivery

- 5.2.1 Express

- 5.2.2 Non-Express

- 5.3 Model

- 5.3.1 Business-to-Business (B2B)

- 5.3.2 Business-to-Consumer (B2C)

- 5.3.3 Consumer-to-Consumer (C2C)

- 5.4 Shipment Weight

- 5.4.1 Heavy Weight Shipments

- 5.4.2 Light Weight Shipments

- 5.4.3 Medium Weight Shipments

- 5.5 Mode of Transport

- 5.5.1 Air

- 5.5.2 Road

- 5.5.3 Others

- 5.6 End User Industry

- 5.6.1 E-Commerce

- 5.6.2 Financial Services (BFSI)

- 5.6.3 Healthcare

- 5.6.4 Manufacturing

- 5.6.5 Primary Industry

- 5.6.6 Wholesale and Retail Trade (Offline)

- 5.6.7 Others

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Key Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (Includes Global Level Overview, Market Level Overview, Core Segments, Financials as Available, Strategic Information, Market Rank/Share for Key Companies, Products and Services, and Recent Developments)

- 6.4.1 Ayala Corporation

- 6.4.2 DHL Group

- 6.4.3 FedEx

- 6.4.4 J&T Express

- 6.4.5 Lalamove

- 6.4.6 LBC Express Holdings, Inc.

- 6.4.7 Ninja Van

- 6.4.8 Philippine Postal Corporation (PHLPost)

- 6.4.9 SM Investments Corporation (including 2GO)

- 6.4.10 United Parcel Service (UPS)

- 6.4.11 Ximex Delivery Express Logistics Inc. (XDE)

7 Market Opportunities and Future Outlook

- 7.1 White-Space and Unmet-Need Assessment