|

市場調查報告書

商品編碼

1910910

義大利快遞、速遞、小包裹:市場佔有率分析、產業趨勢、統計數據、成長預測(2026-2031 年)Italy Courier, Express, And Parcel (CEP) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

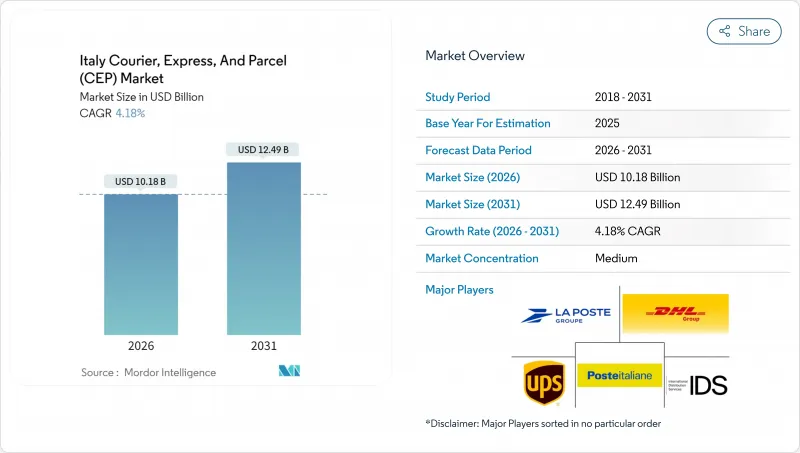

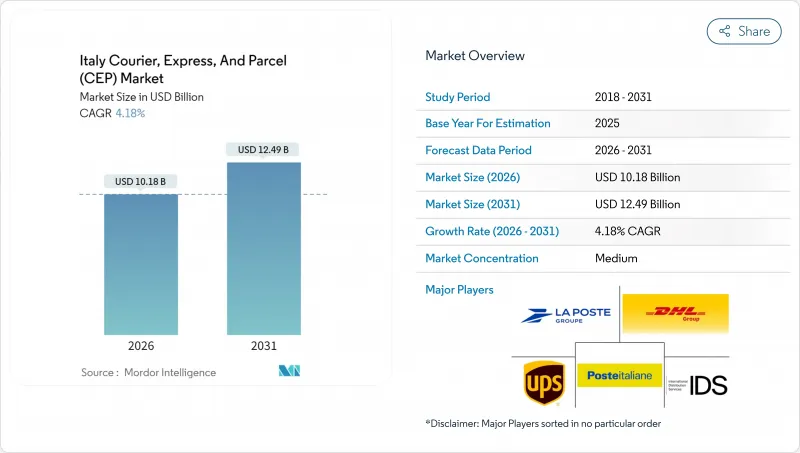

預計義大利快遞、速遞和小包裹(CEP) 市場將從 2025 年的 97.7 億美元成長到 2026 年的 101.8 億美元,到 2031 年將達到 124.9 億美元,2026 年至 2031 年的複合年成長率為 4.18%。

義大利是歐洲重要的物流樞紐。電子商務支出持續成長,預計到2024年將達到588億歐元(約648.9億美元),同時,製造業出口商對小包裹的需求也同步復甦。米蘭和羅馬等都市區的高密度交通網路為高階快遞服務提供了有力支撐。同時,國內道路通行費的上漲和司機短缺正促使營運商實現營運自動化以降低成本。跨境電子商務、藥品出口以及簡化的遊客購物增值稅退稅流程推動了國際物流的成長,其成長率超過了國內運輸。隨著義大利郵政、DHL、UPS、聯邦快遞和GLS等公司投資於自動化分類、異地收件網路和低排放車輛,市場競爭日益激烈。歐盟即將實施的「Fit for 55」法規也加速了車隊更新和基礎設施電氣化。

義大利快遞、速遞、小包裹(CEP) 市場趨勢與分析

從2024年起,中小企業出口的強勁復甦將提升B2B小包裹密度。

2025年3月,中小型廠商的出口量年增5.8%,其業務活動主要集中在連接Lombardia與歐洲主要市場的A4和A1高速公路沿線。出口路線的集中化使得快遞業者能夠提高停靠效率,並增加每條路線上的高價值貨物遞送數量。機械、紡織品和特色食品製造商越來越依賴隔日的CEP快遞服務,以滿足客戶緊迫的交貨期限,同時減少庫存積壓。米蘭和貝加莫周邊的北部物流樞紐正在吸引對自動化分類中心的投資,因為高吞吐量地區能夠支撐更高的資本投入。隨著出口商選擇清關有保障且收件時間較長的高級產品,國際快遞的利潤率正在上升,而國內回程傳輸運輸則降低了搬遷成本。

雜貨連鎖店擴大微型倉配中心規模,促進了都市區的當日送達服務。

2024年,食品零售商加快了微型倉配中心的部署。 Esselunga投資580萬歐元(約640萬美元)興建小型配送設施,能夠在兩小時內完成揀貨和出貨。這些面積不到1萬平方英尺的配送中心縮短了「最後一公里」的配送距離,從而刺激了當日達配送需求的激增,並方便了重量低於5公斤、可裝入輕型電動貨車的小包裹運輸。 MD與Eberly等公司的多城市合作,創造了可預測的晚間高峰需求,使承運商能夠部署專用的城市配送路線,並在嚴格的配送時間段內運作。當日達的食品小包裹需支付更高的費用,以彌補高密度配送點帶來的較高人事費用。隨著零售商試用自動揀貨臂和溫控週轉箱,科技應用推動了門市系統與CEP配送引擎之間資料整合的需求。

人口老化加劇了司機短缺問題。

義大利卡車駕駛人中,僅2.2%的人年齡在25歲以下,而近一半的人年齡超過55歲——這一比例遠高於歐洲平均。根據義大利運輸聯合會(Conftrasport)估計,目前仍有2萬個駕駛人駕駛人空缺,約4,000歐元(4,414.56美元)的培訓費用阻礙了新人的加入。米蘭周邊的物流公司提供的月薪為3392歐元(3,743.55美元),但他們仍難以招募到足夠的司機。運力限制推高了分包商的費用,迫使中央出口運輸網路(CEP)重新競標幹線運輸契約,並延長了運輸時間。政府已提案一些政策應對措施,例如加快非歐盟司機的許可證核准流程和共同資助許可證發放項目,但這些措施的實施進展緩慢。為了提高每位司機的貨運量,卡車運輸公司正在嘗試使用雙層拖車和人工智慧路線規劃工具,但這些努力並不能完全彌補勞動力短缺的情況。

細分市場分析

至2025年,電子商務將佔貨運總量的34.60%,其所建立的服務標準將逐步影響其他產業。高退貨率增加了逆向物流的複雜性,促使承運商實施基於規則的自動化流程,將退貨直接分類至再製造中心。時尚品牌正在米蘭和都靈試行當日試穿服務,雖然這增加了小包裹處理時間,但也提高了每位顧客的總收入。

2026年至2031年,隨著義大利人口老化導致藥品分銷量增加,以及生物製藥製劑低溫運輸運輸的要求日益嚴格,醫療小包裹複合成長率將達到4.33%。運輸公司正在對其貨車進行改造,加裝符合GDP標準的冷卻裝置,並安裝即時溫度探頭,以便向控制中心發送警報。製藥公司傾向選擇與醫院藥局排班同步的專屬配送時段,以確保在安全區域內享有優先通行權。

到2025年,國內配送將佔義大利宅配市場佔有率的66.10%,這主要得益於本地採購和全國性電子商務的蓬勃發展,從而形成穩定的日均貨量基礎。密集的住宅配送中心使承運商能夠最大限度地提高停靠效率,而對郵遞區號的熟悉感也降低了地址更正成本。跨境小包裹雖然目前數量較少,但預計從2026年到2031年將以4.31%的複合年成長率成長,因為時尚、醫藥和工業零部件等行業為了獲得競爭優勢,優先考慮限時送達服務。一站式進口系統簡化了海關手續,減少了行政摩擦,促進了跨境包裹的成長。

國際出口成長主要集中在米蘭、都靈和波隆那機場附近,出口商可以利用保稅設施加快清關速度。旅遊相關的C2C小包裹可享有免稅配額,業者則銷售固定費率的包裝盒以滿足紀念品需求。國內網路仍能維持規模經濟,使物流整合商能夠在國內需求低迷時期將車輛調配至國際幹線。協調國內和歐洲的貨物分類時間對於在不增加樞紐人工成本的情況下維持隔日截稿承諾仍然至關重要。

其他福利:

- Excel格式的市場預測(ME)表

- 分析師支持(3個月)

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 人口統計數據

- 按經濟活動分類的GDP分配

- 按經濟活動分類的GDP成長

- 通貨膨脹

- 經濟表現及概覽

- 電子商務產業的趨勢

- 製造業趨勢

- 運輸和倉儲業的GDP

- 出口趨勢

- 進口趨勢

- 燃油價格

- 物流績效

- 基礎設施

- 法律規範

- 價值鍊和通路分析

- 市場促進因素

- 義大利中小企業出口的強勁復甦將帶動2024年及以後B2B小包裹密度的增加。

- 連鎖超市擴大微型倉配中心規模,並增加都市區的當日送達服務。

- 歐盟「Fit for 55」法規加快了促進車輛電氣化的措施

- 計劃於2026年試運行米蘭和貝加莫機場之間的無人機走廊。

- 由於面向遊客的數位增值稅退稅平台的普及,C2C交易和退款流量增加。

- 郵政銀行整合使農村地區能夠實現最後一公里貨到付款服務

- 市場限制

- 米蘭馬爾彭薩機場貨運時刻短缺

- 人口老化加劇了司機短缺問題。

- 2025年至2027年,A4和A14走廊的道路通行費將逐步增加。

- 南部地區小包裹竊盜率居高不下。

- 市場創新

- 波特五力分析

- 新進入者的威脅

- 買方的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場規模與成長預測

- 目的地

- 國內的

- 國際的

- 配送速度

- 快遞

- 非快遞

- 模型

- B2B

- B2C

- C2C

- 運輸重量

- 重型貨物運輸

- 輕型和重型貨物運輸

- 中型重型貨物運輸

- 交通工具

- 航空郵件

- 陸上

- 其他

- 終端用戶產業

- 電子商務

- 金融服務(BFSI)

- 衛生保健

- 製造業

- 一級產業

- 批發零售(線下)

- 其他

第6章 競爭情勢

- 市場集中度

- 關鍵策略舉措

- 市佔率分析

- 公司簡介

- Asendia

- DHL Group

- FedEx

- GEODIS

- International Distributions Services(including GLS)

- La Poste Group(including BRT)

- Poste Italiane

- Sailpost SpA

- Speedy SRL

- United Parcel Service(UPS)

第7章 市場機會與未來展望

The Italy courier express parcel market is expected to grow from USD 9.77 billion in 2025 to USD 10.18 billion in 2026 and is forecast to reach USD 12.49 billion by 2031 at 4.18% CAGR over 2026-2031.

Italy holds a pivotal logistics role inside Europe because e-commerce spending hit EUR 58.8 billion (USD 64.89 billion) in 2024 and keeps expanding, while small-package demand from manufacturing exporters recovers in parallel. Route-dense urban areas such as Milan and Rome underpin high stop densities that support premium express services, even as national road toll hikes and driver shortages push operators toward cost-saving automation. International flows expand faster than domestic shipments, powered by cross-border e-commerce, pharmaceutical exports and simplified digital VAT refund processing for tourist purchases. Competitive intensity rises as Poste Italiane, DHL, UPS, FedEx and GLS invest in sortation automation, out-of-home collection networks and low-emission fleets, while impending EU Fit-for-55 rules accelerate fleet renewal and infrastructure electrification.

Italy Courier, Express, And Parcel (CEP) Market Trends and Insights

Strong Rebound of Italy's SME Exports Post-2024 Creates Higher B2B Parcel Density

Small and medium manufacturers lifted export volumes by 5.8% year on year in March 2025, concentrating activity along the A4 and A1 corridors that link Lombardy with key European markets. Dense export lanes generate superior stop economies for express carriers, allowing trucks to complete more premium deliveries per route. Machinery, textiles and specialty food producers increasingly rely on next-day CEP options so they can postpone inventory and still honor tight customer schedules. Northern logistics hubs around Milan and Bergamo attract investment in automated sort centers because carriers can justify higher capex where volumes cluster. International express margins rise as exporters pick premium products that guarantee customs clearance and late pickup windows, while domestic backhauls reduce repositioning costs.

Expansion of Micro-Fulfillment Centers by Grocery Chains Boosts Urban Same-Day Volumes

Grocery retailers accelerated micro-fulfillment roll-outs in 2024, with Esselunga spending EUR 5.8 million (USD 6.40 million) on compact facilities that can pick and dispatch orders inside two hours. These sub-10,000 ft2 nodes shorten last-mile distances, create same-day demand spikes, and favor parcels under five kilograms that fit light electric vans. Partnerships such as MD's alliance with Everli cover multiple cities and add predictable evening peak traffic, enabling carriers to deploy dedicated urban rounds that operate on strict delivery windows. Same-day grocery parcels carry premium surcharges which absorb the higher labor costs linked to dense stop frequency. Technology adoption rises as retailers test automated picking arms and temperature-segmented totes, raising requirements for data integration between store systems and CEP routing engines.

Driver Shortage Aggravated by Demographic Ageing

Only 2.2% of Italian truck drivers are under 25, while nearly one-half surpass 55, a gap wider than the European mean. Conftrasporto estimates 20,000 vacant driving jobs, and training costs near EUR 4,000 (USD 4,414.56) deter entrants. Logistics employers around Milan advertise monthly pay of EUR 3,392 (USD 3,743.55) but still struggle to fill shifts. Capacity tightness inflates subcontracting rates, forcing CEP networks to rebid linehaul contracts or lengthen transit windows. Policy responses include proposals to fast-track non-EU driver permits and co-fund license programs, yet uptake remains slow. Carriers trial double-deck trailers and AI routing tools to lift parcels per driver, but these gains do not fully offset workforce attrition.

Other drivers and restraints analyzed in the detailed report include:

- EU Fit-for-55 Regulation Accelerates Fleet Electrification Incentives

- Drone Corridor Pilot Between Milan and Bergamo Airports Slated for 2026

- 2025-27 Road-Toll Step-Ups on A4 And A14 Corridors

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

E-commerce commanded 34.60% share of 2025 volumes and sets service benchmarks that spill into other verticals. High return rates create extra reverse-logistics complexity, prompting carriers to deploy rules-based automation that sorts returns directly to refurbishment centers. Fashion brands pilot same-day try-at-home programs in Milan and Turin, extending parcel touches but lifting overall revenue per customer.

Healthcare parcels expand at a 4.33% CAGR between 2026-2031 because Italy's aging population increases medication throughput and biologic therapies demand strict cold-chain compliance. Carriers retrofit vans with GDP-validated chillers and install real-time temperature probes that send alerts to control towers. Pharmaceutical firms favor dedicated delivery windows that synchronize with hospital pharmacy schedules, ensuring priority access inside security zones.

Domestic deliveries accounted for 66.10% of the Italy courier express parcel market in 2025 because local sourcing and nationwide e-commerce anchor predictable daily volumes. Dense residential delivery points allow carriers to maximize stop efficiency, and familiarity with postal codes reduces address correction costs. Cross-border parcels, while smaller in count, expand at a 4.31% CAGR between 2026-2031 as fashion, pharmaceuticals, and industrial components rely on time-definite services for competitive differentiation. Customs simplification under the Import One-Stop Shop scheme lowers administrative frictions and supports growth.

International outbound growth is clustered around Milan, Turin and Bologna airports where exporters can access bonded facilities that speed clearance. Tourism-linked C2C parcels leverage duty-free thresholds, and operators market flat-rate boxes to capture souvenir traffic. The domestic network still underpins scale advantages, letting integrators redirect vehicles to international linehauls during off-peak domestic cycles. Alignment of domestic and European sortation windows will remain critical for maintaining overnight cut-off commitments without inflating hub staffing costs.

The Italy Courier, Express, and Parcel (CEP) Market Report is Segmented by End User Industry (E-Commerce and More), Destination (Domestic and More), Speed of Delivery (Express and Non-Express), Shipment Weight (Heavy Weight Shipments and More), Mode of Transport (Air, Road, and Others), and Model (Business-To-Business, Business-To-Consumer, and Consumer-To-Consumer). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Asendia

- DHL Group

- FedEx

- GEODIS

- International Distributions Services (including GLS)

- La Poste Group (including BRT)

- Poste Italiane

- Sailpost SpA

- Speedy SRL

- United Parcel Service (UPS)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Demographics

- 4.3 GDP Distribution by Economic Activity

- 4.4 GDP Growth by Economic Activity

- 4.5 Inflation

- 4.6 Economic Performance and Profile

- 4.6.1 Trends in E-Commerce Industry

- 4.6.2 Trends in Manufacturing Industry

- 4.7 Transport and Storage Sector GDP

- 4.8 Export Trends

- 4.9 Import Trends

- 4.10 Fuel Price

- 4.11 Logistics Performance

- 4.12 Infrastructure

- 4.13 Regulatory Framework

- 4.14 Value Chain and Distribution Channel Analysis

- 4.15 Market Drivers

- 4.15.1 Strong Rebound of Italy's SME Exports Post-2024, Creating Higher B2B Parcel Density

- 4.15.2 Expansion of Micro-Fulfilment Centres by Grocery Chains, Boosting Urban Same-Day Volumes

- 4.15.3 EU Fit-for-55 Regulation Accelerating Fleet Electrification Incentives

- 4.15.4 Drone Corridor Pilot Between Milan-bergamo Airports Slated for 2026

- 4.15.5 Digital VAT Refund Platforms for Tourists Increasing C2C and Return Flows

- 4.15.6 Postal Bank Integration Unlocking Last-Mile Cash-on-delivery for Rural Areas

- 4.16 Market Restraints

- 4.16.1 Airport Slot Scarcity for Freighters at Milano-Malpensa

- 4.16.2 Driver Shortage Aggravated by Demographic Ageing

- 4.16.3 2025-27 Road-Toll Step-Ups on A4 and A14 Corridors

- 4.16.4 High Parcel Theft Rates in Southern Regions

- 4.17 Technology Innovations in the Market

- 4.18 Porter's Five Forces Analysis

- 4.18.1 Threat of New Entrants

- 4.18.2 Bargaining Power of Buyers

- 4.18.3 Bargaining Power of Suppliers

- 4.18.4 Threat of Substitutes

- 4.18.5 Competitive Rivalry

5 Market Size and Growth Forecasts (Value, USD)

- 5.1 Destination

- 5.1.1 Domestic

- 5.1.2 International

- 5.2 Speed of Delivery

- 5.2.1 Express

- 5.2.2 Non-Express

- 5.3 Model

- 5.3.1 Business-to-Business (B2B)

- 5.3.2 Business-to-Consumer (B2C)

- 5.3.3 Consumer-to-Consumer (C2C)

- 5.4 Shipment Weight

- 5.4.1 Heavy Weight Shipments

- 5.4.2 Light Weight Shipments

- 5.4.3 Medium Weight Shipments

- 5.5 Mode of Transport

- 5.5.1 Air

- 5.5.2 Road

- 5.5.3 Others

- 5.6 End User Industry

- 5.6.1 E-Commerce

- 5.6.2 Financial Services (BFSI)

- 5.6.3 Healthcare

- 5.6.4 Manufacturing

- 5.6.5 Primary Industry

- 5.6.6 Wholesale and Retail Trade (Offline)

- 5.6.7 Others

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Key Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (Includes Global Level Overview, Market Level Overview, Core Segments, Financials as Available, Strategic Information, Market Rank/Share for Key Companies, Products and Services, and Recent Developments)

- 6.4.1 Asendia

- 6.4.2 DHL Group

- 6.4.3 FedEx

- 6.4.4 GEODIS

- 6.4.5 International Distributions Services (including GLS)

- 6.4.6 La Poste Group (including BRT)

- 6.4.7 Poste Italiane

- 6.4.8 Sailpost SpA

- 6.4.9 Speedy SRL

- 6.4.10 United Parcel Service (UPS)

7 Market Opportunities and Future Outlook

- 7.1 White-Space and Unmet-Need Assessment