|

市場調查報告書

商品編碼

1911329

法國快遞、速遞、小包裹市場:佔有率分析、行業趨勢、統計數據和成長預測(2026-2031 年)France Courier, Express, And Parcel (CEP) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

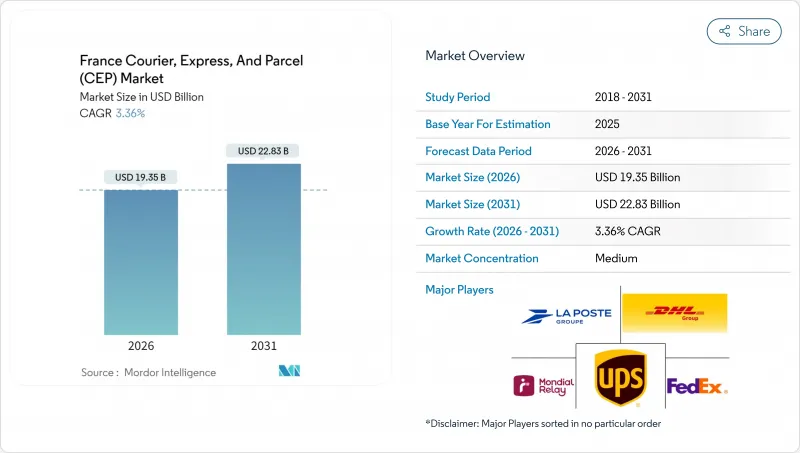

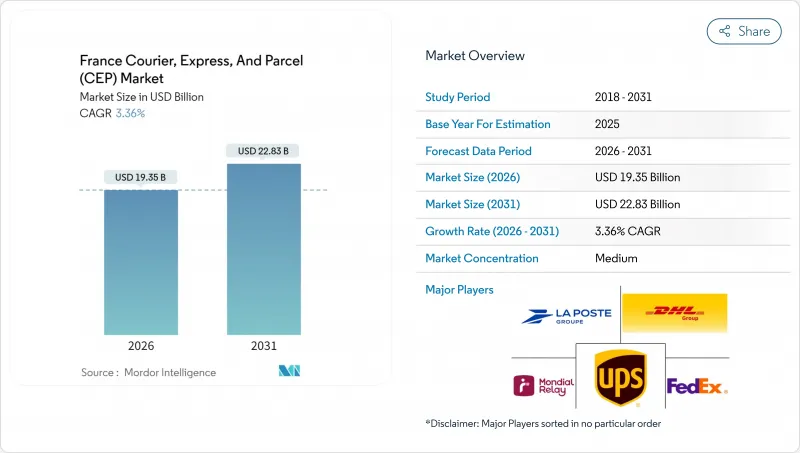

2025 年法國快遞、速遞和小包裹(CEP) 市值為 187.2 億美元,預計到 2031 年將達到 228.3 億美元,高於 2026 年的 193.5 億美元。

預計在預測期(2026-2031 年)內,複合年成長率將達到 3.36%。

這一成長軌跡受到電子商務擴張、亞洲跨境物流以及促進低排放量營運的監管變化的影響。隨著線上消費超過小包裹零售,包裹量不斷成長,戶外廣告網路幫助業者提高配送密度並減少投遞失敗率。國際市場促進了小包裹的流通,增加了公路運輸里程,而低申報價值則對利潤率構成壓力。同時,諸如法國的25個低排放區(ZFE-M)等永續性法規正在加速電動車和貨運自行車在人口密集的城市中心的普及,從而永久性地改變了「最後一公里」的成本結構。為了在維持服務品質的同時達到成本和環境目標,現有企業和新參與企業競相升級樞紐設施、數位化工具和替代燃料車輛,競爭日益激烈。

法國快遞、速遞、小包裹市場趨勢與分析

電子商務滲透率快速成長

2024年第二季度,法國國內線上零售額年增8.4%,各大城市的小包裹量均有所成長。配送點密度的增加提高了車輛運轉率,而全通路零售商則增加了宅配和線上訂購線下取貨服務,進一步拓展了其配送通路。巴黎的「暗店」業者正致力於提供兩小時以內的配送服務,迫使承運商重新設計商店微型倉配區域的路線。法國郵政的12.8萬個收出貨點有助於降低配送失敗的風險並縮短主幹路線,從而有效控制成本。電子商務客戶越來越傾向於選擇永續的配送方式,而擁有碳減排認證服務的承運商在高階配送服務中獲得了定價權。

來自亞洲的跨境小包裹貨運量增加

預計到2024年,將有約46億件小小包裹進入歐洲,其中91%來自中國,將重塑國內物流網路的經濟格局。業者被迫處理大量低價值商品,這些商品佔用空間大,但利潤率低。中國電商平台與國際宅配公司(例如Temu和DHL)的合作,正將貨物轉運至法國機場,而這些機場目前已承擔電商尖峰時段的貨運量。儘管歐盟提案的低價值商品課稅改革方案帶來了戰略上的不確定性,但取消最低價值免稅額度可能會提高獲利能力。國內業者正在透過以下方式應對:加快清關速度,並透過自動化海關資料收集和擴大入口網站地區的保稅分類空間來降低處理成本。

價格競爭和人事費用給利潤率帶來壓力。

2024年第四季度,道路運輸公司破產數量增加了35.4%,原因是許多業者難以將不斷上漲的貨運和燃油成本轉嫁給托運人。由於大規模電商合約的激烈競標,高鐵運價依然低迷,而大都會圈「最後一公里」的工資卻在上漲,因為那裡的就業機會很多。全球物流整合商正在裁員,聯邦快遞計畫在2025年於歐洲裁員多達2,000人,以在疲軟的價格環境下維持利潤率。分散的獨立司機分包模式進一步削弱了價格約束,許多線路的運能超過了需求。

細分市場分析

到2025年,製造業將佔總收入的33.01%,主要驅動力來自汽車、航太和機械出口,這些產業需要精準的B2B交付。電子商務在2026年至2031年間將以4.24%的複合年成長率成長,這將帶來大量的住宅配送,並重塑網路格局。醫療保健和金融服務由於監管和安全方面的要求,仍將保持小眾但利潤豐厚的態勢。

多元化的需求結構將緩解某些產業疲軟的影響:固定間隔的工業取貨服務將提高離峰時段的車輛運轉率,而隔夜住宅配送服務將提高資產利用率。能夠平衡工業物流和消費物流的營運商很可能在法國宅配、速遞和包裹市場佔據主導地位。

預計2025年,國際快遞服務成長將超過國內快遞服務,並在2026年至2031年間維持4.05%的複合年成長率。然而,到2025年,國內快遞仍將主導法國快遞、速遞、小包裹(CEP)市場65.62%的佔有率。來自亞洲平台的低價值進口商品推動了巴黎戴高樂機場和里昂聖埃克絮佩里機場小包裹量的增加,迫使承運商加強海關自動化流程以確保運輸時間。國內快遞業務受惠於密集的收件點網路和符合消費者預期的快速遞送,但由於托運人會將價格與跨境服務進行比較,因此面臨利潤壓力。

為了贏得消費者對國際運輸的信任,營運商正透過免稅選項和即時追蹤功能來凸顯自身優勢。法國郵政(La Poste)2024年跨境商店件(OOH)業務量增加52%,顯示靈活的取件方式可以有效降低不斷上漲的「最後一公里」運輸成本。那些能夠熟練海關數據收集並提供端到端可視性的運輸運營商,預計將在法國快遞小包裹(CEP)市場不斷成長的跨境領域獲得更高的利潤率。

其他福利:

- Excel格式的市場預測(ME)表

- 分析師支持(3個月)

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 人口統計數據

- 按經濟活動分類的GDP分配

- 按經濟活動分類的GDP成長

- 通貨膨脹

- 經濟表現和公司概況

- 電子商務產業的趨勢

- 製造業趨勢

- 運輸和倉儲業的GDP

- 出口趨勢

- 進口趨勢

- 燃油價格

- 物流績效

- 基礎設施

- 法律規範

- 價值鍊和通路分析

- 市場促進因素

- 電子商務滲透率快速成長

- 亞洲跨境小型貨物吞吐量增加

- 更快的最後一公里配送速度和對戶外廣告的需求

- 推動永續性,邁向零排放車輛

- 2024年巴黎奧運物流改善措施(貨運自行車區)

- Z世代(C2C)推動二手市場快速成長

- 市場限制

- 價格競爭和人事費用給利潤率帶來壓力。

- 城市土地利用和ZFE-M法規

- 來自亞洲地區的低價值地塊會降低獲利能力。

- 城市周邊停車場缺乏高功率電動車充電設施

- 市場創新

- 波特五力分析

- 新進入者的威脅

- 買方的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場規模與成長預測

- 收件地址

- 國內的

- 國際的

- 配送速度

- 表達

- 非快遞

- 模型

- B2B

- B2C

- C2C

- 運輸重量

- 重型貨物運輸

- 輕型和重型貨物運輸

- 中型重型貨物運輸

- 交通工具

- 空氣

- 陸上

- 其他

- 終端用戶產業

- 電子商務

- 金融服務(BFSI)

- 衛生保健

- 製造業

- 一級產業

- 批發零售(線下)

- 其他

第6章 競爭情勢

- 市場集中度

- 關鍵策略舉措

- 市佔率分析

- 公司簡介

- DHL Group

- FedEx

- GEODIS

- Integer Capital Group

- International Distributions Services(including GLS)

- La Poste Group

- STERNE Group

- United Parcel Service(UPS)

- Walden Group

第7章 市場機會與未來展望

The France courier, express, and parcel market was valued at USD 18.72 billion in 2025 and estimated to grow from USD 19.35 billion in 2026 to reach USD 22.83 billion by 2031, at a CAGR of 3.36% during the forecast period (2026-2031).

E-commerce growth, cross-border flows from Asia, and regulatory changes that favor low-emission operations shape this trajectory. Parcel volumes climb as online spending grows faster than store-based retail, while out-of-home (OOH) networks help operators raise stop density and limit failed deliveries. International marketplaces drive inbound small-parcel flows that boost line-haul mileage yet compress margins because of their low declared value. Meanwhile, sustainability mandates such as France's 25 active low-emission zones (ZFE-M) accelerate fleet electrification and cargo-bike adoption in dense city cores, permanently shifting last-mile cost structures. Competitive intensity rises as incumbents and new entrants race to upgrade hubs, digital tools, and alternative-fuel fleets in order to preserve service quality while meeting cost and environmental targets.

France Courier, Express, And Parcel (CEP) Market Trends and Insights

E-Commerce Penetration Surge

National online retail sales grew 8.4% year-on-year in Q2 2024, widening the parcel pool in every major city. Higher stop density lifts vehicle utilization, while omnichannel retailers add home-delivery and click-and-collect flows that broaden shipment origin points. Dark-store operators in Paris now target sub-two-hour service windows, forcing carriers to redesign routing for micro-fulfillment zones. Pickup-point expansion underpins cost control, as La Poste operates 128,000 sites that lower failed-delivery risk and shorten trunk routes. E-commerce shoppers increasingly favor sustainable options, and carriers that certify carbon-reduced services gain pricing power within premium delivery tiers.

Rising Cross-Border Parcel Flows from Asia

About 4.6 billion small parcels entered Europe in 2024, with 91% dispatched from China, reshaping domestic network economics. Operators must process vast volumes of low-value items that occupy capacity yet generate slender margins. Partnerships between Chinese marketplaces and global express firms, such as Temu's tie-ups with DHL, channel traffic through French airports that already handle peak e-commerce flows. Proposed EU tax reforms on low-value consignments inject strategic uncertainty but could also lift yields if minimum-value exemptions disappear. Domestic players respond by automating customs data capture and expanding bonded sortation space at gateway hubs to speed clearance and cut handling costs.

Margin Squeeze from Price Wars and Labor Costs

Road-transport company insolvencies rose 35.4% in Q4 2024 as operators struggled to pass wage and fuel hikes onto shippers. Fierce bidding for large e-commerce contracts keeps line-haul rates low, even as last-mile wages climb in dense cities where employment alternatives abound. Global integrators rationalize headcounts FedEx cut up to 2,000 European jobs in 2025 to protect margins in a soft-pricing environment. Fragmented owner-driver subcontracting further dampens pricing discipline because capacity outstrips demand on many lanes.

Other drivers and restraints analyzed in the detailed report include:

- Demand for Faster Last-Mile and OOH Options

- Sustainability Push for Zero-Emission Fleets

- Urban Land-Use and ZFE-M Restrictions

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Manufacturing produced 33.01% of 2025 revenue, anchored by automotive, aerospace, and machinery exports that require precise B2B deliveries. E-commerce, advancing at a 4.24% CAGR between 2026-2031, injects high-volume residential drops that reshape network design. Healthcare and financial services stay niche yet high-margin due to regulatory and security requirements.

Diversified demand shields carriers from sector-specific slowdowns. Fixed-interval industrial collections fill off-peak van capacity, while evening residential rounds improve asset utilization. Operators that balance industrial and consumer flows are positioned to outperform in the France courier, express, and parcel market.

International services grew faster than domestic in 2025 and are on course for a 4.05% CAGR between 2026-2031, even though the France courier, express, and parcel market size remains dominated by domestic deliveries at 65.62% share in 2025. Low-value imports from Asian platforms swell parcel counts at Paris-CDG and Lyon Saint-Exupery, compelling carriers to refine customs-clearance automation to protect transit times. Domestic volumes benefit from dense pickup-point networks and short lead times that align with consumer expectations, yet face yield pressure when shippers benchmark prices against cross-border offers.

Operators differentiate through duty-paid options and real-time tracking to win shopper trust on international consignments. La Poste's 52% jump in cross-border OOH traffic in 2024 demonstrates that flexible collection mitigates last-mile cost inflation. Carriers that master customs data capture and offer end-to-end visibility are expected to secure higher margins on the expanding cross-border segment of the France courier, express, and parcel market.

The France Courier, Express, and Parcel Market Report is Segmented by End User Industry (E-Commerce and More), Destination (Domestic and International), Speed of Delivery (Express and Non-Express), Shipment Weight (Heavy Weight Shipments and More), Mode of Transport (Air, Road, and Others), and Model (Business-To-Business, Business-To-Consumer, and Consumer-To-Consumer). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- DHL Group

- FedEx

- GEODIS

- Integer Capital Group

- International Distributions Services (including GLS)

- La Poste Group

- STERNE Group

- United Parcel Service (UPS)

- Walden Group

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Demographics

- 4.3 GDP Distribution by Economic Activity

- 4.4 GDP Growth by Economic Activity

- 4.5 Inflation

- 4.6 Economic Performance and Profile

- 4.6.1 Trends in E-Commerce Industry

- 4.6.2 Trends in Manufacturing Industry

- 4.7 Transport and Storage Sector GDP

- 4.8 Export Trends

- 4.9 Import Trends

- 4.10 Fuel Price

- 4.11 Logistics Performance

- 4.12 Infrastructure

- 4.13 Regulatory Framework

- 4.14 Value Chain and Distribution Channel Analysis

- 4.15 Market Drivers

- 4.15.1 E-Commerce Penetration Surge

- 4.15.2 Rising Cross-Border Parcel Flows from Asia

- 4.15.3 Demand for Faster Last-Mile and OOH Options

- 4.15.4 Sustainability Push for Zero-Emission Fleets

- 4.15.5 Paris-2024 Logistics Upgrades (Cargo-Bike Zones)

- 4.15.6 Gen-Z Second-Hand Marketplace Boom (C2C)

- 4.16 Market Restraints

- 4.16.1 Margin Squeeze from Price Wars and Labor Costs

- 4.16.2 Urban Land-Use and ZFE-M Restrictions

- 4.16.3 Low-Value Parcels from Asian Sites Erode Yields

- 4.16.4 Sparse High-Power EV Charging at Peri-Urban Depots

- 4.17 Technology Innovations in the Market

- 4.18 Porter's Five Forces Analysis

- 4.18.1 Threat of New Entrants

- 4.18.2 Bargaining Power of Buyers

- 4.18.3 Bargaining Power of Suppliers

- 4.18.4 Threat of Substitutes

- 4.18.5 Competitive Rivalry

5 Market Size and Growth Forecasts (Value, USD)

- 5.1 Destination

- 5.1.1 Domestic

- 5.1.2 International

- 5.2 Speed of Delivery

- 5.2.1 Express

- 5.2.2 Non-Express

- 5.3 Model

- 5.3.1 Business-to-Business (B2B)

- 5.3.2 Business-to-Consumer (B2C)

- 5.3.3 Consumer-to-Consumer (C2C)

- 5.4 Shipment Weight

- 5.4.1 Heavy Weight Shipments

- 5.4.2 Light Weight Shipments

- 5.4.3 Medium Weight Shipments

- 5.5 Mode of Transport

- 5.5.1 Air

- 5.5.2 Road

- 5.5.3 Others

- 5.6 End User Industry

- 5.6.1 E-Commerce

- 5.6.2 Financial Services (BFSI)

- 5.6.3 Healthcare

- 5.6.4 Manufacturing

- 5.6.5 Primary Industry

- 5.6.6 Wholesale and Retail Trade (Offline)

- 5.6.7 Others

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Key Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (Includes Global Level Overview, Market Level Overview, Core Segments, Financials as Available, Strategic Information, Market Rank/Share for Key Companies, Products and Services, and Recent Developments)

- 6.4.1 DHL Group

- 6.4.2 FedEx

- 6.4.3 GEODIS

- 6.4.4 Integer Capital Group

- 6.4.5 International Distributions Services (including GLS)

- 6.4.6 La Poste Group

- 6.4.7 STERNE Group

- 6.4.8 United Parcel Service (UPS)

- 6.4.9 Walden Group

7 Market Opportunities and Future Outlook

- 7.1 White-Space and Unmet-Need Assessment